Yves here. Richard Murphy makes a point in the UK context that applies just as well as in the US. As appealing as a wealth tax might sound, it simply is not an effective way to lower inequality. The big reason in the US is that a lot of private wealth is held in the form of difficult to value assets, particularly interests in private companies.

To put it more simply: the IRS has not won a large estate valuation case since the early 1980s. And large estate valuations raise just the same issues as a wealth tax would, but less frequently. As we wrote in 2019 on Elizabeth Warren’s wealth tax proposal:

While Elizabeth Warren has fomented a good deal of productive debate about the egregious concentration of wealth among the 0.1% with her wealth tax proposal, there’s a lot not to like about her scheme. We’ll focus on one glaring issue: that a substantial amount of wealth is held in the form of investments in private companies. What they are worth is legitimately subject to question and therefore open to gaming. This is such a significant issue that her estimates of what her tax would yield look considerably overstated.

Shorter: there are other ways to skin the fat cats that would work just about as well if not better and not have as many stumbling blocks, both legal and practical. So it is odd that someone vaunted as a technocrat chose a problematic path to achieve her aims….

Warren presents the policy wonk’s version of the economist’s famed “Assume a can opener”. Her version is “Assume effective IRS enforcement on the super rich.” Good luck with that.

The rich and super rich hold the overwhelming majority of their assets in these forms: publicly traded securities, real estate, and private companies. The example from Warren’s website is shockingly inaccurate: “Consider two people: an heir with $500 million in yachts, jewelry, and fine art…”

The problem that Warren is hand-waving away is that private companies are hard to value and even real estate isn’t as easy as one might assume.

M&A professionals, the type who eat liability to issue fairness opinions, will tell you valuation of companies is an art, not a science. Even with public companies, they do not opine that the price paid to the selling shareholders in a merger is correct, merely that it is “fair”. Remember, in these cases, the company being bought has a trading history and the investment bankers can work up comparisons of merger premiums for similar deals.

Anyone who has valued private companies (which yours truly has done for decades, professionally, for US and Japanese companies, billionaires, and private equity firms) or even just a cash flow model for a large corporate project, will tell you that if you vary the key assumptions within a reasonable range, you will regularly get a difference in projected cash flows (which is the basis for valuing the company) of X to 5X.

Similarly, it is hardly uncommon in private equity to have several firms invested in the same deal. Limited partners who by happenstance are investors in the private equity firms that all invested in one company regularly find that the valuation of that company reported to them differs wildly. The concerned limited partners ask for explanations and the general partners have perfectly logical-sounding explanations…..

Moreover, coming up with an independent valuation for a meaningfully-sized business is labor intensive, since you need to sanity-check the owner’s assumptions, particularly if you are assuming liability for your work. Attentive readers may recall that we’ve discussed how private equity is the only type of institutional asset management where the asset managers value the holdings themselves, and then only monthly. All other types require monthly valuation by a third party.

Why is private equity different? Because the cost of valuing a private company by a reputable firm like Houlihan Lokey would be on the order of $30,000 (and that may be low), and that’s deemed to be costly enough to impair returns.

Another way to think of this problem is that it is yet another manifestation of the obliquity conundrum. In complex systems, there is no way to map a simple path to the result you want because you can’t map the terrain, so the supposed straight line is anything but. Here, taxing wealth sounds like a wonderful way to reduce the lucre of billionaires, but as Murphy confirms below, there are much better ways to achieve that end.

By Richard Murphy, part-time Professor of Accounting Practice at Sheffield University Management School, director of the Corporate Accountability Network, member of Finance for the Future LLP, and director of Tax Research LLP. Originally published at Tax Research

Davos is full of calls for the super-rich to be taxed more. The Patriotic Millionaires are at it. As the Guardian notes:

More than 250 billionaires and millionaires are demanding that the political elite meeting for the World Economic Forum in Davos introduce wealth taxes to help pay for better public services around the world.

The Guardian adds:

A “modest” 1.7% wealth tax on the richest 140,000 people in the UK could raise more than £10bn to help pay for public services, the Trades Union Congress (TUC) suggested last year.

Oxfam is also making the demand. Again, the Guardian notes:

Calling for a wealth tax to redress the balance between workers and super-rich company bosses and owners, [Oxfam’s] report says such a levy on British millionaires and billionaires could bring in £22bn for the exchequer each year, if applied at a rate of between 1% to 2% on net wealth above £10m.

