The Financial Times’ lead story is Top US financiers sound alarm on lending standards. As we’ll explain, this piece, which takes the tone “Mistakes were made but we don’t see catastrophic outcomes in store,” follows a series of warnings about US equity market risks.

Yours truly does not give financial advice and does not like doing something that might be mistaken for market prognosticating. However, the evidence is strong that many markets are priced so that the risk/return tradeoff of a long position looks awfully dubious.

But the current situation is vastly more difficult to evaluate than the runup to the 2008 crisis. There, the exposures were in risky US mortgage loans and related derivatives. The information on the underlying loans was high; for instance, yours truly picked apart a granular assessment by CoreLogic of subprime mortgage resets which claimed nothing terrible would occur.1 Our reworking suggested the reverse, which proved to be correct.

Not only do those who want to make sense of what is going now not only lack that level of transparency, but in addition many more financial asset types are implicated, and there are also far more international factors to consider. For instance, we pointed out that in 1987, experts were fixated on the Japanese real estate and stock market bubbles and did not have a US crash on their bingo cards. The fundamentals in Europe are terrible and getting worse, yet the euro and European stock markets are peppy, apparently due to undue optimism that military Keynisianism will deliver happy economic outcomes….even as trying to implement those priorities has led to the lack of a government in France and stunningly low approval ratings for national leaders in Germany, the UK, and Italy.

An additional impediment to diagnosis now compared to the pre-Lehman period is the lack of an econoblogosphere. There, an active community, including Tanta at Calculated Risk, Ed Harrison,Felix Salmon, Barry Ritholtz, Nouriel Roubini, Paul Krugman, “Independent Accountant,” Steve Waldman and many others posted about what we were seeing and debated what it meant. There’s no information sharing/sanity checking community now.

Just like some key points of the seemingly very well covered 1987 crisis actually not being well understood, that it true of some not-distant debt implosions too. The savings and loan crisis masked a second meltdown in leveraged buyouts. One colleague, in charge of workouts at GE, one of the bigger US lenders (the monster suckers had been foreign banks) got two conference rooms for his labors. One he called Triage, the other, Don Quixote. That secondary downdraft increased damage to banks, leading Greenspan to engineer a very steep yield curve so as to aid them in rebuilding their balance sheets.

But the bigger point of these seeming digressions is that historical analogies may miss key points, again even before getting to how many plates there are in the air now: the AI/tech bubble (which also implicates junk lending to AI players), the not-well-understood risks in the private debt market, the extra layer of leverage in private equity thanks to lending against the funds themselves via “subscription lines of credit,” political fractures in most Western states, economic wobbles that may spill into markets from Europe, China (which is undergoing serious deflationary pressures), and Trump kinetic and trade war mongering. Not a pretty picture!

