One of the reasons I’m not a big fan of Twitter is that I don’t see it as being useful save for communicating short updates (Raid on Zuccotti Park! Come help fast!) or a terse assessment with a tiny URL. Even more can be misconstrued (or can pretend to be misconstrued by a nay-sayer) than in longer forms of communication.

Nevertheless, I think we can safely make some conclusions re the following tweet from Economics of Contempt on the over $4 trillion notional of US bank exposure to Eurozone risks. A Reuters story recounts how the Financial Stability Oversight Council is trying to get a grip on the positions. Even the bank lobbying group the International Institute of Finance is cautious:

“As such, the potential for contagion to the U.S. financial system is not small,” the Institute of International Finance, the lobby group for major international banks, said last week.

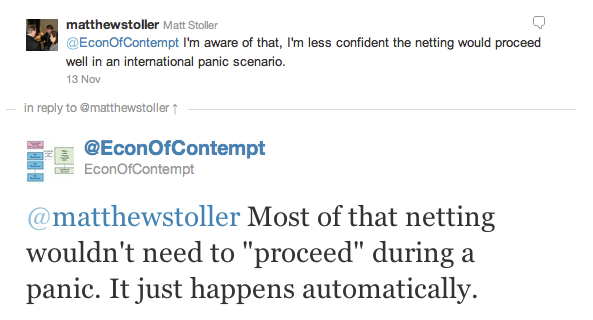

Nevertheless, there is not much room for misinterpretation of this exchange:

In the Economics of Contempt remark, it isn’t hard to detect a patronizing, “Ah, you non-insiders just don’t get how this works, do you?” tone. The problem with EoC’s airy assurance is the intense regulatory focus says the authorities don’t buy the industry’s reassurances, and for good reason. Any time a big dealer implodes (and per Bear Stearns and MF Global, they can fail suddenly and catastrophically), it can set off a domino effect of counterparty shortfalls as one side of supposedly netted positions is suddenly not there. An excellent primer on FT Alphaville that we highlighted earlier explains how this can happen. And remember, MF Global (not unlike LTCM in 1998) failed in an manner that the authorities did not anticipate and would not have been monitoring at other dealers.

And the poster child of this is Lehman. Unlike Bear and MF Global, its distress was widely recognized, if not universally believed. And contra EoC, the position marks, and therefore any related netting, were not as clean and tidy as he implies. One tax lawyer at a major dealer bank (and being a tax lawyer means you really need to understand how the trades work) told me that two years before the death of Lehman, he heard from a colleague that Lehman was so desperate to lower its funding costs that every day the “repo gremlins” would go through the firm to hock anything and everything they could. He even said if there was any way to take the firm’s staplers and put them into a structured vehicle so they could repo them, they would.

Towards the end, Lehman was engaged in mighty aggressive strategies to fund itself, and JP Morgan woke up and realized it might be more than a tad exposed, and seized $8.6 billion in cash and collateral, which was the proximate cause of the BK filing. This example relates directly to EoC’s netting assertion: valuation of complex exposures and instruments is not at all straightforward (JP was clearly hosed by Lehman; even after grabbing the collateral, a lawsuit alleges “JP Morgan was stuck with loans to LBI of more than $25 billion secured by many of LBI’s worst securities.”)

Satyajit Das, in his first of two posts on the Lehman bankruptcy, explains in some detail about how the valuation of positions under ISDA contracts is not at all straightforward and some methods have never been tested in court. In particularly, Lehman’s 1.2 million in derivatives positions have given rise to over 6,000 lawsuits with over $60 billion at issue. You might not deem that to be too bad (6,000 versus 1.2 million) until you read in Das’s post that one lawsuit between the Lehman estate and Normura involves over 4,000 derivatives positions. And in that suit, Normura posted nearly $500 million with Lehman, but now alleges Lehman owes it over $200 million. That is a $700 million valuation dispute that will be settled in court.

Similarly, as Das noted:

According to its own valuations, Lehman’s claim that the day before the bankruptcy filing the firm was actually owed money from counterparties on its open derivative positions. However, following the bankruptcy filling, the banks filed claims for a total of $51 billion.

So if two sides of a trade can have disputes this big in roiled markets, how much faith we can have in netting?

