Reader Andrew sent a research report by Pivot Capital Management, which makes a compelling case that the capital spending bubble in China has reached its limits. This is important in a narrow sense, since capital investment is now the largest component of Chinese growth, and in its broader ramifications, since China is seen as a major contributor to growth expectations around the world.

The highlights of the report:

Given China’s importance to the thesis that emerging markets will lead the world economy out of its slump, we believe the coming slowdown in China has the potential to be a similar watershed event for world markets as the reversal of the US subprime and housing boom. The ramifications will be far-reaching across most asset classes, and will present major opportunities to exploit. There are three key reasons why we take this view:

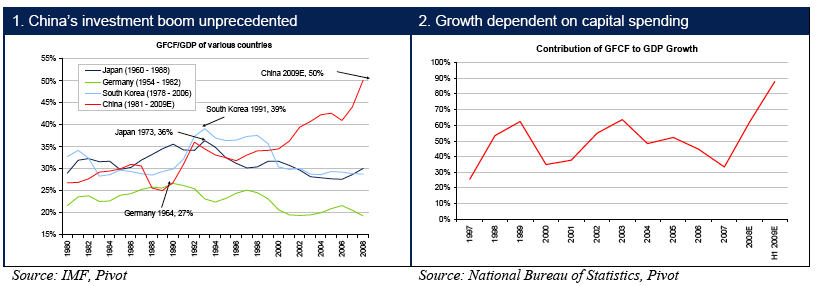

China’s expansion cycle surpassing historical precedents: It is widely believed that China is still in an early development phase and therefore in a position to expand capital spending for years to come. However, both in its duration and intensity, China’s capital spending boom is now outstripping previous great transformation periods.

Policy actions not sustainable into 2010. This year’s burst in economic activity has been inflated by a front-loaded stimulus package and a surge in credit growth. Given their exceptional and forced nature we believe growth rates in government-driven lending and capital spending will collapse in 2010.

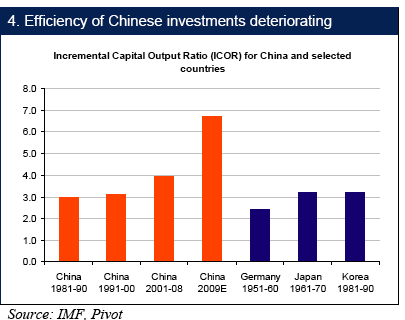

Overcapacity and falling marginal returns on investment: Analysis of industrial capacity, urbanisation and infrastructure development shows that China’s industrialisation and structural modernisation are largely complete. Combine this with falling returns on investment, and it becomes obvious that China’s long-term investment needs are grossly overestimated.

The article argues that China’s investment boom was part of the global credit mania, and unlike real estate and private equity, has not deflated in a meaningful way. While all economies that developed rapidly in the 20th century showed high investment relative to GDP, China’s level is well above historical precedents (click to view both charts):

Not surprisingly, the marginal returns on investment are falling:

Similarly, the expansion of debt is also proving less effective in generating GDP growth. From 2000 to 2008, it required $1.5 in debt to produce $1 of GDP. By contrast, credit efficiency in the US became poor right before our bubble imploded, with it taking $4 of credit to produce $1 of GDP. China now is even less efficient than the US in 208, with it now taking $7 of credit to yield $1 of GDP increase.

The article shreds the usual arguments as to why China can nevertheless continue spending at rapid clip. For instance, the notion that China has a low government debt to GDP ratio is a canard once you factor in liabilities of local governments. bonds guaranteed by the Ministry of Finance and the central bank as part of the 2003 bank bailout, explicit guarantees of the debt of the three “policy banks” and other off balance sheet liabilities. Adding them yields a public debt to GDP ratio of 62%, comparable to most Western European nations. It also debunks the idea that China can spend its reserves, since its reserves are not high in relationship to its liabilities.

