Reminder: the New York event is tonight at Book Culture, West 112th Street between Broadway and Amsterdam at 7:00 PM. Hope to see you there!

Black hole ‘hurled out of galaxy’ BBC

Stanford’s Robot Car Slides into Parking Spot Like a Badass (video) Singularity Hub

In a Job Market Realignment, Some Left Behind New York Times

Neville Chamberlain Lives—In Euroland Michael Hirsh, Newsweek. Clever and insightful

EU imposes wage cuts on Spanish ‘Protectorate’, calls for budget primacy over sovereign parliaments Ambrose Evans-Pritchard, Telegraph

Sarkozy, the new king of Europe Berliner Zeitung (hat tip reader Swedish Lex)

Merkel insists treaty changes are essential Irish Times. Swedish Lex tells us this process, though necessary, will take 2-4 years.

Was the euro saved by a call from Barack Obama? Independent. Obama was the moving force behind the rescue….and argued based on what he did in early 2009…In other words, he was holding up extend, pretend, and giving the banksters what they want as a model of success. Lordie.

Ex-Glitnir investor faces $2bn action Financial Times. This is textbook looting.

Household Debt Around the World Paul Kedrosky

Beijing’s stop-and-go measures Michael Pettis

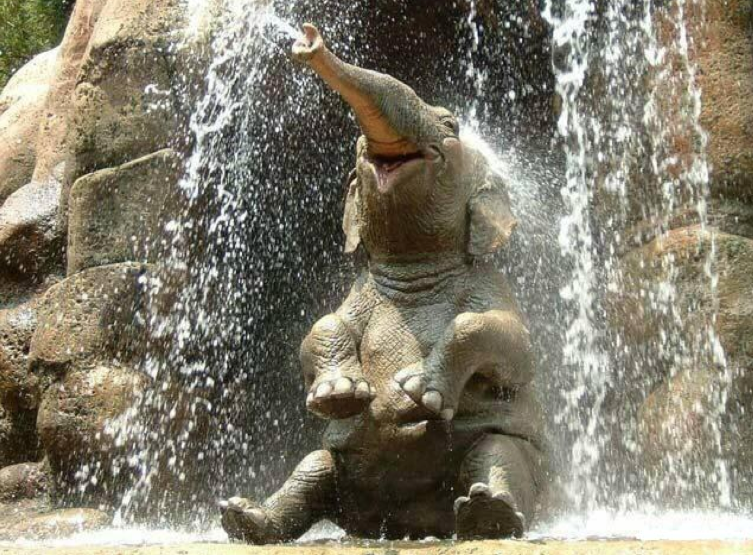

Antidote du jour:

Is the press undercovering the oil spill? – Part of the explanation here is that BP has been quite deft at managing appearances. For one, they’ve poured more than 300,000 gallons of chemical dispersants to break up the oil before it can reach the beaches, causing it to sink down to the sea floor. In some cases, these dispersants may be more harmful, ecologically speaking, then letting the oil wash ashore. We don’t know what is in these chemicals and there’s a very high potential that they could do a lot of damage to the food chain in the Gulf. That’s precisely why Exxon was constrained from using dispersants in Prince William Sound back in 1989. But, from BP’s perspective (and the Obama administration’s), avoiding the sort of graphic imagery that Exxon had to deal with in Alaska has an undeniable appeal.

http://www.tnr.com/blog/the-vine/the-press-undercovering-the-oil-spill

This just goes to show that Obama’s goal is in lockstep with BP’s goal: do whatever it takes right now to keep the Gulf’s coastline looking white and pristine even if it means more harm to its fish and other wildlife in the days ahead. This is the story of the Obama Administration in a nutshell: it’s all about making things look pretty in the here and now even if it means more ugliness in the future.

Yeah I ‘m sure that’s exactly what Obama is thinking. What are you a mind reader? His best buddy? Or just some sad disgruntled nobody projecting a bunch of BS?

Or possibly a keen observer

You sound like a very undemocratic soul who believes that only people of wealth and privilege should be allowed to speak their minds. If this is true, which it probably is, then you’re a clear and present danger to our democracy. So before you do any more damage to our Constitutional rights, it’s best that you pack up your bags and move to an authoritarian police state. And while you’re at it, take two other freedom-haters along with you: Lindsay Graham and Joe Lieberman.

Regarding EU treaty changes with respect to state fiscal solvency, if said changes get done in under four years that would be ‘quick’ by the standard of such things. But whether that fast or less so, changes of this kind are coming. —And have been coming for a generation: this was the implication of currency union.

