By Philip Pilkington, a writer and journalist based in Dublin, Ireland. You can follow him on Twitter at @pilkingtonphil

The so-called ‘market monetarists’ – that is, a growing pack of neoclassical economists who are advocating that central banks should try to generate inflation – are not as strange a breed as many think. Recently we compared classic deflationary monetarism with contemporary QE policies and found that they were based on the same underlying theoretical framework. We also found that the high priest of classical monetarism himself, Milton Friedman, strongly advocated inflationary monetary policies for both Japan after 1991 and the US after the stock market crash of 1929. So, it is by no means surprising that when one monetarist policy fails (I refer to QE), another will quickly be cooked up by Friedman devotees.

That is precisely the role of the market monetarists in the current policy and economic debates. They have introduced the banal notion that central banks should no longer target inflation or unemployment but instead they should focus on Nominal Gross Domestic Product (NGDP) – that is, a measure of GDP that has not been adjusted for inflation. The idea is that the central banks should pump up non-inflation adjusted GDP until economic growth begins once more.

The only thing that market monetarists are more vague on than how such inflation will translate into economic growth (money supply voodoo?) is how they will actually accomplish the NGDP targets. Sometimes they refer to devaluation, sometimes to inflationary expectations, sometimes to banks levying taxes on deposits, sometimes… wait for it… to more QE – indeed, one sometimes gets the impression that they are saying nothing new at all. However, we will not concern ourselves here with peering into their little black boxes. Instead we will focus on what might, in the unlikely event that they succeed in their policy goals, be the likely end result. But first a detour into the distribution of income in today’s US of A.

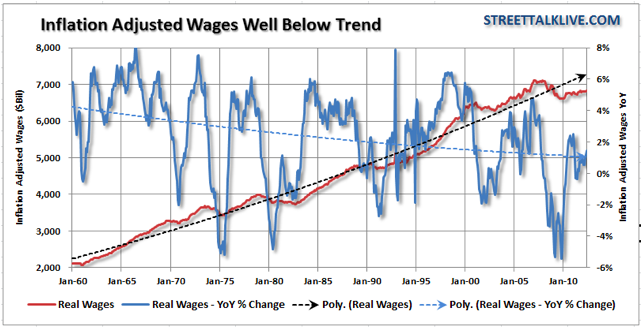

Recently Lance Roberts ran an excellent piece on corporate profitability and wages. He showed that while corporate profits are rising, real worker incomes are falling below trend. He provides the following graph to illustrate this:

Looking into this trend, Roberts notes that it is mainly due to changes in the structure of the US labour market. He is worth quoting in full in this regard:

The single biggest expense to any company is full-time employees: payroll, taxes and benefits. While the economy has grown since the depths of the last recession, demand has remained weak in terms of sales growth. The lack of demand has kept businesses on the defensive with a focus on maximizing profitability of each dollar of revenue. During the recession, and recovery, businesses have kept very tight controls on costs by reducing inventory levels, cutting budgets and maximizing productivity per employee. This has also led to massive changes in hiring and employment. Temporary hires (which have lower wages and no benefit costs) have substantially outpaced permanent employment since the end of the last recession. Since the first quarter of 2009, part-time employment has increased by more than 1.5 million while full-time employment is still lower by 1.25 million. The analysts and media have been quick to jump on the idea that temporary jobs will ultimately turn into full-time employment. However, in an economy that is growing at a sub-par rate with a large and available labor pool, the use of temporary versus full-time employment may well be the “new normal”. This also explains why dependence on “food stamps” have surged by over 14 million participants during the same period.

Roberts notes that this is a curious situation because falling real wages should impart a deflationary bias to the economy as a whole due to less people having money to spend on goods and services. Actually this situation is not so curious if we remember the Kalecki profits equation (which we dealt with in depth here). While there are a few iterations the Kalecki equation is best stated as such:

Pn = I + (G – T) + NX + Cp – Sw

Pn = total profits after tax. I = gross investment. G = government spending. T = total taxes. (So, G – T = the total government budget deficit). NX = net exports (total exports minus total imports). Cp = capitalists’ consumption. And Sw = total workers’ saving.

