By Rob Parenteau, CFA, sole proprietor of MacroStrategy Edge, editor of The Richebacher Letter, and a research associate of The Levy Economics Institute

This 2009 analysis by UBS, presented in FT Alphaville, debunks a central tenet of the deficit terrorist camp:

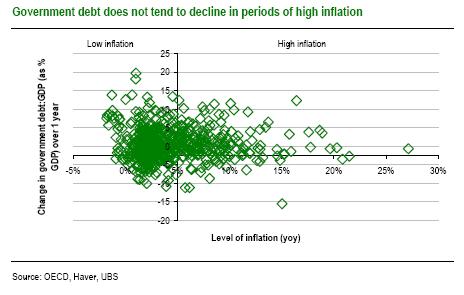

If the deficit terrorists were correct, there should be a much more defined population of the northeast quadrant of the graph attached and discussed in the link. Increases in public debt/GDP ratios should, under the logic of deficit terrorists like Pete Peterson, be associated with observations of escalating inflation. There should be a well defined cloud of historical observations moving up and to the right from the origin of this graph. No such thing to be observed.

Of course, one must be careful with this UBS analysis, since neither do they find a cloud of observations moving definitively in the southwest corner, as many of us might expect from fiscal retrenchment sucking cash flow out of, and reducing the net worth and net financial assets held by the private sector. Public debt to GDP ratios can obviously fall because the denominator is growing more quickly than the numerator, so again, this is a crude display at best, but I know from experience these do tend to become touchstones of market lore.

It also commits the heresy of assuming bond investors can en masse “require” an inflation premium without reducing the value of their existing holdings, a paradox Keynes used to critique Fisher’s interest rate theory which Jan Kregel has highlighted in some of his work, but still remains largely ignored by many.

Yeah? Well his premise is as irrelevant now as it was in 2009. The problem of the ‘spend like there’s no tomorrow’ clowns such as him (since we’re throwing epithets) isn’t inflation, it’s the spending itself and what it turns us into.

Nice attempt at demon-creation though (did he work on the Greek defense also?).

Jo –

I usually do not hurl ephithets, but somewhere between seeing all the schools in NY State and KC that are getting shut down, and seeing Glenn Beck dressed as a storm trooper on the cover of his new book, Arguing with Idiots, at the airport last night, I have to admit a lightbulb did finally go off in my head. Or maybe it was just what the statisticians would call a “spurious correlation”…or as my proper Bostonian grandmother used to say, if the foo sh*ts, wear it.

Take another look at what I wrote. Nowhere in the piece did I make the argument that government spending should be infinite or unlimited, right? For example, if you get accelerating inflation, there is a strong case to be made for sucking cash out of the private sector by raising taxes and cutting government expenditures. Hopefully, that is something we both agree upon.

But maybe you shouls also try thinking about it this way. You don’t want the government to spend like there is no tomorrow. We both want the private sector, particularly households, to save as if there will be a tomorrow. Part of what got us into this mess, after all, was the high deficit spending by households, as they consumed more than they produced.

If you agree that households need to save like there is a tomorrow, and that is part of the solution, not part of the problem, then by definition, some other sector in the economy must be willing to deficit spend if that desired household saving is going to become actual household saving.

Repeat after me: unless one sector spends more than it earns, another sector cannot earn more than it spends. That’s double entry bookkeeping, not high theory. So take your pick: it can be the foreign, the business, or the government sector that deficit spends in order for the household sector to net save, but someone has got to do it or else the attempt by one household to save will just lead to dissaving by another households. Then consider of this list of three other sectors, which one cannot default, unless it choses to do so for political reasons, because it creates the money that we use to pay taxes and buy government bonds.

It really is that simple – if you want households to save like there is a tomorrow, then some other sector must be willing and able to deficit spend. If you chew on that long enough, you’ll get a strong enough jaw to bite the ass off the next deficit terrorist you come across.

And yes, I did work on the analysis suggesting the eurozone has just signed itself up for a half dozen Latvia like implosions to take place, taking Germany and the Netherlands out with them as bad bank loans and eroding trade surpluses with the periphery come back to haunt these two as well. Good to see you are paying attention – send me an e-mail in 6 months and tell me whether I was right or not on the eurozone analysis.

I suggest you and Yves “familiarize yourself with basic fiscal accounting” and retire this old canard.

Repeat after me: money saved IS MONEY SPENT. All bookkeeping can tell you is what sort of goods consumers are spending their earnings on, consumer products or capital goods (“savings”). It is a choice regarding expenditure, not a leaky faucet that must be compensated for by federal deficits — and it is a choice made in view of a government that encourages consumption and discourages investment. Capital is vastly different from govt debt… it is meant to be beneficial both to all parties. Furthermore, unless deficit spending is focused on replenishment of capital – we both know it’s not – then how does it in any way address the problem of a low savings rate, that is depletion of said capital? And why, coincidentally, should deficits change the spending habits of consumers and thereby increase the savings rate? Can you explain the mechanism for that? Are you saying that the primary market for government bonds is the American consumer? I’m chuckling at that. And, since you acknowledge that both sides of the balance sheet must add up, how can you suggest that private savings are a good if they must necessarily only come about from an equal increase public debt, which must then be paid off through taxation or inflation (or default)? How is there to be a net benefit in this scenario? Let me put it another way: who’s the sucker?

Deficit spending is no different from any other spending. It must be paid for. Consequently it does not bring forces to the market, it merely redirects them. So instead of getting what we want, we get what we’re told we need: bailouts, wars, make-work schemes. And WE PAY FOR THIS, no different than if it was groceries or gasoline – do you understand that?

You might try focusing less on bookkeeping and more on common sense. It is entirely possible for the numbers to improve while quality of life gets worse.

Furthermore, this graph of yours is laughable in terms of what you seek to draw from it. You must have a window greater than one year if you’re going to make any judgment on the inflationary impact of deficit spending. Literally, all you can infer from this data is that most great increases in public debt take place during periods of relatively mild inflation — probably because they occurred during recessions.

So why do we get unemployment then Costard?

If everyones savings is in fact another form of spending why does the GDP drop when we save more??

You’ve been completely bamboozled by your econ 101 class. Capital is NO different than govt debt. All govt debt IS capital. It is an interest bearing asset for the private sector (if owned by the private sector)

Deficit spending NEVER has to be “paid for”. It is the creation of brand new money. The govt only requires that you pay a certain tax rate (which can change depending on conditions) they never require we pay the deficit back.

As to your comment “It is entirely possible for the numbers to improve while quality of life gets worse.” YOU ARE RIGHT.

Just wait to see what happens to life in those countries that get bamboozled by the deficit terrorists to make those “deficit numbers” and “debt ratios” look better.

Well said, Rob and company.

I find Costard’s assertion that savings is money spent to be counterintuitive. If I buy U.S. Treasury bonds, is that money spent? Does that provide as much income to others in the economy as if I had, for example, hired a gardener?

Unemployment exists because people quit or get fired. It is exacerbated in any number of ways. Savings rates rise when there is a credit crisis because people can no longer borrow. Savings decline when you have a credit boom pushing easy money. I’d like you to introduce you to Causality. Get to know her, if you get a chance.

“Deficit spending NEVER has to be “paid for”. It is the creation of brand new money. The govt only requires that you pay a certain tax rate (which can change depending on conditions) they never require we pay the deficit back.”

Have you even seen a treasury note? Govt debt always gets repaid. That’s why it’s “safe”. Whether the government can, in the future, issue new debt and recycle the outstanding deficit, is an UNKNOWN because it is in the future. If you think that the issuance of treasury bonds is “the creation of brand new money”, then you are hopeless.