Ultimately, there will be a unified Eurobond market I strongly suspect, where some central body has to pass on the soundness of the bonds in return for putting an EU guarantee on the instruments. No more funny books. What is perhaps as important, there seems surely to come come institution at the center which issues bonds for funding purposes the EU as a whole. How that gets done is very important, and I doubt that the negotiations on this will get resolved in the 2-4 year timeframe. It would be ripe for graft and favorable issuance if not watched closely. Who gets to issue debt is a fundamental question of public organizations. One hope the Euros will do this right.

I’d be very curious to see the replies to this if you post it on the German newspaper commentary sections.

changes of this kind are coming. —And have been coming for a generation: this was the implication of currency union.

Ultimately, there will be a unified Eurobond market I strongly suspect, where some central body has to pass on the soundness of the bonds in return for putting an EU guarantee on the instruments. No more funny books.

I would counter that

(1) there is not enough time to pull this off.

(2) there is not enough patience or sympathy from the citizenry to pull this off (and probably not even from most of the governments, for that matter)

(3) (major point) the global trend for the foreseeable future is towards entities shrinking and splitting apart, not growing and coming together. I wouldn’t bet on many things bucking this trend–and those that do will likely do so based more on “accident of history” type events, rather than some big overarching plan.

BTW, I enjoy reading your posts.

yeah the internet sure is shrinking us, and splitting us apart…just like automatic transaltion softwaredoes…LOL

elephant nirvana!

Fake nirvana it is.

As your Orange County readers likely know, that elephant is a robot in the Disneyland Jungle Cruise ride:

http://www.google.com/images?q=jungle%20cruise%20elephant

Black Hole story link fix:

http://news.bbc.co.uk/2/hi/science_and_environment/10108226.stm

I had hoped the story might be about Fannie/Freddie being given the “heave ho”.

OMG – Obama “Dealing with the markets is the same as dealing with a military enemy – you have to use overwhelming force….” WTF????????????????

I mean, I know the man has an ego, but now he is bigger than the world currency market??????

Euro – 1.2580 as I write……..

Every time I read anything Obama says in his glorious speeches, I imagine the voice of Pee Wee Herman instead of Obama’s great baritone. Try it. Once the spell wears off….. OMG!!!!! What did we do????

I dunno…that one day super-plunge sure did look like “enemy action” to my eyes.

Are you sure that it was not?

Why?

Also, this reminds me of how the Swedes once pushed their suddenly jacked overnight lending rates to – what? Over 100%, IIRC – to hammer speculators.

Overwhelming force works well in the Markets.

Ask any small co ruined by massive naked short selling of their stocks.

Big money has advantages simply from being big.

If you have Big Business, the Republic needs big government to protect the small fry. Or, if you prefer, to stop them from killing the goose that lays the golden egg – it’s in their own self-interest to be subject to strong regulation.

Euro now at 1.2530…..

It’s not “speculators” driving down the price – it’s European citizens who can read government balance sheets, who are fleeing their own currency as fast as they can – many into gold – along everyone else who needs to buy or sell Euros. That is a BIG market, unfortunately for the Euro, that natural market is far bigger than Obama’s ego, and far bigger than the smoke and mirror attempts of the EU to play magic tricks to take everyone’s eyes off the systemic EU debt monster.

Ain’t workin’…..

Yves nailed it beautifully – Obama sold the EU leaders on “extend and pretend and give the banks what they want (full par on their higher-yielding failing Greek bonds)” It’s a sick spectacle.

I can imagine his conversation with the rightfully reluctant Angela Merkel to get her to go along with this insanity –

Merkel – “We’ve worked hard, been frugal, saved…. why should our citizens be on the hook for this?”

Obama – “I’ve been to Dresden. Lovely city. Gee, I’d hate to see anything bad happen to it…. AGAIN!”

Re Hirsch piece:

Clever and insightful? I suppose if one’s looking for pro-Bailout, pro-bankster arguments one might think that.

When I think “appeasement” I think first and foremost of how the finance criminals can never be appeased (the way “reformers within the system” think), and how so long as the rackets exist they will enforce kleptocracy. How we cannot “regulate” them but only destroy them completely.

This piece is just another form of populism-bashing. In this case it conjures up the horrid word, “chauvenism” and compares the people fighting for their very economic existence to nationalist thugs.

It seems like some people have a different standard for the fight of the people vs. the bank rackets in America itself, vs. where it’s “foreigners” in the same position.

Isn’t that the elephant from the Jungle Cruise ride at Disneyworld?

