By Alex Andreou, a successful lawyer turned actor living in London. Cross posted from SturdyBlog

I have never been more desperate to explain and more hopeful for your understanding of any single fact than this: The protests in Greece concern all of you directly.

What is going on in Athens at the moment is resistance against an invasion; an invasion as brutal as that against Poland in 1939. The invading army wears suits instead of uniforms and holds laptops instead of guns, but make no mistake – the attack on our sovereignty is as violent and thorough. Private wealth interests are dictating policy to a sovereign nation, which is expressly and directly against its national interest. Ignore it at your peril. Say to yourselves, if you wish, that perhaps it will stop there. That perhaps the bailiffs will not go after the Portugal and Ireland next. And then Spain and the UK. But it is already beginning to happen. This is why you cannot afford to ignore these events.

The powers that be have suggested that there is plenty to sell. Josef Schlarmann, a senior member of Angela Merkel’s party, recently made the helpful suggestionthat we should sell some of our islands to private buyers in order to pay the interest on these loans, which have been forced on us to stabilise financial institutions and a failed currency experiment. (Of course, it is not a coincidence that recent studies have shown immense reserves of natural gas under the Aegean sea).

China has waded in, because it holds vast currency reserves and more than a third are in Euros. Sites of historical interest like the Acropolis could be made private. If we do not as we are told, the explicit threat is that foreign and more responsible politicians will do it by force. Let’s make the Parthenon and the ancient Agora a Disney park, where badly paid locals dress like Plato or Socrates and play out the fantasies of the rich.

It is vital to understand that I do not wish to excuse my compatriots of all blame. We did plenty wrong. I left Greece in 1991 and did not return until 2006. For the first few months I looked around and saw an entirely different country to the one I had left behind. Every billboard, every bus shelter, every magazine page advertised low interest loans. It was a free money give-away. Do you have a loan that you cannot manage? Come and get an even bigger loan from us and we will give you a free lap-dance as a bonus. And the names underwriting those advertisements were not unfamiliar: HSBC, Citibank, Credit Agricole, Eurobank, etc.

Regretfully, it must be admitted that we took this bait “hook, line and sinker”. The Greek psyche has always had an Achilles’ heel; an impending identity crisis. We straddle three Continents and our culture has always been a melting pot reflective of that fact. Instead of embracing that richness, we decided we were going to be definitively European; Capitalist; Modern; Western. And, damn it, we were going to be bloody good at it. We were going to be the most European, the most Capitalist, the most Modern, the most Western. We were teenagers with their parents’ platinum card.

I did not see a pair of sunglasses not emblazoned with Diesel or Prada. I did not see a pair of flip-flops not bearing the logo of Versace or D&G. The cars around me were predominantly Mercedes and BMWs. If anyone took a holiday anywhere closer than Thailand, they kept it a secret. There was an incredible lack of common sense and no warning that this spring of wealth may not be inexhaustible. We became a nation sleepwalking toward the deep end of our newly-built, Italian-tiled swimming pool without a care that at some point our toes may not be able to touch the bottom.

That irresponsibility, however, was only a very small part of the problem. The much bigger part was the emergence of a new class of foreign business interests ruled by plutocracy, a church dominated by greed and a political dynasticism which made a candidate’s surname the only relevant consideration when voting. And while we were borrowing and spending (which is affectionately known as “growth”), they were squeezing every ounce of blood from the other end through a system of corruption so gross that it was worthy of any banana republic; so prevalent and brazen that everyone just shrugged their shoulders and accepted it or became part of it.

I know it is impossible to share in a single post the history, geography and mentality which has brought this most beautiful corner of our Continent to its knees and has turned one of the oldest civilisations in the world from a source of inspiration to the punchline of cheap jokes. I know it is impossible to impart the sense of increasing despair and helplessness that underlies every conversation I have had with friends and family over the last few months. But it is vital that I try, because the dehumanisation and demonisation of my people appears to be in full swing.

I read, agog, an article in a well-known publication which essentially advocated that the Mafia knew how to deal properly with people who didn’t repay their debts; that “a baseball bat may be what’s needed to fix the never ending Greek debt mess”. The article proceeded to justify this by rolling out a series of generalisations and prejudices so inaccurate and so venomous that, had one substituted the word “Greeks” with “Blacks” or “Jews”, the author would have been hauled in by the police and charged with hate crimes. (I always include links, but not in this case – I am damned if I will create more traffic for that harpy).

So let me deal with some of that media Mythology.

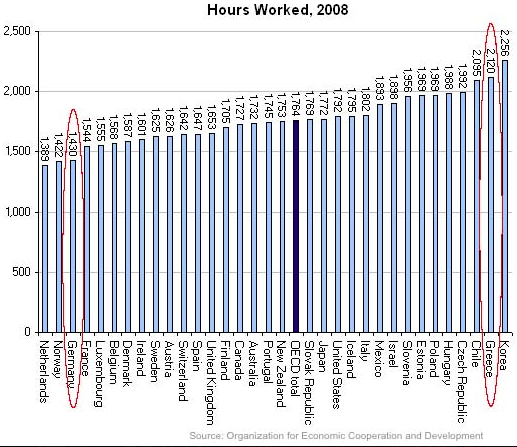

Greeks are lazy. This underlies much of what is said and written about the crisis, the implication presumably being that our lax Mediterranean work-ethic is at the heart of our self-inflicted downfall. And yet, OECD data among its members show that in 2008, Greeks worked on average 2120 hours a year. That is 690 hours more than the average German, 467 more than the average Brit and 356 more than the OECD average. Only Koreans work longer hours. Further, the paid leave entitlement in Greece is on average 23 days, lower than most EU countries including the UK’s minimum 28 and Germany’s whopping 30.

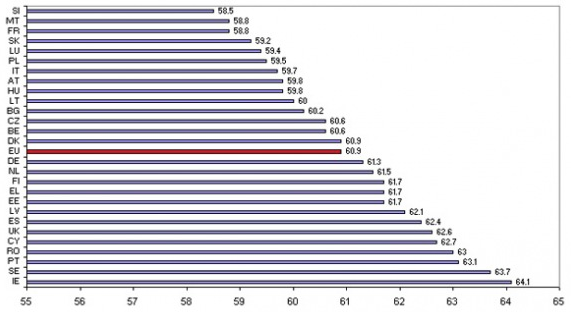

Greeks retire early. The figure of 53 years old as an average retirement age is being bandied about. So much, in fact, that it is being seen as fact. The figure actually originates from a lazy comment on the NY Times website. It was then repeated by Fox News and printed on other publications. Greek civil servants have the option to retire after 17.5 years of service, but this is on half benefits. The figure of 53 is a misinformed conflation of the number of people who choose to do this (in most cases to go on to different careers) and those who stay in public service until their full entitlement becomes available. Looking at Eurostat’s data from 2005 the average age of exit from the labour force in Greece (indicated in the graph below as EL for Ellas) was 61.7; higher than Germany, France or Italy and higher than the EU27 average. Since then Greece have had to raise the minimum age of retirement twice under bail-out conditions and so this figure is likely to rise further.

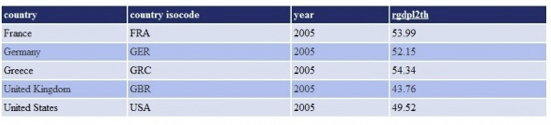

Greece is a weak economy that should never have been a part of the EU. One of the assertions frequently levelled at Greece is that its membership to the European Union was granted on emotional “cradle of democracy” grounds. This could not be further from the truth. Greece became the first associate member of the EEC outside the bloc of six founding members (Germany, France, Italy and the Benelux countries) in 1962, much before the UK. It has been a member of the EU for 30 years. It is classified by the World Bank as a “high income economy” and in 2005 boasted the 22nd highest human development and quality of life index in the world – higher than the UK, Germany or France. As late as 2009 it had the 24th highest per capita GDP according to the World Bank. Moreover, according to the University of Pennsylvania’s Centre for International Comparisons, Greece’s productivity in terms of real GDP per person per hour worked, is higher than that of France, Germany or the US and more than 20% higher than the UK’s.

