I’m behind on commenting on various opinion pieces, thanks to a mild case of food poisoning (ugh), but I wanted to take note of Paul Krugman’s current New York Times op ed, “Is Our Economy Healing?”

As an aside, Krugman has written a lot of good pieces lately that we’ve linked to on income inequality the disastrous austerian policies in Europe, and Republican derangement and duplicity. But he tends to cut the administration far more slack than it deserves.

His current piece voices cautious optimism on the prospects for the economy based on some strengthening in various economic indicators. But astonishingly, the core of his argument rests on the outlook for the housing market:

But the bubble began deflating almost six years ago; house prices are back to 2003 levels. And after a protracted slump in housing starts, America now looks seriously underprovided with houses, at least by historical standards.

So why aren’t people going out and buying? Because the depressed state of the economy leaves many people who would normally be buying homes either unable to afford them or too worried about job prospects to take the risk.

But the economy is depressed, in large part, because of the housing bust, which immediately suggests the possibility of a virtuous circle: an improving economy leads to a surge in home purchases, which leads to more construction, which strengthens the economy further, and so on. And if you squint hard at recent data, it looks as if something like that may be starting: home sales are up, unemployment claims are down, and builders’ confidence is rising.

Implicit in his discussion is that buyers are now irrationally pessimistic, and once the economy looks stronger, housing purchases will pick up.

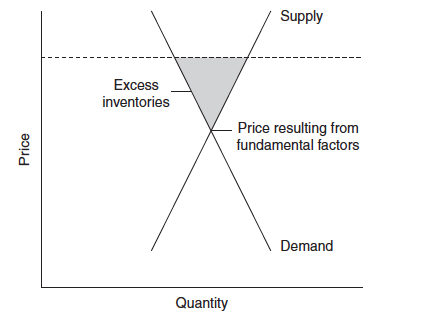

Ahem. Let me use my rendering of a chart Krugman used in discussing oil prices in 2008:

See the “excess inventories”? If prices are artificially high, you expect to see unusually high inventories. As we have written on this blog, there is a remarkably large number of houses that will probably be liquidated, ex a radical change in housing policy. Top analyst Laurie Goodman pegs “shadow inventory” at between 8 and 10 million houses; our Michael Olenick came up with an estimate just below 10 million.

There are large numbers of homes NOW where the borrowers are severely delinquent, and in some cases have been foreclosed on, yet the bank has not taken the house (usually on behalf of a trust in a mortgage securitization). Why? It would be nice to believe that the servicers are trying to help investors by slowly bleeding the housing overhang into the market, but this instead appears to be a cynical effort to milk investors of the maximum amount of fees. Even when a borrower languishes in the zombie land of non-payment, the servicer keeps ringing up his servicing fee and various other charges, such as late fees, broker price opinions (sometimes impermissibly charged to both the borrower and the investor). He eventually pays himself back from the sale of the house.

Now there are also reasons to question whether we will return to historical patterns of homeownership. High unemployment among recent graduates and the great difficulty unemployed middle aged people have in finding work means we may see a sustained reversal of household formation rates, and it may even go as far as leading to larger average household sizes. Extended families living together used to be not all that uncommon; it may go from being a sign of desperation to being seen as a smart way to economize and conferring other benefits (sharing child care duties, for instance).

Finally, the 30 year mortgage does not fit with job tenures that now (per a Yankelovich survey commissioned by McKinsey in the mid 2000s) of under 3 years. The traditional mortgage assumes that the borrower has a rising, or at least stable, income over his working years. We now have shorter jobs and longer periods of unemployment, which sap savings and make defaults more likely. And that’s before you factor in that the mortgage was normally a household’s top priority payment, but the inability to discharge student debt in bankruptcy effectively makes it “senior” to mortgage payments. All this suggests that it may be necessary to go against the pet wishes of the mortgage industrial complex and implement housing policies that do more to promote rentals.

It would be better if Krugman were right, but the monumental legal mess in the housing market, along with the terrible incentives built into the servicing business model, means a housing recovery is likely to be much slower in coming than he hopes.

Glad you posted on this as I too choked on his prognostications for the housing market. I’m guessing Krugman doesn’t know the true overhang numbers, and is also tired of all the gloom and doom and really wants a recovery to happen, so he’s seeing it where it isn’t. Probably also in the mix is his fear of a Republican president. Okay, enough psychoanalyzing Paul Krugman… I’ll take my fee in donuts.

“I’ll take my fee in donuts.”

Giggle.

Make mine Berliners!

http://www.berlin-audiovisuell.de/images/berliner-pfannkuchen-fotolia_460.jpg

Totally OT, but I lived for a few years in Germany, in the Rhineland-Pfalz. Only at Fasching (~Nov-Feb), you could buy in the bakeries a fried dough pastry locally called “Pfaeltzer Grundbeeren” (“Pfaltz ground berries” (the local dialect for potatoes, so called because they looked a bit like potatoes).

So real fried dough (not like we get), filled with real custard, dusted with sugar and cinnamon ! I could eat a half dozen a day, at least.

We get absolutely nothing like even ordinary pastries that Germans get every day, much less like these festival goodies.

Bill C, the American Midwest equivalent is *Spudnuts*, made w/ potato flour.

YankeeFrank, you’ll take your fee in broccoli, for *long life*!

There’s no point in living a long time if you have to eat broccoli.

I don’t know if you meant to use the word “austerian” but I find it hilariously accurate.

I didn’t read Krugman’s piece as an indication that he’s willing to go very far out on that limb. Moreover, I’m pretty sure he’d grant you every point you made after the excerpt. I read his piece as an effort to find SMS array of hope amid all the gloom — gloom that remains very, very justified.

* SMS = some

I am a huge Krugman fan, but I think he’s missing something else: why did household debt get so out of hand in the Bush years? Because salaries would no longer support accustomed lifestyles, and with the housing bubble, people found they could take money out of their homes.

