Lambert here: Can’t have too many charts!

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street.

Earlier today, we discussed the overall labor market. But each industry faces its own unique labor market. In some industries, employment has been trucking from all-time high to all-time high, while in other industries, the outlook is darker, usually due to structural changes. So we’ll look at a decade of employment trends in each major industry, based on today’s employment data by the Bureau of Labor Statistics.

The industry categories are by work location. The surveys are sent to employer facilities. The primary activity at that facility determines the industry category. For example, a worker at an Amazon fulfillment center would be under “transportation and warehousing.” It’s not the company that matters, but the work being done at that specific location.

And we use three-month moving averages (3MMA) to iron out the drama of the monthly squiggles.

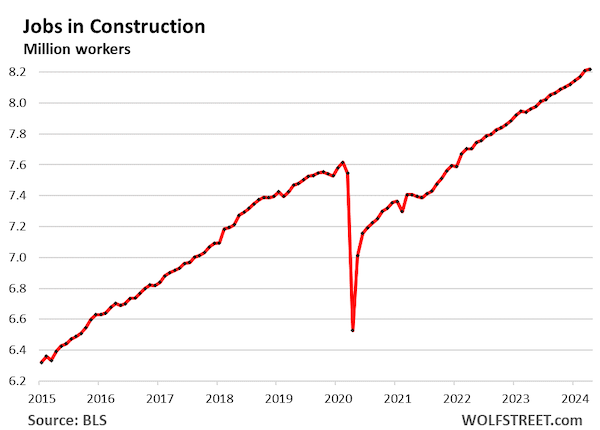

Construction (all types, from single-family housing to highways).

- Total employment: 8.22 million, new all-time high

- 3MMA growth: +24,000

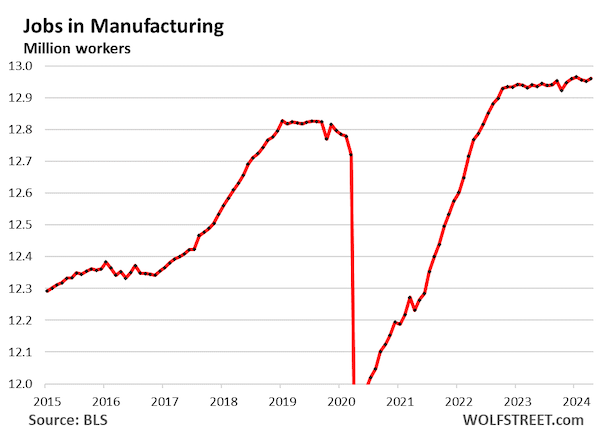

Manufacturing: After a huge surge out of the pandemic, employment has plateaued for over a year but with a mild upward trend, interrupted by a dip during the auto industry strikes in October. The past five months have all been in a very narrow range around 12.96 million, the highest since before the Great Recession. Manufacturing has continued to automate, requiring fewer but higher-skilled workers, including engineers.

- Total employment: 12.96 million

- 3MMA: -2,000

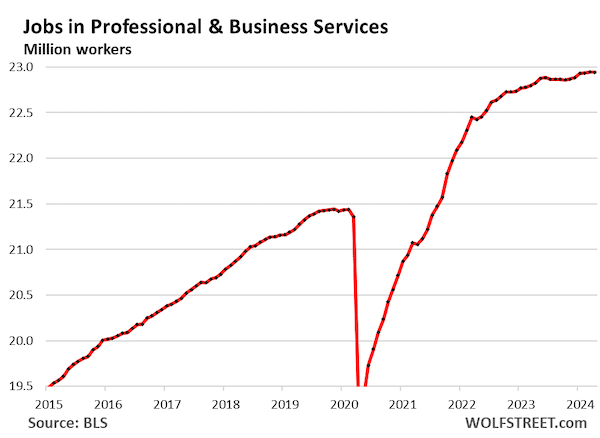

Professional and business services. One of the largest industries by employment, it includes facilities whose employees work primarily in Professional, Scientific, and Technical Services; Management of Companies and Enterprises; Administrative and Support, and Waste Management and Remediation Services. It includes facilities of some tech and social media companies.

