Small businesses have fair weather friends.

Policymakers love to extol entrepreneurship. And in the last business cycle, even in the upswing, large corporations shed jobs while mid-sized and particularly small businesses added them. But when things get ugly, the best connected players get the breaks, and the little guy is left out in the cold.

The latest evidence is an amusingly schizophrenic set of headlines in the New York Times. A story by Eric Dash tells us, “Pace Slows on Losses for Banks“:

Just a year ago, many of the nation’s biggest banks were in such bad shape that their losses threatened to topple the financial system.

Today, by all appearances, their vast problems seem to be easing: a seven-month rally in financial stocks has driven the shares of Citigroup and other troubled behemoths up sharply. And the economy has shown modest improvement, slowing losses that only recently threatened the survival of some big banks….

“There is more pain to come, but they have enough Band-Aids and tourniquets to slow or cut off the bleeding,” said David A. Hendler, a financial services analyst at CreditSights in New York.

In fairness, the article is only cautiously optimistic, but it still has a “the worst is over” subtext.

But the article by Peter Goodman on small business lending makes clear that the banks are not taking any chances:

Many small and midsize American businesses are still struggling to secure bank loans, impeding their expansion plans and constraining overall economic growth, even as the country tentatively rises from its recessionary depths.

Most banks expect their lending standards to remain tighter than the levels of the last decade until at least the middle of 2010, according to a survey of senior loan officers conducted by the Federal Reserve Board. The enduring credit squeeze appears to reflect an aversion to risk among lenders confronting great uncertainty about the economy rather than any lingering effects of the panic that gripped financial markets last fall…..

Some 14 percent of small businesses found loans harder to secure in August than in July, according to the most recent survey by the National Federation of Independent Business. Among companies borrowing regularly, less than one-third reported that all their credit needs were being met.

Yves here. Notice the “great uncertainty about the economy.” Translation: “We don’t see signs of recovery in our local market.”

The article cites economists who argue that the banks are being unduly risk averse, yet are also going to be hit by commercial real estate losses. Um, if your equity base might shrink, it isn’t exactly a sound move to expand your balance sheet.

The article neglects to tie in two other issues: credit cards and CIT. Credit cards are an important, often the only , source of funding for small businesses (the Small Business Administration deems any business with fewer than 500 employees as “small”, but the low end of that range can seldom get bank loans. One colleague who had a 100 employee businesses maxed out his credit card three separate occasions to keep his venture afloat). So the scarcity and higher cost of credit card funding has a direct impact on many small companies.

CIT, another key source of funding to smaller enterprises, looks destined to file for bankruptcy. What is remarkable is that this takedown is arousing so little hue and cry. Goldman, one of CIT’s creditors, will do better if CIT fails, to the tune of $1 billion. Oh, yes, the firm claims it has merely hedged its risks, that all it will get is what it would have earned over the life of the facility if CIT survived. If you believe that, I have a bridge I’d like to sell you. An acceleration of income is more valuable that waiting for it to come in. If nothing else, you get to pay yourselves bonuses on it now. And if CIT is like a pretty much every other recent bankruptcy, there are more CDS outstanding than cash bonds, meaning more winners if it is dead rather than alive (although I’d be curious to know who were the protection writers on these policies).

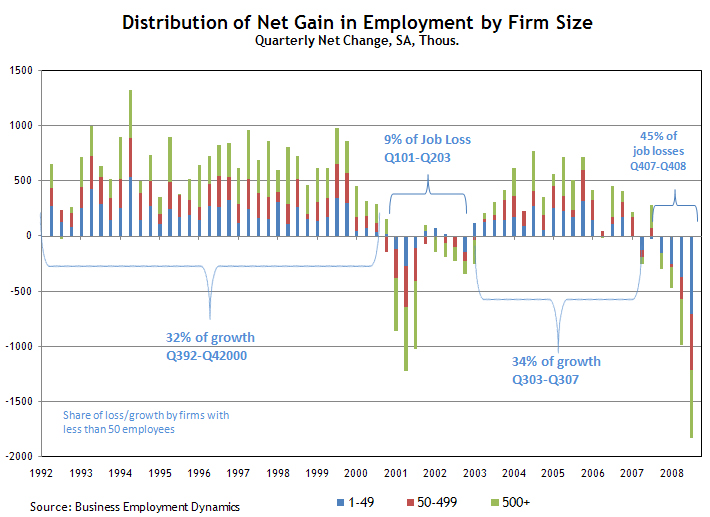

In case you had any doubts that small businesses were the engines of job growth, Robert Oak at the Economic Populist gives a good recap. 65% of the jobs created in the last 16 years came from small enterprises. And they are now shedding workers at an unprecedented rate:

It’s no mystery why these loans are harder to get. They do not make business sense for the banks.

The mystery is why the public tolerates transferring enormous amounts of wealth from everyday Americans to the richest people on Earth.

