Alexander Gloy: Greece – Two Bail-outs and a Funeral

Yves here. Quite a few readers in comments expressed confusion over the announcement of the latest Greek bailout, and some of the details were admittedly a bit murky. This piece will hopefully help clear matters up.

By Alexander Gloy of Lighthouse Investment Management

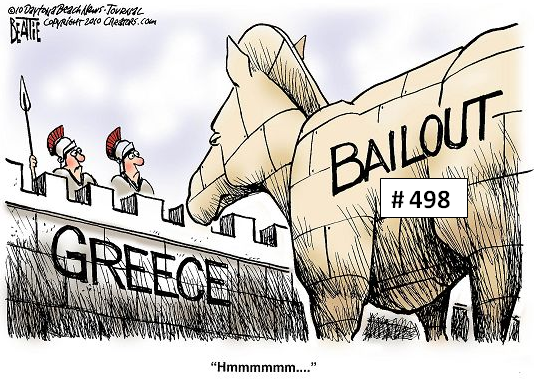

Here we go again. Another bail-out. [Sigh.]

I’ll try to make this as entertaining and easily readable as possible – but first the details of the bail-out agreed on July 21st:

Read more...