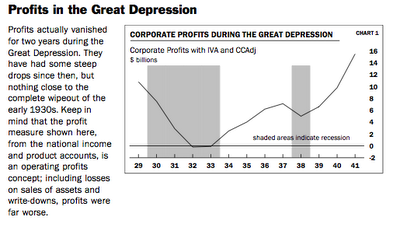

In case you are starting to look to past crises for clues as to how our financial mess might play out, here is a Great Depression factoid. From Levy Forecast, November 2008 (hat tip reader Scott, no online source):

Note that the report itself argues that the US will have a “contained” depression, with deep recession conditions for a protracted period and an anemic recovery. It does not believe the zero operating profits pattern of the Great Depression will be repeated.

That’s a nice little counterpoint to the clowns who are screaming, “We’ve never seen P/E ratios this low in…in… TEN YEARS!!!!! Buy! Buy!”

It might be worth mentioning corporate junk bond spreads and what they might be implying, in this particular context.

I’m beginning to worry our policy responses are totally broken and doing more harm than good.

* Protectionism, particularly abroad

* Fed’s balance sheet is full of garbage, and likely insolvent, especially factoring in decreased seigniorage with interest paid on deposits

* Intervention in markets wiping out, competing with, and discouraging private asset holders

* Dramatically increased government spending further raising real interest rates, potentially making the liquidity trap that much deeper

* Dogged protection of unprofitable industries and companies

* Inconsistent rescue of and abandonment of companies based on unclear, possibly personal criteria

* Faith lost in bankrupt Fed, Treasury, Gov’t as they vacillate in policy responses

I am not at all convinced that Mellon and Samuelson were wrong. I don’t think there is a policy response that will help at this point. We just keep chaining our lifeboats back up to the Titanic in hopes that, together, through all their buoyant power, they might keep it afloat and save everybody.

We will have depression in some parts of the country and recession in most others. Whether depression is 'contained,' a mysterious designation, likely depends upon which areas are depressed, and whether their extent is limited. Industrial Midwest, Florida, Gulf Coast, SoCal, Greater Arizona (including S Nev) get Depression; start worrying, I suppose, if that list lengthens noticably. Even making that analogy has an odious flavor of 'quarantine zones' left to the zombies. *blecchh*

I suspect that the crowding out of private lending by Fed 'asset' swaps will become an issue much studied as an example of unintended consequences. In this case, of abject failure, since the Fed's stated policy goal from this kind of action and the innovative facilities involved was to 'promote liquidity;' exactly the opposite has resulted.

The other Great Mistake of the crisis response to this point in my view has been the wasted time and effort in propping up insolvent moneycenter financial shops. It is easy to see why this was tried—they are Politically Powerful—but the results have been delaying the inevitable at the cost of choosing a softer spot and way to land. The economy is like a thin window washer witha fat plutocrat on his back, plummeting toward the pavement from the 35-to-1 floor. The plutocrat is banking on only breaking a leg, using the window washer as a cushion—and Tres & Fed Co. have done everything to make that possible. Spending the Guvmint's spending power rushing money into flaming insolvent citadels will be condemned in hindsight by everyone who doesn't profit from it, meaning everyone who has no voice in the effort.

I am also of the view that an active policy nets more than doing nothing. If we 'do nothing' where the financial system is now, has been for a year and a half, and his heading, then, yes, we get deflation. That is not going to be the outcome because policy will be active going the other way. We have deflat_ing_ bubble prices to this point. We have not entered surging unemployment and consumption collapse, which are demand-suppressive, and in that respect the first fully deflationary vector of change. Also, and example of 'doing something' with regard to failed money centered banks would look more like seize-and-section, while an example of 'doing nothing' is a whole lot more like More Easy Swaps, i.e. what is being done. Nothing may prevent severe economic disruption, and in many cases economic contraction. How much we get, and what the outcome looks like matters a very great deal, and those levels are impacted by active response.

There are no perfect solutions, probably, but some solutions are more imperfect than others. If you know the analogy, you know which ones and why. Follow me the other way, sez I!

“We have NOW entered surging unemployment and consumption collapse, which are demand-suppressive, and in that respect the first fully deflationary vector of change.” A typo makes me misrepresent myself in the above comment. Yes, we _have_ entered incipient delation through demand collapse over the last three months. We were always headed there. The question is, Now What? And the answer to that is Terra-pixelation in a vapor of monetary digits.