The report continues with a litany of troubling data: that China has few areas with any scope for manufacturing capacity addition, and that the idea that China can urbanize further is also greatly exaggerated (China defines “urban” as a population density of 1,500 per KM, so Houston and Brisbane would not count):

Back in China, a lot of the so-called “villages” and “townships” are in fact highly industrialised. Qiaotou, home to 64,000 people, produces 60% of the world’s buttons and 70% of its zippers. Songxia with 110,000 people is the umbrella capital of the world: it produces 500mn umbrellas per year. Bordering on the edge of surreal is the story3 in the Wall Street Journal about the “village” of Shaliuhe at the outskirts of the city of Tangshan where a month before the Olympic Games, in order to reduce pollution, 26 inefficient cement factories were dynamited. Workers at the local Dafeng Steel Mill had to take an early vacation.

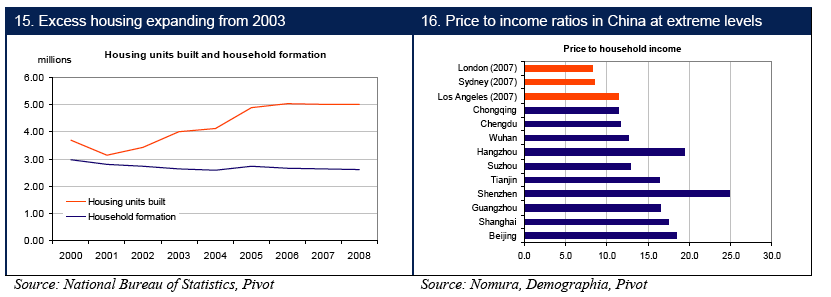

The idea that the Chinese are underhoused is another myth; residential square footage per person is high compared to more developed Asian countries. It would appear that a lot of the inefficient credit usage is going into real estate (click to view full chart):

The infrastructure thesis similarly does not bear close examination. Pivot looked at Chinese infrastructure levels against global benchmarks in some detail and concluded that China has already reached “an advanced level.” For instance:

…there are 600,000 bridges in the USA, of which 450,000 are in use. There are currently 500,000 bridges in China, with 15,000 bridges built every year for the past decade. These numbers are especially astonishing given that the USA has 5 times more rivers than China. Bridges are a great example of the kind of promiscuous spending on infrastructure that mars China.

The last major argument is that domestic consumption cannot make up for a slowdown of investment spending:

…after a bumper year for credit and investment activity, it is going to be hard for investments to continue growing at 30% in 2010. Even if we assume optimistic investment growth rates of 10% for 2010 and 0% for 2011, leaving the trade balance where it is now, private consumption would have to grow at an average real rate of 20-30% for the next two years for overall GDP real growth levels to hit the magic 10%….2007. This means that private consumption would have to grow at anywhere between 3 to 4 times faster than in the past decade to compensate for the imminent retraction in investment.

Ouch.

Germany after 1964, Japan after 1973 and South Korea after 1991, continued growing despite their ‘investment bubbles.’

Did you bother reading the post?

Investment spending has become THE driver of growth in China. Japan, by contrast, had barely made any inroads as an exporter in 1973, and South Korea also showed large gains in exports throughout the 1990s. I’m not as familiar with Germany’s export record in the 1960s, but I’d imagine the story to be similar.

Hi Yves,

You mentioned at the start there is no online version.

The full free report can be found on their website: http://www.pivotcapital.com/research.html

Thanks! I wouldn’t have excerpted it at such length had I known it was on line. I’ll put the link in.

I believe I saw a copy of this report a couple of months ago at Automatic Earth. I really don’t see a good way out of the global imbalances, especially those between the U.S. and China. Michael Pettis has a good post on a Mckinsey report that breaks down the challenges that China faces regarding increasing internal consumption http://mpettis.com/. Yves, first time I have ever commented, enjoy the site, keep up the good work.

People are using this report as an actionable item, making big short bets on China, most especially Kynikos

One can only hope that China has reached a Minsky moment. They will have to pay for their expansionist spending profligacy somehow. Will it be Repatriating dollars, or trading those dollars for more commodities?

