Cross-posted from Credit Writedowns

Last month I wrote an article called “The ECB is the difference” which claimed the ECB was the pivotal institution in the European sovereign debt crisis. I presented two options that the European Central Bank had in relieving pressure on European sovereign debt markets. Option A was monetisation i.e. buying up sovereign debt or guaranteeing a specific yield or spread. Option B was Eurobonds i.e. where “the ECB buys an agreed-upon portion of the existing debt from the sovereigns and then uses these funds to back the [Eurobond] supranational debt.”

My thinking at the time was that Spain and Italy were not insolvent and yet their bonds were selling off as if they were. To me, this had the hallmarks of a classic liquidity crisis which necessitated a lender of last resort to fund the solvent but illiquid sovereigns and prevent dead weight economic loss. The ECB has unlimited firepower and that makes it the only institution which can credibly end liquidity crises in Euroland. And indeed, we see that after the ECB went ahead and bought Italian and Spanish bonds as I suggested they do, yields fell dramatically – the most ever in a single week since the Euro was formed.

It has been clear to me that this was the endgame. As I said in November of last year, there are three options for the euro zone: monetisation, default, or break-up. In my view, the political costs of break-up are still too high, so monetisation and default is what we have seen and will continue to see for some time still. What was not clear, even in the hours before the ECB did decide to buy Spanish and Italian debt, is what the quid pro quo would be for the ECB to move. Elga Bartsch of Morgan Stanley said fiscal austerity would be the pre-condition – and she appears to have been right as Spain and Italy have accelerated plans for fiscal consolidation.

As to Option B, euro bonds, we are now seeing movement on that front. Reuters reports that the German government no longer rules out euro bonds based on a Welt am Sonntag article. The original German article title reads “Deutschland wird zum Zahlmeister Europas” which translates as “Germany has become the paymaster of Europe”. The main point of the article is to highlight the fact that despite official denials by top politicians from the ruling coalition government, euro bonds are indeed being considered as an option to save the single currency. The article says that these bonds would cost Germany €47 billion a year in higher interest rate costs.

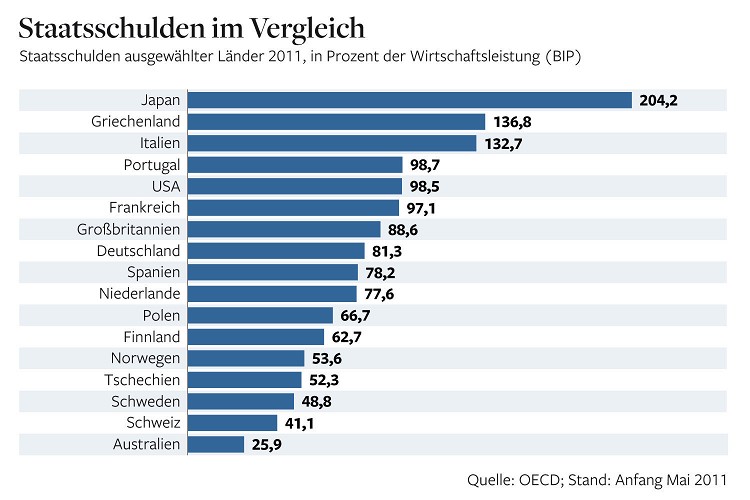

I will write further on this issue. But, for now, I want to segue into some thoughts on civil unrest and austerity. Below is a graphic in German from that article showing the relative debt load of leading developed economies.

Notice that Spain’s debt load is lower than Germany’s. I think “Spain is the perfect example of a country that never should have joined the euro zone” because the euro has acted like a gold standard for the country, which has forced Spain into austerity, a deflationary policy path. And that’s the sort of outcome which leads to civil unrest, economic nationalism, and right political extremism.

