Yves here. For those of you who follow KFF Health News, their “Bill of the Month” often features a howler of an abuse where the provider, typically a hospital, has not backed down on its dodgy charges. The KFF Health News bad press, or prospect thereof, pretty much always forces a climbdown by the biller.

It’s surprising to see KFF Health News here depict an obvious fraud in such anodyne terms. As the headline indicates, a patient was billed for two separate surgeries when only one took place. This was easily verifiable by the lack of two operating/surgical center dates and two anesthesia administrations.

The egregiousness of the fraud is indirectly confirmed by the fact that the patient, a graphic arts designer, prevailed in court despite representing herself pro se, which is usually ill advised. Interestingly, however, the district in which the case was heard has only two judges and hears both regular civil and small claims. as most readers likely know, small claims courts are to accommodate parties representing themselves, since the amount in dispute is typically too low to support the cost of hiring counsel.

The comparatively small amount at issue also raises the question of whether the grifting provider, Pacific Rim Outpatient Surgery Center, engaged in this abuse regularly. One annoying element of this case is it is not entirely clear whether the collection agency that pursued patient Jamie Holmes bought the debt from Pacific Rim Outpatient Surgery Center or its purchaser, PeaceHealth. The article suggest the disputed bill was transferred to PeaceHealth before being sold. It would be useful to know if Holmes also tried disputing the charges with PeaceHealth, or whether the debt was transferred and sold before she was aware of the change in corporate ownership. This is not a mere academic matter, since continuing to dun Holmes would implicate it in fraud too.

The reason for banging on about this case is it’s such an obvious grift that it ought to be possible to curb it with legislation or regulation. For instance, if a medical provider and anyone acting as their agent or successor persists in trying to collect on a duplicate charge, that they are liable for treble the cost of the bad charge plus attorney’s fees. Exposure of these abuses is good, but feasible reform proposals are even better.

By Tony Leys, KFF Health News rural editor/correspondent, who previously worked as a reporter and editor for the Des Moines Register. Originally published at KFF Health News

Jamie Holmes says a surgery center tried to make her pay for two operations after she underwent only one. She refused to buckle, even after a collection agency sued her last winter.

Holmes, who lives in northwestern Washington state, had surgery in 2019 to have her fallopian tubes tied, a permanent birth-control procedure that her insurance company agreed ahead of time to cover.

During the operation, while Holmes was under anesthesia, the surgeon noticed early signs of endometriosis, a common condition in which fibrous scar tissue grows around the uterus, Holmes said. She said the surgeon later told her he spent about 15 minutes cauterizing the troublesome tissue as a precaution. She recalls him saying he finished the whole operation within the 60 minutes that had been allotted for the tubal ligation procedure alone.

She said the doctor assured her the extra treatment for endometriosis would cost her little, if anything.

Then the bill came.

The Patient: Jamie Holmes, 38, of Lynden, Washington, who was insured by Premera Blue Cross at the time.

Medical Services: A tubal ligation operation, plus treatment of endometriosis found during the surgery.

Service Provider: Pacific Rim Outpatient Surgery Center of Bellingham, Washington, which has since been purchased, closed, and reopened under a new name.

