One of the interesting features of the seemingly unending Eurozone crisis is that the half life of rescue measures is decreasing.

The elephant in the room, which we will put aside to focus on the current state of play, is that everyone knows the Greek debts must be restructured. To have Greece pay out punitive rates on past debt will simply grind the economy into a deeper hole, worsening its debt to GDP ratio and eroding its physical and human infrastructure. All the delay of the inevitable does is allow for more extend and pretend while Western financial firms strip the economy for fun and profit. And this is terribly inefficient looting; their profits from this pilferage will be small relative to the pain inflicted on the Greek populace.

Late last week, various commentators made a bit too much of the clearing of one obstacle to the extension of yet another short lifeline to Greece, namely, that Angel Merkel had relaxed one of conditions that stood in the way of a planned €12 billion credit extension. She had wanted private creditors to share in the pain, and agreed that a rollover of currently maturing debt would do. Before she had insisted on a full bond exchange, which would have resulted in a much more significant hit to investors.

This concession did not go over well in Germany. Per the Financial Times:

“What has been agreed is not a real participation of [private] creditors,” said Frank Schäffler, a rebel leader in the Bundestag from the ranks of the Free Democratic party, the liberal junior partner in Ms Merkel’s coalition. “It does not correspond to what the German Bundestag has agreed,” he told the Frankfurter Allgemeine newspaper on Sunday.

Klaus-Dieter Willsch, another dissident backbencher in Ms Merkel’s own Christian Democratic Union, warned that “it will be difficult [for her] to win a majority in parliament” for a new Greek rescue on the basis of a bond rollover.

Even the opposition Social Democrats, who are in principle more positive about a new Greek rescue, are threatening to withhold their votes in the Bundestag if Ms Merkel cannot deliver a majority from the ranks of her supporters.

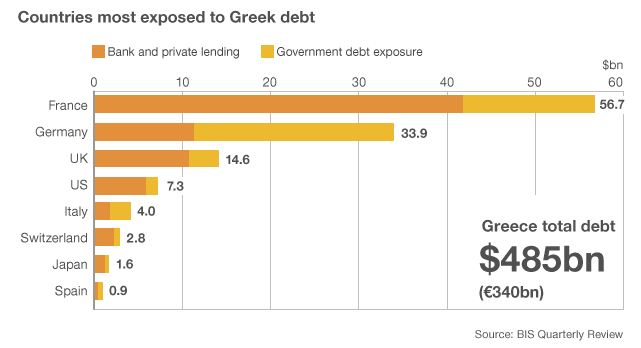

Even though Germany has been the heavy thus far, it is France that is actually the most exposed to Greece, when you include private debt, as this chart from the BBC shows (hat tip Daniel Pennell):

The update this morning from meetings over the weekend among Eurozone ministers is fragmentary and confused (the disparity among various reports on the same story is unusually wide) but the bottom line is clear. First, a deal has not been agreed to although they insist there will be a deal before Greece really needs the dough. Second, the eurozone ministers insist that the Greek parliament nevertheless pass tough austerity measures as a precondition for any rescue.

The BBC, which was more coherent than some other accounts, depicts the action as a “delay”:

Eurozone finance ministers have postponed their decision on a 12bn euro ($17bn; £10bn) loan to Greece until it introduces further austerity measures.

The ministers said they expected to pay the latest tranche of a 110bn euro EU and IMF aid package by mid-July.

But it will depend on the Greek parliament passing 28bn euros of new spending cuts and economic reforms.

The ministers also committed to put together a second bail-out package to keep the country afloat.

It isn’t lost on anyone that “expected to pay” isn’t a resounding commitment. The Financial Times more pointedly called it “A failure by eurozone governments over the weekend to agree the release of a €12bn bail-out payment for Greece.” Bloomberg pointed to another obvious concern, whether the full €12 billion would be forthcoming even if the Greeks knuckled under.

Recall also that this €12 billion isn’t a new deal; it’s another tranche in the €110 billion package agreed (well, supposedly agreed) for Greece last year. And the Greek government does have the upper hand here; it is ironically the same leverage point the US banks used to push through the heinous TARP in 2008: “If you don’t rescue us, all hell breaks loose.” But it has been cowed into not making that threat. As Mark Weisbrot wrote in the Guardian last Friday:

Imagine that in its worst year of our recent recession, the United States government had decided to reduce its federal budget deficit by more than $800bn – cutting spending and raising taxes to meet this goal. Imagine that, as a result of these measures, the economy had worsened and unemployment soared to more than 16%; and then the president pledged another $400bn in spending cuts and tax increases this year. What do you think would be the public reaction?

It would probably be similar to what we are seeing in Greece today, including mass demonstrations and riots – because that is what the Greek government has done….What makes the Greek public even angrier is that their collective punishment is being meted out by foreign powers – the European Commission, the European Central Bank and the IMF. This highlights perhaps the biggest problem of unaccountable, rightwing, supranational institutions….If it had leaders of its own who were stupid enough to massively cut spending and raise taxes during a recession, those government officials would be replaced….

And if that required a renegotiation of the public debt, that is what the country would do. This is going to happen even under the European authorities, but first, they are putting the country through years of unnecessary suffering. And they are taking advantage of the situation to privatise public assets at fire sale prices and restructure the Greek state and economy, so that it is more to their liking…

Because of the massive opposition to further economic self-destruction – the latest polls show that 80% of Greeks are opposed to making any more concessions to the European authorities – the Greek government has so far been unable to reach an agreement with the IMF for the release of their latest loan tranche on 29 June…

The IMF is going to hand over the money anyway…the prospect of a disorderly default… is too scary for the European authorities to contemplate. For this reason, the many news articles about the possibility of a financial collapse comparable to what happened after Lehman Brothers went under in 2008 are somewhat exaggerated. The European authorities are not going to let that happen over a measly $17bn loan installment.

There appears to be three ways that the Greek conditional deal gets upended. The first two are that the austerity plan, which is tantamount to stripping the country of assets, is repudiated by Parliament or in the streets. The third is a bank run (which is already underway and could accelerate if the public pushback is severe enough).

It isn’t clear that the austerity plan will be approved by the Greek legislators. Weisbrot claimed polls showed opposition at 80%: the more widely cited polling results in the Western media is a mere 47% (note that poll showed only 35% in favor of the deal). Given how poorly the economy has performed and how the deal amounts to an end of Greek sovereignity, it isn’t hard to imagine that opposition is over 50%, particularly since reports over the last month indicate that even Greek businessmen are against it.

The key Parliamentary decisions are a vote of confidence on Tuesday, which Papandreou is expected to survive, and a vote on the austerity package next week. A report last week by the BBC’s Paul Mason (which I urge you to read in full) gives a sense of both how deep the discord is in Greece and how the European elites are misreading it. He contends that they are mistaking the protests as typical leftie opposition that can be ignored, when the citizens are withdrawing their consent to be ruled:

There is a social crisis under way and I think it is different from the one our history books teach us to expect. It’s not like the cracking of the state, or mass unrest, but simply that the Greek state – whose reach was never far into society – is beginning to lose its grip slightly on the actual functions a state should do.

It cannot decide its economic policy; it can’t convince its own people of any good intent; the rule of law is imposed hard here – with the impounding of yachts bought through tax evasion – only to break down somewhere else, as people begin to pledge non-payment of bills for the privatised utilities… the violence is a sideshow: it is the political paralysis of the Greek government that is of world importance because – while the European Union bickers about how much bankers should lose versus how much the EU should lose as Greece defaults – you are seeing the lines of defence against financial and social chaos within this part of Europe getting very frayed…

I think the level of mismatch between perception and reality within the Eurozone is worrying. Because last year’s protests were mainly leftist; and the strikes mainly token, a pattern of thinking has emerged that dismisses all Greek protest as essentially this.

But a new situation is emerging: Greek people I have spoken to are beginning to express things in terms of nation and sovereignty – and this makes the Greek situation different, for now, to Ireland and Portugal.