So, in English that equation reads as follows:

Profits – Tax = Gross Investment + Government Deficit + Net Exports + Capitalists’ Consumption – Workers’ Saving

Now, if we follow Roberts and assume that the labour market is being increasingly squeezed we can easily guess where all that extra demand is coming from. It is, of course, coming from two channels – the only two possible channels given the current macroeconomic picture of the US – that is: the government deficit and capitalist consumption (which can be read as: consumption out of previous profits). Of the two of these government deficits are by far the most important.

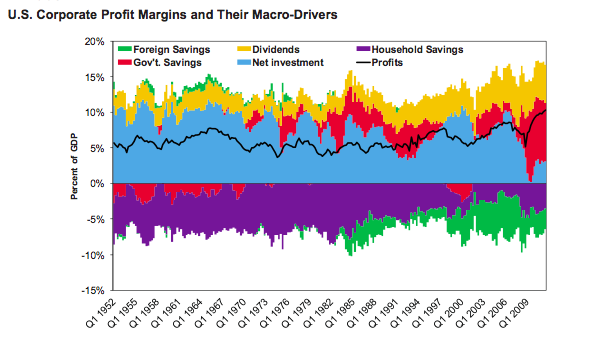

Indeed, James Montier from GMO [] has crunched the numbers and turned out evidence that confirms exactly what we would intuitively expect – namely that government deficits are the main drivers of profits in the post-2008 world:

Now that we’ve run through some structural distributionary features of the US economy, back to the market monetarists. What does all this mean? Well, it seems that although fiscal deficits by the US government are indeed propping up the economy and ensuring that those that have jobs can continue to remain employed, they are also covering up growing macroeconomic structural imbalances. Because there are such wide deficits and because these support corporate profits, companies have been able to suppress real wage growth and this has not significantly affected demand for their goods and services.

So, if the market monetarists had their way and provoked added inflation in the economy it is clear that this would not necessarily result in real wage growth to match said inflation. The labour market is extremely slack at the moment and, as Roberts has shown above, employers are using this opportunity to supress real wages below trend. If a burst of inflation shot through the system there seems no reason to assume that real wages could keep pace. Much more likely that they would fail to rise and living standards would fall. And as people needed to use more of their income to buy fewer, higher-priced goods and services this would also lead to lower economy-wide demand.

Indeed, such a policy might, if pursued with gusto, lead to a stagflation scenario where workers suffered unemployment on the one hand and falling living standards on the other. What a mess that would be… and, it should be said for those New Keynesians who tie their flag to this mast (you know who you are), it would make it all the more difficult to clear this disaster up with fiscal stimulus and other sensible policy measures as this might feed into the artificially generated inflation.

As we said though, it is unlikely that the market monetarists’ policies will be able to generate inflation even if they are implemented. The last time monetarist cranks got into power their policies were used to mask political aspirations that the general public would not have otherwise accepted. This time around, if the central bank chooses NGDP targeting as its new shaman’s stick – since the QE-wand has by now gone completely and comically floppy – they will likely just fall flat on their face. Where once monetarism was a grim mask worn by a disingenuous reaper intent on mass destruction, today it appears as nothing more than a cockscomb worn by an insecure fool trying desperately to convince the financial markets of his continuing relevance.

fwiw, we have wage cuts at work this week. New incoming staff are being offered 10% below previous salaries. Existing staff are seeing no raise.

I just want to know who THEY (1%, TPTB, Captains of Industry, etc – pick your poison) think is going to buy their shit once they have completely wrung the middle and working classes so dry that they are only left with enough money for basis human needs (and I guess we wouldn’t include healthcare in that as the majority of Americans want to keep 50 million people without healthcare. Those people against universal healthcare might want to have another think about that because, believe me, everyone is just a paycheck away from losing their job – and how will they feel about universal healthcare once they no longer have their corporate health plan for themselves and their kids! Anyone?

