The banks giveth and the banks taketh away, big time.

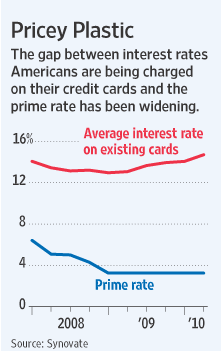

This chart from a Wall Street Journal article on credit card interest rates says a great deal:

Even though banks are getting all kinds of bennies from the Fed and regulators, such as a nice steep yield curve and lots of regulatory forbearance (econ-speak for extend and pretend), they are still out to extract a pound of flesh from the retail borrower. Since that has been a core element of their business model for the last decade, it is probably not so surprising that they are loath to give that practice up.

Even though banks are getting all kinds of bennies from the Fed and regulators, such as a nice steep yield curve and lots of regulatory forbearance (econ-speak for extend and pretend), they are still out to extract a pound of flesh from the retail borrower. Since that has been a core element of their business model for the last decade, it is probably not so surprising that they are loath to give that practice up.

Now some will argue, correctly, that consumers need to delever. But guess what? They are paring debt levels, including credit cards. The number of open accounts has fallen by over 20% since the peak, as has the balance outstanding (over 6%). And not all of this has been voluntary. Banks have been shutting accounts and cutting credit lines.

But (drumroll) increasing interest rates, particularly when the banks are getting very sizeable subsidies, means that more of the money consumers pay to credit card companies goes to interest, less to reducing principal (of course, the banks will maintain that they are merely recouping lost income from penalties, since new credit card rules have curbed abusive practices).

A more serious issue is that not all consumer debt is consumer debt. Credit cards have long been an important source of funding for small businesses. Generally speaking, banks will lend only to relatively large, established “small” businesses, or against assets. For instance, Amar Bhide, in his landmark book on new venture, found that the biggest sources of funding for new enterprises were savings, friends and family, and credit cards. Small business owners often use credit cards to contend with temporary cash flow shortfalls or seasonal borrowing needs. And I’ve known some who have maxed out their credit cards to save their companies.

And in our modern, lend by FICO template world, the cutbacks in credit and increases in prices are often arbitrary. Early in the downturn, for instance, I had readers complaining to me that they had their credit lines cut even though they had an unblemished record and over 700 FICO scores simply because they lived in one of the epicenters of the housing meltdown. Some of those readers included small business owners whose businesses were not local or in real estate, but the curtailment in credit would make them collateral damage.

Yet another example of what Michael Thomas described back in 1998, after the Long Term Capital Management affair:

The thirteen-digit ($1,250,000,000,000) number that’s being tossed around – the chin-scratching classes like to speak of “systemic risk” – is designed to convince us little people that there is a crisis at hand and therefore, if we somehow end up paying for it, it’s for our own good. In other words, to save the king’s castle, it is necessary to destroy the people’s village

From the Wall Street Journal:

New credit-card rules that took effect Sunday limit banks’ ability to charge penalty fees. They come on top of rule changes earlier this year restricting issuers’ ability to adjust rates on the fly. Issuers responded by pushing card rates to their highest level in nine years.

In the second quarter, the average interest rate on existing cards reached 14.7%, up from 13.1% a year earlier, according to research firm Synovate, a unit of Aegis Group PLC. That was the highest level since 2001.

Those figures look especially stark when measuring the gap between the prime rate—the benchmark against which card rates are set—and average credit-card rates. The current difference of 11.45 percentage points is the largest in at least 22 years, Synovate estimates.

By comparison, the spread between 10-year Treasurys and a standard 30-year fixed-rate mortgage is just 1.93 percentage points, near historical averages, according to mortgage-data provider HSH Associates.

On reading this article one would initially think there was a terrific arbitrage opportunity here, namely to carefully cherry-pick a profitable customer list by offering much lower (but still WAAAAYYY above cost-of-funds) rate cards to people with genuinely proven repayment discipline. Sorta like the no-claims bonuses you get with your Car Insurance.

So why hasn’t it happened?

(I don’t pretend to have an answer here. I’m just intrigued by the apparent anomaly, which appears just as true where I live in Australia as it does in the US.)

Seems like this post on high credit card costs to American peasants can be combined with the previous post on surplus nations and the obvious solution is for the Chinese, Japanese, and German rentier classes to one way or another move into the American credit card business and to start low-balling the American rentier class’ outrageous interest rates. Not only will they find a way to recycle their dollars, they will make sure their products find willing buyers.

The other, slightly more heretical solution, would be for American peasants to stop funding their lifestyles with plastic and thus stop voluntarily transferring huge amounts of their ever-dwindling wealth to their rentier class. But with that one sentence I’ve already wasted enough of everyone’s time so I will stop at that.