Lordy, this is a much different picture than what I often see about China in the context of the “decoupling” discussions. In those, we have about 150-200 mill coastal “elites” living nearly Western lifestyles; another couple hundred mill scattered about in different non coastal areas approaching Western lifestyles, and then half a billion or so people who may paradoxically farm with beasts of burden, get clean water from a central pump, ride a bicycle, and have electricity, a radio, a TV. In those exchanges, the question is mostly: Can the Chinese move that half billion up the standard of living and save Western Capitalism at the same time?

Maybe I read all this wrong, but I think Pivot says no – because the world cannot use the capacity (e.g. steel plants – page 5) already there, and the “undeveloped” places are already making the buttons and umbrellas we all use.

I’d think that the following passage suggests some ways in which China can still put people to work, though I don’t know if anybody here can make money off it …

“China is also the world’s second largest and unfortunately also one of the least efficient consumers of energy: per unit of GDP China consumes close to six times more energy than Italy, and three times more than the USA (chart 12).

Heavy industry is notoriously inefficient with China’s, steel makers using on average 20%, cement manufacturers 45%

and ethylene producers 70% more energy per ton of output than producers elsewhere. The reasons for such

inefficiencies are manifold, but are primarily related to the way energy prices are set in China. Companies, and

especially provincial SOEs, receive numerous breaks and subsidies for electricity consumption. These inefficiencies

have probably also led to an overestimation of future power generation and energy needs, another important area of

capital spending in recent years.”

But I’m reduced to what I read and see in picture books.

I’m going back to solipsism….

China is also the world’s second largest and unfortunately also one of the least efficient consumers of energy: per unit of GDP China consumes close to six times more energy than Italy, and three times more than the USA (chart 12).

————–

If the US was to include all the oil consumed in China to produce the stuff it imports, something tells me Americans would show up as consuming way more oil than what the stats show us.

And I’d like to see how clean the US would be vs. China if it had kept its manufacturing base in the US.

Yeah lol, people forget how Mfg *kills* its workers (slowly), the environment down wind and down river, seduces individuals/family’s to set down roots, only to have the Mfg pull up stumps or down size arbitrarily for profit reasons, run away from looming tax credit deadlines to counties/state contracts, run away (sell out or go bankrupt) from environmental reclamation duty’s etc etc etc.

Ain’t it grand, years ago people wanted to stop polluting because of the long term side effects of Mfg, but now the jobs are gone wish it back…bahwwwww…Pass the organic solvents please I wish to remember the good old days ha ha ha.

I saw this analyst report a couple of months ago. Here is another view (the writer has lived and worked in China):

http://www.smh.com.au/business/idle-chatter-has-the-capacity-to-mislead-20091129-jysl.html

I am quite bearish about China, for quite a number of reasons, high inequality, environmental crisis, demographic problems, speculative bubbles, non-performing loans, production glut, energy reliance upon unstable countries to name a few. I am agreeing with the crux of this argument.

But, I think some of the anecdotes are quite misleading. Square footage per person compared to Asian countries for example. If you look at population per area in China compared to a number of advanced Asian countries you will see that the latter are quite limited as far as land goes, which would create a natural constraint on residential square footage per person. Area per population is 3 to 1 in China versus 1.5 to less than 1 to 1 in quite a number of advanced Asian countries.

As a general statement I think that there is quite an abundance of malinvestment in China. But we are looking at a country while having brought quite a large population out of poverty in 2007 the World Bank had to revise statistics on China to 300 million living under a dollar a day. I’ve heard other statistics at about 10% under 1 dollar a day so that means at least over 100 million. Getting good statistics out of that country is quite hard anyway.

That means there is quite a large rural population that lacks access to basic services, sanitation, electricity, infrastructure, healthcare, that could benefit largely from the enhancement of agricultural productivity, and so on. So their could potentially be positive investment in these areas in the periphery. However, what has occurred has been malinvestment in areas that are politically well connected in the core. Therefore you see non-performing assets in state owned banks, heavy asset speculation, and malinvestment in infrastructure.