Apparently they are depending on government deficits to bolster their profits. Ironic since they constantly demand lower taxes, a shredded safety net, etc.

The truth is “they” want what they want now, and they don’t care who it hurts (except themselves of course). And once what they want now stops working, they will want something else. What they don’t want is to have any commitment to the communities they leech off of, and they certainly don’t want us to have any options other than the ones they provide us, which are exactly none. No options for us, infinite flexibility for them. Its really quite simple, and the American people, through propaganda and Stockholm Syndrome, have forgotten who their real enemy is.

“They” know that in the new Imperial order, there are plenty of emerging middle classes to “buy their shit.” Remember globalization? Were Americans so naive to think that we weren’t headed for a global leveling of wages? Of course they were. They were God’s chosen people after all, destined to eat at the table of plenty forever. The leveling has begun, and for the US this means a decline in living standards for most people, a well-documented phenomenon on this blog. As the race for resources heats up it will only get worse, to say nothing of the erosion of confidence in the Dollar as reserve currency.

Beltway Hack: How do you expect foreign workers to buy any of their crap either? Workers in China and India are paid much less than Americans, and they would have to save for a very long time to even buy a pair of Nikes.

Yes, but there are a lot of them, 2,796,529,728 for China, India and Indonesia taken together according to the World Fact Book, 9 of them for each American. So if GDP per capita reaches about %5,500 in this area (which it already does), you’ve fully replaced your old “home” market and all those whiny, pesky consumers who want safe products and honest services and all that socialist bullcrap that gets in the way of commerce.

Or at least, this is how the reasoning goes for Big Corporation Inc. Of course, reality may stand in the way but only in the long term. Meanwhile, the story sounds good and by then, Big Corporation Inc.’s CEO will have retired, very, very rich, anyway.

Jane,

this is actually the “monitorization” of the U.S. and world economies…in other words, products have little to do with it-it’s fiscal, paper debt oriented…

remember 12 years ago credit card co’s were blasting homes with sometimes 4-5 credit card offers per day-then credit card co lobbyists in 2005 actually re-wrote bankruptcy laws.

I don’t know what others were thinkng, but for our family the writing was on the wall-millions of Americans were going to go bankrupt. Now, Americans are so on the treadmill to pay back “debt”, they can’t organize to call for accountability for what Wall $treet has perpetrated, which Yves and others on this forum daily expose to light of day…

..should read monitization…

Yep, a great many of us that saw the “writing on the wall” (even as far back as Reagan, and even Nixon) always seem to leave out that Bankruptcy Act changey/thingy (passed ~2005 as you mention) when laying out a detailed timeline of the dismantling of Amerika over the last 40 years.

Love

“I just want to know who THEY…think is going to buy their shit”

You and every other increasingly impoverished working class (remember those folks? I don’t hear the term “working class” or “working poor” mentioned much) and middle class consumer will buy their shit. Since your wages haven’t grown in decades you’ll go into debt to buy their shit. People like you and me have for decades now. Maybe you’ll conspicuously consume, you’ll be convinced by their flashy ads that you must buy their garbage. You wouldn’t want your neighbor to have the newest gadget before you, right?

Keynes did point out some things that do apply here though. Like the propensity to consume. Working people, poor folk, have the highest propensity to consume, almost always. They, unlike middle and upper class people, don’t have the luxury of holding back consumption. They get a dollar they spend the entire dollar, and quickly. They have to, they have to eat, buy clothes for themselves and their kids, buy gas or public transportation to work. Rich people, especially in this crumbling country, spend a very low percentage of their incomes in the real economy. If they get another dollar they’ll store it offshore, buy up competitors, speculate. They’ll spend SOME in the real economy, they’ll buy luxury goods, which will warp production, but not nearly as much as poor folks would.

Middle class people can go either way, depending on the macroeconomic conditions. If things are going well and they feel confident as far as finding work, or keeping their job, and if the economy is growing, they could have a decently high propensity to consume. Again, in recent times, largely by going into debt. However, given how much debt they’ve piled up, and given how uncertain the job market is, if they are given a pay increase, they are far more likely than during normal times to save that money. They could be next, right? They have been paying bown their debt, which leads to what economists like Keen and Hudson call “debt deflation”.

