In case you doubted that America needs more progressive taxation, the case in its favor has just been made in a study, “Executive Excess 2011: The Massive CEO Rewards for Tax Dodging,” by the Institute of Policy Studies (hat tip readers aet and Vlad via the International Business Times). The report found that the CEOs of 25 major companies paid themselves more than their companies paid in Federal income taxes. Exhibit 1 on page 31 names and shames them (well, assuming they are capable of shame), and they include John J. Donahoe of eBay, Robert Coury of Mylan Labs, Jeff Immelt of GE, and Robert Kelly of Bank of New York. The New York Times article on the report elicited some not-convincing rebuttals.

Note that this was 1/4 of the 100 companies with the highest reported CEO pay. Perhaps it’s time to restrict the total pay over a threshold level to all C-level execs to a percentage of Federal income tax payments?

The summary also notes the increasing disparity between average worker and top executive pay, with the multiple of 263 in 2009 rising to 325 in 2010.

The report debunks the idea that the pay reflected superior performance in any arena other than tax avoidance (note that other studies have found that CEO pay is negatively correlated with performance):

What are America’s CEOs doing to deserve their latest bountiful rewards? We have no evidence that CEOs are fashioning, with their executive leadership, more effective and efficient enterprises. On the other hand, ample evidence suggests that CEOs and their corporations are expending considerably more energy on avoiding taxes than perhaps ever before — at a time when the federal government desperately needs more revenue to maintain basic services for the American people. This disinvestment also undermines the infrastructure and services that small and large businesses also depend upon.

Investigative journalists and tax research organizations have been documenting how U.S.-based global companies are aggressively shearing — and even totally eliminating — their federal income tax obligations. This past March, for instance, The New York Times traced the steps General Electric has taken to avoid U.S. corporate taxes for the last five years. Citizens for Tax Justice, as part of a forthcoming study on tax avoidance among the Fortune 500, has identified 12 corporations that have paid an effective rate of negative 1.5 percent on $171 billion in profits.

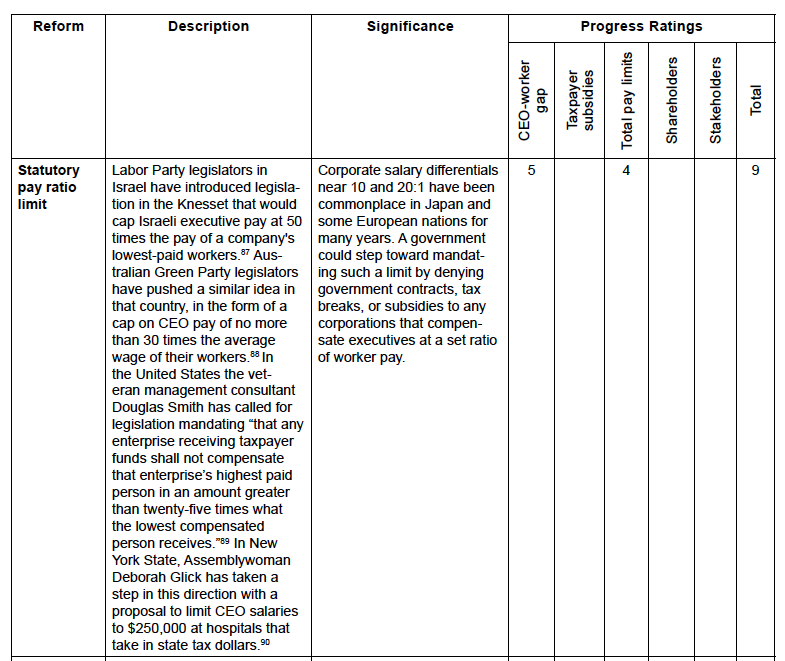

The study includes a table showing how much the 25 companies targeted spend on political contributions and lobbying. It also cites an idea presented here at Naked Capitalism by Doug Smith, that of a maximum wage:

From Doug’s post:

So, be it proposed:

“That any enterprise receiving taxpayer funds shall not compensate that enterprise’s highest paid person in an amount greater than twenty-five times what the lowest compensated person receives.”

First, note that this proposal would not apply to enterprises that do not receive any taxpayer funds.

For those, however, receiving bailouts, deposit insurance, government guarantees, tax breaks, tax credits, other forms of public financing, government contracts of any sort – and so on – the top paid person cannot receive more than twenty-five times the bottom paid person. This ratio, by the way, is what business visionary Peter Drucker recommended as most effective for organization performance as well as society. It also echoes Jim Collins who, in his book Good To Great, found that the most effective top leaders are paid more modestly than unsuccessful ones. And, critically, it is a ratio that is in line with various European and other nations that have dramatically lower income inequality than the United States.