For example, recent research suggests that the austerity we see in places like Spain and Italy will lead to social unrest. “Austerity and Anarchy: Budget Cuts and Social Unrest in Europe, 1919-2009” is the title of the paper published by the Centre for Economic Policy Research. This paper finds that:

From the end of the Weimar Republic in Germany in the 1930s to anti-government demonstrations in Greece in 2010-11, austerity has tended to go hand in hand with politically motivated violence and social instability. In this paper, we assemble cross-country evidence for the period 1919 to the present, and examine the extent to which societies become unstable after budget cuts. The results show a clear positive correlation between fiscal retrenchment and instability.

Additionally, two economists have found that “higher per capita GDP growth is significantly negatively linked to the support for extreme political positions.” The German economists, Markus Brückner and Hans Peter Grüner wrote pointedly that:

Our results therefore make clear that countries should not expect right-wing parties to get majorities unless growth declines quite as much as in the 1920s. Nevertheless, even with a less significant fall in economic growth rates, a rise in support for extreme parties is likely to change political outcomes – for example through their impact on incumbent parties’ political platforms.

So what we should expect is a high level of political volatility and social unrest in Italy and Spain (as well as in Ireland, Greece and Portugal) and an increase in right extremism. The same is true regarding austerity and social and political outcomes in the US, by the way. If the level of social volatility accompanying this outcome is too great, the euro zone will break apart as the future right-leaning governments there will resort to economic nationalism and repudiate their debt by defaulting.

Eurobonds would certainly lower yields across the eurozone and reduce liquidity constraints that have required front-loaded deficit reduction attempts. The effect on Germany is arguable. But, at a minimum, euro bonds would minimize the potential for the extreme outcome from social unrest which I just outlined.

P.S. – We should give the ECB some credit here. Nine days ago I was saying this is a classic liquidity crisis and that “the time to act is now.” The ECB has acted.

…Oh noes, not again…

When forming Euroland the outstanding debt of new member nations was converted to euros with payment to be in euros, a fatal flaw as euro value rises so does the debt load repayment.

Member nations can no longer print (their own) money to repay debts, they have to get a loan from a Euroland bank….

Maybe the solution here is to give each EU country the right to demand a certain number of Euros be printed and delivered to its Treasury Dept (or whatever these depts are called in the EU.) Each country might be able to demand an amount equal to half their economic contribution to the Eurozone as a whole. Thus, if Spain contributes 6% of the Eurozone’s economy, Spain can demand up to 3% printing of Euros beyond the amount planned by the central bank.

What makes this interesting is that Spain could chose to bank those Euros, accumulating a surplus, or they could spend those Euros, or they could loan out those Euros if they felt like it.

Spending those Euros is obviously inflationary. Loaning them out is also inflationary, but probably on a different scale. Keeping their Euros means that after 5-10 years of collecting extra Euros, Spain can stimulate inflation all over the Eurozone if they feel like it, giving them an offensive weapon if they need it.

This also encourages countries like Greece to truly tax their citizens, as taking the money back to the treasury is a method of ensuring against inflation.

Meanwhile, the central bank can chose to print/disperse less Euros due to the expected demand by member countries… In other words, give each member state some true influence over how the central bank allocates funds, but make sure the central bank still has the majority of influence.

I wouldn’t say just right-leaning, but more extreme politics.

If we go into another world-wide recession – and those odds are increasing – then the countries already suffering under austerity will be eager to elect someone who promises to cast off the yolk. Talk about a market jolt.

Here’s a problem I see with the ECB: as they increase support, they run the risk of a country threatening for better treatment. Once that happens, and they say no (which they have to), then a whole chain of bad things can start to happen, happen fast, and spread fast.

This reliance on central banks is not good at all. It’s very bad.

The ironic thing is, these peripheral countries can probably repudiate their debt, and start with a clean slate. The bond market would probably fall all over itself for bonds offered up by a debt-free country. I mean… the possibility can’t be dismissed.

There is also the problem that any state which HAS taken painful measures will not be pleased to see others exempted from doing so.