Yves, I haven’t read all of this either, but for China to claim high growth while exports have collapsed, clearly points to the game over there being nothing but a capital spending game. I get the idea that China is nothing but another Dubai and for that matter has kept the Asian game going with this ongoing expansion that pays little attention to reality, but as Clinton said about Lewinsky, did it because they could. I believe the whole nonsense of a savings glut had nothing to do with savings at all, but instead a lot to do with a dual mode of credit that went on in the US and in China, with the US credit being recycled and used to collateralize the Chinese credit used for the continual business of expansion. The achilles heel of developing countries has always been that they found themselves short of dollars and China found the way around this by impounding the imported money and using their closed system to develop this business of expansion. This artificial boom has attracted capital because glitz always attracts the hot money. An 8% expansion in a declining economy is always a recipe for a bust.

This is something I posted on my blog in August. I wish I had more time to write on it, but I have been trying to gain insight into how the world is going to solve what I believe to be a next to impossible economic situation.

The last green shoot comes from China. The Chinese recovery is more a flood of money pushed into the streets along with doctored statistics. I have read some things about the Chinese real estate market, which has to be 4 or 5 times the size of the normal US market, but only for a temporary period of time. The real business in China is building, not manufacturing and I am reading of entire cities of empty buildings. Thus, once this surplus is exposed, once the speculative bubble bursts and once the truth about the Chinese economy comes to the surface, the whole game washes out. It appears that the Chinese housing game has about 5 to 10 years left then the dance stops. I don’t mean it slows down, but just flat stops. They have enough housing under construction right now for about 70 million people and enough capacity to build about 50 million worth of housing annually. There are only about 300 million people left to move from the rural areas, thus 6 years minus what is already sitting around vacant and the game is done. I don’t even bring up the fact that the Chinese population is set to start expiring at a massive rate in a few years as the 1 child policy begins to take its toll. This is not good news for the mining industry and for those that believe in peak oil as already being reached. It is good news for the rest of us, save the fact that the economic impact on the world is going to be great.

http://mannfm11.blogspot.com/2009/08/what-green-shoots.html

This report is very good at showing the deflationary bomb that there is in China, but it gives no answer as what will be providing the match that will trigger the explosion.

It cannot be through creditor strike (like for the US real estate bubble in 2007) because finance in China is under the thumb of the Party and there are no external financial constraints. In a sense, it is similar to Japan post bubble : After all the Japanese managed successfully to keep the lid on the pressure cooker for two decades (and counting…).

The endgame occurs when surpluses turn into deficits. Then, “hot money” investors smell blood and rush out for the exits, triggering the internal financial mayhem. Note that there is a lot of “hot” taiwanese, HK, and ASEAN chinese money in China, this is where the FDI come from. They will be the first one to try to withdraw their chips if the be turns sour.

How could surpluses in Japan and China dwindle ? My bet is on protectionism : both Europe and the US need jobs and nominal GDP growth and it will be soon irresistible for parliamentary bodies to put tariffs as it brings both goods. Lobbyists representing multinational will try hard to slow that process, but will be ultimately defeated by the survival instinct of lawmakers if popular resentment gets too strong.

if talks in copenahgen go well, the chinese will have a whole new avenue for capital investment with a multiplier effect for return:

invest in clean energy and see long term roi while simultanouesly exporting carbon credits to wold markets for short term capital.

a command economy like china’s with the labor force and experience in capital expenditures in uniquely positioned to take advantage of such a situation

I find it hard to believe that growth can be based on building Potemkin villages…sorry, Potemkin cities.

In Tsarist Russia perhaps, but pretty difficult today, I would imagine.

Thanks for drawing our attention to this interesting report Yves. If China cannot invest productively domestically and is not ready to consume more of its income, perhaps it makes sense for China to invest in the US – providing that the US honours its debts of course!

