Last week, the simmering threat of trade disputes erupted into a full boil when Brazil’s finance minister Guido Mantega said that national governments around the world were weakening their currencies in an “international currency war” to gain competitive advantage. Mantega stressed that Brazil was prepared to back his words with action to lower the value of the Brazilian real. Yesterday, IMF chief Dominique Struass-Kahn warned that countries were beginning to use their currencies as “a policy weapon” in a Financial Times interview:

“Translated into action, such an idea would represent a very serious risk to the global recovery . . . Any such approach would have a negative and very damaging longer-run impact.”

And today, the Financial Times’ Martin Wolf declared China to be a legitimate target in an incisive article, “How to fight the currency wars with stubborn China.”

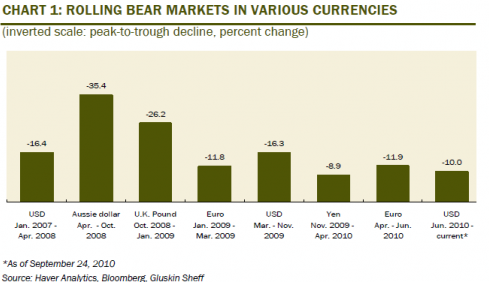

Now it’s fair to point out, as David Rosenberg has (hat tip Ed Harrison) that currency one-downsmanship has been with us since 2007:

And it is similarly fair to point out that America has gotten itself in an unhealthy economic co-dependency with China. As Marshall Auerback pointed out:

There is a curiously perverse but symbiotic relationship that exists between China’s mercantilists and America’s finance capitalism…. And it’s a whole lot worse than what the China apologists are saying (yes, Steve Roach, I’m talking about you). The whole “Bretton Woods II” process contributes to the financialization of our economy, as it continues to hollow out our manufacturing base. It represents an unholy alliance between Wall Street and China’s military, which is driving much of the investment in China because they are reaping so many material benefits. The problem, however, is that at some point Chinese credit expansion has no place to put its money. All of the targets have been saturated, which means that there will be overinvestment in all industries and to an incredible degree. This may well kill industry after industry. It appears to be happening already in Japan.

How can there be an encore? To avoid recession you have to keep the investment ratio up. But capex as a percentage of GDP in China is already off the charts – it is in excess of 50% of GDP. So the Chinese can build an additional round of capacity, which may be equal to ten times annual demand by next year, and fifteen times by the year after. Of course, this process has its limits. When the ratio is this high it is very hard to keep it this high. There is a tendency for it to fall and it will fall faster if there is a trade war. But if it falls there will be a recession in China, so perhaps China is far more recession prone than anyone thinks. It may ultimately be recreating Japanese-like bubble conditions in its own country….

There is no question that China’s mercantilism is a product of our ham-handed approach to Asia during the 1997/98 crisis, Less appreciated, however, is Beijing’s role in creating that crisis via its cumulative 60% devaluation against the dollar from 1992-94. Very few people are looking at the direct impact of China’s trade policies and how it is beginning to hollow out other countries’ manufacturing bases. It’s not just the US. The Japanese economy is now at the cutting edge of this threat Can the US be far behind?

The problem is, as Auerback points out, is that China’s pedal to the investment strategy is self limiting, just as our housing bubble was. And while the US has plenty of its own housecleaning to do, getting the trade imbalance with China reduced is a necessary, if far from sufficient, condition for restoring our economic health.

Martin Wolf goes full bore into the usual defenses of China’s stance:

Has the time for a currency war with China arrived?….I no longer believe there is an alternative.

We have to address four questions. Is China a “currency manipulator”? If it is, does it matter? What might China reasonably be asked to do? Finally, can other countries shift China’s policies, with limited collateral damage?

The first question is the easiest. If a decision to invest half a country’s gross domestic product in currency reserves is not exchange rate manipulation, what is?….

Now turn to the second question: does this matter?…

The Chinese current account surplus is far from the only explanation for the US current account deficit. Yet it is also true that China’s currency policies have driven those of other countries; that capital-importing high-income countries are unable to make productive use of the surplus savings of the emerging countries; and that the net flow of funds from the poor to the rich is altogether perverse…

Given, in addition, the continued savings surpluses of Germany, Japan and a number of other high-income countries, a return to stable growth in the world economy requires the battered high-income countries, as a group, to move into sizeable current account surplus. China is the most dynamic and solvent emerging country. It also runs the world’s largest current account surplus. If all the offsetting shift towards deficit is in much weaker emerging economies, the ultimate result is likely to be another round of financial crises. Yet China could move today’s current account surplus towards deficit, by $300bn a year, at negligible risk.

