Hhm, it’s always intriguing when accounts do not line up. This tidbit from a hedge fund reader:

From the eagerly-read Andrew Ross Sorkin Vanity Fair excerpt of his book “Too Big to Fail” on the meltdown:

Meanwhile, Jon Pruzan, the Morgan Stanley banker who had been assigned to review Wachovia’s $122 billion mortgage portfolio—to crack the tape—finally had some answers. A team of Morgan bankers in New York, London, and Hong Kong had worked overnight to sift through as many mortgages as they humanly could.

“Now I know why they didn’t want to give us the tape!” Pruzan announced dourly at a meeting before they headed over to Sullivan & Cromwell to begin due diligence on Wachovia. “It shows they’re expecting a 19 percent cumulative loss.”

“You’ve got to be fucking kidding me,” Robert Scully exclaimed. “We obviously can’t do this deal.”

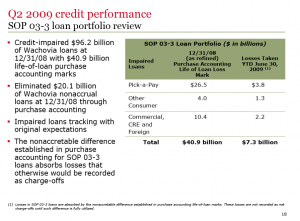

To make it work, Morgan Stanley would have to raise some $20 to $24 billion of equity to capitalize the combined firms, a virtual impossibility under the current market conditions. Scully described Wachovia’s mortgage book as “a $40 to $50 billion problem. It’s huge. The junior Wachovia team is not disputing our analysis.”

Kelleher, who had been keeping a careful watch over the firm’s dwindling cash pile, had just taken a look at Wachovia’s numbers for himself and observed, “That’s a shit sandwich even I can’t get my big mouth around.”

From p. 18 (click to enlarge) of a September 16, 2009 presentation by John Stumpf to the Barclays Capital Global Financial Services Conference:

Impressive.

Yet Wells Fargo insists they need to take less reserves proportionally than other banks.

I often refer back to the JP Morgan loss estimates on WaMu with their worst case scenario being that unemployment tops out at 8.5% and housing peak to trough is around 37% decline. Blew through that by early 2009. Where is the impact?

It stinks.

Yes…One can go back to JPM’s acquisition deck.

Watch for those balance sheet write-downs that pass the income statement.

Sorry I do not have much of a background in banking. Would you mind explaining the slide a bit? it sounds like they’ve already written down a majority of the 40 bil?

Warren buffett is the world’s best investor, so I don’t think he would make this sort of mistake in Wells Fargo.

(btw, here are some books he recommends people read…there is a borders 40% off sale so it might be a nice time to pick up a book or two)

http://www.favaholic.com/people/252-warren-buffett

I cannot but find humorous the foul language used here. However the reality is so dire that even my unborn grandchildren will feel it’s aftermath. In my opinion, the self serving assholes responsible for this, high and low, should face the legal consequences and stigma of those who engage in habitual child abuse.

Why should they not be tried and executed for financial terrorism?

So I clicked on the Vanity Fair link to read more of the excerpt…and I was surprised to find that the article reads more like a puff piece supporting the government’s no-questions-asked multi-billion dollar bailout, than an expose on the banks!

It seems entirely reasonable that Americans should file a massive, class-action lawsuit against ALL the bad actors. We should hire William Black as lead counsel.

I can’t figure out how to do the apples-to-apples comparison.

Scully described Wachovia’s mortgage book as “a $40 to $50 billion problem.

The WF slide mentions $40.9 billion in life-of-loan purchase marks, but only $30.5 billion of it in the consumer portfolio. Is that what we’re supposed to be comparing?