The helter-skelter employment growth coming out of the pandemic has definitely slowed, but continues at a subdued pace at nosebleed-high employment levels:

- Total employment: 22.94 million (record)

- 3MMA growth: +4,000

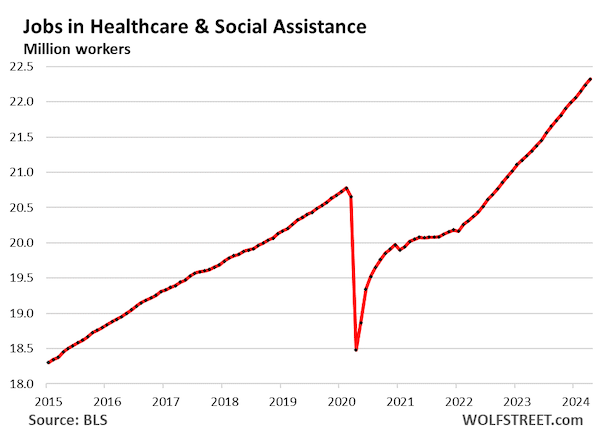

Healthcare and social assistance:

- Total employment: 22.32 million, new high

- 3MMA: +88,000

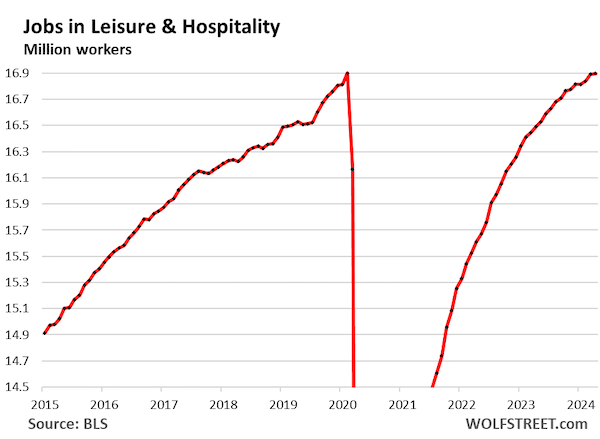

Leisure and hospitality – restaurants, lodging, resorts, etc.

- Total employment: 16.9 million, back at the pre-pandemic high.

- 3MMA growth: +28,000

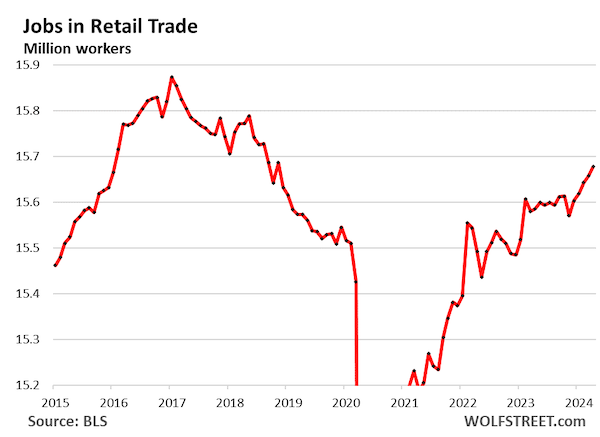

Retail trade counts workers at brick-and-mortar retail stores, such as malls, auto dealers, grocery stores, gas stations, etc., and other retail locations such as markets. It does not include the tech-related jobs of ecommerce operations, drivers, and warehouse employees.

A big portion of this sector has been under heavy pressure from ecommerce operations, and dozens of major retailers have been liquidated in bankruptcy court in recent years, with a total loss of employment, which we have documented in our Brick-and-Mortar Meltdown series. The retailers that are doing well are those that are selling groceries, auto dealers, gas stations, and others that are not under total pressure from ecommerce.