It seems the best bet for now would be to raise the minimum wage, an across the board debt write down, for the federal government to step in and begin doing credit creation and finance as a public utility and for states and the federal government to start having a larger role in production itself.

It seems that the capitalists and the creditors have gotten to be too damn powerful. We have to take at least some of their power away. The only institution that can do that is the government. Sadly, the government is horribly corrupt. If Occupy or similar movements can grow maybe they can force through needed changes and fight the capitalists not only electorally, but also in the work place. The middle class is so thoroughly sold on the free market capitalist idea of how the economy works, they have so bought into how society should be structured along those lines, that I don’t think the movements have that great a chance to grow large enough to push those changes though, at least not yet. More illusions have to be shattered. Struggle has a way of wiping away those illusions.

I have little faith in the unions though. They once had bite, but shortly after WWII got rid of the radical members that pushed things forward and were willing to fight, who had an alternative vision for the economy and society at large. The unions worked with the CIA, and later the NED, in places like Latin America and Europe to beat back the left. They threw their lot in with the capitalists who were itching to destroy them. They’re weak, too attatched to the damn Democrats and don’t even attempt to propose an alternative vision for the economy. The capitalists, the 1%, have nothing to fear with the damn unions.

The whole monetarist nonsense though is puzzling. Prepensities to consume and the so called “velocity of money”, liquidity preference, the feelings and expetations people have about the future, private debt levels, wealth and income inequality, this all is where we should focus. If the monetarists knew what they were talking about QE1, QE2 would have gotten us on the right track. The truth is that there are structural problems with the economy. Since they refuse to consider fundamental changes to the economy, or took pay attention to economic history, what do they have to add to the conversation?

who will buy their stuff?? WE will of course…we are a nation of procurers and buyers, whether we have the actual money or not…when we run out of actual cash, the banks will simply enslave us with even more high interest credit card debt that will keep us prisoners to them for life…we know this and THEY know this…

i watched a lady the other day put $80 on her visa at a convenience store…$60 in lottery tix and $20 in cigs…she pulled away, cig in mouth, scratching the tickets off one by one, and tossing them out the window…

this is america folks…

Interesting graph. The way I read it, by 2000 household savings had already dwindled, making many in the population more vulnerable to debt — which had become the real ‘engine’ of the economy.

But I can’t tell from the graph how much of the net investment was attributed to the FIRE sector, which by at least 2006 was 40% of the US GDP.

Apart from whether GDP is a useful measure (or in what limited ways it might be a useful measure), it’s hard to break out from this graph what percentage of the activity it represents was happening in the FIRE sector. In other words, the economy has been weak for a long time, but GWBush’s ‘ownership society’ and the fraud in the debt markets managed to (mostly) disguise that fact — at least until the last months of Bush’s term in office.

deflation and hyperinflation are tools, like asphyx and electric shock.

the bridge is self-catalytic because the explict gravity centrifuge reduces out all but unique event horizon degrees of unknown resonant tuning.

as you travel, you become increasingly comfortable with the unknown and uncomfortable with the known, in a distribution. naturally, your skill at blending the flux increases to meet timing requirements.

naturally.

you don’t have to fully understand the reactor to employ it. most do not understand the internal combustion engine. the problem arises when stupid aims a 6000 lb truck at stupid, in a game of MAD.

current weaponry is relatively insignificant. do you want stupid to be in charge of what is coming next?

the middle class, of its own free will, chose ignorance, following explicit capital into the FIRE. regardless of ism, capital is a derivative of labor. if you step aside capital implodes. adjust accordingly, and aggregate to re-boot.