The first bail-out was designed to help Greek people, but unfortunately failed. It was not. The first bail-out was designed to stabilise and buy time for the Eurozone. It was designed to avoid another Lehman-Bros-type market shock, at a time when financial institutions were too weak to withstand it. In the words of BBC economist Stephanie Flanders: “Put it another way: Greece looks less able to repay than it did a year ago – while the system as a whole looks in better shape to withstand a default… From their perspective, buying time has worked for the eurozone. It just hasn’t been working out so well for Greece.” If the bail-out were designed to help Greece get out of debt, then France and Germany would not have insisted on future multi-billion military contracts. As Daniel Cohn-Bendit, the MEP and leader of the Green group in the European Parliament, explained: “In the past three months we have forced Greece to confirm several billion dollars in arms contracts. French frigates that the Greeks will have to buy for 2.5 billion euros. Helicopters, planes, German submarines.”

The second bail-out is designed to help Greek people and will definitely succeed. I watched as Merkel and Sarkozy made their joint statement yesterday. It was dotted with phrases like “Markets are worried”, “Investors need reassurance” and packed with the technical language of monetarism. It sounded like a set of engineers making minor adjustments to an unmanned probe about to be launched into space. It was utterly devoid of any sense that at the centre of what was being discussed was the proposed extent of misery, poverty, pain and even death that a sovereign European partner, an entire nation was to endure. In fact most commentators agree, that this second package is designed to do exactly what the first one did: buy more time for the banks, at considerable expense to the Greek people. There is no chance of Greece ever being able to repay its debt – default is inevitable. It is simply servicing interest and will continue to do so in perpetuity.

And the biggest myth of them all: Greeks are protesting because they want the bail-out but not the austerity that goes with it. This is a fundamental untruth. Greeks are protesting because they do not want the bail-out at all. They have already accepted cuts which would be unfathomable in the UK – think of what Cameron is doing and multiply it by ten. Benefits have not been paid in over six months. Basic salaries have been cut to 550 Euros (£440) a month.

My mother, who is nearly 70, who worked all her life for the Archaeology Department of the Ministry of Culture, who paid tax, national insurance and pension contributions for over 45 years, deducted at the source (as they are for the vast majority of decent hard-working people – it is the rich that can evade), has had her pension cut to less than £400 a month. She faces the same rampantly inflationary energy and food prices as the rest of Europe.

A good friend’s granddad, Panagiotis K., fought a war 70 years ago – on the same side as the rest of Western democracy. He returned and worked 50 years in a shipyard, paid his taxes, built his pension. At the age of 87 he has had to move back to his village so he can work his “pervoli” – a small arable garden – planting vegetables and keeping four chickens. So that he and his 83 year old wife might have something to eat.

A doctor talking on Al Jazeera yesterday explained how even GPs and nurses have become so desperate that they ask people for money under the table in order to treat them, in what are meant to be free state hospitals. Those who cannot afford to do this, go away to live with their ailment, or die from it. The Hippocratic oath violated out of despair, at the place of its inception.

So, the case is not that Greeks are fighting cuts. There is nothing left to cut. The IMF filleting knife has gotten to pure, white, arthritis-afflicted bone. The Greeks understand that a second bail-out is simply “kicking the can down the road”. Greece’s primary budget deficit is, in fact, under 5bn Euros. The other 48bn Euros are servicing the debt, including that of the first bail-out, with one third being purely interest. The EU, ECB and IMF now wish to add another pile of debt on top of that, which will be used to satisfy interest payments for another year. And the Greeks have called their bluff. They have said “Enough is enough. Keep your money.”

My land has always attracted aggressive occupiers. Its vital strategic position combined with its extraordinary natural beauty and history, have always made it the trinket of choice for the forces of evil. But we are a tenacious lot. We emerged after 400 years of Ottoman occupation, 25 generations during which our national identity was outlawed with penalty of death, with our language, tradition, religion and music intact.

Finally, we have woken up and taken to the streets. My sister tells me that what is happening in Syntagma Square is beautiful; filled with hope; gloriously democratic. A totally bi-partisan crowd of hundreds of thousands of people have occupied the area in front of our Parliament. They share what little food and drink there is. A microphone stands in the middle, on which anyone can speak for two minutes at a time – even propose things which are voted by a show of thumbs. Citizenship.

And what they say is this: We will not suffer any more so that we can make the rich, even richer. We do not authorise any of the politicians, who failed so spectacularly, to borrow any more money in our name. We do not trust you or the people that are lending it. We want a completely new set of accountable people at the helm, untainted by the fiascos of the past. You have run out of ideas.

Wherever in the world you are, their statement applies.

Money is a commodity, invented to help people by facilitating transactions. It is not wealth in itself. Wealth is natural resources, water, food, land, education, skill, spirit, ingenuity, art. In those terms, the people of Greece are no poorer than they were two years ago. Neither are the people of Spain or Ireland or the UK. And yet, we are all being put through various levels of suffering, in order for numbers (representing money which never existed) to be transferred from one column of a spreadsheet to another.

This is why the matter concerns you directly. Because this is a battle between our right to self-determine, to demand a new political process, to be sovereign, and private corporate interests which appear determined to treat us like a herd, which only exists for their benefit. It is the battle against a system which ensures that those who fuck up, are never those that are punished – it is always the poorest, the most decent, the most hard-working that bear the brunt. The Greeks have said “Enough is enough”. What do you say?

____________________________________________________________

Help us by spreading this message to others – don’t let the media airbrush it out of existence, like they have done with the people of Madison, Wisconsin and the Indignados in Spain. Go to the original article on Alex’s blog here, and use the comments below (no registration is needed) to express your solidarity with the people of Greece. If you have any questions, again use the comments section on Alex’s blog he will do his best to answer. Raise the matter with people in power. Ask questions. Talk about it in the pub. Most of all, wake up before you find yourself in our situation.

Nassim Nicholas Taleb is the Lebanese-American philosopher who formulated the theory of “Black Swan Events” – unpredictable, unforeseen events which have a huge impact and can only be explained afterwards. Last week, on Newsnight, he was asked by Jeremy Paxman whether the people taking to the streets in Athens was a Black Swan Event. He replied: “No. The real Black Swan Event is that people are not rioting against the banks in London and New York.”

I’m swelling with patriotic mucus!

GO GREECE! SHOW US THE WAY!

“a successful lawyer turned actor”

Reminds me of Tony Blair.

Lawyers are actors!!

“Wealth is natural resources, water, food, land, education, skill, spirit, ingenuity, art.”

You forgot a biggie : Trust, both internally (Greeks trusting Greeks) and externally (foreigners trusting Greeks as it is essential to reach a high level of productivity. Actually, it is what differentiates high income economies from low or middle income ones.

It is particularly fragile in financial crisis. Easy to loose and hard to build.

That is why the people of Greece, Spain, Portugal and Ireland are indeed poorer than two years ago.

It is particularly fragile in financial crisis. Easy to loose and hard to build. charles 2

Who cares? A sovereign country should NEVER borrow in the first place.

That is why the people of Greece, Spain, Portugal and Ireland are indeed poorer than two years ago. charles 2

Poorer in what regard other than that it is more expensive for them to do what sovereign nations should NEVER do in the first place, borrow money?

“A sovereign country should NEVER borrow in the first place.”

Which sovereign country on earth DOESN’T borrow??? The United States, before it became the United States, borrowed $$$ for its War of Independence. Ever heard of Chaym Solomon?

Which sovereign country on earth DOESN’T borrow??? KFritz

None that I know of. But that doesn’t mean it has to be that way. According to L. Randal Wray in Understanding Modern Money, government borrowing is used to remove reserves from the banking system to control the Fed Funds Rate. It is not needed at all to finance government.

Question? Why should government be concerned with the private banking system? Ans: It shouldn’t be.

One day, if liberals and progressives are really concerned about the poor, they will fight to separate government from private banking.

I agree. Trust is paramount.