Detroit Dan – the short answer is yes. Every cent you put into bonds is getting spent by uncle sam. This does not mean it’s being spent wisely – I would argue that it’s almost certainly being spent foolishly… but it is being spent. If you deposit or invest your savings, it is essentially converted into a loan – to a bank, a business, etc. Where it is spent. And if you bury the money, there will have a tiny but proportional effect on the money supply, and increase the spending power of someone else’s dollars. There is no entropy.

Costard,

Regular hiring and firing is frictional unemployment, not the sustained sort that poses trouble to an economy. If that were the driver of unemployment (as opposed to a slack in overall activity) the rate would be very low, 3-4%. So you have not answered the question.

And with all due respect, I suggest you look into government funding mechanisms and currency operations. It works very differently that you think it does. A government that issues its own currency does not need to sell debt at all to operate.

I am not familiar with the term “deficit terorist” so obiously I can’t say what their beliefs are.

However, UBS couldn’t even value their own stuff right and didn’t see anything coming before the crash. So, their analysises are probably self-serving, but at least they inform you only of what they want you to believe.

With all due respect, this is a data scatter. All you have done is make an ad hominem attack. That is no way, shape or form discredits their argument.

Please explain deficit terrorist.

Thanks

UBS is not human, so the attack cannot possibly have been an ad hominem attack and their track record speaks for itself.

Alexandra,

I have no doubt you know full well that “ad hominem” is a well known is an attack on the source, whether male (as in the Latin), female, or an organization (“oh you can’t trust Fox”). It is not considered a valid form of argumentation in rhetoric, since it does not disprove the validity of the argument.

Ad hominem is just “argument toward the person” or “argument against the person”

Person 1 makes claim X

There is something “objectionable” about Person 1

Therefore claim X is false

Yes, like if a child molester hands you a scatter graph of his whereabouts in the last twenty four hours, don’t trust it.

Deception is the strongest political force on the planet.

It is either a shoddy or a deceptive graph, were axes are scaled differently and don’t go through the origin. To make meaning of it I have to transform it back mentally.

A deficit terrorist is someone who insists, at all costs, the fiscal budget must either be balanced or brought into surplus (as when tax receipts exceed government spending)as soon as possible…like tomorrow would be best.

They unfortunately (for the rest of us) do not realize that if the government rapidly sucks cash flow and net financial assets out of the private sector, odds are we will get a vicious spiral of falling private incomes and private debt distress, but they will also fail to get to their much vaunted surplus because tax revenues will fall with private income, and unemployment and financial distress related government expenditures will go probably rise as well.

We have seen this movie play out before in Argentina almost a decade ago, in Latvia last year with a real GDP drop exceeding that of the US in the Great Depression, and we are about to see it replayed in Greece this year.

Deficit terrorists are convinced the US is about to default or fling off into a hyperinflationary spiral. They do not realize (even the rating agencies do not get this) that a government with a sovereign currency cannot run out of money to service its liabilities. While it is indeed possible for fiscal deficit spending to fuel a hyperinflation, as we saw in the Weimar Republic in the early 1920’s (and which helps explain why German policy makers are so dead set on imposing arbitrary limits to deficit to GDP and public debt to GDP ratios on themselves and on the eurozone), as I argued in a recent Richebacher Letter (entitled Weimar 2.0) and as the UBS scatterplot above demonstrates, the conditions required for a hyperinflation to rip through a nation seem to be more than just a rising public debt to GDP ratio.

My apologies if I have offended you or anyone else by taking up this epithet of deficit terrorism, but as I explained to Jo above, what is really going on now is all too obvious to me.

From your description, these people you describe are not really “Deficit Terrorists”, but rather…”Overly Concerned About Deficits Terrorists”.

Deficit Terrorist. It’s a stupid term makes about as much sense as calling an Islamic Terrorist an Infidel Terrorist. I guess that makes you an Adjective Terrorist.

Moving on from the riveting etymological discourse and as for your post, I have to admit, it certainly is an interesting counterpoint to the impending doom scenarios.

But, when you responded to Jo earlier about the private sector “saving like there’s no tomorrow”…do you really think that the private sector is even close to such frugality? I don’t. The private sector spent like drunken sailors, and now they’ve cut back. That’s not anything close to “saving like there’s no tomorrow”.

Then, when you say: “So take your pick: it can be the foreign, the business, or the government sector that deficit spends in order for the household sector to net save, but someone has got to do it or else the attempt by one household to save will just lead to dissaving by another households.”

OK, I choose the foreign sector to pick up the slack and not the government.

Obvious response: It’s not your choice!

OK, fine. Then, I don’t want to prolong the inevitable. The epic private sector debt binge, followed by an epic governmental debt binge with no epic reversal on the foreign demand binge isn’t going to end well…and a scatter chart that freezes a moment in time doesn’t mean you are not immune to Heisenberg’s theory.

From a particular frame of reference, you can either know the location of something or its speed…but not both. You’ve chosen locale, replete with 4 quadrants. This point of view is useful and hopefully equanimity to the hyperventilation.

Others, though, like Krasting at 8:05 am choose to look at movement. Many don’t like where this train is headed.

The Non-Nihilist Deficit Terrorist doesn’t want to blow up the train…they just want it to traverse a new track. If the trip will be long and arduous, better to get started sooner than later.

The private sector is retrenching. Saving like there is no tomorrow is overstating it a bit but they certainly need to in order to get out of debt.

Robs point is very simple. When the private sector goes into saving mode and the export sector goes into import mode the public sector MUST run a deficit unless we want GDP to completely tank.

You state you prefer our export sector make up the difference instead of the govt. Well the only problem with that is that means producing more and needing someone else to consume on the other end. Who is going to do the consuming?

It (a stronger export sector) might happen down the road, but for NOW we need to run govt deficits to keep our economy afloat.

The ONLY alternative is continued deflation and unemployment.

Greg, I would add that there is also the added complication of the US dollar being the global reserve currency. Therefore, many foreign countries want dollars (like to pay for their petro imports) more than they want US goods, so they desire to be net exporters to the US. This also works against the US becoming a net exporter. So when the US consumer wants to increase saving and deleverage, this reduces nominal aggregate demand, which also reduces the desire of business to invest. That leaves government to make up the sectoral balance with deficits, if real output is not to fall below capacity, resulting in rising unemployment and recession. This is simple accounting, not theory.

Dean Baker seems to feel that Pete Peterson is aiming to get control of the Social Security fund. If he can scare people and influence politicians to give him control of the management of Social Security under the guise of limiting deficits by limiting entitlements, he can become even wealthier.

One example URL: http://www.prospect.org/csnc/blogs/beat_the_press_archive?month=01&year=2010&base_name=look_for_news_articles_from_th#117965

Yes, what many people who have fallen under the sway of the deficit terrorists do not realize is they have been duped to serve the interests of the financial elite who have been, along with their predatory puppets in DC, been systematically looting the nation for longer than I can stand to recognize.

The day Social Security gets privatized, a wide swath of large institutional investors receive a revenue and profit bonanza. Recognize behind the sweet sounding insistence on sound government finance and fiscal responsibility, there is a not so hidden agenda that lines the pockets of the financial elite…just look at Peterson’s background and you’ll understand his interests. Lehman, Blackstone – need I go on.

Having said that, let me be clear. I was born in a state with license plates that read “Live Free or Die”. I really do not care to have the government telling me how much I need to save out of my income flows and where I can invest it. But I spent over 25 years working for an investment management firm, and I recognize most people in this nation have unfortunately been left in a state of financial illiteracy, because that makes for great broker bait.

So personally, I am quite open to the idea of some form of personal responsibility for retirement, as long as financial literacy curricula are integrated into the math programs of schools…assuming there are any left open by the time the deficit terrorists have completed their scorched earth campaign.

