Yves here. We linked to the underlying New York Times op-ed by Gabriel Zucman in Links today, but this piece is important in that it boils down Zucman’s piece and gets it outside the New York Times paywall. Zucman is a comparatively young academic, following in the footsteps of inequality-trackers Emmanuel Saez and Thomas Piketty who early and loudly warned of widening income and wealth inquality. Zucman made an important contribution years ago with his book “The Hidden Wealth of Nations” which documented the ginormous amounts of money squirreled away in tax haven by billionaires and wealthy wannabes.

By Jake Johnson. Originally published at Common Dreams

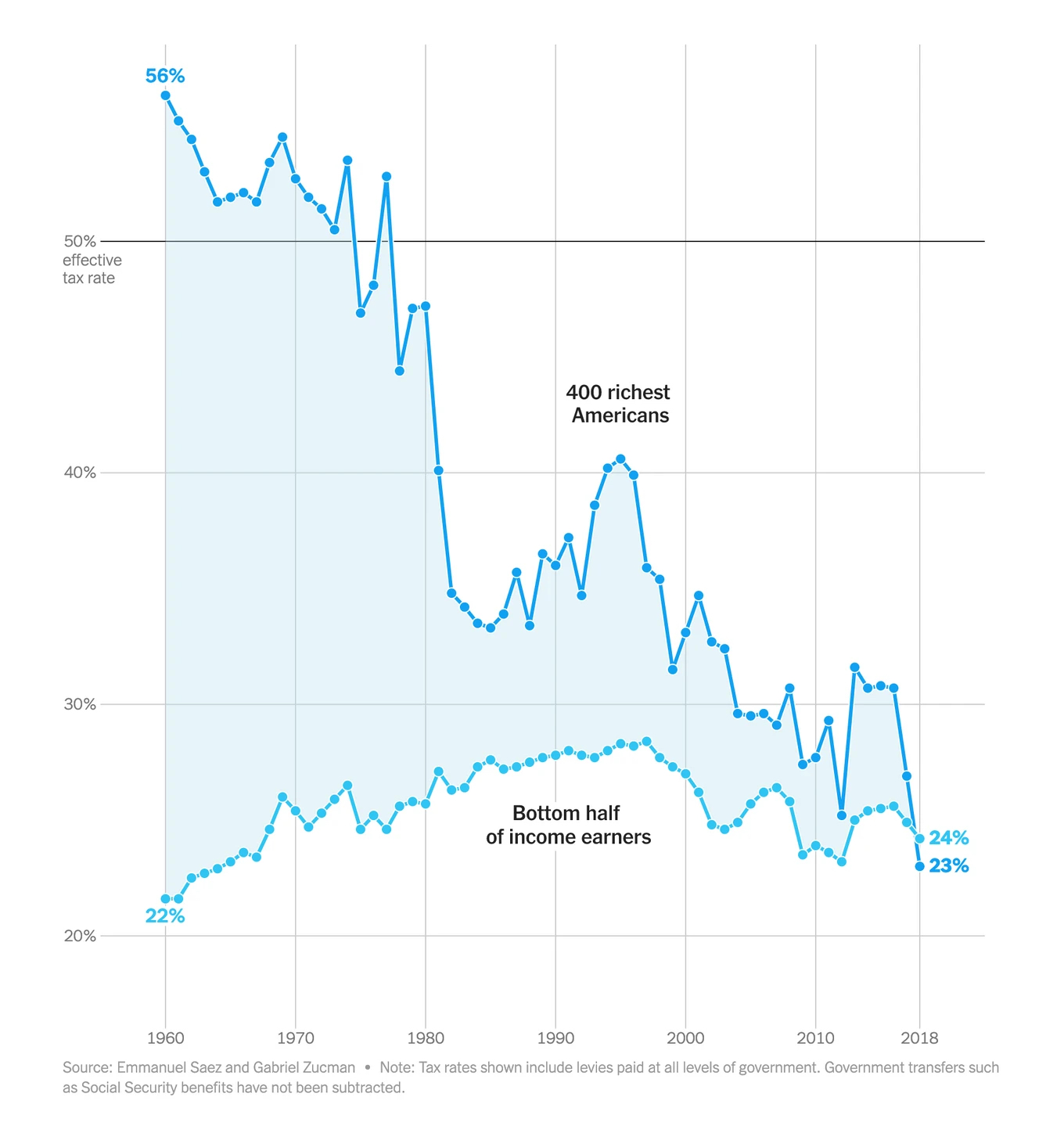

An analysis published Friday by the renowned economist Gabriel Zucman shows that in 2018, U.S. billionaires paid a lower effective tax rate than working-class Americans for the first time in the nation’s history, a data point that sparked a new flurry of calls for bold levies on the ultra-rich.

Published in The New York Times with the headline “It’s Time to Tax the Billionaires,” Zucman’s analysis notes that billionaires pay so little in taxes relative to their vast fortunes because they “live off their wealth”—mostly in the form of stock holdings—rather than wages and salaries.

Stock gains aren’t currently taxed in the U.S. until the underlying asset is sold, leaving billionaires like Amazon founder Jeff Bezos and Tesla CEO Elon Musk—a pair frequently competing to be the single richest man on the planet—with very little taxable income.

“But they can still make eye-popping purchases by borrowing against their assets,” Zucman noted. “Mr. Musk, for example, used his shares in Tesla as collateral to rustle up around $13 billion in tax-free loans to put toward his acquisition of Twitter.”

To begin reversing the decades-long trend of surging inequality that has weakened democratic institutions and undermined critical programs such as Social Security, Zucman made the case for a minimum tax on billionaires in the U.S. and around the world.

“The idea that billionaires should pay a minimum amount of income tax is not a radical idea,” Zucman wrote Friday. “What is radical is continuing to allow the wealthiest people in the world to pay a smaller percentage in income tax than nearly everybody else. In liberal democracies, a wave of political sentiment is building, focused on rooting out the inequality that corrodes societies. A coordinated minimum tax on the super-rich will not fix capitalism. But it is a necessary first step.”

