Yves here. I must confess to having undue interest in this topic by virtue of having a tiny window into what was then and probably still is called “the trade,” as in the New York City diamond district on 47th Street. Back in the 1980s, big and real jewelry was A Thing among female Wall Street professionals, a status marker showing you belonged in the same room as the heavyweights. For instance, a friend bought the perfect double stand of pearls Claire Booth Luce was married in. She later traded them in for bigger but slightly flawed pearls, because the Claire Booth Luce pearls were so good that they could easily be mistaken for fakes.

During this time, I got to know the only goy who was accepted in the diamond trade. The then class act in the industry, Ralph Esmerian, had taken my contact under his wing. He had a remarkable eye and dealt in estate jewelry and related collectables. He understood how undervalued Cartier mystery clocks were then and easily traded a third of all of them, but lacked the capital to buy and hold on to them for their eventual, large appreciation.

I was intrigued by the dealings in the trade, that dealers would lend extremely valuable inventory to each other to show to end customers, on “memo” as in small pieces of paper describing the item and the price, and the party that borrowed the collateral had either to return it in a month or pay the stipulated price.

Esmerian later went to prison for fraud and embezzlement. He had purchased the tony fine jewelry retailer Fred Leighton (storefront on 66th and Madison) and became overextended. He resorted among other things to the fraud of double-pledging collateral for loans. He was convicted and sent to prison.

To my knowledge, my contact, the Esmerian protege, never engaged in funny business in the trade, but his business also went down in flames, in part due to big flashy jewelry going out of fashion, but also to him extending his business into other fine collectables and misrepresenting his wares (for instance, selling modern copies of Art Deco Normandie arm chairs as originals).

By John Helmer, the longest continuously serving foreign correspondent in Russia, and the only western journalist to direct his own bureau independent of single national or commercial ties. Helmer has also been a professor of political science, and an advisor to government heads in Greece, the United States, and Asia. He is the first and only member of a US presidential administration (Jimmy Carter) to establish himself in Russia. Originally published at Dances with Bears

Mazal u’ Bracha has been the Hebrew expression for sealing transactions in the international diamond trade for hundreds of years – in Amsterdam until World War II, and Antwerp since then. Literally, it means “luck and blessing”. Sociologically, it means that if you default, the community of Jewish diamantaires will impose the sanction of religious law, redline your credit, and you will be unable to take goods on approval, buy, borrow, trade, or continue in the business.

In the major Jewish diamond business centres – Antwerp, Ramat Gan (Tel Aviv), New York – the potency of this blessing has been waning under pressure of falling consumer demand, rising borrowing costs, company bankruptcies, government sanctions, and sanctions-busting. And that was before the Palestine war began.

On March 1, after heavy lobbying by Israeli and American diamantaires – and despite resistance from the Belgian businesses – new restrictions were imposed with the aim of driving Russian diamonds – rough and polished – out of the major jewellery markets of Europe and the US. The new scheme has a catch, however. It is now the US Customs Service with whom diamond buyers and traders must shake hands.

In a rule issued on March 1, the US Government requires importers to sign a statement declaring: “I certify that the non-industrial diamonds in this shipment were not mined, extracted, produced, or manufactured wholly or in part in the Russian Federation, notwithstanding whether such diamonds have been substantially transformed into other products outside of the Russian Federation.”

The US Customs Service doesn’t speak Hebrew and it lacks Talmudic authority. Even if it did, there is increasing doubt among trade lawyers that there is anything equivalent to the traditional Jewish community sanction to support the blessing. Israel’s engagement in what the International Court of Justice (ICJ) has ruled to be “plausible genocide” also exposes the Tel Aviv-New York trade to the charge of aiding and abetting war crimes and crimes against humanity.

This is more than a case of the pot calling the kettle black. It’s a case of the Israeli diamantaires financing the genocide of Gaza and the war against the Arabs at the same time as they attempt to drive competing diamond producers and rival diamond traders out of the market. The so-called blood diamond sanction of the Kimberley Process, which was first intended to curtail central and west African diamond supply since 2003, is now being applied to Russian diamonds by the Israelis, the Jewish communities engaged in the diamond trade, and the US Government.