Tom Adams raised other issues via e-mail:

I think EoC is referring to how smoothly the ISDA auctions have generally worked when institutions like Lehman, Ambac, etc. have gone bankrupt. The gross CDS is reported, with much hand-wringing before the auction, and then it is all netted out and everyone is happy after the auction. Because much of the CDS exposure is collateralized in increasing amounts as an institution moves towards bankruptcy, the final amount of uncollateralized exposure at the time of bankruptcy is usually quite small.

This ignores two issues:

1. Can the institution with CDS exposure afford to collateralize all of their exposures? This was a big factor in why MF Global moved so quickly to bankruptcy – as MF and their exposures got downgraded, MF ran out of available assets to post against their CDS. This is probably why they violated their segregated accounts. This is also what drove AIG to needing a bailout – they lacked sufficient funds to post against their very large exposures. Thus, the problem is not the mechanics of CDS and collateralization, but the fact there is no real limit on how much exposure an institution can take on in CDS relative to assets available for collateral posting.

2. What is the credit worthiness of the various counterparties? Gross exposure may be netted down via CDS hedges, but what if the counterparties run into an MF Global or AIG situation? If a counterparty is unable to honor its hedge (either through collateral posting or outright), then the value of the hedge is greatly diminished and more likely to yield something like ten cents on the dollar (a typical ISDA auction level for unsecured CDS debt). This is the issue that ZeroHedge has been harping on with Morgan Stanley and Jeffries – i.e. “gross is the new net”. Since the various gross exposures to various European sovereigns is quite large, a legitimate question can be asked about how secure these hedges (and the resulting netting) will be in the event of significant country or institution downgrades.This also raises a corollary issue – despite widespread criticism of the rating agencies, especially among European governments, the fact is that financial institutions are tremendously reliant on the ratings in their CDS exposure. Credit rating downgrades are generally written into CDS agreements as triggers for more collateral posting.

There is no meaningful effort to find a replacement for credit ratings nor is there any meaningful method to replace credit ratings as triggers in CDS – the parties need an independent arbiter of the risk.

As a result, I think much of the recent criticism of the rating agencies is largely fake, on almost every count. Regulators, institutions, traders etc. may hate the raters, but they are also very reliant on them. This makes me think very little will really be done to fix or replace them.

The fact that European authorities are doing everything they can to avoid having an involuntary restructuring of Greece which would trigger its comparatively modest CDS exposures says the authorities are very concerned that an undercapitalized CDS protection writer could kick off major disruptions, potentially a systemic event. The fact that senior regulators who are in contact with each other (a big contrast to before the crisis, when communication and coordination was limited) suggest that the risk is real.

And that is what makes EoC’s position so troubling. He presents himself as an expert in these matters, even if his expertise on Lehman is limited to having read the Valukas report, rather than actually involved in valuations and litigation for the bankruptcy, as Das is (and has been for all the major financial firm bankruptcies of the last 20 years). So if he really does know this terrain, he should also know better than to keep peddling his “nothing to see here, move along” line as often as he does.

Like to point out to you that if it wasn’t for twitter I would not have known about your website. I wouldn’t have known about your fund raising.

It might be more useful than you know. It has it’s bad points for sure but as a communication tool it’s unequaled so far.

yes its nothing short of a miracle that I found this website without twitter.

In fact, i suppose its my duty to contact the Vatican over the fact that i dont use twitter AT ALL and still manage to be reasonably well informed.

Strange, I can’t remember how I found NC back in ’08.

Anybody who goes to the independent media (i.e. googles current events regarding adult issues) will soon enough find NC.

For years I have begged family, friends, and everybody to go to NC. Here in Texas I don’t think I have succeeded once (not once!) in getting people to look at a rational source of information like NC and away from the garbage that is corporate media. They all think I’m crazy.

So, what you’re saying… people have more trust in twitter feeds than their own personal relationships? Yes, I agree completely… that is a frightening truth about today’s Amerikan society. Though I will still say this… nothing will change until we learn to respect and trust each other again. Amazing how the freaky masters of entertainment have turns us all against each other.

Blogrolls.

Good to see Yves sinking her teeth into EoC again. Once upon a time they got on quite well!

I’ve been tweeting some of Yve’s headlines lately, so I might have to take partial credit for that.

I recall that Felix Salmon was pushing a similar line a while back, that the CDS exposure was no big deal. But the actions of the eurozone PTB suggest otherwise. If the CDS were no big deal, then why go to such great lengths to avoid the appearance of default?

You can fool some of the people all of the time, and

You can fool all of the people some of the time, but

You can’t fool all of the people all of the time.

