Proposed legislation in Virginia, House Bill 1506, which if passed would eliminate the role of the electronic registry system MERS in that state by requiring every mortgage transfer to be recorded in the local courthouse, is having the salutary effect of exposing more information about this generally less than forthcoming company.

Various interested parties offered testimony about the bill. One particularly interesting presentation came from a process and systems expert, Daniel Pennell, who was operating in a private capacity as a concerned citizen. His presentation raises numerous red flags about MERS.

We’ve pointed out troubling weakness in MERS’s operational controls and systems in past posts. Our Richard Smith, a capital markets IT specialist who has worked in high transaction volume environments, provided comments on statements made by MERS officers in various depositions about how various procedures worked. He found serious shortcomings in their “electronic handshake” process and authentication, as well as troubling open questions about access control and an audit trail. From his discussion of the electronic handshake:

I agree about the laxity: 1) if there is collusion outside the system, just about any set of transfers could be input and confirmed by two parties. Where is the dual-keying and management supervision? This ends up at the accountability question, below. 2) There’s no indication of any reconciliation process, ie daily checking for transfers that don’t match and sorting out who made a mistake. It beggars belief that there wouldn’t be confirmation failures, with human beings on either side of the transaction.

Combine 1 & 2 and it’s easy to see how the physical legal reality and the electronic record might not agree. As the lawyer keeps emphasizing in his questions, there is nothing here which would make a chain of transfers evidentiary of anything, if it’s the paperwork that actually counts legally. It does seem to be just a (potentially shaky) electronic copy of the physical docs.

Other observations: the guy being interrogated seems like a low level operator who doesn’t necessarily understand the system too well (*update* after closer reading FUCK ME, he’s the CEO).

Yves here. He appears to be on the verge of being the ex-CEO.

