Even notice nothing is ever said in the mainstream media about Argentina’s economy, save that it had a big default? You’d never know the following about Argentina:

From 2002 onward, Argentina grown nearly twice as fast as Brazil, and has sported one of the highest growth rates in the world.

Its success is not dependent on a commodities boom

It has increased social spending from 10.3% of GDP to 14.2% of GDP

Inequality has fallen. Poverty and extreme poverty have fallen by roughly 2/3

What is particularly striking is how quickly Argentina’s economy rebounded after its default. From a paper by Mark Weisbrot, Rebecca Ray, Juan A. Montecino, and Sara Kozameh (hat tip reader Thomas Ross):

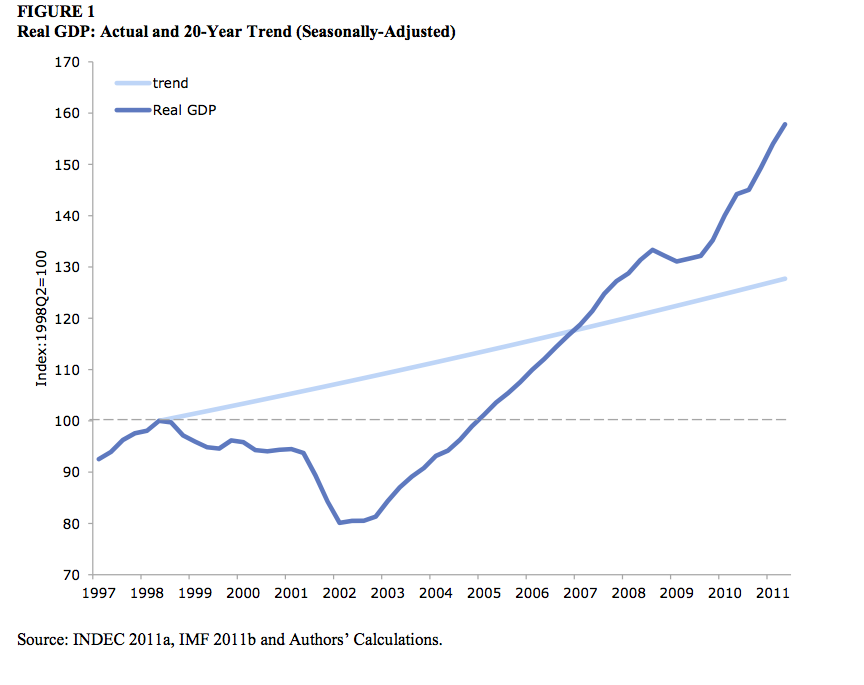

In December of 2001, the government defaulted on its debt, and a few weeks later it abandoned the currency peg to the dollar. The default and devaluation contributed to a severe financial crisis and a sharp economic contraction, with GDP shrinking by about 5 percent in the first quarter of 2002 and nearly 11% for the full year. However, recovery began after that one quarter of contraction, and continued until the world economic slowdown and recession of 2008-2009. The economy then rebounded, and the IMF now projects growth of 8 percent for 2011.

Argentina’s real GDP reached its pre-recession level after three years of growth, in the first quarter of 2005. Looking at twenty-year trend growth, it reached its trend GDP in the first quarter of 2007.

By contrast, the US economy contracted 6.8% in the fourth quarter of 2008, and shrank 2.6% in 2009. The US only now has reached its pre-downturn level of GDP, meaning nearly four years later versus Argentina’s three. In addition, Argentina has regained its trend line of growth, while it is not clear whether the US ever will. The Carmen Reinhart and Kenneth Rogoff work on severe financial crises has found that they result in “permanent” falls in the standard of living, but that has not been the case with Argentina.

Admittedly, Argentina had an advantage the US lacked, that of a reasonable level of world growth as a backdrop. But we need to stress “reasonable” not robust. The advanced economies of the world ex Australia went into a slump in the dot-bomb era, and the US and Europe were running below potential through 2004. But the data show that Argentina’s success was not export driven:

It can be seen that the role of exports is not very large during the expansion of 2002-2008. It peaks at 1.8 percentage points of GDP in 2005 and 2010, and amounts to a cumulative 7.6 percentage points, or about 12 percent of the growth during the expansion. The story for net exports is even worse, with net exports (exports minus imports) showing a negative cumulative contribution over the period. The recovery is driven by consumption and investment (fixed capital formation), which account for 45.4 and 26.4 percentage points of growth, respectively.

Notice the Argentinian example disproves one of the Big Lie about default, that foreign capital will take a hike and the consequences will be dire. Again from the article:

As a result of the default, and the refusal of a minority of creditors to accept the eventual restructuring agreement in 2005, and subsequent legal action by these creditors and “vulture funds,” Argentina has faced difficulties borrowing in international financial markets over the last nine years. Since it has not been able to settle its debt with the government creditors of the Paris Club, it has also been denied some export credits. FDI has remained limited, averaging about 1.7 percent of GDP over the past eight years, with a number of serious legal actions taken by investors against the government.

Yet in spite of all of these adverse external conditions that Argentina faced during the past nine years, the country experienced this remarkable economic growth. This should give pause to those who argue, as is quite common in the business press, that pursuing policies that please bond markets and international investors, as well as attracting FDI, should be the most important policy priorities for any developing country government. While FDI can clearly play an important role in promoting growth through a variety of mechanisms, and foreign capital in general can, in some circumstances, boost growth by supplementing domestic savings, Argentina’s success suggests that these capital inflows are not necessarily as essential as is commonly believed. And it also suggests that macroeconomic policy may be more important that is generally recognized.

Shorter version: sacrificing your economy on the altar of the Bond Gods may not be such a good idea.

The one blot on Argentina’s success record is its inflation rate, which has been as high as 31%. I’ve had Brazilian readers contend that inflation is not as terrible as we Americans have been led to believe if you have good inflation accounting (something we never developed). Unlike our experience with stagflation, it has not been an impediment to growth:

Inflation may be too high in Argentina, but it is real growth and income distribution that matter with regard to the well-being of the vast majority of the population. By these measures, as we have seen above, the government appears to have made the correct decision not to fight inflation by sacrificing economic growth. . To take one important historical example, South Korea registered annual rates of inflation similar to those of Argentina in recent years, in the 1970s and early 80s, while it traversed the journey from a poor to a high income country.

The paper closes by stressing the implications for other debt-burdened nations:

Argentina’s experience calls into question the popular myth, as noted above, that recessions caused by financial crises must involve a slow and painful recovery. Argentina’s financial crisis and collapse were as severe as that of almost any country in recent decades; and yet it took only one quarter after the default to embark on a rapid and sustained recovery. This is not only because of the devaluation and improved macroeconomic policies, but because the default freed the country from having to be continually hamstrung by a crippling debt burden and by pro-cyclical policies imposed by creditors. It is these types of policies, along with the ultra-conservatism of central banks like the present ECB, that mostly account for the historical experience of delayed recoveries after financial crises. The Argentine government has shown that this bleak scenario is just one possible outcome, and that a rapid recovery in output, employment, poverty reduction, and reduced inequality is another very feasible path that can be chosen.

No wonder the IMF and the banksters don’t want Argentina to get good press. The Eurozone countries they are wringing dry might get ideas.

“The decline is in paper values, not in tangible goods and services…America is now in the eighth year of prosperity as commercially defined. The former great periods of prosperity in America averaged eleven years. On this basis we now have three more years to go before the tailspin.”

– Stuart Chase (American economist and author), NY Herald Tribune, November 1, 1929

Paper money – all fiat money, really – has NO intrinsic value. The decline in wages is the real issue, or rather the transfer of national income from wages to capital.

While it’s true that fiat money has no intrinsic value, this is also true of every other commodity. The value does not reside in the commodity but in the minds of human beings (and probably quite a few animals but that is ignored by our human economy). Furthermore the value we ascribe to things is highly variable. After a nice satisfying dinner I might not be interested in buying or eating that cookie, so it’s value to me may be zero. After a week of starvation, I may be willing to kill to get it and eat it, or if I can’t kill I may be willing to give away every scrap of money I possess just to get that cookie.

