There has been evidence here and there of a marked fall in new foreclosure filings. Lender Processing Services, which handles more than half of the loans serviced in the US, said its revenues in its Default Services Group were down in the final quarter of the year. Why? Its revenues are tied to initial foreclosure filings, and its were off 33%, no doubt in large measure due to the robo signing scandal. Recall that it led many banks to halt foreclosures (some all over the US, others in judicial foreclosure states only) while they inspected the state of play and scrambled to revamp procedures. Banks piously claimed that they found no problems in the correctness of foreclosure actions and that ex making the changes needed to assure affidavits were proper, they were going to be back to business as usual post haste.

Now we already know that that isn’t the case. Since the robosigning scandal broke, foreclosure activity has been down. RealtyTrac reported that foreclosures in January were up only 1% over December levels, which was down 17% from the year prior.

But RealtyTrac captures every foreclosure filing in that particular report, so it is a mix of new foreclosure filings plus additional filings for foreclosures already underway (the number of filings required varies by state, but the minimum number is three, and the number can also be increased if a borrower gets a foreclosure suspended, say by entering into a payment catchup plan, and then has the process restarted later on).

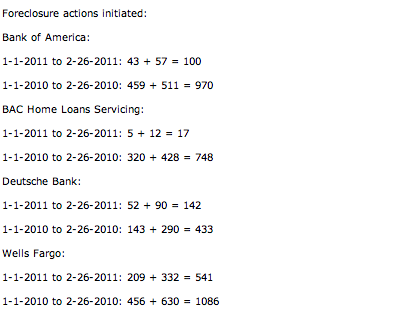

Lynn Syzmoniak of Fraud Digest provides a snapshot for January 1 through January 26 in two counties in Florida, Lee County and Palm Beach County:

Her tally for US Bank over the same period covered only Lee County, but showed similar results: 42 new foreclosures for 2011 versus 143 for 2010.

Now merely eyeballing this sample, and assuming it is representative of Florida (Syzmoniak says other counties show similar patterns), it’s clear the decline is bigger than the 33% fall that LPS mentioned for the fourth quarter of 2010 or the 17% figure from RealtyTrac.

There are reasons why Florida might show a steeper fall than other states. First, the state AG has been investigating all the major foreclosure mills in the state. Some, like the Law Offices of David Stern, have effectively folded. So there could be a bit of disarray simply due to the loss of some processing capacity.

Second, Florida, like New York, has implemented a rule requiring that attorneys verify information provided in foreclosures. That might seem to be merely ceremonial, since lawyers are already responsible for the accuracy of information provided to the court. But I am advised that this measure is more than mere belt and suspenders; it apparently would have the effect of lowering the bar for opposing counsel calling for Rule 11 sanctions if he thought the foreclosing attorney was submitting bogus documents or information. That rule did became effective February 11, 2010 (hat tip Lisa Epstein), and the foreclosure mills have tried to escape compliance. I’d imagine in the wake of the robo signing scandal, their clients are becoming less tolerant of this sort of thing.

If this pattern holds across at least across judicial foreclosure states, it suggests what we have long argued: that failures to convey loans as required by securitization documents are widespread, if not pervasive. Now that servicers and foreclosure mills are finding that a lot of judges no longer take them at their word, which means they increasingly have to provide documentation, they may be finding that a lot of their records do not pass muster. And while document fabrication was once an easy way out, that strategy is a lot riskier than it used to be.

Reader input welcome. Do you have any local data on the level of new foreclosures in 2011 versus same period 2010?

Your case would be a lot stronger with either delinquency data, e.g. from FNM/FRE, or negative equity data, e.g. from First American CoreLogic. If you include that, you could make a fairly persuasive argument that servicer behavior had changed rather than the occurrence of a fundamentally positive shift in the U.S. housing market.

This is NOT arguing “a positive shift in the housing market”. This is suggesting that now that servicers have been forced to look at their records, they are moving forward with fewer foreclosures because, if challenged, they can’t produce adequate documentary backup.

This if true is a huge negative for MBS investors, banks (because they rely on foreclosures to repay advances on delinquent loans) and the prospect of ever restarting the private securitization market (because the mess is so deep the banks will stonewall as long as possible).

This is NOT arguing “a positive shift in the housing market”. This is suggesting that now that servicers have been forced to look at their records, they are moving forward with fewer foreclosures because, if challenged, they can’t produce adequate documentary backup.

Right. So back the argument up with some more data demonstrating that no such positive shift has occurred. I apologize if I missed it in a previous post or two, but I like to link posts to friends, so if an argument is self-contained(and I understand the time pressures you volunteer your services under), it’s very helpful.