I wish I did not have to disagree with the demands of these organisations, but I do.

As I have shown in the Taxing Wealth Report 2024, wealth taxes are not only not required, but they really would be an impediment to progress.

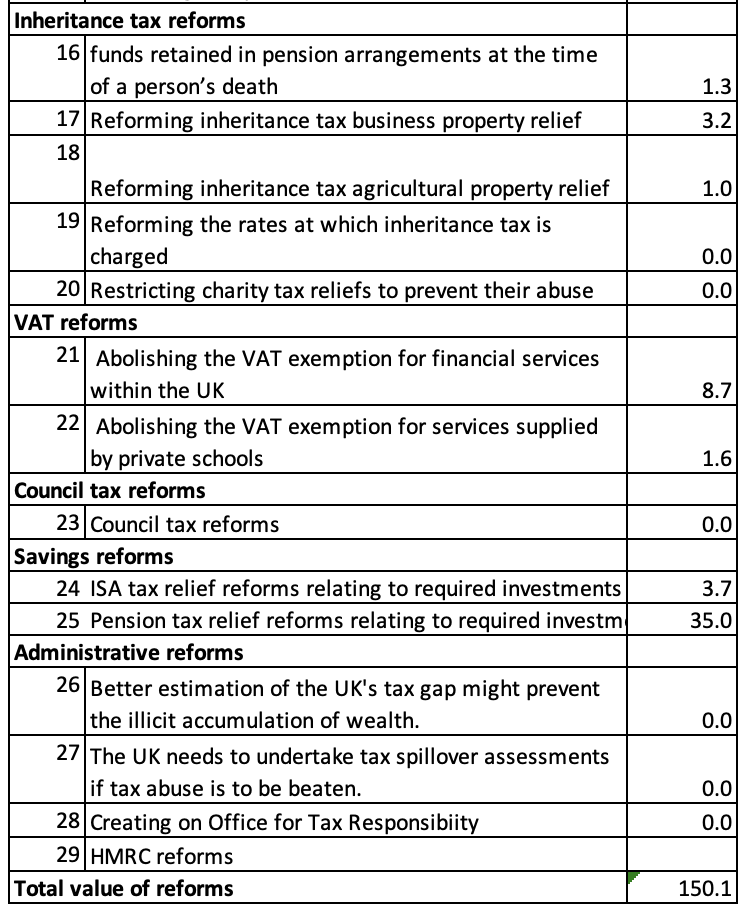

But, even more pragmatically, if we want to tax wealth, there are so many much easier ways to do it that would encounter none of the massive organisational, logistical, accounting and ethical issues that a wealth tax would encounter. For example, take this list, which is my summary of Taxing Wealth Report 2024 reforms right now:

Of course, no one would make all these changes: I am not suggesting that they should.

But if you want to tax wealth, what is better, a few billion in many years’ time after a watered-down wealth tax is introduced, or reforms that could be done almost overnight now to existing laws that would undoubtedly raise more money?

The details of the above are to be found via links here.

Here’s the deal: either the rich choose to make themselves subject to the law, in this manner spreading the wealth, or the guillotines begin to be constructed. I’ll bet the conversations about what is possible begin to broaden once the rich realize that their other option is having their heads removed.

We can discuss how difficult it is to accurately evaluate assets held in the ways described in the article; when inequality is as obscene as it has become, what might be more fruitful is a discussion of the means by which the rich can distribute the booty they’ve got from looting the rest of us, so as to avoid the natural consequences. I’m not sure PMC folks are understanding just how gross inequality has become, or what it would entail to redress concerns.

As an example, here in Wisconsin, several people died, basically from exposure, the other night; they froze to death beacause the didnt own enough things. Businesses went on as usual, of course. If discussions regarding the conditions which led to other humans dying in the cold in the ghetto didn’t take place, the reward for this ignorance will be reaped in time.

Who is going to construct the guillotines? The national security state will very quickly dispose of (with extreme prejudice) all who attempt to do so. The revolution will not be televised,because there will be no revolution.

Who is going to construct the guillotines?

How will you get them through customs into New Zealand, for that matter?

Or into Switzerland? Or indeed Richard Murphy’s own London, which for centuries has run a nice business of letting the globally wealthy park some of that wealth safely in a capital that’s more civilized than anything in the US in return for some of that money supporting London’s 20 percent social housing, NHS, public transport system, etc.

