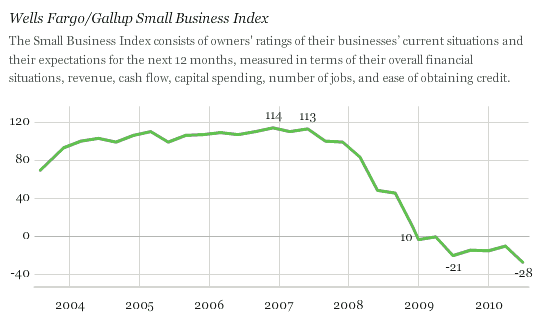

Reader Scott provides yet another example of the disconnect between the cautiously optimistic stock market and those on the economic front lines. A Wells Fargo/Gallup survey of 604 small business owners conducted in early July showed a plunge in already negative readings to new lows. This gloomy outlook matters because small businesses were the biggest source in job creation in the last upturn and are expected again to be the main source of hiring.

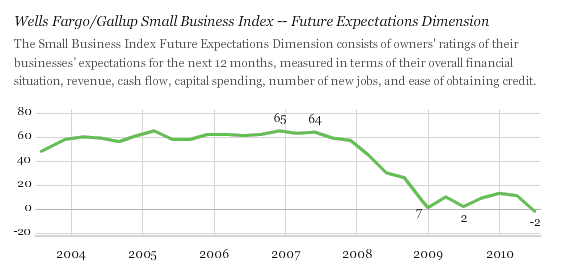

Even worse, small business owners expect things to get worse. The main reason for the decline in the index was the decay in the Future Expectations subindex, which is the first time business owners as a whole have been negative about their companies’ prospects for the upcoming year:

42% of respondents anticipate it will be “somewhat” or “very difficult” to borrow, and 22% forecast their financial condition a year out as “somewhat” or “very bad.”

Gallup noted:

The Wells Fargo/Gallup Small Business Index seems to be something of a precursor of future economy activity. It peaked at the end of 2006; matched that peak once more in June 2007; consistently declined thereafter as the recession deepened, before bottoming out in mid-2009; and finally, improved modestly until its July 2010 decline.

It might be helpful to break out the industry sectors that are small business. What % in high tech, real estate, consumer goods, etc.

Like the poor and middle class, what happens to small business or what they happen to think is of no consequence to anyone of consequence.

Not only do US small businesses still not have access to credit, the average unemployment insurance tax jumped 27% in 2010 from 2009, which will surely be a drag on futures hiring plans. From Moody’s Economy.com summary of the natl fed of independent business NFIB report: “The details of the June survey show that the lack of sales is repeatedly among the biggest problems facing small businesses. That said, retail and construction firms make up a large share of this survey’s respondents, two industries hit hard by the recession. Still, until a sustained improvement in sales takes hold, small businesses will not hire and invest, keeping the demand for loans low.”

However, Wells Fargo is missing the point by looking at just 604 small business owners in the US in July 2010. Yes, the outlook sucks for small business owners in the US 6-12 months out.

Moody’s also puts out a weekly global small business survey, and though one week improvement does not make a trend, for the week ending July 30, business confidence jumped 10 points from 18 to 28. And 6 month expectations jumped 12 points from 36 to 48 (rounded).

The economic data out of Europe has been better than expected (no doubt thanks to a softer Euro in Q2), and China is enjoying the fruits of a ‘great moderation’ – if you believe their monthly numbers that gdp, ppi, cpi, and IP are all slowing dramatically, while retail sales are still rocking out 18% monthly gains….

If we look at the data from a US centric viewpoint, we are looking at incredible challenges, yet, when looked at globally, you find a ‘rising tide lifting all boats’ scenario intact. The baseline scenario for a ‘slow global and domestic recovery’ is very much in play, and the big money is positioned exactly for that going into Q1 2011.

The only safe haven unwinds yet to take place is an unwind in the YEN and Treasuries, these unwinds are likely to take place by the end of the week or shortly thereafter.

There’s PLENTY of access to credit for small businesses – at 20% credit card interest rates.