Kevin,

I love your metaphor, but to blame “middle-class” for LIES by convicted war criminals bushcheney deregulatory legislation, LIES regarding Wall $treet fraud, and so much more in their drive to perpetrate Milton Friedman “Shock Doctrine” “free market should regulate itself” economics, is pure scapegoating of those who are PAYING for transgressions…

FACTS=2001, “financial sector” totaled 19% of U.S. economy-by 2007, 41%. 2001, “derivatives” valued under $2 trillion,

by 2007, $600 trillion…”middle-class” was kept completely in the dark regarding…

Are you suggesting that the way we middle class dress, we deserve to be raped?

The fact is that capital is raping the middle class, and no amount of talk is going to slow the process, which is rapidly cranking up again as I type. Aggregate human behavior cannot be altered in real time.

In other words, get out of the loop while you can. Reorganize. They are not targeting the Syrian borders to reform a legacy empire.

This is why i think everyone should be allowed to have their own M1-Abramms Tank – can’t let stupid have a monopoly on ’em, otherwise MAD doesn’t apply, and we all surely need to rely on GameTheory for end-game event-horizon culmination) :-)

Love

More economic bullshit. Apparently, the only thing economists cannot imagine is a univeral bailout of the 99% that would eliminate the crushing debt overhang and restore aggregate demand, at a cost no greater than the amount already wasted by the Treasury and the Fed in a futile attempt to save the zombie banks and their shareholders and bondholders. All elite propaganda to the contrary notwithstanding, nothing except such a universal bailout can possibly derail the depression now developing. Nothing.

Nothing? How about a good old-fashioned war?

With good old fashioned animal spirits. :(

A universal bailout will never< happen for a multitude of what should be obvious reasons. And “old fashioned” war won’t happen again either. We now have “new fashioned” perpetual war. Other than a few well connected defense contractors, anyone seeing any economic benefits from that lately? I’m only surprised they haven’t sold us on the draft again. Forced conscription would flood the professional killer labor market and drive down wages very effectively, although it would also undermine political support for the perpetual war effort, not that that would necessarily represent a serious impediment either. I’m sure NSA/DoD math geniuses have already studied and sim’d the issue ad infinitum, so I’ll defer to their professional expertise.

A universal bailout will never< happen for a multitude of what should be obvious reasons. James

Let’s hear them. Some, I’m sure, cannot stand the light of day because they’re pure evil.

Although, I must say, I do agree with the thrust of this post. Economic bullshit indeed! I can say with pretty reasonable certainty that when the heavy hitter policy principals are in the room together they’re all rolling their eyes and laughing under their breath when the econo-geek starts rambling. At best, they’re listening carefully to cherry pick snippets of econo-blather to fit whatever political agenda they’re going to implement regardless.

I think we need a “Swordfish” (John Travolta, Halli Berri movie) style solution — with the added requirement of immediate materialization of all those “0s and 1s” that are to be doled out into tangible (hard) assets (Land, Gold/Silver, Oil, Mines, Coal, Food/Agri (Farms), Water/Aquifers, ..commodities, heck, even Universities, Medical Research Labs, Nanotech Research Facilities, BioTech equipment, etc).

Love

p.s. after all, all it takes for a Fiat Currency to thrive and keep it’s faithful followers ensnared in its web of deceipt and confusion is an unwavering Belief in its (future) value, right?

I think Phil is converging on the solution but it takes time for something like “Victims deserve restitution!” to overcome the bias that economics must be

immoralamoral to be realistic.This is what playing with the economy gets you. Especially if don’t know what you’re doing [Greenspan/Berneke]. The gov’t role should only be to insure that it is a fair playing field.

Good article here:

http://www.bloomberg.com/news/2012-07-22/bungled-bank-bailout-leaves-behind-righteous-anger.html

“So, if the market monetarists had their way and provoked added inflation in the economy it is clear that this would not necessarily result in real wage growth to match said inflation.”

True enough, but it does not follow from the preceding argument. OC, inflation need not mean growth in real wages.

As for the Kalecki equation, it does not include wages as a variable, so invoking it says little about wages. (It does include workers’ savings, so if workers save, presumably they got paid.)

As for gov’t deficits correlating with profits now, deficits inject money into the economy. Somebody tell the Republicans!