However, neoclassical economics, our dominant economic paradigm, is built upon a fictitious, or at least incomplete, conceptualization of trust. It relies on a very bleak, highly pessimistic assessment of human beings.

This has deliterious consequences. As the Christian theologian Reinhold Niebuhr pointed out in “The Children of Light and the Children of Darkness”:

A consistent pessimism in regard to man’s rational capacity for justice invariably leads to absolutistic political theories; for they prompt the conviction that only preponderant power can coerce the various vitalities of a community into a working harmony.

For more on this I recommend reading Dan M. Kahan’s essay “The Logic of Reciprocity: Trust, Collective Action, and Law” which can be found on the internet here, beginning on page 339. Here’s an excerpt:

The ‘Logic of Collective Action’ has for decades supplied the logic of public policy analysis. In this pioneering application of public choice theory, Mancur Olson elegantly punctured the premise—-shared by a diverse variety of political theories—-that individuals can be expected to act consistently with the interest of the groups to which they belong. Absent externally imposed incentives, wealth-maximizing individuals, he argued, will rarely find it in their interest to contribute to goods that benefit the group as a whole, but rather will “free ride” on the contributions that other group members make. As a result, too few individuals will contribute sufficiently, and the well-being of the group will suffer. These are the assumptions that currently dominate public policy analysis and ultimately public policy across a host of regulatory domains—-from tax collection to environmental conservation, from street-level policing to policing the internet.

But as a wealth of social science evidence now makes clear, Olson’s ‘Logic’ is false. In collective action settings, individuals adopt not a materially calculating posture, but rather a richer, more emotionally nuanced reciprocal one. When they perceive that others are behaving cooperatively, individuals are moved by honor, altruism, and like dispositions to contribute to public goods even without the inducement of material incentives. When, in contrast, they perceive that others are shirking or otherwise taking advantage of them, individuals are moved by resentment and pride to retaliate. In that circumstance, they will withhold beneficial forms of cooperation even if doing so exposes them to significant material disadvantage.

[….]

It turns out, however, that the conventional theory isn’t right. Individuals in collective action settings might not behave like saints, but they don’t behave like fiends either. They can be counted on to contribute to collective goods, the emerging literature on strong reciprocity shows, so long as they perceive that others are inclined to do the same… Whatever truth there is in the conventional theory is an artifact of the common acceptance of that theory’s bleak assumptions

So we should now reject them. To replace the conventional theory of collective action, we should construct a new and more appealing one founded on our nature as reciprocators. The logic of reciprocity not only reflects a more realistic understanding of individual emotional and moral commitments. It makes the hope that citizens will be morally and emotionally committed to contribute to the common good more realistic.

Downsouth said: ‘ Trust is paramount.’

I would add that to be trustworthy is paramount, without which trust cannot be built.

I believe that, to be trustworthy is a difficult concept to define. But when people are opaque, or speak lies, or attempt to use legalism to force another person to do harm to their own future when that other person did not themselves negotiate the bargain or even have knowledge of it (Goldman’s swaps with Greece), they are the opposite of trustworthy. The Greek bankers and politicicians, and the foreign bankers and politiciansnnwhom they cavort with are clearly not trustworthy for the citizens of Greece.

Ming,

There’s also the issue of forgiveness. Hannah Arendt wrote a most insightful essay on this which can be found as part 33—-“Irreversibility and the Power to Forgive—-of her book The Human Condition:

[T]he remedy against the irreversibility and unpredictability of the process started by acting does not arise out of another and possibly higher faculty, but is one of the potentialities of action itself. The possible redemption from the predicament of irreversibility – of being unable to undo what one has done though one did not, and could not, have known what he was doing – is the faculty of forgiving. The remedy for unpredictability, for the chaotic uncertainty of the future, is contained in the faculty to make and keep promises. The two faculties belong together in so far as one of them, forgiveness, serves to undo the deeds of the past, whose “sins” hang like Damocles’ sword over every new generation; and the other, binding oneself through promises, serves to set up in the ocean of uncertainty, which the future is by definition, islands of security without which not even continuity, let alone durability of any kind, would be possible in the relationship between men.

Without being forgiven, released from the consequences of what we have done, our capacity to act would, as it were, be confined to one single deed from which we could never recover; we would remain the victims of its consequences forever, not unlike the sorcerer’s apprentice who lacked the magic formula to break the spell. Without being bound to the fulfillment of promises we would never be able to keep our identities; we would be condemned to wander helplessly and without direction in the darkness of each man’s lonely heart, caught in its contradictions and equivocalities – a darkness which only the light shed over the public realm through the presence of others, who confirm the identity between the one who promises and the one who fulfills, can dispel. Both faculties, therefore, depend on plurality, and the presence and acting of others, for no one can forgive himself and no one can feel bound by a promise made only to himself; forgiving and promising enacted in solitude or isolation remain without reality and can signify no more than a role played before one’s self.

(…)

The discoverer of the role of forgiveness in the realm of human affairs was Jesus of Nazareth. The fact that he made this discovery in a religious context and articulated it in religious language is no reason to take it any less seriously in a strictly secular sense. … The only rudimentary sign of an awareness that forgiveness may be the necessary corrective for the inevitable damages resulting from action may be seen in the Roman principle to spare the vanquished (parcere subiectus) – a wisdom entirely unknown to the Greeks – or in the right to commute the death sentence, probably also of Roman origin, which is the prerogative of nearly all Western heads of state.

It is decisive in our context that Jesus maintains against the “scribes and pharisees” first that it is not true that only God has the power to forgive, and second that this power does not derive from God … but on the contrary must be mobilized by men towards each other before they can hope to be forgiven by God. Jesus’ formulation is even more radical. Man in the gospel is not supposed to forgive because God forgives and must do “likewise,” but “if ye from your hearts forgive,” God shall do “likewise.” … [T]respassing is an everyday occurrence which is in the very nature of action’s constant establishment of new relationships within a web of relations, and it needs forgiving, dismissing, in order to make it possible for life to go on by constantly releasing men from what they have done unknowingly. Only through this constant mutual release from what they do can men remain free agents, only by a constant willingness to change their minds and to start again can they be trusted with so great a power as that to begin something new.

In this respect, forgiveness is the exact opposite of vengeance, which acts in the form of re-acting against the original trespassing, whereby far from putting an end to the consequences of the first misdeed, everybody remains bound to the process, permitting the chain reaction contained in every action to take its unhindered course … the act of forgiving can never be predicted; it is the only reaction that acts in an unexpected way and thus retains, though being a reaction, something of the original character of action. Forgiving, in other words, is the only reaction which does not merely re-act but acts anew and unexpectedly, unconditioned by the act which provoked it and therefore freeing from its consequences both the one who forgives and the one who is forgiven. The freedom contained in Jesus’ teachings of forgiveness is the freedom from vengeance, which incloses both doer and sufferer in the relentless automatism of the action process, which by itself need never come to an end.

The alternative to forgiveness, but by no means its opposite, is punishment, and both have in common that they attempt to put an end to something that without interference could go on endlessly. It is therefore quite significant, a structural element in the realm of human affairs, that men are unable to forgive what they cannot punish and that they are unable to punish what has turned out to be unforgivable.

(…)

…Action is, in fact, the one miracle-working faculty of man, as Jesus of Nazareth, whose insights into this faculty can be compared in their originality and unprecedentedness with Socrates’ insights into the possibilities of thought, must have known very well when he likened the power to forgive to the more general power of performing miracles, putting both on the same level and within the reach of men.”

It should be pointed out, however, that not all acts are worthy of forgiveness. And this is why, when you read these threads, that so many of the apologists for the bankers and their paid liars and bumsuckers (politicians and propagandists) argue that the bankers didn’t know what they were doing, or that we can’t know what their intentions were. As Arendt goes on to explain:

The reason [that Jesus gives] for the insistence on a duty to forgive is clearly “for they know not what they do” and it does not apply to the extremity of crime and willed evil.