A. Lincoln, (I think)

What do you suppose the critical mass is?

At what point do the number of non-fools get the upper hand?

When is enough, enough?

You can fool some of the people all of the time and those are the ones you want to focus on

geo. W. Bush

Who says they will pay on any of these sovereign CDS?

Then there is no hedge, there is no netting, its ALL exposure.

They seem anxious to change the rules and repudiate Greek CDS

>> “how much faith we can have in netting?”

Well, it sure keeps out the mosquitos.

Welcome to phase2 of the great economic realignment, wherein the American people are leveraged out of what remains of their collective wealth in order to ‘save our economy’.

I believe there has been a concerted effort to ignore the issue of Big Bank CDS exposure to Europes economic problems so as to assure the shortest possible debate prior to the decision that another bail-out must be done.

In the end we will be asked to celebrate dodging the $4 Trillion catastrophe, and be happy that it cost us only our way of life, our homes and decades of recession.

Interest rates constitute overt risk, derivatives constitute covert risk? Interested flows have decreased while derivative flows have increased? Bonds trump stocks, creditors trump bonds, and derivatives trump creditors?

Have derivatives completely captured the risk-reward mechanism that used to be inherent in interest rates? The financial markets, along with our savings, have moved behind secret closed doors where privileged Gods play?

I hope the follow-ups to these article will help me understand how derivatives have changed the creditor hierarchy in restructuring. How much more did those at the bottom lose, who is at the top, and how did they (the Gods) get there?

I assume this must be a typo – “Normura posted nearly $00 million with Lehman, but now alleges Lehman owes it over $200 million.”

I also came across nakedcapitalism.com on twitter… I agree, communicating via twitter is pretty hopeless, but for passing on links (preferably with a terse assessment) it’s great.

Sheesh, thanks. Fixed.

Yea, I stumbled over the Stoller/EoC twit exchange (I follow both) and the breezy assurances. The only surprise so far is the absence of any bailout for MF or its counterparties (other than the noise over JPM’s lien on MF assets). I expected MF to become a bank holding company so as to reach the discount window …

Real shockwaves through the commodities markets and pressure on self-regulating CME to make its customers whole. CME, which sits on its thumbs while its customers are raped, instead.

Customers, raped, the one constant through all the variations on the Wall Street bankruptcy theme …

See – I took the tweet to mean panic is automatic.

I have always thought the whole concept of netting was a scam. At most it is an accounting curiosity. But netting is not so much meaningless as deliberately deceptive when applied to trillion dollar size derivative positions. If these actually had to be netted, the event or events that caused the need to settle them would not need to be enormous but only just large enough to get the process started and wipe out the equity of a few of the over-leveraged counterparties. Once this happened you would have a cascade. Because of the leveraging the equity would never be able to keep up with the counterparty demand. So basically everything would collapse. We saw this all before with AIG and Lehman. The only thing that kept the collapse from being fully realized was massive government intervention and lots and lots of creative accounting. But this in itself was not a solution. Restructuring and resetting the financial system would have been but never occurred. So what we have instead is a temporary impasse better known as extend and pretend and kicking the can down the road. But the moral hazard of netting based on impossible leveraging is still out there and the next time, and there will be a next time, the same risk of systemic collapse due to it will recur.

Let’s see here

1) there is no problem with CDS.

2) however, we must do everything in our power to make sure Greek Default doesn’t trigger the CDS…

3) and we are trying our hardest to ban sovereign CDS…

because there is no problem with CDS.

It’s so stupid it’s sad.

That said: I keep wondering WHY the governments are not tackling the CDS problem. Obviously they and everybody else knows it is a problem… so why keep using them?

a few possiblities?:

1) the Chuck Prince “keep dancing until the music stops” phenomenon. here, might as well use them because it allows the big firms to hide risk and boost short term profits… if they fail the employees keep golden parachutes and taxpayer picks up the tab?

2) they are idiots?

3) Sovereign CDS are still needed, because if there are no CDS then the various private players will not buy Sovereign Debt? With the CDS market they can pretend they are “hedged” making them more likely to buy obviously impaired Sovereign Debt?

My guess is that yields would skyrocket quickly without the FICTION that is Sovereign CDS market. (we see how fictional CDS insurance is with the Greek situation… no trigger here… move along)

thus, Perhaps it is this:

The CDS allows the big players to be “hedged” in theory, when in reality they are not, and know they are not. When the chickens come home to roost and we find that their net exposure = gross exposure due to counterparty failure, then they are bailed out by the governments.

thus: a way to keep sovereign yields artificially low now, wtih very covert implicit govt guarantee… a workaround to ECB intransigence?