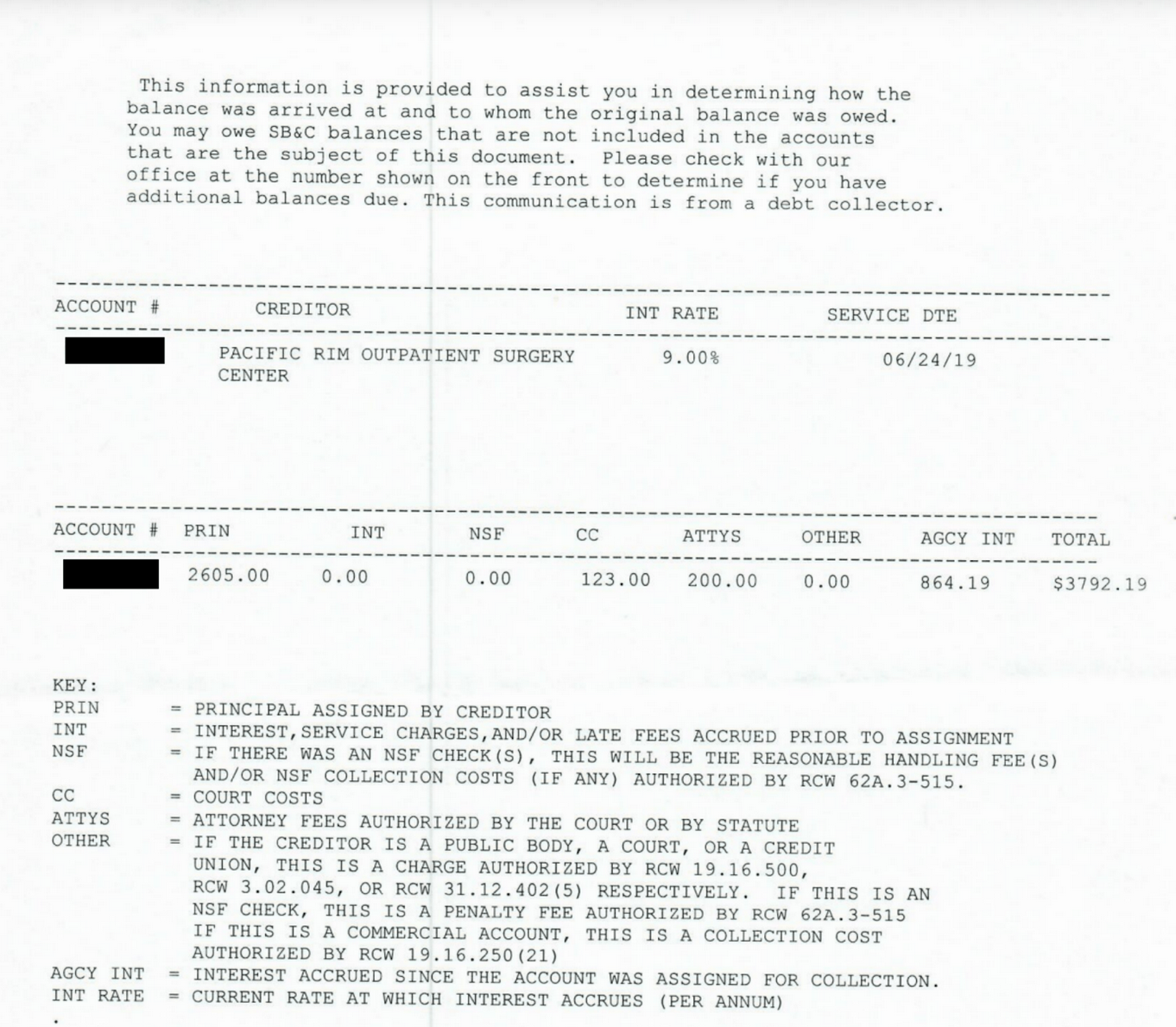

Total Bill: $9,620. Insurance paid $1,262 to the in-network center. After adjusting for prices allowed under the insurer’s contract, the center billed Holmes $2,605. A collection agency later acquired the debt and sued her for $3,792.19, including interest and fees.

What Gives: The surgery center, which provided the facility and support staff for her operation, sent a bill suggesting that Holmes underwent two separate operations, one to have her tubes tied and one to treat endometriosis. It charged $4,810 for each.

Holmes said there were no such problems with the separate bills from the surgeon and anesthesiologist, which the insurer paid.

Holmes figured someone in the center’s billing department mistakenly thought she’d been on the operating table twice. She said she tried to explain it to the staff, to no avail.

She said it was as if she ordered a meal at a fast-food restaurant, was given extra fries, and then was charged for two whole meals. “I didn’t get the extra burger and drink and a toy,” she joked.

Her insurer, Premera Blue Cross, declined to pay for two operations, she said. The surgery center billed Holmes for much of the difference. She refused to pay.

Holmes said she understands the surgery center could have incurred additional costs for the approximately 15 minutes the surgeon spent cauterizing the spots of endometriosis. About $500 would have seemed like a fair charge to her. “I’m not opposed to paying for that,” she said. “I am opposed to paying for a whole bunch of things I didn’t receive.”