- Total employment: 15.7 million

- 3MMA growth: +20,000

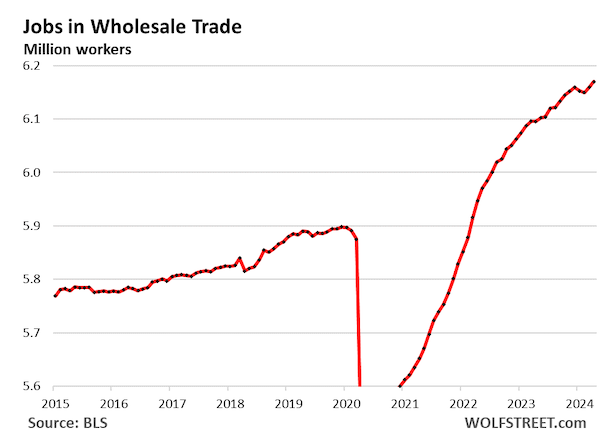

Wholesale Trade:

- Total employment: 6.17 million, new all-time high

- 3MMA: +6,000

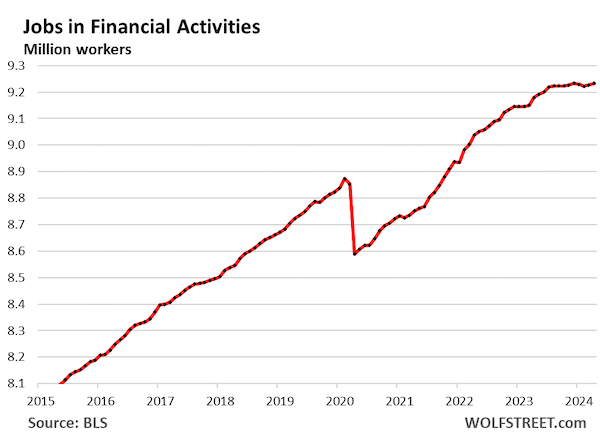

Financial activities (finance and insurance plus real estate renting, leasing, buying, selling, and management). Employment has plateaued at very high levels, as the mortgage industry got decimated after the refinance boom collapsed amid surging mortgage rates in 2021.

- Total employment: 9.23 million

- 3-MMA growth: 1,000

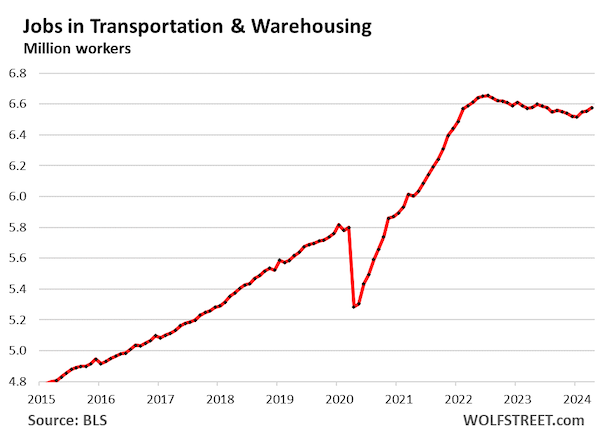

Transportation and Warehousing: Employment surged with the pandemic boom in durable goods, and when that faded as consumers switched back to spending on services, employment began to decline. But in recent months, it began to tick up again:

- Total employment: 6.58 million

- 3MMA growth: +20,000

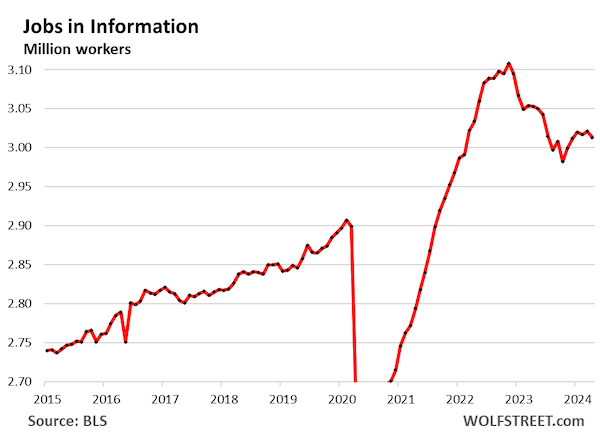

“Information” includes facilities where people primarily work on web search portals, data processing, data transmission, information services, software publishing, motion picture and sound recording, broadcasting including over the Internet, and telecommunications. This includes some work sites by tech and social media companies. You can see the effects of the layoffs.