Note, second, that this identifies the top paid person – not the CEO. Even though outrageous CEO pay and its ill effects on severe income inequality is much in the news, CEOs are not always the highest paid person.

Third, the proposal uses a ratio – 25-to-1 – instead of an absolute dollar figure. If a taxpayer funded enterprise wishes to pay the top person, say, $50 million, they can do so: just as long as the lowest paid person receives $2 million. In other words, instead of today’s limitless top wage being supported by taxpayer money – that is, socialism for the rich and only the rich — this proposal is equitable toward all.

Fourth, the choice of compensation is made by the enterprise – not by government officials.

Fifth, this approach to the maximum wage dramatically benefits the economy through some blend of more job-creating investment by the enterprise (through deploying higher retained earnings), and/or more consumer spending, savings and investment because of increased take home pay (and/or shareholder dividends) for the many instead of the few. It would, for example, immediately provide stimulus to restart our heavily consumer-driven economy.

Sixth, this proposal is competitively neutral: all enterprises using taxpayer funds must abide by the same 25-to-1 ratio of top-to-bottom compensation. In most industries, competitors respond to opportunities similarly; that is, if there are government opportunities, all try to take them and, if there are no such arrangements, none do. Nothing changes except the uses to which taxpayer funds get deployed as compensation. The new maximum wage rule levels the playing field for all competitors.

Nor, seventh, would this proposal have any adverse effect on the market for talent. Again, all enterprises are subject to the same rules. Moreover, there’s never been any – zero, zilch, nada – evidence that top pay correlates with sustained enterprise performance. Indeed, quite the reverse. Which, again, is why Drucker, Collins and others all note that talent and performance are not correlated to income inequality-levels of executive pay. The more likely result is the opposite: the maximum wage ratio will put enterprises using taxpayer funds on a better, sounder path to performance than those who don’t use taxpayer funds!! Meaning, of course, that such enterprises will attract the talent they need – not the talent they do not need.

Eighth, this proposal can and should be enacted by all federal, state and local jurisdictions that provide taxpayer funds to enterprise. And, of course, with the appropriate inclusive definitions of ‘compensation’ (salary, wages, bonuses etc) and “person’ to avoid cheating and evasion.

Ninth, enforcement will be inexpensive. Enterprises would be required to submit just two numbers to the appropriate tax authority: the highest and lowest compensation figures. If the ratio is in excess of 25-to-1, the offending enterprise will be given a simple choice: claw back the top earner’s compensation to the appropriate level; or, within, say, 30 to 45 days, pay all of the lowest earners the required amount; or, a combination of the same steps needed to bring the enterprise in line with the maximum wage rule. (If deemed necessary, generous rewards to anonymous whistleblowers could support monitoring and compliance efforts).

Tenth, and finally, remember that we’re talking about OUR MONEY. It’s not the ‘government’s money”. It’s OUR MONEY. And we insist that enterprises wishing to be funded and/or compensated and/or insured and/or tax advantaged with OUR MONEY abide by the maximum wage in order to reduce destructive, economy killing and unhealthy income inequality. When publicly funded companies operate within the 25-to1 maximum wage band, we all benefit.

It is the free choice of free enterprise whether or not to use OUR MONEY. If you are part of an enterprise and wish to pay anyone, including yourself, more than today’s all-too typical extreme, greater than 300 times the lowest wage earner, go ahead.

But do not use OUR MONEY.

Hopefully this study will provide more impetus to efforts to reform the corporate tax code and executive compensation. As we’ve discussed at length in earlier posts, the modern public company is an excellent vehicle for looting. Public shareholders are too weak and too transitory to have the means and motivation to curb the rent extraction by the executive group and the board.

Felix has devised a reason to say that study uninteresting and/or a non-event.

This looks to be a bit of straw manning.

Felix makes out the “CEOs were paid a lot to reduce taxes” as a central claim of the study. I don’t read it that way. It is an argument they make, but it is more upset about the fact that the CEOs are getting more in pay than the companies paid on a current basis in taxes. It then seeks to look at whether pay relates to performance (as we’ve indicated, that’s been repeatedly debunked). It does overegg the pudding in trying to relate CEO pay directly to tax avoidance.

Felis Salmon claims that “CEOs were paid a lot to reduce taxes” is the central claim of its TITLE, which it _is_, and he points out the paper doesn’t really say much about that. About the paper itself, he says that its “central conceit” is that 25 CEOs get paid more their companies paid in taxes. I am struggling to see why you are disagreeing; this seems to be your point too.