It seems to me a narrow point, but valid, pending more discussion. I looked at the FT piece for reference to currency devaluation or wage inflation, but saw none. I suspect the inflation arguments rest in some part on these. Is there rebuttal?

Deficit terrorists? WTF is the guy talking about? What does he want to see happen?

The argument seems to be that deficits and debt either do not matter or are less bad than the alternative of balanced budgets, or….?

If ever there was a financial adviser to run a mile from, its this guy. No power of logical thought, and even less power of clear expression.

“Deficit terrorist” seems to be a neologism, a web search turns up the above-mentioned sources first.

It seems to be meant as a term for anyone who says “if we keep running such high deficits, something awful will happen”. The use of the loaded term ‘terrorist’ implies that the cassandras who issue the warning are themselves in a position to make the awful something happen, say, by shorting treasury bonds.

Perhaps just saying that the deficit is too high will stampede the herd, like shouting ‘fire’ in a crowded theater.

The use of such terms as ‘deficit terrorist’ by prominent commenters (e.g., Krugman) is an example of the debasing of language and political argument. Anyone who disagrees with you and yours, even on such mundane terms and budgets and interest rates, is a terrorist.

Next they’ll be suggesting that balanced-budget fruitcakes be sent to Gitmo for some economics re-education.

Next up: “Short-sale terrorists wreak havoc in stock market”

Yes Captain, that does seem to be the way it has evolved. As I responded to Jo, it is not my usual style of engagement.

And while your Gitmo suggestion may appeal to Krugman and others, I’m much more interested in Nuremberg Trials for the sociopathic looters in the financial elite and their predatory hand puppets in DC. Geithner and Greenspan up first, then on to Fuld, AIG’s wisest, and the rest of their pals who were performing, as GS CEO Blankfein put it, “God’s work”. We are a good 18 months past the Lehman bankruptcy, and only Madoff got hung out to dry. That is, to my mind, both insane and inexcusable. Now pass me my pitchfork.

Michel,

I suggest you familiarize yourself with basic fiscal accounting.

Domestic Private Sector Financial Balance + Fiscal Balance – Current Account Balance = 0

Again, keep in mind this is an accounting identity, not a theory. If it is wrong, then five centuries of double entry book keeping must also be wrong.

So if we have no trade deficit or surplus, if the private sector wants to save (for emergencies, retirement) the government must run a deficit.

When you get your mind around that, then you might be able to absorb what Rob is saying.

It is worth understanding the fiscal accounting identity you refer to, but that identity does not demonstrate that running a huge fiscal deficit on top of a current account deficit is sustainable. Like anything else that can’t go on forever, it won’t. Where are we in five years if, as many suspect, the US government cannot inflate or devalue its way out of a spiraling sovereign debt?

Yves – Given the state of the US education system, it may be that 6th grade algebra is a bit beyond the reach of many, so do show some compassion if this is not sinking in with everybody.

All you have to recognize here is that one segment of the economy cannot possibly hope to spend less than it earns (net save) unless another is willing and able to spend more than it earns (net deficit spend).

There are, after all, two sides to every transaction. If we look at the financial balances of a sector in isolation, as the deficit terrorists tend to do, we set ourselves up to perrform all sorts of mischief…which we are apparently very good at, and we are about to see demonstrated live, in Greece and the other peripheral eurozone nations. With any luck, the dots will get connected before the swarm of locusts flee to the UK, the US, and Japan.

I think we get the algebra. You assume that those borrowing intend to pay it back. Given what the government is spending it’s money on (banks, wars, pensions, prisons, war on drugs/terror/war), that’s a bold assumption to make. Most people hate a significant amount of what the debt is being accumulated for and will not worry about defaulting on those “investing in torture/bailouts/pork”.

Separating the political nature of spending from the economic nature of government debt should be left for a textbook.

Yes, Brian, I agree the current priorities in US fiscal policy are horrendous, to put it mildly, and evidence of a political class that has been bought and paid for by a variety of special interests, not the least of which includes the best of Wall Street’s sociopathic looters.

Hell, here we are 18 months after Lehman, and remind me again, who’s in jail.

As I replied to another reader, we have a very serious problem with both political and corporate governance in this country. We need to address that. It won’t be easy. But it is long overdue, and maybe, just maybe, we have reached the point where average every day people are willing to stick their necks out to start dealing with this elephant in the room.

But if your main argument is correct, the swarm of locusts should be powerless. They should be beaten in the markets.

They are only powerless if they dont in fact get govts to change their fiscal strategies. That is the power they seek, to force austerity packages on electorates.

They will be “right” if they actually get govts to stop spending because then there will be more unemployment, more hardship, less production and as tensions rise we might see all sorts of financial displacements.

Domestic private financial balance + fiscal balance – current account balance = 0

1) I’d like to see a derivation of that based on the definitions.

2) Where does money printing by the Fed go in that equation?

Less than Prime Beef –

For a derivation, try Part 1 of my piece on Naked Capitalism last week, entitled “Of Fiscal Correctness and Animal Sacrifices” or some such thing. It comes straight out of macro 101, where total expenditures on final goods and services = total income from the same, or alternatively, and equivalently, total saving out of final income flows equals total investment in tangible capital (houses, capital equipment, plant, etc.)

Or you could go to the Levy Economics Institute and find anything written by Wynne Godley, perhaps starting with the earliest pieces from the mid ’90s like Seven Unsustainable Processes. Or you could shell out the dead presidents for the book he wrote with Marc Lavoie sometime in the past decade if you want to go deep with this. In addition, there is a growing base of research on the Levy website that will take you into a stock/flow consistent (SCF) approach to macroeconomics that could get you up to speed as well.

Where does money creation by the Fed or by commercial banks show up in the financial balance equation? If you are familiar with cash flow statements used in business accounting (sources and uses), the financial balance equation is working with the net of the first two sections of that statement – cash flow from operations plus cash flow from (or more likely, used in) tangible capital spending.

What is left is the cash flow from financing section, and this is where new credit or money creating activities shows up.

So the financial balance equation captures the net flows of cash in macro sectors related to the sale of final goods and services. These flow imbalances build up over time in the form of balance sheet disequilibria.

So, are you saying domestic priviate financial balance excludes the macro equivalent of a business’s cash from operations and tangible captial spending?

Less than Prime Beef:

No, I never said that. Nonfinancial business sector cash flow from operations minus tangible capital investment is included in the domestic private sector financial balance. In the financial or business world, this is often referred to as free cash flow, when the difference is positive, if that helps. For further details on these definitions, I would recommend anything Wynne Godley has published on the Levy Economics Institute website. billy blog also promises to go into the details of these calculations in the near future. Suffice to say the inputs to the financial balance equatiton can all be found in the Fed’s Flow of Funds accounts, printed quarterly. Hope that helps.

This accounting identity is new to me. Can you recommend a link which explains it?

How, for example, did this work with the USA in the 19th century? The government was not very indebted, nor was there a big trade deficit. But yet, presumably, net saving was positive. So who was carrying the counterweight of debt? Banks? Foreigners?

Thanks.

Krugman is a sell out neo-con terrorist slut … having been instrumental in conning everyone into this intentional credit bubble/derivative global financial coup he now works to elevate the perpetual conflict in all of those affected.

Deception is the strongest political force on the planet.

Another teenager who has just finished reading Atlas Shrugged and actually believes it.

Seriously, go back to watching the best of Kudlow.

Hey duke … you need to peeeeeeeeel away some of those layers of what you have been through …

Deception is the strongest political force on the planet.

I have often taken issue with Krugman, and you are wrong on this one. He was early for someone who writes in the MSM to call the housing bubble. He was also a critic of the Bush deficits. You may not like a lot of what he writes, but your attack here is greatly overstated.