I suspect that the crowding out of private lending by Fed ‘asset’ swaps will become an issue much studied as an example of unintended consequences.

Strongly agree, so long as you add private borrowing on the other side of the ledger. The Fed’s balance sheet should be consolidated with the Treasury for a complete picture. This new fiscal expenditure surge will only make things worse.

I am also of the view that an active policy nets more than doing nothing….

Why? Deflation will occur naturally of its own, but don’t you think shutting down markets and raising real interest rates for everyone with the hopes of rescuing deeply broken businesses exacerbates deflation?

Let the survivors flee. Don’t force them under by trying to save the dead.

Injecting taxpayer money into Wall St banks will have the result of the money going into treasuries because treasuries are seen as safe.

Supposedly these money injections will cause the big banks to lend to businesses but since we are in recession why would banks lend to businesses?

Instead, the taxpayer money will wind up in treasuries, since they are seen as safer. Government will be happy because they can spend more, more, more!

Businesses are being crowded out by Wall St directing taxpayer money into treasuries. Productivity is near zilch with no business financing.

The governments treasuries offer a guarantee against bk for Wall St bankers putting their money into treasuries. The guarantee against bk of the treasury offerings is causing misallocation of capital into the public sector (treasury offerings), starving business; that is, Main St business, but not Wall St business.

At what point do we drop the pretense of a free market? The unseen hand is clearly visible.

Correction…sentence in my last post should read: ‘The governments treasuries offer a guarantee against bk for Wall St bankers putting OUR money (taxpayer money from TARP) into treasuries.’

“Oh” will make this depression much worse. Just wait until pension plans start going under and SS and Medicare get kicked to the curb just as the Baby boomers hit retirement age. The over indebted US government blowing up the treasury market along with a currency collapse. The problem is too much debt that cannot be serviced by income no matter how much they hope it can.

“The over indebted US government blowing up the treasury market along with a currency collapse. The problem is too much debt that cannot be serviced by income no matter how much they hope it can.”

— so much dialogue to many places by so many people (myself included!) and yet this sums it up. Those in the know say this 50 different ways or hint at it for the people with weak stomachs, but why? Why report the dail headlines? How about if we all just report the generational-headline because it’s the only one that matters.

Deflation vs. inflation are two-sides of the same wooden coin and the end result is the same – default which will make that coin good for nothing but firewood.

ndk,

I like your analogy of lifeboats chaining themselves to the titanic.

Positionally, that is about where we are. The displacement of the Titanic actually sinking has led to RK’s surging UE rate and consumption collapse.

The fact is the size of the displacement of the Titanic was aided and abetted by the series of missteps coming from our lawmakers and the Treasury in the past two months.

It was not inevitable that the stock market had to crash the way that it did. It could only have happened by the mishandling of LEH, AIG, TARP, and the latest ‘failure to act’ with regard to the automaker crisis. These missteps actually accelerated the loss of investor confidence in the market. The utter and total collapse of the stock market is a strong signal that really shines the light on there being a total absence of strong capable leadership throughout the country, not just at the Treasury and Capitol Hill, but a priori amongst the top execs of our biggest companies and financial institutions. We are in shit shape folks.

As a student of stock market history, this crash models the 1973-1974 stock market collapse. But in economic terms, we are smack dab in the early 1930’s. Like the 1930’s, there were a series of missteps by policymakers that made the outcomes far worse than they had to be.

It would take another 8 years beyond 1974 and the measures of the Volker Fed to arrest inflationary pressures, right the economy and thus the stock market.

But in economic terms, where are we in the 1930’s. There are three options to ponder. We could be in 1930, 1932, or 1938. 1932 would be a political correlation because of the regime change from Hoover to FDR and Bush to Obama. But, the political correlation seems weak. A much stronger correlation can be made for 1930, when everyone began to realize the real economy was imploding, the UE rate was accelerating, so that by 1931 the guess was that the national UE rate was something like 16% and still rising. And the deflationary spiral in 1930, like now, only compounded the woes.

1938 was like a second-round effect of the Great Depresssion. We can’t possibly 1938, yet.

If I recall, the Levy originated term, “contained depression”, refers to a deficit mitigated (‘contained’) overaccumulation crisis, so, once again I have to wonder about absolute fiscal limits and deep crisis of the U.S. state.