This is why it is so hard to measure value as opposed to, say, the physical dimensions of something. My iPod classic is 4 inches by 2.5 inches and will stay that way until it is altered by some catastrophic event. But the value of my iPod is less than it was when I bought it and the value of a second iPod is lower than it’s monetary value since I can only listen to one iPod at a time.

But just as one never runs out of inches, a government that is sovereign in it’s currency can never run out of money.

Energy has intrisnic value (if we assume existence of human race).

You have nailed another one good woman.

It is my understanding that Argentina, as a country, decided to reject the Shock Doctrine foisted on them and move away from the class hierarchy that had developed with America’s Empire building there.

I would posit that it will take quite a bit more energy to depose the puppets of industry and finance here because they and the attitudes towards that “class level” in our society have more history and social brainwashing tools at their disposal…….Argentina can be lost for now, it has no nukes.

Similarly, very little is said about Iceland in this regard as well…

People who actually live in Argentina tend to site huge rule of law issues:

http://journals.worldnomads.com/safetyhub/story/72611/Argentina/Argentina-Crime

It is not exactly Mexico, but it can get pretty scary. The economic collapse impoverished a lot of people. The middle class slid down a notch.

Many small rural towns lost their train service and have become ghost towns.

An Argentinian beauty pageant contestant goes to Chili and is caught in the earthquake. She travels home in part of on foot. She makes it home, only to suffer through a home invasion robbery. Says it happens all the time, and that she felt safer in Chili.

The “recovery” in Argentina I think has some similarities to our recent “recovery”: not many people felt it.

Look at the paper at the charts on income distribution and poverty, as well as child mortality. Poverty really went down, and infant and child mortality improved, not only on an absolute level, but relative to similar countries.

That is poles apart from the US. We have record use of food stamps, rising poverty, high and sustained employment, cuts in social safety nets, and falling social indicators.

Yves,

You may also be interested in Molly Scott Cato’s work on Argentina – in particular, – Argentina in the Red: What can the UK’s Regional Economies Learn from the Argentinian Banking Crisis? http://www.ijccr.net/IJCCR/2006_%2810%29_files/IJCCR%20vol%2010%20%282006%29%205%20Scott%20Cato.pdf

Quote:

Abstract: This paper explores the growth of community currencies in Argentina following the financial collapse of 2001 and draws lessons for local economies in developed economies. The paper begins with a brief profile of the Argentinian economy, which is seen to be highly sophisticated and successful. The reasons for the banking crisis of 2001 are then explained, focusing especially on monetarist IMF policies and their disastrous effect on the real economy of Argentina. Information is then given about the nature of the Red Global de Trueque (global barter network), its link to the ecological movement, and its development into a fully fledged system of alternative currencies following the monetary crisis. Problems facing the system as it expanded, and its relationship with local political authorities, and their own alternative currencies are described. Links are then drawn between the problems facing the Argentinian economy in 2001 and those facing many local economies in the UK facing long-term recession, particularly in terms of low levels of monetisation and the low value of the local multiplier. The paper concludes that a local economy with a functioning currency under its control is in a strong position to withstand potential crises in the functioning of the global economy.

Well he Lady is way ahead in the polls. So it is possible I am listening/reading too many disgruntled sources.

The rule of law problem is common in Latin America. It seems to come from the vote broker style of street politics that the Left uses to rally support to its cause. Arguably it is throwing the baby out with the bathwater, but the Left would have a plausible argument of “Whose baby? and whose bathwater?”

Everything you say about Argentina is untrue. And, just so you know, Chili isn’t even a country. Study some Geography and History, then comment on World News.

John Larkin says: “… And, just so you know, Chili isn’t even a country.”

This statement might come as a surprise to most people living in Chili. Please explain.

Chili is a pepper. Chile is a country.

Looks like the second-world troll supplier needs to have a better interview/selection process.

My understanding is that Menem was the Argentine president who phased out passenger rail service to rural areas in the mid 90s, leaving many smaller towns without connection to major hubs.

I believe you are correct, Jim.

The US also has a poor record on the rule of law — by current assessments, about as bad as Argentina. So that’s not actually a difference between the two countries.

However, as Yves points out, on other measures Argentina is doing better.

“about as bad as Argentina.”

Gee! I was not aware that the Argentinian President claim to possess the power to assassinate his own citizens without due process of law, or the power of indefinite detention without trial; both powers are claimed to be so by our actual president of The Most Transparent Administration Ever here in the US of A.

If memory serve me correctly, Argentinians worked very hard to get rid of that after the infamous military regime. Contrary to Americans, they’ve lived through what it means to surrender freedom for illusory security.

Don’t be silly. It only counts as a ‘problem’ if the lower classes do it. The upper classes can rape, murder and pillage to their heart’s content! The law was never meant for them.

Typical biased Yank article, targeted against the eurozone. Argentinians might argue differently about the recent “success”. BTW, why is it that Yanks apply completely different financial standards with Eurozone than to themselves?!

Standards they would fail even more badly than Europeans, like productive differences between US states. Much higher than in the eurozone. Still Americans argue the differences are so high in the eurozone that it should break apart. So where that leaves USA, it should break apart even faster?

Eurozone as whole is less indebted than either US or Japan, trading is much more balanced with the rest of world and eurozone economies actually make much more useful products and services unlike US and UK.

This article is about Argentina. WTF are you talking about?

Jesus I glad someone said something and way to net out Frank.

There’s a grand total of one sentence mentioning the Eurozone. Did you read it one hundred times and then conclude the post was all about you?

Yeah the manners suck but so does the situation but we’re working on it. We’ll get back to ya. Nothing but love.

America

“Still Americans argue the differences are so high in the eurozone that it should break apart. So where that leaves USA, it should break apart even faster?”

Knowledgeable US criticism of the eurozone is based on the fact that it is a monetary union without a corresponding fiscal union. That’s more important than the productive differences.

Should a US state face default there would be far greater confidence that the US federal government would find some fix than there is that Germany, etc. will deal with a Greek default.

As an American I really don’t care how the eurozone deals with its problems as long as there isn’t another Creditanstalt.

TimoT argues, “Argentinians might argue differently about the recent “success”

I ask, what do today’s presidential election results suggest?

“Standards they would fail even more badly than Europeans, like productive differences between US states. Much higher than in the eurozone. Still Americans argue the differences are so high in the eurozone that it should break apart. So where that leaves USA, it should break apart even faster?”

Comparison to the USA doesn’t argue that the EZ should break apart. It argues that a monetary union without a fiscal and political union is unsustainable. They will be forced to go all in or fold.

As it stand now the euro isn’t a union it’s a chain gang.

Yes, they ‘differ’ so much they just handed their leader a 37% voting margin in elections. Clearly, Argentina is hell on earth.

I was in Argentina, work related, in 1989. I visited BA, and Cordoba in the interior. The people were very friendly, although there were armed soldiers in the airports. The BBQ was also extraordinary, but dinner could not begin earlier than 9:30pm. The inflation rate was so high, that proprietors labeled their merchandise with letters, instead of prices. That way they could change the prices once or more times a day easily, by changing only one reference paper that defined what the letters stood for. The workers I knew got raises every two weeks. I hope those days are all in the past for that wonderful country.

SICKENING post, Ms Smith.

http://www.washingtonpost.com/wp-dyn/content/article/2009/08/15/AR2009081502758.html

So some fudging of inflation numbers means what exactly? This sort of manipulation goes on all the time in the US. This story at, of all sources, the Washington Post is a hit job against a country that has, at least for itself, broken the back of the international money mafia. I’m sure there is substantial poverty in Argentina. How bad do you think it would be if they were still paying the IMF or whoever they “owed” all that blood money too? The fact that in 10 years the country hasn’t become perfection itself is not an argument for going back to debt slavery to the fucking “bond markets” hit men. Compare Argentina to the story from yesterday’s Guardian about what is going on in Greece and tell me what’s better.