Until a solid manufacturing economy returns to America, that won’t change. The idea that you can run a world-class economy just by building houses is crazy.

Also, Paul doesn’t get it about China. It’s not (as he claims) about having the supply chain localized — it’s about docile workers living in dormitories who can be rousted at midnight to work a 12 hour shift on a biscuit and a cup of tea.

If anyone thinks that is necessarily the future of manufacturing, they haven’t been watching France or Germany. A young French friend works in QA/QC for a machine shop making surgical prosthetics (outside Valence.) For Christmas all the workers were treated to Champagne and foie gras!

That is exactly the point of the Apple and China story. Workers who cannot unionize and cannot say know when the order comes to work a ridiculous shift. And the people saying that we don’t train enough people for the mid-level skill jobs are just trying to put a nice spin on that reality. There is a reason workers at Foxconn commit and threaten to commit suicide. It is there only bargaining chip towards better working conditions and a better life.

Larry, correct. *Apple* in China is Fritz Lang’s *Metropolis* without the hero.

Exatly, Larry, exactly!

I heard Robert Reich on CBC the other night, and I’ve never been a fan of Reich’s — consider him to be a slightly watered down version of the the Chicago School, and his Work of Nations I considered to be a pile of fewmets!

Neither Krugman, nor Reich, ever seem to understand things very well, although Krugman appears more charitable to the workers….

Kevin Phillips has shown that U.S. has joined historically irrelevant economies who have exchanged manufacturing base economics for bankers pushing paper debt around…up from 20% of economy (or so) circa 2001, to over 40% by 2007.

Bushitters unite! Our first “MBA” president indeed…(“American Dynasty”)

Um, can we get over the whole “it’s O’s/Bush’s/Clinton’s fault” thingy? Anyone who reads stock/commodity charts with any regularity will confirm that housing and banking, two commodities, were due for blow-off top moves in the last decade after LONG bull runs from the eary 80’s. When that blow-off top comes to pass, it does so because essentially EVERYONE in the society is trying to get their piece of the “can’t miss” action, and/or (to give Barney Frank some credit, though it galls me) to help even those on the lower rungs of society to participate in the “good deal.” Who the sitting president is has little to do with anything.

gdude says:

January 24, 2012 at 9:08 pm

[Um, can we get over the whole “it’s O’s/Bush’s/Clinton’s fault” thingy?”] Um, no. Clinton stated when carrying Bush1’s NAFTA bucket to the well that this legislation would “level the playing field of the Canadian, Mexican and American workers.” Anyone here think Clinton gave two figs about Mexican workers? I think even then mildly perceptive folks could read between the lines of Clinton pandering to Globalists.

Bush implemented “temporary tax cuts” that blew a nice sized hole ($350 billion/year?) in the so-called “balanced budget” he inheritied and the $150 billion “surplus” in less than 6 months. Obama unilaterally extended that obscenity. So um, no, we can’t.

[Anyone who reads stock/commodity charts with any regularity will confirm that housing and banking, two commodities, were due for blow-off top moves in the last decade after LONG bull runs from the eary 80′s.] Ah…I see…it wasn’t all smoke and mirrors of accumulationg DEBT? Because I can read, and I can recall Reagan ran up more debt than all the preceding presidents, then Bush1 did the same…then Clinton started to get a handle on the debt bomb…then Bush2 ran up more debt than all the preceding presidents….and now Obama has too…so…. what were you saying, again?

[When that blow-off top comes to pass, it does so because essentially EVERYONE in the society is trying to get their piece of the “can’t miss” action, and/or (to give Barney Frank some credit, though it galls me) to help even those on the lower rungs of society to participate in the “good deal.”] Yes, goodness knows, those little people sure made out like bandits….

[Who the sitting president is has little to do with anything.] As does your “blow off top” gibberish.

Except that France and Germany (and especially the example you provided) hardly represent the “future of manufacturing,” whatever that is. And the Chinese model might as well be considered the US model, as that’s the market it was built to support and which provides its tight-fisted meager funding. The Chinese are merely doing to their workers what American interests are (so far anyway) unable to do to theirs, in the current day at least. Charles Dickens or Upton Sinclair anyone? Options? Further automation or move on to the next third world sweat shop. All for cheap shit that most of us don’t need anyway shipped halfway around the world by cheap energy paid for by blood money. American capitalism’s something for nothing mentality is a powerful illusion, and it seems that all the world’s entranced. And the magicians performing the sleight of hand like it that way.

James, don’t forget the fleecing of the sheep further by the U.S. Army Corps of Engineers on behalf of filthy rich private “shipping business”–creating “shipping lanes for the good of the United States” by destroying wetlands for the profits of the .01% and their trickledown 1% at *public* expense. Savannah and Charleston today are fighting over the right to create greater Hurricane Alleys for their citizens, in order to *accommodate* the monstrous size of ships designed to transport monstrous numbers of monstrous Chinese shipping containers full to the max of cheap Chinese *goods*–and for what? For whom?

These PRIVATE RACKETS at public expense must cease! Bring RICO!

Leonova,

RICO, just another unsavory word for the preferred Ivy league B-School term “fully horizontally integrated business systems.” As you correctly note, in layman’s terms it’s a mere “criminal conspiracy.” Ahh semantics! Ever the tool of the intellectually predisposed with a lot to hide and even more to lose. Elliot Ness, where are you when we need you?

“Also, Paul doesn’t get it about China.”

Ho, ho, ho, Paul gets it fine about China, most of his career has been about making sure you don’t get it about China.

joecostello, Troll, please cite sources to support your claims.

In the markets I’m personally most familiar with, housing is still selling for below construction cost, so there is no new build except condos and apartments. There’s enough overhang to snuff out any flame of recovery for several years yet.

Hope you’re feeling better.

Sorry to hear about your food poisoning, Yves. Many of my most horrific memories involve food poisoning.

Good analysis as usual on the Krugman article, I found myself scratching my head while reading it (even after accounting for the automatic respect that someone like Krugman is due). Glad to know I’m not the only one.