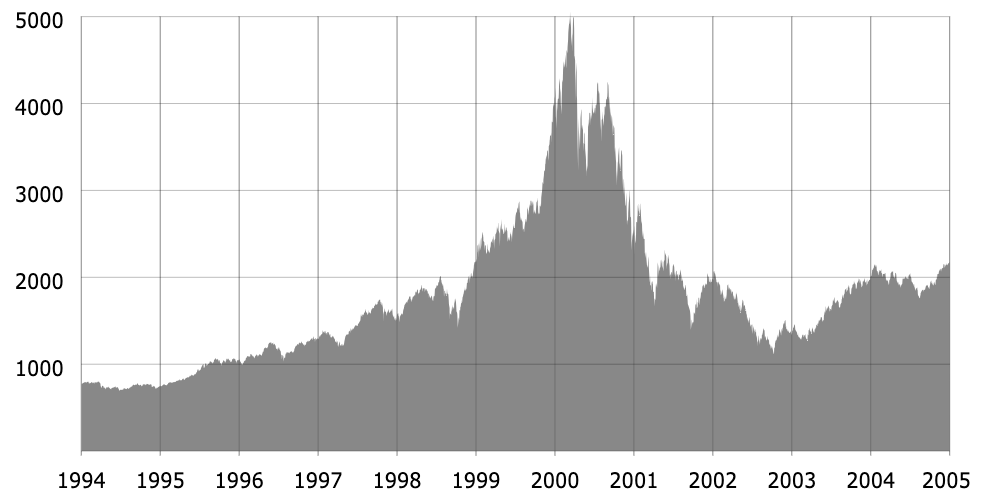

Despite how unusual it is for financial firm leaders to issue what sure look like statements against interest, which could be read as a signal that bad outcomes are nigh, the prototypical pattern for a bull market is for the mania to persist until as the wags put it, the last bear has thrown in the towel. We pointed out to readers that despite the dot-com bubble looking frothy from at least Greenspan’s “irrational exuberance” remark of late 1996, the even more richly priced market in 2000 has a final three months blowout (see the move from 4,000 to 5,000 and even the speed of the increase from 3,000). From Stocks to Trade:

So remembering that it is not over until the fat lady sings, let’s first turn to the fresh financial top brass warnings in the Financial Times about debt:

Top US financiers have warned of an erosion in lending standards after credit markets were shaken by the collapse of First Brands Group and Tricolor Holdings.

Apollo Global Management chief executive Marc Rowan said the unravelling of the two businesses followed years in which lenders had sought out riskier borrowers….

Last month’s failure of First Brands and subprime auto lender Tricolor has reverberated across credit markets and left investors such as Blackstone and PGIM, as well as major banks including Jefferies, nursing heavy losses.

It has also prompted further scrutiny of the private capital industry and the lack of transparency around borrowers, which tend to be highly levered with debt.

“In some of these more levered credits, there’s been a willingness to cut corners,” Rowan told the Financial Times Private Capital Summit in London.

Both Rowan and Blackstone president Jonathan Gray pointed the finger at banks for having amassed exposure to First Brands and Tricolor, but said the collapses were not signs of a systemic issue. “What’s interesting is both of those were bank-led processes,” Gray told the same FT conference, rejecting “100 per cent” the “idea that this was a canary in the coal mine” or a systemic problem….

Banks and private capital firms have been at odds in recent years as businesses have increasingly turned to private credit for their borrowing needs. Traditional lenders have labelled the shift regulatory arbitrage and complained that non-bank financial institutions are too lightly regulated.

But First Brands and Tricolor have exposed how both sides are intertwined through complex financial structures that can obfuscate who holds the underwriting risk, especially as bank lenders aim to maintain their market share.

JPMorgan Chase chief executive Jamie Dimon echoed some of the concerns on Tuesday as the bank reported strong earnings that were marred by a $170mn hit from Tricolor’s collapse.

“My antenna goes up when things like that happen. I probably shouldn’t say this but when you see one cockroach there are probably more,” he said. “There clearly was, in my opinion, fraud involved in a bunch of these things, but that doesn’t mean we can’t improve our procedures,” he added, acknowledging that the Tricolor exposure “was not our finest moment”.

Again, yours truly is old-fashioned. First Brands was engaged in what is called factoring, as in getting loans against receivables. That is a staple of the garment industry. I would regard that in an established being a sign of either a desire to achieve a high level of leverage or distress, meaning heightened scrutiny was warranted, But First Brands had the good fortune to go on its borrowing and as Dimon alludes, fraud spree when lending standards were light and “cov lite” as in deals with lower-than-normal lender protections, were the norm.

It appears that First Brands double-pledged collateral, here its receivables. That’s a crime. For instance, many years ago, Ralph Esmirian, a highly respected figure in New York’s diamond industry, sold collateral he had used to get loans and also double pledged collateral after buying the storied jewelry retailer Fred Leighton. Esmirian was sentenced to six years in Federal prison. See this section of a Wall Street Journal account, Behind the Collapse of an Auto-Parts Giant: a $2 Billion Hole and a Mysterious CEO:

[Patrick] James’s company, First Brands Group, has filed for bankruptcy, acknowledging that more than $2 billion is unaccounted for. Newly appointed directors are probing irregularities in the company’s financing arrangements, and the Justice Department has opened an inquiry, according to people familiar with the matter.