- Total employment: 3.01 million

- 3MMA growth: -2,000

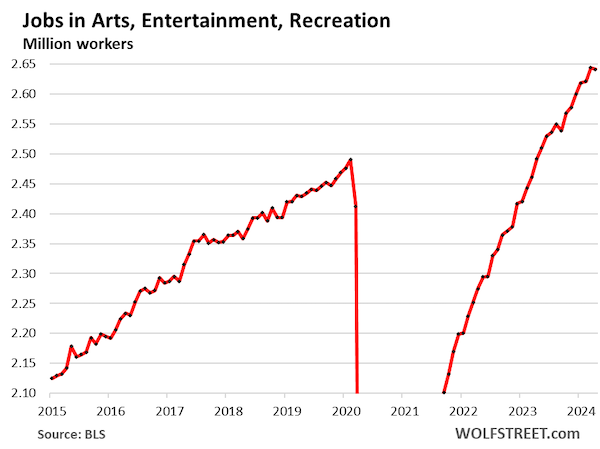

Arts, Entertainment, and Recreation includes spectator sports, performing arts, amusement, gambling, recreation, museums, historical sites, and similar:

- Total employment: 2.64 million

- 3MMA growth: +8,000

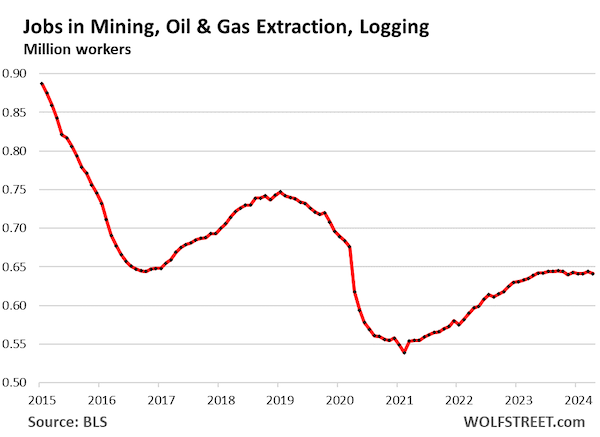

Mining, oil & gas extraction, logging: Major technological advances have impacted employment in this industry, from autonomous mining trucks to the equipment and technologies used in fracking and in logging.

And over these years, the US has become the world’s largest oil producer and largest natural gas producer.

- Total employment: 641,000

- 3MMA growth: unchanged

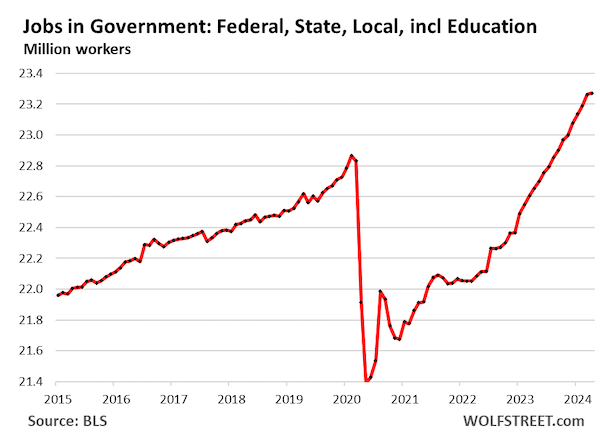

Jobs at federal, state, and local governments. About 12.8% of all civilian government employees work for the federal government. About 87.2% work for state and local governments, many of them in public education, from grade schools to universities.

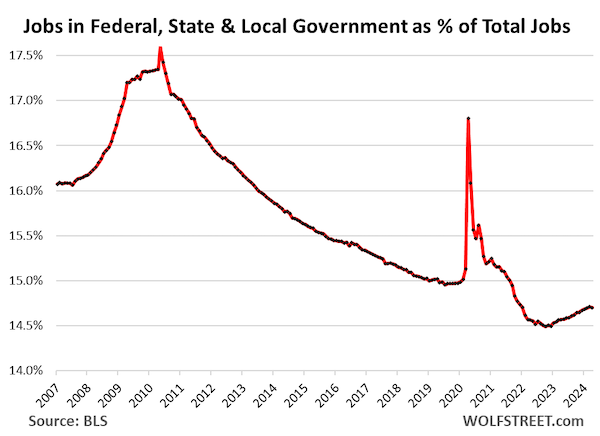

As the economy and the labor market has grown over the past 15 years, government employment has also grown, but at a slower pace than overall employment, and so the percentage of government workers to overall workers has dropped and reached a multidecade low of 14.5% at the end of 2022. Since then, the percentage has ticked up to 14.7%

So this is total civilian employment at all levels of government:

- Total employment: 23.27 million

- 3MMA growth: +45,000.

