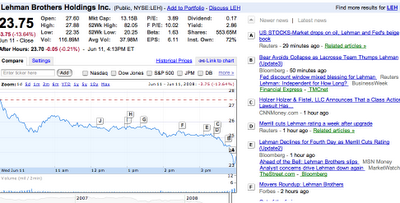

Lehman took a beating today, with its stock down 13.6% versus its previous close, and 15.2% lower than its offering price (and those trades haven’t even settled yet). The volume was three times the normal level. So much for implications of having an oversubscribed deal.

This Google stock chart sadly isn’t as upscale looking as Bloomberg’s (click to enlarge), but it does show news announcements during the day. The real decay in the stock began when Merrill lowered its rating on the stock. The week before, it had taken a neutral rating to a buy, and has now reversed itself.

This is precisely why we have been so critical about Lehman’s between-reporting-date PR campaign. Lehman has been presenting bits of information out of context, and per comments on CNBC, was evidently also calling analysts to pitch their point of view with information (specifically its deleveraging, perhaps other claims as well) about development post its last SEC financial report. That is a violation of SEC Rule FD, but this sort of transgression has become almost routine. Without seeing the whole picture, with proper disclosure, footnotes, the full context, this sort of information can be and apparently was highly misleading.

let’s see…

last week, lehman selectively leaked bits of info to the media portraying everything as ok. then it went into the open market and bought stock. then they did a deal and said everything’s ok. then another selective leak today where a korean institution may pump more money in after the $28 raise broke issue price. if this stock goes bankrupt, somebody’s going to get thrown in a cell with michael jackson and come out with an @$$hole the size of a hula hoop when they get out of prison.

I think she will be in the women’s wing of the jail.

But wait, maybe Michael will be too.

LEH is toast, but look at WM! They have $300B in hot air and IMHO, they are failing fast! LEH is no doubt in same connected boat with lifejackets full of holes!!!

http://msnmoney.brand.edgar-onli…nYirWE7UTloF- o1

Loan held in portfolio = $242 Billion!

Investment securities = $5B

MBS = $18 B

Total available for sale securities = $18B (lots of problems there with Level 3)

WM has more Level 3 issues, do your DD!

Estimates used by the Company to determine the fair value of certain of our assets that may prove to be imprecise and result in significant changes in valuation.

Tangible equity to total tangible assets — Excludes unrealized net gain/loss on available-for-sale securities and cash flow hedging instruments, goodwill and intangible assets (except MSR) and the impact from the adoption and application of FASB Statement No. 158, Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans . Minority interests of $3.91 billion, $3.92 billion, $2.94 billion, $2.94 billion and $2.45 billion at March 31, 2008, December 31, 2007, September 30, 2007, June 30, 2007 and March 31, 2007 are included in the numerator

How much of a hit did Lehman take from the write-down of the monolines?