Yves’ first post contains persuasive statistics. Your reply contains nothing but snark.

Her reply to you, therefore, doesn’t need to contain anything but snark.

And quite frankly, I don’t know why she bothers replying at all. Unless you prove otherwise, ndk, you’re nothing but a Koch Industries attempt at astroturfing.

Lazy response.

snark /snɑrk/

–noun

a mysterious, imaginary animal.

Origin:

1876; coined by Lewis Carroll in his poem The Hunting of the Snark

I looked this up myself and corroborated the definition using two additional sources plus a seance with Lewis Carroll.

Words have meanings, try to use some that make sense.

This is for “Just a thought” — can’t seem to reply directly to that post.

Lazy indeed. A quick search for snark found this…

noun

Combination of “snide” and “remark”. Sarcastic comment(s).

Also snarky (adj.) and snarkily (adv.)

Words have meanings but all languages are malleable.

Example of snark: See if you can look up schmuck.

Yves..

I think you hit it on the head. From what I am hearing and seeing in VA, if you have a lawyer willing to fight and force the banks to show their hand then you have a very good chance of them cutting a deal with you. It is the poor slobs in the non-judicial states that cannot afford an attorney that have the real challenge.

The problem for the banks is that the more they go to court, the more they are being made to look incompetent and dishonest. Each time that happens, even if they are able to foreclose at some point, they continue to lose credability in the courts and increase their chances of future losses.

They should have made good deals 3 years ago to keep people in their homes. At this point, even if they win they lose.

NOTE: Lawyer friend with connections at Fannie told me that they are holding back and monitoring the credit of those they have foreclosed on. Once the credit for these folks starts to look up they are going to suit them right away to persue the difference betweent the note and what the house sold for.

Fannie is going to “suit people” once they start getting paid again? There is no way this can be accurate, imagine the publicity nightmare this would create. Chapta 7 homey.

Incidentally, some Fannie Mae execs need to be imprisoned.

Your post appears to be flame bait – VA is worse then Maryland for example.

ndk,

I never cease to be amazed by people like you.

Instead of doing the heavy lifting to make your case, you instead tell other people that they should do the heavy lifting to make your case.

If you think an argument is incomplete, or is mistaken, then it is incumbent upon you to marshall the evidence to make your case.

But you prefer to sit around on your big, fat, lazy ass and order other people around.

I think he was just trying to provide some constructive criticism that the argument was less than persuasive without additional evidence. He is right. There are multiple factors to consider in the broad range of foreclosures all across the country.

I don’t think anyone should be excoriated for such criticism. It’s not like ndk comes off as a misguided person who thinks he’s clever like DD.

I cannot see why we would think it a negative contribution to attempt to help Yves in her work through constructive criticism and insist rather that ndk do it for her.

I could not disagree more.

Let me spell it out for you.

Here’s ndk:

Right. So back the argument up with some more data demonstrating that no such positive shift has occurred.

Give me a break! What is Yves? ndk’s handmaiden?

What ndk issues is a command, an order. It was pedantic and unbelievably arrogant.

Here’s a hypothetical example of what an appropriate response might look like:

The reason foreclosures have fallen so dramatically was not because of new legal hurdles being imposed upon servicers, but the occurrence of a fundamentally positive shift in the U.S. housing market. FNM/FRE delinquency data, which can be found -here-, indicates that loan delinquency rates have fallen precipitously since last August. Also, First American CoreLogic’s data, which can be found -here-, indicate that the equity position of the average homeowner has improved markedly over the past six months.

But ndk doesn’t do that. Why? Is it because he knows the data he demands Yves go dig up won’t substantiate such a claim? Is it because he’s too lazy to go dig the data up himself? Is it because he’s an arrogant, pedantic jerk who just likes ordering other people around? Or is it, as you claim, that he’s “just trying to provide some constructive criticism”?

Ordering somebody around is not providing “constructive criticism.” So in the providing constructive criticism department, I give ndk an “F.”

Demanding that somebody else provide information adds nothing to the conversation. For his part, ndk provided no new information or insights. So in the participation in constructive discourse department, I give ndk and “F.”

In the propaganda or psych-ops department, however, I give ndk a “C.” Because he doesn’t have the bullets to back up his assertion, and he knows he doesn’t, he posits a question. The intent here is to sow the seeds of doubt without having to stake out a contrary position, a position which he knows cannot be defended. It’s a rhetorical strategy used when one knows the facts are stacked against one. But while ndk’s rhetorical strategy was sound, his execution was lacking. His comment was so ham-fisted and heavy-handed that it ended up being offensive. So in the propaganda department, he gets a “C.”