Um… prefab rat traps with substandard builds and dubious floating slabs et al… is hardly a house.

As the data shows, house finance was based on short time lines ( flipping etc ) and as any production engineer will attest, its only as good as the warranty ( if your lucky ).

Skippy… 360 degree fail. And this was… the way to prosperity? Barf.

I have friends buying-remodeling many houses…then renting. I asked him recently whether he has seen “deed-title”? He says banks hold deed-title till

house is paid off…my question is, where will they get “deed-title” when paid off? Broken up into “tranches”, combined with other “securities”…? My personal

guess (Yves may know) is this is part of reason banks wish to do state’s attorney

general deal…??

nonclassical — “Where” oh where indeed? This is the CRUX of the *crisis*.

House prices took off in 1997 and had reached an already-high level by the early 2000s – Case-Shiller had them at the same real level as the high of the late 80s, so it’s odd to think that things are looking rosy when the prices are back to levels of 2003, a real level that was usually reached at the end of an economic expansion, not the start of one.

Housing prices took off in CA in the 70s. They have a long way to fall before one can say California Bubble is deflated.

Ignim, yep, there’s a lot of hot air in there, a lot of bucket shop pie in the sky.

Uh, care to compare population densities between 1970 and 2012 in the far west state of CA?

Prices may go back to 1970s levels adjusted for CPI because of an overshoot in the bursted bubble, but not because somehow 1970 prices are in-line with fundamental values of land or even replacement cost of the box built on top.

Tim, moreover, construction since the 70’s is crap built of Chinese crap.

I seem to recall, being a home buyer then and a 30 year Bay Area resident, that the real rise in California housing prices was the Reagan/Bush1-era bubble of 1985-1990.

Then jobs went kaput, the economy went to hell, and Clinton ran on “It’s the economy, stupid” platform.

I am looking for California housing prices to bottom at the 1985 level (gdude, recall the Reagan stock market crash?? Apperently not….something “blew off” back then….), and hold there, while the bottom solidifies.

Call it a “hunch.”

..forecasts I have seen show home values down another 15% or so this year…

but it’s state to state…real problems involve where states themselves can get $$$ to replace missing tax revenues…meanwhile, fundamentalist media within

states is playing “scott walker” austerity game, blaming schools, teachers, unions, immigrants, social security, medicare, etc, etc, for economic disaster perpetrated by Wall $treet-world $16.5 trillion per year economy destroyed for

over 3 years already, 10-20 more to come…

privatizer$ blaming the rape victim for rape-while fundamentalist-corporate media censors each time I say so…

Yes, we are *royally screwed* as citizens of States and of the nation. “The Shock Doctrine” has been brought Homeland to Roost, definitively.

Get out the pitchforks. Can the rope and the blade be far behind?

Will the 1% “get it” and turn against the .01%?

Well, the capital flight from Europe has to go somewhere. Krugman has been calling for a new bubble ever since his beloved housing bubble collapsed. He may get his wish after all.

Don’t forget Asia as well. We have been seeing that in California for decades. School districts, school districts, school districts is the lynchpin and the decider.

The best is Cupertino Union in Silicon Valley fifty miles south of San Francisco, and just north of San Francisco in Marvelous Marin, Reed Union, Mill Valley, Ross Valley and the junior more affordable versions in Larkspur, San Rafael

and Fairfax.

San Francisco itself? You’d have to be insane to place

your child in their hands.

Dirk, let’s call a spade a spade. The fascist Neoconlib PUTSCH for 1% Financial Lebensraum began with the Austrian-Southern Strategy NEXUS for the Coup.

Explicityl, I refer to “Proposition 8” and its true purpose to ruin “Government” of/by/for the People of the U.S.A.

That’s not really true. Lowell is an excellent public high school in San Francisco– but well-off white people have decided that they don’t want to mix with Asians. This is the same reason that the UCs have started to trend mostly Asian as well.

I’ll confirm that, though I think they’re seeing a pop in white interest due to the economy. At least at Lowell most of the kids are too busy studying to pay much attention to the PC crap. And many of the teachers are able to slip in actual rational and reasonable thought, though often subtly done.

Next bubble to pop has to be education: student loans inflating post-secondary education costs (just like housing!) and whites fleeing the public secondary schools because of ridiculous PC regs.

I regularly read Krugman’s blog and editorials and I am usually a supporter of his, but it seems to me that he has gone into pre-election mode and he is trying to make the current economic situation look better than it is.

He apparently does not like the current administration much, he is even more scared of a Republican in office – understandably, that is. Still I do not see it as a good enough reason to publish blue-eyed feel-good pieces.

Or maybe the Times is pushing in that direction?

“it seems to me that he has gone into pre-election mode and he is trying to make the current economic situation look better than it is.”

yep…he had 6 posts on or related to romney & capital gains taxes…

Fortunately, Krugman’s wisdom and patriotic fervor for Justice for We the People is not limited to The Times, which must indeed FRAME his comments to a degree. His Times platform makes it possible for his voice to reach a multitude, and to elicit comments from the multitude, in order to cast light on what We the People want.

We must consider Krugman’s Columns and Blogs within the Times frame, giving him the opportunity to reach a broad, mostly educated and informed audience for feedback, within certain Times limits (the frame). This is reality.

Does history not show that Paul Krugman is a WISE Elder and a patriot?

Krugman has lost it. Obama is a walking train wreck, and Paul will say anything to cover for his choice of Prez. After he shot off his mouth about the Arizona shootings, I lost any respect I once had for him.

Nobel Prize winners are NEVER wrong you know. Just look at Long Term Capital….

Krugman is doing what he is paid to do, sell the current public narrative at the fringes.

The current public narrative is to tell your neighbor that it looks like things are getting better. I have heard this repeated recently by folks. Is it in the water or is TV that potent and we all just want to BELIEVE that better is coming real soon now.