Wolf points out the asymmetry of the situation: while exchange rate manipulation helped create this mess, monkeying with exchange rates isn’t necessarily a remedy. If prices in China rise quickly enough (something we discussed as early as 2007), its good will become less competitive even at the same currency peg to the dollar. What really needs to happen is for China to move to more domestic consumption.

Auerback argues for the use of tariffs if China fails to embrace policies that address its imbalances:

It’s impossible to speak about “free trade” when it doesn’t apply both ways. Free trade is another one of these neo-liberal myths, largely predicated on the notion that we need China to “fund” our deficits. That’s nonsense. We continually read that nations with current account deficits (CAD) are living beyond their means and are being bailed out by foreign savings.

A CAD can only occur if the foreign sector desires to accumulate financial (or other) assets denominated in the currency of issue of the country with the CAD. China makes that choice. I would rather go for higher tariffs than a forced revaluation of the RMB, as I don’t think that the promotion of exports per se is a good policy for the US. We seem to be fixated on this idea of reducing domestic wages, often through fiscal and monetary austerity measures that keep unemployment high. The best way to stabilise the exchange rate is to build sustainable growth through high employment with stable prices and appropriate productivity improvements…A low wage, export-led growth strategy sacrifices domestic policy independence to the exchange rate – a policy stance that at best favours a small segment of the population.

There are other reasons to favor Doing Something about global imbalances. The Reinhart/Rogoff work on financial crises found a strong correlation between high levels of international capital flows and more frequent financial crises. While it is in theory possible to have high levels of international trade without having substantial cross-border capital flows, empirically it does not seem to work out that way.

Wolf prefers to respect the free trade sacred cow and attack capital flows directly:

I find ideas for intervention in capital markets far more attractive than those involving action against trade, as the US House of Representatives proposed last week. First, action on trade would have to be discriminatory: there is no reason to attack all imports, merely to change Chinese behaviour. But this would almost certainly be a violation of the rules of the World Trade Organisation. A trade war would be very dangerous. Insisting that China stop purchasing the liabilities of other countries so long as it operates tight controls on capital inflows is, instead, direct and proportionate and, above all, moves the world towards market opening.

Some fear that a cessation of Chinese purchases of US government bonds would lead to a collapse. Nothing is less likely, given the massive financial surpluses of the private sectors of the world and the continuing role of the dollar. If it weakened the dollar, however, that would be helpful, not damaging.

Yves here. I see the odds of things going Wolf’s way as close to zero. China has no intention of “opening” its markets to investment bankers; it is not about to have its capital markets colonized, and it lacks the domestic finance skills to cope. China has made a close study of the errors Japan made in its peak years, in the 1980s, and one was the overly rapid deregulation of its financial sector….in response to US pressure.

Similarly, the impetus to put pressure on China IS coming from the trade front, due to high unemployment. Action on the trade/tariff front looks like a more direct remedy, even if, as Auerback points out, the lags in trade are long. And with more economists lining up behind the crowd-pleasing idea of getting tough with China, the pressures and the intellectual cover, are in place.

Even though no one wants a trade war with China, it is not beyond the real of possibility that we wind up there. Per reader Vlad Ender by e-mail:

I remembered what game theory says about brinkmanship and bargaining – both parties want to avoid the worst outcome, yet if their belief of their costs are lower than their opponents, it will end up in tears.

I suspect that both US and China believe their costs are lower – or rather, their costs of not continuing their course are higher than opponents – say some sort of domestic unrest, and it’s hard for US to judge exactly China’s unrest and vice versa. Historicaly, domestic unrest in US is rare – unlike in China, and China has also status-quo advantage (sort of like management getting unions working on old contracts and then dragging on with negotiations). As a result, it’s resaonable for China to believe that their costs of waiting are lower.

I think the situation is made yet more dangerous by US increasing threat (again, brinkmanship), but by so small steps that China disbelieves credibility of any of those. Thus it disbelieves that the situation actually moved – but from US perspective it does, and at some time US may think it has to commit an action which from its perspective is only small escalation, but from China’s (who might have ignored all the previous signals) it’s a huge jump.

And to add to the odds of misunderstanding: studies of negotiations typically find that the participants’ assumptions about their opponent’s motivations and priorities are often incorrect. The odds of miscalculation have to be magnified when operating across a large cultural divide.