Responding to those who claim a minimum tax would be impractical because “wealth is difficult to value,” Zucman wrote that “this fear is overblown.”

“According to my research, about 60% of U.S. billionaires’ wealth is in stocks of publicly traded companies,” the economist observed. “The rest is mostly ownership stakes in private businesses, which can be assigned a monetary value by looking at how the market values similar firms.”

Since 2018, the final year examined in Zucman’s analysis, the wealth of global billionaires has continued to explode while worker pay has been largely stagnant. As of last month, there were a record 2,781 billionaires worldwide with combined assets of $14.2 trillion.

The U.S. has more billionaires than any other country, with 813 individuals worth a combined $5.7 trillion.

“The ultra-wealthy are paying less in taxes than the bottom half of income earners. That’s absurd!” Rakeen Mabud, chief economist at the Groundwork Collaborative, wrote in response to Zucman’s analysis. “We’ve got to raise taxes on the wealthy and large corporations. Enough with the wealth hoarding. It’s past time for us to take back what’s ours.”

U.S. Sen. Sheldon Whitehouse (D-R.I.), chair of the Senate Budget Committee, called the figures assembled by Zucman “disgraceful” and said that “not only can we fix this, we can make Social Security and Medicare safe and sound as far as the eye can see.”

When I was a wise-guy kid we had a saying, “Big talk, no action!” Well, that’s Sheldon…who by the way is on the smooth, golden path to re-election. Bailey’s Beach will open soon and Sheldon will certainly be taking the annual genuflections of the swells at his usual cabana. Sheldon was also in the vanguard of the local Save The Saintly Ukrainians movement. A bit frayed around the edges now along with the blue and yellow flags that remain on the porches of the bourgeoisie.

The good Senator knows how to play the game, and it’s easy: take lots of money from the “donor class” (bribe-masters), then loudly protest the unfair and perverse distribution of wealth and income of the same donor class. Then he can have a good laugh with his cronies at the club.

When I was younger I called them NATO politicians: No Action, Talk Only.

I disagree with the caste warfare framing of “wealth taxes” or “billionaire taxes” as they play into the persecution complexes of a**-hats like Stephen Schwartzman and all the idiot Ayn Rand acolytes out there.