I am a third of the way into debt: the first 5K years and it is quite a thought provoking book. The public should engage in this sort of anthropological look at itself as it goes forward through this mess…..oh, never mind, I forgot….things are getting better.

2012 is going to be interesting and will be hard to track on the various levels. Thank goodness we have Yves.

psychohistorian, I believe that “things are getting better” because We the People–especially We at NC–have awakened. The Occupy movement indicates this also. This suit filed a few days ago by Chris Hedges against President Obama and his Justice Department (within his Cabinet) demonstrates this. The comments on Krugman blogs at the Times have been more daring, more challenging to the *regime*.

We must admit that things definitely are “getting better.” The Sleeping Giant of We the People is stirring out of deep sleep, and there’s no turning back.

Krugman may not know it, but his whole analysis looks to me like a justification of Hyman Minsky.

Dr. Housing Bubble is optimistic too! He believes the housing market “will remain in a precarious limbo deep into 2012.”

http://www.doctorhousingbubble.com/baby-boomers-4-million-seriously-delinquent-loans-down-size-real-estate-housing-reos-shadow-inventory/#more-5274

Make no mistake, “precarious limbo” is fantastic!

Remember, there are other more disturbing scenarios. For instance: in the Protestant Bubble Scenario, there are no unearthly pauses or post-mortem second chances.

Nope, in the PBS, you descend straight into hell, and you take up eternal residence.

Yeah, Krugman’s housing market analysis is shallow.

Expect a continued crash in overall housing prices. Eventually the buy-for-rental market will start to pull up housing prices.

50 ways to leave your lover.

http://www.youtube.com/watch?v=aVXX6NFpcT8&feature=related

Skippy… more like: http://www.youtube.com/watch?v=aVXX6NFpcT8&feature=related

PS. Da plan man.

skippy! you nailed the OWS theme song: “Fifty Ways to Leave Your Lover”– whether by Paul Simon or by the Muppets. This should be a world-wide STAPLE on the Web, on social sites, at Occupy encampments and rallies, a STAPLE to remind We the People how to escape our programmed *dependency* on *the Man*. This SYMBOL of grown-up independence (Washington’s *Entaglement with None*), and freedom from the corruption and oppression by nefarious Agents of *the Old Country*, is succinctly captured in “Fifty Ways to Leave Your Lover”.

Surely this replaces any folk anthem from The Rocky Horror Picture Show. Let us flash our Bics in solidarity to the tune and words of “Fifty Ways to Leave Your Lover”. We the People CAN walk away from Corrupt Crony Capitalism for the 1% Global Reich IV, together with its lying, looting Agents in MonopolyFinance Banking, its Treacherous Agency Government, its Global M-I/Security/Police/Drugs Complex meant to facilitate Lebensraum and Lebensborn of/by/for the .01%-unto-their 1% Agency.

Skippy, thanks for the second full link above to “The Muppet Show – Fifty Ways to Leave Your Lover” by Scooterpiety on Sep 29, 2008.

LET’S DISPLAY, and LET’S ROLL! Occupy Charlotte 2012!

BILL BLACK/SUSAN WEBBER 2012 for We the People Right Now!

Chris Hedges: Secretary of State

Paul Krugman: Secretary of the Treasury

“If not now, when?

IMHO Yves comment on student loans being senior to mortgages is the real insight here on the inherent drag this debt is putting on our economy. Education costs are even more unrestrained than medical. I don’t see how they will be controlled unless the colleges assume much more of the risk for these loans and those loans can be discharged in bk.

Bingo. It’s not just that education costs are non-dischargeable in bankruptcy (haven’t they always been? I honestly don’t know, but think so), but the fact that education costs have spiraled so wildly upwards, with no signs of slowing down. My daughter just graduated college in May, and says the average student has $25K of debt (undergrad only – from an ART school, mind you – how do parents not intervene???), and plenty have $100K+ debt. In my day, 20 years ago, debt figures like that were found only among professionals, incurred in obtaining professional degrees – which were far more likely to yield incomes that could service that debt. To be at this debt level for undergraduate only, well it’s a ticking time bomb in the economy. This bomb will blow up slowly, over time, only adding to the economic downturn we are now but 5-6 years into.

http://www.finaid.org/questions/bankruptcyexception.phtml

Krugman is beginning to shill for Obama in an election year. remember folks its not the lesser of two evils- its the evil of two lessers.

That’s how I read the column, as a fluffer for tonight’s State of the Union speech.

And I prefer “the evil of two lessors” myself. :-P

Begin to shill? Hilarious.

Granted he shills a lot but has been mildly critical of Obama in “off-years’, ie 2010 and last year. By “Beginning”, what I mean is that this column will be cited as authority for a statement in a Krugman column later this year that the “housing market is improving” under Obama ( and hence the economy) and that’s why, even though Krugman doesn’t agree with him on some things, you readers should vote for him.Kabuki theater all the way.

As for “two lessors: , yeah pretty good, but wouldn’t it have to be “one..two..three.. many lessors?”

I thin Krugman needs to stick to the most obvious of predictions and not try to get too fancy.

And the wealthiest generation in history, having most of it’s wealth in real estate is preparing to sell for retirement over the next 10-15 years to a middle class which is disappearing daily.

Not to mention that they have eliminated all the jobs for their childre.

Goodbye housing for a long time to come.

Fully agree max. There is no reason for it to do anything but fall.

Only when enough become a drag on municipalities due to massive tax forfiture as reciever financial institutions decide that that is how they chose to dispose of them will there actually be the auctions held that should have been held in October of 2008. We could have known right off and had what good money there was applied to properties and securities that would hold. It was known which ones they were. Given a couple of weeks that information could have been disseminated.

The rest we could have dealt with, with the debt gone off them.

