A newly released report, “Grow Together or Pull Further Apart? Income Concentration Trends in New York,” by the Fiscal Policy Institute (hat tip reader Thomas R) gives a picture of how New York City is now at Latin American levels of income disparity.

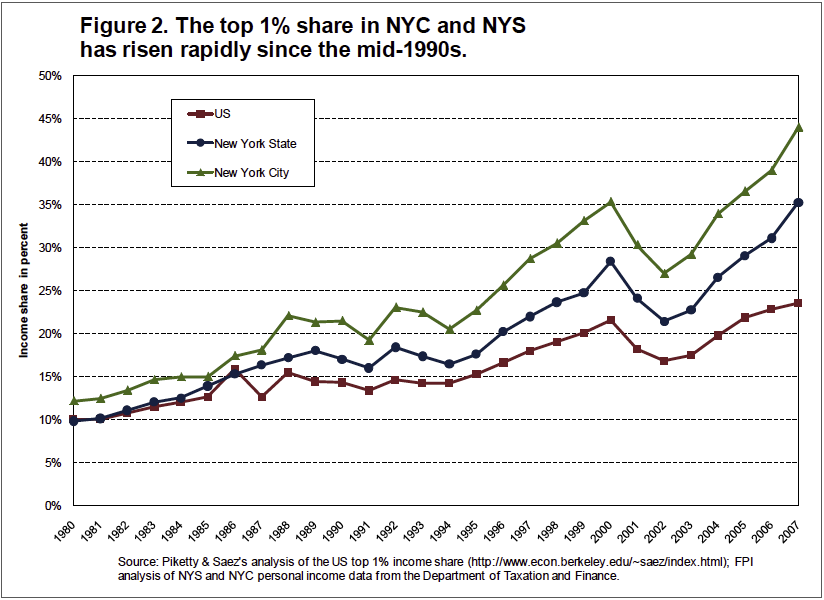

New York’s top one percent has an income share that one and a half times as high as the 23.5 percent historically-high national level….The city used to have a broad middle class, rooted in a vast manufacturing sector and mid-level positions in corporate headquarters as well as in education, government, construction and other good-paying blue-collar jobs. But manufacturing is about one tenth the size it used to be, and the city’s labor market has seen the disappearance of thousands of middle-paying jobs and the growth in their place of moderate- to low-paying jobs, mainly in services.

Given its degree of inequality, if New York City were a nation, it would rank 15th worst among 134 countries with respect to income concentration, in between Chile and Honduras. Wall Street, with its stratospheric profits and bonuses, sits within 15 miles of the Bronx—the nation’s poorest county.

And if you think that the rising tide of burgeoning financial services profits has improved the living standards of those at the bottom, think again:

The concentration of income growth at the top does not necessarily mean that those below the top are not experiencing real income gains and generally rising living standards… However, over the period from 1980 to 2007 in New York, when total inflation-adjusted income in the state grew an average of 2.1 percent a year after adjusting for population increase, incomes for those in the bottom half of the income spectrum generally declined while those in the middle income range rose but at only a fraction of the pace of total income growth.

In addition, taxes do little to redistribute income:

Because the city has a mildly progressive personal income tax, high-income residents pay a lot in New York City taxes. However, when local sales and property taxes are factored in, it does not appear that high income residents pay more than their proportionate share in local taxes. In fact, as discussed later, they pay a smaller share of income in local taxes than residents in the middle of the income structure.

The reason rising income disparity matters, as we have discussed before, is that highly unequal societies produce poor outcomes on virtually all social indicators – mental health, crime, teen pregnancy, lifespan – to such a degree that it has a negative impact even on those at the top of the foodchain. But no one in the kleptocracy wants to hear that message.

Just a minor quibble – the report is wrong in naming the Bronx as the country’s poorest county, it’s nowhere near that. It is the nation’s poorest _urban_ county, which seems to be a county with over a million people.

http://www.ny1.com/?ArID=106559

http://en.wikipedia.org/wiki/Lowest-income_counties_in_the_United_States

Chile is no Banana Republic!