Take Estonia, which is ironically almost the definition of ‘peripheral’ in this context. They took an 18% hit to Real GDP during 2007/2008 so they could meet the requirements to join the Eurozone, and would no doubt be (quite justifiably) enraged if existing Eurozone countries suddenly started getting special treatment.

It’s nice to see an upgrade in the political discussion here. Hopefully, what is widely known in the social sciences worldwide, for over a century now, that not only are there the business cycles of economics but the revolt cycle of politics, will start to allow for a consensus. Naturally, it comes from Germany, where all the serious sociology seems to emanate. But then, they really can’t pretend that their NAZI era was some sort of Black Swan interlude, but an event well measured and in the context of many other European debacles going back centuries. The Germans don’t fuck around with freedom of speech about the pros and cons of Hitler, unlike the bullshit that passes for valid criticism in the US.

We need to stop pretending that the world wide financial problems are liquidity problems. Most are solvency problems. This is why Japan has never fully recovered. Government spending and central bank liquidity is masking solvency problems. Same for the US and much of Europe since 2008. Central bank liquidity will work for a while longer (until the bond market begins to price in the monetization of debt through inflation). The TBTF zombie banks need to be blown up, restructured, split apart. Bad debt needs written down. The central bank/TBTF bank cartel must be dismantled!

I agree with you John. And frankly, after reading some data put forth by Edward which indicates that Italy will not grow fast enough in the next decade to service its debt, I’m surprised that he continues to insist that Italy’s is a liquidity crisis.

How can Italy, which will grow no more than 1% real GDP over the next decade, continue to service debt of 120% of GDP.

I agree. “Deficits don’t matter,” in its multiplicity of forms, is part of extend and pretend.

I agree too, John. If liquidity were the only issue, tiny Greece wouldn’t be making banks freak out. A few euros thrown its way, voila, problem solved. The fact of the matter is, the banks are loaded with bad debt and capitalized with it too.

Right wing extremism + nationalism + Germans != good times

Spain in the EU seemed natural until a couple of years ago. Spain and Portugal have made substantial strides. The countries had workers from other parts of the EU, new freeways and massive restoration were built and supported with EU money and, of course, a common currency. Just because the situation now is different does not seem to me as a reason to nullify the whole experiment.

We all, EU+US, suffer from the oligarchization of our countries. An oligarchy is not a democracy, despite the EU+US being traditionally democracies. Decisions are made on Wall Street and not on Capitol Hill or 1600 Penn.

I hope that this will cause a lot of unrest. Since the GOP seems to many as fanatically supporting the oligarchs, I hope the extremism will be on the progressive side.

Interesting comment.

I differ. I see many similarities between the GOP in the US and the EuroCrats in Brussels.

In both cases, the pols are trying to force something down the electorate’s throats. In the US, it’s Ryan and his Austerity Pact. In Europe, it’s the EuroCrat and their insistence that Germany and other Northern nations should bailout the south, even though they were explicitly promised this would never be necessary.

In both cases, in the US and Europe, the GOP and the EuroCrats seemed convinced that they know better than the people they should represent, that the voter is too ignorant to realize the error in his thinking.

Well, it is actually saving the banks all over again. All these countries will never be able to pay back these debts and the whole process is simply pretend and extend. And all the while those guys at the higher echelon in the financial institutions continue to enrich themselves.

Unbelievable how corrupt the system has become. A default is a simple matter and should have been employed for Greece a year ago already. But no, let us get the problem grow in size and make it more and more difficult to solve and transfer the losses again to the tax payer at the end.

It seems a simplistic assumption that Northern Europa would not bail out the periphery, when they already will fight and die for one another via NATO, what did they think the One Currency One Market push would lead to, fewer obligations to the ties that bind?

Edward has given himself and the EU the impossible task of “working out” the unsustainable and impossible-to-pay debt load of the insolvent – NOT illiquid – member states by his self-imposed blinders.