See Revenant’s comments further down this page. As they indicate, the UK’s HMRC (His Majesty’s Revenue and Customs service) has far sharper teeth and more small print than the US IRS, and that’s in part because London and the UK provide services to the internationally wealthy and expect to extract part of that wealth in return.

Nonetheless, the really wealthy always have the option of moving somewhere else if you make it worth their while. So even in the UK it’s a continuous calculation of just how much you can extract before they run to another nation state’s jurisdiction.

“But if you want to tax wealth, what is better, a few billion in many years’ time after a watered-down wealth tax is introduced, or reforms that could be done almost overnight now to existing laws that would undoubtedly raise more money?”

I couldn’t agree more!

Lots of ink has been spilled on the Moore case that the Supreme Court has on its docket right now. The issue at play in Moore is whether the US federal income tax requires a realization event to trigger income recognition. IOW, if there is no realization event, then there is no income recognition, and therefore no income tax.

Many wealth tax proposals rest on the idea of marking a taxpayer’s assets to market and taxing as income the change in wealth from one tax accounting period to another. So, in part, there is a lurking beneath the surface question in Moore that the Supreme Court may shed some light on, namely: must the mark be a realization event in order to tax increases in wealth from one tax period to another? There are tons of other issues with marking, but I won’t raise them here.

Without getting into the technical merits one way or the other, my strong suspicion is that this Supreme Court, in Moore, will not endorse the view that realization is but an administrative tool to aid tax administration and is not required for income recognition. Rather, I’m more inclined to think that the Supreme Court will endorse the view that realization is a constitutional requirement for income recognition, or it may figure out a way to address the tax issue in Moore, but duck the big questions.

So, against this backdrop of the potential Supreme Court position that realization is a constitutional requirement, we turn to the issue of introducing a wealth tax in the US that relies on marking. Think of the political change that would have to happen to pass such a wealth tax. Thus, I observe that the political moments in time amenable to passing a wealth tax are few and far in between, raising the question of how best to use any such opportune moment in time to pass tax reform. Wouldn’t it be a waste of such an opportunity to pass a wealth tax that would only be struck down by the Supreme Court (particularly if the political moment has passed and tax reform measures that support the great mass of the population can no longer be passed)? I think it would. It would be snatching defeat from the jaws of victory, and would be political malpractice of the first order.

I have previously noted here the Professor Geier has written that income inequality in the US is worse after the imposition of tax than prior to the imposition of tax. I think the far better effort for tax policy makers who want to benefit the majority of Americans is to focus on those provisions that are responsible for what Professor Geier has written about. Therefore, I would submit that the following items should instead be the focus of reform efforts:

*Eliminating the long-term capital gain preference for for capital gain income in excess of $400,000 (this proposal was in Biden’s campaign platform);

*Taxing stock buybacks;

*Instituting a financial transactions (a/k/a Tobin) tax;

*Eliminating carried interest provisions that provide hedge funds with favorable tax rates;

*Reversing full expensing of capital goods and reining in accelerated depreciation (fully expensing capital goods and accelerating depreciation exempts normalized income earned by capital goods – like robots/AI – from tax);

*Strengthening the appreciated financial position and sale or exchange provisions;

*Eliminating or reducing basis step-ups for appreciated property upon death;

*Eliminating the qualified business income provisions of section 199A;

*Minimizing tax deductions for asset-stripping acquisitions by hedge funds and others;

*Eliminating the foreign-derived intangible income regime;

*Revising the global intangible low-taxed income regime;

*Revising the base erosion anti-abuse tax regime;

*Revising the sourcing rules for sales or exchanges of inventory property; and

*Strengthening the tax whistleblower function.

Progress on any of these reform items would be a quite tangible achievement and would reduce the inequality that Professor Geier has described.

Additionally, and FWIW on a policy note, given my worries about tax economics, downward bracket creep and the effects I have seen of rising property taxes (which are kinda analogous to a wealth tax) on people with fixed incomes who own homes, I don’t think that a wealth tax is good tax policy. Far better would it be to reform any or all of the items listed above when a rare political moment in time amenable to tax reform occurs. Hence my concurrence with the author’s post.

Rising property taxes are a real issue – some form of cure might be to hold a tax rate at time of purchase for as long as homeowner lives in the property – the tax increases to a budgetary level when a new owner comes on board – any homeowner properties converted to rentals would be taxed at higher rate – any companys buying properties for rental will be taxed at higher rate in effect – The depreciation expense will be eliminated and in it’s place any repairs, maintenance or upgrades are deductible expenses.