I like your article and your reflection on the article. I like your article because it points out that people are fallible, and may have events transpire against them, resulting in harm to others. I would add that occasionally, in time of great temptation or great stress, even those that are ‘trustworthy’ may make intentional tresspass against the other who trust them.

But I disagree with your commentary at the end…’Some actions cannot be forgiven’. The brilliance and miracle of forgiveness is that it can be applied to any action, regardless of how horrendous, BUT, it does not answer the questions of ‘should the other party be forgiven’ and ‘what do we do, and how de we relate, now and in the future’. A party that is truly contrite for what it had done, and who will freely try to undo the damage done, or will try to help the wronged party recover, is worthy of forgiveness

and can be trusted again.

Since the bankers in Greece ( and the USA) do not acknowledge any wrongdoing, and are using the unacceptable defense of ‘oh we did not know what we were doing’, or ‘it so complex’, and more importantly, are trying to enforce consequences that are very negative for the prosperity of th people and the nation, these men and women are not to be trusted or forgiven.

Downsouth,

I must disagree with your passage,

‘The reason [that Jesus gives] for the insistence on a duty to forgive is clearly “for they know not what they do” and it does not apply to the extremity of crime and willed evil.’

I beleive that Jesus did understand the deliberate intention of the Pharisees and Jewish priests, which was to have Him handed over to the Romans and crucified. But He did nonetheless pray for their forgiveness. (And I am sure that He has forgiven them).

There is a place in life for people to act with a divine level of extreme forgiveness. When we should do so, and how we can muster the emotional/spiritual resources to do so, is a mystery to me.

But I believe Jesus was quite reasonable when he said, ‘ if someone slaps you, turn the other cheek’, which implies that we should tolerate a

small level if tresspass; If He wanted us to regularly forgive very large sins he would have said, ‘if someone wants to take your liver, let take you kidney too.’

Very apt quotes Downsouth.

After all, it is not for nothing that debt resolution is also named “debt forgiveness”.

This is why I am so pessimistic about the outcome of the current GFC, we are so far, for all parties concerned, from understanding, acceptation and forgiveness. All necessary conditions for renewed trust.

Instead, we have Jean-Claude Juncker saying “when it is important, one has to lie”…

@charles 2

Instead, we have Jean-Claude Juncker saying “when it is important, one has to lie”…

It’s much worse than that, alas Jean-Claude Juncker lying, Jean Claude a former finance minster and president of Euro Group (finance ministers of the eurozone, the political control over the Euro currency) and a key architect of the Maastricht Treaty. Juncker was largely responsible for clauses on economic and monetary union.

Jean Claude does not understand, Jean Claude really don’t get it why e.g. US and Japan have relatively high dept and low interest rates and ditto inflation while indebted euro zone countries have exorbitant interest rates.

“The real problem is that no one can explain well why the euro zone is in the epicenter of a global financial challenge at a moment, at which the fundamental indicators of the euro zone are substantially better than those of the U.S. or Japanese economy.”

Poor Jean Claude believe it’s a mystery and haven’t read or heard from anyone of those who can explain, Jean Claude walk around in life with blinders.

Can Sesame Street Help Europe’s Finance Ministers Understand the Debt Crisis?

Another highlight from the increasingly brighter Stephanie Kelton on neweconomicperspectives.blogspot.com.

Well, when a country is run by criminals, trust is hard to achieve. Take the United States — please!

And when we send in the Marines, they take names don’t they?

How can the purchase of subs, jets and destoryers protect the Greeks from bankers?

A doctor talking on Al Jazeera yesterday explained how even GPs and nurses have become so desperate that they ask people for money under the table in order to treat them, in what are meant to be free state hospitals. Those who cannot afford to do this, go away to live with their ailment, or die from it. The Hippocratic oath violated out of despair, at the place of its inception.

I read that the doctors were among the biggest tax evaders. Is this not true?

private/public distinction?

Not really.

“About three years ago, Rakintzis discovered 32 doctors who worked at the largest hospital in Athens and had performed about 400 appendix, heart and eye operations — at least according to what they had written in patient files. In reality, they had performed cosmetic surgery, which is not covered by insurance, and had sent the bills to the patients’ health insurance agencies. “It was a gang,” says Rakintzis, and it even had the audacity to place the cosmetic surgery at the top of their priority lists, while patients with serious conditions and emergency cases were kept waiting.”

http://www.spiegel.de/international/europe/0,1518,729492,00.html

Maybe those docto are paying off their student loans or their children’s Oxford tuition.

I don’t know. Why do they steal from their own people?

http://october2011.org/statement

Here’s the FAQ, which explains the plan in more detail:

http://october2011.org/node/168

People unsure about committing to join this protest can sign up with a promise to take part ONLY if 50,000 others sign up as well. Strength in numbers:

http://october2011.org/besure

At the october2011 site, you can find lists of people and organizations that have signed on to participate.

http://october2011.org/organizations

http://october2011.org/people

Remember, any system made by people can be completely changed by people, too. There ARE alternatives.

Re: the IMF and retirement age

The IMF allows its employees to retire as early as 50 with a pension:

http://www.imf.org/external/np/adm/rec/policy/pension.htm#1

And they complain that Americans and Greeks retire too early.

Now, I think there should a Victims of Taxation in every country.

I would ask you why:

(1) If Greeks “have already accepted cuts which would be unfathomable in the UK”, why was 2010 Greek defence spending 3.2% of GDP, which I believe is the highest in the EU and higher than the UK despite our involvement in Afganistan?

(2) If “there is nothing left to cut”, why does Greece still hold 111.4 tonnes of gold, which represents one of the largest gold holdings as a proportion of foreign exchange reserves in the world?

Perhaps that there are still some things that Greece could give up without causing hardship except to Greek national pride. I would be disappointed if the UK loaned (or more realistically, donated) any more money (in our case through the EFSM and the IMF) to Greece without such sacrifices being made.

The article did claim that defense purchases from other Euro countries was tied to the bailout money. How you square that with “austerity” we can only wonder.

The gold stash is a good point tho. That’s worth a few bucks and India and China are in the market big, I hear.

This information together with the sentence about NG fields under the aegean sea would greatly benefit from some reliable sources.

I know a few thousands in Europ that would be delighted to read about it.

Defence expenditure: http://en.wikipedia.org/wiki/List_of_countries_by_military_expenditures

Gold holdings: World Gold Council World Official Gold Holdings June 2011 ( http://www.gold.org/government_affairs/gold_reserves/ login needed)

And who the heck cares about gold?

Some rebel you are. You should change your name to ReactionaryEconomist. :)

Circumstantial evidence of the Argean oil/ng deposits. But the circumstances do seem propitious from reading this article. http://www.keeptalkinggreece.com/2010/08/01/us-energy-envoy-greece-should-cooperate-with-turkey-on-the-aegean-sea/

I’m all for cutting military spending but the way you put it: as a demand, I am all for keeping the military at full power, just because it is a demand (and also because if they are going to declare unilateral bankruptcy and a socialist revolution they may need it to defend the country against their NATO “friends”).

As for the gold it’s obvious that if they need to create their own currency because they will be kicked out of the euro, then they need gold to back it properly.

I understand that Greece is being bullied and scammed and that it owes nothing at all. Let the creditors tighten their belts: they knew what risks they assumed, did not they?

… then they need gold to back it properly. Maju

Government money is backed by its taxing ability, not PMs.

as has been pointed out on NC in previous posts, the gold is only worth $4B or less than 1% of the Greece’s debt–not much there, especially if you have to keep an eye on leaving.

I see that it was not their fault at all. These were decent hardworking people living and managing their economy most responsibly.

Then what happened? Some outside banksters invaded their fine country and forced them to borrow more than they can afford. These hard working people resisted for a while, they knew it was wrong. In the end the banksters forced them too by sheer physical violence and terrorism. I well recall the appalling scenes of mass shootings and beatings in Athens strees, where masses of riot policy (in the pay of the banksters) ran through Athens beating anyone who refused to borrow.

The apogee of this particular trend occurred when Parliament itself was invaded by a force of the German and French banksters, and made the then Government borrow, literally at the point of a gun.