Yves, wrt your point about multigenerational families again becoming the norm, you may be interested in this Pew Research Center Study: Multi-generational Living During Hard Times. The framing of this is that it is related to hard times, but I think, as you do, that this is all part of the wake-up call that the American Dream is untenable. Ultimately, the dream cannot work because it is founded on the false notion that we all live in our little individualized spaces, and that the economy can continue to grow and grow and grow and that we can each have all that we want and not have to share. The model of atomized self-interest and individual prosperity defined by home ownership and the individual acquisition of stuff is unworkable. We will never be able to work enough hours to sustain that model and to consume the amount of resources it takes to fulfill that dream.

I, personally, don’t necessarily see this as a bad thing, because the idea that I can’t have my own lawnmower, my own ladder, my own car means I will have to create sharing relationships with my neighbors. And, like you say, households and families will become less ‘nuclear’ and more multigenerational and extended as people adjust to learn how to live well in a resource scarce environment. This is how it works in large swaths of the so-called undeveloped world, in which resource scarcity is a fundamental fact of life. But there are advantages to this way of life, in that sharing necessitates better social cohesion and, some might say, a better quality of life, at least in some respects.

Actually, I don’t know if you think that the American Dream is untenable…I was more responding to this point of yours: “it may go from being a sign of desperation to being seen as a smart way to economize and conferring other benefits (sharing child care duties, for instance).”

Dear Stephanie;

Consider that it isn’t necessarily the Economy that grows and grows and grows, but the amount of usable energy available to the average person that has been growing during the Industrial and now Quasi Post Industrial Revolutions. When usable knowledge is factored in as an energy stream, there is no upper limit to the expansion of the Peoples Economy. What is a limiting factor, and everyone here and on similar sites intuits this, is the control of access to the ever growing available ‘energy stream.’ Ray Bradbury wrote a wonderful short story about an ancient Chineese inventor who exhibited a workable ‘flying machine’ to the Emperor, and what resulted. Much the same is happening now.

Well, I get that. You’re speaking of efficiency, no? Is that the only thing on which a growing economy would rely? I think there are limits to efficiency. I don’t know what the limits are, really…but at this point, we’ve obviously gone beyond what’s sustainable.

Stephanie, “efficiency” is Global Fourth Reich CODE for whatever will eliminate us the “surplus population.” Caveat emptor.

Shouldn’t that be “Cave Populii?”

I have no idea what that means.

Stephanie: “I have no idea what that means” — delve into history.

“Delve into history”

Ahem…make your point less obliquely. Some of us have jobs (well, kinda, sorta)

Or Mark Ames’s Going Postal..

Stephanie, read books by Gotz Aly, in conjunction with Naomi Klein’s “The Shock Doctrine” for starters.

If we broaden our time horizon beyond the need to absorb the inventory overhang of foreclosed/stolen/abandoned houses that will remain on the market for at least a decade, the fact remains that most of American housing is worthless crap wildly unsuited to an energy constrained future. A 3-4000 square foot house built out of sticks of wood & minimal insulation, with windows facing the street no matter how that relates to the sun, deposited on a suburban lot ten miles from the nearest grocery store and forty miles from the place of employment— what value does it have when we can no import 70% of our crude oil to keep the system running and pay for it by printing dollars because we control the reserve currency?

Crazy, they ought to bulldoze that worthless crap, declare the Year of the Jubilee for debtors, and start construction of really decent housing for C21, made with non-toxic materials: urban, with self-irrigating urban gardens/farms, self-contained solar energy, solar-powered *unit* transportation, etc.

Time to start over.

Thanks for pointing out what I have been saying; you emphasize the aspect of urban sprawl associated with suburban home owning. That is a feature of home ownership that Americans do not want to address-among several issues I would like to add. Someone needs to emphatically show Americans the reality of home owning.

Destruction of the environment-if there are 100 million American families, the case of all them owning their home is dismal indeed. Many do not want to but about 67 million families seem to believe destroying the environment for the sake of backyards and swimming pools is ok

Only desperate people got to loansharks. Or very foolish ones.

So with foreclosure fraud and chain of title issues still pervasive, why would anybody want a mortgage?

It follows that one action that would help the housing market would be prosecuting some banksters for fraud pour encourager les autres.

We would have to roust them all out of Obama’s bed, first, and of course Krugman can’t say that, so he doesn’t say it.

Lambert, he can’t say it in the Times, for obvious reasons.

Krugman (like the PIMCO Man) appears well attuned to the “animal spirits” of the “plunge protection” crowd, that is, he knows when to set aside market fundamentals in anticipation (or knowledge) of maket manipulation.

Hussman’s last two weeklies are interesting – last week he expected a confirmation of leading recession indicators iwthin 6 to 8 weeks, this week he observes a stabilization of the decline not justified by the actual situation.

I think Krugman has nothing to fear if he can feed into a narrative on top of another temporarily successful attempt to kick the can down the road. There is a reason he slacks and self-censors on Obama where he did not hold back on Bush. At the end of the day, the cocktail parties still matter, and Krugman will not fundamentally question the authority of the consensus, only its most obvious errors.

b. — What good can Krugman do us, if he is assassinated literally or figuratively? He walks a very high wire continually, with only his wisdom and love of the Government of/by/for the People to guide him.

Also, too, if one believes that the 1% are engineering a long-term fall in life expectancy, a la the other collapsed continentally scaled multinational imperial police state, just as they have successfully engineered a permanent increase in the so-called “natural” rate of DISemployment, that doesn’t bode well for a housing rebound either. Not that I’m foily.

Mr. Strether;

Wonderful how we’ve been conned into calling it the Housing INDUSTRY, isn’t it? What say we start calling it the Housing COMMONS and start putting more Left leaning Overtons Windows in those structures?

I like the “housing commons.” Foreclosure fraud would be like the enclosure movement, inverted….

Indeed, Occupy Housing has already begun.

“Krugman has written a lot of good pieces lately that we’ve linked to on income inequality the disastrous austerian policies in Europe, and Republican derangement and duplicity”?

Are we reading the same columns? Krugman is making himself irrelevant: http://www.WeWereWallStreet.com/Krugman-Oscar.html.

