Yves here. We posted in May on a prominently-placed Wall Street article that lamented plunging birthrates in advanced economies, and increasingly even in developing ones. The problem of course is that despite lowering the amount of resource consumption and garbage production would be good for the planet, it’s bad for the economy. It means no or negative groaf via an increasing population (barring immigration) and the supposed difficulty of managing a society with proportionately more old people and fewer young people.

Of course, no one mentions how neoliberalism has played into this equation. Nuclear families are just about the worst way to manage child and elder care, due to inefficiency and hired caregivers too often not developing emotional bonds to their charges. From that post:

The perceived need for growth is so strong that a new Wall Street Journal story, Suddenly There Aren’t Enough Babies. The Whole World Is Alarmed, does not feel the necessity to unpack much why declining birth and population rates are perceived to be highly problematic. Ambitious young men need new worlds to conquer, and that impulse can become destructive when the economic pie shrinks or increases only slowly. And lordie, what will happen to real estate prices?

Similarly, the press and punditocracy covers Japan, which has merely had a static but aging citizenry, with horror, even though the Japanese, between having generally very robust oldsters, plus high levels of social cohesion, seems to be wearing its affliction awfully well….

It seems odd for a business paper to be so puzzled as to what is happening. Late stage capitalism is not child-friendly. It expects workers to be mobile when that can mean moving away from relatives that provide back-up junior care. The now scarce-as-hen’s-teeth 9 to 5 day for office workers and professionals, and regular shift work for factory laborers, gave scheduling predictability that helped with organizing child supervision and gave the kids themselves a sense of order in the world. Late-stage neoliberalism has also produced in the US and many other advanced economies a large increase in income and wealth inequality and a corresponding fall in income/class mobility. That further increases the stakes of raising children well: getting them into the right schools and/or making sure they travel in circles that increase the odds of landing good jobs and/or good romantic partners.

A final factor is at least some, and perhaps many, potential parents are concerned about the state of the world and wonder if having children is the right thing to do. And that does not just mean that their progeny will add to the environmental load but also that those offspring might suffer from societal upheaval, violence, and other dystopian outcomes as competition for scarce resources becomes desperate.

The study below looks at how higher housing costs are playing a role in lower birth rates and posits that policies that would promote more affordable housing. But that is contrary to the interests of powerfully placed rentiers, who with their allies in government, have succeeded in creating a system which keeps pushing prices higher, in recent decades well in excess of population growth rates.

By Jeanne Lafortune, Professor, Department of Economics Pontificia Universidad Catolica De Chile and Corinne Low, Associate Professor of Business Economics and Public Policy at Wharton University Of Pennsylvania. Originally published at VoxEU

Marriage has declined as the central organising structure of the American family, and some worry this will increase inequality. This column posits that inequality creates the marriage gap in the first place because access to assets, such as homeownership, may be essential to foster the commitment necessary for both partners to benefit from marriage. Marriage now offers a weaker contract than it once did. Policymakers looking to encourage marriage should enable more couples to commit, for instance, by facilitating home ownership.

The rise of inequality in the US has been described by many observers (Saez and Zucman 2020, Hoffmann et al. 2020). Others have highlighted that institutions like marriage may make this worse (Greenwood et al. 2014, Eika et al. 2019). Kearney’s recent book (2023) on the ‘two-parent privilege’ suggests that the uneven retreat from marriage in the US, documented by Lundberg and Pollack (2014), has had negative economic impacts. Rather than decrying the disappearing tradition of marriage, we suggest instead that understanding the reasons behind it can lead to interesting policy solutions, like making housing more affordable for all.

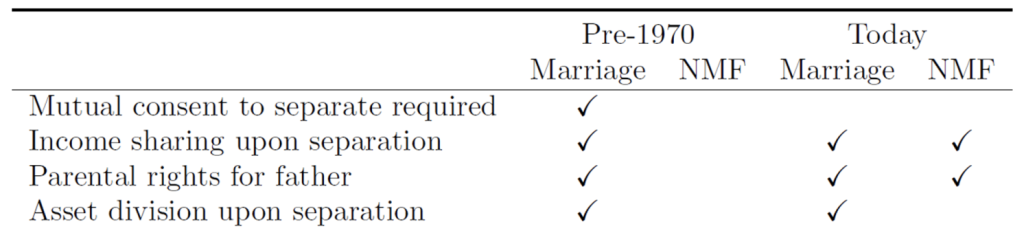

We hold the view that one reason for the decline in marriage is the increasing similarity between marriage and non-marital fertility, which has led more people to drift between these two potential family structures. Before the 1970s, marriage was difficult to exit and was the only way to obtain transfers, post-separation. However, unilateral divorce (i.e. divorce without mutual consent) and the establishment of paternity rights outside of marriage have increasingly blurred the lines between marriage and non-marital arrangements such as cohabitation (Table 1).