This was raw terrorism of a sort the world had not experienced in Europe since a few days earlier, so it is not surprising they yielded.

After that, for a while, all seemed well. Their strong national currency vanished of course as part of the deal. Cowed, the kept electing bankster govermnents, but it seemed not too bad.

All of a sudden, these guys came back however! And this is where we find ourselves today. They are taking all the assets of the workers, they are invading, they are oppressing. Finally it is time for the Greeks to resist. No more loans, they cry.

Stand with them my friends. Do not let the banksters do this again. Never allow another worker to be oppressed at gunpoint into borrowings he has no desire for, is strongly resisting. And if he is forced into borrowing, tell him to refuse to pay.

And then borrow some more.

Banks lend money they don’t have for interest that does not exist in aggregate. They are thus counterfeiters and gamblers.

Question? Is debt to counterfeiters morally valid?

Ever hear of Murray N Rothbard? He argued that national debt was immoral and should be repudiated. I agree.

However, in the case of a monetarily sovereign nation like the US the national debt need not be repudiated. It can simply be paid off as it comes due with new, debt-free fiat.

As for Greece, it should default.

You are again displaying a remarkably selective reading of the facts. Or rather no facts, that seems to be your stock in trade.

Germany and France both broke the Maastricht rules as far as fiscal deficits are concerned as badly as Greece did, so they are hardly alone in that club.

And the blowout in debt level was in fact caused by the crisis, pretty much every economist who has written on this topic stresses that the spectacular rise in debt levels is the direct result of the financial crisis, which led to a collapse in tax revenues. You’ve also ignored the fact that the tax evasion, which is another reason for the shortfall in tax revenues, is done primarily by wealthy Greeks, while the austerity is falling on ordinary citizens.

Moreover, as we and others have pointed out repeatedly, cutting government spending makes matters worse. GDP fall, which makes debt to GDP ratios worse. It has happened in Latvia and Ireland and is happening in Greece.

I do agree that austerity will not solve the problem, that they can must and will default, that tax evasion was not class-neutral.

What I don’t see is that there is any free ride here. After that, and whether they leave the euro or not, they are still going to have to implement ordinary,prudent fiscal management. They aren’t rich enough to afford the welfare, they have to live within their means.

Of course austerity reduces GDP which in turn reduces the ability to pay. I fully accept that is not a solution. But there is no solution once you have unsustainable debt. And defaulting is not pain free either.

The answer is not to get there and once there and out, not to go there again.

Ah, “unsustainable debt.” The Peterson trope. Some options:

1. The lenders should take the consequences of their bad business decisions. If that means they fail, so be it. They’re parasites anyhow. A mutually self-reinforcing web of parasites.

2. One policy option is MMT’s — Greece is not sovereign, but the EU could be. Europe is far from any danger of inflation because productive capacity is unused. So the EU should print some money and put Europe back to work.

3. A second policy option would be a Jubillee year…

Yep. #3. When debt is unsustainable on a societal level *it is repudiated*. This is what has been done throughout history, this is the only thing which has ever been done in history.

I expect Greece to repudiate its national debt — as it must.

LRT said: “What I don’t see is that there is any free ride here.”

I think what is at issue is what you do see. And what you do see is an opportunity to make debt slaves of the Greek people. Your intentions became abundantly clear in this comment of yours from yesterday:

…if a nation gets into debt over its head, for whatever reason, and no matter what class it benefits to do it, it will lose its sovereignty and probably its democracy will take a hit too.

That’s highly deterministic. Greece could choose to do what Argentina and Iceland did. The people could reassert their control over their government and tell their elites, and foreigners like you, to go take a hike.

On the other hand, if the United States is willing to intervene to subvert the popular will, and the general welfare of the nation—either through overt military invasion or by sending in its covert operatives—-your wish (prediction) may come true.

I’m guessing the shipyard worker and the archeology employee were not savvy to the way that their so-called ‘leaders’ were selling their souls (and future generations of Greeks) into debt slavery to big banks.

Meanwhile, if these banks are such brilliant thinkers, then WTF were they doing lending sums far greater than could realistically be paid back? Why don’t all those Great Economic Analysts ever have to face the music for their reckless conduct?

At what point does the political stranglehold of impetuous, reckless banks get called out and exposed for the mathematical system of computerized shams that it has become?

I’d say the Greeks are doing their part to expose this nonsense.

More power to them!

If you want to be a moralist and scold the shipyard worker and the woman at the Ministry of Culture, then you appear to be somewhat myopic. After all, they weren’t lending an entire nation far more than it could repay.

On a related subject, contracts awarded where the

government official approving the contract receives

a bribe from the company that gets the contract, I’ve

been looking for a logical way to proceed (once it’s

proven and public knowledge).

Firstly, I’d say such contracts lie in a “gray zone”,because

of the conflict of interest, and because for the nation,

the “deal” could be anywhere from not so bad to very bad.

I’ve been searching for an equitable way to proceed

once a “deal” or contract is deemed to be in the

“gray zone”.

Suppose six submarines were ordered under a “gray zone”

contract, and two were delivered. The contractor

might argue that four of the six are “in production”.

The people of the nation, if a referendum occurred,

might say by 95% that one submarine is Ok, but that’s

all.

All I see is a messy situation, with no obvious

equitable (logical) solution. One could argue that

no valid contract existed, but that there was a flow

of goods one way, and a flow of money paid in the other

way. Beyond that, I can’t see a clear, equitable way

to resolve the messy situation …

Well, ajax (the Telamonian? or the Oilean?)

One way to do it would be to create a grid, with center = 0, 0

To the left X axis, negative numbers for amounts of money not fulfilled by the contract (i.e., looks like in your example, you are missing 4 ships out of a contracted 6?) In other words, the X axis *could* represent ‘value supplied per contract, relative to negotiated terms’. (That’s just one idea; obviously, that X axis can represent whatever you want.)

Then, you could have a Y axis, again negative below the central X=0, Y=0 center point, then the positive numbers moving up. Perhaps it could represent government departments, or some other identifiable measure that could be plotted.

So perhaps in your upper right quadrant, it would turn out that the Ministry of Archeology had a pretty good return on contracted investment (say the calculations for their contracts come in around x=200, y=150.

And then perhaps your ship contract (from Ministry of Defense?) comes in around x= -400, y = -200.

So you could glance at those quadrants and get a quick view of patterns: do some of the government divisions always end up in the bottom left quadrant? If so, you call it your ‘incompetence and corruption’ quadrant (or whatever name you choose).

Then, as another layer, you *could* put circles radiating out from the 0, 0 position … say, 100 per circle layer in concentric circles radiating out from the center. Anyone in the 100s is doing okay, in the 300s, needs attention, in the 600s “red alert”.

There are plenty of ways to get your head unlocked from ‘grayspace confusion’.

Hope this humble blog comment helps…

http://en.wikipedia.org/wiki/Ajax_(mythology)

(But you probably know all that…?

;-)

I am not quite sure why you are resorting to re-posting fact free articles. As much as I want to sympathize, if Alex is all the Greek intelligentsia can muster, the situation indeed is hopeless.

Ahem, his post points out that Greeks work more hours than most Europeans (that has been discussed elsewhere and has not gotten the attention it deserves) and debunks the incorrect factoid that they retire early. So it most certainly is not fact free. It also point out correctly that while middle class people got some benefits from the cheap lending era, it went disproportionately to the top, and they are not going to take the hit on the downside.

So let me turn that around: why are you engaging in a not only fact free, but affirmatively inaccurate criticism, with a snide ad hominem thrown in?

The age at which people leave the workforce is only part of the story. I dare say what matters more is when they are entitled to their state pension (similar across the EU), and how generous it is. I know the Daily Mail is a bit eurosceptic, but consider this information: http://www.dailymail.co.uk/news/article-493293/Britons-worst-state-pension-EU.html

Yep.

And all that so the British bankers can cruise around the Mediterranean on their mega-yachts, go globe hopping in their Gulfstream G650s and buy diamond studded human skulls at $100 million a pop.

