By Delusional Economics, who is horrified at the state of economic commentary in Australia and is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

The news from Europe was all Spanish overnight as the country continues to struggle to find traction on any plan that will lead it away from the need for external help:

Spain backtracked on a plan to use government debt instead of cash to bail out Bankia, as Prime Minister Mariano Rajoy struggles to shore up the nation’s lenders without overburdening public finances.

An Economy Ministry spokesman said yesterday that the government was considering using an injection of treasury debt instead of cash to recapitalize BFA-Bankia, as laid out in legislation approved in February. Spanish bond yields rose and investors criticized the idea, which the spokesman, speaking anonymously under ministry policy, said today had become a “marginal” option for the 19 billion-euro ($24 billion) rescue.

The government’s push to merge banks continues with the announcement that three savings banks, Ibercaja, Liberbank and Caja3, will vote shortly on whether to combine into a single entity. The merger, if approved, would create the country’ seventh largest financial institution with a combined £96bn in assets. Obviously we’ve seen this before with Bankia, which unfortunately didn’t go to plan.

Overnight the Spanish government also announced that its joint national-regional bond issuance scheme would go live within days:

Spain’s government said it would approve the issuing of joint bonds — “hispanobonos” — by the 17 regional governments next Friday, so as to make it cheaper for them to finance their debts.

“The goal is to reduce the pressure on the regions, which is often greater than the pressure on the state in general, with some regions not able to borrow on the market,” a spokeswoman for the Economy Ministry said.

Spain’s 17 regional governments have suffered a plunge in tax revenues and soaring debt since the collapse of a decade-long property boom in 2008, and they are struggling to pay suppliers.

Moody’s Investors Service last week warned of the deficit challenges as it downgraded its credit rating for economic powerhouse Catalonia and three other regions, Murcia, Andalucia and Extremadura.

Catalonia president Artur Mas called Friday for the central government to approve the use of “hispanobonos”, which would be issued for all regions and guaranteed by the state.

And so the blurry line between Spanish banks and national and regional governments gets a bit more out of focus. Although this may lower the rate at which the regions can borrow, it is very likely to do the opposite to the sovereign which continues to see yields returning to late 2011 pre-LTRO levels.

These plans, however, will do nothing at all to address the major underlying problem of the Spanish economy and in many ways are akin to a re-arrangement of the Titanic’s deck chairs. The problems of Spain’s economy all stem from the fact that the government sector is attempting ( or being forced ) to implement an austerity program at a time when the private sector is in deep retrenchment. Given the economic and political circumstances the country finds itself in it may have no choice, but that won’t change the outcome. The simple fact is that private sector demand is falling as economic circumstances continue to make it harder for the private sector to recover from the economic shock of the housing market collapse.

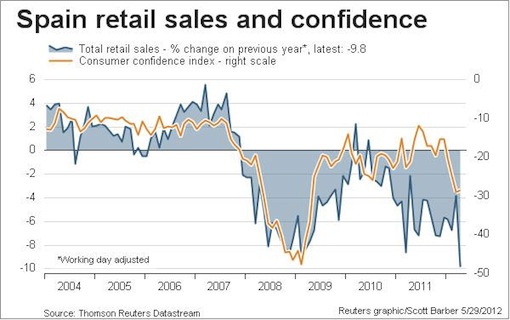

Spain will sink deeper into a recession in the second quarter, the Bank of Spain said, as data showed retail sales fell by a record annual rate in April.

Indicators suggest output will keep falling in the quarter through June, the central bank in Madrid said in its monthly economic bulletin today. The National Statistics Institute INE said retail sales dropped 9.8 percent on a calendar-adjusted basis last month, the most since the series began in 2004.

And in an ominous sign that things are about to get worse, the Governor of Spain’s central bank hasannounced he will depart his position earlier than intended:

The governor of the Bank of Spain said Tuesday that he would quit his job early, just days after watching the country’s banking sector sink deeper into crisis because of a huge bailout request from Bankia, the country’s biggest mortgage lender.

Miguel Ángel Fernández Ordóñez, the governor, told Prime Minister Mariano Rajoy that he would leave a month ahead of schedule, on June 11, arguing that his early departure would give his successor a chance to take better charge of the situation and open “a new chapter where important decisions must be taken.”