How can you call Chile a Banana Republic! (Although it does have a high level of inequality)

Does the post accuse Chile of being a banana republic? It says Chile has Latin American levels of income disparity. And “watch” as in “tornado watch” is not a statement that the adverse development under inspection has materialized, just that it is in danger of happening.

In other words, please read more carefully.

Sorry Yves,

But you put up a headline that says; Banana Republic Watch, NYC more unequal than Chile. That to me sounds like you are calling Chile a Banana Republic. The article may not call Chile a Banana Republic but the headline sure implies that. Sounds a bit unfair telling your readers to read more carefully.

I don’t mean to get rude, but this is not hard to parse, and your reading is skewed. “Watch” does not mean the factor being watched for has happened yet. And it’s not just for weather alerts. When rating agencies put a company on “watch” for downgrade, that does NOT mean they’ve downgraded it!

And since New York City is lower rated than Chile, the headline is more aimed at NYC than Chile. Funny no one is defending New York City against the being too closely associated with the expression “banana republic”. The lady doth protest too much.

Rent and taxes and bankster looting will soon make most of us envious of Chile. No doubt in this decade we will see martial law too, but you mistake the problem when you discuss income of the “top one percent”. Those at the bottom of this range pay most of the income taxes and many are just getting by. The real inequality is located in the top 1/10%.

If Yves had meant to write “banana republic,” I’m sure she would have done so, doubtless being familiar with Simon Johnsons’s article on that subject.

For my part, our “little Republic of San Marcos” is a banana republic, marked not only by the income inequality that Yves points out, but by elite impunity for criminal acts, another salient characteristic. But that’s not what Yves wrote.

Pitchfork?

the article clearly states that nyc is between honduras and chile, i.e. it’s now more unequal than chile, and the next stop, if the trend continues, will be as unequal as honduras. having written that in the article, it’s quite easy to see why one would create the title “worse than chile”–it’s actually just being precise. should the headline have rather said “almost as bad as honduras”? careful reading makes this apparent immediately.

“In addition, taxes do little to redistribute income”

Wow. You’ve bought into the meme that taxes are supposed to redistribute income.

That simply isn’t true. A tax policy– properly implemented within a broader framework of complemenatry accounting rules, fiscal policy, and monetary policy– redistributes how WEALTH is distributed between speculation and investment.

Current tax policy encourages pure speculation in the secondary bond and equity markets. We call this investment, but it is rank, casino-like speculation.

Such speculation does not and cannot create jobs. What creates jobs is true capital investment in domestic businesses.

When you properly reframe the discussion of rebalancing a portfolio into equivalent instruments, and tax policy does not seem so much like borrowing from Peter to pay Paul (or worse, stealing from Peter to pay Paul).

Excellent comment on the role of taxation on investment/speculation, I appreciate that dichotomy…that’s kinda what I tend to argue but I never elucidated it enough. Thanks.

It looks like you’ve bought into the meme that markets allocate capital efficiently. If you contend that it takes tax intervention to produce that outcome in financial (or as you call them, investment) markets, you’ve already undermined your argument in a serious way.

It looks like you bought into the meme that non-rational market participants will, as voters, rationally elect politicians who will then rationally choose policies that will rationally help the least well off, while, rationally, same said politicians will not line their own pockets with filthy lucre they wonderously dole out to the masses. Because of course, lining one’s pockets would be just, well… damned rational.

Hard pill to swallow there.

It worked well from about 1935 to 1980, and it also works pretty well in much of Europe, Australia, and New Zealand. It is possible to have a progressive tax structure that delivers better social outcomes and broadly comparable levels of growth.

So you need to factor in why the US is more inept on this front, which we are. This is about the US’s particular foibles, not the general premise.

So from 1935 – 1945. I don’t think the depression was a time when economic inequality was actually shrinking. Quite the contrary. Given the levels to which the poor fell, this would be hard to argue. Same with WWII. You would have to factor in the men who dying in your calculation. That leaves, WOW, about 35 years during which progressive taxation evened the score, then blam blow blooey it all went haywire again.