Eh… the Kalecki equation does include wages. Investment and government spending pays the wages in — whether public or private — and taxation and saving takes wages out of the system. All wages that are not saved are spent.

I did a piece on the Kalecki equation that is linked in the above piece. I suggest you read it.

It does not include wages as an explicit variable. If some variables can be split into wages and other variables, then we do not have to guess. :)

Inflation is causing wages to decline? Won’t deflation do the same? What’s the solution then?

In America people love solutions–solutions have been the alpha and omega of political debate and governmental power at least since the progressive era. There are no “solutions” to this. There are outcomes to be sure and consequences. But with respect to a solution which I understand some measures taken to insure the status qou or a previous state–no dice buddy.

I disagree. There is an easy way out for everyone (except the true SOBs who desire misery for others) – a ban on further credit creation plus a metered, universal bailout.

See Steve Keen’s “A Modern Debt Jubilee” for the basic idea.

Gee wiz. It’s only some new fiat and a little principled ingenuity that is needed.

(except the true SOBs who desire misery for others)

Too bad. They are the one in charge. Power is a magnet for true SOBs.

See “Wall Street”, “High-functioning psychopathy”, “Wealth effects on personal morality”, etc.

And I’m not trying to be witty. I really think that’s the problem and that it’s getting worse because of technological progress. Technology increasingly allows small groups to exert very large amounts of power.

Think about it. We went from the feudal nobility of the Middle Ages who had to go about their ruling business in full armor on a horse, to the kings of the 17th century who could command the power of entire states though networks of couriers and the rule of (their) law, to the Robber Barons who managed their railways empires thanks to the telegraph and armies of clerks, to the Wall Street scum who can turn upside down wheat markets worldwide with a few keystrokes and throw hundred of millions into hunger and billionaires who buy elections and pervert democracies with their wealth though mass media and manipulation of public discourse and culture (think-tanks, etc).

Like it or not, technological progress is here to stay (and I rather like it, personally). But we need to either severely curtail anything that looks like an accumulation of power (and I mean that very broadly: wealth, influence, fame, medias, etc) or to find a way to assess reliably antisocial disposition and somehow neutralize individuals who score badly.

Although water is the universal solvent, I find alcohol to be a fine solution

One solution is to produce inflation via wages. E. g., let the Federal gov’t hire people to repair infrastructure, maintain parks, write poems, etc., like it did during the Great Depression. Let it give grants to schools to retain or even hire teachers and other workers, and to spend for supplies. (That may not actually induce inflation, but if it does, wages will not be left behind.) Then we can get out of our Not So Great Depression.

Philip,

This goes to you as you deal in truth battle people who want hope and easy answers…

It was the function of these passionate sentimentalists to find hope and Promise … in the end … [Idealism] converted itself bravely into the doctrine that there is a mystical virtue in optimism, even in the face of massive proofs that it is unjustified. That is to say, the man who hopes absurdly is, in some mysterious manner, a better citizen than the man who detects and exposes the hard truth. … bear this doctrine clearly in mind. It is, fundamentally, what is the matter with the United States.

H.L. Mencken [S.S.; The Idealist; April, 1922, p. 44.] Immune by H.L. Mencken (From the American Mercury, March 1930, p. 289)

This is an excellent article, that seems to accurately piece together the REAL WORLD:

Government Structural Debts are keeping us out of a depression, but are not translating into wage growth, and are being fed by monetarists which results in lower wages and higher cost of living.

If we remove the structural deficits we force ourselves into a depression where the imbalances are exposed through collapse of the corporate profit centers, which purges the system creating new opportunities and giving the monetarists the opportunity to butt-out of our economy.

There is no good way out of our current predicament.

There is no good way out of our current predicament. Tim

Wrong! It’s called restitution and reform and it’s not that complicated either.