I used to be a C-Span junkie, and somehow i remember Sen. Maria Cantwell raising this issue during one of the many hearings re the “meltdown”. She, if i understood her properly, was suggesting that because CDSs had proven to be so dangerous, perhaps we should eliminate them. The response was, basically, “Next!”

I remember this because i remember thinking at the time – “sounds like a good idea to me!”

As an occasional C-Span junkie, I’d point to a June 200?9? Senate subcommittee hearing, in which George Soros testified.

Also testifying was a gentleman from avsmall town in the middle of Wa state (Maria Cantwell represents Wa, which has huge ag production). Indeed, that gentleman testified about commodities manipulation in the energy sector and it’s huge implications for agricultural production. It might be worth noting that something like 40% of the Washington state wheat production in recent years was sold to Egypt. Then note that for the Egyptian poor, food costs are apparently in excess of 70% of their income. Further note that following Cantwell’s Subcommiittee hearings on futures manipulations — and failure of any national or international body to rein it in — wheat prices rose in Egypt, followed by Arab Spring.

That C-Span hearing is archived .

Maybe I misunderstand the issue, but

1. How’d it work for netting Lehman’s sovereign CDS exposures? With their MBS portfolio, I know FICC stepped in and netted out the exposures (http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aojt5wVkz_EM). It was not some kind of self-executing process. And MBS were being accpeted as collateral at the discount window at this time, so it was still a highly liquid market.

2. I don’t know of anybody clearing CDS on European sovereigns, so it seems its all a bespoke mkt. How do they go about netting without a CCP?

3. Even if you assume the Fed netted counterparty positions booked by AIG before it paid them out, you still had the Fed sitting there funnelling as much cash as it took to close the hole.

Is it permitted for those of us non finance types to ask what is “netting”? i look to NC, perhaps unfairly so, for a good deal of my “financial” education, and have learned a lot (I think) from coming here .. If this is too stupid a question, just let me know …

The back and forth discussion is great – if you understand the “definition of terms” …

me too — a search for “netting cds” returned this page which I appreciate for its simplicity:

http://derivativedribble.wordpress.com/2008/10/24/netting-demystified/

This seems relevant to the twitspat:

“There are all kinds of things that can go wrong while your money spins around the globe, and banks and swap dealers would prefer, quite reasonably, to minimize those risks.”

Usually panic does not help keep things from going wrong. I don’t know if the necessary alogrithms are in place for handling the situation. If EoC knows something about this then it would be helpful to spell it out.

The best explanation that I have ever heard was on a Dylan Ratigan podcast this past summer with Mohammad El Erian, who is a wonderfully clear, effective communicator.

The podcast covers a lot of territory, but it is easy to follow.

http://soundcloud.com/dylanratigan/rfd-64-mohamed-el-

You can search Ratigan’s Soundcloud archives for a podcast w/ Yves and Josh Rosner, which is also excellent. I’m thrilled Yves is going to start doing podcasts of her own ;^>

A little boost here:

http://soundcloud.com/dylanratigan/rfd-64-mohamed-el-erian/

so while I was there:

http://soundcloud.com/dylanratigan/rfd-25-josh-rosner-and-yves/

Now on to the headphones …

See the FT Alphaville primer:

http://ftalphaville.ft.com/blog/2011/10/27/713826/how-gross-and-net-cds-notionals-really-work/

Aquafir:

we are all here to learn.

here is how I think of it.

Made up Example:

Pretend that You owe Me $100.

And I owe Yves Smith $50

and I owe Richard Smith $50

one way to think of this would be to add up what everybody owes. this is called the “notional value” of all the contracts. here, it would be $100 plus $50 plus $50 = $200.

So the notional amount of what is owed is $200

however: in the end it’s not really that much (if everything is working), becuase we could “net this out”.

I am owed $100 by you, and I owe $100 (total) to Yves/Richard

so really, my “net” exposure is 0. (the $100 you owe me is canceled by the $50 I owe to Yves and the $50 I owe to Richard).

another way to think of this… is that we could say that it is YOU who owe $50 to Yves and YOU who owes $50 to Richard.

thus, although the total notional value is $200, the “netted” value is $100… because only $100 really is moving around.