While the centre right New Democracy would probably win any snap election, it is hard to find support for pro-austerity politics among ND’s natural support base, the business class. Because austerity for them means getting hammered with a tax bill the like of which they have never dreamed, nor indeed paid.

And I will repeat the point about hostility to the media…The “mainstream” – whether it’s the media, politicians or business people – is beginning to seem illegitimate to large numbers of people.

As one old bloke put it to me, when I said: “Don’t you want us to report what’s happening to you?” – “No.”

He was quite calm and rational as he waved his hand in my face: “It’s too late for that.”

Gavin Hewitt, the BBC’s Europe editor, echos the same theme this morning: the real risk is not from the not well focused protests, but the simmering resentment among broad swathes of the public.

The ever pragmatic John Dizard thinks the public be damned, the real hazard is a bank run:

Again, don’t pay too much attention to the striking civil servants. They aren’t going to destroy the country. The issue is the avoidance of deposit runs, and widespread decapitalisation of the Greek financial system. These could quickly overwhelm any reasonable commitments of multilateral support.

Among the problems with the buy-time kick-the-can approach to restructuring of troubled European sovereign debt is that it creates a succession of critical dates before which panic can build. After a while, the depositing public gets educated to the advantages of withdrawing pre-restriction, or pre-devaluation, currency.

The tacit assumption underlying the eurozone push for the Greek government to put its neck in the noose before any commitments are made is that the markets will go along with this gamesmanship (or to be more precise, any adverse reaction will be short term in nature). So far, they’ve won this game of Russian roulette. But with everyone with an operating brain cell understanding that a Greek restructuring is inevitable, the point will come when kicking the can down the road is no longer credible. And that juncture is likely to come before the eurozone officialdom is prepared to make tough decisions and force losses on to bondholders and banks.

Of course they will default. But as long as they, as a country, refuse to limit spending to what they can reasonably raise in taxation, and refuse to pay taxes, they are going to have endless economic crises.

You can’t run a country like that and expect anything different. Why anyone thinks this is oppression by the bankers to just point out this obvious stuff is a mystery.

LRT, I think the point is that this is first and foremost a crisis of sovereignty. This is increasingly how it is being presented here also (I’m Irish). An economic crisis swiftly moves to a political crisis and then moves to a crisis of sovereignty/democracy. Have a look at Irish blogs and you’ll see this. Read about what’s happening in Spain and you’ll see this. You can solve an economic and political crisis with relative ease, but when foreign and unaccountable institutions threaten your country the game is up. We’re democracies. Everything else is secondary.

disgruntled observer,

Liberalism and its ugly stepchild, neoliberalism, are failed paradigms. This has been demonstrated repeatedly since the birth of the liberal dogma in the late 18th century. But this lamed horse—-both a moral and intellectual cripple—-continues to be flogged because it serves the special interests of the commercial and banking elite, both domestic and foreign.

I know of no instance in the 200+ year history of liberalism and neoliberalism, once the native population figures out what it is all about, where it has not required violence to impose it and maintain it. Domestically, neoliberalism is imposed by the implementation of a police state. Democratic institutions, where they exist, are infiltrated, co-opted and undermined. From without, neoliberalism can be imposed either by direct, overt military intervention or by sending in covert operatives, like the CIA, as with the current situation in Mexico, to set up puppet governments to unleash a bloodbath on the native populations of the victim countries.

While the US has had no compunctions about unleashing a bloodbath on Mexico or other countries in the Southern Hemisphere (read brown and black people), the question now becomes whether it will do the same to European countries like Greece, Portugal, Ireland and Spain, where the people are not quite as “other”.

Do you perceive the veiled threats and specter of violence being raised in this interview, Trichet: Greece is part of bigger problem, or am I being overly alarmist?

But regardless, I don’t see neoliberalism being imposed on any nation, sovereign or not, from within or from without, sans violence.

While the US has had no compunctions about unleashing a bloodbath on Mexico or other countries in the Southern Hemisphere (read brown and black people), the question now becomes whether it will do the same to European countries like Greece, Portugal, Ireland and Spain, where the people are not quite as “other”.

History shows that the answer is yes — if they are brown skinned Southern, Eastern, or Central Europeans.

* The US likely backed the 1967 military coup in Greece, and openly supported the Pinochet-style regime until 1974. The initial coup was bloodless, and based on US plans for a hypothetical coup, but there were many similarities between the Greek and Chilean regimes: the widespread use of torture, Henry Kissinger’s support for the dictatorship, and policies favoring multinational corporations.

http://en.wikipedia.org/wiki/Greek_military_junta_of_1967%E2%80%931974#Civil_rights

http://www.time.com/time/magazine/article/0,9171,904102,00.html

http://www.greece.org/cyprus/Takism5.htm

http://www.rieas.gr/research-areas/greek-studies/340.html

* The US-backed Operation Gladio helped maintain support for NATO and capitalism in Italy by staging (often fatal) terrorist attacks and coup attempts. http://en.wikipedia.org/wiki/Operation_Gladio#First_discovered_in_Italy These attacks often escalated when it seemed that left-wing parties were gaining power. http://en.wikipedia.org/wiki/Strategy_of_tension

“General Gianadelio Maletti, commander of the counter-intelligence section of the Italian military intelligence service from 1971 to 1975,” testified in 2001 that the CIA had foreknowledge of many terrorist attacks that were allowed to happen, supplied weapons to terrorist groups, and may have directly staged attacks in order to create a nationalist backlash.

http://en.wikipedia.org/wiki/Operation_Gladio#General_Maletti.27s_testimony_concerning_alleged_CIA_involvement

* Post WW II, the UK and the US tried to “solve” the problem of Eastern European refugees in Western Europe by shipping millions east to the USSR and certain imprisonment and/or death. http://en.wikipedia.org/wiki/Operation_Keelhaul The shipments continued even after American troops saw that the refugees were being massacred at the point of return.

I know of no instance in the 200+ year history of liberalism and neoliberalism, once the native population figures out what it is all about, where it has not required violence to impose it and maintain it.

I’d go a little further than that. I can’t think of an instance where a candidate was frank about neoliberal policy goals and won election. On the contrary, it requires systematic lying. Shock Doctrine has lots of examples of such electoral fraud, in addition to its many examples of brute violence.

IOW, to the best of my knowledge not once has any populace anywhere ever voted for neoliberalism.

To be clear, since DownSouth is not always clear on this, economic liberalism = neoliberalism are NOT the same as social liberalism, and in fact only rarely go together.

I think sovereignty is only half of the story. If I borrow a ton of money, try to start a business, go bust, then to call the result ‘debt slavery’ is only half the story.

We have to accept that what we are seeing is the consequences of ridiculously imprudent and improvident behavior. Borrow and spend like crazy as the Greeks have, and Ireland too, and you will end up in situations where you lose sovereignty. The time to get serious about democratic control was a few years ago.

The point people here make is those who suffer most were not necessarily those who borrowed most. No, maybe not. And I don’t think the debts are repayable, so in that sense, austerity is not going to work.

What I don’t accept is that in some way a wrong is being done by the repayment obligation, or that repudiation is without costs, or that there is some sort of conspiracy to defraud, or that this is in some way intrinsic to capitalism and in some kind of undefined socialist or anarchist order, none of this would ever happen. Or that it is all the fault of joining the euro.

The problem is, you can’t borrow and spend without consequences, either as a country or as a company or as an individual. Repayment is a really serious obligation and once incurred, there is no good or painless way out. Default is not painless either.

Greece and Ireland are going to have to default, but they will pay a high price for that. What’s needed is for these countries to run their economies on entirely conventional lines. Keep control of borrowing. Make everyone pay taxes. Why is it the cause of so much surprise and indignation that if you do not do that, you run into real crises?