A shill mouthpiece for; corporate globalization, the Clintons, ‘free trade’, ‘deregulation’, Enron, etc. … a corporate media, New York Slimes system choir boy, Krugman is an opportunist. He piles on milliseconds after the hard work of revealing the hypocrisy is done to ‘relate’, and then, spews the hate mongering divisive dialogue. All of that Bush bashing was a very late to the party, fake partisan, pile on ruse. He has been instrumental in co-opting and steering ‘progressives’ with his trumped up credentials and ‘Nobel Prize’, you know, like fellow puppet Obama was awarded. He should get the Leo Strauss ‘Noble Lie’ prize.

Sorry, I don’t share your enthusiasm — he helped to create this bag of shit and now he stirs it up.

Deception is the strongest political force on the planet.

Yves,

“He was also a critic of the Bush deficits”

This brings up an important point. Perhaps it is heretical of me to ask this, but were the Bush deficits really wrong in light of what we are reading in this post? Shouldn’t Krugman be defined as a recovering Deficit Terrorist?

I think this is the problem that many people, particularly on the Left, have with all this talk of deficits. They spent eight years denouncing the Bush deficits only to be now told that Cheney was correct after all!

Personally I think Keynes was right that normally the government should act counter cyclically: tax during the boom and spend during the bust. If we look at the time Bush came into office, a recession was starting and just before, during the late nineties, we had been running a surplus. It seems to me that it was quite orthodox for his Administration to start deficit spending at that point. Furthermore once the recovery started it was often called a “jobless recovery” and that was even with the huge deficits Bush built up in his first few years. Surely had he cut the deficit, unemployment would have sky-rocketed higher.

My point is not to defend Bush. What I worry about is a partisan system that corrupts critical thinking. How many people on the Right in the 90’s, when Clinton was in office, were so against the US being the world’s policeman and all they could talk about were “exit strategies”. Then as soon as their boys got into office they suddenly dumped all that anti-war rhetoric and cheered the disaster in Iraq.

So perhaps there needs to be a discussion of when deficits are appropriate that would distinguish between the Bush deficits and the Obama deficits. Just like war is not always wrong (if someone attacks you you have the right to defend yourself), deficits have their place as well.

But own thought is that the real problems in the US are trade-based (the destruction of the manufacturing base) combined with a parasitic financial sector. Deficit spending just tends to cover up the real nature of the problem, similar to the way a stimulant helps disguise a serious underlying disease. So while it would be very painful short term — cutting the deficit and allowing the true problems to be revealed — this seems to be the first step towards finding a solution. This would force some of the imbalances due to Chimerica to be resolved – hopefully in a peaceful way (which I know is the danger in what I am proposing).

Kevin,

Andy Xie makes an interesting point in passing in a piece that will be listed in Links (going up in the next 15 minutes). The problem isn’t Keynesian deficits (and I stress Keynesian, Keyneianism is NOT Keynes), it is that the fixation on macroeconomic policy is a bad policy focus. It is an economist’s version of “if the only tool you have is a hammer, every problem looks like a nail.”

Of course, there are TONS of other tools to influence economic performance, but macroeconomic policy is seductive because it is fast and easy. So we try to fix structural problems with hits of amphetamine. It works for a while, but as the structural problems remains unresolved (and even grow worse) the adrenaline gives you less in the way of results.

And the predisposition not to use other tools in the US is even greater than elsewhere because we have a pervasive “free markets” ideology, so we have industrial policy set by special interest groups rather than by setting national priorities. So we over-invest in housing, subsizide sugar like crazy, give massive R&D to Big Pharma and still allow it to charge consumers a ton (and spend more on marketing than on their OWN R&D).

Yves (and Kevin):

That’s right. Read the General Theory. You will find little reference to the countercyclical fiscal policy that is associated with Keynes’ name.

What you will find in his writings is an emphasis on using monetary policy to lower interest rates to encourage private investment spending, and an emphasis on using longer run public and public/private investment to take the economy to the point of full employment without inflation when the private sector could not get us there on its own.

So now we have definable long term needs that are not being met by the ultra short run focus that institutional investors bring to the market (because of the short run incentive structures they face). These include energy, water, health care, and education infrastructure, to name but a few areas. Assuming we the people could take power back from the parasitical sock puppets posing as our elected representatives, which I admit is no easy task, Andy Xie is right.

There are plenty of policy tools to encourage growth in the new, higher value added, higher social return areas of investment, which will help put the structure of productive capacity on a better, more competitive footing while older, lower value added industries fade out.

Asia has been doing this for decades, and the reason they are eating our lunch has something to do with this conscious and policy facilitated shift to higher value added industries. I also address this at the Levy Institute/Ford Foundation speech I gave last year at the Minsky conference in NYC with my triple threat comments (audio and text at Levy Institute website).

It is so obvious you are right, and this long run strategic investing issue must be brought to light. Investors playing for next quarter’s earnings report to be the management guided expectations by a penny are not necessarily going to get us where we as a nation, or a as a world, need to be, and can be.

I-on-the-ball,

>> Deception is the strongest political force on the planet.

I’m having a case of deja vu. But, did I ask you to explain this phrase once? It sounds good at first. But, “deception” itself is not a force. It’s a tool. Maybe it should be “deception is the strongest political tool in the arsenal”?

Maybe that needs work. But, it makes more sense, at least to me.

Deception is a force within an organisms sensory integrating control center. It works in conjunction with its opposite force, perception, to create tools of dominance [externalizations in higher organisms] in order for the organism to get its needs met.

Deception is the strongest political force on the planet.

Does it debunks a central tenet of the deficit terrorist camp?

A scatter chart can just suggest various kinds of correlations between variables with a certain confidence interval. Far from suggesting linearity or any causation like saying that low debt/gdp ratio means inflation later on. Even because the data on the chart seem to be collected on the same year whereas correlation or causation effects between debt/gdp and inflation could be stronger at different time (debt/gdp variable might lag behind inflation of 1 or 2 years).

M.G. – Totally agree. At best, this scatterplot is only a first cut. The relationship between changes in the public debt to GDP ratio and the level of inflation may be complex and contingent.

But you must admit, it is interesting that no obvious correlation between rising public debt ratios and accelerating inflation emerges from this scatterplot…and UBS did not even see this, judging from the text (although I realize, they were not looking, and I should also say I have met Paul Donovan and he is quite adept).

If others have seen more complete or more sophisticated research, please do post the links. As I mentioned to Jo above, I do believe most people familiar with the Weimar incident and Latin America’s hyperinflation history reasonably acknowledge fiscal deficit spending can play a role.

This is especially the case in the context of labor markets with rapid cost of living escalator clauses in their wage contracts, and especially when productive capital equipment and plant is being taken off line or laid to waste as entrepreneurs divert their reinvestment efforts into speculating in hard assets that are not easily reproduced, like land, antiques, and gold (what the Austrian School calls the flight to real values). In other words, there are supply side elements that have to be brought into play as well to get a full blown hyperinflation episode – fiscal deficit spending may at best be a necessary but not a sufficient condition.

From all the stuff Ive seen examining Weimar and Zimbabwe (Bill Mitchell does a great job here http://bilbo.economicoutlook.net/blog/?p=3773 ) I think a safe statement to make is that hyperinflation results when fiscal spending increases in the face of REAL price increases (shortages usually).

We are not in a real price increase situation right now. Deflation is the order of the day currently

Yes, Greg, there tends to be a destruction or abandonment of productive capital equipment and plant that produces a supply shock or adverse supply curve shift as well. This appears to be a crucial component of a sustained hyperinflation episode which the deficit terrorists do not always mention.