(hope this makes sense).

HOWEVER: this only works in an orderly unwind.

For instance, let’s say that YOU go broke.

if YOU go broke: then you can’t give me the $100, and thus I can’t give Yves/Richard their $50.

this is what we call “cascading defaults”. Because everybody is so inter-woven.

They are “netted” ok. but they depend on the people who owe them to pay them back so that they can pay back others.

this is the crux of the argument that

“net becomes gross”.

to understand “net becomes gross”

I could say “I owe nothing, because Aquifer owes me $100 and I owe $100 total to Yves/Richard, so I really owe nothing”

(so my notional = $100, but my net = $0)

but if you go bust then you can’t pay me my $100, but I still owe $100.

(so now my net doesn’t work… thus my notional is what matters)

——

A CDS is kind of like “owing” someone else (if a trigger happens)

the problem here is that there are 1,000s of positions amongst many different players, and nobody knows what their positions are.

each party says “sure, I am at risk for losing $100B if Greece defaults, HOWEVER I’ll get back $90B so my exposure is only $10B”.

but this won’t work if their counterparties go bust.

hope that helped.

This puts me in mind of a Barron’s Roundtable money manager who said he had never gotten into derivatives because “I don’t know who’s sitting across the table from me.”

Aquifer I had same problem. Google to the rescue:

Netting

The settlement of obligations between two parties that processes the combined value of transactions. It is designed to lower the number of transactions required. For example, if Bank A owed Bank B $100,000, and Bank B owed Bank A $25,000, the value after netting would be a $75,000 transfer from Bank A to Bank B ($100,000 – $25,000). http://www.investorwords.com/6594/Netting.html

or

Payments netting

Reducing fund transfers between affiliates to only a netted amount. Netting can occur on a bilateral basis (between pairs of affiliates), or on a multi-lateral basis (taking all affiliates together).

////

A way of settling transactions that minimizes the need for funds and securities to actually change hands. To give a very simple example, suppose a brokerage buys shares in a company for $100,000 and later sells them back to the original owner for $120,000. A payments netting method would have the securities stay with the original owner and mandate that this owner transfer $20,000 to the brokerage. Payments netting can be complex because of the number of actors involved, but maximizes the likelihood that, at the end of the trading day, every party has received exactly what it should have, and no more. Clearing houses provide most payment netting services. http://financial-dictionary.thefreedictionary.com/Payments+Netting

Netting vastly reduces the amounts owed on swaps at the end of the day, with one caveat…..that all involved counterparties are able to meet their obligations. It can end up such a tangled web however that one party like AIG can make the whole system collapse like a house of cards. And unlike traditional insurance, sellers of derivatives are not required to hold any reserves to back what they have sold. Estimates I’ve heard are that there are $600 trillion of derivatives floating around in the global market, multiples of total global GDP, however its unknown how much of this is being held on sovereign debt, much less Euro or PIIGS sovereign debt (presumably small percentage).

Or thus is my understanding.

Yes, and that caveat is a very big caveat.

Although I’ve read at various times that the total CDS market may exceed $700 Trillion, (who knows?) even at $600 T that pretty much makes it an order of magnitude above the global GDP, so even if netting brings the net balance to .10 on the dollar, that still leaves the total exposure of various parties enough to result in financial Armageddon.

And, after netting, who is left owing that $60 Trillion?

So, in their infinite wisdom, the Europeans have decided to pass a law outlawing naked CDSs, and that law will go into effect in 12 months, assuming the EU hasn’t collapsed in 12 months.

What bravery.

And, after netting, who is left owing that $60 Trillion?

The taxpayer, of course

Yves,

On a completely unrelated note I was wondering if you had some information on the average interest rates on repos on the run up to the crisis? I can’t find anything in your book.

Thanks

Netting means that Citi buys CDS on Greece from BoA, while BoA buys CDS on Greece from Citi. Thus if you total the value of both to each other, you come up with a small net number (say $50 million) instead of the gross number (say $4 billion).

The problem with netting is that it interconnects everyone because Goldman did the same kind of deal with Citi and BoA, and all three did similar deals with Euro banks, etc.

The result is that if *any* one bank in this huge web of relationships fails or can’t post collateral for the CDS, it suddenly turns what was a small *net* exposure into a massive *gross* exposure for all the counterparties.

It is actually worse because if you suspect any of your own counterparties to be in trouble, you should force them to post collateral with you ASAP, otherwise you get stuck in line during the bankruptcy which just turned your net into gross.