Although the Spanish bourse was off overnight it seems other markets are bouncing about on the perception that if things get any worse there will need to be some more action from central banks. The ECB, however, continues to throw cold water on that idea:

It is up to national governments, not the European Central Bank, to rescue any banks that get into trouble, ECB policymaker Ewald Nowotny said on Tuesday, adding that the central bank was not discussing restarting its bond purchases or priming to cut rates.

Fellow central banker Andres Lipstok reinforced the message, saying European central banks are being pushed into functions that are alien to them and that the ESM bailout fund would be a more suitable vehicle for tackling the bloc’s debt crisis.

Asked by reporters about problems in the Spanish banking sector, Nowotny, who is Austria’s central bank governor, said the problems were ‘unfortunate’.

“We have to be aware that rescuing banks is the responsibility of national governments,” he said. “The role of the ECB is in the field of liquidity and not solvency.”

Which leads to the question, what happens when the nation in question is also having solvency issues?

“” “We have to be aware that rescuing banks is the responsibility of national governments,” he said. “The role of the ECB is in the field of liquidity and not solvency.”

Which leads to the question, what happens when the nation in question is also having solvency issues? “”

Interesting that the ECB seems to understand the basic problem better than the Fed. It recognizes the difference between a solvency problem and a liquidity problem.

Creative destruction seems to be what is needed. Flush out the failing and fraudulent parts of the financial system. Focus on the productive aspects of national economies.

Dear financial matters;

From this ‘man on the streets’ perspective, it seems to be a case of ‘too little, too late.’ The Spanish Government is admittedly on the cutting edge of what could be called Mainstream European Economics. I believe that old line Economics said that an effective governing body got out ahead of a crisis and acted ‘before the fact’ as it were. The Spanish are somewhere in the middle of the curve and swimming mightily up the curve, in a belated enlightenment? (To scramble metaphors somewhat.) The question now is, how much political damage are the ruling parties in Spain willing to take to move the process along? “Creative destruction” here can, and probably will, include the fortunes of a lot of the Spanish governing class. Do they have the requisite ‘intestinal fortitude’ to do what’s best for Spain and ‘let the chips fall where they may?’

On another front, what would be the reaction if consumer spending fell off a cliff here in the US? I think that Americans have no idea at all just how bad the economy in Spain is. Some of the figures floating around recently concerning Spains’ economy are frankly Depression level. No wonder the Indignados arose in that benighted nation.

Creative destruction has the same problems in the US with the tight entwining of the political and financial classes and with the enabling actions of the Fed.

The excesses and inequalities are just getting to be too much. Debt and demand need to be refocused to address these inequalities.

As you say the governments have not shown much ability to stay ahead of the curve on these problems and may veer off the road. (social instability)

Let the bank fail, remove witch Lagarde via public humiliation, debt jubilee. Alcanzar el

orgasmo!

Spain, unlike Portugal or Greece, hasn’t received a bailout from the EFSF/EFSM funds (soon to be super duper ESM) or from IMF’s NAB arrangement. So, it’s just a matter of time before they will.

In my opinion Rajoy’s term will not last 4 years while Spain sinks deep into depression. His discourse was that the conservative party has the knowledge and the tools to bring back confidence and growth. He was going to manage the crisis “as God sends” (one of his favourite expressions) but he is discovering that it is much more difficult that anticipated. The guy is not particularly clever.

Moreover, the need to apply for ESFS rescue may well be around the corner and it could well be unacceptable for Rajoy. He could well resign and blame the “disastrous progressist legacy”. So, who will be the m.f. that the troika will select to follow suit with this austerian holly shit?

Rajoy sounds like a Spanish Romney. Maybe Romney quits after two years and blames Obama.

He is the Spanish Romney, including a tad of asperger syndrome as well.

He’s not “not clever” however, as Ignacio above claimed, but he’s a man of his party, which is involved in the shit of Bankia’s corruption (it’s primarily a corruption case) up to the eyebrows and even more.

He is somewhat shy and above all Galician by birth and uprising, what means that you have difficulty finding what he really means, because in that culture, hiding the true intentions by means of discretion and a confusing discourse is traditionally considered a virtue.