From the article:

“Economists say the official inflation rate of 8.5 percent in 2007 was really about 25 percent. In the 12 months ended this June, the INDEC put the rate at 5.3 percent, but economists say it might be three times higher. Argentina’s vaunted economic growth this decade might have been exaggerated, too. Credit Suisse said the 7 percent expansion the government reported last year is likely 2 to 3 percent lower…

The controversy has raised questions about the government’s official poverty figure. The INDEC’s calculation is 15.3 percent; the Catholic Church says it is closer to 40 percent. After Pope Benedict XVI called poverty in Argentina a “scandal” this month, the government acknowledged that as many as 23 percent of Argentines might be poor.”

So much for miracle! This should be the model for Greece?! But anything goes when trying to trash the euro, right?

We’re supposed to accept that Argentina is going to hell because anonymous economists and some old guy in a stupid hat say so?

Looks like you only read the headline.

Guess what? Argentina has high inflation, AND has great growth, a big reduction in unemployment and poverty, and improved its social safety nets too.

The post acknowledged the high inflation rate. You seem to have missed that part. It also pointed out that South Korea also had a high inflation rate while it was developing with no adverse long term outcomes.

And there are plenty of right wing economists that claim, and continue to claim, Chile’s economic reforms under Pinochet were a great success story. If you believe that, I have a bridge I’d like to sell you.

The proof is that the incumbent government was reelected by a BIG margin today. If things were really as bad as the Post tried to claim, that would not have happened. Making people poorer or failing to produce a rising standard of living does not lead to big popular victories.

So tell me what is wrong with inflation in Argentina, exactly? The burden is on you to prove how high inflation has hurt Argentina, given the otherwise stellar results.

Mexico’s had very low inflation for over a decade. And during that same decade, it’s experienced annual real GDP/capital growth of about 0.7%.

Okay, guess we don’t have to take you seriously. Fact is, Chile is miles ahead of Argentina in poverty reduction and their economy isn’t wholly dependent on exports.

Moreover, if inflation had been 25% v. 8.5%, that means the economy would have been in a VERY steep contraction. The evidence does not appear to support that.

So even if the Argentinian government has been fudging data, the critics appear to be at least as badly.

Unbelievable! You guys just ignore all evidence to the contrary?! Typical arrogant New Yorker.

That website (inflacionverdadera.com), comparing regularly 150 products in supermarkets, is just making up the inflation rate?!

@TimoT

And you accept all the evidence presented to you in an impartial and totally Spock-like analytical manner, while respecting the Prime Axioms of the Vulcan School of Logic?

Yeah right!

Tickle me Timo!

You didn’t even read the article, did you? You just read the headline, and that was good enough for you. They accused Argentina of doctoring data in 2007, more than 5 years after the end of the crisis. By 2007 Argentina had already recovered from the crisis, and returned to trend growth.

reporting 10% inflation when it’s 25% is not trivial, it means the *real* growth numbers are vastly overstated.

As for Greece, real incomes there are 65% higher than Argentina.

Did you read the article? All the growth figures are real. GDP growth is always reported as real for international comparisons.

And unlike China, Argentina’s statistics add up.

I’ve had Brazilian readers argue high inflation isn’t a problem once you get good inflation accounting in place and businessmen can adjust prices quickly enough.

How real is the “real GDP”? seems to be JCK’s point. It depends on whether the GDP deflator is the true rate of inflation or the doctored one. It’s not clear which was used in the study. Either way, “sickening” your post was not.

To get from nominal to real, you subtract inflation. So if inflation is understated, real is overstated.

Nominal growth = 20%, Official inflation = 10% ==> Official real growth = 10%.

Nominal growth = 20%, True inflation = 25% ==> True real growth = -5%.

Or, you could measure growth through objective, non-financial measures, like people did 100 years ago. Industrial production, food production, housing supply, standard of living, poverty rate, hunger.

Argentina’s been doing well on the real measures. Well, anyway, it’s been improving rapidly on the real measures; the US has been declining on the real measures.

“All the growth figures are real”

LOL, only if the inflation figures haven’t been cooked and they have.

At least one person behind this paper is a well-known cheap whore for Hugo Chavez and the Argentine kleptocracy.

http://goo.gl/T1y9R

That’s worth mentioning.

That’s ad hominem. That is generally a sign of a lack of a substantive argument. And you’ve provided nothing to prove your assertions re Argentina. You don’t like the conclusion and are making unsupported statements.

And the US cooks its GDP numbers worse than anyone, Our GDP is overstated by 22% as of 2005 and since these adjustment mechanisms continue to be used it, it has probably gotten even worse:

Let’s look at GDP. That’s a fundamental figure, surely beyond question or compromise. Really? Our GDP stats include something called a “hedonic price index” basically to allow for the fact that computers are becoming more powerful at lower costs. In essence, the US grosses up the price of computers in its GDP reports to adjust for the fact that computer prices are dropping.

These adjustments are significant. The US is the only country that uses hedonic indexing. The Bundesbank complained that if they calculated GDP the way we did, their GDP growth would be 0.5% higher. And the cumulative distortion is massive. In 2005, Michael Shedlock contacted the Bureau of Economic Advisers and they supplied some dated information on hedonics (including a spreadsheet). Even so, he found that hedonic adjustment to GDP was 2.257 TRILLION dollars, or 22% of then-current GDP.

http://www.nakedcapitalism.com/2007/05/america-banana-republic-watch.html

GDP’s actually such a hard number to measure that I don’t take it seriously.

“News from 1930” was following the WSJ from 1930. Notice that at that time they measured the economic situation in terms of steel production, grain production, railcar movements, etc.; industrial, agricultural, and transportation measures which are hard to fake. Soon, the employment rate was added. Nowadays we would want to add measures of standard of living (housing quality, access to food, etc.)

This stuff is real, and relatively easy to measure. In contrast, GDP is a computed figure based on financial reports — *and they’re fraudulent*. The current claims that finance contributes some huge percentage of GDP should be the giveaway: finance actually doesn’t contribute *anything* to the economy directly, so this shows that it’s just not being measured right.

If this were true, then the ruling party would be in deep trouble because you can’t hide inflation from your own citizens. They are going to notice it no matter what you do, and that number combined with reported GDP growth (which is extremely difficult to ‘fake’) would indicate declining wages. electorates differ from country to country, but the one thing most of them agree on is that leaders who preside over declining wages are forced out one way or another.

Which is to say, the notion of 25% inflation is BS.

As far as I know, FerFal would have a very different opinion on Argentina’s success story. And he is the author of “Modern Survivalist” website as well as the book “Surviving the economic collapse”.

Based on opinions and experiences of FerFal, I would say that saying “Argentina is a success story of default” is like saying “Somalia is a success story of minimalist government”.

Iceland may prove to be a success story. It already has had some limited success.

No country with over 20% inflation will ever be a success story in the long term.

Argentina was extremely lucky that their main export was food, and food prices exploded during that period because the Chinese started to afford meat.

The article starts with:

“Its success is not dependent on a commodities boom”

But they don’t elaborate. Well, if you care to look at stats, their main export is food and food prices soared. So, yes, their success is dependent on a commodities boom.

Not just food, but energy, too, is a major export if I recall, and oil took off around that time. Brazil is also its largest trading partner (if memory serves), and Brazil’s GDP more than doubled since the time of Argentina’s default.

So yes, Argentina got very lucky, and it had a sizable but not enormous pension obligation when it defaulted (again, I’m just going by memory–I had just barely learned how to drive around that time, and Argentina wasn’t my foremost concern…).

Having said that, Argentina defaulted when it realized the pointlessness of spending needed cash to keep a stupid currency peg that it could never hope to maintain. Eventually, the government realized that it couldn’t just keep throwing good money after bad and succumbed to the inevitable.

Greece and the other PIIGS are facing the same inevitability. Why delay it and continue to throw good money after bad? Just default, deal with the hell that comes along, and start fresh. I think it’s a little absurd to assume that Greece will recover as quickly as Argentina did, but it will not recover at all if it doesn’t recognize reality first…

JMO, of course.

@Typing Monkey,

the only incentive for Southern Europe to stay in the euro is to hope for the best, to hope that a European economic government forms with the generosity to help Southern Europe.