Here, let me fix that for you:

I am not quite sure why you and LRT are resorting to re-posting fact free comments. As much as I want to sympathize, if you and LRT are all the neo-imperialist intelligentsia can muster, the situation indeed is hopeless.

Don’t make fun of the greeks. In CA I saw lots of people forced to buy a Porsche a gunpoint.

Why they always do that I’ll never know.

It’s like LRT, for all his oh-so-heavy irony, never heard of marketing or scamming. He’s also identifying the Greek people with the Greek government. Why do that? In any case, the idea that the borrower is always to blame, and the lender never, though pleasing to bankster enablers, isn’t true for the case of accounting control fraud. Bill Black:

And if the European elites are like our own, fraud is that the base of what they have done, just as it is with our own elites.

Hear! Hear!

LRT said: “Then what happened? Some outside banksters invaded their fine country and forced them to borrow more than they can afford.”

Have you ever picked up a history book in your entire life? It appears not, either that or you have a built-in censoring faculty that blocks out any factual knowledge that clashes with your neoliberal dogma. How many nations must suffer the ravages of liberalism and its ugly stepchild—-neoliberalism—-before the doctrine is finally discredited in the eyes of its defenders?

Liberalism has never worked as billed. The problems became manifest well before Adam Smith even formalized it as a doctrine, as C.R. Boxer explains in The Dutch Seaborne Empire 1600-1800:

When the States of Holland formally renounced their allegiance to King Phillip II of Spain in 1581, they also enacted a law forbidding town councilors to consult with the representatives of the guilds (from whom they had originally sprung in the Middle Ages) or of the civic guards (as such) on any provincial matters. The regents thus took advantage of the struggle with Spain to consolidate their position as a self-perpetuating burgher-oligarchy and to exclude the ordinary citizens from any direct say in either the local or the provincial administration.

Liberalism’s failures since its very inception are manifold, and run through history like a thread. Jean Simonde de Sismondi amply documented its pernicious consequences in his Studies in Political Economy (1818-36), completed soon after Smith formalized the liberal dogma in Wealth of Nations, first published in 1776.

In The Buried Mirror Carlos Fuentes describes how the liberal dogma was used to subjugate Latin America during the 19th century:

In the phase immediately after independence, Britain managed Latin America’s foreign trade; in the latter part of the nineteenth century, the United States came to be the principal partner. However, they employed the same instruments of economic power, namely favorable agreements for their merchants, loans and credits, investment, and the handling of the export economy of minerals, agricultural produce, and natural products acquired by Anglo-American expansion. A highly privileged local minority served as intermediaries, both for these exports and for the imports of manufactured European and North American goods, which were in demand among the urban population in the interior.

And then in A New Time for Mexico, Fuentes describes how, after a short partial reprieve from liberalism in the middle part of the 20th century, it, like Freddy Krueger, came back from the dead:

It is worth recalling that the prefix “neo” is particularly well suited to this doctrine, which already had its change in Latin America during the last century. Throughout the nineteenth century, Latin America followed the precepts of laissez-faire and the magic of the markets, and its nations implemented policies geared toward exporting raw materials while importing capital and manufactured goods. Powerful economic elites emerged from Mexico to Argentina. The hope was that the wealth accumulated at the top would sooner or later find its way down to the bottom. This did not happen. It has never happened. Instead, the wealth generated at the working base found its way up to the top and stayed there.

Fuentes describes in great detail how neoliberalism played out in Mexico. Mexico’s experience may be of special interest at this particular time, as leaders in both the United States and Europe appear hell-bent on imposing neoliberalism upon their populaces. The short and long of it is that neoliberalism in Mexico has proven to be a fast track to economic polarization and social chaos.

Up until 1982 Mexican governance was dominated by statism, “a straitjacket of extreme protectionism, subsidized consumption and production, captive markets, and lack of competitiveness,” as Fuentes puts it.

“Riding the crest of the oil boom, Mexico contracted gigantic debts that it could not pay when the oil glut, followed by a plunge in prices, left the country without liquidity. In 1982, Mexico went broke,” Fuentes explains.

What came in place of statism was “a demonization of national states, a delusional faith in the free play of market forces, and the cruel complacency of social Darwinism in lands of extreme hunger and need,” Fuentes says. He goes on to explain:

And Mexico, battered by the debt crisis of the 1980s…sought strong and revolutionary macroeconomic solutions, first under the de la Madrid administration, and then more fully under the Salinas administration. These measures included bringing inflation down to single digits, balancing the budget, increasing foreign reserves, welcoming foreign investment, keeping interest rates competitively high, and privatizing as much as possible. And enshrining supply-side economics, known in Latin America as neoliberalism, the equivalent to the trickle-down theory (or voodoo economics, as candidate George Bush called it back in 1980).

But neoliberalism’s promises were never fulfilled:

The neoliberal model espoused by the Salinas administration responded by fighting inflation, balancing the budget, inspiring confidence in Mexico, attracting investment, concentrating wealth in a few competitive firms and individuals, and hoping that trickle-down would take effect. But the hope was undermined by evidence that the economy was not growing, that fighting inflation had become a fetish, that excessive foreign spending was not compensated for by increasing local production, that real growth was hindered by one of the lowest savings rates in the world, and, finally, that flight capital had become unmanageable.

[…]

Mexico needed—and did not get—policies encouraging investment in activities that would further employment, wages, growth, and savings. Instead, the Salinas reforms provoked a flood of speculative, unregulated capital that did not go into productive areas. Like flight capital in any other emerging market, it stayed in Mexico as long as it was profitable to stay and fled as soon as dark clouds started accumulating in the sky…

Never has Mexico received as much foreign investment as it did during the Salinas years: almost $59 billion between January 1989 and September 1994, but of that enormous sum, almost 85 percent was speculative flight capital.

[…]

The economy became hostage to foreign investment in order to maintain the peso’s parity and pay the current-account deficit. But foreign investment was concentrated mainly in stocks, bonds, and other short-term instruments: in the volatile and transitory paper economy. Only 15 percent of foreign investment went into the real economy, into creation of factories, increased employment, and increased production. The country was threatened with an acute case of schizophrenia. A minority centered their lives on the New York Stock Exchange, and a majority on the price of beans. One economy was all gilded wrapping paper, the other all huts and untilled land. The former was the minority’s, the latter the majority’s.

When the neoliberal house of cards came tumbling down in 1994, Mexico did not turn away from the neoliberal model. Instead, the newly inaugurated president, under extreme pressure from the United States, opted for neoliberalism on steroids:

In effect, President Clinton withdrew the original $40 billion loan requiring Congressional approval and gave Mexico $20 billion out of a discretionary fund. Strings were attached: Mexico’s oil revenue would serve as collateral and be paid directly into the Federal Reserve Bank in New York. President Zedillo didn’t even blink at this onerous condition and both Zedillo and Clinton knew that the U.S. lent Mexico money to repay U.S. banks, and investors, who had already harvested enormous earnings in their Mexican ventures. Production, employment, salaries, education, and social services—the real saviors of the Mexican economy—were once more postponed. Sovereignty was severely affected: the agreement gave the U.S. the right to monitor Mexico’s economic policies.

[…]

Mexico is pledging to follow an economic policy that is precisely the one that led to the current situation: zero growth in the money supply, cuts in government spending, and more privatization. This is a renewed formula for disaster in a country that needs to stimulate growth even at the risk of inflation, as Brazil has done (though one need not go to the same extremes). Mexico has yet to learn the lesson that economists everywhere else have deduced from the crises perpetrated by the supply-side economics practiced during the twelve years of Reagan, Bush, and Thatcher: that to restrict money supply and spending during a recession leads to depression, not recovery.

[…]

The draconian self-discipline imposed by the Zedillo administration, though temporary, is, by the president’s own admission, cruel: steep increases in the prices of gasoline and transportation, a 50 percent increase in value-added taxes, cuts in government spending, and almost total credit restriction. These are coupled with a 2 percent fall in the GNP, 750,000 people out of work, 42 percent inflation, and only 10 percent in wage increases.