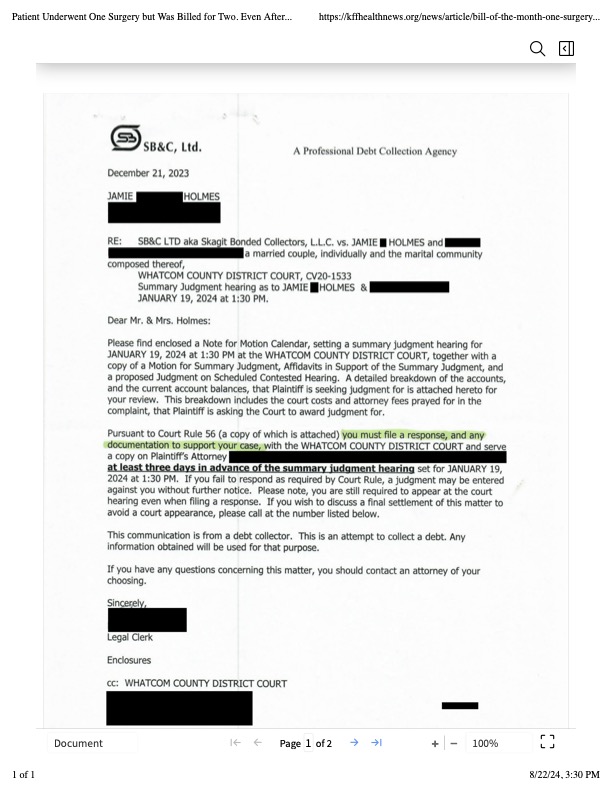

The physician-owned surgery center was later purchased and closed by PeaceHealth, a regional health system. But the debt was turned over to a collection agency, SB&C, which filed suit against Holmes in December 2023, seeking $3,792.19, including interest and fees.

The collection agency asked a judge to grant summary judgment, which could have allowed the company to garnish wages from Holmes’ job as a graphic artist and marketing specialist for real estate agents.

Holmes said she filed a written response, then showed up on Zoom and at the courthouse for two hearings, during which she explained her side, without bringing a lawyer. The judge ruled in February that the collection agency was not entitled to summary judgment, because the facts of the case were in dispute.

Representatives of the collection agency and the defunct surgery center declined to comment for this article.

Sabrina Corlette, co-director of Georgetown University’s Center on Health Insurance Reforms, said it was absurd for the surgery center to bill for two operations and then refuse to back down when the situation was explained. “It’s like a Kafka novel,” she said.

Corlette said surgery center staffers should be accustomed to such scenarios. “It is quite common, I would think, for a surgeon to look inside somebody and say, ‘Oh, there’s this other thing going on. I’m going to deal with it while I’ve got the patient on the operating table.’”

It wouldn’t have made medical or financial sense for the surgeon to make Holmes undergo a separate operation for the secondary issue, she said.

Corlette said that if the surgery center was still in business, she would advise the patient to file a complaint with state regulators.

The Resolution: So far, the collection agency has not pressed ahead with its lawsuit by seeking a trial after the judge’s ruling. Holmes said that if the agency continues to sue her over the debt, she might hire a lawyer and sue them back, seeking damages and attorney fees.

She could have arranged to pay off the amount in installments. But she’s standing on principle, she said.

“I just got stonewalled so badly. They treated me like an idiot,” she said. “If they’re going to be petty to me, I’m willing to be petty right back.”

The Takeaway: Don’t be afraid to fight a bogus medical bill, even if the dispute goes to court.

Debt collectors often seek summary judgment, which allows them to garnish wages or take other measures to seize money without going to the trouble of proving in a trial that they are entitled to payments. If the consumers being sued don’t show up to tell their side in court hearings, judges often grant summary judgment to the debt collectors.

However, if the facts of a case are in dispute — for example, because the defendant shows up and argues she owes for just one surgery, not two — the judge may deny summary judgment and send the case to trial. That forces the debt collector to choose: spend more time and money pursuing the debt or drop it.

“You know what? It pays to be stubborn in situations like this,” said Berneta Haynes, a senior attorney for the National Consumer Law Center who reviewed Holmes’ bill for KFF Health News.

Many people don’t go to such hearings, sometimes because they didn’t get enough notice, don’t read English, or don’t have time, she said.

“I think a lot of folks just cave” after they’re sued, Haynes said.

Emily Siner reported the audio story.

Total Bill: $9,620.Operation duration: 60 min. 9600$/hr 160$/min. Probably the MBA types in charge of the hospital focus on metrics like these and push for improvements in every way and form. In Spain, according to this site the cost of this operation can go between 1.000€-3000€ depending on the clinic and the methodology used.

You’re just another European deeply envious of the best health system in the world, perhaps the universe.

That needed a coffee warning…

Hahaha WUK. The envy is killing me!!!