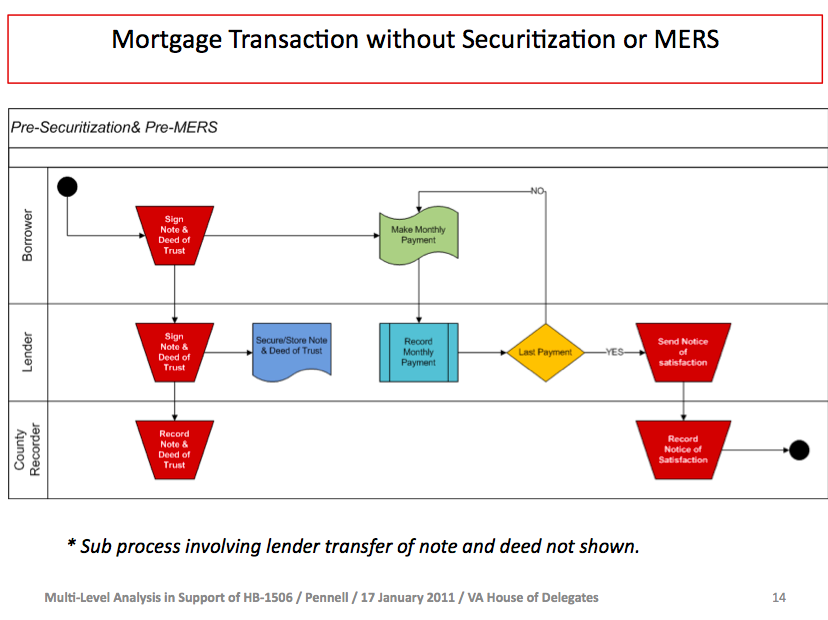

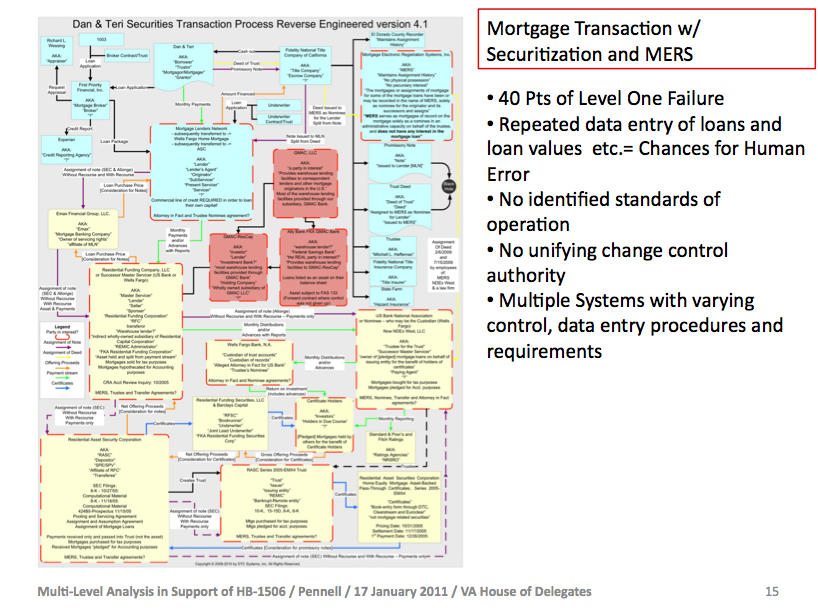

The Pennell assessment comes at MERS from the perspective of overall process flows, system complexity and propensity to error. The entire presentation is very much worth reading, and as an inducement, I’m highlighting these two slides (click to enlarge):

Here is the full presentation.

VA House Presentation HB 1506 by Daniel Pennell

Pennell goes through a series of known problems with securitization (some of which extend beyond MERS’s purview) and concludes, “Any of these would satisfy the definition of an out of control process.”

Needless to say, the closer you get to MERS, the uglier it looks.

Combine 1 & 2 and it’s easy to see how the physical legal reality and the electronic record might not agree. As the lawyer keeps emphasizing in his questions, there is nothing here which would make a chain of transfers evidentiary of anything, if it’s the paperwork that actually counts legally. It does seem to be just a (potentially shaky) electronic copy of the physical docs.

In the In re Vargas case the court rejected the attempt to cite the MERS database as evidence as “hearsay”.

That’s exactly what it is. It’s also like a fake ID you manufactured yourself.

Every thing looks better with a bow attached.

BTW Richard I liked your F1 analogy, Ayrton Senna da Silva found out the hard way even after spending his final morning meeting fellow drivers, determined after Ratzenberger’s accident to take on a new responsibility to re-create a Drivers’ Safety group (i.e. Grand Prix Drivers’ Association) to increase safety in Formula One, only to succumb to that which he personally was prepared to fight for.

http://en.wikipedia.org/wiki/Ayrton_Senna

Skippy…lets hope that the same mentality that got him killed is thwarted by better minds, just imagine what the bits flying off the RMBS/CMBS speed machine would do to spectators…eh…the law of dirt is not unlike the of physics, flaunt them at your peril.

It has become clear that processes and IT systems for the management of mortgage and securitized credit are seriously flawed and a huge burden for the liquidation of the US mortgage and derivative credit bubble.

As a consequence, rights and duties of participants are in doubt. Data and documents on loans, collateral, and derivative products linked to that loans (MBS, ABS, CDO, CDS) seem to be badly managed, and to a large extent hidden from stakeholders, e.g. borrowers and investors.

One focal point is MERS, which should be seized by the FDIC, and audited by process and IT experts to uncover the truth. The audit result should be published.

This would be in the public interest, and a step to a transparent resolution of the current mess.

Agree with your points.

I have recently been marveling that a Babylonian scribe of 2,800 BC would have kept better property records using only a clay tablet and a reed carved to a sharp point.

Truly, wonders never cease.

The Babylonians obviously had one central repository which nobody could challenge, while the information on mortgage loans and derivative credit contracts is distributed across multiple entities, and nobody seems to be sure what constitutes truthful data and documents in that environment.

While both these MERS articles illustrate that which we have known all along, that the entire scheme is an illegal affront to the legal system,we are missing the main point in the securitization chain. Under every PSA (pooling and servicing agreement for those not familiar with PSA),and NY Trust law,under which most if not all of the securitization “trusts” are created,we have an A to B to C to D to E assignment path mandated by law. This would be NY trust law,IRC Remic1120 requirements,and PSA,which is the controlling document in any court of law. So ABCDE is originator>depositor>sponsor>MERS>Trust. The loans/notes have to be sold/transferred 2x in order to create a BRE,or bankrupt-remote entity. This is NY trust law to protect the investors,so that they don’t get hit by predatory lending lawsuits,which of course is what the whole “mortgage crisis” is about. Well what we are all seeing instead of ABCDE is A>D>E,originator to MERS to Trust,with the Trust portion coming via assignment of the mortgage rather than endorsement and delivery,as the note is,purportedly,lost. And every assignment of mortgage is being made just prior to and in many cases after the filing of the notice of default. So a mortgage written in 2002,is being assigned say DEC./2010,when a foreclosure is pending. This violates the PSA in that the closing date of the trust was in 2002, 8 years back. This is,well,illegal. And every one in the US is done the same way. MERS? This confederacy of dunces was set up to let this occur.