Martin Rapaport, a Tel Aviv-New York diamond trader and publisher of an industry bible called Rapaport.com, has published a warning that the new system is not only an unenforceable mazal-bracha system, but it is also a devious scheme to channel diamond certification through loopholes in Antwerp, at the expense of alternative, stricter channels in Tel Aviv and New York; and also to favour the Anglo-South African De Beers diamond group over the Russian rival miner Alrosa and other diamond miners in Africa.

“Previously, goods ‘substantially transformed’ (i.e., manufactured) in countries such as India were technically legal in the US,” Joshua Freedman of the Rapaport group reported on March 11. “The US and other member countries have released information on how enforcement will work, but many questions remain. The industry is still unsure how the ban will work in both the short and the long term. Dealers have begun sending goods to the US with self-declaration statements, but there is uncertainty about what will happen if customs authorities ask for evidence about a particular shipment and whether the US will add more complex requirements later…[there are] allegations that Belgium is using the sanctions to benefit its own diamond sector…Those importing diamonds into the EU [European Union] between March 1 and August 31 may choose between doing so via the Diamond Office [DO] in Antwerp, ‘leading to the issuance of a G7 certificate,’ or by providing documentary evidence with detailed information about the diamond and its origin. Single-origin Kimberley Process (KP) certificates — or mixed origin for De Beers DTC [Diamond Trading Company] goods — qualify as acceptable proof of origin, according to question 12 of the EU’s FAQs. However, there is an important caveat: documentary evidence is accepted only ‘provided that goods of CN codes 7102 31 00 and 7102 10 00 with a weight equal to or above 1 carat are submitted without delay’ to the Antwerp Diamond Office. These codes are for rough diamonds. In other words, all 1-carat or larger rough diamonds entering the EU must go to this Belgian entry point.”

In an international marketplace in which weak demand for diamonds is already squeezing the profitability of the trade in key jewellery manufacturing centres in India and China (Hong Kong), the Russian strategy is to bust the sanctions, defeat De Beers and the hostile Israeli-American operations, and create alternative businesses structures, Of course, the details are now secret.

There are diamantaires in the market who express confidence that Alrosa, Russia’s dominant diamond miner, will be as successful as the Russian oil, gas, and coal exporters who have been under sanctions for longer. “The market will be in a state of shock for the first few months,” comments a Russian diamantaire now based in Dubai. “Most likely, the cost of stones may increase by 10% to 20%, but after the first shock, a correction will occur. Eventually, workarounds will be found for the export of Russian diamonds. To establish parallel imports — from Russia to the outside — will not be so difficult.”

There are also sources who claim Alrosa will fail. Says a diamantaire in Europe, “even before Putin’s invasion, the Russian share of rough production was under 30% in value and volume. Since then of course, all production and sales figures coming out of Alrosa have been pure make-believe and are up for the next Nobel prize for fiction. It could be said there will be more incentive to prospect for future rough in Africa or Canada, or for De Beers and others to lengthen the life of some of their mines – as they are already doing at Venetia [South Africa]. I don’t see any real change in the trading and polishing centres, in the diamond jewellery-consuming countries, and in the structure of the pipeline generally. Just less legal Russian rough.”

In outcome, these two diamond industry sources may be predicting the same thing. The reason is what in the Russian diamond business is called submarining.

For the past thirty years, as Russian language diamond publications have come and gone, this website — and before it the diamond media of London and Johannesburg — have reported on Russian diamond mining, manufacturing, exports, and submarining. By contrast, diamond industry reporters in the US, Belgium, UK, and Israel generally follow the Russian war line of their governments; in South Africa diamond reporters follow the De Beers line. Click to open the archive.

The most recent chapter in Rapaport’s attempt to mobilize the US and EU sanctions agencies against Alrosa was published last December. But at that time the Russians made an alliance with the African miners against the Rapaport scheme for tightening US sanctions. The Indian diamantaires attempted to play both sides – “neutral, waiting to see who would win”.