If the envy does not kill you, then the American healthcare system certainly will.

My buddy in Tucson had similar dental work done down under, down Mexico way and it cost him 40% as much for the same thing I’m paying 2.5X too much for here.

You guys understand that when they say costs x amount in Europe that is the cost a European insurer pays to the hospital? The patient doesn’t pay a dime or only nominal fees such as 10€ per hospital day. It’s a system called healthcare insurance.

Perhaps I should have taken up my previous employer’s offer to sponsor my Green Card after all. To miss all the drama and possibilities offered by the American health system, I shall rue the day I left the US till the end of my days. /s

The gap between that Total Bill and Amount Paid seems to be a fixture in the healthcare world. Yet another reason for transparency to allow consumers, those with real-live bodies in play, to attempt to make informed decisions.

If you received some Medicare Part C explanation of benefits showing the following, from actual correspondence, would it not raise a few questions about fraud?

Provider Billed to the plan $34,875.70

Total cost ( plan approved) $11,562.19

We paid $11,367.19

Your share $ 195.00

Instead, the obfuscation allows creative accounting, and likely incentive pay, in addition to some questionable tax work. Has that been looked at by a few researchers, or the state or fed tax people, to see what is being claimed as income and expenses?

It’s quite shocking. I continually see that huge difference between what’s billed and what the plan pays. I thought we had transparency in billing now.

I caught Covid a 2nd time from Typhoid Mom and was skiing in Utah 3 weeks later and was short of breath and fatigued even going up on a chair lift, so one of the Dartful Codgers suggested I go have myself checked out and I dutifully did and they took x-rays, did a blood test and other routine stuff, and my bill was $4,800, of which I paid $167.

What if the real world was like that and say I wanted to buy a new Tacoma truck and MSRP was $964,495, but they’d let me have it for $41k out the door.

Jajaja! In the real world the MSRP of that Tacoma might be $41k MSRP+ $10k excess dealer markup+ refusal to honor the warranty when it burns to a crisp next to the highway, because you had exceeded 85mph at some time during it’s short life.

https://youtu.be/Nad4CLg6F-o?si=VzbCH_IVzT2-FmJ9

You forgot:

Dealer preparation fee = $5,000

Floor mats = $600

That gap looks as if designed to proof that somehow your interventions are subsidized and one should be thanking god for such subsidy and being charged so little.

As a rough rule-of-thumb outside the US, medical procedures seem to run 25-35% of list price in the US pretty consistently, Europe or Latin American making little difference.

That said, it seems like US list prices are more like place-holders, where insurance companies or medicare usually pay something far more reasonable. It’s only when they can screw a relatively defenseless individual for full retail that they apply that price. Understandable behavior of a predator: focus on the weak at their most vulnerable moments.

Maybe I’m wrong. It also seems that if this is the common practice/attitude, it might have been legislated through the tax code to let providers right-off the “loss” between their jacked-up list price and that at which it had to “settled”. When there was a pre-negotiated price that would presumably not work.

Is something like this how the game in the US actually works?

Yes. My son needed his wisdom teeth out so we went to an oral surgeon (who had worked on my husband a few years ago). They did a consult with xrays and agreed that it was necessary but not urgent. At the time, we didn’t have insurance and they quoted me $2900 for all 4 teeth as a cash patient. Due to my sons school schedule, we didn’t schedule the surgery until 5 months later. In the meantime I got a job with dental benefits so with our insurance (in network provider) the total billed amount would only be $2200 and I only paid 10% or $220.

Cash customer pays $700 more than the insurance company for the same procedure.

‘The judge ruled in February that the collection agency was not entitled to summary judgment, because the facts of the case were in dispute.’

What I find strange here is that her debt was sold while it was still in dispute. If a judge cannot adjudicate a case as the facts are in dispute, then how can a debt be sold when it is in dispute as well? It may be that those debt collectors may be one of those vulture outfits that buy up debt on the cheap and then profit by suing to get massive payouts. The same thing happens for entire countries too.

Debt collectors buy up entire blocks of debts and then go through and mine them for what they think they might be able to squeeze out of the consumer.

That happens mainly with large financial institutions, such as credit card portfolios. This was a not-large physicians’ practice. The debt collector was a mom and pop and a standout bad actor. This Google review seems to sum it up:

Funny, but this sounds like assault to me. The surgeon performs non-emergency surgery on a patient without her consent, and then sends her a bill. Sounds like a counter-suit would have been in order.