The report seems to have intellectually dishonest style. Felix’s example of the “CEO’s with higher pay than their peers have higher pay than their peers” seems pretty clear cut? Do the authors not see how silly this is, or do they not care because it advances their message.

Here’s another example. Note that if a company is unprofitable, it will generally pay no tax. Yet every employee will earn more than taxes paid! Why is this unfair? Do you really think that a CEO should be paid zero until her company is profitable? If no, what if that CEO is brought in to turn around a losing situation? What about young start-up companies? Still no? That’s crazy IMO, and maybe even illegal (minimum wage?).

So this raises the question: did the authors filter out truly unprofitable companies, and focus only on the 25 who got there by tax games? Well, … to their credit they address this head on:

“A large majority of the 25 companies on our list reported high profits in 2010. The low IRS bills these companies faced reflected tax avoidance pure and simple.”

Ok! Thanks for addressing that. So most, in fact large majority, paid no taxes purely because of tax avoidance. That’s ok then… so instead of 25 companies, we should be concerned about – I don’t know? 18, 20, 24, whatever a “large majority” is (presumably that’s in the detailed report, not their summary). But why is the headline

figure “25” rather than something a bit less. Let’s read

the _very next line_ in their summary after the above:

“Our 25 hyperactive tax-dodging corporations employed a variety of avoidance techniques”

Non sequitor! “Large majority of 25” slides into “25”? Are we not supposed to notice? Or not supposed to care because the message is so attractive?

bxg,

The report has a hyperventilating writing style, I will grant that, but your charges are similarly overstated. And you in fact AGREE with the point I made, that the report does not argue that the high CEO pay is a direct result of tax avoidance.

You can accuse them of bad taste, and the style of the report too often is overblown. But you are using a classic cognitive bias in your argument. Google “halo effect”. The argument I made in the post keys off their information, not their sometimes overly florid text.

First, this study started by focusing on the 100 highest paid CEOs.

I am of the old fashioned school that CEOs of money losing companies should get no or minimal pay. Lee Iacocca took $1 of pay when Chrysler was in trouble. More recently, Vikram Pandit took $1 in salary and no bonus in 2009.

The leader should take a hit along with troops, ideally more than the troops. If there are large scale firings, the CEO should take minimal pay. I’ve worked with large private companies and this is standard practice. The fact that CEO have persuaded some boards to continue to dole out lavish pay while a company is having serious earnings trouble is a con, pure and simple.

So any CEO in that hundred in a money-losing company deserves to be named and shamed separately.

And no,we don’t need to pay egregious amounts to CEOs. The book Good to Great found that the companies with the best performance had CEOs that were very modestly paid. And they wanted it that way. They gave credit to their successes to their teams and took responsibility for mistakes.

So you don’t have any evidence for your insinuation, that the fact that they said “highly profitable” means some were unprofitable, as opposed to not hugely profitable. You imply the their language implies the opposite for the balance, when that isn’t a given. The 25 CEOs are listed, they aren’t hiding anything. And I don’t buy unprofitable by virtue of a one-year extraordinary write off as counting, BTW. This is another trick to try to boost stock price and CEO pay, of not taking reserves or other types of losses on an ongoing basis, then taking big writeoffs every 5-6 years (don’t take my word on this, folks like Francine McKenna have discussed this much longer form).

And since CEO pay does not reflect performance, tell me exactly what it is rewarding?

Second, it has been well documented GENERALLY that US companies, in particular, large public companies, pay much lower effective tax rates than their statutory tax rates. Nicholas Shaxaon, among others, has discussed the lengths to which major multimationals go via the use of low tax jurisdictions and creative transfer pricing to minimize their tax bills.

Put it another way: do you seriously believe CEO pay would be unaffected if major companies were paying their full statutory rates? You have to believe that to say the two are not related.

Thanks for the trouble of your reply.

I have objections. First, I continue think your criticism of Felix Salmon is strange; he (IMO) is making the same point as you about the headline vs content and though you differ in emphasis I just don’t see how you can accuse him of straw-manning.

I take your point about those in the 25 who are “not in the large majority” who are highly profitable, whose (lack of) IRS bills reflect “tax avoidance, pure and simple.” Absolutely, we don’t know (at least from their summary) about the rest of even how many there are. Maybe they are all tax avoidance, maybe there is one among them who is genuinely losing money for “legitimate” reasons, I don’t know. But can you not concede, their presentation is a nasty rhetorical trick?

And that Felix’s “average salary” objection is another?

Want me to sign up to a party that claims wealth and incoming inequality is a cancer on America? I’m in (and I would suffer financially in such)! Are CEO’s overpaid? Sure?