He reminds us of Marlon Brando in On the Waterfront. He coulda been somebody, but he chose celebrity over serious economics. What a waste.

WeWere, you are a TROLL. “Hit the road, Jack, and don’t come back.”

You might’ve mentioned that his ‘trollness’ was obvious from his self-implicatory link.

“His High Trollness” — poetic.

@ – “we may see a sustained reversal of household formation rates, and it may even go as far as leading to larger average household sizes. Extended families living together used to be not all that uncommon; it may go from being a sign of desperation to being seen as a smart way to economize and conferring other benefits (sharing child care duties, for instance).”

http://facingzionwards.blogspot.com/2009/04/future-of-retirement.html

Luke Lea, “forward to the past” — the shop below and the dwelling above, in sets of “local” communities: “the neighborhood.”

You need new meds.

No, this was the time-honored tradition in New Orleans for centuries, and it worked very well indeed: peace, harmony, and prosperitly.

wait a minute

didn’t this guy get a nobel for economics?

you know from the same people that gave obama a nobel for peace

Actually, not the same guys:

http://en.wikipedia.org/wiki/Nobel_Memorial_Prize_in_Economic_Sciences

Friends;

Every once in a while Krugman will post a Style Parameter Notice to rein in the more vociferous of his ‘commentariat.’ One memorable time he chastised us and justified the spanking with the comment, “This is the New York Times after all!”

Q.E.D. (The Other Q.E.!) Q.E.Duh!

What still amazes me is the superficiality and

lack of depth and breadth in the mass media.

A few quotes from Tom Miller, other state AGs,

a few numbers here and there, and after a few

hundred words it’s over. Nothing about the

Case-Schiller data, nothing about citing

court decisions going against the banks, etc.

But I do admire the 60 Minutes program of

December 4th, 2011 where Steve Kroft interviews

Eileen Foster, who worked on Fraud Control at

Countrywide and was fired just after

BofA bought Countrywide.

Well said, ambrit. Prof. Krugman is a wise, tolerant, and compassionate teacher of We the People. Truly, he is better than Socrates by far.

A few days ago someone tweeted ironicaly, to all Democratic commentators, only good economic news in 2012. Apparently Krugman got the message.

This is a typical Krugman piece where he attacks those crazy Republicans, sucks up to the Democrats, and treats his mentor Ben Bernanke with kid gloves.

There has still been no serious effort to deal with the roiling morass of systemic fraud that is the housing market. Housing prices are still twice their historic (1997) norms. We have this huge overhang of millions of houses, but Krugman is seeing green shoots everywhere. Of course he does sound a note of caution, some understandable CYA given the load of BS he has just dropped on us.

Even if you accept the McKinsey report Krugman cites and I am not sure why anyone should, one of its highlights is US households “may have roughly two more years before returning to sustainable levels of debt,” that is this report says that it will take at least two years before Americans don’t get out of the water but get their heads above water. It takes more than squinting to make that look like a green shoot now.

Hugh, don’t you think that Krugman knows something we don’t? How have WISE leaders of the People behaved throughout history? Maybe like Virgil for Dante?

YVES, investigate that “food poisoning” immediately with a full blood check. Can there be any doubt that you have *a target on your back* now?

Be checked for *radioactivity* also.

May you flourish in fine health and fortune with We the People in the Tao.

Krugman’s mistake is that he thinks consumers can be irrational as he is.

Alan, Krugman is by no means irrational.

Housing simply will not come back until the listing/sold time line comes down to under 90 days. If you can’t get out from under a mortgage when you are on a corporate career fast track and your corporation is not helping with housing you simply postpone buying.

If we ever get past the huge post-crash housing inventory, we will then face the boomer retirement housing sales. That could take 10 years to unwind.

It just doesn’t look good for single family housing for a long time.

I have mentioned before, and it is worth mentioning again, that there are not many material, manufactured goods in the world that accumulates in value. I’ll just run through a few categories to show my point; in advance of criticism, I believe the exceptions emphatically prove the point. Let’s start with things consumers most often buy after housing:

Food-definitely not, with again the exceptional bottle of wine proving the point; this being a category of items that do not increase in value.

Clothes-not; Princess Di’s tiara don’t count either.

Electronics-the average value is %50 after one year from purchase.

Auto; no need to even comment.

We could go to the business side of town and look at some common investments:

Factory equipment-standard write off is what, 6 years?

Factories and warehouses-if they are carefully maintained and kept up they may keep their value but there are many rusting hulks that show what happens after the original intent and purpose of building the factory is no longer an operational factor. The Ford Wixom plant in Michigan designed to build Town Cars-filled with lots of specialized equipment, has no value to anyone else on the planet and sits empty lo these 7 years after its closing.

And on that last note we have the key ingredient to analysis that states that real estate accrues in value-if the property is maintained. Empty lots are of no use to anyone-and in general real estate is like that ‘rare’ bottle of wine having great value-there must be a connoisseur willing to shell out. Owners of Rental units-mainly apartments, are doing a doing a brisk business as people realize the cost of maintaining a home (often shoddily built in the first place-I don’t know of a singly dwelling I have seen that shows an acceptable degree of excellence in building that would make it worth an investment) is outside the reach of all of but the top 2 or 3 percent of the country. Unless one is willing to take considerable losses, individual home owning has proven to be a selling of pie in the sky.

Ray, here is the fact: ONLY the .01% are avid buyers of the most *valuable* goods in the act of “Financial Lebensraum” by/of/for the .01%. The next avid tier of buyers is within the 1%.

All brokers of any goods are concentrating on deals for the .01%-1%.

If you have goods appealing to the 99%, E-Bay is where you will be fleeced.

This is the *shearing of sheep* stage of Global Reich IV workout.

After this comes “the lambs to slaughter.”

We are dealing with “The People of No Mercy” — the ones Toni Morrison’s characters understand so well. Today, “We the 99% are All Black” – believe it.