“If prices in China rise quickly enough (something we discussed as early as 2007), its good will become less competitive even at the same currency peg to the dollar.”

And as I mentioned back then, there are structural forces in China that caused it to teeter into and out of deflation throughout the late ’90’s and most of the ’00’s. Their demographics are of rapid aging with very few children, so the structural deflationary pressures would be expected to have increased.

We must also remember that the RMB wasn’t pegged vastly out of line; the relative rates of growth and inflation were such that the imbalance arose over a period of years. The U.S. trade deficit only grew through the ’00’s, despite the dramatic weakening of the currency.

What would cause any of these trends to reverse and allow for a peaceful REER revaluation through inflation differentials?

So, I have some measure of empathy for the Krugman tariff approach. But I think the best voice in this debate is one that you do not air: Robert Reich. We have serious internal, domestic issues that we need to solve. Lashing out at the world and asking them to change because we can’t is a bit dangerous and not at all certain to work out well.

Oh, and some have suggested that the lunatic monetization schemes we have going on globally are a clever backdoor way to force China to repeg the RMB as a surge of inflation overtakes them.

I think this viewpoint is absolutely barmy. It’s an absurd amount of collateral damage, it would be scorched Earth policy, and it does nothing to ensure that inflation happens more rapidly there than here(e.g., work).

Stiglitz put it succinctly when he suggested the Fed and ECB are throwing the world into chaos. Exactly what the hell they think they’re accomplishing is beyond me, but I dearly hope it’s something marginally more clever than Sack’s suggestion that it makes asset prices stay high. Which I hope we’ve had about enough of after the last 15 years — and even if it were to work, would only make this entire currency war worse, as U.S. consumption stays high…

Setser, what happened to you, man?

“Lashing out at the world and asking them to change because we can’t …”

I know of no serious commentator, certainly not Krugman, claiming that furriners are to blame for all our problems and that we have nothing to fix at home. However, there is no silver bullet, no one magic fix to make the economy better, and the trade imbalance and currency misvaluation are an important part of our economic problems.

The cause of the global imbalances is the unbreakable will of TPTB to continue Ponzi Scheme at all cost.

FED is totally out of control and must be stopped. Before blaming others, the culprits in US and Europe should be held accountable.

Now the usual suspects(Krugman, Wolf, etc) are in full attack mode to divert anger of the masses to China in order to save the TPTB.

“with limited collateral damage?”

The FT well knows that “limited” collateral damage is of course ok, as opposed to “large” collateral damage, which is bad for PR. In a recent blog post, Paul Krugman used Iraq war rhetoric in the context of “action” on China. No doubt it was a joke about how people wonder if Krugman is advocating military conflict as a solution to the Great Recession, yet I wonder if world war is what he will get anyway, even if he doesn’t want it.

The first question is the easiest. If a decision to invest half a country’s gross domestic product in currency reserves is not exchange rate manipulation, what is?….

If a decision to fund your standard of living via the manipulation of your treasury bond market is not an monetary manipulation, what is?

China is certainly buying Treasury and other stuff on purpose.

Ok ! But why the hell are rich OCDE countries marketing their treasury bonds to their suppliers… And later claim they suffer of the collateral damages.

This possibly a joke. But not a good one. Who does believe that those “national treasuries” are anything but negative equities of immense size.

I rather liked Michael Pettis take on what happens if the RMB is forced to revalue. He asumes the US will overreact acting like a child rather than a real grownup by intrioduces tariffs. What is interesting is his exploration of what China will do in response and the consequences for global consumption. Namely china will move towards zirp and try to bring about a credit expansion bubble shifting reliance on exports to investment, but not really rebalancing anything.

Perhaps this is why Nicolas Sarkozy is currently in talks with the chinese to agree some sort of timetable for adjustment.

One area I would query is in the argument that the stuff Americans used to import before the devaluation would now be produced domestically. I am not sure that this manufacturing would not just move to India and I am not sure how price sensitive manufacturing is in the US (considering how it is still there). What we don’t really want is more credit bubbles so we should perhaps take note of how pettis sees things developing.

“One area I would query is in the argument that the stuff Americans used to import before the devaluation would now be produced domestically.”

Certainly not everything we used to make here would be made domestically again, nor does it need to be. And we’ll still keep buying from China, which is fine as long as we have a multilateral trade balance.

The biggest problem I see is convincing investors that the US has a long term commitment to balancing its trade. Investing in actual production, and recouping that investment, takes years. This ain’t no hot money scam where you can make a quick buck.