Borrow and spend like crazy as the Greeks have, and Ireland too, and you will end up in situations where you lose sovereignty

the irish aren’t where they are because they borrowed and spent unwisely.

they are where they are because their financial instutitions LENT foolishly and then needed (and got) a bailout from the sovereign nation.

it was this bailout of the PRIVATE banking cartel that caused Irish insolvency.

Greece does not equal Ireland.

Ireland was more like Iceland, except Iceland gave the big finger to the banks, as should have Ireland.

now, did ireland ALSO over spend and over borrow? probably. but they would not be part of the PIIGS in 2011 were it not for bailing out PRIVATE banking liabilities.

the rest of your argument may have merit, but hard for me given such a basic misunderstanding about the Irish situation.

Yes, that is true, Ireland is indeed more like Iceland. There is the element of recklessly tolerated real estate lending followed by bank rescue, which is what led to the debt, and that is indeed a different aetiology from Greece.

However, end result is the same: can’t pay won’t pay. Their error was unlike the Greeks, they incurred the debt to bail out the banks, unlike the Greeks. However, end result is the same, if a nation gets into debt over its head, for whatever reason, and no matter what class it benefits to do it, it will lose its sovereignty and probably its democracy will take a hit too.

This is not of oppression from outside or victimhood, its from mismanaging its affairs.

The economics and the politics are starting to sound a lot like the U.S.

Political paralysis.

Large debts.

Tax avoidance.

What is happening in Greece could happen here. The difference is that Greece does not have more registered firearms than citizens.

I was at a gun show about 6 weeks ago where I got into a conversation with a group of fellows on the economy, WS and the government. Mind you we live in Northern VA which is heavily dependent of Federal spending and the financial services industry.

Now the the guys I am talking to are not a bunch of red necks. One owns a small insurance firm. Another is an IT Director and cyber security expert. Another is a VP for a national home builder. The last guy is a GS-15 working for the Feds. Not a radical, liberal or uneducated group. These guys are chamber of commerce, 4-H, rotary club types. Two of the group are veterans of Iraq.

One guy says with a very straight face and a serious tone “You know, this crap aint gonna stop until blood flows on Wall Street.” So one of the other guys laughs and comments that “Jamie Dimon needs a double tap, huh?”.

I will not bore you with the conversation on the government except to say that the group has Tea Party types and leans largely republican.

What I suspect you are starting to see is the effect of people losing faith and trust in the system. These guys are convinced that they cannot invest their money because the game is rigged. They are convinced that their kids futures are deminishing every day and that Obama and Wall Street are to blame. Despite the fact that most of them are dependent on Federal spending to earn a living, they distrust and dislike it.

The culture we live in is fragmenting. Our politics is so polarized that nothing of substance can be done. People have forgotten how to compromise without compromising themselves.

I suspect that the financial and governmental elites have no real understanding of the tensions that are building. In part I think they believe this because they are so insulated from the general populace. How often does Bryan Moynihan sit and talk with his auto mechanic about the mechanics life and concerns? How many U.S. senators actually talk with average constituants or are directly accessible by thier constituants? But both move together and reinforce the others world view.

I am starting to suspect that this world view they have of wealth, power and control, is blinding them to what is happening on the ground.

This weekend Simon Kuper of the FT wrote an excellent column referencing this phenomenon entitled, “The Rich Are Always With Us”. Some excerpts below:

The global elite has grown fantastically rich in recent decades: the average person on Forbes’s list pocketed an estimated $45m last year. Consequently, we’re forever reading about rich people. Indeed, being rich has become almost the criterion for being newsworthy. A sportsman or artist who isn’t rich is not counted as successful and therefore not given airtime.

…

The daily focus on the rich has two consequences. First, these people become part of our own imagined peer group, and so we grow dissatisfied with our own income. It was more soothing to read about the local butcher than about the commodity trader Ivan Glasenberg and his £5.8bn.

Second, we forget the poor. They may always be with us, but not in the media. The perhaps 2.5 billion people with less than $2 a day get ignored, due to the triple whammy of being poor, non-white and non-Anglophone.

@LRT

I think you are describing the wrong countrty. The country you describe is the U.S.A. USA taught Greece and the rest of the world that the superrich and the corporations do not have to pay taxes and that they can keep their assets abroad.

When the USA lent and leased money and material to England during WWII, there was the distinct possibility, that England would not repay the loan. There ability to tax was insufficient to the loans coming in, and they may have been overwhelmed by NAZI air force and military. We would be throwing our money down a rat hole never to see it again.

When France, and others, lent the N American British colonies money to pursue a war of Independence, the odds of getting that money back were pretty slim. But, we got the money, and LaFayette as well. The rest is history. But, at the point in time of lending, it was not a simple business transactions, but clearly a political one. Getting a good return in money was not the objective.

When a small country like Greece, with not much of an industrial capacity, is lent hundreds of billions, the underwriting of the loan must have been very poor to miss the tax collection capacity as being very thin. Municipal bonds issue in America look at similar cash raising capacities in what are called ratables, taxable real estate on the books at city hall. If you know that you are probably lending more money than you really should, could there be a secondary political rational to the loan that is operational, by tying Greece more firmly into the standards and practices of the Eurozone, than merely statutory requirement for debt ratios to GNP? Of course, they had to meet certain requirements, but in lieu of non performance, do they deed over portions of sovereignty in exchange for relief? Spain, Britain and France regularly threw money into trouble spots to bleed their rivals, to distract them, to get something, other than just a good business return on their investment. By politically integrating Greece more tightly into the EU than it otherwise would be, due to being a sovereign nation historically, are they really pursuing a course of socialization of the nation state culture into a new nation of Europe, with dependent constituent states?

“When a small country like Greece, with not much of an industrial capacity, is lent hundreds of billions, the underwriting of the loan must have been very poor to miss the tax collection capacity as being very thin.”

The infestment bankers get their deal fees up front and then sell off the loan to pension funds in Duesseldorf, so what do they care?

Besides, noone ever got a bonus for saying “No, this is a bad deal.” Lots of people have gotten bonuses for making deals that looked sour but then turned out to be money good.

But as long as they, as a country, refuse to limit spending to what they can reasonably raise in taxation, and refuse to pay taxes, they are going to have endless economic crises. LRT

Not necessarily. If Greece was monetarily sovereign then some deficit spending would be permissible so long as price inflation in its money did not result.

Why anyone thinks this is oppression by the bankers to just point out this obvious stuff is a mystery. LRT

Because bankers are essentially government backed counterfeiters. To not borrow from them is to be priced out of the market by those who do borrow.

Greece could borrow to reasonable levels whether monetarily sovereign or not. Its not unlike a US state or municipality. What it could not do, whether monetarily sovereign nor not, was borrow more than it had any chance of repaying, partly because it refused to collect taxes. You cannot seriously expect to get away with that for long.

What it could not do, whether monetarily sovereign nor not, was borrow more than it had any chance of repaying, partly because it refused to collect taxes. LRT

A monetarily sovereign country can always pay debts in its own money. Furthermore it has no need to borrow at all and should not either since it just confuses the issue.

You cannot seriously expect to get away with that for long. LRT

The only real constraint a monetarily sovereign country has is price inflation in its money.

IIRC, federal debt to GDP went to 200% in WWII. And we were spending the money on a lot of unproductive stuff, like tanks and bombs and bullets. And teh workforce after the war ended shrank, between women leaving the workforce and many of the returning soldiers took advantage of the GI Bill and went to college.

We got a wee shot of inflation in 1946 or 1947 but that abated pretty quickly.

Japan has terrible demographics, had a bigger bubble than we had relative to the size of its economy, and has “printed’ like mad. Not only does it have low inflation, but it is regarded as a safe haven currency.

So explain them to me.

I guess the issue is whether it is the debtor’s fault that the debtor is in deep or the creditor’s fault that the debtor can’t pay the money back.

I think anyone who blames the problem only on the debtor is a fool or a bankster. I think that Greece needs to restructure its debt so that the debts can be paid back rather than having another bailout.