In the December 6 report, the prediction for 2024 was uncertain. “If the diamond market cracks in half, as the oil market has done, the value of market price-setters like Rapaport’s Rapnet will be erased. No one in the trade is ready to predict with confidence what the alternative diamond trade will look like, and what impact it will have on diamond pricing.”

Click to read: https://johnhelmer.net/

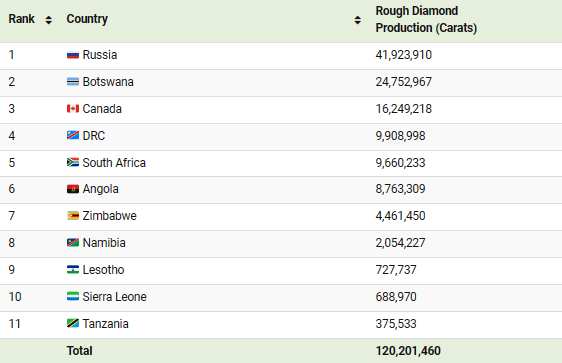

In charts of mine production of rough diamonds by weight in carats, and of value in US dollars, this is what the global diamond business looked like at the beginning of last year:

OFFICIAL DIAMOND MINE PRODUCTION BY COUNTRY, 2022 – BY WEIGHT IN CARATS, BY VALUE IN USD

Source: https://www.visualcapitalist.com/

On these official figures, the Alrosa share of world output by weight was 35%; 21.8% in value. The corresponding De Beers totals – counting De Beers mines in Botswana, South Africa, and roughly half of the Canadian figures – are 35.3% and 46.2%. Alrosa’s 41% share in Angola’s diamond mining output has not been counted in this comparison; Alrosa’s stake in the Angolan mine at Catoca is in negotiation for a form of divestment.

As visible as diamonds are in the global trade in luxury goods, and as dominant as Alrosa is at the mining and export end of that trade pipeline, the value of diamonds in Russia’s commodity exports is tiny. Even if the US-Israeli sanctions were to be as effective as Rapaport hopes they will be, the reduction in exports would not have a significant impact on Russia’s balance of payments — in 2022, Russian commodity exports, according to the Federal Customs Service, reached $591.5 billion; exports of diamonds by contrast fetched $4.7 billion, less than 1%. As Forbes Russia reported recently, “of course, this may negatively affect the financial performance of Alrosa, which produces most of the Russian diamonds, because a small part of the stones is sent to the domestic market. But everyone understands that the bankruptcy of the state-owned company is not in danger. Even on the news of the suspension of diamond sales in the fall of 2023 due to the demand situation, the company’s shares sank by only 2.5%.”

FIVE-YEAR SHARE PRICE TRAJECTORY OF ALROSA ON THE MOSCOW STOCK EXCHANGE

The federal government shareholding of Alrosa amounts to 33%; the Sakha region and local district shareholding is 33%; the free float, 34%. Nominal market capitalization at the current share price is Rb551.4 billion; the share price of Rb74.70 is 25% above the wartime low of Rb59.88 set in March 2023. Source: https://markets.ft.com/

Russia is also the only state in the diamond mining world capable of doing for the state’s benefit what De Beers has traditionally done to protect and profit its own diamond-pricing cartel – buy and sell mined rough with the state stockpile, known in Russia as the Gokhran. For the backfile on the politics of Gokhran’s diamond stockpiling, click to read.