I’m just curious (worried really). Let’s suppose for a minute that China is successful in stimulating domestic assumption, the G20 is able to agree to a global policy for re-balancing trade, and we successfully avoid a trade war, and the global economy booms.

What will happen to price of metals, oil, coal, wheat, corn and other commodities in such a case. How can China and S.E. Asia continue with 10 % annual growth rates if the demand and price for basic commodities truly begins sky rocketing? Or for that matter, with real income in the U.S. falling or stagnant, how will the average person keep up?

I’ll admit I’m not an economist. I’m just concerned about where this is all leading. I’m hoping Yves or some of the economists that comment here can offer a little insight. I realize that we currently have a fire to put out and it requires all of our attention, but I am just wondering what things will look like after the blaze is extinguished.

It just seems to me we are always caught up in fire fights to save our homes and have no policies in place for fireproofing it.

“What will happen to price of metals, oil, coal, wheat, corn and other commodities in such a case.”

They’ll go up. Possibly a lot. That’s always been an issue with the rest of the world catching up to Western standards of living. Not that I think that’s a reason to suppress the economic growth of other countries, but it is a consequence that mindless boosters generally fail to examine.

Not being an economist (although I did recently finish Steve Keen’s Debunking Economics), I feel somewhat qualified to make this comment.

It seems to me a big part of the problem with China is with runaway consumerism here at home in America. My gut tenses up every time I hear economic recovery defined in terms of more consumer borrowing and more consumer binge spending.

Since when did the meaning of life in a democracy get reduced down to how many material things you can have? Rather than building and strengthening the shared institutions or our nation and our communities, we have been acquiring increasingly larger piles of largely worthless, usually Chinese made, trinkets. (What morally sane definition of GDP allows us to say someone is better off when he has half a dozen flat screen televisions plugged into the thousand channel universe streaming vacuous and voyeuristic blather day in and day out?)

It seems to me that there were a great many people from my parents’ generation who lived through and survived the last great depression (their heads bloodied but unbowed) who achieved a wisdom about life and society that will not soon be recaptured so long as we continue to define our economic and personal well being in terms of relentless consumption. Perhaps that thing which is most feared– the collapse of our potemkin economic system– is in fact the single most important event which must occur before the phoenix of can rise again.

And why beholdest thou the mote that is in thy brother’s eye, but considerest not the beam that is in thine own eye?

Yvette says: “And to add to the odds of misunderstanding: studies of negotiations typically find that the participants’ assumptions about their opponent’s motivations and priorities are often incorrect. The odds of miscalculation have to be magnified when operating across a large cultural divide.”

Diogenes says: “Rather than building and strengthening the shared institutions or our nation and our communities, we have been acquiring increasingly larger piles of largely worthless, usually Chinese made, trinkets.”

I think that Western elites have a different worldview than the Chinese, Diogenes, or most Americans.

Most Western elites are wedded to a post-nation state, global citizenship idea that we are one planet with “shared humanity” and values. (to use a recent buzzword) National borders, in many of their worlds, will be as insignificant as county, or possibly state, borders are today.

Chinese elites seem more attached to the idea of acting to benefit the Chinese nation-state, retaining Chinese values (e.g., Confucianism), not losing autonomy to the international bankers, etc.

China to be blunt, wants its turn to be a superpower and/or global hegemon. It does not want to be just a player, albeit, an important one, in a global governance scheme that cements the current global power structure the way that the UN crystallized the post-1945 world order.

“Most Western elites are wedded to a post-nation state, global citizenship idea that we are one planet with “shared humanity” and values.”

Only when they think it will line their pockets. Convince them otherwise and suddenly they’ll wrap themselves in the flag.

‘If a decision to invest half a country’s gross domestic product in currency reserves is not exchange rate manipulation, what is?….’ — Martin Wolf

If holding foreign reserves of 50% of GDP is so very outré on China’s part, then how would Wolf characterise the Federal Reserve’s off-budget custody account, amounting to 25% of the larger U.S. GDP? Or is acquiring absurdly large financial assets and liabilities only bad when foreigners do it?

The overarching fact is that the US dollar cannot continue continue serving as a global reserve currency with the US locked into chronic trade deficits and dependence on capital imports.

A fortiori the US dollar cannot maintain its reserve status if the US starts imposing punitive tariffs on major trade partners. Tariffs are the best way I can think of to provoke a dollar crisis — one which will overshoot to a painful degree. Fancy $6/gallon gasoline?