So it would appear that the wheel of history is becoming harder and harder to turn back.

Since when is “small business” on the economic front lines? Is this 1880? In the United States in 2007, the last year for which this information is available, revenue per employee at firms with 500 or more employees was $100,000 (okay, $100,748) more than at firms with fewer than 500 employees. Average annual pay per employee was 26% higher at firms with 500 or more employees than at firms with fewer than 500 employees. (Source: http://www.sba.gov/advo/research/data.html.) Is it so detrimental to our economy that less competitive, poorly paying firms are having a difficult time borrowing money?

Jake [or whoever you actually are, guy] it boggles the mind that you would make such an ignoramus, if not wholly disingenuous, argument. Here’s two salient facts for those who actually use numbers to reach conclusions. That ‘average’ salary at larger firms is hugely skewed by a small number of very large salaries, essentially being meaningless as presented. And the large majority of _all_ those employed in the US work either at small business or are public employees. So yes, it really DOES matter what happens in these sectors, and they are always first in terms of hiring shifts when actual expansion occurs. There are many other problems with your non-presentation, but I’m not going to spend further time on this.

Richard Kline is 100% correct. Half the people in the US work for small businesses, and small businesses were the main source of job growth in the last expansion. Large enterprises SHED jobs over that time period.

There is no recovery. Not unless you’re in or tied to the speculative sector which our government has thrown the rule books away to stuff with money. For the real economy, for the entrepreneurial set, for small asset holders: nada. It’s no wonder that small business sentiment is down for the simple fact that sales continue to contract while credit is ruinously expensive (for them) when it can be gotten at all. For the media, and the government, and a few dittoheads, the 10% tied to the speculative sector _are_ the country: no one else even matters. That was true even before the soft coup of the TARP et. al.; truer than ever now that the Phoney Recovery is selling well inside the MSM and the Press. —And that’s how it’ll stay until a plurality at least of the other 90% decide that they want their country back.

The Rest of the World (except Japan)? They pursued different strategies for recovery from different starting points. It should be no surprise there either that many other places are doing better. There was no ‘global crash.’ We had a global liquidity and credit crunch in the Unwind of Autumn ’08, dragging everyone down in tandem. Six months on, separate circumstances led to disparate vectors. Could the Rest of the World be the engine which drags the USA out of the swamp? Nah, we’re clutching our dead assets and drowning under the weight, all but the top 10% standing on everyone else’s heads.

Here’s some real world stuff for you. I own a small business with 30 employees. I notified 22 of them on Friday that they won’t have a job as of 08/31/10 because we are moving from Ohio to NC to cut costs and hook up with an equity investor. I made this decision after banging my head against a wall for 18 months trying to find debt to expand and was unable to do so. My company is: profitable; audited; well capitalized; has a world-wide customer base, and; is the leader in its field. If I can’t grow (my last start-up was a two time Inc 500 winner that employed 150) and hire more people, how are new wealth and new jobs going to be created ? I’ve met with at least 20 bankers over the past 18 months. Not a single one of them is connected to the real world in any meaningful way. Perhaps Jake could provide my soon to be unemployed people with a list of big corporations who are looking to hire them on September 1st.

Thanks Mr. Carroll… Great Example!

Unbelievable that we’ve allowed this system to be so corrupt that well-connected ‘gamblers’ (our bogus ‘financial sector’) get free money from citizens to play with… and are bailed out when they lose in their zero-sum games…

Meanwhile productive enterprise is continually beaten down, ignored and/or discouraged.

After all, its hard to convince a corrupt financial sector to seek sound investments to make when unsound speculation can be so much more fun… and its so easy with all the ‘powers-that-be’ there to help!!!

Awesome example Joe. This really goes to the core of the problem. Apparently there’s $700 bn floating around if you’re a broke Wall St investment bank who needs to get bailed out of your CDS positions (twice if you’re GS!) .. BUT when it comes to working capital and debt to finance a real-world business it’s “sorry, can’t help ya”.

This is just unbelievable. These greedy fools will kill us all.

This is very nice blog and having the good information related to my searchings .