Table 1 Changes to separation in the US, pre-1970 vs today

Notes: NMF = non-marital fertility.

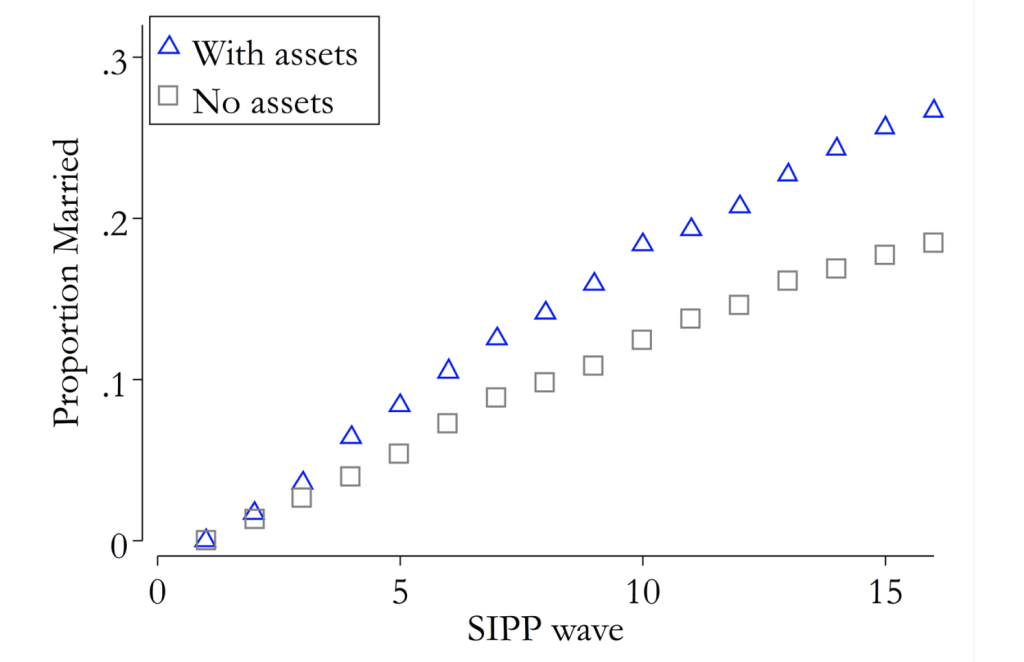

This has led some to suggest that modern American couples desire less commitment, which is why they avoid marriage. But this does not align with the observed relative selection. In modern US society, only individuals with assets that are divided upon the end of the relationship in marriage, and not in cohabitation, continue to marry (Lafortune and Low 2017). Those for whom relationship dissolution is more complicated and costly are the ones who continue to marry. We suggest that this implies the retreat from marriage is because it provides too little commitment and not too much.

Figure 1 Marriage rates for those with and without assets

Notes: SIPP = Survey of Income and Program Participation.