This happens naturally as entrepreneurs turn into commodity speculators, art collectors, real estate (especially ag land holders), and precious metal horders as inflation escalates, rather than reinvesting profits in tangible, productive, capital equipment. Those of you who were adults during the ’70s in the USA will recognize some of these features. Chinese porcelains became the rage amongst high net worth individuals as the stock market went nowhere, and the middle classes got caught up in real estate speculation. I should mention it may also take the form of capital flight from a nation with escalating inflation, as I would suspect is often the case in Latin American hyperinflation episodes, but I will let people with an expertise or experience in that area speak for themselves.

It seems to me whether inflation

occurs or not depends on where the next speculative

bubble shows up. For example, say oil

prices are subject to a speculative

bubble fueled by all those lurking

dollars. Then what happens is that the prices

of everything that depends on oil

must rise also.

Can we predict whether there will be a

speculative price bubble on the value of

oil? I imagine this cannot be predicted

because price bubbles are by definition

irrational. It’s the nature of the thing.

Well, the FT article and the UBS analysis do (or try to) “debunk the myth” that governments could inflate their way out of debt.

quote\: Here’s an interesting counterpoint to the theory that governments are attempting to inflate their way out of their financial crisis-related debt dilemmas.\end quote

It does not say that large deficits wouldn’t matter.

BTW, it is not the deficit as such, which are the problem, but the interest you pay on it. Once you get past a certain point, you will be unable to service your debt.

This is not a problem, as long as you assume that you will always find someone willing to lend you money, even if they know that it will never be paid pack. But that would be more of a gift, than a loan.

I suggest you reread the headline and the post. They are both pointing to the data display shown. The post is not invoking either the FT article or the UBS report’s conclusions. It is using the data to make a different point.

And what would it be exactly the point to be made just looking at the chart? I would say from the chart we cannot say anything…

Precisely, M.G.

There does not appear to be an automatic and well defined relationship between rising public debt to GDP ratios and accelerating inflation.

Yet this is one of the planks of the deficit terrorists fear mongering campaigns. Apparently, it is a rotten plank.

All I am doing is saying take a look for yourself at the facts, not the assertions, and make up your own mind, which is what we are supposed to have the luxury of doing in the land of the free and the home of the brave. But there are too many people preying on your fears so they can get you to serve their purposes.

Your mind sees no well defined relationship, or at least no obvious connection between rising public debt to GDP ratio and escalating inflation pressures. I concur. So next time a deficit terrorist is corralling the herd with hyperinflation fears, this might be an interesting chart to put in front of them.

Alternatively, we can follow the late President Reagan, and simply conclude “facts are stupid little things” and just go along with Glenn Beck, Peter Peterson, and crew…although as was noted in the Naked Capitalism piece on the eurozone I co-authored last week, even David Walker seems to be having second thoughts these days.

Alternatively you can follow Berlusconi and get in the same cognitive dissonance of Bush’s supporters…

http://mgiannini.blogspot.com/2009/12/cognitive-dissonance-case-of-italy.html

Alexandra Hamilton says — “BTW, it is not the deficit as such, which are the problem, but the interest you pay on it. Once you get past a certain point, you will be unable to service your debt.”

Bingo!

And … add to that, the problem is also what the deficit is used for; to bail out a parasitic banking industry, finance the drone bombing of innocents in Pakistan and Afghanistan, and of course, pay for the sell out gangster slugs in government.

Deficits would be OK in a democratically controlled country with a utility banking system that made zero interest loans directly to citizens. That is what we should strive for.

Deception is the strongest political force on the planet.

Perhaps I’m just confused, but the article refers to the “northeast quadrant” and data points “up and to the right” of the origin as places on the graph where one would expect increasing inflation to produce lower levels of government debt. Shouldn’t that be the southeast quadrant, or data points down and to the right?

No, Mark, I am looking for something else in the UBS chart.

They are asking the question, does higher inflation reduce the public debt to GDP ratio in a way that is historially evident enough to warrant governments trying to inflate their way out of rising public debt to GDP ratios (since inflation, or rising price levels, will tend to increase nominal GDP, or the money value of final goods and services, which is in the denominator of the public debt to GDP ratio).

I am saying we can use the same scatterplot of historical observations to answer the question, does a rising public debt to GDP ratio tend to be associated with a pattern of higher and higher rates of inflation.

I hope that clarifies things. And as M.G. concurs above, there does not appear to be any such simple relationship evident in their data, so this must make us question the deficit terrorist assertion that higher public debt ratios are the sure road to Zimbabwe or the Weimar Republic.

I am a deficit terrorist. At least I have been called that. Too much has been made of the debt service to GDP ratio. Steglitz et al just look at that number and Say, “We can issue tons of more paper! The real cost of the debt is still very small”.

That is a way of thinking that is going to pulverize the big deficit countries. The total amount of the debt, not its annual cost is now the issue to focus on. The US leads in this. Look at Moodys today. We are going to lose the AAA in a few years. But that does not matter so much. The real problem is that the cost of this debt is going to rise in both real and nominal terms.

In two-three years we will be faced will a cost of the debt at 5%. The amount of debt will rise to 16T. That would put debt service at $800b per year. We won’t last long at that level.

Bruce, judging by what I have seen of your blog, I would submit you just aren’t hysterical enough to make the cut as a deficit terrorist – at least not when the time comes to round them all up in stadiums and drop them out of airplanes.

Yes, the higher the level of debt outstanding, and the higher the interest rate on that debt, the higher the annual interest expense will be on that debt. That is surely the case.

So in the future, there is certainly a case to be made that interest expense will be a larger share of government expenditures. But that does not tell us much about the size of the fiscal balance, because remember, government interest expense represents a cash inflow to households owning government debt, so GDP will also be rising, tax revenues will be rising (unless interest paid on federal debt is also made tax exempt like state and local municipal bonds) and the government interest expense to GDP ratio, as well as the government fiscal deficit to GDP ratio, may not rise as much as you would otherwise think.

These by the way are feedback loops rarely discussed these days, but once understood at the Fed, when Evsey Domar wrote an article “Burden of Debt and National Income” in 1944, when nations were staring at even larger public debt to GDP ratios and wondering how they were going to make it through the postwar period without runaway interest expense on public debt. His work deserves to be rediscovered, because this reflux channel to private income and tax revenues of government interest expense is rarely mentioned – yet it clearly has a thwartinng effect on the so called problem of the compounding of interest expense which is often cited by deficit terrorists, but which somehow policy makers managed to avoid following the huge public debt load incurred in WWII.

You do neglect to mention an additional point, which I believe is very relevant this time around that much of the US public debt is held by foreign bond owners. So the interest payments on public debt, which are credits by the Fed (on behalf of the Treasury) to the bond owners bank accounts for each bond coupon paid, will represent a flow of purchasing power to people outside the US. All else unchanged, this will tend to deepen the current account deficit, unless we develop our export products enough to attract those dollars back to us as sales revenues from our export shipments. Otherwise, foreign bond holders will net save those government interest payments and reinvest them in US issued liabilities.

That means ownership structure changes over time as US assets come under foreign control, but then again, given the state of corporate governance these days, as evident in the paucity of lawsuits against the looters of Wall Street firms, banks, and insurance companies, maybe this ownership change is a second or third order consideration. Maybe it is better that foreign owners get defrauded by those with a sociopathic bent operating in the executive suites of the financial world.

So no, I doubt you are a deficit terrorist Bruce, but you do raise some relevant issues, even though the challenges they involve may not be the ones you directly cite.

http://www.jstor.org/pss/1807397

Link for Evsey Domar “The burden of the debt and the national income”

Now on my reading list.

You are doing god’s work here. I lose my shit trying to reason with these people who have been so badly beaten and misinformed that I fear they (and we) are lost. I really hope not.