That hope is fading fast, so you may be right that there are not many options left for Greece and others regarding the euro.

However, once you have devalued, you do have different courses of action. You can liberalize your economy, stabilize inflation, and reform your political system to make a less corrupt, fairer, more democratic society.

Or you can do just the opposite and hope for a commodities boom. That’s the Argentinean way.

Will Spain and Greece reform themselves after a euro devaluation? If their political systems do not agree on fair burden-sharing, democratic reform and wage adjustment inside the euro, will they be able to do so in a stabilization plan after locals lose their lifetime savings?

Did any of you bother reading the paper? Exports were less than 1/4 of GDP growth only 1.8%! And net exports were a NEGATIVE contributor.

And of that total, over 60% are manufactured goods, not commodities.

I’m really appalled in the way readers resort to prejudice rather than dealing with data.

Sorry, Yves, but exports are 20% GDP, and most of them are related to oil and foodstuffs (categories “Mining”, “Agriculture” and “Manufacturing: food products” in Fig. 3).

If food prices hadn’t soared, ceteris paribus, Argentina would have had to run a large trade deficit to finance their current level of imports. This does not seem much realistic, since there are no capital inflows, only capital flight.

We read the paper, but I believe you misread it.

As Diego states, Figure 3 on page 7 of the Weisbrot paper shows that in 2010, exports were 18.4% of Argentine GDP. By comparison, US exports were only 11.2% in GDP in 2009, indicating that exports are of considerable strategic importance to Argentina.

Table 1 on page 6 of the Weisbrot paper shows that exports contributed 1.8% out of 9.2% total GDP GROWTH. This does not mean that exports are 1.8% of GDP. It means they contributed one-fourth of the GDP growth in the year 2010. How the authors can conclude that this is trivial and unimportant is beyond me.

Without its trade surplus, Argentina’s GDP would have grown 7.4% instead of 9.2%. But more importantly, it would run a slight current account deficit, and (lacking the ability to finance it externally) would have been obliged to draw down its international reserves of some $50 billion. This is quite contrary to Argentina’s strategic policy, which seeks to accumulate a growing cushion of prudential reserves, given that it still lacks much access to international borrowing.

Yves Smith says:

“Did any of you bother reading the paper? Exports were less than 1/4 of GDP growth only 1.8%! And net exports were a NEGATIVE contributor.”

Jim Haygood says:

“We read the paper, but I believe you misread it.

Table 1 on page 6 of the Weisbrot paper shows that exports contributed 1.8% out of 9.2% total GDP GROWTH. This does not mean that exports are 1.8% of GDP.”

I’ve never seen such violent agreement.

Saying that net exports were a negative contributor only means that from 2009 to 2010, imports increased at a faster growth rate than exports (though there was still a trade surplus).

Not coincidentally, as discussed on page 14 of the paper, the real effective exchange rate increased from 2009 to 2010. The effect on the trade surplus was exactly what one would expect.

Can you read a table? Either you can’t or you are making this up.

Look at Table 1. Every year since 2002, the sum of import and export growth share is NEGATIVE. The ONLY exception is 2009, and that is probably crisis related.

This is the opposite of what you have been claiming.

To amplify on the theme posed by Diego Méndez, this quote from the paper by Weisbrot et al is a bit odd in its emphasis:

‘The government appears to have made the correct decision not to fight inflation by sacrificing economic growth.’

In fact, since Argentina remains effectively cut off from international bond markets (although it has settled with 92% of bondholders eligible for the 2005 swap), its policy has focused on keeping the peso relatively weak to ensure export competitiveness and (crucially) a trade surplus.

To accomplish this, the central bank of Argentina runs a dirty float. Until this past summer, it was constantly buying US dollars, paying for them with newly-minted pesos which kept the peso money supply booming at 30%-plus annual rates. Quoting from the central bank’s biannual Financial Stability Report for 1st half 2011 [posted in English on the bank’s website from 2004 forward]:

In 2010 the trade [surplus] amounted to US$ 12.06 billion, making possible a positive result for the current account for the ninth consecutive year.

http://www.bcra.gov.ar/pdfs/polmon/bef0111i.pdf

Unlike neighboring Brazil, which experienced severe currency strength, Argentina’s dirty float succeeded in keeping the peso relatively weak. However, the price paid was money supply growth in the 30% p.a. range, which in conjunction with 9% GDP growth produced inflation in the 20% range [although official figures from Indec never exceeded 10%. This was enforced by firing officials who refused to fudge the inflation numbers.]

BCRA confirms what Diego Méndez said: ‘Foodstuffs were the leading component of the rise in domestic prices, in 2010 accounting for approximately 40% of the increase in retail prices.’ [page 29]

Relevant to Greece’s plight is the strong recovery of the Argentine banking system. After a couple of rocky years in 2003 and 2004 following the devaluation, the banking system has restored its solvency and is yielding — according to central bank figures — almost pornographic profits. BCRA claims that the consolidated Argentine banking system (including both private and publicly-owned banks) achieved a Return on Assets of 3.5% in 2nd half 2010! [Table IV.2, page 56] An ROA above 1% is considered good in the US context.

DID YOU READ THE DAMNED PAPER?!?

Go read it.

Argentina’s success has NOTHING TO DO with its cheap currency. The export sector (exports less imports) had a NEGATIVE impact on growth. The cheap currency was a net drag.

Have you been reading the BCRA’s biannual reports that I linked?

They make clear that: (1) Running trade and current surpluses is essential since Argentina cannot avail itself of adequate external financing; (2) The peso is managed with a dirty float to maintain export competitiveness and build foreign exchange reserves [currently in the $50 billion range]; (3) Export taxes are an important source of revenue, e.g. the Federal Solidarity Fund which distributes 30% of export taxes on soybeans and soy derivatives to the provinces.

Do you recall that president Cristina Kirchner had a MAJOR BATTLE with Argentine beef producers in 2009, in an attempt to impose a higher, floating-rate tax on beef exports? No president would risk her political career over an export tax, if exports were such a supposedly trivial matter. This was the biggest, most bruising battle of her first term (she will be re-elected today).

The paper represents one opinion. I think the author is quite wrong in his conclusion, missing the clearly articulated policies of the Argentinian authorities themselves. In their own way, Argentines are as fanatical as Japanese in their ‘export or die’ mentality. Exporting beef and ag products is WHAT THEY DO; exports are the source of otherwise unavailable external financing; thus, exports are strategically critical and drive Argentine policy. From the BCRA:

http://www.bcra.gov.ar/pdfs/polmon/bef0111i.pdf

Jim,

I don’t know how many times I need to tell you to go read Table 1. The trade sector was a NEGATIVE contributor to growth in every year since 2002 save 2009.

Now many of those imports are no doubt unavoidable (energy, technology). So exports would be imperative given 1. The need for FX and 2. The need for those particular imports.

Argentina’ recent economic track record no doubt INCLUDED exports, but exports were not the driver of growth. The data is very clear on that issue.

@Yves: that table is simply wrong. That exports are a massive part of Argentina’s growth is simple fact.

Amazing how many people deny facts. South Korea did have inflation of over 20% and has prospered.

Yves, many countries had inflation over 20% during the 70s. My point is: those countries which tackled the inflation problem (like South Korea and Spain), prospered.

Those which didn’t (like Argentina), did not prosper *UNTIL THEY TACKLED IT*. Argentina had to peg their currency to the dollar in order to tackle inflation and prosper. They couldn’t grow before that, and if hyperinflation takes hold once again and Argentina’s politicians do not tackle the inflation problem (once again), Argentina will get Argentinean, financially (once again).

Paraphrasing Krugman, facts have a known anti-hyperinflation bias.

Jesus H Christ on a pogo stick …

Hyper-inflation has no relation whatsoever with run-of-the-mill inflation, high or low or negative. 20 or 25% inflation is not hyperinflation. It’s high inflation.

Hyper-inflation is 1000% per year or per month. Hyper-inflation is not an economic problem but a political problem, the product of a total lack of trust in the government and the currency. The currency is literally worthless, and its fall in value is only limited by the difficulty for those who hold some to get rid of it. This is where Argentina was up until 1989. Inflation was 100% and sometime even 200% a month.