The starting point of this debate should be this – How did the Chinese get to holding US$2.3 trillion of foreign reserves when its per capita gdp is only US3,500? All the arguments about low return on capital (ie low productivity growth) is not supported by factual observations like high reserve holdings and dramatic improvement in standard of living (does anyone know what China in 1992, when it launch its stock-market looks like?). In fact, if one loosk at the total accumulated capital stock in China, its amazing how little they have accumulated in the past 30 years. Many of the arguments of over-investment is confusing balance sheet item with profit and lost item. Remember – fixed investment is an asset on the balance sheet, gdp is more like the revenue item on profit and loss statement. Ratios based on comparing these two items need to be handled with care, especially in an emerging economy still in the process of accumulating capital stock. Japan and US are no longer accumulating basic capital stock. Most emerging economies should still be accumulating basic capital stock! History has proven that without capital stock, there will be no increase in productivity!

It is rather amazing that the experience of a country that has against all odds, engineered unprecedented improvement in living standard of 1.3bn humankind, is not being more carefully studied. Having read the book “The Coming Collapse of China”, I am still waiting for it to come true. Fortunately, even when it comes true now, the average living standard of the 1.3bn Chinese would still be tremendously better than when the book is written.

Lohorrea,

The US should still be accumulating capital stock – see the thirteenth of today’s NC links (which mentions the potential for investment in NE US railways). But Americans obstinately refuse to exploit opportunities for collective investment.

Apologies for getting your name wrong Logorrhea!

This is the guy that produced the video of empty buildings in Beijing a few months back? I wasn’t terribly impressed by his presentation back then either.

I’m not exactly a China Bull. A decade ago, I moved here a terrible China Bear, in light of its then property bubble bursting. The experience schooled me pretty well. Even Andy Xie, who has been bearish since the property recovery began in 2002, decided to buy Shanghai real estate in 2007, and probably hasn’t lost any money on the investment.

I seriously doubt the existing square footage in the comparisons were not better quality than the current Chinese comparison. I also comparing population density with the US is bullshit without also showing how tier-2 cities have populations larger than the greater New York City area. It’s a different world, and those comparisons are disingenuous.

The banking sector here will soon be encountering difficult predicaments. There is serious analysis that can be done. But this feels like a series of one-sided “gotcha” points that are only applicable without legitimate context.

Was just re-reading Galbraith’s classic account of the 29 crash, and he lists several causes of why the crash occurred:

-Overspeculation and bezzle

-Income inequality and consequent dependence of the economy upon non-disposable goods (poor people buy food, rich people buy cars etc)

-an economy highly reliant on capital spending (since non-disposable goods require more capex)

– poor business structure (overuse of leverage in holding companies)

– imprudent banking

– an economy overly dependent upon exports (remember, this is 1920s America) and as a result a large amount of capital held overseas in risky countries.

-captured regulators

Ummm, does any of this ring a bell in the context of China? I have no close knowledge of the country and so can’t judge the report’s claims that urbanisation has largely run its course, but Pivot does seem to make a compelling case. Combined with Galbraith, it’s rather alarming.

Yes, context is important …

The ruling elite gangs and their central banker shills are very smart. Trade wars, tariffs, and protectionism are coming for sure. They are a divisive layer of the intentional perpetual conflict being created in the masses globally. China was sucked into the global credit bubble with the intentionally false demand created by that cheap global credit bubble (and concurrent deregulation/corruption in scamerica; NAFTA, favored nation status, dumping the Glass-Steagall Act, etc.). And now, with that false demand in decline, the Chinese scramble to build domestic markets and will only become domestic debt slaves to their local ruling elite banker gangs. Its classic formula bubble with a geopolitical twist.

Who has the big guns? Who has the big financial guns?

Are credit and derivative products financial bunker busters, daisy cutters, and predator missiles?

Deception is the strongest political force on the planet.

Knock-knock! What’s the difference between a capitalist economy and a socialist one? Investment can be made without reference to the rate of return. The only limit is the amount of physical waste and the population’s perception that their living standards are declining. Has this person ever been to China? The Chinese are “overhoused” especially compared to the rest of Asia? How does one make such a blanket statement? I guess the must be overfed overclothed and overeducated too.