I have owned real estate for most of my adult life. I pay an annual property tax on the assessed value of my real estate holdings. I also pay a use/property tax on my automobiles. The assessments where I currently live are re-evaluated annually and rise and fall with inflation and deflation based on Fair Market Value, with an appeal process.

There is no reason not to assess a national property tax on intangible property, such as stocks and bonds, other than political lobbying by Our Billionaire Overlords and the Wall Street Casinos. Stocks are nothing but tax shelters at this point. Very little of this “market” activity is fund-raising.

Problem solved. You’re welcome. Good luck getting it passed…

“Stocks are nothing but tax shelters at this point.”

And used as collateral for loans – including loans for property development/buying.

So yeah…some sanity needs to brought to asset “value assessments” all around.

“Stocks are nothing but tax shelters at this point. Very little of this “market” activity is fund-raising.”

“Market” activity now includes people’s employment retirement plans. Those are used for fund-raising by retirees, so to speak. The streak of consecutive decades of employment at decent enough wages to give someone a realistically stable retirement through SS benefits is a bit of a fantasy. It’s a fantasy with the way the cost of living increases for necessities like food, housing, energy.

And working to 80, making big money, and loving it is an achievable dream most often of people who own companies and/or are on the boards of companies – or become elected officials.

But most of all – not everybody needs or wants a mortgage. There’s also that to consider.

Hitching everything to stock market performance was perhaps the most “genius” move of the 80s. Thus government can no longer allow the stock market to crash, or it will make the great depression look like a walk in the park.

I guess the real question is ‘are we in a corporate led oligarchy yet’ ?

I’m kidding of course. Corporate financed politicians will never agree to a minimum wealth tax.

In other words ‘yes’ Western neoliberal countries are budding oligarchies…. And oligarchies do not give up easily.

Strange how the devolution into serfdom for a majority of the population has been and will be. Addiction to social networks being an obvious catalyst.

@David, in the interest of intellectual honesty you seem to be confused about the nature of property tax. Capital gains tax happen when sold, same as stock, except there are very generous terms that allow Real Estate capital gains to roll over in many cases. Real Estate is the oldest, and perhaps largest, tax shelter there is.

I’d also note that the annual property tax is going to pay for externalities like roads, utilities, schools — without which the property (as a tax shelter) has little viability. It is essentially a self-licking ice cream cone tax.

@Everyone else — the big problem with extreme wealth is that is impossible to avoid corrupting the system with such concentrations of power (money being the most fluid form of power). Attempts at taxing simply won’t work over any extended period of time (most voters being both stupid and slothful, and politicians being the ones who depend on the wealthy to get elected in the first place), and all debate about this deflects from the real problem.

Put another way: extreme equality is a symptom of how distorted and broken the system is (and it is getting worse). Trying to change the symptom is an amateur’s mistake.

You are incorrect about rollovers. Those were eliminated a long time ago. I have a friend who mistakenly assumed they were still in effect.

See here: https://www.investopedia.com/ask/answers/06/capitalgainhomesale.asp

The only break in the US on the sale of a primary residence is an exclusion on gains if the property sells for <$250,000 for a single person, <$500,000 for a couple.

Thanks for that Yves, good point. Though I think that the limits are the actual gains that can be rolled over, not the property value itself. (I wonder if the solution is to just move every time property increases by X amount?)

However, the rollover isn’t the only way that Real Estate has built in tax sheltering that is similar to Elon’s stock example above. The biggest (that I am aware of) being the ability to take out an equity loan and use the money to finance a new property (the original not being sold at all) — this being much more a super-power for commercial properties than residential. Soon, income from the property provides the cash flow for the property payments and the cycle repeats (it seems you can either pay taxes to the “government” or pay interest to bankers, funny that!).

I can’t really fault people for making money this way if they can, but it should be obvious that this sort of cycle is going parabolic and can’t extend itself forever.

“Put another way: extreme (in)equality is a symptom of how distorted and broken the system is (and it is getting worse). Trying to change the symptom is an amateur’s mistake.”