But IMO Rajoy is the brightest and most acceptable guy that Aznar’s government had and that’s why he was first vice-president and then national leader. All the rest were very mediocre or simply extremist, with the possible exception of Rodrigo Rato (who was economic vice-president then and is surely one of the main culprits of the worst of the bubble in Spain and Worldwide, let’s not forget he was IMF Director also).

The problem of the PP is exactly that: that their best leaders are that mediocre as Rajoy is or are extremely greedy and corrupt, or both (or are otherwise sidelined, as happened with Gallardón).

The problem is that they all bow to the Bee Queen Esperanza Aguirre, President of Madrid region and ringleader of all the corruption in Bankia, a very vulgar woman who was once the main focus of political satire shows.

I think you can make your point without saying something offensive about a group of people…while they may have difficulty with social interaction, they are generally loyal friends and ethical which is more than can be said of most people….don’t take my comment as support for Romney.

“Como Dios manda” is more like “as God commands” or “according to God’s will.” Mandar is used in the sense of ruling (sending commands). For example, the 10 commandments are called mandamientos.

Perhaps a better translation would be “As God directs”. I agree that you can find “send” in the dictionary but it isn’t the best choice here.

There’s absolutely nothing Spain can do to resolve this other than leave the euro. You can’t extract money from a private sector that doesn’t have any. But our friendly neighborhood neo-liberals and austrians seem sure that money just spontaneously appears when the non-government sector performs work. So it’s all the fault of those lazy slobs who aren’t working hard enough!

How leaving the euro will solve anything? That would cause a panic and also we all would use preferentially euros, pushing the new peseta to nothingness in a matter of weeks.

I dare any state other than Germany (or maybe Sweden or Finland) to leave the euro and survive the fall. Leaving the euro is out of the question, I believe.

What Spain can do is not being Ireland-2 but Iceland-2 and letting Bankia collapse “como Dios manda”, and getting a bunch of peole in jail for that. That would work because it’d send a message to private speculators, national and foreign, that they do not rule, that the state is in charge.

Was the peseta nothing before the euro? It won’t be nothing after the Euro for the same reason. The Spanish government will be making the traditional “offer you can’t refuse” to its people called taxes. And then the fate of the Spaniards will be in their own hands, not in the hands of innumerate psychopaths at the ECB hell-bent on restoring feudalism, enslaving Spain to criminal financiers. If you don’t realize how criminal these people who control Europe’s economies are, you don’t understand what is going on. They’ve proven themselves to be a predatory mafia worse than any seen in Europe since WWII, not a governing institution.

What the Spanish should do is find the way that they can f%$# the krauts to the maximum degree possible.

Make it clear that all the bondholders in the banks get NOTHING.

Don’t make the Irish mistake.

F%$# the bond holders, HARD.

While some Spanish institutions will take a hit, it will hit the German, French, and British banks hard as well, particularly since they are almost certainly counterparties on the CDS constracts, which will almost certainly unravel.

When the sovereign is facing insolvency you pray for time.

Spain’s 10-year spread to Germany surpassed 5% for the first time on Monday and today reached 5.5%.

Without any imminent promise of further easing by the ECB or stimulus from the EU, it appears investors are not waiting to test the Troika’s limits. Even if the ECB were to attempt another LTRO, many of the European banks are already heavily underwater from their sovereign debt purchases in the first couple go a rounds. Will the banks be willing to triple down on the same risks?

Apart from the severe costs of bailing out Spain, which may require more funds than previous bailouts combined, the decision also removes Spain from the group of countries promising capital to back the ESM/EFSF. Without Spain’s contributions, the burden of the bailout mechanisms will fall even more squarely on Germany. France and Italy will also see their shares increase, which the latter can ill afford at this moment.

http://bubblesandbusts.blogspot.com/2012/05/crisis-events-in-europe-speeding-up.html

If a sovereign can “face insolvency” then, it seems to me, the sovereign is not sovereign; not a “supreme ruler” but rather the subordinate of some other ruler.

So it would devolve to us to determine who or what the real sovereigns might be. Eh?

The sovereign bondholders are the likely culprit. Who else? Isn’t it all about them getting paid their “corporate welfare” as Bill Mitchell calls it? Isn’t the State their usury collection agent?

