Submitted by Leo Kolivakis, publisher of Pension Pulse.

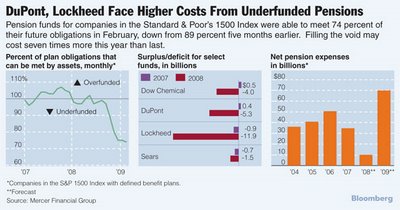

Pension funds for companies in Standard & Poor’s 1500 Index met 74% of future obligations in February, down from 89% before the market crashed, Bloomberg reports:

The amount by which U.S. pensions are underfunded has almost doubled since October to $373 billion, increasing pressure on companies to give more to retirement plans as the global recession saps earnings.

U.S. retirement plans are able to meet 74 percent of their future obligations, down from 89 percent five months ago, after global stocks fell and contributions were delayed, according to Mercer’s Financial Strategy Group, a Marsh & McLennan Cos. unit. DuPont Co., Caterpillar Inc. and Lockheed Martin Corp. are among the companies that say they expect higher pension costs in 2009 (click on chart above to enlarge).

Last year’s drop in U.S. stock prices, the deepest in seven decades, will saddle the 53 percent of companies in the Standard & Poor’s 1500 Index with defined-benefit plans with about $70 billion in pension expenses this year, a sevenfold increase from 2008, as they seek to close the funding gap, Mercer analyst Adrian Hartshorn said yesterday in an interview.

“Everybody is facing the same problem: big companies, charities, non-profits,” said Judy Schub, managing director of the Bethesda, Maryland-based Committee on Investments of Employee Benefit Assets, whose members’ plans are responsible for more than 11 million workers and retirees. “The call on their cash is going to be significantly higher, two or three times higher, than they had planned.”

Legislation passed last year requires the companies to pay down the shortfalls in seven years, Mercer’s Hartshorn said. Watson Wyatt Worldwide Inc., an Arlington, Virginia-based consulting firm, has analyzed the 100 largest U.S. pension plan sponsors and said some companies are making contributions in advance, anticipating larger future commitments.

DuPont’s Expenses

DuPont’s pension expenses may rise 40 cents to 50 cents a share this year after the plan’s assets fell 28 percent to $16.2 billion, the company said in a Feb. 12 filing. The pension is underfunded by $5.3 billion, compared with a $412 million surplus a year earlier, DuPont said.

The $5.14 billion decline in the value of the plan’s holdings last year won’t change the company’s investment strategy, Valerie Sills, DuPont Capital Management president, said in an interview.

“Equities are very attractive at this point in time,” Sills said. “We’ve always had a healthy equity weighting.”

DuPont, the world’s third-largest chemical maker, plans to increase the amount of equities in its plan to 52 percent this year from 49 percent in 2008, according to its filing. About a third of its portfolio will remain in fixed income, with the remainder divided between real estate and other investments. Equities made up 55 percent of DuPont’s assets in 2007.

Wilmington, Delaware-based DuPont said in a filing it hasn’t determined how much it may contribute to its pensions this year and it isn’t required to add funding to the plan at this time.

Loss, Job Cuts

DuPont in January reported a fourth-quarter loss of $629 million as global demand for materials used in cars and homes deteriorated. The company has cut 2,500 jobs and 8,000 contractor positions.

Lockheed Martin, the nation’s largest defense contractor, slashed its 2009 earnings forecast by more than 60 cents a share after falling stocks eroded pension assets.

The negative return on plan assets in 2008 and the change in the discount rate will increase 2009 pension expenses to about $1.04 billion, more than double the $462 million in 2008, Bethesda, Maryland-based Lockheed said in its annual report filed in February. About 85 percent of the increase was driven by the drop in plan assets, Lockheed said.

Dow Contributions

Dow Chemical, the largest U.S. chemical maker, expects to more than double pension contributions to $376 million from $185 million last year, according to a Feb. 20 filing. Midland, Michigan-based Dow’s pension was underfunded by $4 billion at year-end after posting a $526 million surplus a year earlier.

Sears Holdings Corp., the largest U.S. department-store chain, may need to almost triple its pension contributions to $500 million in 2010 from $170 million this year if pension reforms aren’t enacted and the markets fail to recover, the Hoffman Estates, Illinois-based company said in a filing.

Caterpillar, the largest construction-equipment maker, said Jan. 26 that it had a $3.4 billion year-end charge because of lower returns on pension assets. The company plans to put $1 billion into the pension fund this year, Chief Executive Officer Jim Owens said on a Jan. 26 conference call with analysts.

“Hopefully, the equity markets will return to some semblance of normal multiples and therefore recover,” Owens said.

Caterpillar’s pension obligations were $5.8 billion underfunded at the end of 2008, according to a Jan. 26 filing. The Peoria, Illinois-based company said in the filing it aims to keep its portfolio 70 percent invested in equities.

‘Near the Bottom’

“Some companies that see the market as near the bottom and are expecting a rebound do not want to take money out of equities now and are definitely not rebalancing,” Mercer’s Hartshorn said.