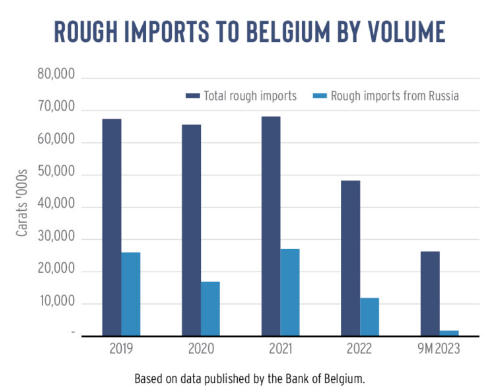

Starting in 2022, the diamond exchange in Dubai, United Arab Emirates (UAE), had overtaken Antwerp as the leading import-export hub or exchange between the mines, cutters and polishers, and the jewellery industry in the worldwide trade. The rivalry between Dubai and Antwerp is, however, muted on both sides, covered by the traditional double-dealing of the business; the blood-diamond sanctions and the anti-Russia sanctions; and now the political and military vulnerability of the UAE in the war of Israel and the US against the Arabs.

For the official Dubai exchange statement on competition with Antwerp, read this.

Source: https://rapaport.com/

There is rancour in the diamond business to the attempted profiteering from the March 1 sanctions by the Antwerp diamantaires; especially hostile are the African miners and the Indian manufacturers. Their opposition is reflected in this industry-wide letter sent to the G7 member states last month. “We stand united against forcing all participants who wish to sell their polished diamonds in the G7 markets, to send their rough to Belgium first. As diamond experts, we know that this would add no value to the objectives of the G7 member states and would result in a major restriction for all non-Russian diamonds, with terrible impacts on the industry. It would also force, a functioning trans-global trade into one centralised point that would create bottlenecks in supply and give unwarranted power and advantage to one participant at the detriment of all others… The process detailed by the EU, as it stands, undermines Sovereign African Governments to send their diamonds directly to the market of their choosing. It also undermines legitimate local industry beneficiation and could encourage smuggling, which would be counterproductive.”

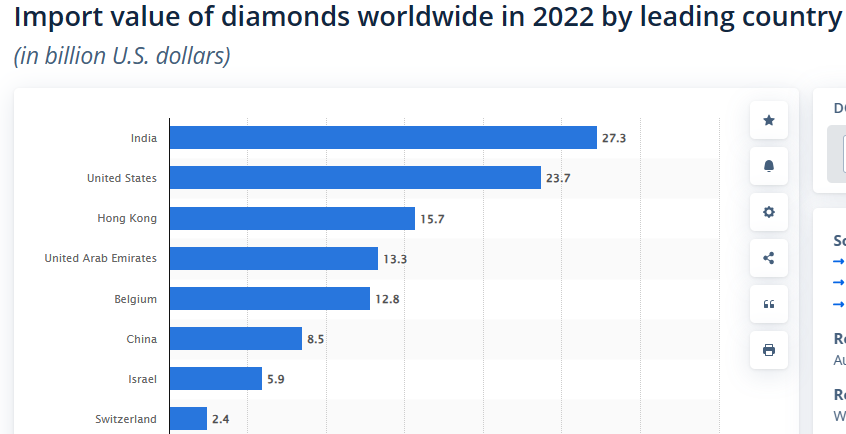

Source: https://www.statista.com/

Last week the Dubai Diamond Exchange (DDE) announced that in 2023 it had broken its records for rough and polished diamond trading, as it continues its year-on-year revenue growth averaging 11% over the past five years. A total of $21.3 billion-worth of rough diamonds were traded by the DDE in 2023, the exchange reports; carat volume was up, offsetting the 13% decrease of rough price over the year. The value of polished goods traded in Dubai surged by 32% year-on-year, reaching $16.9 billion in 2023. Total value of diamonds traded through the exchange in 2023 came to $38.3 billion. Laboratory grown diamonds (LGD) are also being traded through Dubai; the value of LGDs traded in 2023 rose 10% year-on-year, reaching $1.6 billion.

According to Ahmed Bin Sulayem, Executive Chairman and CEO of the diamond exchange’s parent company Dubai Multi Commodities Centre (DMCC): “At $38.3 billion in rough and polished trade last year, these figures are further proof of Dubai’s meteoric rise as a global diamond trade hub. Our appeal to diamond industry segments across the world is exemplified by our ability to maintain strong trade volumes in rough whilst rapidly advancing polished and lab-grown diamonds. The polished segment now represents almost half of our diamond trade, consolidating our status as the world’s number one hub for rough and polished and, with major industry players continuing to be drawn to Dubai away from the old hubs of yesterday, DMCC will continue to set the benchmark for the services and value that diamond traders need to grow and prosper.”