Would I like the government to intervene. Actually, yes. But that doesn’t mean I need to blindly ignore bad reasoning and dishonest headlines the like of which you too would be all over if arguing the other side.

In points of substantive disagreement rather than about the rhetoric of this report:

“I am of the old fashioned school that CEOs of money losing companies should get no or minimal pay. Lee Iacocca took $1 of pay when Chrysler was in trouble. More recently, Vikram Pandit took $1 in salary and no bonus in 2009.”

I ask again: what about start-ups (money losing for many years)? Trouble shooters brought in to fix failing companies? Still 0? (Upside all equity or ???)

*I* am from a different old fashioned skill that would holds as an (unattainable) ideal that we reward people according to ability and effort, and reduce the lottery like aspect of executive compensation. If it’s ok to pay the janitor in an unprofitable year I don’t necessarily seen any moral problem in paying _something_ top a CEO who we (“the board”) think is doing the right thing either, even if it doesn’t work out. The flip side of course is that I’m going to be less happy paying her $100M down the line just because her tenure coincide with a bull market or the up-roll of the business cycle.

If it’s ok to pay the janitor in an unprofitable year I don’t necessarily seen any moral problem in paying _something_ top a CEO

Um, maybe because the janitor actually works?

I deny that corporate executives do any work at all, produce any value at all, should exist at all. But evidently you think they add some value. Well, by your measure what could possibly be the function of a CEO other than to make the company profitable? Therefore, if the company isn’t profitable, on its face the CEO deserves nothing.

On the other hand, the janitor, or any other worker, actually does real work, regardless of the artificial and fraudulent measure of corporate profiteering.

when you have a shit job, often you don’t even have any work at all, and the hardest part is making it through the day trying to look busy. THAT is real work. Especially when the firm has one of those web site blocking things going so you can’t log on to eHarmony or Twitter.

I’ve worked at companies where most people don’t do real work and neither does the CEO. The company sort of coasts along from inertia. There’s enough work to keep the company alive, but I think most folks could work 3 or 4 hours and get it all done. The CEO could probably work 1 day a week and get it all done. Whatever it is he did.

There’s lots of meetings, which give the illusion of work. Sometimes those really are work, just to sit there and listen to the miserable sanctimonious nonsense.

hard to know what to do about this stuff. When you put 3 or 4 people together to try to get something done, it’s usually not easy. ecce homo. there are beautiful exceptions, but that requires real leadership — maybe 1 in 500 is up to that, as a leader. Or one in 100, not to be snarky. Not many, anyway. Everyone else (CEOs that is) is a free rider on society’s insanity. And the employees are mostly in chains.

in fact, just to follow up briefly, when I read Plutarch’s Live of the Noble Greeks and Romans, I thought I might gain some insights into character and leadership.

Instead, in most cases, it was something out of Lord of the Flies or portraits of nearly complete psychopathology blooming like a garden of hideous flowers gathered into bouquets and painted by Odilon Redon.

The system produces the CEOs as much as they produce the system, in a mutually reinforcing side to terminal chaos. The other classic analogy it brings to mind is the myth of Saturn eating his children, that moster face gorging himself with fists of his own offspring. Such is the contemporary public company CEO with his rape and loot. How long will that gene pool last? One generation. Maybe two if a few kids escape.

Re startups: 9 our 10 new businesses fail. Most are financed via savings, credit cards, friends and family. I’ve looked at investments on behalf of VC investors, and I have to tell you the ratio is at least as bad at that level. So the assumption, that paying a salary to outside managers improves the odds of success is questionable. It does help with fundraising, but otherwise, the evidence does not appear to support your implicit claim.

I run my own business and take salary only when earned. Most entreprenuers I know take no salary in their ventures until they are profitable. If outside investors want to pay for a CEO that insists on a salary, presumably to persuade other investors to come in, that’s, as I indicated above, an investment with not strongly proven returns.

Tax avoidance and executive looting are two sides of the same coin. Each is enabled by a hopelessly corrupt legal system. In the case of taxes, the cause is transfer pricing which makes all US income tax payments by US international companies essentially voluntary. Executive looting is a feature (not a bug) of our balkanized corporation law, which indulges the fiction that resume peddling bought and paid for corporate directors, hired by management and selected for their stereotypical credentials and unprincipled willingness to give way to executive demands, are somehow “in charge” of corporate decisions. The first time one of these clowns objects to a CEO pay demand he or she will be out or his or her affirmative ass. If you want to write about this stuff spend at least a little time trying to understand it.

“*I* am from a different old fashioned skill that would holds as an (unattainable) ideal that we reward people according to ability and effort, and reduce the lottery like aspect of executive compensation… The flip side of course is that I’m going to be less happy paying her $100M down the line just because her tenure coincide with a bull market or the up-roll of the business cycle.”