That is a ridiculous assumption, that income equality was directly related to progressive taxation and not other factors in the economy.

It also assumes that progressive taxation was progressive and the numerous tax breaks to the rich, did not actually make their effective tax rate actually lower or more equal to the middle and lower class rates. Also, foundation and endowment grants allow the truly rich access the returns from their principle at a lower rate,(last I remember 10% of the net proceeds must be paid to charities, alowing an effective tax rate of .. yeah, 10%.) You would have to factor that in as well.

A better assumption, one that fits well with the trend lines, is that government spending and entitlements actually favor the rich, (see Bailouts, see Redevelopment which converts low income neighborhoods to shiny white ones) while the taxation hits hardest on the middle and lower income levels. That would be a better theory and more in keeping with the trend lines.

That would fit the trend line much better.

Matthew,

You do not appear to have a good handle on economic history. Depression bottom was 1932-1933. You most assuredly had a reduction in disparity from then onwards, with a bit of a reversal in 1937. So your first paragraph is inaccurate.

Second, you’ve similarly made no response to the rest of my argument re Europe and other nations that have used progressive taxation to reduce income disparity and produce better social outcomes.

Third, you may be showing your age, or more accurately, the lack thereof. The use of foundations as a way to have one’s cake and eat it too is a development of roughly the last 15 years. You need to ALREADY have accumulated a good deal of wealth for that strategy to make any sense. With very high marginal tax rates and very high estate taxes in the past, it was far more difficult to accumulate large concentrations of liquid assets.

Fourth, you are straw manning. I never said it was the only factor. The bailouts do not explain the increased wealth concentration pre the crisis (I was writing about it a ton then), nor does urban redevelopment (look at the ranks of the Forbes 400, you see a lower concentration of real estate types than in the past).

Why do some revile the notion of community so much, you been, you know…sigh.

Skippy…a country predicated on the notion of superiority by faux individual wealth and that such a paradigm will triumph in the end…DBL sigh.

PS. maybe it has to do with origins, like the stocking of a country by the rentiers of old for indebtedness, the bad taste of being born poor, with out a voice in things or a disposition against violence until the end.

Matthew,

Your screen name is most appropriate:

For whosoever hath, to him shall be given, and he shall have more abundance: but whosoever hath not, from him shall be taken away even that he hath.

–Mathew 13:12

Since you seem to be such a great proponent of the Matthew Principle, was the selection of your screen name by design or do we have poetic justice at work?

DownSouth, you shouldn’t propagate the capitalist hijacking of that great parable.

It refers to one’s faith in the struggle, and how victory will come to those who believe and fight, while cowards and shirkers and those who cling desperately will lose what little they have.

Certainly an apropos parable for the deteriorating middle class today.

“You’ve bought into the meme that taxes are supposed to redistribute income.”

Seriously, what does this sentence mean?

Are you claiming that tax policy is incapable of redistributing income? If so, that is not just incorrect but daft. Every government policy has at least some subtle form of redistribution of income, wealth and power.

Or instead, are you saying that in your ideal world, tax policy “should” not be used to redistribute income? Great, we all have two things: assholes and opinions…What is your point? That this sort of redistribution is not good for you? Why would I care? Cui bono? Just you?

The Kleptocracy hears it loud and clear.

They are answering with a resounding “Mission Accomplished”

Chile has transformed itself into a Wine Republic. NYC just imports wine.

NYC does not export bananas. NYC IS bananas.

Cute, but copper is still Chile’s biggest export:

http://en.wikipedia.org/wiki/Economy_of_Chile#Foreign_trade

Since some defend the honor of Chile, I’ll defend the banana. It’s a very nutritious fruit. As for inequality, it’s a good point to remind ourselves of the genius move of our so called president who is trying very hard to help the GOP widen the gap with the Bush taxes. No surprising since he was elected with Wall Street money; they knew who they are electing.