Edward: “”In my view, the political costs of break-up are still too high, so monetization and default is what we have seen and will continue to see for some time still.”

Thus we pander about looking for the magic bullet that will provide for growth, liquidity, employment and prosperity.

Take off the blinders, Edward.

Your last option, denied any discussion here, is the only valid one.

Breakup of the European Monetary Union will enable the European Economic Union to claw back to reasonable prosperity, nation by nation.

By making every EU country again sovereign in its currency, each country can begin to achieve whatever limited well-being this insolvency crisis will allow.

What we need you and the others to “begin” to work on Edward, is the “exit-strategy” from the EMU.

Once one embraces that the political fallout from breakup will be better in the long run than insolvency-driven austerity-cum-insurrection-cum-police-state, the EU can be on the road to recovery.

Once these nations achieve sovereignty, they will hopefully see the light of the impossibility of continuing the debt-based system of money, which has caused all of these problems.

http://blip.tv/file/4111596

Thanks.

Amen, Bruthuh Joe! Let’s turn the floor over to the Reverend John Hussman, to finish pounding that nail home:

http://hussmanfunds.com/wmc/wmc110815.htm

Jean-Clodhoppeur Trichet is the Greenspan of Europe — a poseur, a knave, a failure and a fool. His bank is bankrupt. Too bad we can’t short the insolvent ECB to zero. But there are other means to profit from the fathomless fecklessness of effete eurocrats.

I couldn’t agree more with Joe and Jim. Especially with the comment that Ed is hampering himself by failing to see the insolvency that exists and treating it as illiquidity. You can’t look clever by proposing analyses about and solutions to problems whose formulation you have got wrong.

Allan, you don’t understand my argument. I believe this is solvency crisis too, yes. But I am saying that when you reach a panic stage, you have to deal with liquidity first.

See here for example:

http://www.creditwritedowns.com/2010/05/liquidity-and-solvency.html

“When bankruptcy comes, it does so normally as a result of a liquidity crisis. This is true for countries as much as it is for companies. It’s not as if someone in charge walks in one day and says “you are insolvent so you must default immediately.” That is what happens in the case of banks seized by the regulator.

In other cases of insolvency, creditors become spooked about longer-term insolvency. At first, they demand a higher return for their loans. Eventually, they pull in their horns altogether. Liquidity dries up and the company or country is unable to roll over its debt requirements. It literally runs out of money.

This is exactly what happened to Northern Rock, Bear Stearns and Lehman Brothers in 2007 and 2008. They ran out of money because no one was willing to lend to them – quite different from the bank seizures we see the FDIC conducting every Friday.

The problem, of course, in a financial crisis is that everyone is panicked and eyeing everyone else warily. Solvent companies can be taken down in the crisis too.”

It’s exactly what we saw with Lehman. Had we dealt with the insolvency of Lehman, Citi and BofA, I’m sure that M&T or Northern Trust would have been just fine. But we didn’t and then came the panic. When a panic occurs, even the solvent come under attack. That’s what has created depressions, post-panic – and why JP Morgan was forced to intercede to prevent the same thing from occurring in 1907.

It is debatable whether Italy is solvent longer-term, sure. That’s why they are under attack. But the right way to deal with this is to stop the panic and address the issues that could lead to longer-term insolvency. Remember, Italy has a primary surplus. It is high debt and slow growth which is their problem.

At my own site, the links posts regularly have articles talking about this (including today) http://www.creditwritedowns.com/2011/08/links-08152011.html

Finally, I should add, I am a eurosceptic.

http://www.creditwritedowns.com/2011/08/euroscepticism.html

It would easy for me to say something like, “see I told you so. The euro is an abomination and the peripherals should simply leave or be tossed out of the euro zone.” But how does that add any value? It’s easy to just throw your hands up and make gloomy predictions but that adds zero value.