Let’s put it this way. Didn’t the banksters help Greece disguise its debt from the public? So why shouldn’t they be prepared to pay when the scam which they helped facilitate collapses.

The banksters are not innocent parties to this debacle. As with Enron, they came up with ingenious scams to hide debt and fake compliance with the financial ratios that Greece was supposed to meet.

David: “didn’t the banksters …”

Not all the banksters. It was Goldman Sachs.

David: “As with Enron…”

Unfortunately, this is not like Enron, as in that case the big accounting firm who aided the fraud — Anderson — was put down to extinction.

Whereas Goldman Sachs, who financially innovated debt lies for the Greek government (in return for handsome fees, off course), is still in business (and doing very well, judging from the salary and bonus of its CEO).

PLUS:

in addition to the very wealthy Greeks not paying taxes, and the banksters, I do not come across in these comments the role of the 3 wall street friendly rating agencies.

“S&P’s Kraeemer said whether extending a bond’s maturity voluntarily or not is of lesser importance.

“What’s decisive is how does it compare to what was promised to creditors when they first invested their money,” he said.”

(source: http://uk.reuters.com/article/2011/06/20/uk-eurozone-greece-default-idUKTRE75J5AF20110620).

The banksters have put a lot of fear into EU politicians and are very much helped by all the noises and downgrade threats by the rating agencies. As we all know, these are the same agencies that rated subprime and Lehman as A+.

Not that they misrated by mistake, but they knowingly misrated as they colluded with the bankster.

It smells very similar this time……

Anyone with an operating brain cell also realizes that this is the most extreme example yet of using an alleged crisis as the pretext for literal robbery and looting.

Second, the eurozone ministers insist that the Greek parliament nevertheless pass tough austerity measures as a precondition for any rescue.

No hypothetical believer in a debt crisis could possibly think this “austerity” could make any substantive difference. Obviously it’s direct robbery for the sake of robbery. (Krugman, ever eager to deny the class war, has to psychoanalyze it and chalk it up to a quasi-religious urge to punish. But even he recognizes that it has no reality basis vis the alleged goal of the bailout policy.)

Here’s a pretty good opinion piece from Aljazeera (their “news” coverage of the Greek assault and resistance has been MSM-toned):

http://english.aljazeera.net/indepth/opinion/2011/06/2011617112541750476.html

It describes the upwelling of participatory democracy in the squares of Greece. The people aren’t just recognizing the illegitimacy of the existing government; as everywhere with such spontaneous street councils, they’ve immediately begun exercising democracy in an affirmative way, beyond even the issues of the day, thus once again proving that the truly human nature is truly democratic.

Tell me, who committed the robbery? Those who borrowed what they knew they had no chance of repaying? Or those who lent to them and now want to collect?

Nice frame, but it’s never that simple. Consider the sub-prime mess. Who is the criminal? The original lenders knew that their borrowers couldn’t re-pay. They didn’t care. They either re-sold or re-packaged the loans or they probably kicked the can down the road. In fact, the lenders probably lied to the non-believing borrower. Borrower thinks, “I can’t believe I’m getting this house. Can I really afford it?” Lender says, “Home prices never go down. Come back in 12 months and we’ll pull money out.”

At the end of the day, LRT, it’s two-sided transaction that requires shared sacrifice.

The whole debt economy was forced upon civilization from the top down, and it was done in order to deliver humanity into the hands of these villains. Financialization has been the core of the neoliberal strategy.

As for the particular case of Greece, its elites brought it into the EU on structurally unfavorable terms (the whole point of the EU was to enable German and French banks to manipulate currency and trade within the enclosure; the periphery countries were the marks), and from there an orgy of predatory lending ensued. As in America, the point from the start was to blow up a bubble, crash the economy, and use that as the pretext for bailouts and austerity looting. The borrowed money, meanwhile, was stolen by Greek elites. So it’s also odious debt.

Finally, the banksters are the chattel of we the people. They’ve stolen so much that if we put them all in chains tomorrow, it would take a million years for them to work off their debt to us. It’s they who owe the people of Greece, not the other way around.

Everything I said about Greece here applies to all the other countries as well – Latvia, Ireland, Portugal, Spain, Italy, and on up to the UK and the US. All of them.

But so far only Iceland seems to have had a basic understanding of any of this.

Why should the people repay what the rulers spent? Because LRT wants them to?

I wonder how much of a retard you have to be to confuse the rulers of a country with it’s people.

LRT asks: Who committed the robbbery? In the case accounting control fraud, the lender. Bill Black explains the formula:

And if their banksters are anything like our banksters, accounting control fraud is exactly what’s going on.

Clearly both.

Does the graph “Countries most exposed to Greek debt” give a distorted picture of where the exposure truly lies?

Could it be that the United States is the nation most exposed?

According to this CNN report, Could Greek default equal Lehman’s bust?, in addition to the $7.3 billion in Greek debt US financial institutions hold, they hold an additional $41 billion in credit default swaps that a Greek default would trigger.

In addition, as the CNN report goes on to explain, American financial institutions are heavily invested in German and French banks. A Greek default could make these banks insolvent, triggering an indirect credit event that could have profound repercussions for US financial institutions, as this Fortune article, End of the line: What a Greek default means, explains:

A collapse of the Greek economy would also put Greek private debt in trouble, forcing even more write downs in the European banking sector.

This prompted Moody’s this week to issue credit warnings for three large French banks, BNP Paribas, Societe Generale and Credit Agricole, which hold a combined $65 billion in public and private Greek debt. Write-downs that large would begin to rock the world financial system.

The CNN report also says the ECB is heavily exposed, although it doesn’t give a numerical figure.

And how much time have the holders had to exit their positions?

At this point, any bank exposed to CDS’s on Greek bonds is a TBTF counting on another public freebie.

Horrifyingly, most of the megabanks have doubled down on risky lending and CDSes.

There’s a principal-agent problem involved. The execs get paid if the bank wins, they get paid slightly less if the bank goes bust. Either way it’s no skin off their backs. They have strong incentives to gamble and no incentive not to gamble.

The traditional incentives not to gamble included being barred from the industry, and being imprisoned. With these seeming remote, they are literally repeating the same things which got them into the 2008 crisis.

They don’t realize that they’re tiger-baiting. They are literally risking their actual lives by pulling this shit.

AFAIK the figures are consistent with what the BIS published a few months ago, I assume that most of the public exposure (which is largely German) implies the first “rescue”, which was not accounted for then.

It does not matter much if the ECB is exposed because the ECB is the one creating money here: the worst that can happen with that is that euro goes down a bit and that is not bad but good (improves international competitiveness).

The TRILEMMA rears its head…

National sovereignty, representative democracy, and economic integration/globalization…

Pick one or maybe two, but all three simply will not work.

Expecting a sovereign nation, a people, to knowingly vote for a decrease in their standard of living to belong to the global economy is a bit of a stretch. Such irrational behavior is feasible only in the United States where the choice between AUSTERITY and AUSTERITY-LIGHT is almost a given – the willing penitent syndrome. American Exceptionalism is alive and well in this respect.

But elsewhere perhaps one must ask if further econommic integration/globalization is compatible with national sovereignty and/or representative institutions? Or has it come up against the wall as nations begin to contemplate their future in this brave new world order?

Is Greece merely the tip of the iceberg? Giving up the drachma for the Euro is one thing, but now that the costs of doing so appear to outweigh the benefits, will Greek elites be able to deliver their nation into the hands of the IMF and other supranational organizations intent on buying the country at fire sale prices? Will the lessons learned be lost on the Irish and the Portuguese or the American people?

Mickey Marzick in Akron, Ohio asks: “Will the lessons learned be lost on the Irish and the Portuguese or the American people?”

That seems to be the question of the hour, and a question the enforcers of neoliberalism seem to want to kick down the road as long as is possible.