“Seems like this post on high credit card costs to American peasants can be combined with the previous post on surplus nations and the obvious solution is for the Chinese, Japanese, and German rentier classes to one way or another move into the American credit card business and to start low-balling the American rentier class’ outrageous interest rates”

That will be an interesting second step in revision of the results of WWII (the first was the dissolution of the USSR).

The free market is supposed to prevent this sort of thing from happening.

It looks like competition isn’t working. Has it ever?

Once upon a time government flexed its muscle to protect the public from these sort of Gilded Age and Roaring Twenties sort of abuses. Now it seems to be a willing participant.

Whatever the cause for the steep yield curve, it’s just another subsidy for an undeserving rentier class.

Did you read the article?

“Even though banks are getting all kinds of bennies from the Fed and regulators, such as a nice steep yield curve and lots of regulatory forbearance..”

Does this sound like a free market to you?

Hardly, but then, life itself is not inherently fair.

You sound like my boy, recent grad of a prestigious University.

Completely clueless on economic matters.

When one removes risk from the system, when one prints fake money to paper over the debts that results, when one promotes credit to the folks unable to handle the responsibility and then bails them out, one is not in a free market.

The only failure here is on the part of folks who ever thought socialism was a good idea. Wasn’t then, isnt’ now, won’t be in the future.

“The only failure here is on the part of folks who ever thought socialism was a good idea. Wasn’t then, isnt’ now, won’t be in the future.”

Well, it seems to work well up in Canada.

Psychoanalystus

MAN i wish you were president! we might actually have a chance

Oops, sorry siggy.

Meant that for down south.

If you think that was the most egregious inanity in your comment, then oy, you have a lot more problems than you can possibly imagine…but please, continue telling us about your mastery of all matters economic. It’s helpful.

kstills,

Yours is yet another “utopian” vision in a similar category to socialist, Marxist, or other economic utopias of the past. It is also utopian in a political sense because politicians in any real-world democratic system are unlikely to grant the sort of market autonomy necessary for the realization of your market utopia.

As the economic historian (and winner in 1993 of the Nobel Prize in economics) observed,

[T]he economics profession today must devote a much greater part of its research to the detailed analysis of institutions. Taking up issues that Samuelson altogether failed to address, economists must “explore much more systematically than we have done so far the implications of the costly and imperfect processing of information for the consequent behavior of the actors.” The profession must somehow “come to grips with the subjective mental constructs by which individuals process information and arrive at conclusions that shape their choices.” This will require a radical redirection of economic methods. As North puts it, the traditional economic “preoccupation with rational choice and efficient market hypotheses had blinded us to the implications of incomplete information and the complexity of environments and subjective perceptions of the external world that individuals hold.”

–Robert H. Nelson, Economics as Religion: from Samuelson to Chicago and Beyond

“Life is not inherently fair”. An interesting metaphysical platitude that though open to debate, is widely held. Yet in your case, I hope it doesn’t mean that you think that striving for a free market or complaining about a rigged market is irrelevant, hopeless, or ignorant. The advance of civilization does include things like the rule of law and the ideal of economic and political policies that improve quality of life and limit the ability of power to create unfair advantage for itself.

molecule,

There are myriad reasons why free markets don’t deliver on their utopian claims.

Government and union interference are only a couple, but they are the only two that free market fundamentalists and neoliberals ever seize upon.

Government and unions, if functioning properly, act as a corrective to market failures and inadequacies.

Oh, I get it. You’re saying that unless we have a perfect free market, economics don’t work.

Great. Since a perfect free market is impossible to achieve, let’s scrap economics all together, starting with the Chicago and Austrian schools of economics.

Exactly. We haven’t had a free market in decades.

The government is the most powerful corporation in the world and all those corporations high enough on the pecking order get to suckle from mama corporation’s teat.

The rest of us are considered too scrawny and worthless to survive, so we’re left high and dry. Somewhere Thomas Jefferson is rolling in his grave.

There’s nothing “free market” about a system where the government takes billions from poor people to give to rich people so the rich people can continue to bilk the poor people. Democrat or Republican it doesn’t matter.

The steep yield curve and regulatory forebearance are intended to create an arbitrage for the banks that will permit them to extract unearned profits which are to be used to absorb the write offs of all the trash that the banks have created and hold on their books. Sadly, the banks have insisted on continuing to pay bonuses that should have gone to retained earnings and then write downs of bad assets.

Without the gift of the steep yield curve and if the trash were written off, the banks would be the wards of the FDIC or the bankruptcy court. So what is being extracted from the retail market is the funding of the write downs necessary to bring the banking system back to stability. The Fed is quite purposeful in this endeavor in that it and many others fear a collapse of the global economy. Just ask helicopter Ben.