Lets say I am an investment bank, and that I also own a mortgage servicing company. And lets say I make lots of money by successfully investing in CDS against MBS. And lets say it is getting close to bonus time, and I need to generate some ficitious revenue. I buy CDS on MBS A, and instruct my mortgage servicer to after the fact, add foreclosed mortgages to the mortgage pool of MBS A, and claim that was the inention at the get-go, just cannot find those missing notes, and it was just an oversight that the list of mortgages was absent.

Is this a likely scenario? There must be profit in all of these lost notes and the proliferation of the lost note afidavits, forgeries and perjuries conducted by the agents of MERS.

Are you John Paulson in real life?

Actually, to answer your question, the PSAs and the IRS I believe put a 90 day end date after launch to get the loan docs to the trust funds in order to keep the trust funds from turning into a toxic waste dump after the fact. But if no one is allowed to look in the trust fund…..

No need to go to those elaborate lengths, the mortgages already in every trust were defaulting just fine thanks.

Yves, nice job keeping the pressure on. Looks like the MERS system is in trouble. Which, perversely, makes the MERS data even more valuable. Instead of offering information on proper title chains, the data now offers information on broken title chains. Fannie/Freddie are nationalized, and the large banks will be too. Once the government owns the mortgages, there will be perverse incentive for the creators of the faulty title chains to create Paulson-like businesses to scour those faulty chains for recoverable assets. And it will all come down to the MERS data again. So who gets the MERS data when the system is shut down? I think we know the answer to that.

The MERS system is seriously flawed.

I have a recorded assignment which assigns my old mortgage from Colonial Bank to MERS as nominee for Homeside Lending. That assignment is by a Vice President of Colonial Bank and and her signature is below the name of Colonial Bank. The notary statement on the same page says that the Vice President is known to him and that she did take an oath. The assignment gives the property address and Property Tax ID number. All of this information is on one page.

I believe a court would accept this assignment as evidence because it was sworn when made. All the necessary facts are there.

I refinanced the home to get a lower interest rate, so Homeside Lending was paid in full and a release was filed.

The 1st page is identifies the property by Tax ID number “That the UNDERSIGNED, of the county of Bexar, State of Texas, the present legal and equitable Owner and Holder of that one certain Promissory Note …. “ (Then goes on to identify the original mortgagee and mortgagor) Next it gives the address and refers to exhibit A attached on second page. Then it acknowledges payment in full and “by these presents do hereby release and discharge, the above described property from all liens held by the undersigned securing said note. Below that is: MERS as nominee for Homeside Lending. It is dated, and signed by the Assistant Vice President and an Assistant Secretary. (Apparently officers of MERS.) The 2nd page of the assignment identifies the property by Tax ID number and deed. The 3rd page is the notary and lists the names of the signers on the first page who appear personally and are known by the notary to be those persons. The notary identifies them as of MERS. Under the Notary signature is a note that “This instrument Prepared By: …. Homeside Lending but there is no indication of her title and her name is not mentioned in the notary statement.

Point 1, No officer of Homeside Lending released this mortgage by their signature.

Point 2, the release is is done by MERS which was never the Note Holder, only a nominee.

Point 3, MERS’s release is undoubtedly based on bits in their database which eventually will be challenged on it’s suitability to serve the intended purpose.

Point 4, The notarization is done on a separate page. Would a court have to accept that.

This release seems to be very similar to what we are hearing about assignments.

Since I have not received any complaint from Homeside Lending, I assume they got their money and I will not have to go to court. And what the hell, Homeside allowed MERS to act as their nominee in the assignment to Homeside.

I would add that my situation would be much worse if Homeside Lending had assigned the mortgage to another Bank and done that assignment through the MERS system instead of recording it at the court house.

Then the release would have been from MERS acting as nominee for the latest bank. I would have no way of showing that Homeside had actually assigned the loan to the latest bank or that they had been paid.

We need to see some source code – rather then histronics and hand waving and lawyers venting colon, let’s see the source code. It’s not paranoid at all to conclude you’ll be fucked by what you can’t see and understand.

I agree, code inspection could turn out to be necessary.

But especially, the data model is of interest (including the historical dimension and audit trails), and an analysis what is stored in RDBMS, and what in Excel spreadsheets etc.

Furthermore, let process and IT experts draw relevant diagrams, e.g. process diagrams, context diagrams, activity diagrams, and the like.

And of course all considerations regarding authenticity and integrity of documents and data are important, as already highlighted by Richard Smith.