This Fortune article, End of the line: What a Greek default means, sums it up succinctly:

The biggest fear of a Greek default, though, isn’t the default itself, but the message that it would send to other countries struggling to pay off their debts. Already Ireland has started to renege on some of its bond payouts, triggering CDS claims. That could accelerate if Greece defaults as the populations of those countries facing harsh austerity measures push their leaders to “pull a Greece” and simply stop paying off the debt…

…For now, the official policy of the ECB and the IMF is to keep the Greeks afloat, notwithstanding the moral hazard of doing so. It is possible that they will throw the rulebook out the window and continue to fund the Greek deficit. But that would just delay the Greek default.

Remember all the terrible things that were going to happen to Iceland for repudiating their debt?

They have access to all the capital they want at 5% right now.

They not only have their dignity intact, but they have my respect.

The solution, as usual, is to think and act outside the box: direct democracy, popular sovereignty and economic socialism: a mixture of Switzerland, Iceland and Cuba is the only thing that can work.

I’m with you on trying new things, but I can’t help noticing that two of your three examples are islands, and all are small countries. Last I checked, the United States was an multinational empire of continental scope, and Europe might as well be. Will your approach scale?

All the delay of the inevitable does is allow for more extend and pretend while Western financial firms strip the economy for fun and profit. And this is terribly inefficient looting; their profits from this pilferage will be small relative to the pain inflicted on the Greek populace.

Earth to Yves: The Greek government borrowed the money!

If creditors seek repayment of their loans, how is this looting? Is it not more the case that what the socialists in Greece and the EU “government” are up to, coupled the cynicism of the Left-wing government of Greece in taking these loans all the while full well knowing that they will never be payed back, is “looting”? Is it not really the beneficiaries of the patronage systems of the socialist parties in Greece (ad the EU at large) who are the real crooks? just who is ripping who off here? Are you saying that Greece does not legitimately own its creditors?

“Looting” indeed. You are projecting.

The government and “the people” of Greece–“the people” here being the patrons and the clients of the socialist state—live pretty high on the hog for quote some time, mostly without anything approaching productive labor. Is the “Western financial community” really supposed to finance such sloth and dishonesty?

Really Yves, you need to get over this “evil capitalistic” Marxist cant. It is literally sophomoric.

The mess that is Greece has been caused by decades of unchecked socialism and not by “greedy bankers” or capitalism.

It amazes me that you claim to actually “consult” for a living in the “Western financial community” and yet have such a adolescent grasp of how the real world works.

I agee with Yves.

When you force the sale of national assets at discount prices under the threat of withdrawing support…that is looting.

They may have borrowed the money but someone else was dumb enough to lend it.

Further, there is a big difference between reposessing an auto from some 20 something and stripping a nation of control of its heritage and self determination.

You are making the same argument that is being used in the housing debacle.

It strikes me that those who make this argument always seem to forget that government exists only to provide for the nation. The rules of the economy. The laws on debts are made by governments. In a democracy that can mean passing laws that could go so far as to forgive all debts or nationalize a private company…any number of things. Despite the arguments made, in the end, if the people of a democracy say FU to a debtor then FU it will be. Not that there are not consequences. BUT…consider this. Those that make their living or derive their income from lending NEED to lend. Hence..that is why we have banks offering credit cards to those who just defaulted on mortgages.

In some ways, the best thing Greece could do would be to default. By wiping out their national debt they free up revenue that would have gone to interest. The lenders will put for a few years but they will be back if they see the Greeks get their budgets in order. ALL they will see in few years is an opportunity to lend to a nation that has no debt. The same reason that banks are offering credit to those who default on mortgages.

You can question the morality of this if you like but I do not see that it changes the reality.

Neither a borrower nor a lender be;

For loan oft loses both itself and friend,

And borrowing dulls the edge of husbandry (the management and care of resources.

Of course, Palonius is generally written off for an old fool but I’ve learned lessons.

Thanks for the quote. Continuing, ” … neither a borrower nor a lender be.”

Seems there are 3 possible outcomes:

1. hold course, administering spoonfuls of bailout, heavy boots to the neck, and asset stripping, until the GReeks scream and leave the EMU in favor of the brave old Drachma, and then European vacationers in Greece will double. Sadly there won’t be anything but service jobs left.

2. buzzcut creditors, and tolerate a few crashes and a few bankster bailouts, but Greece stays in the EMU and Merkel, Sarkozy and the KOmmission feel proud.

3. Default, Greece goes into a fast tailspin and some junior officer calls on the nation to finally drive the Turks out of cyprus, many major bankster hits, mucho bailout, the Euro shrinks to 4 northern European members.

this Guardian report shocked me:

http://www.guardian.co.uk/news/datablog/2011/jun/17/greece-debt-crisis-bank-exposed

If I read it correctly then 27% of equity at Commerzbank is threatened by a Greek default.

As the epicenter (good old USA) of the GFC I concur…PAY…your bills deadbeat nation.

Skippy…We only have to create, push buttons, print our way out…Greece you have to sell it all…you gave printing away…suck it up.

PS. willnotbecensored I’ve heard some disturbing things about your credit worthiness, are you ill, about to lose your income…eagerly awaiting your next quarterly statement…knife at the ready…its me or you…I pick me.

Earth to willnotbecensored:

Debt is a two way street – there’s responsibility both on lender and borrower. Irresponsible lending is as much of a problem as irresponsible borrowing.

Given the asymetry of the relationship (borrower cannot force lender to lend – but borrower who cannot pay back has little to no incentive not to borrow if offered – more so under the pure-rational-expectation, no-morals-at-all, theory), I’d actually say we need responsible lenders more than responsible borrowers.

There’s an agency problem.

For well nigh on 30 years bank management, and to a lesser degree the banks themselves, through the flexing of political power have successfully gained indemnification for the losses resulting from their deleterious lending practices. At the end of the day, what it boils down to is that they loan out other people’s money. Access to other people’s money can be achieved either explicitly or implicitly, but for this risk-free activity the banks collect enormous fees and commissions, and the management is paid huge salaries and bonuses. As long as this political arrangement remains intact, the soundness of the loans, as far as bank management is concerned, is of no consideration whatsoever.

In ancient times we had a saying…”The easiest job in the world is giving away money”.

Of course when we said it, we were talking about selling products below cost. But banks have developed this into an art form, and now giving away money is the highest paying job.

It amazes me that anyone would apologize for the rapacious logic implicit in lending to begin with. Due diligence and risk assessment are part and parcel of lending. If one lends without ever considering where the money to repay the loan will come from who’s the dummy? At some point, western financial institutions should have pulled the plug decades ago or never even opened the credit spigot, but that would have impeded the larger goal of economic integration/globalization. And who would dare to ask CUI BONO in such a new world order? French and Germans lending money to Greeks to purchase goods made in the former is little more than “tying” and a subsidy to domestic industry/employment, etc. All boats would be lifted in the long term… but with French/German yachts serviced by Greek triremes in the Aegean in perpetuity.

The larger logic involved is that of debt penury and debt peonage worked out by the IMF in the developing world over the past half century. Lend until the fiscal crisis of the state becomes self evident then prescribe a neoliberal solution of wholesale privatization and austerity on the nation – its citizenry – in return for much needed funds. Of course some citizens suffer more than others. Why when the entire nation is presuambly at fault?

Now the process is working its way back to the CENTER, starting with the nation-states on the periphery of Western Europe. Once the PIIGS are sacrificed on the altar of economic integration and financialization, it will be the fattest cow of them all’s turn – the US. What else could the rule of law and sanctity of contract mean in such circumstances? Reneging on either is the prerogative of the lender only not the borrower. Investment/lending without risk – the borrower not having the ability to default – is nothing but looting. In such a setting, the securitization of risk is little more than financial-speak for the socialization of risk underwritten by taxpayers with the profits from such securitization remaining private. If this isn’t LOOTING by the TBTF WTF is?

Yes, that is it: all is nothing but a game of circulating money or not doing it in order to heat or cool the economy.