You beat the banks by using a credit card and never having a balance that accrues interest. But then you do get pay for the use of the credit card by incurring a price that includes the discount fee the merchant pays the bank. On the other hand the merchants have yet to offer discounts for cash.

you probably don’t even beat the bank then since they’re still collecting 1-2% on transaction fees. they’re beating you with less severity. Even if you only charged $10, say, every month, on your card and forced them to send you postage, how are you paying otherwise? With cash? At some point, they’ll get you with a $3 ATM fee when you really need $100.

Still, I try to do my part and let them beat me with less severity.

It is possible to live on cash, and only use a credit card when you absolutely must, such as renting a car. Online you can pay with PayPal. No time wasted paying bills at the end of the month, you’ll know exactly what you spend, and certainly you won’t be able to go into debt.

Most of the world runs on cash, so why shouldn’t the American people be able to as well?

Psychoanalystus

I kind of have a hard time getting worked up about this. Relying on credit cards to pay bills is, as we all know, not the best approach unless you pay it off every month. In that case, rates don’t matter.

Those unable to fund their daily needs with income have always been at the mercy of lenders and loan sharks.

“Those unable to fund their daily needs with income have always been at the mercy of lenders and loan sharks.”

That’s not exactly true. The banksters were unleashed on the American public, thanks to a ruling by the Supreme Court, in 1978:

Each U.S. state has its own statute which dictates how much interest can be charged before it is considered usurious or unlawful.

If a lender charges above the lawful interest rate, a court will not allow the lender to sue to recover the debt because the interest rate was illegal anyway. In some states (such as New York) such loans are voided ab initio.

However, there are separate rules applied to most banks. The U.S. Supreme Court held unanimously in the 1978 Marquette Nat. Bank of Minneapolis v. First of Omaha Service Corp. case that the National Banking Act of 1863 allowed nationally chartered banks to charge the legal rate of interest in their state regardless of the borrower’s state of residence. In 1980, because of inflation, Congress passed the Depository Institutions Deregulation and Monetary Control Act exempting federally chartered savings banks, installment plan sellers and chartered loan companies from state usury limits. This effectively overrode all state and local usury laws.

[….]

Some members of Congress have tried to create a federal usury statute that would limit the maximum allowable interest rate, but the measures have not progressed. In July, 2010, the Dodd–Frank Wall Street Reform and Consumer Protection Act, was signed into law by President Obama. The act provides for a Consumer Financial Protection Agency to regulate some credit practices, but does not have an interest rate limit.

It always amazes me that Americans still haven’t grasp the historical significance of this ruling. How many times in history did any civilization didn’t impose a limit on the interest charged on debt?

Pretty much any Republican/”libertarian”/propertarian:

“I’m for States’ Rights! Except, er, um, when I’m not.”

The banks dare to exact the penalty on their customers that the government did not dare exact on the banks. That’s how you pay for “financial innovation.”

If you see the master on the road kill him.

Early FICO scores …

“Determinants of Slave Prices

The prices paid for slaves reflected two economic factors: the characteristics of the slave and the conditions of the market. Important individual features included age, sex, childbearing capacity (for females), physical condition, temperament, and skill level. In addition, the supply of slaves, demand for products produced by slaves, and seasonal factors helped determine market conditions and therefore prices.”

http://eh.net/encyclopedia/article/wahl.slavery.us

The difference today is that there are too many slaves, and to the top wealthy ruling elite masters, the high resource consumption, in the aggregate globally, for maintenance of slaves is a problem. So those top masters now shift slavery from profit to control and elimination. Thus we have the very intentional, long in planning and implementation, global financial crisis meant to thin the herd and create a sustainable two tier ruler and ruled world with the ruled in perpetual conflict with each other. The sustenance of credit, the source of slave consumption, is withdrawn.

Deception is the strongest political force on the planet.

I think that what is happening now is that the rates are finally being disclosed. The borrowers were always paying these rates, after all of the penalties and add ons, and the lower rate was just a marketing illusion.

To the extent the disclosure of the actual rate they need to justify making the loan to borrowers is relatively truthful now, vs before this law, it may be a good thing – it may discourage borrowers from using or getting the card. It may also harm the banks by limiting their ability to hoodwink borrowers with deceptive marketing schemes promising them low rates, etc.

I’d be happy to see the result be that banks get less credit card business and have their portfolios shrink.

Being a small business owner I can tell you that my rates have gone from 4.99% to 9.99% to the last increase 17.99% in a matter of 14 months. This does make it rather difficult to do business I now require a deposit of 50% up front prior to ordering any materials

Sounds like wack-a-mole. Control fees, raise rates. I did not read the suggestion to control the rate. Would banks issue less cards if the next logical step was taken and the government controlled the rate? Maybe not if its still profitable (risk adjusted, of course). But if the banks do not think its profitable that probably means less credit available, right? So I guess the next, next step is force the banks to offer credit cards and the lower fee and lower rate?