First Brands, of which James is chief executive officer and sole equity owner, borrowed more than $10 billion from some big names despite a history of lawsuits from business partners who had alleged that James made misrepresentations in his convoluted financing arrangements. Major banks including UBS Group and Jefferies Financial Group are exposed.

Unbeknown to most, the company raised billions through off-balance-sheet financing, especially through a form of borrowing against money it is owed by customers such as AutoZone….

James’s company, First Brands Group, has filed for bankruptcy, acknowledging that more than $2 billion is unaccounted for. Newly appointed directors are probing irregularities in the company’s financing arrangements, and the Justice Department has opened an inquiry, according to people familiar with the matter.

First Brands, of which James is chief executive officer and sole equity owner, borrowed more than $10 billion from some big names despite a history of lawsuits from business partners who had alleged that James made misrepresentations in his convoluted financing arrangements. Major banks including UBS Group and Jefferies Financial Group are exposed.

Unbeknown to most, the company raised billions through off-balance-sheet financing, especially through a form of borrowing against money it is owed by customers such as AutoZone.

In theory, Jeffries, which is the most exposed, to the tune of $715 million Point Bonita fund, could take the entire loss. But there likely will be, as occurred during the financial crisis,2 demands from investors who participated in the fund, for Jeffries to make them whole. That would entail an entirely different level of damage.

Now to the stock market alerts, again courtesy the pink paper:

The leaders of Goldman Sachs, JPMorgan Chase and Citi warned investors that investor exuberance risked driving a recent-run up in financial markets into bubble territory.

Goldman chief executive David Solomon said: “There is no question that there’s a fair amount of investor exuberance at the moment, with US equity markets consistently hitting record highs over the last several months.”

“Much of this has been fuelled by a tremendous amount of investment in [artificial intelligence] infrastructure, which has driven significant capital formation. But as students of history, we know that following periods of broad-based excitement around new technologies, there will ultimately be a divergence where some ventures thrive and others falter.”

JPMorgan boss Jamie Dimon said: “We have a lot of assets out there which look like they’re entering bubble territory. That doesn’t mean they don’t have 20 per cent to go. It’s just one more cause of concern.”

Citi CEO Jane Fraser said the global economy has “proved more resilient than many anticipated”, thanks in part to investments in AI.

“That said, there are pockets of valuation frothiness in the market so I hope discipline remains,” she said.

And the related debt exposure is not trivial. From Bloomberg on October 7:

The amount of debt tied to artificial intelligence has ballooned to $1.2 trillion, making it the largest segment in the investment-grade market, according to JPMorgan… AI companies now make up 14% of the high-grade market from 11.5% in 2020, surpassing US banks, the largest sector on the JPMorgan US Liquid Index (JULI) index at 11.7%, JPMorgan analysts including Nathaniel Rosenbaum and Erica Spear wrote… The analysts identified 75 companies across tech, utilities and capital goods sectors that are closely tied to AI, including Oracle Corp., Apple Inc. and Duke Energy Corp. Many of these firms are prolific debt issuers and in the case of tech, they are cash rich with very low net debt. The cohort trades at 74 bps, 10 bps tighter than the broader JULI index, they said

Keep in mind that investment grade equals, or is supposed to equal, pretty secure. Yours truly has also read mentions of AI-related junk debt but has yet to see any aggregate estimate.

But even if you consider stock market froth alone, this bubble is as bad and even by some measures worse than the dot-com affair. And we aren’t alone in thinking things could get even more frenzied. Hoisted from comments:

FWIW Mark Spitznagel of Universa Investments [engages in Nassim Nicholas Taleb style hedging and has Taleb as an advisor] is calling for a blow off top and then a like 80% crash in the stock market and thinks we are currently in the middle of that rally. IIRC he said we, “could see” SPX around 8000 before the massive crash, so maybe 20% higher from here- obviously predicting exact numbers is a fool’s errand but still… so if that is what comes to pass then getting in now could be lucrative short term but potentially devastating if you don’t get out in time, so pretty high risk…. I think Spitznagel compared what is happening right now to the beginning of 1929, euphoric high ahead, then massive crash. Good luck man, probably don’t let FOMO lizard brain overtake rational brain and make you put all your chips on the table at a time of irrational euphoria though, always be in a position where your gonna have $ to buy stuff when its cheap. I believe Spitznagel thinks there are lagging effects from the Fed raising rates so quickly and for so long that are going to be the catalyst that pops the bubble.