I agree that the bonaz boyz culture fosters malign anti-social practices. If they didn’t have such a big incentive to exploit every corporate, government, legal, illegal and labor oriface, they wouldn’t “work” so hard.

It would be interesting to know the relationship between the growth of performance based compensation practices and the appearance/ increase of other unethical business practices.

My general impression is that there probably is such a correlation.

“Performance based pay” in all assets up environments, meanwhile, just fosters the pervasive sense of executive entitlement. Tying pay to the performance of our manufactured bubble economy as if they actually “earned” it is preposterous. Now they all expect it.

We’ve generated a completely centrally manufactured nouveau aristocracy here. Meanwhile the nation is left in shambles and they think they’re self made Ayn Randian heroes.

“…the appropriate inclusive definitions of ‘compensation’ (salary, wages, bonuses etc) and “person’ to avoid cheating and evasion.”

These definitions, especially of compensation, had better be good, otherwise it would be a simple matter to work around the law by compensating top executives in kind rather than in money.

I know a teabagger who thinks it’s just fine for corporations to have more money than the US government. Of course the teabagger has had a government job, that he just lost, so he’s an unemployed teabagger, the very best kind. Sorta like a military base that i know. The workers are all professed Republicans, but they’re at the government trough.

Your concept of 25-1 of the lowest paid person is silly at best. Any exec, attorney or upper mgmt of a company is certainly worth more than 250k

Dear Captain Kirk;

And where, dear friend, do you get supporting evidence for that assertion? In my lowly strata of society, 250K is a lot of money. You can live quite well on that, if your tastes aren’t extravagant. “How much is enough?” is a question not asked often enough in our excess obsessed society.

Pardon the french, but f*ck it – why not make the 25-1 ratio society wide? Essentially, you can’t pay somebody more than 25 times the lowest minimum wage in any given state. Wyoming has a minimum wage of $5.15 (wow!) for some kind of exempt company or work or something. So,

2000 hours a year * 5.15 = $10,300

2000 hours a year * 128.75 = $257,500

Anybody complains about not making more than 250k a year, they can lobby for higher minimum wages. Only downside of my plan is the bottom would fall out of the real estate markets in about 4 different 5 sq mile areas of the country.

Oh and the innovators wouldn’t be able to job create by efficiently allocating resources… not.

Studies like these have been attacked for the past 40 years, especially when it appeared they might affect profits. Which is why we are where we are now. Look at the obedient rot in management – everywhere from Whirpool to Verizon. Have a big enough corp and you can run to daddy and get bailed out. We’re a nation of subtely. After big 80s era layoffs, a whole assemblage of so-called academics, think tanks, the press and corporate money supported the end of job security. Austerity ain’t nothing new, don’t be surprised when CEOs really start to make ‘bank’.

I’m with you. All these desperately shrill cries for austerity mean austerity for thee and me, but NOT for them. Of course since we are used to living on less, it wouldn’t be a hardship for us, but these poor CEOnistas would really suffer.

In case you doubted that America needs more progressive taxation, … Yves Smith

So long as we have a government backed counterfeiting cartel then let those who benefit the most from it pay for it. However, would it not be better just to eliminate all government support for banking including the lender of last resort, the Fed?

Take note of bagger propaganda that pushes the thrill of xenophobia: ‘imigrant slave labor get’s thar’ stuff for free because they don’t pay taxes.’ False, factually false.

Industrial data motivates their followers to gravitate from being “taxed to death” to “hating social security” and since land always has some value “hating deadbeats who don’t pay their mortgages”. Some of the belligerence only goes so far, particularly to victims of Banks. They’ll now only identify with some of the things Facists big brother tells them.

Hi Yves/Susan

I have been an enormous fan of your blog for several years, a huge thank you.

Not relevant to the article above, but unsure how else to contact you.

Others may well have pointed you towards this article by Bruce Krasting:

http://brucekrasting.blogspot.com/2011/08/feds-plan-rumors-of-news.html

I’d be very interested in your take on this, although appreciate your time has vast demands from other avenues.

Regards and again thanks for your tireless work

David Porter

Nelson, New Zealand

I’ve written about this already, Krasting has unfortunately fallen for Administration PR. See this post for a discussion of the issue:

http://www.nakedcapitalism.com/2011/08/memo-to-ezra-klein-doing-something-stupid-isnt-smart.html

Yves,

Bruce predicts this will be the mechanism for Ben Bernanke to inject another Trillion dollars into the markets via Quantitative Easing. It’ll do wonders for people chasing yield via equities and commodities. Little to nothing for homeowners.