We are in a crisis and what we need are workable solutions that reduce the potential for worst-case outcomes. A euro breakup increases them.

Well thanks for taking the time to reply Ed, much appreciated. I have no problem accepting that you are a eurosceptic (aren’t we all?) and no problem, after your further explanation, that you can see the solvency problem that we have all pointed to. I’m not going to quibble about semantics so I guess we’re only really talking about ‘at what point in the cycle or circle do you intervene to produce a solution when everything is connected’. You’re saying that panicked investors and public need calming and so we should find some stopgap method of buying time; I’m saying that all governments have tried that approach since 2007 and it hasn’t worked.

If the basic problem, the issue at its root, is the debt mountain then ONLY a reduction of that will in any meaningful sense reduce the problem and provide a calming effect upon all concerned; Haldane can see this, quite a few others see this but no-one in power seems to be able to either see it or want to make it happen.

I know we’re on the same side Ed, I just think Joe, Jim and I were reacting to the perception that you seemed to miss the solvency point; I’m happy to be put straight.

I understand what you’re saying and can see the logic in cutting the cord now. Politically, it’s not a reasonable thing to expect at this stage. Things will have to get a lot worse. I’m just being realistic on that score.

By the way, Felix Zulauf is saying the same thing I am saying. I reckon he comes at it from an angle similar to yours and mine but also believes liquidity comes first.

Read here:

http://www.creditwritedowns.com/2011/08/zulauf-expect-market-lower.html

Thanks for the link Ed. Felix seems to be saying similar things for the same reason as we were discussing above. I’m a little less optimistic that the current economic and financial constituents can be preserved by the actions you suggest than either of you, I’m afraid. And I’m rapidly arriving at the conclusion that they shouldn’t be; root and branch changes in regulatory regimes, accounting standards and financial market operations seem to me to be desirable to try to avoid the mess that the current status quo has created. I think that’s why I’m of the opinion that ONLY addressing the debt mountain is the way forward. After all, the reason why the pressure on all western governments has not receded since 2007 and in fact has escalated (most noticeably in Europe) is that the core problem of debt remains largely untouched; that just won’t be solved by any formulation of creating more debt. Ask Japan.

Well , whaddya know? A few days later the perfect phrasing for our differences comes courtesy of Ryan Avent’s piece;

‘Fundamental macroeconomic imbalances require correcting the imbalances. Financial support packages are no substitute: they do at best buy time to make corrections; but they do not change the imbalances as such. And they are doomed to fail if imbalances are that large that they cannot realistically be corrected within the existing institutional framework. In this case the framework itself is part of the problem and needs correction.’

That’s the difference between us I believe. Thanks Ryan.

Joe,

EMU is a political construct and unworkable in its current state. It’s not about the economics. The question is whether the Europeans want to take the political steps necessary to support a workable currency union.

If not, if they want an exit, the thing to do is to find a way to pay for the bailout of the various banking systems that would occur with an exit of Greece or Italy. I don’t see any way to do this now while we are near a double dip without creating yet another panic and cratering the global economy. A better solution is to provide enough liquidity and support enough growth so that the breakup can be done when economies and banks are healthier. Liquidity issues first, then solvency issues and/or breakup. In some ways, you could argue this is the German strategy right now.

Edward,

So, you think the time to begin the exit strategy will be when things are going great again.

Illogical to me.

The time will never be ripe.

Yes, the need in the transition will be for ‘liquidity’.

And temporal steps are necessary to ensure that adequate money exists to maintain some semblance of economic order.

But until you, the Germans, the Italians and the IMF all come to understand that this global financial crisis represents the “debt-end” of the debt-based system of money, the debt-hole that will need to get filled in order to address the exit strategy will just get deeper.

We cannot end the debt-crisis by issuing more debt.

As the EMU cannot itself issue debt-free money that role for money must revert to national governments.

And that can only be addressed within an EMU Exit Strategy.