Even if the bubble pops at more or less where we are, the knock-on real economy effect would be considerable:

⚠️This is truly INSANE:

US households now own a RECORD 52% of their financial assets in equities.

This share has more than DOUBLED since the Great Financial Crisis and surpassed the 2000 Dot-Com Bubble by ~5 points.

The hold just 15% in cash and 14% in debt assets. pic.twitter.com/6DRmtxYSze

— Global Markets Investor (@GlobalMktObserv) October 13, 2025

These holdings are concentrated in wealthier households, natch, which as we have chronicled for the past 2 years plus have been the main driver of what passes for growth in the US. So that group battening down on spending would have an even bigger effect than normal times.

We have been mentioning deflation for some time, since it is clear China is experiencing it and is to some degree already exporting it. Its domestic real estate prices are still falling. The government has admitted it has way too much capacity in large, critical sectors, above all electric vehicles, leading to what was once called ruinous price competition. It’s in the process of trying to rationalize them, but a similar campaign in the mid-teens took years to resolve the problem. And it is over my pay grade, but experts say that the current overcapacity will be harder to remedy. China at least currently ramping up exports to Southeast Asia is a sign of weakness, not strength. Some of it is intended re-export to the US; some of it is channel stuffing. We are already in borderline deflation here (signs of pay rates for casual labor falling; no inflation; official forecasts only for 0.5% to 1.0%).

Aside from the deflationary effect of a big stock market crash, another vector is tariffs. I don’t know Lacy Hunt but his reasoning is persuasive. He contends that the initial effect of tariffs will be to increase inflation, even as businesses also try to absorb some of the costs (given that profit share of GDP has been at record highs in recent years, there is some room for bigger businesses to eat the tariff expenses). But the second set of effects, as happened due to Smoot-Hawley, is that consumers and businesses cut spending, and that the effect of the reduction in the deficit is to reduce capital inflows, which has an additional deflationary effect. Hunt argues central banks wrong-footed what to do then and are likely to do so again:

"The only other time this ever happened was between 1929 & 1930"

Lacy Hunt sees a deflationary debt spiral unfolding now caused by tariffs & lack of liquidity in international markets.

This is how the Federal Reserve & President Hoover intentionally collapsed the system in 1929 https://t.co/5D925EiJ3l pic.twitter.com/KJVOn5vrop

— Financelot (@FinanceLancelot) October 9, 2025

None of this is cheery, but with a lightweight like Bessent at Treasury and Trump more concerned with dominating the Fed than having sound policy, expecting good emergency responses if things start going south is wishful thinking. Stay alert.

____

1 No joke. From the March 2007 post, quoting the Wall Street Journal:

[Author] Christopher Cagan, director of research at the real-estate-information concern [CoreLogic] based in Santa Ana, Calif., said those foreclosures are likely to occur over six to seven years and won’t be enough to damage the national economy.

2 This occurred with the sales of credit card receivables, which were by their explicit terms non-recourse to the seller. But then the buyers effectively said, “Dream if we’ll buy another deal if you don’t provide some sort of restitution.”

https://finance.yahoo.com/news/ai-rally-fuelled-junk-debt-050000390.html

Coreweave, a data centre provider, is one of many companies cashing in on the latest AI-driven debt boom. In recent months, it has raised $3.75bn in high-yield debt to finance a surge in spending on infrastructure – including Nvidia chips.

Kioxia, a Japanese chipmaker, has also raised billions in junk bonds.

“We think this debt build-up would mark a concern in the event of a downturn, particularly an unexpected one or one with a sudden trigger that could see primary markets dry up,” said Nick Kraemer, a credit analyst at S&P.

Candidates there for New Century/Countrywide-style canary in the mine role. Subprime AI?