President George W. Bush late last year signed a law easing pension-funding requirements by eliminating some penalties on companies whose funding falls below federal guidelines.

Trade groups have lobbied lawmakers on four Congressional committees for more regulatory changes, according to the lobbying group Committee on Investments of Employee Benefit Assets.

One proposal would allow companies to make contributions to their pension funds for 2009 and 2010 based on 105 percent and 110 percent of their 2008 required contribution. Another proposal would prevent the growth in pension-fund shortfalls for companies paying interest on their plans’ 2008 losses.

No legislation has yet been introduced, the group said.

“Members of Congress do recognize there is a problem,” the Committee on Investments’ Schub said. “Unfortunately, this stuff is complicated and they have so much on their plate.”

Members of Congress better start paying attention to the pension tsunami because it will only get worse from here.

I expect equities to rally in Q2, but don’t be fooled into believing this is the beginning of a new bull market. That is a pipe dream. There are still far too many challenges that plague the earnings of major corporations, including the underfunded status of their pension plans, weak credit markets and rising unemployment around the world.

In my last post, I wrote about how the Hospitals of Ontario Pension Plan (HOOPP), which runs pensions for Canadian health-care workers, increased its bond holdings and cut equity investments to limit losses in 2008.

On Wednesday, Bloomberg reports that South Korea’s government said it eased the national pension fund’s asset choices, giving the country’s largest investor more flexibility to avoid stock purchases when markets tumble:

National Pension Service, which avoided losses in last year’s global rout, will target a domestic stocks weighting of between 10 percent and 24 percent, wider than the current 12 percent to 22 percent range, the welfare ministry said today in an e-mailed statement. The change may “prevent us from excessively buying stocks, in order to meet the permitted limit, when stock prices fall,” the statement said.

“The fund appears to have a bit of a negative view for equities,” said Park Se Girl, a fund manager at Meritz Asset Management Co. in Seoul, which oversees the equivalent of $1.6 billion in assets. “National Pension has served as a safety net for the market when stocks fell as it has to buy stocks to be in the permitted range, and now that role may weaken a bit.”

The government in January last year asked National Pension Service and other state-run investors to buy shares ahead of schedule to stabilize the market as the global meltdown accelerated. National Pension Service’s 236 trillion won ($174 billion) of assets were little changed in 2008 as bond holdings countered the equities slump, outperforming other nations’ funds.

Albeit the worst return in the Korean fund’s two-decade history, it beat the 26.6 percent tumble for the California Public Employees’ Retirement System in the seven months ended Jan. 31, and the 31 percent plunge for Singapore’s Temasek Holdings Pte in the eight months ended Nov. 30.

Asset Mix

South Korea’s fund will now get more flexibility to mix investments between stocks and bonds. National Pension, which was set up in 1988 and covers private-sector employees and those who are self-employed, posted returns of more than 5 percent between 2003 and 2007.

“The recent volatility in domestic stocks has increased much above the level we previously anticipated,” the welfare ministry’s statement said. “High volatility is likely to continue for the time being as expectations of economic recovery vie with concern about a prolonged recession.”

South Korea’s benchmark Kospi stock index has gained 9.3 percent this year after tumbling 41 percent last year, the gauge’s worst performance since 2000, when the technology bubble burst. The global rout has wiped out more than $32 trillion in stock values since the peak in October 2007.

The pension fund will be given a range of as much as 7 percentage points either side of the target weighting for local stocks of 17 percent, the ministry said. Previously, the range was as much as 5 percentage points.

The range for local bond investments will be widened to between 56.3 percent and 82.3 percent of total assets in 2009, or a difference of as much as 13 percentage points either side of the target weighting of 69.3 percent. Previously, the range was as much as 10 percentage points.

It is interesting to see how some pension funds are still aggressively allocating to equities while others are scaling back risk, allocating more to bonds.

My view is that while equities have been clobbered and bond yields are at historic lows, it is foolish to conclude that we hit bottom. In times of great uncertainty, it’s better to err on the side of caution, allocating more to bonds to minimize your downside risk.

After the big rally, which at the moment looks set to continue, if albeit not as spectacularly as it began, things will probably look better in March.

But I’m sure the problem will not go as many pension plans rely on absurdly high expected returns, and to achieve that they have to pursue relatively risky strategies, e.g. investing in equities.

Is there any point continuing reading this blog if it consists more and more of posts from and links other locations with very little geniune original content?

“Is there any point continuing reading this blog if it consists more and more of posts from and links other locations with very little genuine original content?”

So what are your insights into the pension crisis and how we are going to deal with it? More equities? More hedge funds? More private equity?

Let me know your thoughts, but stop criticizing Yves’ blog which exposes some hard truths on ruthless markets.