These short fuses may set off the Mexican bomb: bank failures, company closedowns, or street demonstrations and acts of vandalism, as in Venezuela of President Perez’s second term—a Mexican reprise of that caracazo.

I certainly hope that none of this occurs. The Mexican people are extraordinarily patient, though most have never known anything but misfortune. But in 1982 the debt crisis struck a middle class with money in its pockets thanks to the oil boom. Today, Mexican middle class families will be unable to pay the mortgages on their two-bedroom apartments, the monthly payments on their Volkswagens, and maybe even the rent. Their dramatic pauperization is evident in every corner of our larger cities.

Do we have time to set the stage for economic renewal?

The answer to Fuentes’ question now appears to be no. Fuentes published his book in 1996, and since that time neoliberalism in Mexico has created some of the world’s richest men, including Carlos Slim who is reputed to be the wealthiest man on the planet. But it has created a level of inequality previously unknown in Mexico, and a majority of the population has been reduced to abject poverty, robbed of all hope. The country borders on social chaos, with crime and corruption spiraling out of control.

Economic polarization and social chaos: These are the fruits of neoliberalism, and what the people of the United States and Europe have to look forward to if they cannot figure out some way to wrestle power away from global corporations who view the planet as their own private plantation.

Jonathan Schell also takes on liberal mythology in “From Laissez-Faire to the Military Revolution”:

The early champions of the free market, most of them British, had in fact looked to industry mainly to create the wealth of nations, as the title of Adam Smith’s classic book had it, not the power of nations, which had been the preoccupation of their mercantilist predecessors. The advocates of laissez-faire declared the independence of economics from state power. (The eventual coining of the word “economics,” identifying a distinct realm of human activity subject to its own laws, was one sign of their faith in that independence.) The market worked best, the worldly philosophers of the late eighteenth century believed, when the government kept its hands off it. Classical economics, in fact, “had no place for the nation, or any collectivity larger than the firm.”

Smith’s successors proceeded even further in this line of thinking. In the early nineteenth century, the most prominent champions of the market, including the British champions of laissez-fare Richard Cobden and John Bright, contended that free trade, by breaking down or ignoring national boundaries, naturally tended to foster world peace. The market, they ardently believed, was a solvent of national units and a pacifier of national conflicts. “I see in the Free Trade principle,” Richard Cobden said in a speech in 1846, “that which shall act on the moral world as the principle of gravitation in the universe, drawing men together, thrusting aside the antagonism of race, and creed, and language, and uniting us in the bonds of eternal peace.”… An unbroken thread of faith in free trade as an abettor of peace runs through the entire tradition of liberal internationalism, surviving many disappointments and continuing, in attenuated form, to this day.

–Jonathan Schell, The Unconquerable World

But, as Schell goes on to point out, “soon a different relationship of markets to war emerged.” And in the late nineteenth century, “economic motives for empire steadily yielded to geopolitical ones”:

However, events did not proceed as the liberal imperialists expected—-neither in Asia nor in the Ottoman Empire. The economic arrangements forced upon those lands did not strengthen and liberalize their governments but undermined them and drove them, one after another, toward collapse. The Egyptian government, for example, accepted loans from Europe, spent the funds on large but unproductive public projects, and, when these failed, sought to keep up payments on the loans by raising taxes on the poor, who grew discontented and rebellious. The imperial powers then were faced with what seemed a drastic choice: between withdrawing entirely and imposing direct rule. They chose direct rule.

To clarify for the less educated reader, you are referring to what is known as “economic liberalism” and its descendant “neoliberalism”.

“Social liberalism” means something quite different although the two have been connected during certain historic periods (and not others). “Political liberalism” sometimes means one, sometimes means the other, and sometimes means neither.

The root adjective “liberal” means something entirely different from all of the above: it’s a synonym for “generous”.

Thanks for that, Nathanael, – less educated or not, I find the usage and meaning of that word ‘liberal’ is very confusing, and although I love downsouth’s posts, I wasn’t clear about how the term was being used, liberal > neo-liberal…

To clarify, the term “social liberal” doesn’t make any sense unless conjoined with economic liberalism. Otherwise, one would be a socialist, period.

Well, I’ll ask anyway: What does it mean to be a “social liberal” but not support capitalism, but also not be a socialist? There is such a thing as market anarchism, but that’s not what you meant, since liberals (every sort) also support the State.

This is indeed war by other means, and must be resisted and counterattacked as such.

The whole bubble-crash-bailout-austerity-feudalism process is a planned strategy for the complete looting of nations and the imposition of tyranny upon them.

The people must respond in kind:

We owe nothing. On the contrary, only society ever enabled finance extractors to exist at all, so they were already our creatures before the crash they imposed upon us and the bailouts they stole from us. The latter have only cinched it once and for all. Through the bailouts we the people own the banksters and their political lackeys. We own them, we own their banks, we own their corporations, we own every cent they stole on a personal level, we own it all. They owe us everything. They must repay it all upon demand.

And then there’s their systematic assault upon our jobs, upon the real economy, upon the safety net, upon social stability, upon civil society itself. There’s their crashing of the economy and the systematic robbery of trillions for which they used this crash as the pretext. The restitution they owe for these crimes is beyond tallying. Here again, for the second time, they owe us everything they have, and vastly beyond. They must repay it all upon demand.

The debt they owe us is literally infinite. We owe them nothing.

This is the simple, wholesome, true consciousness all of humanity must develop, if we intend to continue as human beings at all, as opposed to being reduced to the most wretched servitude.

Every human being is standing tall in Syntagma Square.

an invasion as brutal as that against Poland in 1939

Oh, get real. Estimates of casualties for the invasion of Poland by Germany and Russia are:

66,000 dead,

133,700 wounded,

694,000 captured

904,000 total casualties

Two sentences in, and you manage make it clear your judgment is flawed, and that you should be ignored.

It’s just now unfolding.

If there is just a 2% increase in mortality brought about through austerity, that will mean 220,000 dead.

Stick that in your pipe and smoke it.

The Polish invasion increased mortality and decreased lifespan a hell of a lot more than 2%. Life expectancy at birth in parts of Poland fell to *10 years*. You may have also heard of a place called Auschwitz. I have better suggestions where you can stick *your* pipe.

there is a form of thanatic brutality which is equivalent to some degree in its noospheric mind wave presentation, but certainly the bloodletting and bone breaking aren

t equivalent. at least not yet.

anyway, metaphors aren’t always identities, and they can be stretched.

and anyway #2, I don’t see this as Greeks vs. Northern European bureaucrats and bankers as much as kleptocrats and the beneficiaries of kleptocracy vs. labor. I’m sure there are plenty of reasonably well-off Greeks who could pay a fairer share of taxes and ameliorate the problem, but they don’t see “fair” that way and they don’t, presumably, get sentimental at the notion of “Greek” nationhood. Why not? A very interesting question for those who pursue it.

If there’s a collapse in Europe (or the United States, for that matter) like that in Russia when their own multi-national, continental, imperial, and sclerortic political economy collapsed, then life expectacy will drop 10 years indeed, as it did in Russia for males. Those are the stakes. Put that in your pipe and smoke it.

Life expectancy is already falling — rapidly — in 8 out of 10 counties in the United States.

Where does it continue to rise? In the counties populated by rich people, of course.

http://www.medicalnewstoday.com/articles/228612.php

Why only males or why only they were hit harder, I wonder?

Straw man. He said the invasion BY GERMANY in 1939. That can be read as the initial conquest. It certainly does NOT include the Russian invasion. So at a minimum, you need to take those casualties and deaths out. As I read it, you need to restrict it to the deaths related what it took to subdue Poland.

And many of the deaths inflicted by Germans were the result of the Final Solution which was not implemented until 1942. Again, not part and parcel of the invasion and conquest, but a separate, later decision.