But this is not the issue now.

As I see it, 20% inflation in the long term is incompatible with a high savings rate, foreign direct investment, and a high investment rate; hence, it is incompatible with having a competitive manufacturing industry and being an advanced economy.

You can have high inflation for a couple of years, maybe some more time. But you have to tackle this problem as soon as it is politically feasible, or your productive economy goes down the drain.

Luckily, Argentina is benefiting from a very high & growing food prices. Will they last forever?

“Verboten”? Argentina was the subject of NPR’s “Planet Money” podcast last week, and they ended with a description of Argentina’s recent success. They also described what Argentina had to go through to get to that point. We Europeans have the strange aversion to having all our savings devalued by 80% overnight …

We Europeans have the strange aversion to having all our savings devalued by 80% overnight …

The alternative is … ?

Europe isn’t rich enough to go through a Japanese-style experience of two lost decades just to keep zombie banks afloat. Default is pretty inevitable, I think.

The alternative is … ? TM

Put the banks out of the counterfeiting business (so-called “credit creation”)and bailout the entire Euro Zone population equally, including savers, at a rate that just equals and tracks the repayment of existing credit. Continue the bail out till all private credit debt in the Euro Zone is paid off.

The above would fix everyone from the ground up, including the banks, without serious price inflation risk and without screwing the savers.

F. Beard,

The Bailout amount should not be based on credit paid off. It should be based on the inflation rate. Based on the resulting inflation rate (once private credit creation is outlawed) is what your constraint is. That means, the bailout can be even higher (or lower) than the credit paid off.

And even after all private credit is paid off the checks can continue as long as there is no inflation.

However, if peak oil is true. You will get inflation.

Mansoor

The Bailout amount should not be based on credit paid off. It should be based on the inflation rate. mansoor h. khan

That is a more difficult sell since price inflation measurement is controversial.

And even after all private credit is paid off the checks can continue as long as there is no inflation. mansoor h. khan

That is an even more difficult sell.

I have been interested in Mr Beard’s comments. But don’t understand many details — feel like I started near the end of the book.

One example: how does it bail out savers if you bail out based on credit paid off? What if there is no debt, do the people still get a check?

I raise this first b/c otherwise people will say it’s rewarding irresponsible behavior (and we can’t have that for people, only for banks).

how does it bail out savers if you bail out based on credit paid off? What if there is no debt, do the people still get a check? diddywa

Yes, every adult citizen would receive equal bailout checks. The checks would taper off over time to $0/mo.

Based on mortgage payments alone, every US adult citizen would initially receive $306/mo. The repayment of student loans, car loans and credit card debt would increase the amount of that payment but I don’t know by how much since I don’t have those figures.

I raise this first b/c otherwise people will say it’s rewarding irresponsible behavior (and we can’t have that for people, only for banks). diddywa

Agreed. And savers have been cheated – of honest interest rates.

F. Beard said”

“That is a more difficult sell since price inflation measurement is controversial.”

Yes. But long term we have to teach humanity that in a money economy Say’s law is not true (or anywhere near it). What workers get paid and even what business owners make even if completely spent is not sufficient to use-up (liquidate) the production capacity of a modern economy.

That is what banks do they issue credit (new currency) to use-up this slack capacity of the economy. But there is no reason to have banks do this (this is what leads to recessions/depressions) as peak credit causes no more ability to borrow and lowered production of goods and services due to lowered demand (spending).

For centuries banks have propagated this lie. The proper thing to do is to come up with acceptable way to measure inflation and let the government (not banks) use-up the slack capacity of the economy for social good which could include regular monthly checks to the citizenry.

Mansoor

The proper thing to do is to come up with acceptable way to measure inflation mansoor h. khan

Measuring price inflation will always be a matter of opinion. That is why we MUST allow alternative currencies for private debts. That way, people could choose to use fiat for private debts if they thought it was well managed or use a private currency if they thought it was not.

and let the government (not banks) use-up the slack capacity of the economy for social good which could include regular monthly checks to the citizenry. mansoor h. khan

Alternative private currencies would allow government to spend freely without damaging the goose that lays the golden eggs – the private sector.

F. Beard says:

“Alternative private currencies would allow government to spend freely without damaging the goose that lays the golden eggs – the private sector.’

Repealing legal tender laws, the income tax, the capital gains tax which is what would be required for “alternative private currencies”.

I very much doubt we could have a strong central government with an expensive military force to deal with the likes of Hitler and Stalin.

Mansoor

Repealing legal tender laws, the income tax, the capital gains tax which is what would be required for “alternative private currencies”. mansoor h. khan

The income tax could remain since every private currency of consequence would have a free market exchange rate with fiat. The capital gains tax would have to go though.

I very much doubt we could have a strong central government with an expensive military force to deal with the likes of Hitler and Stalin. mansoor h. khan

Hitler and Stalin were symptoms of our so-called “free market capitalism” which is in fact banker fascism. If we abolish banker fascism we can have considerable hope that there will be no more Hitlers and Stalins, at least during our watch.

So when you say people get a check based on debts paid off you mean debts paid off in the aggregate, not what they personally pay off. Oh.

So when you say people get a check based on debts paid off you mean debts paid off in the aggregate, not what they personally pay off. difddywa

Precisely. I don’t know the amount of total monthly debt repayment (mortgages, student loans, credit card, auto loans, etc) in the US but that is the amount that could be distributed equally to every US adult citizen. Of course the amount would shrink over time as debt was repaid so as to keep the money supply constant.

You all should have had a deeper aversion to separating monetary policy from fiscal at the ECB. Do you all not understand the horribly broken system you all have created? Germans aren’t ardent and Greeks aren’t lazy. You have basically created a system which holds fiscal policy ransom to private banking interests and renders monetary policy impotent. Once again, I am rooting for a Greek default, and I hope they flat out refuse to repay much of their so-called debt too. Oh the humanity!

One report on NPR no doubt in response to this article.

The head of Argentina’s central bank was in the US last year and made presentations on Argentina’s results. She got a hearing only in places like the Minsky Conference (as in heterodox economists) and the MSM said nada.

The story in not new yet you are hearing about it only now in select venues.

Yves, the Planet Money NPR piece is actually a remarkable example of anti-Argentina journalism supporting your thesis. It consists of about 15 minutes of fear mongering (“disaster!”, “catastrophe!”) followed by a short admission that it wasn’t all bad. Talk about burying the lede.

The original podcast and introduction are here[1], and their disingenuous reply to Dean Baker and Paul Krugman is here[2]. I’d love to see you do a propaganda analysis of the piece, but it’s probably not worth your time, especially since there doesn’t seem to be a transcript.

[1] http://www.npr.org/blogs/money/2011/10/14/141365144/friday-podcast-the-price-of-default

[2] http://www.npr.org/blogs/money/2011/10/19/141499114/argentinas-default-contd

NPR Planet Money – neoliberalism for Gen-Y.

Look into Adam Davidson’s , um, sensual servicing of Ken Rogoff: http://www.npr.org/blogs/money/2011/07/20/138518262/the-tuesday-podcast-how-much-debt-is-too-much . Anyone with a quick gag-reflex, be advised.

Only you rich Europeans with savings have an aversion to having your savings devalued by 80%.

The poor Europeans living paycheck to paycheck don’t.

Now, think about that. I realize a larger fraction of Europeans *have* savings than in the US — but in the US well over half the population is living paycheck to paycheck or worse. So in the US the democratic vote would, very much, be to devalue savings in order to get people jobs with good wages.

I have to agree with Diego. Having studied Argentinian political economy, I feel that the paper understates 2 things.

Inflation: It really is rampant and has been so for at least 5 years. I lived in Argentina in 2008, went back in 2009 and prices were up 50% on many things. The government clearly massages the figures. I tend to think that high inflation (say, below 40%) is not a bad thing in itself, but the continuation of this inflation over many years is sure to have an negative impact on society, especially the poor.