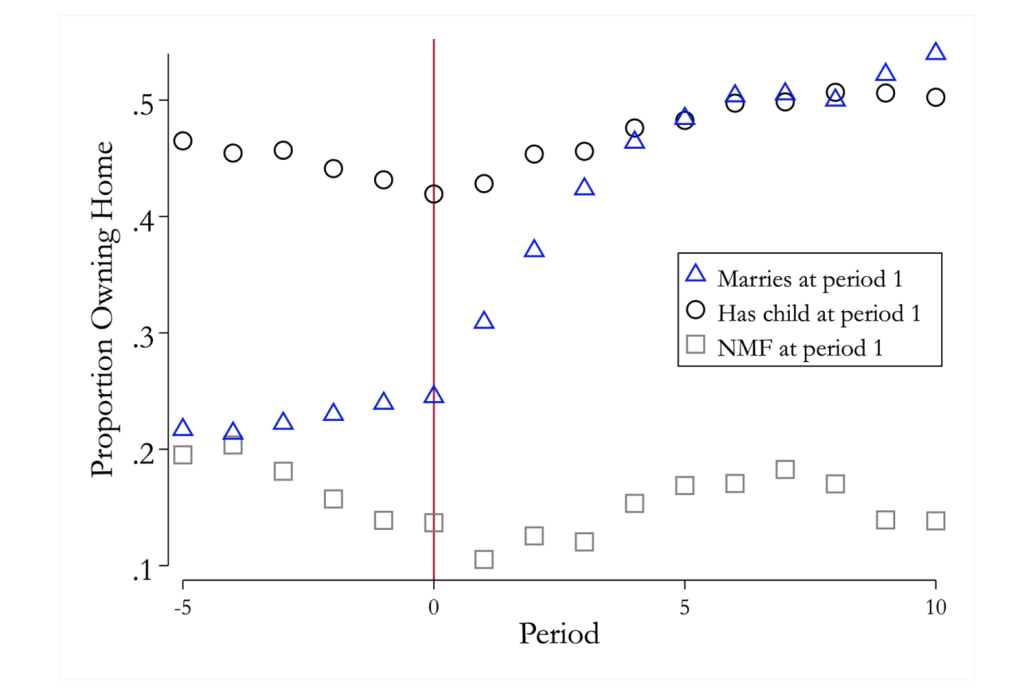

Housing, the largest asset class Americans own, appears to be particularly relevant in this relationship. American couples tend to combine the decision of marriage and homeownership. This is not the case for the birth of the first child, whether within marriage or outside of marriage (Figure 2).

Figure 2 Marriage or non-marital fertility, birth of the first child, and home ownership

Notes: NMF = non-marital fertility.

Why would couples seek more commitment? If we consider marriage merely as a means for couples to generate returns to scale, such as preparing only one meal for all or sharing a common roof, there appears to be no economic incentive for commitment. Marriage may be more about creating joint value by allowing for jointly optimal decisions that place some possible future risk or burden on one individual. For example, Choukhmane et al. (2023) documented that spouses take advantage of higher retirement matches in one another’s accounts by shifting savings toward the spouse with the higher match, when they would never dream of creating such an arrangement with a friend, no matter how close. The secret is commitment.

The same may apply to one of the other major sources of gain in marriage, specialisation. This is an old story going back to Becker (1991). If one partner will be making a significant investment in what we may call ‘marriage-specific capital’ (Stevenson 2007), such as their children’s human capital, they need some guarantee of protection in case the relationship breaks down. After all, post-divorce, both parties would continue to benefit from having well brought-up children, but only one would continue to cash pay-cheques if the partners have highly specialised roles. Thus, a partner would only be willing to make a substantial investment when provided with adequate protection in case of a relationship breakdown.

How can a partner be ‘insured’ in the relationship? We propose that purchasing a house during the relationship is likely to provide such insurance, or ‘collateral’. This is because, even in US states with equitable division (i.e. where relative contributions are taken into account), the family home tends to be divided in a way that gives more benefits to the custodial parent, often the one who may have invested more heavily in the children during the relationship. Thus, housing in the context of marriage guarantees a higher payoff to the spouse who invested more heavily in the relationship while also reducing their spouse’s incentive to seek divorce, because they will face a higher loss at that point.