That’s putting it politely. The more Alrosa rough which is submarined into Dubai and then traded out of DDE as polished, the more effectively the Israel-American sanctions will be defeated, and the traditional prosperity of the Belgians and the Jewish diamantaires of Antwerp will go down with them.

Russian sources confirm the trend toward price discounting, as has already occurred in Russia’s oil and coal exports. According to Alexei Kalachev, an analyst at Finam in Moscow, the geography of supplies in the diamond pipeline will shift to less profitable markets, where the prices for stones are lower and discounts are higher, such as in India. “A direct ban on the import of diamonds cut from Russian diamonds will be difficult to implement, if at all possible.” He also acknowledges that Russian diamonds will remain on the US and European markets, but only in a “laundered” form. He cites Germany as an example, which refuses Russian oil, but does not give up Indian fuel made from it. At the same time, the markets of Asia, Africa and Latin America will remain open for Russian diamonds, Kalachev adds. The margin of profit for diamond trade intermediaries, particularly the Indians based in Dubai, is jumping.

Roman Semenikhin, CEO of Ingosstrakh Investments Management Company, declines to answer questions from foreign reporters, but told Forbes Russia last October: “In the event of a significant and prolonged decline in demand in foreign markets, we are likely to see significant purchases of diamonds from Alrosa by Gokhran as one of the measures to support the company and the industry as a whole.” Other Moscow industry analysts following Alrosa agree that the reorientation of Russian diamond exports to the UAE, India, and China will limit the impact of the new sanctions on Russia. They warn that in the short term, by reducing supply to the market there will be an increase in diamond prices, and that in turn will stimulate growth in the production and sale of artificial stones – the LGDs.

Boris Krasnozhenov, head of the Securities Markets Analytics Department at Alfa Bank, says that in 2023 the value of jewelry-quality diamonds on the world market was in the range of $155-$160 per carat. He is forecasting “a significant increase in prices” this year.

Deputy Finance Minister Alexei Moiseyev, who supervises the state stake in Alrosa and the diamond stockpile in the Gokhran, says that in the international market it will be impossible to compensate for the artificial restriction of the supply of Russian diamonds from other sources. So there will be a combination effect – sharp decrease in supply, sharp rise in the price of natural diamonds, and sharp increase in “affordable synthetics”.

Ahmed Bin Sulayem of the DDE and DMCC, meeting Deputy Finance Minister Alexei Moiseyev in Dubai on January 12, 2024. Sulayem will return the visit to meet Moiseyev in Moscow later this year.

Moiseyev has held one of the fifteen seats on the Alrosa board which is carefully balancing the revenue requirements for the Sakha republic and the regional districts which depend on preserving mine production, employment, tax and social funding levels; stock levels at both Alrosa and Gokhran; and the pricing of exports. In effect, this means reversing twenty years of the privatization scheming of Russian oligarchs, promoted at the Finance Ministry and on the Alrosa board by the ex-finance minister now in exile, Alexei Kudrin. Re-nationalization of Russian diamonds is another of the results of the Israeli-American sanctions.

In the present circumstances no Russian source will discuss these details.

A remarkable post and column. This description of the diamond trade is completely new to me, however I am struck that Russia is twice the size of the US including Alaska and evidently has enormous resource distribution to be yet discovered. China shows me the extent of US and Russian resource distribution when methodical new national surveys of China are discovering profound resource stores.

After all, China is the size of the US with Alaska and is turning out to be resource rich as is the US.

About Botswana, which since 1977 has been about the fastest growing country in Africa by real per capita GDP, for all the growth Botswana is still a remarkably low per capita GDP country.

https://fred.stlouisfed.org/graph/?g=18X0W

August 4, 2014

Real per capita Gross Domestic Product for China, South Africa and Botswana, 1977-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=18X11

August 4, 2014

Real per capita Gross Domestic Product for China, South Africa and Botswana, 1977-2022

(Indexed to 1977)

Now that I understand the centrality of the diamond trade to Israel’s economy, I am inclined to think very poorly of anyone who is still buying “new” diamond jewelry.