Thanks for the link Bob. It requires some math, but maybe I can find someone to translate this for those who are uncomfortable with that.

I will tell you, on a personal note, when Lehman went down, every bone in my body told me to take my family as far from Oakland as I could get them, find some land, and starting digging holes for potatoes. And as it turns out, I resisted that impulse, even though it does turn out my intuition was right – the system, if you read Sorkin or any of the other accounts, even Paulson’s, was that close to going t*ts up, if you will pardon my french.

The problem I quickly realized about trying to go Robinson Crusoe or Swiss Family Robinson in the face of the GFC was that no sooner would my potatoes be ready to dig out of the ground, a hungry crowd from the Bay Area would be killing me and my family to steal them from my land, regardless of how many boxes of ammo I stored.

So yes, we probably need to drop the illusion that we can all just say f*ck it, walk away form the mess, and go Daniel Boone. We probably need to start to figure out ways we can pull together and develop plausible, small d democratic solutions, or we will all hang together.

If this work is helping you get there, more power to you. Spread it wide and far because this is not going to be easy unless we are all willing to grow up a little more and face reality. It is very easy just to say screw it and give up, but that is unlikely to get us where we want to go…and time is running out to get this right.

Bruce,

Yo must be psychic!… “In two-three years we will be faced will a cost of the debt at 5%…”….I didnt know that!

I look forward to you becoming the richest man on earth with this knowledge…Lookout Carlos Slim! Resp,

Tell me why we should listen to Moodys??

Didnt they (sell their ratings)rate all those subprime CDOs, filled with liar loans, AAA so they could get top dollar.

I believe they made the same noise about Japan like 12+ yrs ago. Look at that hyperinflation in Japan. They’ve defaulted how many times since the downgrade?

Greg, my question is, who is paying Moody’s to put out this nonsense. The rating agencies had Japan lower than Botswana.

This “Humble” blog amazes me time after time. This was about the most moronic post I have read here. GDP means jack.

The author would be well advised to look at the 90 day late F2009 GAAP deficit and subscribe to John Williams so he can read that GAAP now stands for Geithner Acceptable Accounting Procedures. With a 9 trillion GAAP deficit if you are expecting ANYTHING but hyperinflation you are going to get your clock cleaned.

DavosSherman –

I am familiar with the work of John Williams, I have met the man on more than one occassion, I applaud his willingness to dig beneath the appearances of government data, because I know it is painstaking work, I know he gets little credit for it. I don’t always agree with his conclusions, but I do admire both his sincere intent and tireless effort to get to the bottom of things and capture the inconsistencies in the government reported figures.

I would encourage you to open your wallet and take out one of those green, black and grey pieces of paper folded in it. Ask yourself, where does this piece of paper come from? You cannot print it. It does not come from any other household. It does not come from your employer, unless you work for the government. The nonbank private sector cannot create money (and to be clear, by money I am referring to a means of final settlement, so credit cards are not money) – that, under current monetary arrangements, is called counterfeiting and will get you jail time.

The reality is the source of the dollars we use to pay taxes and buy government bonds is coming from none other than…the government itself. Unless the government deficit spends (credits more private sector accounts for expenditures than it debits for taxes) or unless the Fed buys assets from the private sector, the only money appearing in your wallet would be that created by banks.

Now the dirty little secret is that banks do not need to acquire savings before they make a loan or buy an asset – they can simply credit your account for the principal of the loan they give you or the value of the asset they buy from you, and then they get reserves from the interbank lending market or from the Fed itself, which must, if it is targeting a fixed short term policy rate like the fed funds rate, provide all reserves demanded at that interest rate target (just like any monopolist in any market, they can set the price, but they cannot at the same time set the quantity of reserves – you all have been fed a huge bowl of bullsh*t with this money multiplier story in textbooks and Fed comic books).

The money created by banks is what was once recognized as ” inside money” – it is not a net financial asset of the private sector. One man’s bank deposit is an asset he holds on his portfolio, while the counterpart loan is a liability in the portfolio of another man. These net to zero for the private sector, so bank created money cannot, for the private sector as a whole, be used to meet contractual commitments to other sectors – as in, they cannot be used en masse by the private sector to pay tax liabilities, buy bonds, etc.

The money you require to pay taxes or buy bonds ultimately came from the government spending more than it earned, or buying more assets than it sold, and crediting private sector bank accounts accordingly. Nothing more, nothing less. Think about that one. Let it really sink in, and you might just begin to see under current monetary arrangements, the government can never use taxes and bond sales to finance itself. It must create the money it collects and get it in the hands of the private sector first.

This is so obvious, we all tend to miss it. And it has and can be done without leading to a hyperinflationary result, if we understand what we are actually doing, rather than falling for the usual brainwashing we have been submitted to over the years.

The full-court press is on. James Galbraith and Marshall Auerback (in about a dozen near-identical) posts are flogging the same argument, which–when you strip out the ad hominems and some weak factoid–always amounts to: the US can print money and inflation won’t be a problem. Some simple questions which never seem to get directly answered: how high do you want our deficits to run, and how much will oil then cost? How high will mortgage rates be in 5 years unless we socialize the entire housing market? Is your explanation of Japan simply that they didn’t spend enough, or are you going to surprise me with something original?

Yes, that is right. Some of us who have been willing to think independently about economics and finance over the past decade or so, and were willing to stand up and warn about the impending crisis early on (if you doubt my words, listen to what I had to say, and what Jamie had to say, at the Levy Economics Institute in the spring of 2007 linked here: http://www.levy.org/vdoc.aspx?docid=930 for the audio, where my analysis appears in the second half of session 1, or here in print summary form, http://www.levy.org/pubs/16th_Minsky.pdf ),have each independently reached the point where we are fed up seeing the systematic looting of the nation by sociopathic financiers and their predatory sock puppets in DC. We suspect we are not alone in this frustration.

We are no longer prepared to keep silent while the US is submitted to the same bloodletting scenario now visiting Ireland, Latvia, Greece, and soon a half dozen other peripheral eurozone nations.

So yes, you should definitely try to engage with this perspective, because it challenges alot of the lies you have been told.

As to your specific questions Namazu, to my mind, the correct and most sustainable fiscal deficit is the one that allows the private sector to accomplish its net saving target at a full employment level of income, near current price levels. Regarding, read Richard Koo. They chickened out before they got there, time and again, because of fiscal orthodoxy. Regarding oil, I can see multiple ways we could use the government to reduce foreign oil dependence, from their own procurement policies (say stimulating the development of electric car battery development by ordering such vehicles for replacement purposes), to R&D tax credits and private/public university based incubators in new energy tech, to tax subsidies for insulation of homes in the North and solar installation in the South, to ending wars that consume lots of fuel (and lives), and on and on.

The sucess of this country was in no small part built on the back of public investment – from the canals to the railroads to the interstate highway system to the aluminum industry stimulated by WWII production etc. Know your history – it helps pierce the lies flying all around that serve very select, rapacious interests.

Regarding socialization of the housing market, please note that the failure to enforce existing regulations along with giving the GSE management the free reign to ape their sociopathic colleagues in senior management on Wall Street, has already delivered the virtual socialization of the mortgage market. But I will let Bill Black fill in the blanks for you on that one.

Hope that helps Namazu. Keep questioning all of this stuff. I would not pretend to have all the answers, nor would I pretend all the answers are simple. But I think we all are beginning to recognize something has gone dramatically wrong, and we need to be willing to think outside the box to find some plausible answers. If you believe you have better answers, sincerely, I am all ears. We are just running out of time to get this right, and the deficit hysteria is cloaking some obvious approaches to viable solutions. But I have no illusions it will require a reworking of both our existing political and corporate governance structures, and that this will require that ordinary people be willing to stand up for the future they wish to see delivered to their children, and for generations to come.

best,

Rob

I share the concerns from M.G. in Progress, above, over the time connection between the variables. It is not at all clear which way the cause and effect direction flows (does inflation impact government spending, or does government spending impact inflation?), nor how long that effect takes to manifest.