As long as there is profit (plusvalue), there is looting. And that is specially aggravating when there is no production involved anymore, as is the case with usury – oops, banking.

But they BORROWED the money!!! Predatory borrowers!!!!

Who gets the long jail sentence? The pusher with a trunkload of dope, or the user with a dime bag?

Read Michael Hudson’s “Super Imperialism”.

Oh wow, and the man himself is posting right underneath me!!

*embarrassed fanboy blush*

You lend me 100 bucks, I cannot pay them back, what do you do: demand my home, the blood of my children, forced labor, my liver?

Maybe but that’s from the Merchant of Venice and it’s not considered acceptable behavior in most cultures. Usury is bad, pushing people (or whole nations) beyond their limits via usury is despicable and deserves immediate death penalty.

Is it an Ayn Rand thing, the way the pro-bankster lackeys keep coming on here with these pseudo-defiant names?

I picture them feeling like they just stormed Omaha Beach if they swat a spider in the bathroom.

The Greeks are going to be looted not twice, but three times.

As you correctly point out, their elites looted them the first time around. They borrowed all this money from the rest of Europe, stole it and moved it offshore.

Now the bankers will come in and privatize national assets at cut-rate prices. The Greek taxpayers (is this an oxymoron?) will pay to rent back their own national assets. Yves is right about this, although she forgets to mention the first looting because it doesn’t fit with her political views.

It’s amazing to see all the self-proclaimed democrats on this site applauding the screwing of German taxpayers.

The bankers should pay and the Greek elites should pay. I don’t see anyone on this site talking about hunting down the bank deposits of Greek elites in Switzerland, Cyprus or wherever else they’re hiding the money. When the Greeks inevitably default, the Greek elites will bring their hard currency back, buy back all the Greek assets at 50% and laugh all the way back to their offshore banks.

I hope Yves will follow this third looting as aggressively as she follows the misdeeds of bankers. Surely she knows it takes two to tango.

Earth to “willnotbecensored” (why the most reactionaries choose the most “rebel” nicknames?): private property is at the service of the People not the other way around. If a bank defaults is a problem but it’s essentially a private problem, if a state defaults it is not just a much bigger problem but it is a common shared problem of all the People.

You cannot sacrifice the People for private interests, well, you can I guess but it’s evil, immoral and the People will fight back and your stupid system of exploitation will collapse in no time.

And, btw, Greece is no socialist state, thanks to NATO imperialism and thanks to the Stalinist betrayal, Greece is one of the wildest Capitalist states in Europe.

Well, Yves wrote a good book, so don’t be too harsh. More than half of it was brilliant.

I think its more complicated than either side of this debate thinks. Yes, they did borrow it. Yes, it is not looting to want repayment, its entirely reasonable. On the other side, there was wild and reckless lending.

On the whole a serious haircut for both borrowers and lenders seems in order, and following that, no-one should lend to Greece again unless they get their house in order and start collecting their taxes. I mean, really. If you refuse to collect taxes you will go bust. This is not a state of extraordinary virtue, its just really, really stupid.

I don’t think any American in Bush Obama tax cut land gets to point fingers at Greece or the PIIGs because we helped create the situation.

What has truly changed is that the wealthy elites no longer have any nationalist loyalties-they are robbing the United States right now and have been since the 1970s. Who set up Greece? Goldman Sachs. Who set up a heads I win, tails you lose pyramid scheme that destroyed AIG? Goldman Sachs.

Where LTR falls short is the naive assumption that there is no conspiracy to rob honest people. There is.

I think much of the financial discussion here misses the point that the Greeks are making.

What they resent about the banks is not so much that they are NOW demanding austerity, but that their PAST loans have subsidized tax cuts for the wealthy, for real estate owners and big shippers, for doctors and others.

From the perspective of the Greeks that I talk to, the problem is not that bankers have “lent Greece money and now want to be paid back.” It is that they have subsidized a domestic class war in Greece, on the side of the kleptocrats and wealthy, with a regressive tax system. That’s what has forced the country into debt.

It would elevate the discussion within Greece itself to let them know that banks could monetize debt, as in the United States. But if that were done there the way it is done here in the US, it would only further enable Greece to pursue a bad tax policy.

The moral is that fiscal and financial reform must go together. THIS is the dimension that is missing from the European discussion.

The moral?

But aren’t you one of the seminal figures of MMT?

And in the name of MMT, wasn’t the neoclassical economists’ war on morality taken up just a couple of days ago in this post, Philip Pilkington: Economics as Metaphysics and Morals?

Will the real MMT please stand up?

And if it is even possible to purge morality from economics (I for one don’t believe it is), is this something we want to do?

Based on what I’ve read of him, Hudson himself isn’t an assertive MMTer even though he’s on that same faculty.

And his writing is loaded with moral implications. This comment doesn’t recommend monetizing the debt (although it would like the Greeks to know that this could be done and would be preferable in every way to “austerity”); it endorses the Greeks’ correct view of this as class war, which can’t be other than a moral concept.

(Hudson’s usual prescription is to shift taxation from labor to rents, and that’s what he recommends here, unless I’m mistaken.)

I picked up that little tidbit of info about Michael Hudson from a comment on your blog by Willima Wilson, who was quite a fan of MMT seemed to know quite a lot about it:

Dr L Randall Wray is currently affiliated with the U of MO at Kansas City [his prior affiliation was with the Levy Institute at Bard College in NY]. He also heads the CFEPS (Center for Full Employment and Price Stability):

http://www.cfeps.org/

He publishs at several blog spots including New Economic Perspectives [where Michael Hudson, also an emeritus prof of economics at U of MO at Kansas City, Wm K Black, Scott Fullwiler, Stephanie Kelton, Marshall Auerback and other promoters of modern money economics articles also publish].

http://attempter.wordpress.com/2010/11/20/guns-bonuses-and-butter-money-deficits-and-mmt-1-of-2/

Hudson seems capable of typing many more words without exhibiting the carpel turrets affliction of babbling in MMT mid paragraph that the typical MMTer suffers from.

Bill Black should not be associated with MMT. He has bank regulatory experience and has a grasp of what is important, and it able to explain it in accepted english, financial and economic terms. This has an advantage because we don’t need to learn a different language to figure out if he makes sense and knows what he speaks of.

One of the many annoying things MMTers like to harp on is that taxes control inflation because the government withdraws (destroys) money thru taxation, this takes money out of circulation and moderates inflation. We long ago decided the Fed can’t do quantity of money theory, but I guess now the Treasury can. Then there are some practical problems with this because it works fine as you are lowering taxes all the way down to the zero bound, but think what happens to the household budget know hooked on lots of fixed expenses like long term debt, and the USG decided it’s time to fight inflation and hand everyone a big tax bill to pay. Deflation! Then the happy ending for the government debt is that we are a Sovereign Nation and we can just print money (after repealing the Federal Reserve Act). Shocking news there. Sure spooked the gold market.

If that is the real M. Hudson posting above, and he thinks that leads to a regressive tax system, and the rich have figured out how to win the game, I’ll take that as a complete retraction of MMT.

“We long ago decided the Fed can’t do quantity of money theory, but I guess now the Treasury can.”

Quantity is only part of it. The fed can and does set the COST of money.

Greek-bashing, worker bashing.

There is an epidemic of anti-social thinking, a self-induced and self-congratulatory anti-otherism that prevents presumably decent people from having any empathy for their fellow humans (let alone other animals).

Why do people want to punish those who are worse off than themselves?

This is sickness masqueradng as economic thinking.

For once, think of the lives of others! You are not going to any heavenly paradise. Stop trying to bring (more) hell on earh for others.

Wake me up in a million years.

It’s a sovereignty issue. When you’ve got ratings agencies and banksters dictating fiscal policy, in Europe as here, you’ve got to ask yourself who the sovereign really is, and where the government (as opposed to the trappings of government) is really located. That’s why the development of new forms of citizenship in the squares of Europe and the Arab world is an interesting and yet mostly overlooked story.