Other stones can be cut to sparkle just as prettily without the blood, environmental degradation, and enmeshed criminality of the diamond trade. I hope that instead of spending the price of a car on a sparkly rock, people will use the money to pay down their debts, give to charity, and help out family members and friends. We should be recycling existing jewelry or be satisfied with simple metal bands, not giving more money to Israeli or de Beers cartels for a piece of well marketed carbon.

They are not even rare. They don’t hold value. It’s a stupid stone sold mostly to Americans because of a massive marketing campaign in the 20th century. Only in America a guy has to pay a ridiculous amount of money to buy a stone to propose to his fiancee so she can show off to her friends lol. In all other countries gold is still king.

If one wants a cheap half carat diamond a diamond dresser for a grinding wheel is around 10 bucks. A very flawed diamond but a very useful diamond if a grinding wheel needs cleaning up. Some diamonds are inexpensive

I hope this article gains traction. If the diamond boycott and the anti-Israel boycott can join forces, this could make a real difference.

Hasn’t GE been making synthetic diamonds for decades? Aren’t they in cahoots to only mfg to the industrial markets?

Ironically as part of a VC investment evaluation, I looked at a competitor to GE in the early 1990s.

Back then, the diamonds they were making were for industrial uses. They could not “grow” big or good enough stones for jewelry.

Now they can but synthetic diamonds trade at a big discount to natural, see the chart in this post:

https://www.leeread.com/blog/2023/Mar/21/advantages-natural-diamonds-over-lab-grown-diamond/

I read a while ago that Brussels in the past sought to bring the diamond trade in Belgium under control but the major Jewish diamond businesses fought back with charges of – you guessed it – antisemitism.

When dealing in coins, many numismatists did the smalls (anything of some value you can hold in your hand) such as diamonds, watches, silver flatware, etc. I was a GIA certified gemologist, but truth be said, I hated the damn things, as they were often way overpriced when the groom went all in on a marriage proposal, and more than likely the jilted ex-wife had grandiose expectations which were in no way to ever be close to being fulfilled.

I’d claim diamonds are the most overvalued item on this good orb, and now you can sparkle plenty with lab created diamonds that look the same as the real thing pretty much.

Similar to the diamond biz, it was very common to borrow another numismatist’s coins if you had a potential customer, and it was all handshake deals, no contracts or anything like that,

We called it in the trade, ‘getting something on the arm’

Most diamond jewelry don’t look that great under ordinary light. People buy them out of jeweler showcases with optimized lighting but most of them look little better than cut crystal in normal life. To me the best looking pieces have lots of tiny diamonds to increase the reflective surface. And unless you keep up a good cleaning regime, they’ll get grimy very quickly.

Big engagement rocks for certain kinds of women are like big trucks for certain kinds of men. It’s a marker to tell their peers that they made it. Luckily for the rest of us they often marry, for a time, each other. Their spouse may cheat or refuse to have sex or is hated by the rest of the family, but just look at this big useless thing that show their life is actually going great.

So, to Arab states and Russia the diamond business is a side-hustle, whereas to Israel it may be a lot more important. Also, the times being what they are, demand for diamonds may have more downhill journey to go. Not a good time to be dependent on diamond business I’d say.

This also reminds me of how the Swiss secrecy banking operations ( don’t know a better term) were blown wide open by the US terrorism laws on tracking funds. I have always suspected the Israeli/AIPAC Lobby was behind to take out Swiss competition to their own secret banking/ money laundering operations.

Blood diamonds is a very apt term given who controls the western markets.

Something like this article bringing details to light really makes me think Israel was the mastermind behind the ‘73 OPEC oil embargo that turned everything on its head. Wish someone would look into it. Maybe Whitney Webb?