The progressive tax is to blame for the distribution. The middle and upper middle class move out of new york city because of the progressive tax. The poor don’t pay tax and the rich can often avoid the tax, and if not they aren’t going to let that stop them from living in Manhattan if they want to.

I was thinking mildly along these lines…. Based on my sample of me, the middle class moves out of NYC because of the schools. The Schools are either out of reach private $chools, or a public system that has its problems and is a gamble depending on your neighborhood.

The middle classes moving out for the schools is 1970s and 1980s behavior. It was also a perceived safety issue then too, I’ll admit.

The middle classes move out now as soon as they can no longer stand living in tiny apts, which usually means once they get married or have kids. The cost of housing is directly, not indirectly, forcing people to live in the suburbs. Artists, who used to live in Manhattan have also for the most part been driven out.

But for the most part, living in the ‘burbs is not singles friendly, so getting hitched is a common driver.

I like the way Stiglitz puts it in Freefall..

“Economics is a social science. I soon realized that my colleagues were irrationally committed to the assumption of rationality. Robert Putnam has emphasized the importance of our connectedness with others.””

“”It has become a cliche to observe that the Chinese characters for crisis reflect “danger” and “opportunity”. We have seen the danger. The question is, Will we seize the opportunity to restore our sense of balance between the market and the state, between individualism and the community, between man and nature, between means and ends? We now have the opportunity to create a new financial system that will do what human beings need a financial system to do; to create a new economic system that will create meaningful jobs, decent work for all who want it, one in which the divide between the haves and have-nots is narrowing, rather than widening, and, most importantly of all, to create a new society in which each individual is able to fulfill his aspirations and live up to his potential, in which we have created citizens who live up to shared ideals and values, in which we have created a community that treats our planet with the respect that in the long run it will surely demand. These are the opportunities. The real danger now is that we will not seize them.””

this post is so self-evidently true it doesn’t even need the support of facts.

new york sucks. it’s like wizard of oz without the wizard. instead there’s a moron behind the curtain. LOL.

you go to times square and there’s no more strip joints, no more drug dealing, no more head shops, no more wonderful debauched tapestry of l’conditione humane. It’s all glass idiot boxes for securities industry or global consulting firms and fat tourists fromn Iowa pointing their cameras up at everything. WTF?

you go to the east village and there’s no more poet cafes, no more down and out ukranian diners, no more art galleries. It’s sleek quasi-corporate manicured shit, everywhere. Forget Soho. That was toast decades ago.

And then there’s the slaves. The nail salon slaves. The delivery boy slaves. The Chi-gong massage parlor slaves. On every damn block. Or you’re a publishing industry slave, or a freelance writer slave or a public relations bimbo slave.

Either you’re a rich money-sucking SOB or you’re a slave. Not much in between. Just a few upper middle class hustlers, climbing the Wall Street money rope so they can be rich SOBs themselves.

What a kultcha! Oy Vey.

Look, you’re saying “slaves” like that’s a bad thing. Can’t we please have some objectivity here?

You describe a murky Bladerunner-Darwinist dystopia, not far off. The madness of an empire that spends fully half (officially) of its budget on military violence is self-evident. But I wonder if Harrison Ford and replicant Rachel will ever find a sunny green paradise beyond the urban gloom.

We only WISH we could become a banana republic. Unfortunately, for those poor souls left-behind by the rapture of parasitic capitalism, the US cannot even aspire to such status. Sadly, we don’t have nice weather, and we can’t grow bananas.

“An imbalance between rich and poor is the oldest and most fatal ailment of all republics.”

– Plutarch

No matter what form of government prevails…

At its root, a civilization (or any social organism) is a product of individual and group decisions (ideas+actions) operating within the confines of the physical environment and natural law. we then see culture as the expression of this “social energy”.

Money was developed originally as a technology for the allocation of excess social energy where complexity (and loss of various forms of proximity) required conventions beyond the less formalized methods of a hunter-gatherer group.