When baseball card trading (investing in secondary market – wall street) tax at full rates – and tax HFT at high rates. If investing in start-up and actual capital improvements – allow tax breaks and actual depreciation.

So many tax rates – except for workers and homeowners – have been removed – some needs to come back

Both property tax and mortgage interest deductions should be eliminated. These two tax benefits serve only to distort property values and are an expensive subsidy to middle and upper class people.

I like these suggestions, but there are also some steps that would be conceptually simple though unpopular with Congress. Like raising the top income earners’ tax rate–make it 89% or whatever it was back in the Eisenhower years. Then eliminate or severely restrict many of the deductions that are currently only used by the very wealthy. Why is my tax form always asking me about oil depletion allowances, etc.? It’s absurd.

I also think there should be something that we would call a “prosperity dividend” (never “guaranteed income”) which everyone who has been a citizen for more than two years should get. It would not be redistributing income, but sharing the nation’s prosperity! We could let Trump out of jail to sign the checks, even.

How can those numbers to sum to 150.1.

The first half of the list wasn’t in frame.

My original query on how the numbers sum went to moderation. Apparently they will (eventually) if one clicks through to the underlying link:

https://taxingwealth.uk/2023/09/13/the-taxing-wealth-report-2024-recommendations-to-date-and-their-suggested-value/

Let the rich calculate their wealth themselves and self report. Then draw lots for some ratio of the reports where you take them at their word, expropriating ALL of their property and possessions in exchange for a deposit equal to the value self reported, minus the wealth tax rate.

I wonder whether or not under such circumstances there might suddenly be an outburst of generosity in the amounts reported, and therefore the amount of wealth tax collected at the posted rate?

Regardless, we shouldn’t wait around for either such a scheme nor Richard’s list of tax reforms. Just start spending whatever is necessary to provide for the well-being of the citizenry NOW and worry about collecting later — if there’s inflation, respond with payments to households below a certain income threshold to keep them whole in order to shrink the gap between them and the upper income brackets.

Trouble is … the people with the power to make tax reform possible are the same people who benefit from the status quo or no change.

Sorry, I disagree vehemently.

It’s too hard is no attitude for a tax authority. Yes, taxes should be cheap and simple and inescapable to administer but only up to a point. I’m the UK we also have fiendishly complex taxes catching tiny numbers of people but they were erected for the very good reason of dissuading others from arranging their affairs that way and, like Chesterton’s fence, we must remember their purpose and not dismiss them. If you want an example, the capital matching rules on distributions from offshore trusts, which impose a swingeing tax rate on benefits received in the UK from offshore, in all guises (loans, property, etc) calculated to remove the imputed benefit of rolling up investment returns taxfree offshore.

The UK already had a wealth tax and Richard Murphy is playing dumb not to acknowledge this. Simple inheritance tax charges 40% of assets on death, with a much smaller exemption than in the US (£500k per individual, £1m for a couple, including the home in that). Most people fall in this regime. Complex inheritance tax charges up to 6% every ten tears on relevant assets, a true wealth tax. The actual rate, what is a relevant asset, what are the exemptions and reliefs etc literally fill a book and all of these aspects could be broadened and simplified for a proper wealth tax.

Currently IHT only catches the haute bourgeois, who have illiquid investment assets (houses, art, debt securities) and trust their children less than they hate HMRC so don’t give them away before dying. Truly wealthy people are essentially exempt because there is 100% relief on farmland (aristocrats and now James Dyson) and on unquoted equity in “trading” businesses (anything except property and investment businesses, basically, so James Dyson again) and they can arrange their affairs so non-exemlt wealth is held offshore or given away seven years before death to sidestep the tax entirely.

Obviously the IRS has been gutted but HMRC still retains a full set of capabilities. The District Valuer’s office values land and buildings and does so regularly, in order to assess property taxes (annual rates paid to local authorities and stamp duty land tax assessed on sales of freeholds and leases). The Shares Valuation Office assesses the value of unquoted securities for transaction taxes (stamp duty). Both of these obviously assess estates for inheritance tax.