>>The sovereign bondholders are the likely culprit. Who else? Isn’t it all about them getting paid their “corporate welfare” as Bill Mitchell calls it? Isn’t the State their usury collection agent?<<

Sovereign bondholders? You mean like, pension funds, insurance and municipal trusts, mutual funds and so forth? Yeah, screw those corporate bums and the German horse they rode in on. Oh, and while we're at it, let's have a debt jubilee and hang all the bankers from the nearest lamp post, like Mussolini and his girlfriend.

I swear, the level of discourse in this group is even lower than zero hedge. At least there some of the comments are actually funny.

Do you people have jobs? Do you ever leave the house?

Feh

screw those corporate bums ebear

No. The US National Debt should be paid off as it comes with new fiat and no new US Government debt issued.

And if pensioners need additional income then increase Social Security Benefit Payments.

Nice try with hiding behind the old people though!

Make that “as it comes due“

>>No. The US National Debt should be paid off as it comes with new fiat and no new US Government debt issued.<>And if pensioners need additional income then increase Social Security Benefit Payments.<>Nice try with hiding behind the old people though!<<

Which old people? The ones who worked hard and saved all their lives to avoid being government wards? People who put their life savings into what they believed were secure investments?

Hiding behind the old people? What a worn out cliche. If you can ever tear yourself away from that keyboard you should go work for FOX.

I'm done here.

ebear

>> Sovereign bondholders? You mean like, pension funds, insurance and municipal trusts, mutual funds and so forth?

>> People who put their life savings into what they believed were secure investments?

It’s sad. But, it’s one of their miscalculations. People have been calling these debt/GDP ratios unsustainable for a long time.

Creditors must always consider the borrower’s capacity to repay loans and contemplate that too much lending/borrowing may lead to the borrower’s bankruptcy. If creditors / “investors” overextended credit, it’s their fault as well as the borrowers’.

Too many promises have been made for them to all be kept. Default is occurring one way or another.

Compromises are in order. Yet, so far, the less fortunate have been making all the sacrifices. Since nearly 50% of financial assets are held by the 1%, bailouts of financial stakeholders has merely maintained and indeed aggravated wealth disparities. Meanwhile, social programs are being cut even while people can’t find jobs.

People who put their life savings into what they believed were secure investments? ebear

They would be paid off and if MMMT is correct then they would be paid off with equal (or greater) value money since the debt of a monetary sovereign is ITSELF a form of money but one that pays interest. Thus paying off the National Debt (as it comes due) should be deflationary.

Hiding behind the old people? What a worn out cliche. If you can ever tear yourself away from that keyboard you should go work for FOX. ebear

Haha! You are the one defending the status quo. So sovereign debt is the true “3rd rail” of politics? So it appears.

If the old folks need charity then we should give it to them generously but no one is entitled to a risk-free return at everyone else’s expense. Take your principal and risk it in the private sector. And if you lose it then society should see to it that you are reasonably comfortable in your retirement anyway.

How the system corrupts!

ebear: thanks for trying a little reasoning, but it’s hopeless with the COMMENTARIAT on this blog. the combination of hard left ranting and MMT

“print all the money we need” is insane. i continue to read the blog because i

think yves does a good job of exposing banking problems we need to correct.

the combination of hard left ranting and MMT “print all the money we need” is insane. Andrew Hartman

Borrowing by the US Government, a monetary sovereign, is a major part of the fascist money system. It should be abolished if one is truly anti-fascist.

Sovereign “Spain” (the Spanish crown of Philip II, not yet formally Kingdom of Spain until the Bourbons) faced insolvency back in the day, repeatedly. And I’m pretty sure that Philip was quite sovereign.

So how is it that a sovereign state can’t face insolvency? The USA, as it issues the new gold standard of sorts in form of US dollar may dribble that matter at least for the time being by means of inflation, some of which is distributed through the World, but for the rest there is always external conditionants: you are as good only as your credibility is and credit and credibility are about the same word.

Dollars to donuts, they were on the gold standard and couldn’t just print fiat.

“We have to be aware that rescuing banks is the responsibility of national governments”

Actually that’s not the responsibility of anyone: banks should not, never, be rescued. The state already guarantees basic deposits via a mechanism similar to the FDIC – the responsibility of the state ends there.