I believe this suggest some re-thinking about the nature of money and capital (and capital creation) but that’s another story…

The point here is that the nature of this “social energy” in a scaled organism requires that the exchange of this energy NOT be bound by transaction costs or other complications IN AREAS RELATED TO COMMONS-DEDICATED FUNCTIONS ESPECIALLY…

These particular areas of exchange actually pre-date the need for or existence of the commercial transaction and require special attention.

An unburdened microtransaction is a fundamental requirement for Speech and Association (politics/ journalism) in a scaled social organism.

Does this have anything to do with the situation above? I believe it does… the degradation of the social contract is a product that slowly arises with imbalances in influence.

“A full 90 members of Congress who voted to bailout Wall Street in 2008 failed to support financial reform reining in the banks that drove our economy off a cliff. But when you examine campaign contribution data, it’s really no surprise that these particular lawmakers voted to mortgage our economic future to Big Finance: This election cycle, they’ve raked in over $48.8 million from the financial establishment.” (“Crony Capitalism: Wall Street’s Favorite Politicians”, Zach Carter, ourfuture.org)

I don’t like the way money is controlling politics either. Sometimes you have to fight fire with fire…

$48.8 million? It’s disgusting how these special interests can network their money!

$48.8 million is less than 35 cents per registered voter…

It’s just a matter of implementing the technologies to harvest other sides of the debate..

Most people NEVER give to a cause or campaign. It’s a hassle and unless you’re giving substantial bucks you feel pretty impotent anyway.

It doesn’t need to be that way. Its just a matter of catalyzing the network.

I feel like Ignaz Semmelweis… http://en.wikipedia.org/wiki/Ignaz_Semmelweis

Fixing the Political Relationship

http://www.youtube.com/watch?v=S5qxJDnwXAU

http://CulturalEngineer.blogspot.com

Catalyze the Network!

yes Tom it’s “the other story” that contains the heart of it all.

I do believe you are correct about many things. To get at the root of money one has to go to the tribe and the connections within the tribe, back to barter and even before barter. And one has to look at social relations and the many ways they have been structured, throughout history — and I mean 10,000 years ago and even farther back.

it’s quite an adventure for the interested mind. Money is a very Protean “thing”. It contains so many opposites and contradictions. Like guns or electricity. There’s always, at the end of it all, the need to control the Imagination, which is where all Hell breaks loose, anywhere and everywhere.

you can ‘catalyze’ the Network, but you’re not gonna get the influence of money out the cold dead hands of the Rockefellers, Andersons, the non-Madoff ponzis soon to be deceased, (Pete Peterson that means you), or Bill Gates for that matter.

How does one style the disparity in the distribution of income? How does one describe the loss of class mobility that gives a society the best opportunity for positive social outcomes?

Banana Republic is an appellation for describing countries that have no to minimal middle class citizens. The export of bananas is only incidental to the disease that such a country suffers from.

Our great recession is part of a larger process. It is process in which we all have the opportunity to make choices that will collectively coalesce into a structure that will partially determine the path of our society.

In the conduct of trading activities there is a certain amorality that prevails. The problem is how does, or will, the society achieve fair markets? For those who prefer ‘free’ markets, they should consider just how they would overcome the unbounded human capacity to connive, lie, cheat, steal and perpetrate wanton frauds. The ethos of Wall Street is that if there will be no prosecution, do it! So just why is it that we have had so few prosecutions, and for those that are now coming, why are they so late in occurring?

Income disparity and the loss of a middle class and class mobility is a serious disease and most often the harbinger of the terminal dissolution of the society. Tax schemes that are directed toward the redistribution on income, rich to poorer are avoidable and the intent of leveling incomes is thwarted as rapidly as the tax schemes are created.

It once was that class status was defined by: income, its level and source; education; and family status. I don’t believe that those criteria hold today. What I see is that those who would have once been counted as being upper class are increasingly isolating themselves in gated communities and employing educated but underclass individuals to manage their wealth. In the process of managing, the underclass minions are amassing riches but very little wealth. And be very clear, there is a considerable difference between being rich and being wealthy.