Note that the definition of small business is fluid. In the chart above, it’s below 50 employees. Oaks uses the SBA definition of below 500 employees to get to 65 percent.

I’ve been running numbers with State of Washington data (the state portion of the data underlying the Business Employment Dynamics database used for the chart above) and got quite different results (a much smaller share of job losses). There are some differences in classification (firms that look small at the state level may be part of a large national corporation, and so in a different size class in the BLS analysis) but I’d be surprised if that were the source of the discrepancy.

One factor not mentioned in the post are the bank examiners beating up the banks to increase their TCE capital, up to 12% in some cases,and to mark to market commercial loans, even though that is not required if the loan is performing and intended to be held, which, of course, reduces capital. On the capital increases, the banks have 4 options: (1) sell stock (hard to do in this environment for non-money center banks), (2) convert debt to equity (debtholders are not too keen on this and demand a high conversion ratio); (3) sell assets (and you can only sell your good assets, as selling the crap at a loss triggers a writedown, so the bank is left in a weaker position); or (4) cut loans as every dollar in loan reduction reduces your capital needs by 12% (if 12% TCE is the target).

Once again, with feeling: This is the mechanism that connects the financial economy with the real economy. In broad daylight, repeatedly, it is reported that this mechanism is broken and will remain broken for at least another year.

But no one makes this a top priority issue on The Coasts. Instead we see whining about banks’ fear of realizing (existing!) losses and how risky these small businesses are.

I’d call the Waaahmbulance for you but it’s kinda booked up these days.

In the 1930s it took about three years, until the Chicago and Detroit collapses, for the Feds to get their act together with the Reconstruction Finance Corporation and get, in effect, public agents behind the lending desks. You simply must have a deliberate policy intervention, backed with the force of the state, to erase the word “NO” on the lending memos and instead write the word “APPROVED”.

So what if there are some losses on new small business loans? For the most part there won’t be, and if there are these ‘mini-bailouts’ can easily be absorbed into the ‘monster bailouts’ that the billionaires are getting.

This in a nutshell is the reason why the system has delegitimized itself. People who can’t understand this just don’t understand political economy. This is the exact thing that will turn our small-d depression into a large D Depression. Remember, we haven’t seen the next several stages in the crisis yet–you know, the ones the banks are so terrified of? How do you think employment, personal income and (oops did you forget this part?) consumer spending are going to react to several new mega-hits on top of the current debacle…with NO POLICY INTERVENTION to cushion the blow for the most critical, obvious and well-documented jobs-creating mechanism in the whole economy?

Sad. It’s not even worth commenting on any more. But when Main Street moves to full scale revolt, perhaps a boycott of megafinance in favor of credit unions, or a debt strike, or just…stopping…don’t be surprised. Just be grateful for as much cake as was allowed you before the end.

–Jim in MN

Small business spending habits reflecting both ownership and business decisions have been excessive for years. The down draft in the economy since the dot.com bust and now the credit contraction are bringing an end to living off borrowing. CIT on a routine basis provided not only financing for equipment but added significant amounts to the loan for marketing and sales to assist the business. Many of these loans covered 10 year periods based on equipment life but technology change has been so rapid that most of this equipment was useless within 3 to 5 years leaving the business with large debts and an appointment with a consolidator.

Owners themselves have been big spenders buying vacation properties for use by clients, leasing upscale auto’s and trucks for family, excessive client entertaining junkets and family spending.

Small business spending will be missed but much of it has been credit induced rather then based on solid company profits.

I don’t think you understand the role of credit in business formation. You are mixing up ‘excess’ with the whole notion of business expansion. They are not the same. We are losing both. This is a problem.

The point of credit is to use savings throughout the economy, mainly individual households, to fund investments. This enables much more economic activity than if all investments had to be internally funded, i.e. you can’t start your venture until you yourself save up a million dollars.

Thinking small business should ever run on an internally financed basis makes no sense. Furthermore, without the failures there are no successes, and suddenly you are advocating that half of the Fortune 500, and effectively half of the economy, should never have happened.

Which also makes no sense. This is the problem with the complacent responses to this issue.

ron,

There are many people who would disagree with your portrayal of the situation, including these people:

http://money.cnn.com/video/smallbusiness/2009/09/01/sbiz_bank_loan_financing.cnnmoney/

The rapid pace of technology change combined with high volume manufacturing has significantly changed what small business can accomplish given the huge start up and continued funding required. The easy credit of the past 20 years have generated false market demand combined with lower barriers to entry due to soft equipment financing all leading to a business glut in every niche. Having been part of a small business operation for 30 years my depiction is based on real time observations rather then academic theory or wishful thinking. I agree with Jim in MN that credit availability is an important aspect of business life but so is generating a profit which means that margins can’t be based on marketing plans but real day to day costs and market realities.