Leo

I think it is to a large extent a matter of testosteron. Real men invest in equities. Real men like to take risks. Real men like bungee jumping. Investing in bonds is for [insert your favourite derogatory phrase here]. This also explains why equity investors, even after having taken the largest beating in several decades, will go on investing in equities. This is just the way the alpha male’s mind works. The ability to learn from his mistakes is comparable to that of the person who, while being completely drunk, runs his Toyota into a tree, decides that this won’t happen again, and proceeds to buy a Volkswagen. Yes, he does change his behaviour, but not where it matters.

OFF TOPIC: BoA and CitiGroup are using TARP funds to purchase toxic mortgages in the secondary market and outbidding all others to do so.

‘Buying Toxic Assets With Bail Out Money’

http://www.ritholtz.com/blog/2009/03/buying-toxic-assets-with-bailout-money/

“….Sills said. “We’ve always had a healthy equity weighting.” “

Healthy? This silly fellow needs to, ahem, recalibrate his euphemisms.

I’ll bet executive pension plans aren’t underfunded. Just a wild guess though.

Executive and Congressional pension plans are defined benefit.

Everyone else has a defined contribution plan

Sorry, River, but you are a day late. Yves had some comments on that yesterday

‘Has the Gaming of the Public-Private Partnership Begun?’

http://www.nakedcapitalism.com/2009/03/has-gaming-of-public-private.html

Leo….please fix your style. All you do it seems is repost other articles with a couple paragraphs of your own analysis. You do have good things to say; I trust Yves wouldn’t have asked you to contribute to NC if you didn’t. By all means, quote an important paragraph or two with the appropriate introductory context, but don’t repost entire articles and then pretend you’ve added any value to the discussion of your topic….

It really is bad blog etiquette to just block quote stuff and call it a post.

“It really is bad blog etiquette to just block quote stuff and call it a post.”

I will say this one last time. I will not change my style for anyone. I do not get paid for blogging and for now, I do not plan on it.

If I quote entire articles and highlight paragraphs emphasizing certain things, it’s because that is how I like doing it.

I provide a hyper-link to everything I quote and I do add my analysis when I feel I have something to add.

Please go to my blog (Pension Pulse) and carefully read the upper box on how to navigate my blog.

I spend hours every day to find material, post it, and then write some thoughts.

If some of you do not like my style, then stop reading me. I won’t take it personally.

I have my regular readers which include government officials, union leaders, regulatory bodies, hedge funds, pension funds, private equity funds, asset managers, and regular people who are curious and want to learn more about what goes on in financial markets and pension funds.

Just today I received an email from a senior pension fund manager praising me for my work and my insights.

A simple kind word is very appreciated but if you don’t like my “blogging etiquette” then move on. Nobody is forcing you to read the entire post.

Again, I do not get paid for blogging nor do I have any ads on my blog.

This allows me to be fiercely independent and critical when I write my thoughts.

Thanks for understanding,

Leo

I wonder how the CEO’s would feel if their pay package was underfunded.

Yves, I think the change to a guest blogger style is a bad idea because it is your style as much as your ideas and the way you conduct a conversation that is the attraction of this blog. Equally important is the style and intelligence of the people you attract to the blog.

Providing fewer posts of your own and more links is a better alternative to the guest blog idea. There’s plenty of information on the ‘net, but only one of you.

Thank you, LeeAnne

Leo, the gripers do not represent the majority of people that read this blog. Your post was both informative and timely.

Congress has allowed companies to over estimate returns and rob cash from well funded plans for years. Like health care, government has aided corporate America in shifting the risk of retiremnet to the wage earner.

Either this country changes direction from the Plantation Capitalism of Republicanism, or we will lose most of what we have all considered good in the American way of life.

After the big rally, which at the moment looks set to continue, if albeit not as spectacularly as it began, things will probably look better in March.

Are you for real?

Let the ponzi scheme continue.

Yves, it’s true. Your blog is getting very stale. You must be moving on to other endeavors. You’ve done a tremendous service to your country in the last couple of years. Why don’t you mix things up a bit to keep yourself interested?

Just came across this tonight: http://finance.yahoo.com/news/Top-bank-regulator-placed-on-apf-14761773.html

“OTS Chief out amid scandal”…”ots giving secret bailout to indymac” Also at http://online.wsj.com/article/BT-CO-20090326-718651.html

LeeAnn and Anons,

I have mentioned several times I am working on a book. I really should not be posting at all, frankly, given my other commitments.

I hate to sound crass, but I make less than minimum wage on the blog and it takes an enormous amount of time and energy. I need to devote time to the book. I am already on the verge of a nervous breakdown, and complaints DO NOT HELP.

The traffic stats on the guest posts say they are generally well liked, even if they are not your cup of tea, and are therefore easy enough for you to skip if you so choose. Please show more respect for the writers.

I find it very strange that anyone would give Yves any shit. Couple of years doing this would send most mortals troppo.

Disagree if you like, but with a message not just where are you, no little baby’s here, eh.

I enjoy this site not just for information, but some of the banter too.

We all could use a sunny weekend basking in the sun, enjoying a cool drink or two.

Time for her to get on with “her life” and for others to PULL for awhile.

Skippy