Better that this particular blog would consider just what is the disease that afflicts the Big Apple, and this country, than to dither about the very brown bananas that litter the discourse.

This is the biggest load of crap I have ever read. New York City has one of the highest, if not the highest, combined tax rates in the country. But forget that, New York is one of the most cosmopolitan cities in the world so surprise – rich people want to live here!

You could say the exact same thing about the east bay/San Fran but that would not further the cause of spitting at the evil financial industry. How about the evil tech industry that exports jobs and charges to much for an i-pad.

One other thought – consider the change in the quality of life in New York for the last 30 years – cleaner, less crime, better schools, strong social safety net. All paid for with taxes from the city.

One more – FPI is not exactly an unbiased source.

unbelievable

Of course, one could say many bad things about many other places.

Why are so intent on deflecting attention?

Your point is that there is never anything wrong with NYC?

Because there are a few things that are better, this means nothing could be worse? Because you have high tax rates, you pay enough (even though we haven’t heard you discuss whether or not the other side of the equation (the expense in running a city like NYC) justifies these high rates)?

Perhaps you should climb down off your high horse, go back to college, and take a course in logic.

Also, if *this* is the biggest load of crap you have ever read, you must have learned to read yesterday. I could find a hundred other articles published *this morning* that are outrageously biased and full of blatant inaccuracies. Seriously, why do you insist on making a fool of yourself?

It seems a little more analysis is warranted here.

For example, does the following fact have anything to do with income disparity?

“Health care industry employs approximately 375,000 people in New York City, making it the city’s largest employer.”

http://en.wikipedia.org/wiki/Economy_of_New_York_City

I had a thought about the estate tax today. Let me try to explain.

What I see happening in the real world is that the baby boomers accumulated vast sums of wealth. The rich elites want to take that back. But if they took it by taxes, it would have to be put to use building roads, schools, things people like. So instead, if they can lower the estate tax, that inheritance by the children of the boomers can be put to use being spent on health care, electronics, paying down credit card bills so that they can then spend again on the credit card. So this is a different, more profitable way for the rich elites to extract that baby boomer wealth. Which I feel is their only motive right now. The baby boomers gained too much wealth. That keeps them complacent in the voting booths so that real change doesn’t happen. Their children have been building up tremendous debt thru bigger homes, health care, credit cards because their standard of living has not kept up. This has been the way that that boomer wealth is being taken back. By not taxing any of it, more will be spent and grow the profits at various companies, while also breaking the social safety net thru starve the beast.

Tyler Cowen had a great article on income inequality; though it was perhaps a little fatalistic in addressing the financial sector: http://www.the-american-interest.com/article-bd.cfm?piece=907

Excerpt:

“First, the inequality of personal well-being is sharply down over the past hundred years and perhaps over the past twenty years as well. Bill Gates is much, much richer than I am, yet it is not obvious that he is much happier if, indeed, he is happier at all. I have access to penicillin, air travel, good cheap food, the Internet and virtually all of the technical innovations that Gates does. Like the vast majority of Americans, I have access to some important new pharmaceuticals, such as statins to protect against heart disease. To be sure, Gates receives the very best care from the world’s top doctors, but our health outcomes are in the same ballpark. I don’t have a private jet or take luxury vacations, and—I think it is fair to say—my house is much smaller than his. I can’t meet with the world’s elite on demand. Still, by broad historical standards, what I share with Bill Gates is far more significant than what I don’t share with him.”

Yes, I sit in a tree in Central Park in a t-shirt and shorts — even in the winter. I eat acorns and fish from the pond.

But I have solved the problem of the conscious perception of pain, life, death, good and evil. I have transcended the infinite duality and achieved the One-ness of all awareness.

I am beyond it all. And I am happy, without a cent to my name. Even when I’m a block of ice, frozen.

I am a God. :)

RichFam:

What does the fact that the City has a high income tax rate have to do with the unequal income distribution?