Oh, and the “architects” of the EU, if one can call those passive aggressive plotters such, “designed” the system for just such a contretemps. They full well knew that forcing “Monetary Union” on the “nations” of the EU without political unification would result in this just this sort of mess. It was their expectation when these crises came they would erode national sovereignty, and that sooner or later “national sovereignty” would be destroyed. Could they have directly coerced political consolidation into a European-wide superstate way back when, they would have. They had nothing but contempt for the sovereign nations of Europe or their peoples. They sought complete and total power and nothing else, and sought it ruthlessly. This plot goes far beyond the current “European Union”: this is rooted in people such as Delors, the Council of Rome and the old EC.

There were warning voices all along the way; the mist notable being Thatcher. None of this is new at all and no one should be surprised in the least. For those who point out at this late date that “it is about national sovereignty”, all I can say is that you have missed that boat–you have not been paying attention these last 50 years.

When the people of Europe joined the EU they de facto surrendered their “national sovereignty”. They cannot have both. That is just the point. Greece is at the moment neither a country or a province. To posit that the forces of the EU represent “democracy” and that they are somehow pitted against s cabal of “International capitalists” is just pure baloney.

And yet the problem here has little to do with national sovereignty per se… and Thatcher was an idiot, as is her successor Cameron.

The problem has to do with a lack of democracy. If the European Parliament was trying to solve the crisis, what do you bet that they would say “Issue Eurobonds, transfer money to Greece, print euros, big stimulus package, everyone wins”. Well, they might, anyway. That would be a case of no-national-sovereignty, but who cares? Good government by a democratically elected parliament.

But the undemocratic, elitist, banker-controlled European Central Bank isn’t going to do any of that.

While the US has had no compunctions about unleashing a bloodbath on Mexico or other countries in the Southern Hemisphere (read brown and black people), the question now becomes whether it will do the same to European countries like Greece, Portugal, Ireland and Spain, where the people are not quite as “other”.

DownSouth: You are wholly delusional You imbibing of the swill of Marxist agi-prop has detached you from reality, and rotted out your capacity for critical thought or even an honest recall of history.

]) The USA has “unleashed” no such “bloodbath” on Latin America. This is a fiction in your mind. The vast majority of Latin American problems today are do to various Left-wing “experiments” such as those of Peron, Castro, the Nicaragua socialists, Allende or Chavez. It is these who have cause much damage and spilled much blood. Any advances have been due to what ever timid measure approached Liberalism and Neoliberalism. This s most surely a matter of fact.

2) Liberalism has been one of the most dramatic successes in history. To claim otherwise is to literally not know history at all. A great deal of the wealth, the high well being of its peoples and the great cultural achievements of the the last 300 of the West have depended upon it. On the other hand, socialism has been an abject failure Every place it was tried. The 20th century was one great bloodbath due to the rejection of it. Nor is it “rejected” by “real people”, they clamor for it and seek it. How do you imagine that it was so predominant in our history. Is is the fruit of a long struggle against tyranny, aristocracy and autarky.

3) This “war against the South”, is a wholly irrational concept and straight out of CONINTERN agiprop out of the 1920’s and 1930’s. It also is an evasion of responsibility. Consider: a) Just what would have happened to “The South” if Europe had left it alone. You speak as though “Liberalism” interrupted some sort of aboriginal Space Program or something. b) Please stop conflating the depredations of the Acien Regime and later mercantilism during that regime’s decadent period with “Liberalism”. It is just intellectually dishonest of you.

Your claims are the exact opposite of reality, as is typical of Marxists.

On either side of the ideological divide between liberalism and Marxism we find dogmatists with tar brush and gold leaf in hand, ready to manufacture misleading stereotypes.

And while liberalism was indeed a revolutionary ideology for the merchant, manufacturing and financial classes, its benefits extending even down to some of the petty bourgeoisie, it never held out any promise for the poor, the working-class, or a majority of the petty bourgeoisie. The masses had to wait for Marxism, along with its socioeconomic paradigm socialism, to come along, which were perhaps the first things since the early Christian Gospels to advocate for poor and working people.

I’ll take Martin Luther King’s assessment of Marxism, that he expressed in My Pilgrimage to Nonviolence, hands down, anytime, over your distorted Manichean stereotype:

In short, I read Marx as I read all of the influential historical thinkers-from a dialectical point of view, combining a partial “yes” and a partial “no.” In so far as Marx posited a metaphysical materialism, an ethical relativism, and a strangulating totalitarianism, I responded with an unambiguous “no”; but in so far as he pointed to weaknesses of traditional capitalism, contributed to the growth of a definite self-consciousness in the masses, and challenged the social conscience of the Christian churches, I responded with a definite “yes.”

“This s most surely a matter of fact.”

I hope this was some kind of poorly constructed sarcasm.

If not, this word you use, “fact,” you seem not to understand its meaning.

[Of course, there also seems to be a complete lack of understanding on your part of many other labels and ideas, but not understanding the meaning of the word “fact” seems the most basic and egregious of your errors.]

If it was intended to be sarcasm, you should work on your writing skills and tip off the reader a little better.

Read “Shock Docrtine” and then we might have an intelligent conversation. I’ve examined the record re Chile and Russia, and you could not be more wrong re the success of “neoliberalism” or neoclassical economics, which is what we are discussing here.

And calling people who disagree with you “Marxists” simply shows you know you are losing the argument and are forced to resort to ad hominem attacks to pretend otherwise. You call yourself “willnotbecensored” yet you try to resort to censorship (which is what the “Marxist” tag is intended to do, to shut the other person up) when the going gets rough. It shows your commitment to honesty is paper thin.

“Read Shock Doctrine and then we might have an intelligent conversation”.

Hilarious.

Yeah…

And read James Patterson, and then we might talk about intelligent literature.

And…and…listen to the Black Eyed Peas, and then we might talk about intelligent music.

And…and…and…go see Transformers VI, and then we might talk about intelligent cinema.

And finally…gaze at anything by Thomas Kinkade and then we might talk about intelligent art.

“Read Shock Doctrine and then we might have an intelligent conversation.”

Seriously, that is some funny sh*t right there.

Well, at least we have comedy covered: Read Yves talking about an intelligent conversation over the work of Naomi Klein.

Steady Dan, god is testing you, making you stronger, ready for his plan, watch for the sign, America will rise again!

Skippy…on the other hand, you could just end up as a serf to a cabal of billionaires…what ever gets you by…eh.

You clearly haven’t read her book And accordingly, your comment is pure ad hominem.

I was persuaded by the extensive bashing of her to assume her book is lightweight. It isn’t. It’s very well documented.

So I repeat my challenge and include you in it.

You have clearly never learned anything about the history of South America. Start with the Contras, work back from there to Chiquita Banana and the origin of the term “banana republic”.

South America was repeatedly interfered with in an essentially ancien-regime, antidemocratic, imperialist manner by the US — which often made a special point of overthrowing democracies — and *anyone* who has studied the *slightest* bit of South American history knows it.

This is not a liberal vs. Marxist thing, both liberals and Marxists know about this and agree that it was bad. Right-wingers know about it too, in fact, but the right wingers *approve* of violent authoritarian intervention to overthrow democracies. Only the *ignorant*, especially those fooled by right-wing propaganda, do not know about it.

About the myth of the lazy Greek, please read in today’s Guardian

http://www.guardian.co.uk/commentisfree/2011/jun/20/greek-mythology-boris-johnson-debt-crisis

and “EU” link in above. Quoting from link:

“Long working hours can affect health and time for family relationships. Britons work some of the longest hours in Europe. Full-time employees in the UK work an average of 43.0 hours a week, and are TOPPED only by the Austrians and GREEKS, who work 44.0 and 43.7 hours respectively”

(capitals mine).