That’s the conclusion I drew from his post.

Ref: Doug’s proposal

So lets describe some hypothetical companies in the apparel industry.

USA Company A makes 2 products: Underwear and military uniforms. The underwear is made in a factory in Singapore where the average salary for a garment cutter is $3.74 per hour. The CEO’s salary is $500,000. Underwear sells in the United States for $20 per package on a moderate profit. The military uniform contract goes through 2014.

USA Company B makes 1 product: Underwear comparable to company A and sold at a comparable price. CEO’s salary is also $500,000. They had bid on the contract for military uniforms but had lost to company A.

China Company C makes underwear: The underwear is comparable to Company A and Company B’s product at approximately the same price.

“Doug’s law” now goes into effect.

Company A:

CEO is now forced by law to lower his salary to $187,000 (a 62% cut) since his company has a government contract.

If he raises the salary of the Singapore workers to $7.48/ hour (Double the average wage in that country!) He can raise his salary to $374,000. But since labor is 60% of the cost of the product, that will raise the sales price of his product to $32.

Q1: Will American shoppers be willing to pay $32 when there are substantially identical products on the market for $20?

Q2: If he does raise the salaries of the Singapore workers and happens to stay in business, what happens to the USA balance of trade?

Company B:

CEO’s salary has no effect since he doesn’t get any money from the government. He thanks his lucky stars that he lost the government contract to Company A.

Company C:

This has no effect on the CEO as he is a Chinese citizen living in China and does not pay USA income taxes.

Now suppose the government wants a new military uniform contract that will go through 2016.

Q3: Will Company A CEO bid the contract and limit his salary for an additional 2 years?

Q4: will company B CEO bid the contract with the result that his salary will be cut by 62%

Q5: will the Chinese company who is unaffected by the income restrictions of USA citizens bid on the contract?

Econ newby:

I have two possible solutions, which our Free Marketeers will hate. (and I absolutely love that they’ll hate it).

1) All bidders should be on the same policy. Thus, Chinese Company C should abide by the rule and have documentation/proof of this.

I’ve had enough of this “free trade” crap which really means “use slave labor elsewhere to avoid taxation, export inflation, circumvent humanitarian ideals, and circumvent any type of regulation, no matter how sensible”.

2) Should the military be outsourcing it’s contracts? any of them? especially to China?

How about this: US contracts to US companies with US workers. ONLY.

I’ve had it with paying Halliburton, A MIDDLE EAST COMPANY, billions of dollars and paying each one of them MORE than what an American Soldier would make doing the same thing.

Fait accompli!

with my rule: ALL contractors have the same pressure. all can bid or not bid.

if none of them bid, my guess is that at some point some enterprising young person will be willing to only make 25 x $6/hr or $150/hr to run an underwear making plant.

======

On a side note: the real problem with the 25-1 rule is simply outsourcing.

Company A has a CEO that makes $100,000,000 per year and a Janitor making $10/hr.

Simple fix (for the CEO): outsource all cleaning.

Her secretary makes $30,000/year.

Simple fix (for the CEO): outsource all admin staff.

you’d basically get a bunch of holding companies and umbrella companies and shell companies all over the place… where the executive class would officially work for one company, and all the support for other companies.

that’d be hard to figure out.

” He can raise his salary to $374,000. But since labor is 60% of the cost of the product, that will raise the sales price of his product to $32.

Q1: Will American shoppers be willing to pay $32 when there are substantially identical products on the market for $20?”

Oh, this is SO not a problem:

http://www.youtube.com/watch?v=YK2VZgJ4AoM

You ARE an econ newby!

Good idea and all, but many corporations would simply get around it through contracting out employment. Of course, that’s assuming our millionaire-friendly Congress would even consider the idea (they won’t).

As Overquoted and others have noted, the clever legal, accounting and other minds who advise corporations will have a field day finding ways to circumvent the maximum wage — for example, through outsourcing, vendor relationships, corporate structuring and so forth. All of which is why I added the need for inclusive definitions of ‘compensation’ and ‘person’ and so forth. The point being: lawyers, accountants and others can also advise law makers about how best to anticipate and defeat evasive and circumventing action in advance. And, after laws are enacted, the same skills can be brought to bear at IRS and elsewhere to monitor and respond to those who are determined to circumvent the law.

Will such skills be brought to bear effectively either before or after such a law is passed? Well, the answer to that does not arise from a corollary question: Do such skills exist? Yes, they exist. And yes they can be brought effectively into play. It’s happened for decades in the US at all three levels of government.