The FPI, while it does have an agenda, is also carefull with its numbers. Yes, NYC has a high income tax, BUT: Property taxes are not high, and they are actually lower on condos and co-ops than other residential properties (and these are the kind of properties many rich in NY County are likely to own). The Fed tax system also allows people to get a credit for their local income taxes, so while the rich pay more in State and local income taxes, they consequently pay less in their Federal taxes (rate-wise), and this isn’t even taking into a ccount the lower capital gains rate. The sales tax hits everyone, and this of course is generally regressive. And FPI does acknowledge that the poorest folk get the EITC, so if you look at their examination of the actual tax rates (all taxes combined) they credit the poorest with a negative income tax rate. What they do show is that in NYC the middle class pays the highest combined portion of their income when you factor in all taxes and the nature of the combined tax regime.

Remember that fellow with “the rent is too damn high”? Same with the taxes. I admit to defending my town a bit but not on taxes (or rent subsidies for that matter). Taxes are big in New York and you know it when you look at the pay stub. New York is set up to squeeze the middle and create the inequality:

* taxes are high and you’re right, they marginally hit the middle – either way NYC has the highest income tax burden

* real estate is expensive – a direct result of rent control/subsidy imposed by government – this attacks rents and sales prices – so you’re either poor or lucky to get subsidized housing or rich enough to overpay for housing (or you’re a senator)

* property taxes are lower than some – like New Jersey – but not low by any stretch. Not in the city anyway and surely not in the surrounding area.

* Three words on the federal exemption for local taxes: Alternative Minimum Tax – the exemption is worthless

* Sales tax 8.25% – killer

This is ALL government creating an “inequality zone” in NYC

Another thought – You’re right – the tax rate has nothing to do with inequality – but tell that to the owner of this blog, not me. Attacking inequality through taxation is like giving out pain pills for cancer. Deals with the pain rather than the disease. The patient will die, which means move away or shelter income when it comes to taxes. The sources of inequality in this country are many – poor schools, poor corporate governance, globalization, etc.. But taxing to create equality on moral grounds will never solve the problem. Look at New Jersey – all the “rich” people have been leaving. And living in NYC I get no sense of stirring unhappiness over inequality – I’ll use a term here I totally hate: straw man.

Also, inequality arguments always ignore long term changes in quality of life derived from a capitalist system. Think about how crappy it was for a poor person in NYC 100+ years ago versus today. If our system creates some inequality but creates overall quality of life whats so bad. Would you rather be poor in India or here?

dude, you sound like you’ve got a guilty conscience.

I’d rather be poor here, though, for sure.

Unless I had lots of hot women in India who were even poorer than me, and who hung on me like a Rock Star. ha ha.

It’s all relative.

Someone should check the whole state of Florida out and see if it’s any better. Probably not.

There are only 3 kinds of folks in that state: 1. Poor, 2. Rich, 3. Tourist. It’s undoubtably just as bad as NYC!

Everytime I visit that place all I see is poor people with no hope for the future waiting on a bus after working too hard for too little money.

It always makes me glad to get back to Ohio where there is at least a pretense of middle class although I question the reality of a middle class here also.

Yves, it seems that much of the swing in the entire country has emanated out of NYC. Well we know the main industry in NYC is the creation and amassing of credit. Credit has no end solution but bankruptcy and it appears the disparity came from 2 things, Volkers massive interest rates to get the game going and allowing the bankers to operate without capital. The stock bubble and housing bubble and every other bubble and the income disparity all came out of this.

There has to be something wrong with a mathematical model that allows a group to invent, lend and at the same time keep it all. If a banker really had to lend out what they created in credit, they wouldn’t go on too long. If we took the bad debts out of the system, all of them would be broke. It is this compounding, this piling up of rents on society that is going to take the system down.

The problem with all of this is the entire economy has been financialized, meaning one persons debt is anothers pension and the bankers are the middle men in the game, taking out the only guaranteed slice in the game. This is headed to feudalism if we don’t get a handle on it. This isn’t isn’t a conservative-liberal or socialist-capitalist situation, but a survival of the American system situation.

