By Moses Kim of Expected Returns:

Moving forward, the most critical indicator of the viability of our economy will be consumer spending. Simply put, without a buoyant consumer, there will be no recovery. Due no doubt to the negative characteristics of consumer data. the death of the consumer is receiving scant coverage.

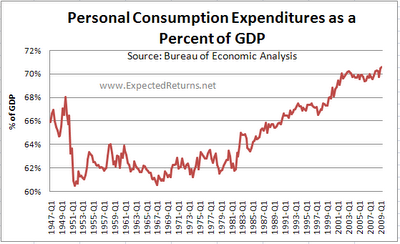

America is a nation whose growth in recent decades has been predicated on a model of consumption. From a nation that used to save to invest, we now borrow to consume. As buying power in Treasuries from foreign entities wanes, we will be forced to fund our consumption through currently non-existent savings. An increased savings rate will put pressure on consumption, which will in turn pressure GDP. In the following chart, notice how consumption as a percent of GDP remains above historical norms. Consumption would have to contract another $800 Billion for personal consumption expenditures as a percent of GDP to revert to historical levels.

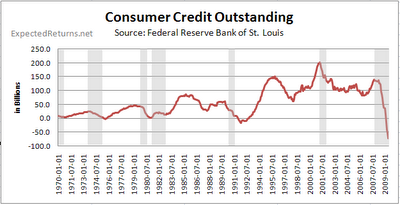

It is important to realize that what we are experiencing now isn’t a classic inventory-led downturn, but a structural debt deflation. Since Americans have been wont to save, consumer credit has played an outsized role in our economic growth. As such, it is critical to be keen on developments in the availability of credit, which can be measured by consumer credit outstanding.

Consumer credit outstanding, a measure of short and intermediate-term credit, is falling precipitously. Banks are, quite justifiably, not willing to service loans to deteriorating credit risks. Until the unemployment picture improves, banks are unlikely to rapidly increase the extension of credit.

Notice that consumer credit outstanding has rebounded off of every single downturn besides the recession of 2001. Before we can realistically call for an end to the recession, we need to see a halt in the decline of consumer credit outstanding, and eventually a rebound. We are experiencing nothing of the sort yet.

Retail Sales

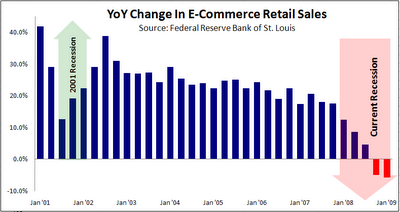

Consumption in the past decade, as reflected by retail sales, has enjoyed an impressive and inexorable rise. Year over year E- commerce sales growth remained robust even in the midst of the recession of 2001.; in fact, the rate of growth accelerated. As you can see from the following chart, E-commerce retail sales are declining dramatically.

The consumer is conspicuously missing in this supposed “green shoot” environment. At the very least, the V-shaped recovery thesis is not corroborated by data on the consumer front. Hopes of recovery must therefore be regarded as mere presumption until the outlook for the consumer improves.

Personal consumption is still above 70 % of GDP; Private Investment has collapsed but Government I & C. has increased and Net Exports has narrowed.

Sometimes the discussion revolves around total private market debt to GDP (which reached 370% at its peak in 2008) and sometimes it is consumer debt outstanding, which is around 70%.

The problem is we don't know how much is "too much" consumer debt outstanding and how much time it will take to get to that "sustainable level". Is 50% OK? 40%? 90%? And for private market debt to gdp… is 350% OK? or 250%?

Historical levels are just a rule of thumb, as there have been "structural breaks" in the global macro economy in the past decade especially. If anybody has thoughts on this, I would certainly like to hear them: how much debt is "too much"?

Available credit is incredibly high "at the source" (Fed), but credit worthy borrowers are scarce and more generally credit demand is low since we seem to have all realized we couldn't live in a mega Ponzi scheme forever. The Fed is pushing on a string. Given this fact, is there any hope at all to see consumer grow even above 1% per year for the next decade, given it should actually decrease in absolute terms, even if income increases?

Using "optimistic" back-of-the-cover calculations, say consumer credit outstanding must decrease to its 1990 level, so roughly 65%. It must go from 70% to 65% of GDP permanently – a 5 pp drop. Since "C" occupies roughly 70% of GDP, that is a 3.5% pp drop in GDP LEVEL (actually more than that because GDP drops as C fdrops, but whatever), permanently, unless the slack is picked up permanently by G, I or NX. Given the limited possibilities for eternal fiscal spending, G will actually have to decrease y-o-y some day. "I" will not pickup without a consumer. So this leaves NX to save the day.

A very important drop in the value of the USD is absolutely required, which means high inflation one day… any thoughts?

PascalMtl: "A very important drop in the value of the USD is absolutely required, which means high inflation one day… any thoughts?"

The US$ call is very tricky. I'm not an economist and just a newbie investor and here is how I see things…

I think theory would call for US$ to decline, in order to make USA more competitive. Due to merchantilist practices and various other reasons, this may or may not happen any time soon, but the thinking of most is that US$ should decline.

However, if you are like me and think there is a potential for huge wealth destruction, then there is no way the US$ is going to decline. The whole world is synthetically short the US$ (because so much US$-denominated debt has been created.) Every time assets deflate and debt, which stays constant, needs to be serviced, everyone will be scrambling for US$.