I would just add that this is why Biden is so safe talking about the rich “paying their fair share”. It’s a dodge and the donor class knows it.

There is still a S. 1031 like-kind property exchange which permits deferral of taxable capital gains. Only for income properties. Technically, an investor could make serial property sales and purchases of like properties and defer taxable capital gains indefinitely.

Rollover – do you mean a 1031 Exchange for investment properties?

Sounds like a “capitation or other direct tax” which must be apportioned to states based on decennial census.

Everyone with a 401K would be up in arms?

Forget Congress, I need to buy a lobbyist.

Not sure there is a difference. At least over on the European side, retired politicians seems to flock to big name lobbying firms. That is, if they have not already lined up lucrative board positions or built up enough of a portfolio to sustain a passive lifestyle.

Perhaps a good time to revive an ancient practice concerning rulers. When the King could no longer carry out his duties, (often equated with sexual ability in pre-industrial agrarian societies,) said ruler was ritually sacrificed.

Clearly, a similar program is being implemented on the mass of the population today. Neo-liberal Rule #2 says it explicitly: “Go, die.”

Thus, my call for a return to “Old Fashioned Virtue.” When the Head Honcho is “made redundant,” he or she shall be sacrificed to the Gods on an altar erected in front of the appropriate national stock exchange. (Make it a Quarterly Event. The Triple Witching Hour. That should encourage them.)

Ah, the smell of roast bankster…

Long pork?

Are they trying to tax stock ownership? That will not work. Does it make sense to look at the value at one point in time, or the average price over a period of time, of something that may be worthless tomorrow? And taxing stock ownership means that a worker who holds company stock for retirement will pay more in taxes than a trader who profits from buying and selling stock. Is that fair?

How about 1% (2%?) of any corporation reverts to federal ownership, perhaps to the SS trust fund, per year? Probably easiest for corps to issue new shares for the purpose every year.

How about sales tax(es) when stock is purchased. 20% of the purchase price amount to the Feds and 10% to the state of residence of the purchaser. If a non-American buyer then 30% to the Feds. The purchased would be taxed the same no matter the source of the purchasing money.

These ‘tax the rich’ proposals seem to tend to get bogged down in the legal system which is already biased towards the rich, which is why instead of taxing them in the interests of a slightly fairer society, I’d be in favor of abolishing the unproductive, and destructive, capitalist and landlord classes.

One can’t address inequality by half-measures, long-term. Material inequality is the physical negation of the concept of equality of worth and value of all humans.

Bingo. The name of this blog says it all, and as long as the rich are allowed to get richer nothing will change. We need laws that take their money from them and redistribute it, with fundamental material equality (there is no social justice without economic justice) as the target. “Democracy” as practiced, is over-rated.

Coincidently, I just listened to a very good interview of Dr Art Laffer by Adam Taggart from Thoughtful Money. You can find it on YouTube.

The good Dr pointed out that although “fundamental material equality” (quoting you, not him) may sound admirable and desirable, sharing equally in nothing may come as a surprise and a disappointment.

I know this is ad hom, but anything by Laffer (Mr. Supply Side) needs to be taken with a fistful of salt. He’s a pretty lousy economist. And here, pray tell here how does he fabricate that equal sharing results in nothing to share??????

Like many things, it’s about incentives. Anyone producing more than their equal share has no incentive to continue to do so, so they produce less. Anyone producing less than their equal share has no incentive to even do that, so they also produce less. Take that to its logical conclusion and everyone has an equal share of nothing.

Logic has nothing to do with it. Greedy people just keep wanting more.

“But they can still make eye-popping purchases by borrowing against their assets,” Zucman noted. “Mr. Musk, for example, used his shares in Tesla as collateral to rustle up around $13 billion in tax-free loans to put toward his acquisition of Twitter.”

That’s an interesting example to chose. I remember reading that when Musk did do some Tesla share selling, it was to pay taxes on all kinds of loans he had been getting. (It could have been a bit of speculation and not all that he was doing with his money.) So interesting in the sense that the billionaire was using share collateral for the loans, inflate asset shares, sell some shares after hyping the price in order to make payments on low interest loans.