‘Respect the free trade sacred cow’? Oh, my! No wonder the US feels like such an intellectual backwater these days, as it lapses into Third World reflexes as a means of refusing to face its structural problems.

“Or is acquiring absurdly large financial assets and liabilities only bad when foreigners do it?”

While I’m no defender of the Fed buying trillions in trash, the fact remains that it is worse when foreigners do it. Historically large sustained trade deficits have led to crashes. The Fed has at least some allegiance to the US (although it sees the banks as the only important thing in the country) while the PBoC does not.

“The overarching fact is that the US dollar cannot continue continue serving as a global reserve currency with the US locked into chronic trade deficits and dependence on capital imports.”

Good. The USD as the world’s reserve currency is a golden noose.

“Tariffs are the best way I can think of to provoke a dollar crisis”

The thing on our side is that the world can’t afford a dollar crisis. Even in the unlikely event that China decides to shoot itself in the foot by suddenly selling $2T in USD, the rest of the world would be unlikely to join them in committing economic suicide.

You’re arguing for a (continuation of) extremely timid and self-destructive US policy based on a lack of appreciation of the strength of our bargaining position.

“as it lapses into Third World reflexes as a means of refusing to face its structural problems”

Misvalued exchange rates _are_ a key structural problem. Far from the only one to be sure, but nevertheless and extremely important one.

Jim Haygood says: “A fortiori the US dollar cannot maintain its reserve status if the US starts imposing punitive tariffs on major trade partners. Tariffs are the best way I can think of to provoke a dollar crisis — one which will overshoot to a painful degree. Fancy $6/gallon gasoline?”

Or do we want even more outrageously high unemployment?

The dollar occupies it’s current high value due to it’s safety. Where is the safe currency to replace it? If the world wants to sell dollars, so be it, the Fed should sell dollars too!

Dollar is not in current position due to safety anymore. It merely the least hassle invoicing currency.

The half life of value staying in dollar is getting shorter and shorter. So basically, within a few years, Dollar will function a lot more like grocery coupons.

Trent says: “The half life of value staying in dollar is getting shorter and shorter. ”

I say bring it on.

I’m betting the boogey-man is not really under the bed!

“Power, a famous Chinese leader stated, “comes from the

barrel of a gun” The Fifth Field Army often armed

itself from war material taken from the KMT.

The last decade has had had China building a

first-class Navy on money earned by selling us

trinkets.

Naked Capitalism ala Prescott Bush has no morality

and has made big bucks peddling the trinkets

China has turned into spears.

China not AQ is and has been our geopolitical

enemy.WTO rules are not worth the paper they are

written on. While we still have time we must

show China the barrel of our gun.

A simple across the board 25% tariff on all

Chinese exports is a must.

If not we will die the death of a thousand cuts.

Reed Smoot, we never knew ye.

If China’s construction bonanza ever has to stop, the next move in the Yuan will be to DEpreciate it, to spur MORE exporting, not less.

Do not rule out a cheaper yuan.

In china, unemployment means starvation, and they will need to keep the factories humming.

But even if China appreciated, for whatever reason – Vietnam, Mexico, India all offer dirt cheap labor.

So the problem isn’t China, so much as it is 3 billion poor workers ready to labor 17 hrs a day for 2$ an hour.

IMO, our real Trade imbalance, on a global perspective, comes from importing energy, not ipods and shirts from Wal-Mart.)

So unless America wants to go full retard and close the borders to everyone (which would decimate our standard of living) China is just a another labor pool ready to work.

The answer is, as it has always been, high productivity. High skill labor (programming, tech, IT, surgery, weapons…) it the only way out.

This starts by policies that are geared towards to economy of the future, not the manufacturing economy of America in 1955.

We don’t need more steel in America. We need more Googles. And more Cisco’s. And more Microsoft’s.

We need to export technology to the developing world. Let them export steel.

This will be a fun game to watch.

Assuming that today all cuurencies are revalued such that all are fair to US dollar. Come tomorrow and days after the Fed implemented QE2, QE3,…Qn. These QEs will debase the value of US dollars, rendering all other currencies overvalued again unless adjustments are done after each QE. Why is it that US is entiltled to constantly devalue US dollar in this manner causing exchange rates to be out of whack? Government increasing deficit spending also leads to similar debasing of US dollars.

“These QEs will debase the value of US dollars, rendering all other currencies overvalued again unless adjustments are done after each QE” should read “These QEs will debase the value of US dollars, rendering all other currencies undervalued again unless adjustments are done after each QE