There would be no difficulty in the UK operating a wealth tax, even if the US has issues. Given that, why tinker at the edges and continue to leave taxation on a regressive basis, with VAT (hurts the poor taxing consumption) and high income taxes (hurts labour generally) and low capital taxes (favours capital and finance)? We need to put the vampire through oligarchy’s hurt and attack the accumulation of capital.

I’d like to think of a graduated wealth tax as the Oligarch’s Olympics. I would set the tax rate as log2 of the wealth/1m, so a millionaire pays log2(1) ° 0% tax. Then we will see who is the better entrepreneur, the guy who turns $1bn into $2bn at a 10% tax rate on the additional wealth or the guy who turns $10bn into $11bn at a 13% tax rate?

I’d abolish income tax and CGT at the same time. Tax the wealth, not the changes in wealth.

The progressive rate would penalise oligarchs who do not split their fortune up or who don’t generate real BG Swinging Dick alpha on their fortune, as the constant headwind of tax pushes them down the rich list.

Lordie…did you not understand that the US has LOST EVERY LARGE VALUATION CASE FOR DECADES???

Valuing private companies is not like valuing real estate. And it may be harder in the US due to how we structure commercial leases.

IRS determinations can be and are challenged all the time. The IRS loses in big estate tax cases, which are EXACTLY the same issues you have in wealth taxes.

This is not a matter of too hard. This is not daable. This is why most countries who had them have abandoned them.

I trust you have never done large company valuations. I have. You can make them credibly worth whatever you want them to be worth. And credible valuations also cost a lot of money….so the IRS runs up huge expert witness bill on its cases and loses. And you seriously recommend this?

And there is no reason to have a wealth tax. An estate tax works the same way and is administratively way cheaper due to less frequent complex (difficult, costly, subject to challenge) valuations. The heirs might also sell assets so you could conceivably have additional duties if the assets are sold for more than a 20% premium w/in 5 years of the estate transfer.

I didn’t mean to provoke so many apologies if I came across as obtuse. I am not trying to be! I am familiar with company valuation, I have run venture funds and reported portfolio valuations, negotiated investment and M&A valuations etc. Profit is vanity and cash is sanity etc..

I am trying to point out that Richard Murphy is putting only a partial explanation forward of how the UK tax system works, in support of his policy views. I have a lot of time for his overall objectives for a tax system, I just disagree with some of his prescriptions and, here, with his withholding some key elements. The UK has a full functioning wealth tax in the shape of the IHT regime for “relevant assets”, it just does not bear that name. Not acknowledging this does his argument against a wider wealth tax no favours

What works or doesn’t work is clearly going to different in the USA and the UK. I know that you are very familiar with the US system but I wanted to highlight that things can be different in other countries, even Anglo-American neoliberal ones.

HMRC has not lost any big shares valuation cases that I am aware of. This is partly because UK civil procedure rules are run very differently to US litigation and the use of experts is very tightly controlled and the venue is a specialist single judge tax tribunal (very rarely the high court or supreme court). Indeed, some of the most famous cases concern shares valuation. HMRC has the capacity to assess high volumes of share and land prices because it does this all the time for its existing transaction and capital gains taxes (which may have no US equivalent, I don’t know).

Obviously, in the UK at the moment, unquoted shares are excluded from relevant assets except where the company is an investment company (mainly holds or trades real estate or securities). In this case, the valuation is straightforward because the underlying assets can be valued.

Extending relevant assets to unquoted equity would in theory put HMRC in the IRS position, of having to challenge unquoted valuations for estate taxes. But actually, does it really matter? The UK relevant assets regime is charged on the ten year anniversary or any earlier disposal. A successful business is going to generate cash which will either be retained as cash, invested in assets or distributed to shareholders. Cash at bank will be picked up on the balance sheet, as will assets. Distributions to shareholders will end up as cash or assets likewise. And if the company is sold, an exit charge can be used to recapture any excess in sale value over declared value, and the exit proceeds will still be subject to tax in the hands of the recipients. Correctly drafted, wealth is a closed universe like bank reserves, you can push the air mattress down and another bit pops up (if you stop up all the leaks…).

The reason to have a wealth tax is to clip the coins of the wealthy on a regular basis and stop the concentration of capital. Taxing every generation does not do this effectively. Also, I would move the whole basis of taxation to unearned rent (land value tax) and wealth which is made/protected via public goods (trust, rule of law, public services, private bank money with a public backstop etc). I would abolish income tax or capital gains tax (except as an exit charge from the wealth tax regime), so there would be plenty of tax inspectors to reallocate to a wealth tax.