Commodities: Argentina has benefited greatly from the worldwide commodity boom. This is the case with Latin America in general (history repeating itself once again) and does not bode well for the future. Argentina exports huge amounts of soya and others foodstuffs (wheat, lemons, meat) and as Diego mentions has ridden the wave of price increases. It had also benefited from the growth of Brazil, its largest trading partner.

That is not to say that the general point about devaluation is flawed- it is an important point and Iceland provides another good example. But the phrase-

“Argentina’s experience calls into question the popular myth, as noted above, that recessions caused by financial crises must involve a slow and painful recovery”

overstates the point I think. Yes, growth resumes quickly but the recovery was still painful and slow. Argentinians suffered immensely from the crash, the middle class and the poorest in society are sometimes still recovering. While the chart shows a fall in poverty and inequality, Argentina is still immensely unequal (more so than the US on some measures).

The most interesting point for me is the position of the IMF in the case of Argentina and Greece. In both places the electorate was radicalised against it- to me this suggests that Greece may follow the Argentinian path (big haircuts, failure to repay creditors) if it defaults and is given a sovereign choice of how to recover. While some anglophone newspapers do not look at Argentina closely, the Greek newspapers do.

Argentina has benefited greatly from the worldwide commodity boom. This is the case with Latin America in general (history repeating itself once again) and does not bode well for the future.

Why is this a bad thing? Canada and Australia are benefiting from a commodities boom, and they are among the most prosperous countries in the world. And this commodities boom likely has at least another two decades to run (with the inevitable blips downwards), so the future for Argentina could be very, very bright.

Again, jmo.

@Typing Monkey- it is not necessarily a bad thing to benefit from the boom, but the key to my point is ‘yet again’. There is precedent for a boom in commodities helping Argentina (and other L.Am countries) grow fast, the economies did not diversify and crashed afterwards. Argentinian economic history is sadly a case of several booms and busts. I think the same thing is possible again given the policies of the political class.

As I’ve said repeatedly above, the data disproves your beliefs. Look at the breakdown of GDP share. Argentina is as net importer, gross exports are less than 20% of its GDP growth, and most of those (over 60%) are manufactured goods

The data disprove your beliefs. People think of Argentina and they think pampas and beef. Please deal with the facts.

Argentina is NOT a net importer, unless you disbelieve its central bank. See Chart II.6 on page 29 of this paper. It shows that Argentina has run a consistent trade surplus since 2001:

http://www.bcra.gov.ar/pdfs/polmon/bef0111i.pdf

Concerning manufactured goods, the relative cheapness of the peso versus the strong Brazilian real has boosted exports of automobiles (produced mainly in the central province of Córdoba) and white goods to Mercosur trade partners, primarily Brazil.

Argentina’s greater success in keeping the peso cheap, relative to other Mercosur currencies and particularly Brazil, has facilitated its manufactured exports.

Imagine the capabilites of WAPO or Huff Post Readers! Yes, Argentina is beef and pampas and Australia is Kangaroos, Vegemite and Holdens…. Hard to believe the inability of readers to read an article, tables and draw factual conclusions. Yeesh. Maybe BRyan Kaplan is correct–we should parcel out votes based on rudimentary skills. Have spent a lot of time in Argentina and its a great place. The lack of cosmopoltism or total prejudice and solipsism of even somewhat educated americans is stunning…..

Greeks are lucky to be inside eurozone. Without it the Drachma would have crashed, widespread bank runs and into eurozone and most Greek banks would have collapsed.

Some economists still continue believing currency devaluation is the answer. If that is the case why USA has not broken apart? It has even bigger income differences between states and inside states than in the eurozone.

At least Greeks have their savings still intact. Argentinians lost their savings and are still struggling ten years later. Argentina had to even enforce strict withdrawal limits back in 2001 and banks were even closed for weeks!

Thousands of factories went bust. Go to Youtube and search for “La Toma”. They went through much much worse than Greeks are now going through.

If Greece had stayed out of the Eurozone there never would have BEEN a debt crisis.

You are either ignorant or lying. I just landed from Barcelona and SE Spain, where the economy is also in shambles. Spain, Ireland Portugal, and Italy all threaten to cripple the euro without Greece.

Without GERMANY there would be no crisis, as they are the true major issue… Their exports combined with the Euro peg allowed the PIIGS to accumulate the debt in the first place. Note- I am not blaming Deutschland or their people… Only suggesting that the only country who could and can keep this going is Germany… With French support.

As from the beginning, this as always been a banking crisis, enabled by a currency peg.

You would see the same disparities in wealth and income if you traveled from small towns in Alabama and Mississippi to Palo. But thanks to the permanent federal fiscal transfer from the taxpayers of Palo Alto to Mississippi, the situation is sustainable.

My point? Those who argued that Spain and Greece would eventually be as productive as Germany are wrong. If it hasn’t happened in the USA, why should it happen in the EuroZone.

And if it’s not going to happen, the currency peg is unsustainable.

Unless Europe agrees to become the United State of Europe, and Germany thereby becomes one state of 17.

Greece is experiencing a debt crisis because it has surrendered its sovereignty and adopted a foregin currency which it does not control. Had it stayed with the drachma it could have serviced its debts without depending upon other countries for emergency loans.

At this point the EMU members have two options: either proceed to fiscal union with a currency transfer system to deal with problems like this, or break up. I honestly don’t give a damn which, but this dalliance with being a half-assed United States of Europe is destroying your member countries’ economies.

Boom.

You are effectively a troll with that Finnish-sounding name as a disguise. You keep going on and on about the “imbalance” among American states, as if they were somehow comparable to European sovereign countries. Do you even understand how EU is structured? One of the major reasons for this European quagmire is exactly that the EU countries, particularly the ones in the euro zone, are NOT AT ALL like the states in the US.

Your entire argument is based on an irrelevancy.

I agree with you, Yves, that default is better than extend and pretend. Today’s problem however is a much larger issue with that many mainly western countries over-indebted to such a high degree. The reason I say this is that once default is selected by many countries all the pension funds will suffer seriously and consumption will most probably collapse seriously. The present crew of leaders do know the consequences of letting those countries default but medium to long term, I do not think that they can avoid the final outcome. That is reason for me to be extremely cautious at this point in time about my investments. The real resolution still lays ahead and will not be a pretty sight.

What do other people say about this — about pension funds. I don’t know enough to guess. Is it possible the banks were saved in the U.S. to save the pension funds? Or is it partly a red herring?

If European banks are allowed to ‘go down,’ (whatever that means exactly), does that mean European pension funds go broke?

This was brought up the other day and no one responded that I saw.

By the media avoiding this story, I take it you mean other than Krugman (who had a similar graph on his blog June 23,2011) who has discussed the issue a half dozen times and you’d be right.

What differences do you think are likely since Greece doesn’t control it’s own currency? They do have the same propensity for lying about their official numbers, so there is that.

As compared to Greece, whose debt-to-GDP ratio is in the 120% range, here is where Argentina stands now (according to the central bank’s Financial Stability Report for 1st half 2011, page 45):

http://www.bcra.gov.ar/pdfs/polmon/bef0111i.pdf

I suspect BCRA omitted provincial debt, which is also important. But third party sources put Argentina’s overall public sector debt-to-GDP ratio at around 50%. This is what Greece needs to shoot for, if it’s ever to emerge from austerian depression.

Public-debt-to-GDP ratio has been demonstrated to be totally uncorrelated to, well, anything economically interesting.

Reinhart tried to paper over that fact, but unfortunately that’s the actual result of looking at her data.

It’s just not a meaningful number. It has nothing to do with anything.

Argentina would not have recovered without genetically modified soy production. Agricultural exports are highly taxed and the proceeds redistributed with the effects described in the post.

Ongoing high rates of inflation tend to induce a marginal propensity to spend. Argentina officially under-reports its rate of inflation in order to manage its interest burden on inflation indexed bonds. These things make calculation of real GDP difficult.

A bit of history is important. Argentina’s defaults came after a period of IMF-promoted privatization undertaken by a corrupt political regime. Excessive indebtedness was an inheritance from an earlier ultra right military dictatorship under which both money and people disappeared.