Sorta kinda like the surgeon in the UK who burned his initials on patients’ livers.

Nonsense. It was a justified medical procedure. The patient herself expressed approval and willingness to pay $500 extra for this additional procedure.

I may be mistaken, but I would say that this outrageous attempt of theft and extortion is only possible in the USA. The combination of private, largely unregulated, so-called health care, and perverse legal norms and practices produce situations like this one. Only in America.

In the larger context, I guess things like this should not be surprising. The US as a country doesn’t give a toss about health care, elder care, child care, or care of anyone who does not have wealth. Health care is little better than legal extortion. I agree, some sort of regulation or reform is in order, like decades ago. However, I don’t hear or see anyone in the Bipartisan Consensus doing anything about it, just some typical empty platitudes at best. They are too busy sending weapons to blow up little kids. The D/R crowd is led by a suicide-death cult.

I often half-joke that if he were still around, I would much rather have Richard Nixon as pres. Although he illegally carpet-bombed SE Asia, he at least signed the EPA and proposed a comprehensive health care system for the US. The current crop of crooks commit genocide but don’t even throw us a bone (sorry, bad metaphor) a crumb.

“…I don’t hear or see anyone in the Bipartisan Consensus doing anything about it…”

“The word bipartisan usually means some larger-than-usual deception is being carried out.” — George Carlin

I read this and was excited to share it with my chiropractor this morning. He, of course, is constantly battling insurance companies and our banter gets us through some tough sessions. I didn’t get a chance to tell this NC story because he had a doozy to share.

Blue Cross has been denying coverage for all of his patients across the board since July, and he finally got an “explanation.” His office has to switch to Medicare coding for all BC patients retroactively in order to get coverage. Apparently this coding makes little to no sense for the work he does and the fix is of course an administrative nightmare. He went to his insurance consultant for an explanation for this change by BC. The consultant explained that insurance companies do this periodically when they see an investment opportunity in the stock market. They pool the money from the rejected claims to take advantage of these high returns, before eventually going back and paying the claims. The consultant explained that the chiropractor can expect another disruption after the market changes, at which time the insurance company will force him to retroactively go back to his previous coding regime. Meanwhile his practice is squeezed by a drastic cut in their cash flow and his patients are put through hell. Just another day in the enemy factory.

This stuff is rampant in healthcare. I’m currently going back and forth with my oral surgeon about “price”. After intensive diagnostics a price was quoted me (which I agreed to with a signature). Later this week I get a bill 10% above the ‘price’. What the $%$%$?! After climbing the phone tree to get to the Practice Manager, she tells me the ‘price’ was really just an estimate. (Even though there were no complications to the surgery and the Doc thanked me for my ‘cooperation’ in making the implant surgery go smoothly.)

Most patients probably would have acceded to the ‘up billing’. I have too much experience with healthcare shenanigans to be cowed. That’s the last billing they will ever send me.

Jamie Holmes lucked out here because of a shrewd move a few years ago by WA Attorney General Bob Ferguson, now running for WA governor. Until a few years ago, collection agencies like the one here would do the collection in WA superior court, a higher court than the one here, and get an easy default judgment against someone like Jamie Holmes by doing “pocket service”: serving the debtor with a summons and complaint before filing it in court, which is allowed by WA superior court rule 3. The debtor would often be confused because there was no case number on the paperwork and the court would have no record of it because it hadn’t been filed yet, so the debtor wouldn’t know how to respond. Ferguson convinced the WA legislature to ban this slimy practice in 2019.

It sucks to have bad credit. It sucks more to be broke which will lead to bad credit. Don’t pay the bill if you can’t. There really isn’t much they can do but call you once a day and send you letters.

This debt collector, Skagit Bonded Collectors LLC, d/b/a SB&C, LTD, has been sued more than 10 times in federal court, usually for violating the Fair Debt Collection Practices Act, which bans “abusive, deceptive, and unfair debt collection practices.”

Here’s a typical complaint in a case that they lost by using abusive, deceptive, and unfair debt collection practices:

https://storage.courtlistener.com/recap/gov.uscourts.wawd.299876/gov.uscourts.wawd.299876.1.1.pdf

There is one sentence in here that makes me wonder if this wasn’t actual part of a temporary accounting fraud.

“The physician-owned surgery center was later purchased and closed by PeaceHealth…”

Inflate your revenues and accounts receivables and now your negotiated sale price goes up.