The one implication of the graph, taken in isolation from other factors, would be that high levels of inflation seem to limit government’s ability to either increase or decrease its debt. Nations with lower inflation can run deficits or surpluses at their leisure; but when inflation is high, options seem to be much more constrained.

Also, I would be interested in seeing this graph expanded out to include data points from non-OECD countries. The silent implication of the selection of the dataset–that developed economies are fundamentally different from developing economies–is suspect, and the distinction between the two sets of countries in recent years has become increasingly blurred.

Peripheral –

All of these are good points, and as I wrote above, I entirely agree this is nothing more than a simple scatterplot, and it may be cloaking deeper, more complicated connections between public debt to GDP ratios and inflation.

So I invite any and all to link in better, more comprehensive work on this matter at hand. In the meantime, the deficit terrorists do not seem to have this connection quite right, and so it is worth doing two things: first, widening the scope and sophistication of the search for a relationship between the two, not just in the data but in the historical investigation of hyperinflationary episodes (where, I submit, you will find escalating fiscal deficits will tend to be a necessary but not a sufficient condition for hyperinflation episodes in the past), and second, asking yourself why deficit terrorists might have this widely and often hysterically asserted positive correlation between higher public debt to GDP ratios and accelerating rates of inflation so wrong.

To my mind, those are the next steps if you wish to pursue this further. You at least, on the basis of the UBS results, need to plant a large question mark around this central plank of the deficit terrorist fear and loathing campaign.

I worked my way back to this discussion now two weeks late, but fwiw, as I recall that UBS piece all their conclusion is cloaking is that the maturity profile/rollover rate of government debt tends to be such that the higher interest rates that accompany inflation are priced in too quickly for inflation to provide much relief. Given the daily-weekly-monthly rollover of shorter-term debt (and maturing longer debt debt issued long ago), instead of repaying principal with cheaper dollars, government issuers just pay more interest and the net burden remains about the same.

Rob, you’re making an incredibly generous contribution here and everywhere you put so much time, effort and knowledge into the debate.

I considered the chart for a bit and then I pondered the identity.

I conclude that taken by themselves you can’t really conclude very much from either. There is simply too much description that has been omitted.

I guess one could say that old Siggy is a deficit terrorist because I believe that you cannot borrow your way to prosperity. When the government spends money, for bombs and bullets, for a stimulus package, to service medicare and social security payments; the money comes from either taxes or debt. The difficulty with debt is that it needs to be carried by way of interest payments and ultimately repaid. Not infrequently the interest payment exceeds earnings and at that juncture it is necessary to repudiate that debt which cannot be serviced.

The identity is particularly puzzeling to me in that how does one get the amounts attributable to each of the factors? Where is it that all of the private domestic balance sheets are recorded? And the other items, where are they recorded? Who adds them up? Are these numbers really just statistical artifacts only loosely related to real activity?

Has anyone done work to evaluate the relationships between debt, earnings and interest rates in conjunction with the purchasing power of the currency? The more I root around in the available data sets the more I am convinced that an awful lot of people are using complete fictions to very precisely calculate whatever point of view they wish to champion.

I observe the following dictum’s: You can’t calculate away inherent risk; You can’t add up the elements of GDP because there is no record of the component amounts that occur within the economy; and, The economist’s tactic of asserting ceterus paribus is absolute nonsense because economic systems are dynamic and energized by people who are anything but homogeneous in their preception and response to politcal and economic activity.

Debt is a lovely instrument when used to acquire the means of production yet even in that it is critical that the rate of return to the means of production must be greater than the rate of interest plus some rate for profit. It is the failure to recognize that aspect of the use of debt that is ignored in most financial failures. National failures tend to occur when the nation borrows to fund a war or a social benefits program either or both of which cost more than the earnings capability of the population to be taxed.

Inflation at say 2% per year would be accepted by many in today’s economic conditions. Do that 2% year in year out over 35 years and the price of everything doubles. That’s what we deficit terrorists are mad about. For a lollipop today we’re denying ourselves even a lick in the future. And that is what is so frustrating. The current government largesse is about relative lollipops while it allows, no fosters, the greatest financial fraud since Teapot Dome.

Siggy

The govts money to pay for anything NEVER “comes from” taxes. Your money to pay taxes “comes from” the govt.

THINK ABOUT IT

The only source of money is the currency issuer. It provides the currency we spend it and pay taxes with it. Sometimes the taxation matches with the spending (balanced budget) sometimes its less (a deficit) and sometimes it more (a surplus). One can NEVER say that a surplus is always preferable to a deficit, it depends on the rest of the economic metrics like unemployment or inflation rate

“When the government spends money, for bombs and bullets, for a stimulus package, to service medicare and social security payments; the money comes from either taxes or debt.”

the money actually comes from the FIAT power of the government to create money. In this, the US dollar is no different than the Disney dollar. Can you imagine going up to tell Walt Disney Corp. that they can’t print Disney dollars to use on their property? Why would you think you can say the same thing to the US treasury?

This is pretty basic stuff with no controversy. Rob lays out an elegant counterpoint to the deficits hyperbole.

Maybe this needed to be a “part 2?” “Part 1” might have discussed the way deficit fear mongerers mutilate/conflate trade deficits, sovereign debt, and fiscal debt? “Part 3” might be the describing the political means-to-an-end game that the deficit fear mongerers are pursuing?

It seems the label “deficit terrorists” was created to punch-up the story. I don’t agree with it’s use because it can easily take on a life of its own that takes away from the quality of the discussion.

Otherwise, keep up the good work.

I understand the point the writer is trying to make here, and it’s a worthy point, but the idea of refuting ‘hyperbole’ while tossing the word terrorist around is enough to make me want to change this channel. It doesn’t help seeing Yves and Rob so adamantly defend an arguably hyperbolic argument by responding to commentators with venom. That I disagree with several of said commentators while appreciating the post’s thesis does nothing to diminish the off-putting sensation I get from reading this thread. Indeed, it makes me regret handing over dollars, just hours ago, for a book that might described what is happening to me here: Getting econned.

I thought the use of the term “deficit terrorist” was very useful, and it seems to go back at least a few years (Google has changed its search algorithm to be more news oriented, which is annoying, I’d much rather see the biggest traffic matches first rather than most recent).

It’s useful precisely because it reveals how invested people seem to be in the idea. If you call someone a “climate change denier” which is mildly pejorative at best, they get outraged. Look at links here. Even when there is a story about greenhouse gases and climate change that is strictly scientific in tone, you see some people go batshit in comments.

So my take is the virtriol of the reactions has much more to do with the subject matter. The “terrorist” label just gives some people more license to get even more upset. But they’d get upset regardless.

And given the venom of the remarks, I don’t see Rob and Yves as all that out of line (yeah, more chill would have been better, but look at the hysteria directed at the post). The reactions were knee jerk, very few bothered even to consider the argument. The same thing has happened on other posts on MMT that haven’t used the “deficit terrorist” expression. This is about people being closeminded much more than the use of provocative terms.

Yves (& Rob)

perhaps I am mistaken but the accounting entry your flouting is predicated on another accounting entry whcih says that the current account balance + capital account balance = 0 (simplified). Therefore the gimmickry assumes away currency/devaluation risk, ceterus paribus.

What are the assumptions about the current account deficit/surplus. Namely what are your assumptions about export growth (how we get there) and the ramifications for the price of oil?