It is widely believed that in the moment of crises, I mean the run on the banks, the banks illegally repatriated dollar deposits to their foreign affiliates and holding companies. The banks were closed for several weeks, leading to business failures and plunging real estate values. When the banks reopened, dollar deposits were redeemed in pesos at 30 cents on the dollar. Before the crisis, dollar-peso parity was the rule, and it lasted so long as there were government assets to privatize.

Argentina has a unique political tradition, Peronism, which, among other things, does concern itself with the poor, and is also aligned with organized labor, amenable to crony capitalism and enrichment of the political class and willing to bend the rule of law to its purposes.

Argentines have experienced very high rates of inflation, and cycles of booms and busts. High highs and low lows. They

do not expect long periods of price stability, moderate interest rates and low unemployment.

Given the timing of its default and its unique background, the Argentina economic experience is not highly applicable to the Greek situation today. Sociologically speaking, it may be interesting for what it suggests about a “post default mentality.”

In these stories about how Argentina survived its default so well, we are seeing a rationale for what is about to happen to Greece. It’s like the CEO who suddenly announces that a bankruptcy process has some attractive qualities, after weeks of categorically denying that there is an unsolvable problem.

“It’s like the CEO who suddenly announces that a bankruptcy process has some attractive qualities, after weeks of categorically denying that there is an unsolvable problem.”

So true…

This is one of those blog posts where the comments are better than the initial blog. I was just in Argentina visiting bankers and it is a topsy-turvy world there with nominal bank deposit rates in the single digits, investment grade borrowing rates in the teens and inflation in the 25-30% rate. You also have an insane government – about to be re-elected – which just confiscated the entire pension plans of the entire nation and is promising to pay them out in the future while continuing to collect the pension payments from workers, which is why the federal government’s fiscal position is acceptable. The population is so afraid of confiscation that all savings are poured into real estate, which is of course more difficult to seize than financial assets. As others have posted, the country has also benefitted from rises in prices of natural and agricultural products. I sincerely doubt that Argentina is a model for anything, frankly. It’s a very weird country in almost all respects.

Yves – I think you’d make your points stronger by adding some nuance to the picture and cutting out the polemics.

The government just won the election in a landslide. You may not like how it looks, but the population thinks this is a successful program.

China also pays vastly less than its inflation rate on bank deposits, it guarantees that they lose out to inflation in a serious way. China has been running that model for years.

The government also has also enacted strict restrictions on media.

http://www.nytimes.com/2009/10/11/world/americas/11argentina.html

Without a free press there is no such thing as free elections.

Argentina as an example of anything! Too funny. 31% inflation is not that bad! Lol.

Argentina will collapse yet again as it always does since the Peron madness started. The key template for the US vs Argentina is from 1850. Everything else is cherry picking to support the absurd position that Argentina is a well run country.

When the adrenaline from this latest default and their inflating away their debt, Argentina will revert back to a broken society. Poverty again will sweep the land with virtually everyone poor except the 200/300 families that have run the country, like Mexico, from colonial times. It is this vestige that marks Spanish colonialism as the most loathsome of the colonizers.

Unlike most folks I have personal friends who live in Argentina and several expats that live in the Virgin Islands and California who scoff at such a paper as the one written. Charts don’t convey the economic horrors and mis management of the last 40 years.

Patrick, could you please make an argument to your claim, other than the lame and illogical ” I have friends”, don’t we all, and also wide, sweeping generalizations that say little about the present situation, other than this country is doomed because of its history and culture. I believe we can say that about this country as well.

There is nothing in our history that says we are doomed. Friends, really? If you have friends in and from Argentina than you can also make the claim. My comment here is to prove nothing. It is simply an observation gleaned from experience and a non partisan review of history as regards the US and Argentina. To even remotely compare the US and Argentina in any category is absurd especially by cherry picking a minuscule time frame that encompasses a rip off default where they basically bankrupted retired Italian pensioners.

Get yourself some Argentine friends, there are tens of thousands who have migrated to the US to end the madness of what passes as economics in their native country.

Ah, you are making the “some of my friends didn’t like it, therefore it was bad” argument. Sorry, that’s not a valid argument.

The fact is that the Argentine government policies benefit the masses at the expense of the rich. Let me guess, your friends are rich. Such policies generally lead to a stable and healthy society rather than the things you claim they will lead to.

It’s funny that this story came out. I was listening to CNBC last week and they said we didn’t want to become Argentina. This sent me on a quest to see exactly what had become of Argentina. I googled and googled and could not find much info on the economy.Other than how bad the default had been. Finally had to settle for pictures and vacation info. From looking at these I had a suspicion the story above was correct.

I have been to Argentina several times since the “corralito”. I speak fluent Spanish. I couldn’t see any signs of a big recovery, most people are just scraping by.

While the investba site has a cheerleading bias, they are not just making this stuff up:

http://investba.com/2011/10/palermo-soho-real-estate-construction-climbs-70-2010/

This is a world away (literally) from the treading-water US economy.

Who were you talkin’ to … los piqueteros? Los cartoneros??

I find it hard to discuss the Argentine recovery. i speak piss poor Spanish, but try hard and do make a go of it.

I was in Buenos Aires (shortened “BsAs”) and also Puerto Iguazu (las cataratas) and Missiones in February.

As with other places on Earth, the poor are suffering mightily, but the upper tiers are doing rip-roaringly.

The people in rural Argentina were scraping by (by Puerto Iguazu), and the people in the slums were clearly having a hard time due to inflation.

However, you would never know it walking around Recoleta or Palermo Hollywood or Palermo SoHo. (the prime nabes of BsAs). There was construction galore and the real estate is far stronger than it was just a few years ago. Every luxury you could ask for was front and center, and clearly being enjoyed by some Argentines (their Spanish is hard to mistake) as well as South American and European tourists.

The rich and upper middle classes appeared to be doing well right now, but I couldn’t tell whether or not the country as a whole is doing better or even well for that matter.

I will tell you that the feeling in Argentina in Feb 2012 was far lighter than that of Barcelona and the Priorat region of Spain this week.

altough the sit-ins were not present (or at least not as visible) in Placa Catalunya this week, the tone of many of our friends and associates was downbeat to what I am used to in Spain.

Many instances of talking about the lowered dollar, the real estate market, and the overall debt hurting everyday Spaniards.

it could simply be that I visited Argentina after the worst was over, but visited Spain during the worst of the strife?

Regardless, I loved both areas and will be back to both. As always, the people of the region far surpass the politicians and financiers of a region.

Rural areas always get hurt worst. This is a 200-year trend, at least. I suppose it may reverse as peak oil and global warming hit, so that agriculture becomes more labor-intensive and there is less good farmland, but until then it’s a worldwide phenomenon and means nothing. Rural poverty in the US is pretty damned awful too.

Argentine inflation rates: 1980. 100.8%,1985, 672.2%,1989,3079.5%,…you get the idea.

http://www.indexmundi.com/argentina/inflation_rate_%28consumer_prices%29.html

Those are pre-default and not pertinent to the conversation. The peak post default is 31%. So your series suggests inflation actually got better post default!

Yves.

Those are not pre-devaluation numbers but pre-Memen and pre-dollar peg numbers. By definition, in the very mind of its own citizenry, Argentina’s currency was worthless. It had no credibility and hadn’t had any credibility for the past century. It was hyperinflation proper.

The real break was in 1990. The dollar peg was bad in the long term but it was the only way to pound in the brains of Argentinians that a piece of paper printed in Argentina could be worth something and would not evaporate overnight. It was shock therapy but it was the only thing that worked.

I offered a link to the full series. My point was that this is/was a highly inflation-prone political-economy tradition, which got broken by the Menem dollar-peg, which led to disaster. So arguing over relatively minor rates of elevated inflation since is largely beside the point, since the population at large knows how to cope with much worse.

Are you joking? The rampant gentrification which started in Palermo Viejo some twenty years ago has reached even the impoverished southern barrios of Buenos Aires along the Riacheulo, such as Barracas. Don’t believe me, here’s the FT on the subject:

http://www.ft.com/intl/cms/s/2/b6f7a47e-6920-11df-aa7e-00144feab49a.html#axzz1M30ZGrYA

Or check out apartment prices, up 23% in Palermo (the most populous barrio of the city) in 2010 — in US DOLLARS, mind you:

http://articulos.inmuebles.clarin.com/aumento-el-precio-de-los-departamentos-usados/

Real estate sure ain’t poppin’ like that back in the pokey old United Snakes!