I finished ECONNED yesterday – just wanted to say it was great. Far and away the best book I’ve read on the current financial crisis.

IMHO the must read for today:

http://preview.bloomberg.com/news/2010-05-13/rigged-market-theory-scores-a-perfect-quarter-jonathan-weil.html

That is a mechanical elephant from the Jungle Cruise ride…(could be Disneyland or the Magic Kingdom at Disney World).

Nothing is real these days.

I, too, miss the days when things were real!

re: Household Debt Around the World Paul Kedrosky

I notice no Asian countries are listed…

The UK is missing also. This must have been put together for a specific purpose rather than to be comprehensive.

The Governor of the Bank of England has been talking about the scale of the problems facing many countries.

http://blogs.telegraph.co.uk/finance/edmundconway/100005657/us-faces-same-problems-as-greece-says-bank-of-england/

Neville Chamberlain rescued the Western world with his reluctance to go for war. Everybody reading a history book should immediately grasp that. But of course it is incompatible with the US propaganda, that the Nazis were mostly beaten by American GIs. Most of WW II happened in the Soviet Union, and if one would have followed Churchill’s advice, either the Nazis would have simply won the war, or the Soviet Union could have an easy grab of Europe after the Western countries warred sufficiently against each other.

Why are people insulting Chamberlain and warshipping racist and mass murderer Churchill (he ordered the death of 3 million Indian civililists, because some of them wanted independence of the British empire).

RE-Obama’s phone call

This is a rather scathing rebuttal, found in the comments-

http://news.independentminds.livejournal.com/7157275.html?thread=54708251#t54708251

” Angela Merkel has been campaigning for strict regulation of banking and finance ever since 2007…..The same story throughout the G20 and Davos meeting ever since: Merkel says this madness has to stop, Obama and Brown giggle and jeer, telling the media she’s just having hot flush. But what we have seen since then is that the UK has been “saved” by Crash Gordon’s trillion-pound cash handouts to the point that it is on the verge of being downgraded to PIGS status and the US is not doing any better”

Commenter sure makes it sound like Brown and Obama are following full-court-press Neo-liberal policies and Merkel is the German Naomi Klein.

But then, I don’t necessailry understand all of this. Any thoughts? Much appreciated…..

Robin,

I wouldn’t go so far as to say that Angela Merkel is the German equivalent of Naomi Klein, but she does carry some of her traits. And Gordon Brown is somewhat of a neolib, but Barack Obama is about as neolib as they come!

I agree, Cynthia. I have never heard the situation put this way, Merkel seeing all this as the Eurpoean version of the TBTF Banks–but this commenter thinks she does. Here’s a great diary from DKos on the Neoliberal European/IMF crack-down-

http://www.dailykos.com/story/2010/5/14/866400/-Could-Congress-Block-Antiworker-IMF-Bailouts-in-Europe

“The purpose of the IMF packages is to force European working families to pay off the banks’ bad loans through economic austerity, rather than forcing the banks to take their losses on their bad bets….”

May 12, 2010

Disaster unfolds slowly in the Gulf of Mexico

In the three weeks since the April 20th explosion and sinking of the Deepwater Horizon oil rig in the Gulf of Mexico, and the start of the subsequent massive (and ongoing) oil leak, many attempts have been made to contain and control the scale of the environmental disaster. Oil dispersants are being sprayed, containment booms erected, protective barriers built, controlled burns undertaken, and devices are being lowered to the sea floor to try and cap the leaks, with little success to date. While tracking the volume of the continued flow of oil is difficult, an estimated 5,000 barrels of oil (possibly much more) continues to pour into the gulf every day. While visible damage to shorelines has been minimal to date as the oil has spread slowly, the scene remains, in the words of President Obama, a “potentially unprecedented environmental disaster.” (40 photos total)

http://www.boston.com/bigpicture/2010/05/disaster_unfolds_slowly_in_the.html

Re: singling out Goldman.

Partnoy’s piece was a disgrace, Interfluidity’s piece on the up and downside is more like the argument I would have expected from Partnoy.

In case you missed it, its worth a read

http://www.interfluidity.com/v2/843.html

“Hearing highlights problems with Deepwater Horizon blow out preventer” at MarineLog has some interesting info on the blow out preventer. Link is

http://www.marinelog.com/DOCS/NEWSMMIX/2010may00123.html

You should soon be hearing a lot more about BOP mods even beyond those in this report. This recklessness with a critical safety system is the primary (most avoidable) root cause of the oil spill, which resulted from a blowout which can be assumed as an unavoidable occasional operating condition on a rig.