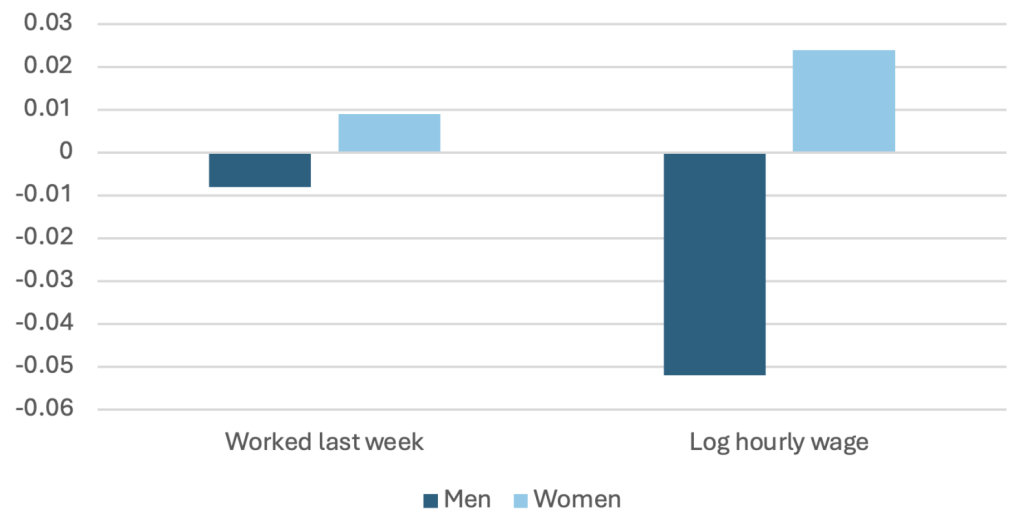

We test this hypothesis using variation in housing prices around the age of first marriage (Lafortune and Low 2023). We find that couples who faced higher housing prices and were thus less likely to buy and then later own a house were less specialised. Given that 75% of couples have a higher-earning male partner, this manifests in a gender difference: couples having a harder time buying a home have women working more and spending less time on home production, and men working less and subsequently earning less.

Figure 3 Effect of an increase of House Price Index at time of marriage

While Lundberg and Pollack (2014) emphasise that those who do not wish to invest in children will find marriage less attractive, we suggest that it may not be a lack of will but rather a lack of way. Couples with lower wealth, who have nothing to risk in the event of a break-up, will find marriage offering them limited benefits. Due to the weaker contract, they would receive lower benefits from marriage, including the family investments that are often cited as reasons to encourage marriage.

This conclusion also changes the policy prescription. We should not engage in a cultural war trying to make family formation something more desirable. We should instead focus on helping couples in lower socioeconomic strata accumulate wealth, particularly in housing, so that they have something to ‘collateralise’ their marriage. And our work points to the tremendous potential downstream impacts of discriminatory practices that create wealth inequality, particularly in housing, such as redlining.

We offer some direct evidence that there is a link between marriage commitment and marriage rates. We show that asset ownership did not predict marriage rates prior to the change in the 1970s toward unilateral divorce. But, as unilateral divorce was introduced, asset ownership became an important predictor of who got married. Similarly, as non-marital contracting was strengthened through paternity enforcement out of marriage, the gap widened further between those with assets and those without when it came to marriage rates. Policy changes, in other words, have created the gap in marriage rates between the haves and have-nots, which carries deep implications.

Our work shows that more wealth, in particular access to home ownership, leads to more specialisation and higher levels of marital stability and investment. Linking this to the literature that has emphasised the role of two-parent households in transmitting human capital, income, and wealth reveals further implications for intergenerational inequality. If higher-wealth couples are more likely to commit and thus more likely to invest in their marriage, their offspring may benefit from the strength of that contract, leading them to have more wealth and economic opportunity and in turn also be able to enter such a union.

We think this is a timely conclusion. Newer generations are particularly struggling with the ability to become homeowners and accumulate assets (Paz-Pardo 2022, Lewellyn and King 2024). They are also delaying marriage at rates never seen before (Fry and Parker 2021). These two facts may be interconnected and require more than societal disapproval to resolve.

Some may argue that we perpetuate a traditional and sexist view of marriage. First, we would like to emphasise that there is nothing in our argument that states that it should be women who specialise in household production. Irrespective of gender, the spouse that dedicates resources more disproportionally towards the household at the cost of their career progress will only do so, we argue, when insurance on those investments is provided. As a demonstration of this, our results on specialisation are only visible in the case of couples where the man outearns his spouse. Thus, it is not gender but rather relative earnings that seem to matter.

Second, our results say that for couples who wish for one of the partners to invest more into the union, marriage with housing as collateral is needed. Finally, we think our results speak to any kind of investment that carries a risk for one person – such as moving for a spouse’s job – which may make up the very foundation of what we find valuable in the marital relationship. The idea that such investments are only possible with commitment, and that asset-holding and homeownership affects commitment, is our key emphasis.

Overall, the results of this new strand of literature emphasise that the marriage contract has weakened too much for some socioeconomic groups, highlighting the need to facilitate asset accumulation, particularly homeownership, to reverse that trend. Therefore, the challenge now lies with policymakers to consider how to enable younger, poorer couples to access the commitment required for ‘collateralised’ unions. What policies do we need, especially as mortgage rates hover at 7%, to make homeownership and the benefits it offers accessible more broadly?