I work at a very small company and the health insurance premium increases for next year are quoted 30% higher than 2010. We use a large payroll service so that we get group rates on insurance so this is not confined to our firm. Sound familiar to the above story?

whatever…

Actually a number of credit unions only require that you join some meaningless association for $10 and you can join.

As this linked article discusses, this again is an example of how a growing oligopoly (in this case the widespread consolidation of banks in the 1990s and Oughts) has given a few large concerns pricing power. One can find lower rates at banks such USAA and credit unions, but of course they are limited to certain parts of the public. Although the lack of anti-trust enforcement started with the law and economic boys came into power under Reagan, it unfortunately was another of the free market idols adopted by the Clinton, and so far by the Obama administrations. http://www.washingtonmonthly.com/features/2010/1003.lynn-longman.html

This makes it seem as if there is 10%+ pure profit here. But credit cards right now have a default rate of 10%+, so what you’re actually seeing is the “deadbeat tax” — which actually, in this economy, is more probably the “unemployment tax”, since most of those who can no longer pay their credit card bills are in that situation because they lost their jobs.

– Badtux the Money Penguin

I thought about that too.

But does it really make any difference? I don’t think it does. The steep yield curve still goes to bail the banks out for their past sins—-poor lending practices—-whether that lending was for consumer debt, mortgages, commercial real estate or business loans.

One has to keep in mind that, back before the GFC, the most profitable credit card customers for the banks were those customers who either chose to or were forced to operate on the edge. They not only paid the highest nominal interest rates, but also the most late fees and over-limit fees. They were also the highest risk.

While everything was Cadillacing along, this high-risk lending provided outsized returns—-read huge bonuses—-for bank executives. However, when the correction came, it provided outsized losses, which the public is now being forced to pay for.

So while your observation may be true, I don’t find in it any legitimate justification for the steep yield curve. The banks should be the ones to pay for their mistakes, not the public.

The banks don’t have to issue credit cards to “deadbeats” but they do so because they find it profitable to do so. The impose the “tax” upon the rest of us to maintain the illusion of earnings growth, and they’ll keep on increasing the tax to continue showing earnings growth. This is the essence of Ponzi finance.

Its not a “deadbeat tax”.

Its a “perpetual conflict war combatant tax”. All scamericans are being forced to pay for and engage in the perpetual conflict war of their own demise. The mechanics are simple.

The prudent pay the cost of the not so prudent who have been taken in by the debt traps set out by the wealthy ruling elite through higher interest card rates and reduced access to credit, both of which spiral down the economy. Yes there are a few intentional “deadbeats” but most are victims of the intentional debt trap bubbles and counterfeit derivative products made possible by global corruption of government. A part of that process has been to demonize those caught in the debt traps by co-opting and Orwellianizing the word “deadbeats”. They are not, they are combatants, unwillingly thrust into a war of perpetual conflict with their once friends and neighbors. Don’t fall for it!

This is why not using your credit card and being self sufficient in its singularity — a superb idea in and of itself — will in the end be folly as the intentional chaos being created will affect all as the elite slowly increase the pressure until all are engaged in the perpetual conflict. The goal is no longer profit, it is control. The solution is for both the prudent AND the not so prudent to get into a more sustainable consumption mode but also focus on eliminating the wealthy ruling elite.

Deception is the strongest political force on the planet.

Here is a complete summary of yesterday’s new credit card rules:

http://helpsavemydollars.com/2010/08/save-money-from-the-credit-card-act/

Here is a complete summary of the rules that made most all scamericans such limp dicks and so accepting of their FICO scores and usurious interest rates.

Note the ‘stick up his ass’ look on the face of the judge and that he is even there!

http://www.teach-nology.com/worksheets/misc/back/rules/elem/

Deception is the strongest political force on the planet.

FICO scores are irrelevant. The banks are treating badly everyone, regardless of their scores. As you say, their goal is now control. And since this is combat for our freedom, we break this control by breaking the banks. How? It’s simple. Max out, cut all your cards, and then declare bankruptcy. What could they do? Ruin your FICO scores?…LOL

Psychoanalystus

The above was for i on the ball patriot

Just bumping a good read. Glenn Greenwald, as always, writing powerfully and getting to the heart of the matter:

http://www.salon.com/news/opinion/glenn_greenwald/2010/08/23/park51/index.html

A number of insolvent, and not so insolvent people were running up tens of thousands of dollars of debt on credit cards which were charging 8 to 12 percent, or less on the credit balance transfer programs. In the day the transfer programs even had no cash advance fee.

The alternatives were the personal line of credit, HELOC or plain old austerity.

With consumer debt under 2.5 Trillion, that is only about 8,000 for every man, woman and child in the US. With another 600 Billion in revolving HELOC.

Seems pretty high to me, especially at a 29 percent interest rate.