Same would work for other forms of property.

I would like to know the financial terms of the Musk Twitter purchase loans. If the terms stipulate that loans are contingent on price per Tesla share, does the bank acquire more shares to equal the value of the loan? Tesla shares are down 40% since the Twitter purchase. Is Musk risking bankrupting Twitter? (Or at least a bank ordered distress sale?)

Keep in mind that the real tax rate the ultra rich are paying is even lower than this diagram.

As the Panama Papers, Paradise Papers, and other leaks have revealed, the rich are not only paying lower taxes than they should through official legal means, but they also have various tax shelters and other tax evasion schemes. Rich people will always be able to hire the best tax accountants and lawyers to not just do tax planning, but also outright tax evasion.

If they are caught, they have an army of lobbyists and lawyers. Note the lack of persecution from the governments around the world as these leaks came out. The rich own the government, through lobbying, campaign contributions, and other means in a system of legalized corruption. It’s a plutocracy and kleptocracy pretending to be a democracy.

From an inequality standpoint and justice standpoint, this is terrible. It also shows who society works for. Society works to make the rich at the expense of the people. The rich have become a parasite class. It’s a profound moral failure and reveals the true nature of the Western elites.

Essentially the people who benefited the most from the past investments of society contribute the smallest percentage of their income to the future of that society that made them so rich to be gin with. If you want to talk about “entitlements” (a conservative smear term), talk about how entitled the rich are and how they are parasites on society.

The high comedy is the expectation by “our betters” that we all ought to be excited by the prospect of fighting and dying to preserve their status quo.

The perversity of income/wealth distribution seems to just get worse over time. As Vicky C points out, Congress/SCOTUS/POTUS has de-regulated financial fraud, allows formal political bribery, and when the law is still broken, simply ignores the outrageous legal abuses of TBTF institutions. The situation appears even worse than Zucman portrays, but maybe I’m just too critical and pessimistic.

And not to forget the huge subsidies that oligarchs like Musk, Bezos, Gates et al. and their monopoly/oligopoly corporations have received. Also, some of the corporations owned by oligarchs have been rewarded with very lucrative Fed gov. contracts, which could be considered a subsidy as well. Oligarchy Inc. – subsidized by the gov. This gives even more meaning to the term “financial parasite”.

https://www.forbes.com/sites/ikebrannon/2023/04/28/amazon-tax-subsidies-are-inefficient-job-creators/?sh=6f437d6959d0

Let’s ask Michael Hudson to comment on this one as well. He has weighed in before on issues of income and wealth with some interesting points in a “debate” with Thomas Piketty

https://www.youtube.com/watch?v=3Mdcam6pGG8

The dismantling of Glass Steagall basically handed the foxes (investment banks for speculators) the keys to the henhouse (commercial banks for producers and all of us working stiff “chickens”) so it’s no surprise that the feathers are flying and speculators are privatizing MediCare and care providers and still have Soc Security in their crosshairs. As was discussed in a post yesterday, rather than the hopium of a wealth tax, a good start would be to raise the capital gains tax rate, institute a financial transaction tax (‘high freq trading” and private equity/hedgies can “game the casino” (markets) by exploiting “asymmetrical information”), and finally re-institute a truly progressive income tax rate – a “New Deal 2.0”, if you will. As I’ve said before, in the meantime I remain “long on pitchforks” – power will not yield without a struggle. “TANSTAAFL!” (h/t Robert A. Heinlein, The Moon Is a Harsh Mistress, an early exploration of AI, btw!)

this statement is more of the same,

“Zucman made the case for a minimum tax on billionaires in the U.S. and around the world.”

the E.U. tried it recently, it was turned down. biden even said he was willing, it went no where because, the horse is already out of the barn throwing money and power around like drunken sailors.

not gonna happen, till we take the bull by the horns and restore sovereignty.

it has to be done one country at a time, most likely without government involvement, that is the hard way. because most governments are owned now.

and any one who thinks finance will not move off shore, you can see the parasites trying to set up countries within countries like what is being proposed in california, what was tried in Hondourus, and what will be tried and maybe accomplished in Patagonia Argentina.

if the parasites eventually are able to establish their utopia. their ill gotten gains will be even harder to crack. it will take military action.

because the parasites will continue to drain away the wealth of the nations, simply because that is how free trade works.