With Krugman as an Economist we have no chance!

what i wonder about and here little discussed is the quality of the houses in the u.s. inventory of foreclosed or abandoned properties.

my wife and i have looked at a few of these for investment and because we know remodeling well. the houses themselves are extremely, even ridiculously, cheap. many would probably be a good investment just for the lot.

these houses are in “good”, “solid” neighborhoods. outside they are standard middle middle-class brick or clapboard ranches and bungalows. inside, though, they are often a mess and not from abuse or vandalism, just age decades of wear – single-pane windows, scratched, water-stained flooring, worn, damaged wall-covering, old kitchen and bath appliances.

i am told that houses like these are being bought up as investments by small groups of real-estate agents.

what i wonder, looking at the american housing market through my porthole, is whether houses like these would satisfy even young, energetic american couples these days. two jobs and two children does not eave a lot of time for remodeling except for the most disciplined and committed.

one question i have is: what portion of the 10 million inventory are like these – cheap to buy but expensive to make livable? 1%? 5%? 20%? 50%?

might these houses, together with houses with clouded titles, be by-passed entirely by home buyers of the future, so the working down of the inventory might involve fewer numbers than appears to be the case?

I’m currently looking at low-priced townhouses in the suburbs around Minneapolis as a first-time homebuyer. I know there are risks to this, but there are plenty of reasons.

So far, most of what I’ve seen is either in poor shape or moving off the market quickly. I’ve had five showing cancel in the last two weeks because the seller accepted an offer tha day. Driving around a development at night, there will be lights on in half the places even though there are two listings.

YVES, you need to know the following facts:

After Katrina, I had to repair the roof of my house before I could sell it to a buyer certain. I was urged to go the Small Business Administration outlet across the river (Gonzales) and apply for an SBA loan to accomplish this: a loan @ $10,000.00–the maximum allowable amount not backed by the collateral of my antique house on the Great River Road in Donaldsonville. The SBA Rep urged me repeatedly to apply for a loan up to 50% of the recently (officially) appraised value of my house (made by an appraiser recommended by the bank of the buyer)–which would require my pledging my house as collateral. This I refused to do.

Then, the Rep ASSURED me that if I could not find employment in exile (in Savannah), that the SBA loan @ $10,000 WOULD be FORGIVEN. This claim turned out to be false. In fact, I never found permanent gainful employment– after losing my job in a suburb of New Orleans, due to partial destruction and total disruption of the business where I worked by Katrina and the Flood of 2005. My savings exhausted, and in debt by 2008, at the end of my rope, I was harrassed aggressively by a merciless AGENT of a *private* collection service that had taken over my *debt* to the SBA. Finally, I was forced into bankruptcy, and existence through the kindness of blood relatives.

I am fully prepared to die of poverty at any time, as *surplus population* that cannot rely forever upon the *family members* whom I put in jeopardy of want through my inability to find gainful employment.

Hence, I am hereby a supplicant to the U.S. Government, as a *Nobody* elderly (but fit) citizen of the U.S.A., to provide a quick, painless EXIT to us “useless eaters” so that we are not compelled to die the agonizing slow and horrible death of starvation and death which I have witnessed at close quarters several times.

YVES, what is the remedy?

Dear LBR;

I have to get off to my “employment” at a DIY Boxxstore, but I ‘validate’ your pain, as it were.

We lived in Pearlingtom MS, at the Delta of the Pearl River when Katrina came to visit. After we came down out of our attic, the fun really began. We too had to take the $10’000.’ USD loan from the SBA, but in our case, to qualify for the State of Mississippi grant program. It was made quite clear to us; no loan, no grant. Corruption, generally endemic around here, exploded like the Red Tide with the inflow of huge amounts of poorly managed Federal money. I could, and often do, go on ad nauseum, but you get the drift.

Keep fighting the good fight. America will be free again one day.

I think security is underrated as an economic force. Over the last 40 years, corporate interests have succeeded in erasing anything resembling job security and dumped their pension obligations on the taxpayers. People can be fired at any time for any reason and no one can count on a pension anymore. Who is going to take on a 30 year commitment in that kind of employment landscape?

Now the Republicans are threatening Social Security and Medicare, the last safety net many people have.

The lack of security is going to continue to undermine our economy in ways that are difficult to predict, but the housing market will feel it most immediately and most acutely.

chris, the ONLY security for the 99% is in our solidarity against the .01% Global Despots of the Holy Roman Reich IV and their *trickledown* Agents of the 1%.

“We Will Overcome” our status as *Nobodies* only through our Solidarity as *Somebody* — We the People of the United States of America, through our “more perfect union” in 2012.

a question separate from inventory but highly relevant to home sales is family income.

until adequate family incomes (and the jobs that provide it) are both available and stable for a very large percentage of americans, houses are not going to sell well, making the size of the housing inventory seem like a secondary issue.

orionATL, it all works together as a *vicious circle* of *fate* dictated and facilitated for the .01% by their 1% Agents against We the People the 99%.

Hope you feel better, Yves.

Krugman is looking at trends that are already happening. You can point to any of a number of factors that would seem to indicate that the housing market could continue to fall for years, and that’s what you have done. What Krugman is saying is that despite all of that, it appears that housing may finally be finding the bottom here.

One thing that neither of you guys mentioned: Former homeowners who in past years have given up their home in a short sale, deed-in-lieu, or foreclosure, will be coming out of restriction periods lasting a few to several years on federally backed mortgages for borrowers who have such an event on their credit record. So they have not been able to qualify for mortgages, even though many of them may have begun to re-establish their finances. Many in this group, who are likely to want to buy a home– they all owned a home before, and presumably most do not now– will be coming back into a far more reasonably-priced market.