That’s absolutely true. German and Anglosaxon media have totally fell for the topic of Mediterranean “siesta” culture. In practical terms Greeks work about the most for the less (their salary levels and “welfare” are ridiculously low) and pay the most for most products (partly because they are relatively apart from the rest of EU). IF they have any competitiveness issues these are:

– Tax evasion by the very rich

– Not the top tier education/research maybe?

– That they are trapped in an overvalued currency (blame Germany and their chore of pseudo-economists)

– Lack of welfare, which amounts to salary subsidies in practical terms

Selling the country off won’t solve any of these problems at all, so it’s not any solution, just plain looting.

A solution (within the capitalist paradigm) would be: devalue the euro gradually, declare war to tax heavens and recapture the stolen money by force if need be (tremble Cayman Islands, Andorra and Jersey!), expand the welfare state so Greek workers get similar subsidies as German or Swedish ones (so they can work for less), specially offer hyper-cheap public housing massively. All that implies public spending and intervention but, mind you, it is still pure capitalism.

Socialism would be plan B: nationalizing all that matters and split jobs and wealth equally so everyone gets what he/she needs and gives what he/she can.

Greetings:

From the very beginning of this “entire” (2007) crisis, my primary thought has been….

“…… Doesn’t anyone own a calculator….?”

My secondary thought has been….

“….. Who put the ExLax in the Koolaid…?”

Best regards,

Econolicious

It’s very disturbing to see large numbers of supposedly intelligent people on the side of the banksters!

The banks made loans that they knew or should have known in the exercise of reasonable prudence could never be repaid in order to finance massive tax cuts to already wealthy elites.

Those investors bear the sole risk of default. That is why they charge INTEREST on their loans after all!

Now, instead of allowing the investors to suffer the losses from their stupid loans they are trying to force the Greeks to suffer — as Yves points out NOT so that the loans can be repaid — everybody KNOWS they will never be repaid even if the Greeks sell every public building in the entire country.

Rather, they are forcing this suffering on the Greek people simply in order to PUNISH them out of a vindictive sense of entitlement. The majority of the Greek people never got anything out of those loans.

Just as in the U.S. where over $700 billion went in tax cuts to the top 1% richest Americans, the American people are now being asked to suffer. NOT so that the banks can be repaid, but simply out of the twisted desire to PUNISH the INNOCENT.

Because they can get away with it. It’s IDEOLOGICAL CLASS WARFARE against the Greek people — and it’s aimed at their own people as well.

You see the same fascist comments here in the U.S. where a bankster like Alan Greenspan — who more than any single person bears the ultimate responsibility for the current debt crisis in the U.S. — says that the “solution” is for banksters to be put in charge of governmental functions.

I.E. the citizens will be TAXED to pay the banksters but will have ZERO REPRESENTATION — exactly what the REAL tea-party Patriots of 1775 fought against.

Or as Mussolini put it: FASCISM!

“Fascism should more properly be called corporatism because it is the merger of state and corporate power.” – Benito Mussolini.

They say that the higher interest rates represent a risk premium for lending to Greece. But why should we trust them? Why not let them acknowledge that the loans were risk free and the premium was because they could get away with it?

Cugel wrote: ‘NOT so that the banks can be repaid, but simply out of the twisted desire to PUNISH the INNOCENT … It’s IDEOLOGICAL CLASS WARFARE against the Greek people — and it’s aimed at their own people as well.’

Nah. You’re naive, which a Vance fan should not be.

It’s about the looting first, the looting last, and the looting always. The ‘ideological class warfare punishing the innocent’ component is just lagniappe.

It’s always about practical matters.

Of course, there is a pragmatic element of deterrence in how Greece is being treated

It’s a large practical concern for the financial overclass that the Greeks do not set the example of defaulting on their debts.

Everybody know that Greece is bankrupt and will default, the only doubts are in the how: will it be orderly or will it be radical and chaotic, will it include flogging, branding and other barbaric tortures or will it be friendly and in good terms?

Lending more money to an already bankrupt state won’t solve the central problem: it’s like giving more heroin to a junky. And that is exactly how “Greece’s friends” in Brussels are behaving, and they are asking for the family’s silver in exchange for their drugs.

Instead the Greek People in Syntagma are the conscience of the Greek Nation. Someone said that revolutions are nothing but the emergency brakes of societies in suicidal course.

I also read today that it is said that Marie Antoinette wrote in her diary a 14th of July of 1789: “nothing important today but for some riot at a bakery near the Bastille”.

willnotbecensored; you fail to see anything outside of your Western bias.

This global monetary system is only, what – 30 years old? The US Dollar Standard and system of floating exchange rates, laxed capital controls, etc etc has demonstrated finance’s control (tax) on capital and moreover, an overall increase in the tendency of financial crises. The West traded controlled growth, pegged to gold, for fictitious/unlimited growth at the expense of state guidance and control.

(yes i understand the positives that finance has brought to the world, but these are associated with crossborder financial transactions – a common sense feature of a globalized world)

What I wonder every day is, when will Western government stop pissing in the wind, when it comes to they’re economic policy?

Why, when in the last 100 years all economic policy has been experimental, does the neoliberal/US Dollar Monetary Standard have to be upkept, when growth isn’t unlimited as has been evident for the past 10-20 years?

This sort of monetary system cant last, and will maybe do so for another 40-50 years; once the price of oil surpasses the stagnant production that we’ve had for the last 10 years (a fact)…then what, some sort of axe’ing of liberalism? i think so, how will the human race maintain without such an affordable source of energy? THIS IS WHERE A DICTATORSHIP OF THE PROLETARIAT WOULD APPLY, when everyone figures out that WE DO NEED a collective way of living!

“…the real risk is not from the not well focused protests, but the simmering resentment among broad swathes of the public.”

Spot on. And that’s the real sign of a crumbling power structure. Not 1917 — but malaise. Think Jimmy Carter — not Lenin.

These sentiments are, across the world, becoming more and more mainstream. The malaise is building. And it’s unsustainable. Greece is a symptom — it’s not the disease.

http://wlcentral.org/node/1907

“What is going on in Athens at the moment is resistance against an invasion — and this invasion is being justified with the extensive use of mythology.”

By Alex Andreou

Maybe one of you Euro experts can answer a question I have been wondering about.

Given that several of the lead actors, like Papandreou and Zapatero, are nominal Socialists, how is it that European Socialists have not been able to offer some kind of coherent, anti-capitalist response to this crisis of capitalism?

Papandreou is the current Chair of the Socialist International, for crissake!

I think I know the answer — that mainstream European socialists have become craven, venal, lickspittles of international finance capital just like the Democrats in the U.S. — but I’d like to hear from the experts.

You put the finger right into the wound. When Greeks a little more than a year ago, massively voted to Papandreu and the PASOK, they were clearly rejecting the cleptocracy of the Right (which in turn was appointed earlier to counter the cronyism of the PASOK… sweet democratic farce!), and hoping that the “socialists” would do things a lot better and restore the dignity and the stability of the nation.

As soon as Papandreu took the command rod, the black hole was uncovered and he was thrown to the arms of the now highly right-wing EU commissariat and the IMF. The People voted socialist with a social-democratic program, they wanted a genuine socialist party to rule them… but they were betrayed the day after.

It’s interesting anyhow that all the states pushed to their knees by Brussels have (had in the case of Portugal) “socialist” governments (the only exception being Ireland where two conservative parties played as main opposition to each other). Britain, Italy, Belgium and Denmark, most of which have conservative governments have been spared so far or at least put under much weaker media pressure. This is probably not any coincidence but a deliberate political choice, because a lot in this crisis is manipulation by the media and the rating agencies, which of course have owners with full names (even if we do not know who they are).

There is a clear tendency to prop the Right in this macabre dance of orchestrated looting. Why was not the black hole of Greek debt exposed years before, when the Right ruled, for example? Why is Italy being spared? Are they holding the fatal shot for when the Left takes over as it will happen unavoidably now that Berlusconi could not fall lower?