“if the parasites eventually are able to establish their utopia. their ill gotten gains will be even harder to crack”

They’ve got the mechanisms of supranational organizations that they created that excel at funneling wealth upward.

Tax stock transactions? Bernie Sanders gave it a try.

https://www.sanders.senate.gov/wp-content/uploads/The-Tax-on-Wall-Street-Speculation-2021-Summary-v12.pdf

Of course with half the Congress trading for themselves you know how this will go…

According to this thread, his figures are iffy:

https://x.com/philwmagness/status/1786802145221632036?s=46&t=rkrvYEs4rPHnskyeeLxSjg

I see this as a clear sign that the wealthy/billionaires/oligarchs are in charge in America. They have bought the government and bent the rules so that an ever increasing amount of wealth and political power are funneled to them. Even though the clear signs of economic decline are everywhere in America, nothing will fundamentally change.

I think that the collapse of American empire goes hand in hand with this rise of the American billionaire oligarchs, and the collapse of the American middle class.

According to Forbes, the world’s billionaires have $14 trillion in net worth. If we could tax it at 100% this year, we could pay down 1/2 of the US national debt. And then what?

2% of it would be $280 billion, which is maybe $1,000 per capita in the US.

This discussion on tax rates conflates income tax with wealth tax. No one is assuming that changing the income tax would make any difference. If you are talking about consumption, then that is addressable by VAT taxes or other consumption taxes. But nobody is saying billionaires are consuming very much of their wealth in typical ways. If excess wealth is simply dumped into reasonably efficient capital markets, so what?

I suppose the fantasy is that we could take a little chunk of it annually and spend it collectively in a very efficient and effective way (that is, differently than we spend everything else), it would solve things.

A Value Added Tax is applied to a physical product or service? It really is amazing to me that countries managed to sucker their citizens into believing that this tax would do something good.

But I guess here in the USA, I am instructed to believe that Biden is fighting for democracy and freedom…. he ought to be more forthcoming with his remarks…Trump as well… seems the political class goes for obfuscation and every point beneficial to the financial geniouses… Biden should say he is fighting for a freedom of the protection market (free-for-all predatory and usurious market) for which the Market requires you to purchase life liberty and the pursuit of happiness at extortionate prices. Pay-up, shut-up or be decapitated.

TomD you are correct. and i am betting a VAT tax is coming soon to america. even wilkipedia has not changed the criticism part of the Vat tax. the Vat is clearly a tariff not paid for by the rich parasites that import cheap goods that undercut a countries labor, driving a country deep into debt, and makes labor pay for their replacement.

i am betting plans are being made to cushion the blow to the dupes that actually believed bill clintons characterization that free trade would take us to the golden land.

a VAT tax is a tax on labor to subsidize free trade. thus reducing consumption even further and fueling poverty even more.

https://en.wikipedia.org/wiki/Value-added_tax

“The “value-added tax” has been criticized as the burden of it falls on personal end-consumers of products. Some critics consider it to be a regressive tax, meaning that the poor pay more, as a percentage of their income, than the rich.[citation needed] Defenders argue that relating taxation levels to income is an arbitrary standard, and that the value-added tax is in fact a proportional tax in that people with higher income pay more in that they consume more.

The effective regressiveness of a VAT system can also be affected when different classes of goods are taxed at different rates.[citation needed] Some countries implementing a VAT have reduced income tax on lower income-earners as well as instituted direct transfer payments to lower-income groups, resulting in lowering tax burdens on the poor.[93]

Revenues from a value-added tax are frequently lower than expected because they are difficult and costly to administer and collect.[citation needed] In many countries, however, where collection of personal income taxes and corporate profit taxes has been historically weak, VAT collection has been more successful than other types of taxes.

VAT has become more important in many jurisdictions as tariff levels have fallen worldwide due to trade liberalization, as VAT has essentially replaced lost tariff revenues.”