In our little example, assume Citi gets into trouble and Goldman forces collateral. Now Goldman has ensured their net risk is safe but that collateral call just forced Citi into bankruptcy. Now BoA is no longer “netted” because Citi’s rotting corpse has nothing left to post collateral with. Now that BoA is massively exposed, BoA’s counterparties may require collateral and bam… one failure just turned into a massive cascade.

Then there are all the other CDS issues like naked CDS where you buy the protection but don’t own the underlying asset, etc. And all the perverse incentives where you make more money if you hasten or force a bankruptcy.

None of this has been reformed, reigned in, or slowed down in any way.

So what we’re really talking about is fake insurance on financial gambles, the safety of which depends on the existence of the bookie.

Sounds like all financiers do is invent new ways to skim more off the soup.

They don’t really help us at all. They used to be called money lenders, and people hated them, because they meant the economy was failing.

There’s a big difference between collecting free capital, and incentivizing debt with appeals to gambling instincts. The first is a good thing, saving for the future, making society efficient. The second is a bad thing, pandering to our worst grasshopper instincts.

Could someone explain what “netting” is and how it works to me? That or point me in a direction that I could teach myself.

Thanks

Appreciate the lesson on netting. Here is another question that perplexes me. I have heard that outstanding notional value on ALL derivatives is in the 500 trillion dollar range.

Is that really true?

And if it is, what are these derivatives? What is the total for CDS?

Yves, The negotiated settlement for Greece included a 50% haircut on its issued bonds. Obviously, if this “solution” were imposed, CDS-holders would seek recovery. But I understand, and this was very little discussed by MSM, that the International Swaps and Derivatives Association declared that this haircut would not be a default event covered by those CDS. I have several questions about this.

1) Does the ISDA have the horsepower to do this? CDS are contracts. What gives ISDA the authority to abrogate contracts? Oh, I found it: http://www.zerohedge.com/news/isda-says-50-greek-bond-haircut-appears-voluntary

2) If this power exists, why would anyone in their right mind purchase a CDS?

3) There is an unholy relationship between the Fed and the IMF and the ECB. Has the Fed been pushing the IMF to contribute to the bailout due to fears that if an uncontrolled default occurred, a plethora of CDS would trigger and it would be Sept 08 all over again?

4) Is Greece bigger than Lehman?

I’ve read even in the FT some skepticism as to whether the ISDA view means bupkis. The rights are defined by contract. If someone wants to argue the counterparty should pay out and the counterparty refuses, this will wind up in court. I am pretty sure the judge will look to the contractual terms and precedents, not ISDA apple pie and motherhood

Thanks for the response. That is exactly what I thought. And it leads to more questions, which I’ll pose rhetorically. Because the IMF is funded primarily by the U.S., I assume that the U.S. is firmly behind the bailout plan as it uses IMF funds. I further assume that Treasury and the Fed understand your response – ISDA Determinations Committee commitments may not prevent a plethora of CDS being triggered. As a CDS avalanche is (or appears to be) the primary international banking concern, why would the IMF support a plan that is unlikely to meet the objective of preventing a CDS avalanche? The only answer I can think of is REALLY UGLY – the IMF, ECB, et al., are hoping to help the banks by making sovereign bonds look like a good buy – so the banks could offload it and leave investors holding the bag. And right on cue, JPM is creating a new distressed sovereign debt fund you can buy.

My understanding is that the members of ISDA use an ISDA contract for their swaps, thus if ISDA offers an opinion that its contract permits the Greek haircuts to be interpreted as not in default then that carries water with the members. And of course ISDA would make such a proclamation because to do otherwise would bring down the house and we can’t have that now, can we?

An opinion by an industry organization does not trump contract terms. And as Das points out, the master agreements actually vary. The American Securitization Forum has also tried opining about chain of title (basically saying there was not problem) and the courts didn’t consider their views in adjudicating the issue when it has come up.

The issue is not the the net exposure overall, which is quite small. The issue is whether any systemically important institutions are over-exposed on one side or the other. If there is someone who has taken one side of the trades consistently, like AIG in the subprime crisis and MF Global, the fact that the overall CDS exposure nets out won’t do anyone any good. All it takes is one bad actor among the SDIs for everything to go completely ass up. As Corzine proved, there’s no reason to expect that the banks are all doing the right thing and hedging their bets.