Surely, the capital account also warrants some discussion here, not just from an identy standpoint but a very real discussion of what happens when the wel TIC Tic tic tic tic tic.

As an aside i am surprised that yves is such a proponent of accounting identities when this blog repeatedly lambasts bank balance sheets and their own A = SE + L. Anything can bemade to balance – the issue is your assumptions.

Yves lambastes SHODDY accounting not proper accounting.

Not anything can be made to balance when done properly. When you mix identities and hide liabilities off balance sheet you can create a lot of “balanced sheets” but that doesnt meet that the real identities are in balance.

S –

Please see my response to Bruce Kasting above on the question of possible current account balance effects of higher public debt servicing payments.

Regarding the balance of payments account having to balance at the end of any accounting period, such that the capital account + the current account nets to zero, I am not entirely sure I understand where you want to go with that.

If it is a point about our dependence on foreigners to finance our deficit spending, please look again at my responses above. Foreigners cannot print US dollars. They have to earn them by running trade surpluses with the US and accepting US dollars as a means of final settlement, or they have to net sell their assets to US dollar holders.

Households borrowing money from banks that create money when they make a loan, and deficit spending while the housing boom was on, is the source of many of the dollars that foreigners net saved and ploughed back into US dollar denominated assets.

The Chinese would not have dollars to invest in US Treasury securities unless we persistently ran a large trade deficit with them. They cannot, to repeat myself, print or create dollars on their own. This point is essential and really quite simple, yet it is another one that eludes the deficit terrorists.

Now changes in foreign portfolio preferences – changes in the desired mix of existing wealth holdings – can wreak all kinds of havoc, as we see when deficit terrorists wake up one day and decide a country has an unsustainable fiscal path based on an arbitrary definition of what constitutes the appropiate fixed public debt to GDP ratio. Then asset prices have to clear the change in desired portfolio exposures, until all existing assets are willingly and voluntarily held. But foreigners cannot “finance” US deficit spending until they somehow first earn the US dollars, because they have no way of creating US dollars themselves, short of counterfeiting.

The wage labor arb is so wide that even if china revalued the US labor is not competitive. As an academic exercise what happens if China revalues and say loosens capital restrictions (for say investment in the USA at the same time? Would the dollar go up or down? The US export strategy to devalue is fraught with many risks not least of which is the identity you mention (or Yves). Even if it was mildly accretive to the balance the capital requirements remain huge. it is a bit cavalier to dismiss changing preferences isn’t it? Typically when you go down this route we end up talking about the number of US aircraft carriers.

You say:

“Foreigners cannot print US dollars. They have to earn them by running trade surpluses with the US and accepting US dollars as a means of final settlement, or they have to net sell their assets to US dollar holders.”

Well the fed (and BOE, BOJ etc..)can and are printing money in a coordination reflation – that has to be the reason that oil is at 80 with horrible fundamentals and copper, al and steel etc..That is devaluation of standards period. Call it whatever you want.

While I do not endorse this thesis one might also consider that an effective unearned money laundering operation might be had in the supression of say gold for oil such as outlined by FOA – also the various thesis on gold lease rates. Have a read of the ZH post re gold and fed meetings (via GATA) yesterday or the many post of FOFOA. Much as the barbarous relic is the enemy of the bankers it tells an interesting story when judged by its 1000 years as the defacto standard.

I find your arguments about rising interest as a net positive to consumer also a stretch. I assume you think there is no capital loss/wealth effect on legacy holdings from spiking rates (Fed balance sheet also) or that the Fed doesn’t hold down rates below real inflation which would of course result in a declining standards of living. GDP, is beocmeing ever more irrelevant as a measure of anything particularly the nominal. Also you make no mention of the fact that rising deficits and no more regualtoy underbrush to clear circa the 80s/90s that consumers don’t begin to mentally account for and discount the higher taxes coming. The fallback we will grow out of this is simply not borne out by facts (wages) other than to argue that another asset bubble is coming.

Is that what youa re arguing here? becuase if another asset bubble doesn’t form those freshly minted FRN are going somewhere unless the fed plans to roll them for a decade plus until we can hope to grow into the bloating zombie

As an aside, the entire derivatives market is a mechanism to create dollars: a synthetic CDO seems to fit the bill (bundled CDS, or the market entirely net of cash, or securitization)? All are ways to create money, no? Actually, as you alluded to, I stand corrected, when the markets are not allowed to clear it is a virtual liscence to steal/make money. Isn’t that what AIG was all about. We do not operate in a closed system much to the chagrin of academia

So if the GDP grew by $5T since 2000 and we created no jobs, while debt exploded, why should nominal GDP be static to mildly down.

The problem with your argument is that you assume as a starting point that the aggregate demand curve rested at a stable equilibrium in 2006/07 (or the debt creation machine is about to rev back up and compound forever). As a result asset prices were properly cleared during the greatest monetary bubble in history. Enter the fed and you know the rest. Therefore, to assume that there you can introduce money into a system to levitate an unnatural eequilibrium and not have devaluation in standards is the stuff of structured finance. Unemployment isn;t rising because the demand wasn’t real. Utilization is at 73% with trillions of stimulus/guarantees becasue the world is massivily capcity long.

Apparently others are anticipating the same thing on taxes.

http://www.taxfoundation.org/news/show/25985.html

Also, perhaps you could address the following question? If real GDP increased by $5T and no jobs were created, how does nominal GDP stay anywhere close to level? if your answer isn’t inflation, I’d like to see an identiy that addresses how you no job growth, no wage growth and shrinking leverage sustain a bloated GDP number?

Since there is such an attachment to the term deficit terrorists, and no one can seem to admit that they’ve gone over the top, I see no alternative but to fight rhetorical fire with fire. I’m going to start calling all big-spending liberals (or big spending “conservatives” for that matter) money-printing terrorists, since in the end that’s what it will boil down to.

This is akin to the AGW crowd terming all skeptics of the IPCC party line, even the luke-warmers, “deniers.” So, in response, I have decided I will call Al Gore and other climate alarmists “Climategate deniers.”

I’m sure fans of fiscal restraint can come up with some kind of a scatter diagram to illustrate the likely outcome of the money-printing terrorists. Anyone want to help out?

Again, stooping to name calling is not my preferred method, even though I realize it does appear to be the dominant form of discourse in much of the blogosphere and MSM. However, as I explained in a reply above, I think it is time for a wake up call. I see the wrecking ball and I want you to see it too.

But by all means, feel free to bring your evidence to the table. I am perfectly willing to change my mind on compelling arguments and evidence. I have no illusions that I am perfect or have perfect views. Minds distort and conceal, so maybe you can see a clearer way forward. Please share it when you are ready.

Just don’t bother misrepresenting my views, because then you will be wasting our time…and the time to get this straight is, in my estimation running out, as, I argued on Naked Capitalism last week, we are about to see in Greece.

I understand your point somewhat eric but the definition of terrorism is;

“the systematic use of terror especially as a means for coercion”

In spite of absolutely no evidence of a hard cap on deficit or govt debt levels, (meaning, no one can say what level of debt is unsustainable in and of it self) there are people who fancy them selves experts and have a voice in the national economic discussions who continue to try and frighten people that we are on a road to debt default, hyperinflation or some other such financial calamity. The terms thrown around are quite intentionally frightening and often times self serving. They are doing it to coerce the govt into paying higher interest rates on their bonds, not to actually decrease bond issuance.

Bond demand would actually increase with a rise in interest rates meaning those folks have no interest in decreasing spending they simply want better returns on their savings. Completely self serving bull$hit

It is ABSOLUTELY UNTRUE that the US Govt can default in US$. It can never happen. They may decide NOT to make a payment but they will NEVER be unable to make a payment.

So really I think the label works.