I disagree. I’d rather have on-the-ground, unfiltered data like Lynn produces than some conflicted corporation’s view of events. One thing we’ve learned here — don’t trust the formulas. Plus, Lynn’s data is immediate and timely. By the time the companies produce their outputs, the info has become less relevant. Why wait for CoreLogic’s stamp of approval?

A fundamentally positive shift in the US housing market?

Those are numbers I would like to see explained. With Case-Schiller now showing falling prices again nation wide, and Schiller himself now saying we could be up to 25% from the bottom; with Core Logic claiming that the NAR has overstated existing home sales over the last 2 years by up to 20%; and with income still dragging along for the bottom 90% at~33k, a ‘fundamentally positive shift’ in housing would be miraculous.

Did you really mean to say that?

It was nice to see that ndk was so understanding “I understand the time pressures you volunteer your services under.” After all, he likes to send links to friends and that has to take a great deal of time and effort on his part. So he has nothing of value to offer (info or a contribution), but he wants more from those who do offer something. You can add boor to the previously posted lazy description.

Oi! Proofreading alert! “Its revenues are tied to initial foreclosure filings, and its [???] were off 33%, no doubt in large measure due to the robo signing scandal.” There’s a similar problem in Smith’s post, which follows this one.

Lots of invisible inventory out there. If there were for sale signs out front of all the REO property, we would have seen a revolution already.

I am personally going through a Foreclosure. In Oct 2010 the foreclosure was pulled by the Law firm. I found out that the county I live in issued an order (the court).

Kenton Kentucky Court Order – Foreclosure Complaints Must be Accompanied by Note and Recorded Mortgage with ALL Allonges, Endorsements, and Assignments.

I have not seen anything since Oct.

Iirc defaults have been trending down but nowhere near as much as filings have dropped. I think much has to do with private loanmods. Those delay the inevitable by a year or less. Im defending about 3 dozen foreclosures and half got loan mods, and the rest are in legal limbo literally doing nothing. My sister is squatting in my pparents house right now and the bank has done nothing since filing suit in december 2009. My parents stopped paying in early 2009.

http://www.miami-dadeclerk.com/property_mortgage_foreclosures_2010.asp

Here are the 2010 Foreclosure monthly filing statistics for Miami-Dade county:

Month Filings

January 4,128

February 4,880

March 3,245

April 3,449

May 2,621

June 2,840

July 2,901

August 3,158

Sept 3,206

October 1,720

Nov 1,106

Dec 1,146

Year-to-date: 34,400

http://www.miami-dadeclerk.com/property_mortgage_foreclosures_2009.asp

Here are the 2009 Foreclosure monthly filing statistics for Miami-Dade county:

Jan 6,063

Feb 5,942

Mar 7,103

April 6,510

May 4,277

June 4,842

July 5,180

Aug 4,436

Sept 5,032

Oct 5,076

Nov 4,038

Dec 5,502

Year-to-date: 64,001

DrewG, I also live in Kenton county and it has been about a year since I last paid on my mortgage. My loan was originated with TBW and is now serviced by BOA. I have received nothing in the way of a foreclosure filing thus far…

In my neighborhood here in Los Angeles (Hancock Park) The banks seem to only be foreclosing on homes that have serious location flaws…in other words…located on an arterial. The last one to go was one of Nic Cage’s (the actor) on Rossmore.

http://www.zillow.com/homedetails/540-S-Rossmore-Ave-Los-Angeles-CA-90020/20775167_zpid/

It doesn’t show up on Redfin or Zillow yet but it does show up on RealtyTrac.

The Realestalker blogged it a few days ago.

http://realestalker.blogspot.com/2011/02/more-nic-cage-foreclosure-news.html

There are other homes that the banks *just* got around to foreclosing on that have been vacated since 2006 or earlier. I’m able to discern the date as I can still see the car I sold in April of 2006 parked in the driveway of the house I used to live in (2 blocks to the west) before it was sold in 2007. The pool is empty in the 2006 picture.

The empty swimming pools are very telling. Yay for google earth!

Lot’s of fishy stuff going on out there.

I suspect that there are numerous $3,000,000+ homes on the “better streets” that haven’t made payments for years yet haven’t recieved a single NOD.

Yves hit paydirt when she heard about all the people with $20,000 mortgages that haven’t made payments in years.

To let you in on a little secret. BAC’s old CFC servicing is here. I met a woman that works for them. She told me they were short selling houses that had been empty for months and even years. They are just using another way to get title is all. Keeps the losses off the books and the property off the open market.

You make blogging look like a walk in the park! I’ve been trying to blog daily but I just cant find writing material.. you’re an inspiration to me and i’m sure many others!