Watch for NVIDIA as they buy up their customers’ bonds…..

Maybe the Mag 7 will do for the federal reserve and treasury this time.

My dad started in penny stocks in Denver in the mid 50’s, and went west to be involved in the Pacific Stock Exchange action and ended up having an apartment in Manhattan in the 60’s and flew back and forth to the Big Apple for bigger fish @ the NYSE.

His world revolved around the market, and as luck would have it, he and my mom were in Hong Kong when the 1987 market crash transpired, and it was a vastly different world a couple of generations ago, this isn’t my father’s market crash, you see.

He called me up in a panic, and frankly I never cared much for the stock biz, not my bag. He could’ve punched my ticket to be like him, but apathy reigned-I had smaller round things to chase.

I’m 25 and of course i’m doing all I can to find out what’s going on-as he’s rather completely in the dark, and what do I have aside from a few talking heads on radio or tv, or if I can wait a day later, the LA Times, or if a week is ok, Time magazine.

I know nothing-like everybody else.

He can’t press a button on a QWERTY to sell, I can’t find out what happened a minute ago on Drudge, it’s a speeded up world now and shit is gonna happen in heartbeat when the deal goes down.

The problem is pervasive and systemic. The looting and pillaging has been going on for so long that the financial system -needs- the kind of loosey-goosey supervision that allows for sketchy activity to fester in the growing shadows in our public marketplace.

Frankly, any kind of corrective efforts risks tumbling the house of cards. Which would suck for everyone, but would serve to allow some sunlight in to start disinfecting things. Which should have happened back in 2008, when the triggered cross-defaults would have nuked a vast swath of the financial-industrial complex, but would also have allowed for a re-direction of that malinvestment back into value-building (as opposed to value-extracting) activities.

In a sense, a stock bubble and crash can be seen as a determined wealth extraction effort. What is AI for?

I think AI is a means of pulling the accumulated wealth out of these households and the entire financial sector. It is then spent on the data centre supply chain, energy inputs, data science offshoots etc etc. One final heave to strip mine the only “wealth” left in the US, then throw up your hands and say it was all so complicated after. MF Global on steroids.

The warnings down are credibility theatre. The big boys knew the play from day one. Incidentally I wonder whose buying all that gold and silver

Couple things. As the smoke clears around First Brands, it appears that Jeffries $715M was mostly hedged to an insurance company (whose name I don’t recall). There may well be more insurance companies who come up the ultimate bag-holders like AIG in 2007. Recall that PE and hedgies have become heavily invested in insurance companies. They may finally be out of luck with their bogus co-co’s and payment-in-kind. It could get ugly very quickly. And if serious fraud is involved, nobody will want to pay anybody…except, of course, the Fed will pay all the golfers.

Thanks for mentioning debt-deflation. While all the froth is on the surface, debt deflation remains the powerful unseen current. It will sweep us all along if the 10% of the US population that is currently doing 50% of the spending reverses the flow. Soon, the only sector of the workforce with full employment will be the lawyers.

“Soon, the only sector of the workforce with full employment will be the lawyers.”

Don’t forget the police and the Pinkertons. As financial and social conditions deteriorate, crime, especially property crime, will soar to empyrean heights.

The old New Deal safety nets have pretty much been dismantled by the neo-liberals. Their ideological answer to any future socio-economic upheavals is that ‘The Market’ will heal all wounds. Alas for us all, I fear that this Market will rebalance the wealth and resource inequalities, at the point of a gun.

Go long guillotine futures.

Stay safe. Go grey.

It was the GD that brought the new deal into existence. And only a GD might be powerful enough to break the oligarch’s grip on gov.

The establishment might be able to hold fast to the guillotine rope longer than the victims can live.

I’m sure Macron will have traded the patents already( a la alstom), with a robocop style 4th directive.

thank you Yves. Fpr Yves, or any other enlightened financial services professional, I have a question.

I am a lawyer, but not in financial services; however, I did at one time aim to do commercial work, and undertook the required secured transactions class. IIRC, a good lender would have completed a security filing for the factoring, which would have provided notice and prevented fraud. Was I lead astray back in law school? Or do these big banks just not bother with such formalities these days?