The credit system is so paradoxical that even to understand it, it is hard to wrap ones mind around its totality. Some of it has to do with trying to converse with others and help them understand it. Banks are nothing but accounting ledgers. If Bernanke printed it all up and people took it out, the banks would collapse long before the last dollar was paid and the assets Bernanke took in would collapse as well. Compound interest needs a loan to keep going and this is the disparity. In the meantime, NYC is sucking the rest of the country dry.

The source of all evil is NYC? Really

* Sales tax 8.25% – killer

In Ontario we have 13% sales tax, down from 15% as of a few years ago. In many countries in Europe it is over 20%.

In comparison to other developed countries, the USA has very low (or no) sales tax, yet the highest inequality levels.

For the answer, you have to look to the overall government policies in the other developed countries versus the USA. Here’s a hint – start with investment in public education.

Americans should be talking about the overall rise in inequality in their country, not a special case like NYC where there are special factors at play.

The source article does cover that too, and I have discussed income inequality often on this blog. But craazyman is right re the “slaves” here, NYC has a remarkable number of poorly paid service workers in a very high cost of living area.

See this for more useful detail:

http://feedproxy.google.com/~r/BronteCapital/~3/NCJC2U0F17M/lessons-in-my-laundry-part-1.html

http://feedproxy.google.com/~r/BronteCapital/~3/yidkNRcW9Yo/laundry-lessons-first-follow-up.html

I am thinking if we compared urban areas rather than an urban area to a country New York would probably not be the worst off. Yes inequality is staggeringly high in the USA in comparison to other OECD countries but I think we would find strikingly similar inequality rates amongst urban areas throughout the world, although less so amongst the OECD. My guess is Los Angeles might be higher. Although it is high New York has nothing on Latin American, Asian, African, and former Soviet urban regions. But, that isn’t the standard that we should be going for nonetheless, I find that argument miraculous, like automatically the bar has been set lower that we should be comparing ourselves to developing or emerging economies.

I had a rather distinguished professor try to peddle the Europe is more unequal than the US notion once in class. Although I called him on the bullshit, I found it bewildering at supposedly top-tier economics program at a school soley focused on economic and social inquiry that no one else in a masters level course would say anything.

It depends on how you compare, they were using US States compared to European countries. Which that point is true. Inter-regional inequality is higher in Europe, interpersonal inequality is lower. So when they suggest in academics that inequality in the world has gone down over time, what they mean is that inter-regional inequality has gone down, however, inter-personnal inequality has gone up within and between regions.

There are some other problematic parts, as to what constitutes a functional urban region, or purchasing power parity disputes. That is where we get wonkish.

Calling Chile a banana republic is not only ignorant but stupid, as only the dumb pretend they know things they don’t. In a banana republic–term which comes from the appropiation of the natural resources of a small central american country, specially one that produces the banana, by an oligarchy sold out to the U.S. empire–most people live in abyect poverty; infant mortality is high, so unemployment, and diseases like cholera and tuberculosis run rampant. Social services are inexistent, crime rates are very high and the police and the military are utterly corrupt. None of these elements are present in Chile, which the last time I checked was about the 40th in the world in standard of life. If you go to the sites like Chile Forum you’ll see that this is a preferred country of destination by many of those U.S. citizens who would like to emigrate to other places, at a same level with Australia, New Zealand and Costa Rica.

I suggest you read the comment thread. You’ve done quite a job of projecting your own issues onto the headline.

My own issues IS ALREADY IN THE HEADLINE as it is announced with CAPITAL LETTERS in the title. I’m not such an ignorant as not to understand the implicit relation between terms. You don’t have to explicity say that Chile is a banana republic as it is enough with impliyng it. It is like saying: The U.S. of A. invaded Iraq and Afghanistan. Man, we are now in Nazi Germany’s territory. I didn’t say your country is like Nazi Germany. I just had to imply it. And, after all, What exactly means “Banana Republic Watch” and Chile right after it, in the same sentence….?