See original post for references

Quelle surprise! applies here. All kind of social contracts are destabilized by current policies including the “extract as much as you can for housing renting/owning”. Except those of the privileged elites of course. Familiar ties, neighbour ties, marriage etc. This very much explain the worsening relationship between the PMC and the rest of the society. The leadership despises the citizenship because they aren’t clever enough to reach their position and privileges and the citizenship realises these individuals work only for their own benefit. This article adds to on the experimental evidence piling up.

Here the only difference between so called “progressives” and the rest is that the progressives sometimes put some band aid in the form of subsidies that do not solve the problem but makes them feel generous and great, though possibly yet more contemptuous. Their 2 cents after the Sunday mass. Here you have 600$/€ for your children.

And American President “Creepy” Joe Biden still owes we Americans $600 USD! Our children could use that money now.

Group homes, a survival movement in the American lower classes, are now giving way to ‘group encampments’ in the waste areas of America’s cities.

I don’t know about Madrid, but around here there has been a sharp increase in street begging and panhandling.

Stay safe.

For decades, poor people have been shamed for irresponsibly having children they could not afford and spending money they did not have. Now, the birthrate is dropping and Applebee’s and Target are going bust, and tptb continue to complain about the selfish poors…

Much of this topic (family formation and housing) is just the slow paced rationalization that now the middle class way of life is too difficult to enter into and even more difficult to stay within.

Even though poorer families shrinking in size was always a much more serious demographic issue from a consumer/workforce point of view, the problem had to climb up the economic ladder into the middle and lower upper class before it got this kind of attention.

It could be that single family homes are an anomaly of history.

Multi-generational housing seems to be how most of the world connects both elder care and childcare.

I won’t argue that it’s an easy living arrangement but it might be the more pragmatic answer during hard times. It also requires a complete 180 in retirement expectations, you have to transfer wealth (and time) away from yourself and towards your grandkids.

This is happening by default in my neck of the woods. I know multiple households with “kids” in their late 20’s and 30’s who are living with parents. Sometimes these kids are married and/or have kids of their own. One of my dearest friends & her husband, both in their late 50’s has her mother (with Alzheimers) and their college graduate employed daughter living in her home. Most of this us driven by economics. Housing and caregivers are both very expensive.

I don’t understand the wealth argument whatsoever. Say a couple stays together, does that mean they are wealthier in terms of assets? Well no, because then there’s no incentive to sell the house and even if they wanted to do so, they can only become wealthier if houses were to appreciate in value in which case you are back to square one. So basically their happiness will come at the expense of other couples that did not get into the game earlier.

In case of a divorce, one side has indeed become wealthier but at the expense of the other partner for a total net asset change of ZERO.

Having a house also does not help you if medical costs, child care costs, etc continue to increase.

Also if asset maximization a.k.a Greed can discourage couples from divorcing, billionaires won’t ever divorce right? https://en.wikipedia.org/wiki/List_of_most_expensive_divorces. Bill Gates alone lost 76 Billion USD, which is worth how many middle class homes in the US?

But hei what do I know really? Hopefully the government will step in and incentivize the banks to create a new type of MBS that’s short for Marriage Based Security backed by Real Estate. That way I can bet on other people’s marriages using a couple of those trusty CDS es. It worked well last time for John Paulson, so someone just needs to create an ETF, and voila, yours truly too can become rich while doing God’s work i.e. busting unworthy couples. Winner winner chicken dinner.

I cannot see Neoliberalism changing any but continuing practices that discourage young people having kids and forming homes which is leading to a drop in the population. If I was a scifi author, I can see an interesting book to be written. So in the future those with wealth will be allowed to have morganatic marriages so that they could have more wives and would have the wealth to support the children that they would be having. It would be a bit like the original Mormons but the only religion in it would be the worship of Neoliberalism. If this sounds unlikely, look how in the recent past gay marriage and couples living together has been normalized so adopting morganatic marriages in society is not such a stretch-

https://en.wikipedia.org/wiki/Morganatic_marriage

While home ownership might have benefits, I would argue that the issue is more generally cost of shelter, so removing real-estate generally as a vehicle for money laundering and speculation would help.

Home ownership should not be a source of appreciation, just a store of wealth.

Also, note that even under the best of circumstances, multi-residential housing more ecologically sustainable.

I’ll take Things that are Completely Obvious for $1000, Alex.

People are more likely to have a family if they are financially secure. Housing is a huge component of that.