(This was a reply to Bruce’s comment at 9:09 a.m.)

Move along…. nothing to see here.

Question is: Who is on the hook via CDS contracts for Greek default? Ireland, Portugal, Spain, Italy and France (or at least its banks) for that matter.

My bet would be Danske Bank, historically always involved in some terminal-stage bubble investment, then getting bailed by the state to lose another day.

Denmark had the 2’largest “rescue”-package in Europe during 2009, around 506 Billion EUR in loans and “gurantees”. This was probably not gratis, one assumes there was a good reason for it. One of the excuses for the package was that the one-year rate for mortgages went from 2% to 8% after the government enacted a 100% deposit insurance for bank accoounts to “ensure confidence” – of course people liked borrowing at 2% and saving at 8% very much, forcing mortgage rates up to the deposit rate of the shittiest bank – FIH erhvervsbank. Anyone could have predicted that. So, either it was done on purpose to set the scene for the rescue package or the minister of finance at the time Lene Espensen is retarded. Both are possible.

To understand what lead up to the Argentine crisis:

video:

http://freedocumentaries.org/int.php?filmID=345

article:

http://newleftreview.org/A2410

Interesting article, and video, thanks.

Here’s a brief description of the video “Memorias del saqueo” by Fernando Solanas (2003), followed by a link to the complete film (114 minutes):

“Documentary on the events that led to the economic collapse of Argentina in 2001 which wiped out the middle class and raised the level of poverty to 57.5%. Central to the collapse was the implementation of neo-liberal policies which enabled the swindle of billions of dollars by foreign banks and corporations. Many of Argentina’s assets and resources were shamefully plundered. Its financial system was even used for money laundering by Citibank, Credit Suisse, and JP Morgan. The net result was massive wealth transfers and the impoverishment of society which culminated in many deaths due to oppression and malnutrition.”

http://video.google.com/videoplay?docid=-4477082254339304915

correction: the full video is 1:54:06

Here is the true picture of inflation in Argentina:

http://www.inflacionverdadera.com

Annualized inflation is 25-30 percent!

“Cavallo, who has a Ph.D. in economics from Harvard and is a professor at the Massachusetts Institute of Technology’s Sloan School of Management, has developed an ingenious way of measuring what he says is Argentina’s real inflation rate.

To estimate inflation in Argentina, Cavallo created the website Inflación Verdadera, which tracks the price of 150 products at two supermarkets in Buenos Aires.

The site is based on data from the “Billion Prices Project“, run by Cavallo and MIT colleague Roberto Rigobon.”

http://www.argentinepost.com/2010/11/measuring-argentinas-true-inflation-rate.html

TimoT,

Let me repeat: So what?

Argentina is doing extremely well on pretty much all other important measures.

The reason inflation got a bad name in the US is it hurt growth. It has not done so in Argentina.

So what?! Real GDP growth really looks fantastics when a government understates inflation to be around ten percent, when it is 25-30 percent…

Alberto Cavallo is the son of Domingo Cavallo, the architect of Menem and de la Rua’s economic plans that resulted in the 2001 implosion. I’m not going to discredit his work completely, because the inflation rates in Argentina are definitely higher than the official government estimates, but he has as much of an agenda as the Kirchnerista economists.

You can’t have a really good debt peonage system unless the rule of bondholders is upheld as an absolute.

To say that Argentina has had recent economic success is probably accurate. And all things considered that nation has done an astonishing job of becoming better than its residents could have dreamed in the nightmare of the 1970s-80s.

But to cherry-pick one recent 9-year period in that nation’s economy as justification for anything else–especially to justify other nations going into default at this point in history–strikes me as naive in the extreme.

I expect better analysis of NC.

You seem to miss the entire point of the article.

This is not a cherry picked time period. The point it to look at Agentina’s experience post default. So you need to start with the default.

Yves,

I strongly encourage you to view this video and consider posting it for your readers. It is a brilliant documentary focusing initially on Greece and the need for default, then moves on to debt forgiveness in general. From the video:

“For the first time in Greece a documentary produced by the audience. “Debtocracy” seeks the causes of the debt crisis and proposes solutions, hidden by the government and the dominant media. The documentary will be distributed free by the end of March without usage rights and broadcasted and subtitled in at least three languages.”

http://www.debtocracy.gr/indexen.html

Here is a review published in the Guardian:

http://www.guardian.co.uk/film/2011/jun/09/debtocracy-film

I got your point Yves. Our tragectory landing is Russia, circa 1998 and whether the US government remains or is rebranded is still questionable. America 2.0 will certainly be different from the last 40 years. There are pros with the cons. War and outcomes are wild cards.

For a great illustrated insight into how bad things

were before the “Go To Hell IMF Recovery” see

http://www.verdant.net/argentina.htm

I strongly agree.

Argentina is a case study in the positive welfare effects of defaulting on international debts if the only alternative is internal welfare-crushing deflation. The welfare of bondholders should not be the final policy consideration. Inflation is not the concern. The bugbear of inflation is another invention of bondholder welfare. High inflation is perfectly compatible with growth in social welfare.

But it is wrong to think that the outcome of default will necessarily be more than a “best possible” result for any country. Agricultural and mineral wealth accounts for a lot of the standard of living, and so does competitiveness of manufacturing exports. It is not a myth that the commodity boom greatly worked in Argentina’s favor to fuel growth of wheat and soy exports, among others.

Not all outcomes of economic policy can fully compensate for the unfair distribution of natural resource endowment. That may be the unhappy lesson for Greece, which does not have abundant resources. In that case, a lower standard of living may be inevitable, with lower future rate of population growth and higher rate of emigration as long-term solutions.

Anything is better than wholesale clearance of national assets, a solution that has rapidly become this era’s version of 19th century imperialism

Whether or not you survived the default depended on where you kept your US dollars (no one in their right mind kept savings in pesos). If they were in an Argentine bank you had them forcibly converted to the new devalued currency, whereas people with US dollar deposits in Uruguay and elsewhere not only retained their savings but could now buy Argentine assets at a the new devalued and depressed prices.

Social spending increased, eh? It would have to, wouldn’t it?

ebear

Yves — even though I believe default is the answer to over leveraged countries, Argentina is a hard one to use as an example.

Once again some boots on the ground experience in the middle 70’s. At that time Argentina was the most dangerous conuntry in the world and the only country that our world wide insurance policy would not cover. With that said I was consulting for a US company operating there from 77 to 83 for a couple of months at a stretch.

Argentina has been a basket case since at least the early 60’s. It is really quite sad because Argentina was probably the wealthy country in the western hemisphere in the 30’s and the place to be not — the US. Buenos Aires was the Paris of the Western Hemisphere. Then arrived the Perons and a rampant growth in govt and social spending financed by the printing of money. The currency went to nothing. Finally a military junta took control of the country. In the 70’s people would just disappear off of the street never to be seen again — thus no coverage by international insurance policies and why it was considered the most dangerous country in the world to visit at that time. Inflation was running over 100 percent and currency controls were in place making it impossible to get currency out of the country. The economy basically went to zero. Trying to get any thing done in Argentina was near impossible. Once inflations gets that high people just go crazy.

I believe Argentina has defaulted at least one other time prior to this time. About 15 years ago every one was saying that Argentina had turned things around when it pegged its currency to the dollar and opened up its borders to imports. This resulted in its localized industry which was protected for 40 years to be destroyed by chinese imports and led to its last financial collapse.

Let me put it this way, whenever someone says Argentina has turned things around I take it with a grain of salt. Argentina demonstrates what happens when you have strong government unions and money printing. It has been a basket case since the 60’s with small bounces up followed be devastating collapses.

Would encourage you to read Naomi Klein’s The Shock Doctrine..

Patrict says — virtually everyone poor except the 200/300 families that have run the country

———————————————