Spain should not rescue Bankia: it is a tragic error and a power abuse, transferring the cost of private corruption and mismanagment to the general public. It’s Ireland again!

Maju, your “It’s Ireland again!” called to mind Japan and the US.

In the early 2000s, Bernanke repeatedly argued that the Japan did not allow its financial institutions to collapse in the early 90s, thereby leading to decades of lost growth.

Then the US suffers from a balance sheet recession, but Bernanke does exactly as Japan did!!!!

Perhaps both the monetary and fiscal authorities in Japan and the US did know what had to be done.

But politically, it was impossible for them to do so.

Quizas.

Jim,

You are correct, Bernanke did say this before becoming chair of the fed. Bernanke doesnt give a shit about citizens, his concern is his bank buddies.

I hope when you say politically, you mean banks. Obosso is also a coward.

I like it.

Spain should leave the Euro and default on their bonds. Or at minmum force a haircut on bond holders.

The banks should also be allowed to fail. Should Spain do this, it would be the first EU nation to come out of recession.

Go for it and show the world free markets work Spain…

Leaving the euro is not a realistic possibility for anyone other than Germany… unless they go socialist first. Leaving the euro in market conditions is summoning uncontrolled inflation for the new currency and massive black market in euros (or dollars or whatever).

Ohh it is not only a possibility, i will stress that there is no way in hell for Germany to bail out Spain, forget all EU.

I think most of us miss the boat. Spain got otself in this mess. You are saying you would rather see unemployment hit 50% before doing it?

The more spain waits the more painful.

Let the free market take course and remove the garbage from the system, and make sure bondholders pay for taking the risk.

We are so enamoured with the old, we are missing the great riches over the mountain. Let it go already and be another Icelad. Set an example to the developed world that your economy doesnt need fake worthless pieces of paper to function.

What bankers are afraid of is not that Spain will collapse into the abyss, its that it wont and that others will follow.

And one more thing.

This should also prove that free markets are more efficient.

To those acting as if free markets are a fantasy, fantasy is fighting nature like EU and the US have done.

Is what’s happening in EU also fantasy?

Get ready because the same is comming our way whether you believe in unicorns or not. When you see our “educated” class proposing making everyone rich we cannot be too far off from the cliff.

Why would Spain’s leaving the euro help them? Being a sovereign issuer of its own currency did nothing for Zimbabwe. By itself, it would do nothing for Spain either, thus something else is being overlooked.

No it would work. The debts become denominated in worthless currency, and themselves worthless. Now, largely debt free Spain issues a new currency, the Real, with value tied to a “real value” concept, (c.f. URV, Brazil), which stabilizes hyper inflation and restores order. Expect chaos in the mean time.

They would need to leave the European Union as well. There are many provisions of the EU that EU debtors to the Spanish state could employ if debts contracted in Euro were transformed to another currency (unless the bond allowed it as issued). In fact, as EU citizens themselves, Spanish people have legal manuevering room to push back very hard against a conversion of Euro deposits to pesetas. Spain and the other EU countries are not so sovereign as they were 30 years ago. Defaulting on Euro debts is a better option if Spain were determined to stay in the EU – not a good one, perhaps, but better.

Once debts are either defaulted or paid off,back the currency with gold and squash the bloated gov and the capitalflight will be from germany to spain.

http://www.youtube.com/watch?v=GhuvaKLJbNw

I enjoyed that video a lot. Go figure!

“The government’s push to merge banks continues with the announcement that three savings banks, Ibercaja, Liberbank and Caja3, will vote shortly on whether to combine into a single entity.”

Hey, I’ve got a great idea. You’ve got a good, solid house, right? And I’ve got a rotting, crumbling house, right? What say we get together and COMBINE our two houses? Then we’ll have one nice big sturdy house where we both can live. Good idea, eh? (I got it from a banker.)

I suspect it is more like multiple insolvent banks merge to form a bigger insolvent bank, which is too big to fail.

More like too big to bail. If yields go over 7%, either Spain or Grrmany leaves. If Germany leaves, floks expecting capital flight from Germany to the Euro have it exactly backwards.