This gets even more fun when you realize MERS is just the front end to someone else’s CDO Squared or CDS software backend, which is like running MERS thru a woodchipper.

Then they tell us all the cashflows, mortgage ownership, and insurance policy pieces all point to their rightful, legal recipients!

Actually I can’t believe no one has ordered audits of MERS and the trust funds yet, but instead prefer to believe that a bunch of lawyers swearing on a bible that they know what is going on will suffice for the truth of the matter.

Who’s going to order an audit? That would bring on the MBS apocalypse for those zombie bank balance sheets.

Congress would then have no choice but to pass a brazen “law”, but that would be the most explicit banana republicanism yet, and I doubt it could keep the zombie propped up. Who could possibly still invest in such a system?

This is extend-and-pretend taken to the ultimate extreme. No doubt the investors also don’t really want to know, and would prefer to quietly settle rather than sue.

Rats. No one ever wants to go looking for WMDs in the good ol’ USofA.

We’ll have to wait until all of Wall Street wants to be on the sell side.

If MERS unwinds then the default solution firms will too.

The option markets will be very busy in the coming weeks.

Pennell’s chart is great. But this visualization is simpler.

Ewwwwwww. You do make a point with that visualization.

But another point, at least as good, should be highlighted here IMVHO: your point that the MERS database should be held, intact, for auditing. I happen to agree with the view that it’s probably being manipulated as I type this, and that if DoJ or FBI were ‘on the case’ that MERS database would be under lockdown — but Richard Smith would have more details about how such a thing could work.

And FWIW, the next time that I hear anyone moan that individuals can’t make a difference, I’m going to look them straight in the eye and start naming people who ARE ‘making a difference’, starting with Yves, Richard Smith, Pennell, and screen names of some savvy NC commenters.

readerOfTeaLeaves:

Yes, the YT is the hook to get to that paragraph. And Yves is Marge Gunderson!

(Chuckling ;-)

Yves; Marge Gunderson.

I didn’t see the connection before, but I definitely think you’re on to something ;^}

“Yves here. He appears to be on the verge of being the ex-CEO.”

WSJ: The firm’s board has met in recent days to address the fate of the company and its chief executive, R.K. Arnold, people said.

KABOOM!! The next sound will be the shattering of the TBTF balance sheets.

from Richard’s analysis:

FUCK ME, he’s the CEO

Priceless! (& should be the title of a sitcom about all this once the dust settles.)

Is anyone else concerned about the fact that per MERS-honcho Arnold, CountryWide entered loans into the MERS system that did NOT bear CountryWide’s name as LENDER?

Arnold made his statements in recorded testimony. The CLAIMED the entity named on the loans was a ‘DBA’ of CountryWide. It was NOT EVEN a DBA. CountryWide and their TRADE NAME, “America’s Wholesale Lender” were even the cause of a court RULING (PAGANO) that documents the fact that foreclosures can not be brought in the name of this TRADE NAME.

So, if court actions are not allowed in the name of a company’s unregistered TRADE NAME, can you tell me how ‘PERFECTION’ of the mortgage was achieved when that mortgage was recorded in the local county recorders office using that TRADE NAME?

And thus, I question why MERS should be allowing the CountyWide membership in MERS to be used to enter such a loan into the MERS system. The lender name cited on the documents is ONLY this “America’s Wholesale Lender”. The CourtryWide name is NOT in any section of the agreement on either the NOTE or the Deed of Trust.

Other issues abound with the ‘AWL’ loan documents but the usage of MERS should be restricted to entry of loans that are CLEARLY being entered by the actual LENDER.

This individual may indeed be a process expert but his presentation is mostly random snippets of various fraudclosure/MERS related stories covered previously/better – on this blog in many instances. That’s not to say it wasn’t news to the audience he presented it to.

VA BILL DEFEATED

RICHMOND, Va. (AP) – A House subcommittee voted Monday to effectively kill bills that would have slowed Virginia’s fast pace of foreclosures.

With one dissent on an unrecorded show-of-hands vote as the potent banking lobby watched, a Commerce and Labor subcommittee sent the bills for more study by an obscure gubernatorial task force.

The action included all House bills addressing what Sen. Chap Petersen, D-Fairfax, calls “drive-by foreclosures.”

Republican Sen. Bob Marshall’s bill, which was before the 11-member panel, would have extended the foreclosure notice requirement from 14 days to 45. It would also require that loan and property records be recorded in local courthouses.

Marshall called Monday’s vote “government of the banks, by the banks and for the banks.”