The other shoe, as in real economy symptoms of the credit crunch, are starting to show up. One that was widely anticipated was rising default rates in private equity loans. This last cycle was particularly overheated, with not only the predictable peak-of-cycle high prices, which therefore implies high debt levels to make the private equity return calculus work, but also unprecedented lax terms, the poster child being “cov light” deals. Corporate bonds and loan agreements typically contain covenants, which require the company to meet certain requirements, such as a minimum net worth, a certain interest coverage (ie earnings as a multiple of interest charges), restrictions on taking on more debt. Thus if a company’s condition deteriorates, the bank can use the violation of covenants to force a restructuring of the loan.

Because many companies took on heavy debt loads, and more than half the companies are rated junk (in the vast majority of cases not due to downgrades as much as high levels of debt at the time of a private equity deal). Many observers wondered how things would play out in these cov light deals when companies started to run aground, Looks like we are about to find out. And Nouriel Roubini anticipates that junk bond defaults will reach an all time high. Leveraged loans ought to track that performance closely.

From the Financial Times (hat tip reader John):

The percentage of large syndicated US loans rated as problematic has nearly tripled in the last year, highlighting the damage done by the lax underwriting standards of the private equity boom, …

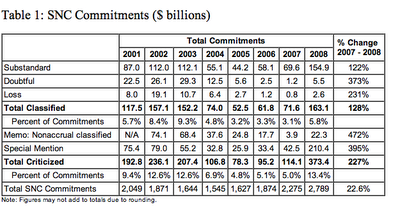

The annual federal “shared national credits” survey – which examines credit committments of more than $20m held by three or more banks – found that $373.4bn of such loans faced actual or potential difficulties at the end of the second quarter.

That was an increase of $259.3bn from the total of “criticised” loans during the previous year. Such problem credits accounted for 13.4 per cent of the total held by lenders in the US, up from 5 per cent the previous year, the survey showed.

The report by banking regulators including the Federal Reserve said many of the loans in the “criticised” category could migrate to more severe classifications, suggested default risk is increasing.

So-callled “classified” credits – rated as substandard, doubtful, or loss-making by the regulators – rose 128 per cent to $163.1bn, or 5.8 per cent of the total, up from 3.1 per cent in 2007.

”These portfolios are cyclical in nature and do track the general economy,” said Joseph Evers, deputy comptroller at the Office of the Comptroller of the Currency, one of the four regulators who conducted the examinations. “We may see criticised loans are increasing for a while and top out before getting better.”

Mr Evers said that similar patterns were seen during previous period of economic stress including the early part of the decade and the late 1980s and early 1990s.

The report criticised the underwriting standards that prevailed during the private equity boom. ”Examiners found an inordinate volume of syndicated loans with weak underwriting characteristics,” it said.

“The most commonly cited types of structurally weak underwriting were liberal repyament terms, repayment dependent on refinancing or recapitalisation, and non-existent or weak loan covenants.”

Here is the link to a joint Federal Reserve/OCC press release on the report. A juicy tidbit (click to enlarge):

From the text, providing a definition of SNC:

The volume of Shared National Credits (SNC),2 loan commitments of $20 million or more and held by three or more federally supervised institutions, rose 22.6 percent to $2.8 trillion, and the volume of criticized credits increased to $373.4 billion, or 13.4 percent of the SNC portfolio, according to the 2008 SNC review results released today by federal bank and thrift regulators.

I for some reason thinking of post apocalyptic novel, and how this situation looks like a start for one novel. I dont mean this specific post, i mean this whole mess. Countries close to bankruptcy, sliding down economy, brakes not working.

So-callled “classified” credits – rated as substandard, doubtful, or loss-making by the regulators – rose 128 per cent to $163.1bn, or 5.8 per cent of the total, up from 3.1 per cent in 2007.

”These portfolios are cyclical in nature and do track the general economy,” said Joseph Evers, deputy comptroller at the Office of the Comptroller of the Currency,

Yup, leading economic indicator is heading south. Not good, but expected, and expecting to see more of this.

Matt Dubuque

One of the worst things about thecrisis management in Hurricane Katrina was that when the levee actually broke, that meant that all aspects of our policy response SHOULD have changed and that a very bad situation had become a dire emergency.

Instead, it was not treated as a “different type of a difference” event and a catastrophe occurred.

Similarly, when Condolezza Rice received a comprehensive warning from the NIE in August 2001 that al Qaeda was clearly and actively planning attacks INSIDE the US, that should have been a game changer in terms of policy response.

It was not.

Our moderator Yves made a one-hour video one week ago that is a must see for all. You need to sit through the entire discussion.

One of her key points that she made is that the appearance of these “covenant light” provisions a few years ago should have been a screaming red siren to ANYONE that something was SERIOUSLY wrong with the entire intermediation process.

This HAS to be regarded as a turning point in the development of this entire catastrophe.

No rational person could have concluded that the proliferation of covenant light loan provisions was anything other than a critical symptom of an entire system run absolutely amok.

In this post, Yves raises that essential point again. Why are the chatterboxes in the blogosphere, Congress and the corporate media silent about it?

Any competent history of this debacle needs to treat the lack of regulatory response to covenant light loans front and center in the etiology of this crisis.

Matt Dubuque

The silver lining is that there probably won’t be any time soon any more new LBO loans that might eventually become “troubled”.

Bill Mauldin called for a meltdown in junk some time ago. The problem with default swaps is now pretty well known. AIG has put the default swaps in the lead in the meltdown race. My esoteric dark horse cadidate would be the interest rate swap market. The market may be more vanilla on first appearance but it is much larger than the default swap market (6x?), and we have been in a time period of relatively docile interest rates.