My comment just got lost in the ether. Big thunderstorm here. I’ll edit myself down to this point: We need a social safety net in this country and a full-employment mandate. Not a conflicting Fed mandate to balance inflation on the back of unemployment. And we discount altogether a good affordable education. And completely forget single payer health care. Global trade is going to kill us because all other countries have these social benefits and have learned to make a profit regardless. We have not. Instead we have offshored our corporations to capitalize against their own country by gaining the difference. Not just keeping wages down, keeping social benefits down, and any progress that does not feed the pockets of our corporations. Philip just proved we live in a government that supports corporate profits. It does not support labor. Not to even touch on health care for all and education. Ergo ours is not a market at all. Ergo it is officially open for egalitarian revision. The only thing in the way is our totally ignorant and corrupt politics.

Back in the day, it was widely understood that high corporate taxes were good for workers and the country as a whole because they caused tax avoidance, consisting of reinvestment in the company, including higher pay for workers. Lower corporate taxes results in profit taking.

I think part of the reason neoliberalism has taken off among dems is because they don’t realize that what’s good for companies is not necessarily good for the average person.

One of the main features of the brainwashing of the U.S. populace consists in maintaining them in the most complete ignorance about where exactly their Welfare System came from—-a system that’s all but lost anyway at this time. No, it didn’t appear because of the generosity of U.S. capitalists (har, har, good one) neither because FDR was a great guy. It actually became reality thanks to what, who, yanks have hated the most in History: the Commies; Stalin. It’s thanks to the USSR that U.S. working stiffs had it so good for more than half a century. If you don’t think so, just check the coincidence in time between the respective lives of the Welfare State and that of the USSR. The only reason why the New Deal took place, during the Depression, is because FDR went to the U.S. elites and said to them, so to speak: listen, you have to give something to the people, to bribe them, give them a bigger piece of the cake, or we may have a Bolshevik Revolution here also. FDR was no more of a Socialist than Keynes but, as Keynes, he wanted to save Capitalism. I remember when Larry King was still doing night radio and he had once a guest who told him something that so much fascinated him, he kept repeating it for the lenght of the program: that FDR stole 21 of 22 programmatic points of the U.S. Socialist Party in the 1932 Presidential Campaign. So after all, FDR’s motto seems to have been: to defeat Communism, let’s became Socialists ourselves and give the people Health Care, UI, Old Age Pension and the rest. No wonder then that with the USSR gone the U.S. capitalist class lost all fear and started taking from the working stiff everything they had given to them while they were scared. (Who put it better is Scott Adams, Dilbert’s creator, who said once that during the 1990’s U.S. workers had lost their dignity). During the 1990s Downsizing became the most popular word amongst the U.S. economic elites and then the culprit was sindicated to be the computer technological revolution, the Internet and so on; we may understand that, but that doesn’t give an excuse for destroying the social security net. That was a good one the oligarchy played on the populace. And there you got it, 60 years of U.S. History in a single paragraph. The most intriguing thing, though, at least to me, is that the two biggest butchers of the Welfare State, the two men who have done the most to destroy it, are not only Democrats also but also both have gotten public images of Great Liberals, even of Socialists (!): Bill Clinton and Barak Obama.

BTW, James Petras has a detailed article about the Welfare State in both countries but the shows too much a pro-Stalin bias and also, for some reason, completely ignores the first eight years of FDR, he writes it as if all this business had started in 1940, with WWII.

Some very sad posts on the Irish economy blog.

1.Regaining Competitiveness

2.The External Value of the Euro

It looks like Ireland will be first economy on the planet with zero domestic consumption.

Its only purpose is to farm external capital flows using ever more absurd mechanisms.

What is wrong with these people ?

Do they not realise a domestic economy needs a domestic currency ?

Soon we will be land without spuds.

We have become a sort of lucky bag economy complete with lucky bag like economists.

How do you solve the Saudi Arabian Problem ?

A oil defecit country inflates via true printing of currency……its oil imports and $ exports falls but it ability to work falls also as energy is defined as the ability to do work.

Saudi Arabia or some other country (China?) has now more surplus oil to burn…(the ability to do work)…it “grows” at the wests expense.

Its a catch 22.

A recipe for war.