But not so much recently. Not because the skills are missing. Rather because — as NC readers know so well — the corporate persons who run the government for their benefit as well as the elected officials those corporate persons control/influence choose not to apply such skills for this kind of purpose. Instead, they choose to apply the skills to increase tax evasion, eviscerate regulatory oversight, etc etc — to make markets ‘free’ so that CEOs can haul in over 300 times the average worker’s compensation.

Bottom line: the 25 to 1 law CAN happen and happen effectively. Is it likely to happen in our corpocracy? No.

But “likelihood” as a matter of politics and culture is subject to change.

I don’t have a problem with the 25-1 ratio. I would add in a marginal tax rate of 90% for all income of whatever type over some figure. I have used $1 million in the past but it could be lower. I would increase the estate tax to 90% for all estates over $5 million. Again you can raise or lower this number but I would think a $3-$10 million range is about right. And I would restrict the formation of trusts and foundations and outlaw offshore havens. I would add in an asset tax of between 3% to 10% on all wealth above $10 million.

Parenthetically, for corporations I think there should be some minimum tax on companies with a cap over $10 million based on their gross profits. I would tax those that export or have exported jobs out of the country in the last 15 years more heavily. OTOH I would tax corps less that created jobs domestically and tie the tax cut to the durability/income level of the employments. I would repeal corporate personhood and make management and their boards criminally and civilly liable for corporate bad acts. I would eliminate stock options.

I have not considered the corporate side as much and would be interested in other people’s suggestions.

What I don’t see in any of this discussion is that when these top folks make more like their peers (25 X 1) then they identify more with them and their life but if they are paid to be budding global inherited wealth for hewing to the greed and selective global genocide narrative then they expect to be paid to be the anti-humanistic puppets they are.

The real problem we have is the abdication of responsibility – in this case, of the shareholders.

For example, I cannot understand why shareholders are not allowed to vote on the executive comp. FGS it’s their company, they should be able to do what they want – and not only via the onerous process of management captured board. At the moment, the public companies are upside-only (ltd.) vehicles that generate money for management as opposed to anyone else. The “shareholder society” could be good in principle – if the wealth in publicly traded companies wasn’t being appropriated by the management layer. So both the employees and the owners are being ripped off.

I came to believe that C-suite in a publicly listed company (i.e. weak shareholders almost by default) should be actually paid not even multiple of the average wage in the company – they should be paid exactly the average wage (as at the company) in cash. That could be topped up to the highest non management person wages (ex bonus) with normal shares (with a long vesting period), and anything over that (including any bonus) would have to be in unlimited-liability class of shares only (transfer of which would include transfer of the unlimited-liability, thus making them hard to get rid off if the company is perceived to be run badly).

I wonder how much the large amount of shares owned by index funds affects governance or lack thereof. A very large block of shares are likely agnostic as to matters of CEO pay, performance etc.

Anyone with a brain can see that top management is looting the companies for which they work. Bernanke is aiding and abetting them by continuing the process of putting money in the system for bad checks.

For year the CNBS crowd has raved about stock buybacks. Who was buying back more stock than any other group 5 years ago? Yeah, the big banks. 2 years later they were out of capital and their shareholders, those people who failed to sell their stock to the banks, were left holding the bag. This is a widespead practice and it provides a market for the insiders to sell into. If they were paying dividends, the money would be spread around.

FNM was a money pot for Raines. Immelt has his money pot at GE, despite the fact the company would have failed without a government guarantee. It goes on and on and the only people that can’t see it are those hawking stock.

This isn’t about equality. It is about the board of directors and the shareholders having their heads up their asses while the bankers are inflating the income of these companies and aiding and abetting the management in taking it out. If earnings are so high, there seems to be a piss poor amount to give to those that own the company and plenty for its head.

I agree with the idea of limiting the pay of the top executives. However, if the limits are going to apply to the “highest paid” person in the company there should be an exception for salespeople who work on commission. These are the people who actually make the company viable since “nothing happens until a sale is made” (an old saying from my years in the life insurance business). In addition, commissioned salespeople generally have no say in top level decision-making. I know of instances where top salespeople have made almost as much as some of the top executives. Higher earnings for these people means higher revenue for the company; they should not be limited.

Just my two cents worth.

Since Yves mentioned Lee Iococca, one of my favorite quotes from him was that a good CEO should always be selling. The problem has arisen that the CEO’s were selling to government to cheat instead of innovating.

So the politicians and these CEO’s enriched themselves. Both classes are ‘management’.

I don’t vote for any restrictions on CEO compensation. Until lobbying ends and is considered criminal conduct and legally codes that way, regulating pay is merely chopping at the leaves.

The problem is sound money and capital requirements that facilitated massive fraud on the entire globe. The second massive problem are the management. They will obviously cause problems on the way out and many won’t leave nicely.