I defer to you whether a wealth tax would work in the US but all of the machinery exists in the UK and it us only the political will to expand it that is missing.

PS: the above should refer to the relevant property regime, not relevant assets. Brain glitch

PPS: I forgot to mention (the mind suppresses the horror) that the relevant property regime (and UK tax general) is a lot more complicated than explained above. Imagine a tax system designed by the Old Ones, it is inexorable, the Inland Revenue Shoggoth!

The relevant property regime taxes trusts. The total chargeable value of all assets in the trust are valued and then reliefs claimed. This is used to calculate the historic value placed in trust. A ratio of the current chargeable value (with exemptions and reliefs) and the historic value is then used to calculate the applicable rate. The point is that there is a regular disclosure of all assets’ valuations and then a claiming of relief, so inconsistencies will be noticed (if shares have negligible worth but a valuable stream of dividends, for example).

Oh dear, I wrote an apology that I have provoked because I am not being deliberately obtuse and then an extensive explanation of the differences in the UK system that make it more plausible to tax wealth – we have the mechanisms already but perhaps not the will – but I then added a PS and the moderation appears to have eaten the apology and left the afterthought!

Anyway, sorry, not trying to be obtuse, genuinely trying to show that even neoliberal Anglo american countries can successfully run a wealth tax. Whether we can broaden it is the question because right now it falls only the upper middle class, not the truly rich, who like it that way….

If the WEF is proposing a wealth tax it is because they know they can game it. The answer is not individual income tax. The answer is corporate taxes based on consumption of fossil fuels, offshoring of jobs and AI replacing workers. That is where the real money is at and that is what the Davos clowns do not want to have discussed.

The proposals listed, and the tradeoff’s goal, is for raising revenue! Any decrease in inequality appears to be incidental. (Though the cited headlines do appear to have a goal of decreasing inequality.)

So the premise is flawed, especially from an MMT perspective where we don’t need to ask the rich to contribute in order for the state to provide services.

If nothing else this is conflating revenue raising with inequality targeting.

One channel that cuts through this is taxing capital income as punitively as labor income, at least in the US. Flows are much easier to measure than stocks, as the discussion is focused on the challenges of the latter.

Why not do both?

What is the point of more taxes? At least here in the USA the funds can and will be shunted to the next military intervention or weapons program. Maybe the Team America World Police people need less access to cash, not more.

before bill clinton, 1993, we had about 16 billionaires, since 1993 that number has ballooned to about 800.

to not recognize the reasons why, is to send us down the wrong rabbit hole like warren is always trying to do.

we can never recover let alone reform, as long as free trade which is a billionaire minting machine remains in place.

getting rid of free trade is simply the first step, in a long long line of steps that need to be made.

the left is slowly coming out of its slumber, and naming names. lots of good stuff lately on naming names.

https://truthout.org/articles/free-trade-and-unrestricted-capital-flow-how-billionaires-get-rich-and-destroy-the-rest-of-us/

Free Trade and Unrestricted Capital Flow: How Billionaires Get Rich and Destroy the Rest of Us

The bottom line is simple: A u201cfree tradeu201d system is a regime in which capital always wins, everywhere.

By

Gaius Publius ,

AmericaBlog

Published

March 27, 2013

“My point is about unrestricted free trade and capital flow in general and why understanding both is crucial to understanding:

There’s a straight line between “free-trade” — a prime tenet of both right-wing Milton Friedman thinking and left-wing Bill Clinton–Robert Rubin neoliberalism — and wealth inequality in America. In fact, if the billionaires didn’t have the one (a global free-trade regime) they couldn’t have the other (your money in their pocket). And the whole global “all your money are belong to us” process has only three moving parts. Read on to see them. Once you “get it,” you’ll get it for a long time.”

“At its heart, free trade doesn’t mean the ability to trade freely per se; that’s just a byproduct. It means the ability to invest freely without governmental constraint.”

“Free trade is a primary tool of wealth extraction.”

On close examination, the problem with the wealth tax will prove to be trying to force annual cash payments out of it. Annual percentage lien solves all.

Agreed. Any implementation needs to deal with the widow-in-a-big-house issue. This can be dealt with by setting a high minimum – politically, let everybody be millionaire before the wealth tax bites – and allowing election for payment to accrue with interest on real property. The UK IHT regime allows the IHT charge arising from property to be paid over ten years.