Also, one thing to look at is the default rates on new mortgages… it is tiny! The banks are reluctant to loan to anybody without solid gold credit, because the last thing they need is more foreclosures. It is hard to imagine that mortgage credit will be getting any more restricted, even if the economy languishes… but it certainly could become less restricted, especially if unemployment continues to fall and the economy continues to improve. More credit means more buyers can get back in the market. More buyers will help solve the inventory problem.

I respectfully believe that you are grossly underestimating the scope of this situation.

It may play out as you say on the comebacks, but we are still looking at no better than 20-25 cents on the ddollar in the end. A dime or less in areas where there is no hope for sustainble and relatively secure employment. That could be most of the heretofore retirement/service economy, highly air conditioning dependent areas.

There will be random sales here and there that will be seen as bargains by those with cash who pick them off on the way down if they see them as a good place to park it. But those who will rely primarily on credit and hoped for earnings will not get to play much for quite some time.

And as has been from time to time over these pages, there is no shortage of living space, beds, toilets or table space. Working out multi-generational family and good old fashioned communal living among people who get along with each other has a long, long way to go before there is a practical need for another nail to driven or wall to be raised. The most onerous obstacle to the practical application of that my be once well intnetioned bourgeoise zoning requirements.

farm manager, well said. Yours is the Voice of Reality.

Krugman is not talking about a housing boom, nor am I… we are merely talking about housing turning from a drag on growth to a contributor to growth.

I seriously doubt that most folks who have had to double up in this bad economy are looking forward to staying in that arrangement indefinitely. Not saying that it would be a bad thing in a social sense for extended families to life together in harmony and mutual support, but I just think that most Americans would want their own place if they had the choice.

The idea that you can run a world-class economy just by building houses is crazy.

Haven’t you heard? We are now going to run a world-class economy just by Tweets and Facebook postings.

Finehoe, this is (life support) squared. Time to pull the plug, and bring Zuckerberg down to the earth we inhabit.

When Krugman stuck by Bernanke and Geithner he forever forfeited being taken seriously for any reason – as an economic forecaster/prognosticator/advisor/analyst, I wrote him off back in the Internet bubble lead-up. The piece presented is mere hackery on behalf of the Admin.

However, he does see something. And what I believe he sees is a more visible de-coupling inside the US, the result of serial use of trickle-down policy in response to economic strains. There really are 2 distinct economies and the half with OK jobs up through to the wealthiest really are spending more and paying less attention to the constant blaring of warnings of “crisis”. In other words, the top half is actually feeling more secure (it does not matter what the real situation is, as they don’t know in any case, but the better off the more relaxed)in their particulars of job, income, investments, etc. After all, they’d been the big winners since 2008. And they’re in the mood to stretch. Just wait until $1 trillion in off-shore profits returns in exchange for a promise to create a bunch of crappy jobs and other re-election wonders roll out.

There can be both improvement in housing and no improvement in housing. Depends which half you live in.

Yves, I believe the crux of your argument is servicers have misplaced incentives to string out foreclosures to earn fees. This has lead to inflated shadow housing inventory. This reflects a very deep misunderstanding of the mortgage servicing business. Mortgage servicers rely on an idea of velocity to be profitable – how quickly can we either bring someone current or foreclose? Stringing a borrower out is very expensive for the servicer, primarily because it requires equity for what are called “service advances” not to mention increased labor and other costs pursuing delinquent borrowers (even if it’s going through the motions as you imply). Fees don’t accrue to the servicer unless they foreclose or bring someone current. Instead, the servicer bears the cost of the workout until the foreclosure takes place or the borrower is brought current, when they earn a fee. These costs are particularly acute for the big servicers that are incompetant and have poor businesses processes in place to service (BoA) but more transparent in public servicers (PHH, servicing prime loans, OCN and WAC, non-prime). If you spent a few minutes with their business models (sec.gov) you would quickly understand that delaying a foreclosure would be suicidal. It would just mean a lot of equity in advances and a bloated labor structure – not a windfall in fees. Only the biggest banks can afford to delay foreclosures and the only (repeat) only reason they do that is to avoid negative headlines or a mandate from mgmt or regulators. You’ve written many well informed pieces on this blog; this one is not one of them.

Interesting, I read the article and the comments, took me a good hour and a half.

What I come away from reading the comments is that there is a good section of the edumacated society that comments here but is unable to come to grips with realities.

It is not all about China and workers and mortgages etc, those are the obvious visible evidences to base ones opinions. One has to accept certain facts and then be willing to shape public policy that will take a tremendous amount of energy to change the system that has been in place the last 40 years in the U.S.

When Richard Nixon visited China in 1972 there were 14 Million credit cards in circulation in the U.S..

Mr.Nixon’s visit was historic in one sense but in another sense it was genius at work. The Republican/Capitalist membership in America was coming to grips with worker rights and costs to manage those rights affecting their profit margins. As every capitalist would do, we found a source to keep our costs down. With the partnership of the corrupt Communist Party of China most U.S. capitalists were able to shift manufacturing to China and lowered their costs. AT the same time the capitalist in the U.S. also realized a need to sustain consumption while decreasing wages, that’s when the capitalists made credit available cheaply to the masses, today there are 609 Million credit cards in circulation in the U.S. While real wages have either been stagnant or decreased. This increased availability of credit has allowed people to borrow against their houses or just have a line of credit to maintain their consumption.

So unless several things happen in parallel we will not get back to a norm that is healthy and sustainable.

What we need to do:-

1.Politicians need to be blunt and state the problem at hand.

2.The people need to stop being in denial, have to take responsibility for our inactions.

3.Accept housing prices have been inflated since 1075 and have to be deflated by another 70%, bankers and bond holders of the mortgages need to accept that and take a cut in their values, can’t be just the home owners.

4.Consumer resistance to buying has to be very strong.

5.adopt shared sustainable models that take advantage of idle capacities in many things without having to create product/service anew.

6.Become progressive and stop trying to sugar coat it, don’t blame government as the cause for the malaise, we did not get here because the government fucked us over, we got here by choice that was based on our stupidity, so wake up and smell the dandelions.