So, who’s working on that?

Thanks.

It’s regrettably that so many ignore the wished of the German electorate. It’s beyond clear that the majority of German voters are against a fiscal union, including a EuroBond.

Yet, so many EuroCrats and their enablers continue to insist that the Germans simply don’t know what’s good for them, that they’re too ignorant, and therefore their wishes should be ignored.

Perhaps Congressman Ryan is correct. Perhaps the American voter too is too ignorant to appreciate his Austerity Plan, and perhaps Congressman Ryan’s enablers are correct when they claim that the only way to “save” Medicare is to convert it into a voucher program.

Yesterday, while reading on the history of the formation of the EU and later the invention of the Euro, I was struck by how cavalier was the additude of the ‘Founders’ reasons for setting up the ECB without any fiscal mechanism to enforce “discipline” on the member countries. The fiscal discipline, if you want to call it that, was a ‘request’ for “3% cap on budget deficits”. The utter nonsense with which the Euro was launched is now attributed to “idealism” and “mutual good will” by those who invented the Euro system. But, now, as we see the power of the ECB, and the austerian purpose to which it is being put, my mind turns to a conspiracy theory question; to wit: Was the European Union first an idea by and for bankers to wrap up all the rents of Europe, or did the bankers simply sieze on the opportunity to gather up all the rents of Europe when the financial/sovereign debt crisis hit?

During the last EU referendum debates in France, the political left was pointing to the “treaty” as a trojan horse to deliver Europe into the hands of its largest banks, and ‘create a European neoliberal economic system’ to drive down wages and destroy labor. So, joined by the anti-EU right they defeated the “treaty”. Undeterred, France, Netherlands, Ireland, I’ve forgotten who else, all managed to ‘redo’ the treaty into something that didn’t have to be passed in referendum. Actually, Ireland threatened its citizens with armageddon; the threats worked, and it passed the second time – barely.

I commented on NC some time ago that it was extremely disheartening to me to see Europe’s banks acting as privateers if not outright pirates. I feel like my dreams of an expanding social democratic Europe may be dashed – at least in my lifetime. Whether by design from the beginnings, or acting opportunistically, the bankers are well on their way to destroying social democracy in Europe.

I grieve.

I think you’ve hit the nail on the head Okie. Once the ECB saves the EU with Eurobonds or whatever, that spells the end of social democracy. In it’s place will be a system run by oligarchs, with zero accountability to the people. Call it neo-fuedalism, or some other appropo term, the result will be the end of sovereignity.

Not a conspiracy, Okie, just the ultimate goal of leaders big and small everywhere. To wit: to place within their reach as large a pot of money as possible, the better to get their hands into it.

when the bankers go to jail my friends

when the bankers go to jail

we’ll finally see justice done

when the bankers go to jail

http://thepeakoilpoet.blogspot.com/2011/07/when-bankers-go-to-jail.html

Assuming that this correlation can be reverse engineered this way:

You’ve got USA political involution in a nutshell.

My! My! My! Whoccoodanode?

I wonder if the broad plan here is to foment civil unrest and nationalistic hate of the global system. The more people distrust the current system, the easier it will be to dump it and adopt something else.

As in; when the desperation is so deep that the people want any sort of change, the powers that be can allow a fake coup to take down the inconvenience of democratic structure.

I’m all for civil disobedience for positive change, but I am also wary of civil unrest being fomented, then co-opted by the very same powers that are currently destroying society for personal gain.

Well, that’s another story.

The unsustainability and certain crash of the debt-money system has been known to cycle on through since the days of the Rothschilds.

The difference is today’s “globalization” of the certain failure through a cascading of cross-defaults across national boundaries.

Surely resort to financial stability through international macro-prudential regulation under the IMF will be far superior to the bands of dispossessed who would take to chaos and insurrection in the streets on their way to filling up the modern debtor-prisons.