After each of these discussions, I am reminded of the most poignant speech I’ve ever heard on the subject of REVOLUTION.

The speech was at an Eris Society meeting in Aspen in 1994 or 95… the speaker was the president of “Jews for Firearms Ownership”.

He said we will entertain polite discourse on these subjects until our ox is gored. As the educated middle class loses more and more of it’s wealth and power – it will align with the fringe …goading the fringe to violence.

AGAIN – I was reminded of the alliance between the sans culottes and the professional class in 1788 France… an unlikely alliance, but a powerful force against the ‘elitists’ of the day.

You and me don’t want to risk jail – so we won’t be gassing billionaires in their sleep in Corsica… but we will be CHEERING the story.

You and me won’t be putting a necklace bomb on the daughter of a hedgie from Malaysia… now retired to his mansion in Sydney…. but we will BE CHEERING that enterprising scheme to further torture the super rich.

The tipping point is when the educated middle class understands that the game has been rigged. That we may aspire to enormous wealth, but those who achieve it are not worthy of our praise, but our enmity.

Behind these great fortunes are GREAT CRIMES.

When I read that Steve Jobs purchased a million robots to replace his suicidal Chinese workers… I thought to myself… THAT is the solution to intolerable working conditions?!?

I’m glad Jobs is dying a slow painful death from pancreatic cancer…. it gives him time to reflect, if that’s possible in that kind of monster.

I hope he lingers another DECADE. He looks positively ghostly. But he deserves it. Sorry… I used to be a believer… a life long conservative, and entrepreneur.

But I know too much now. It won’t be polite conversation that changes the way things are done… it’s the FRINGE PLAYERS with nothing left to lose….egged on, if you will, by the class they aspire to.

You and me.

These are the stories I awoke to yesterday. Each made me smile. The least we can do to the gangsters… is make them live in TERROR.

Steve Jobs – who purchased a million robots to replace his SUICIDAL Chinese workers is still dying a painful death from pancreatic cancer. CHECK!

Bank of America faces new lawsuits! CHECK!

Billionaires in Corsica gassed in their sleep by house thieves. CHECK!

Billionaire Hedgie can’t unload 32 billion $$ home in Seattle… must sell at auction! CHECK!

This is going to make GREAT reality TV… imagine Lloyd Blankfein, or Jamie Dimon pleading for their youngest … who is wearing a necklace bomb… due to explode if X amount is not paid.

You think the middle class will be outraged? — they’ll be laughing their asses off.

The real problem is that there’s a corporate income tax in the first place. If corporations were taxed like REITs (tax-free so long as 90%+ of earnings pass through to shareholders, with dividends taxed at ordinary income rates) then corporations couldn’t hide money offshore or overpay CEOs without unavoidably cheating their shareholders.

beowulf — Great Idea!

Its off topic, but the mention of Robert Coury of Mylan Pharmaceuticals triggered a memory of a $100 million settlement with the FTC in 1999 for price fixing by buying up the company that was the sole source of an ingredient for Lorazepam and then tripling the price. The company president is Heather Manchin Bresch, daughter of former governor, now senator Joe Manchin.

I don’t see any reason to limit the pay of executives. I do see a big reason for taxing the hell out of high incomes. There was once a time when people did not want to accept raises because the raise would put them in a higher tax bracket. This left money in the companies to be used for productive purposes. When Reagan cut the taxes they just sucked the money straight out of the companies and socked it way. Tax income, tax capital gains, tax every dollar the same as any other dollar.

It’s not just the money. It’s the behavior. People heading up powerful institutions have amply demonstrated that they need to get put on a short leash.

As far as the money is concerned, we can’t allow them to trash the joint and expect to tax it back to clean it up. It doesn’t cover the damages.

I’ve had it with these people.

1. This may work because no one at the top cares how much money they make, they just have to make more than their friends at the country club. Keeping up with the Jones’ combined with Prisoners’ Dilemma.

2. But what keeps this proposal from fueling yet more outsourcing? Wouldn’t any moderately crafty “CEO” simply outsource himself as a consultant and make obscene amounts on consulting fees? Then they have more liability remoteness, and since they aren’t taking government money directly, they can pay themselves any amount they can dream up? Just install a friendly puppet-CEO to keep renewing your contract. Wouldn’t the board go along with such a scheme to retain “talent”?

It’s a CEO’s job to maximize profits to shareholders, it’s their job to minimize tab liability.

This is not a case for “more progressive” taxation, it’s a case for *less progressive* taxation and tax code simplification. i.e. a flat-tax rate with no deductions, no tax credits, no subsidies.