Not really my area but:

1. Factored receivables OUGHT to have a UCC filing

2. However, as indicated, cov-lite deals became common….suggesting that that important step might not have been observed

3. The fact that some collateral does seem to have been double pledged suggests no UCC filing OR fraud. One of my lawyers told me of a case where the collateral claim was voided due to the discrepancy of a mere period in a name of an entity referenced in a UCC filing v. the entity’s legal name. So perhaps someone did a clever like that?

thank you! To me, this is just a great example of how the masters of the universe can’t even meet their own standards. “X” for me, but not for thee.

Or maybe that don’t even understand what they’re doing at all. I’m a low level accountant and my company recently had a vendor of ours give us new remittance advice, and it was for what sounded to me like a factoring company. When I called to confirm the new bank info, they explicitly told me that yes, they were using factoring now. I then told our legal department and some upper management to make sure we had some secondary sourcing just in case, but first I had to explain to them what factoring was and why it was a sign that a company may be in dire straights.

I should have gotten one of those MBAs that upper management has and cashed in, since clearly the standards can’t be all that rigorous.

MBA is Morals By Auction, I doubt you would have made it.

This was my bailiwick in the leveraged 90s; things haven’t changed much. If you really want to perfect your security interest in receivables, you use a lockbox arrangement where customers send their checks to a specific p.o. box or bank account that is not under control of the borrower. Once cash gets to the borrower’s bank account, it’s virtually impossible to separate out from the other assets of the borrower, so a UCC-1 does little good. I’d be almost certain that nothing of the kind was done.

thats pretty wild,lol.

i once had a ticket in another state that i ignored…got the summons, etc a year later, but they had totally mangled the spelling of my one of a kind name, so i have been ignoring it ever since(“well, i dont know who that is…”). almost 40 years ago.

Small correction: I believe that Tanta commented mostly at Calculated Risk, not at Angry Bear. CR still shows today a picture of her in memoriam years after she passed away.

I visited NC for the first time about 20 years ago because Tanta had very good commentaries about NC.

That’s how I found out about NC as well!

Correct! You beat me to it.

Gah, huge bad! Fixed.

Tanta. Now there’s bit of happy and sad that I had forgotten. She was wonderful. Will never forget the pig spreadsheets. 🐷🐷🐷

“But the current situation is vastly more difficult to evaluate…”

“An additional impediment…is the lack of an econoblogsphere…no information sharing/sanity checking community now.”

“Historical analogies may miss key points…”

Totally agree.

I don’t know if anyone mentioned but there is a big difference between the Dot-Com era and this bubble and that is the Government budget deficit. Back then we were technically in a surplus (the famous “Clinton Surplus”) which, according to some commentators especially on the MMT side, triggered the bursting of that bubble where currently we run at 6% or more AFAIK….that is a lot of money sloshing around looking for a place to go…

aye thats what was in me head while reading about all this(and not just here, altho Yves is the best at this): is there the wherewithal to do a giant bailout these days?

the legitimacy?

or would even the attempt to make the golfers whole just further destroy everything?

Those large deficits in ordinary times, go straight into corporate profits, check out the Kalecki Profit Equation.

Just look at the charts, the rise in hyper-profits started at the same time as these not really needed deficits. Just more plundering of the public purse. The corps won’t want to give up this gravy train and generate profits the hard way again now. Get used to them.

At the start of Covid M2 was $15.5 trillion, now it is $22.1 trillion. Peak after Covid recession is now.

Lots of liquidity.

Fed balance sheet, $4.2 trillion Feb 2020. Peak $8.95 trillion Apr 2022. Today $6.6 trillion.

Not much tightening in 42 months. Less than 60 billion a month. Half the covid QE.

Do the bankers ever wonder if the ROI they use to underwrite is equal to the note rate?

My brother died in May 2023. We would talk economics every week. He was aghast at the banking state then. The plates are spinning a long time ago.

Can you explain this a bit to a non-banker?