It’s either that or a new money system.

http://kucinich.house.gov/UploadedFiles/NEED_ACT.pdf

The Money System Common

Wow, love it! I just skimmed it so far, but I think the intro summs it up good, and bears repeating:

“A Bill

To create a full employment economy as a matter of national economic defense; to provide for public investment in capital infrastructure; to provide for reducing the cost of public investment; to retire public debt; to stabilize the Social Security retirement system; to restore the authority of Congress to create and regulate money, modernize and provide stability for the monetary system of the United States, retire public debt and reduce the cost of public investment, and for other public purposes.”

What’s become of this bill? I haven’t heard too much about it in the voluminous debate on financial stability. Gone the way of Henry George, I suppose?

That a bill of this sort wasn’t strongly embraced (or even seriously considered) in a time of need suggests to me that financial stability isn’t even desired by those with power to effect it. I worry that we are being set up – that our revolutionary ire will be used to catalyze revolution in the other direction.

The Bill was introduced last session just before it ended in order to establish the record.

It will be re-introduced again very soon we are told.

The Bill establishes a public money system. It ends government borrowing by restoration of the money-creation power back to the government, who privileged the ‘other’ one-percenters with our money-creation powers for a hundred years.

Now that we are all indebted to the financial-service industrialists, we are in desperate need of a new means of providing the national medium of exchange on a scientific and legal basis to meet our public purpose needs.

The result of a switch to a public money system have been macro-economically modeled by Prof. Dr. Kaoru Yamaguchi. He finds the debt-money system is what leads to this “debt-end”, and that a debt-free system of exchange media issuance achieves GDP-potential without inflation or deflation.

http://www.monetary.org/yamaguchipaper.pdf

It’s all in the Kucinich Bill – waiting to be understood.

For the Money System Common

The last thing the Dupont’s,Rothschilds and Bundy’s want is conservatism and socialism merging again. That is why propoganda is usually decried to “rightists” extremists or “liberal-left”. Conservative leftist are the bane of globalism, anti-capitalism,extremist nationalism and economic isolationism tied into one package.

For America as a whole, this is a very “seductive” package considering we don’t need the rest of the world to survive. We call make all our consumer goods here, have enough food to feed the people and enjoy free sex to the point of vulgarity lol. Though, nobody has figured it out yet and if the bloodlines have their way, nobody will.

Dennis Malloy of KPMG killed Jane.

Dennis Malloy of KPMG is a lying murdering tax shelter thief. Dennis lied and people died. Dennis Malloy claims to be a mormon and love Jesus, well if Jesus does exist , Jesus likely won’t be impressed since last time I checked Jesus does not abide lying murdering thieves like Dennis Malloy of KPMG.

One of the many lies Dennis Malloy of KPMG told the U.S. was as follows: “KPMG Partner X hid his files in a locked cabinet”. Dennis Malloy of KPMG knew this was a lie but said it to curry favor with the new KPMG scum autocrats like Judge Holmes and the U.S. government.

Of course no one bothered to verify Dennis Malloy of KPMG’s lies but rather they threw partner X into prison to be ass raped, beaten and tortured with promises from the U.S. Government that the ass raping and torture would stop if Partner X would lie about others as Dennis Malloy of KPMG did.

Of course Dennis Malloy the lying KPMG Partner very well knew the files were not “hidden”, in fact the files had resided there for years, right where Partner X’s secretary kept them, no one even touched them after the secretary left but of course Dennis Malloy the lying Partner of KPMG did not care and his actions directly resulted in Jane killing herself by inhaling chemicals causing a painful vicious suicide (suicide is not painless) and leaving her child without a mother, way to go Dennis Malloy of KPMG, wonder what your Jesus will say to you?

Fortunately, I have all the Skadden Arps and Government memos describing Dennis Malloy of KPMG’s duplicitous lying behavior and will be releasing them soon.

Jane is dead and you are to blame Dennis Malloy of KPMG.