And this is total government employment as a percent of total nonfarm employment. The big spikes are during the Census taken every 10 years, which in 2020 fell on the pandemic, when overall employment had plunged, and so the percentage of government employment to total nonfarm employment spiked more than normal:

sorry to be the Pedant….the charts should have a right-axis for per capita values.

The official US pop. rose by 6% since 2014. with some of these values up there, 6% is enough to make a nominal uptrend actually be stagnant or negative on a per capita basis.

Like this?

Manufacturing Employment

I think this chart illustrates your point about getting meaning out of a graphic, but this one is as a percentage of those employed. As a proportion of population is interesting as well, and has a different meaning.

The overall BLS worker participation rate still does not show the same kind of post-pandemic upswing as those particular charts.:

https://www.bls.gov/charts/employment-situation/civilian-labor-force-participation-rate.htm

The decline in information jobs is interesting and belies the notion of some sort of AI jobs boom.

I know that those are classified as working for software producing companies, so being a developer for a gaming company counts but being a developer for GM doesn’t.

But, I would presume these include AI jobs at Facebook and the Goog-ster, so, maybe AI really is just marketing hype after all.

PS – had lunch with a friend who is getting laid off from a technical position at a Fortune 500 co. He found out that not just the worker bees are getting their jobs outsourced to India, now it’s managers and directors, too.

That is interesting. Many different ways to look at the data. Looking at the different data series is also interesting. I had no idea that the population of employed men was so high relative to women!

From my point of view, we can’t hire enough people. We desperately need engineers and skilled tradespeople. We can’t find enough of them. Many of the younger people we offer to hire and train fade out before they’ve really learned what we needed them to learn. Turning wrenches, working in construction, learning how to be a field engineer, or applying what people have learned in school to real projects all seem to be things people aren’t much interested in anymore.

Even when they learn what we need them to learn, they take the first chance they get to jump into project management. It’s really sad. But I guess I can’t blame them. Who wouldn’t find the idea of high pay and less work alluring? Except now we don’t have enough technical staff to do the work they want to manage… so I’m not sure how this ends well.

“We desperately need engineers and skilled tradespeople…”

Really interesting comment.

Yeah. I need HVAC/R designers. I need tin knockers. I need plumbers. I need electricians. I need code officials who know what they’re talking about. I need engineers who earned the scuffs on their boots. I need steel erectors and welders. I know structural engineers who have designed things in practice more than theory. I need mechanical engineers who have had to maintain the systems they’ve designed. I need people who aren’t afraid to learn and who think they can devote more than two years of their life to learning a skill and maybe, just maybe, are interested in mastering something. I need tradespeople who can put down their phones and focus on critical tasks. I need people who are interested in learning how to integrate technology into building systems and construction, but who also know what to do if the tech fails. I need people who speak metric. I need people who want to work safely. I need people who can read and think.

They are all in short supply these days.

Funny, none of those involve moving bits and bytes or learning the latest crapified framework for building cloud-based systems or crypto currencies.

And virtually all of them are not susceptible to automation or AI replacement.

Young folks should be attracted to these fields as they are more secure than being code monkeys.

1. If AI is successful, won’t that result in there being fewer jobs in AI?

2. How much post-pandemic employment growth stems from the need to hire more people to get the same amount of work done?

In the first quarter of 2022, warehousing completely stopped its COVID recovery. Since many of the other categories are derivative of the movement of goods, perhaps this is a keystone indicator.

Changes in slope are correlated with the first quarter of 2022 in most sectors, particularly business and professional services.

Of course, professional services (offshoring/automation inspired by COVID) could be the driver, warehousing the response, followed by manufacturing after a delay of a few months.

The growth of health care, though, is puzzling – its trend post-inflection point seems to ignore trends of other sectors of the economy (It is discontinuous on the first and second derivative). Replacing doctors with physician assistants as fast as they can be ingested?

Aside from per capita, it would be interesting to see per dollar of employee compensation.