And under Pinochet, people were killed and “disappeared” by the thousands as part of the implementation of neoliberal reforms. As a minister of a kinder and later Chilean government said, “People died so markets could be free>”

Straw man. He said the invasion BY GERMANY in 1939. That can be read as the initial conquest. It certainly does NOT include the Russian invasion. So at a minimum, you need to take those casualties and deaths out. As I read it, you need to restrict it to the deaths related what it took to subdue Poland.

First, he didn’t indicate Germany specifically, so you’re not justified in inserting it, unless you can read his mind. Second, you seem to be misinformed about this bit of history. Germany and Russia invaded Poland at essentially the same time as part of a plan to split the country in two spheres of influence. The Germans invaded on Sept 1, 1939, and the Russians invaded on Sept. 17, 1939. Fighting took place simultaneously on both fronts. Because of this, casualty estimates are not listed separately.

And many of the deaths inflicted by Germans were the result of the Final Solution which was not implemented until 1942. Again, not part and parcel of the invasion and conquest, but a separate, later decision.

The deaths listed in my initial comment were just for the invasion in 1939. Total deaths in Poland from 1939 to 1945 ran into the millions.

And under Pinochet, people were killed and “disappeared” by the thousands as part of the implementation of neoliberal reforms. As a minister of a kinder and later Chilean government said, “People died so markets could be free>”

What does this have to do with the comparison of the imposition of an austerity package by the Eurozone heavies on Greece, to the invasion of Poland? A domestic police state isn’t the same as an invasion and occupation, enforcing neoliberal economic policies wasn’t the only reason, or even the primary one, for the Chilean police state, and you’re loopy if you think Germany is going to try to enforce some austerity package at gunpoint.

Here’s some background on the relevance of Pinochet’s Chile and the international bankers’ “invasion” of Greece:

http://en.wikipedia.org/wiki/Chicago_Boys

Chester Genghis,

The waters are without a doubt getting pretty murky with all the exaggerations, but PeakVT certainly hasn’t risen above the fray, and has shed more darkness than light. PeakVt’s stock and trade is not outright lies, but distortions and half-truths.

—————————————-

• PeakVT: “….enforcing neoliberal economic policies wasn’t the only reason, or even the primary one, for the Chilean police state….”

• From your link: Although the coup was described as a military coup, Orlando Letelier, Salvador Allende’s Washington ambassador, ‘saw it as an equal partnership between the army and the economists ‘ “.

—————————————-

• PeakVT: “….you’re loopy if you think Germany is going to try to enforce some austerity package at gunpoint.”

• Andrew J. Bacevich, The New American Militarism: “We have chosen to marry the means of the Old World to the ends of the New, relying on force and the threat of force to spread the American Way of Life, or, as the writer Max Boot has with unusual candor observed, ‘imposing the rule of law, property rights and other guarantees, at gunpoint if need be.’ “

—————————————-

• PeakVT: And under Pinochet, people were killed and “disappeared” by the thousands as part of the implementation of neoliberal reforms. As a minister of a kinder and later Chilean government said, “People died so markets could be free>”

“What does this have to do with the comparison of the imposition of an austerity package by the Eurozone heavies on Greece, to the invasion of Poland? A domestic police state isn’t the same as an invasion and occupation…”

• John Ross, The Annexation of Mexico: “U.S. National Security is a global strategic doctrine, relative to maintaining economic, political and military supremacy in its zone of influence is how Mexican politilogue Adolfo Aguilar Zinser defines theses same polices.

“U.S. ‘National Security’ is a Cold War concept codified in the 1947 National Security Act, which also created the National Security Council, to combat Communist penetration of U.S. spheres of influence. In the name of its hallowed ‘national security,’ the United States has mounted military invasions and suppressed internal dissent in Latin America, encouraged political assassination, civil wars and military coups, winked at torture, applauded fraudulent elections and ignored genocide…

“As the U.S.’s Latin American ‘sphere of influence’ has deepened, every challenge to U.S. hegemony—-from guerilla movements to a moratorium on foreign debt payments to a reluctance to privatize a national petroleum corporation to drug money laundered in Latin political campaigns—-is evaluated by Washington as a possible threat to its own ‘national security.’ “

—————————————-

• PeakVT: “Fighting took place simultaneously on both fronts. Because of this, casualty estimates are not listed separately.”

• Adolf Hitler, instructions to his generals in a briefing to his generals before the invasion of Poland: “Be harsh and remorseless. Act with brutality, close your hearts to pity. It is the stronger man who is always right.”

• Wikipedia: “The Polish September Campaign was an instance of total war. Consequently, civilian casualties were high during and after combat. From the start, the Luftwaffe attacked civilian targets and columns of refugees along the roads to wreak havoc, disrupt communications, and target Polish morale. Apart from the victims of the battles, it is alleged that the German forces (both SS and the regular Wehrmacht) murdered several thousand Polish civilians. Also, during Operation Tannenberg, nearly 20,000 Poles were shot at 760 mass execution sites by the Einsatzgruppen.”

PeakVT,

For someone like myself who lives in Mexico and has been an eye witness to the ravages of neoliberalism—-the poverty in the shadow of unfathomable wealth, the human misery, the mass migration, and the eventual complete disintegration of the society with the attendant mass murder that entails (40,000 and counting as we speak)—-I find your defense of neoliberalism to ring hollow, to say the least.

I have no doubt that someone like you, with your ability to distort and cherry pick history and screen out anything that doesn’t conform to your point of view, can justify just about anything you set your mind to. As I was reading your comments, this quote from John Adams came to mind:

Power always thinks it has a great soul and vast views beyond the comprehension of the weak; and that it is doing God’s service when it is violating all His laws. Our passions, ambitions, avarice, love and resentment, etc., possess so much metaphysical subtlety and so much overpowering eloquence that they insinuate themselves into the understanding and the conscience and convert both to their party.

You might have to go back to Xerxes and his invasion of the ancient Greece for comparison.

I suggest to my Greek friends that they trap the IMF, ECB and the Germans at Thermopylae. I think they have a chance there.

As a defence of Greece this is quite a good one, but I think I have to argue from both sides of the fence here. Firstly how are you going to react when it comes to your countries turn. What will you say to the rest of the world when they say.

1) All americans are fat and lazy stuffing their faces with MacDonalds and 30lb steaks.

2) The retirement age for americans is very low wih some public employees retiring at 48.

3) Americans are too busy watching their big flat screen TV’s in their Mcmansions running up bills on their credit cards.

4) Americans are warmongers splashing out money on interfering in other countries.

5) The US economy is a weak economy due to the vast inequality in its structure.

6) American politics is all about money and rife with corruption.

There are elements of truth but it is not a real picture of much of America, just as we don’t see a real picture of Greece. News media yet again has been pretty poor about getting the picture accurate.

From the other side of the fence I would have to question some of the numbers and point out that over the next few years those graphs are going to change significantly. Most Eu countries are raising retirement ages, productivity levels are rapidly changing and perhaps Greece needs to think less about comparisons to where the EU members are now but where they are heading. The whole of the EU is in rapid flux and change when compared to the US.

The real problem though is that the Greek population don’t appear to have a solution to promoting growth or at least preventing the economy shrinking. Adjustment is fine providing you at least keep the economy ticking over, otherwise each contraction forces more adjustment and you get into a contractionary spiral. That the EU and IMF solution is probably even worse for the Greeks I would not argue with and their solution smacks of teaching a lessons rather than working as a partner. Devaluation if Greece was out of the Euro would seem like a solution to the growth problem but as the UK has found out, time delays and funding costs can completely negate the positive benefits. In a way I see Greeks as throwing a hissy fit that they don’t like any of the options for them (understandable in a way).

I think Greece should default, have a small internal devaluation and be shouting very loudly that eurozone spending should be diverted from France, The UK,The Netherlands and Germany towards Greece. This does mean that likes of France would have to finally sort out its agricultural policy, eastern europe would have to start to stand on its own two feet. At the moment it seems all about the Greeks making hard decisions while parts of the rest of Europe get to ignore many of the hard decisions they should be making. Just maybe we will have proper financial regulation and stress tests at the end as well. Unfortunately we all know its going to be a kick the can down the road solution if politicians have their way.