It'll be interesting to see what actually happens. The consensus is for the US$ to decline but it remains to be seen…

How much debt is too much?

Debt becomes excessive when it cannot be serviced from income. That's not a fixed amount, nor is it a fixed percentage. The relationship between the level of debt and income is dynamic and constantly changing.

As to the Dollar. With ongoing deflation there will be a degree of support for the Dollar. I expect that it will be under pressure, but, I do not expect a major sell-off. There is the potential, however, for a substantial sell-off in the stock market, quite possibly in October/November.

The consumer will be under extreme pressure until such time as the labor market improves and we see improvement in personal income. Until that occurs, the retail sector will be very soft. Overall economic performance will be sluggish. There is a very high probability that the election of 2012 will be determined by a very soft economy.

The mid-term election in 2010 will be very interesting. Will the body politic decide to simply clean house and throw the bums out, I wonder.

I'm reminded (once again) of Potter in It's a Wonderful Life, where he asks George if he has any stocks or bonds that he can use for collateral, for the loan he needs – and of course George just has a few bucks on a life insurance policy.

The metaphor is fairly clear to me in terms of asset values and consumption and future values and future consumption, i.e., people today have no real ownership of their assets. Americans (everyone around the globe in reality) have been taught to speculate versus invest and as a result, with our lotto fever and casino bookkeeping, we have a global society that is bankrupt.

In reality, where is the future value in any financial instrument today? How does one value something that is not linked to historical economic reality? How does a meatpacking plant like Fannie package its meat and how can you be sure if their selling Madcow patties and mixing in dogcrap with the flavor of the week, as the regulators and places like FASB and SIFMA re-write the ingredients on each label?

We live in an insane time where we have to think about the process by which confidence shapes itself — how do we come out of this period, when the next economic model is essentially based on some tatoo'd drugged out punk with a mohawk, who is pierced like a riveted piece of rusted sheet metal, who will skip from job to job in a sequence of 4 to 8 month gigs — and then finally end up, face down in a gutter with a meth pipe (versus a bank account)?

Maybe that's a harsh and ugly example of the dark future of cash flow, but as our new changed society spins the wheel of future value, we need to be able to clearly explain the relationships and economic correlations between Treasury instrument from George Bailey's day — and the current worthless garbage being packaged into the next illusions which will be called assets.

Asset ownership: I'm still trying to come to terms with that concept, as to what it means to "own" a bond, or a share of some company like Lehman or WaMu, or the assets related to getting a mortgage for a house you can't afford — where you really own nothing, but the right to pay interest or go into foreclosure and default.

We have a banking system that should have been and should be nationalized, but instead, we have a stock market trying to shoot for 14,000 — but to do so, every corporation in America gets to re-write its earnings on newly issued FASB toilette paper…and then write off all these bad assets so that consumption can begin again ………….is this retarded or what?

FD: Barfing. I'm too tired for this stuff…

siggy:

How much debt is too much?

Debt becomes excessive when it cannot be serviced from income.

How much debt is too much debt for the entire money system?

Debt becomes excessive in the entire monetary system(un-payable, unsustainable, implosive) when the money system itself cannot voluntarily CREATE enough new debts-as-income, because all money MUST be created as a debt, to make the debt-service payments on the debts already out there (*).

You are here(*).

As a result, we have the mother-central-banker, as he is about to be re-ordained, creating new "incomes" to the money system in the form of excess reserves – just to make the bankers' balance sheets appear solvent.

We already have an excessive amount of debt in the system.

Listen to Nassim on this.

The debt-money system is broken.

It is insolvent.

We need a new, honest, democratic money system.

The Money System Common.

So Moses, I appreciate the post exactly because this point is missing from most all commentary on our putative 'recovery.' There is no indication of any recovery for anything that matters at the consumer level; rather the reverse. No consumer recovery equals no recovery, conventional definitions notwithstanding. To me, discussions of 'recovery' are primarily a political exercise, enabled by fundamentally flawed economic standards for assessing what 'recovery' and 'decline' are in fact.

So Pascal, historical standards are just that, a history; in this instance they are a record of at what debt levels national economies tend to go broke. I'm not going to name 'The Level' but rather raise a parallel issue. The level of debt which is too much is not the level which can be carried during an expansion but the level which can be carried during the depth of a contraction. This point is forgotten because a great lot of incompetent economists declared that we have entered a global Long Boom where contractions are technically impossible. I seriously doubt that private parties can carry debt at 100% of GDP through the depths of a moderate depression. A national state may be able to if its international credit holds good, but private parties, no. . . . And that's a problem. There will be inflation, and there will be even more probably partial repudiation of that debt, through devaluation and 'renegotiation.' When, though, is the $64T Question. What I think likely, though the conditions are notably different, is that the state-change will be precipitous when it comes. That is, from a mildly deflationary condition the bifurcation to rapid dollar erosion may be fast indeed, something on the order of months if not weeks. That is an eventuality for which few are prepared because it is in fact hard to prepare. But it strikes me as the most likely. We may never see the point at which the debt is too much, it will pass quietly on a Spring day, the counters whirring. Then on a Summer's day a Treasury auction fails, and a bunch of folks try to get out the same door of the building all at once.

We will know when it's too much only after the sucker blows. . . . The bad news is, it's already too much. So wait for that other shoe to drop: it's a real kicker.