Yves here. The article below explains how both advanced and emerging economies can remedy their seemingly intractible problem of high public debt levels and low growth: by properly focusing spending on productivity/output increasing areas, such as infrastructure and health, and increasing efficiency of govenment operations. Note that this analysis immplicity assumes that the countries in this fix are, like Eurozone member states, not monetarily sovereign. But even those that are often have to contend with the objections of budget hawks.

Even Larry Summers, a mainstream economist of only a mildly Keynesian persuasion, stressed that infrastructure spending more than paid for itself (when you have as much backlog and deferred maintenance as the US does), generating GDP growth of as much as 3x the expenditure.

Yet many advanced economies have bought the neoliberal fairy tale that private development and ownership of pubic services such as infrastructre will be more efficient. The fees associated with complex legal strucuting and fundraising for these deals alone makes the idea that they will be cheaper (ex delivering a very inferior product) dubious. A simple proof: in the US, every newly-built public toll road has gone bankrupt. As we wrote in 2021:

One obvious form of grifting is toll roads. A 2014 article on privatizations, describing the economics of new toll road projects, explains how they always go bust. I have seen no evidence that the structure or terms of these deals have changed to favor users and taxpayers. From Thinking Highways:

Beginning with the contracting stage, the evidence suggests toll operating public private partnerships are transportation shell companies for international financiers and contractors who blueprint future bankruptcies. Because Uncle Sam generally guarantees the bonds – by far the largest chunk of “private” money – if and when the private toll road or tunnel partner goes bankrupt, taxpayers are forced to pay off the bonds while absorbing all loans the state and federal governments gave the private shell company and any accumulated depreciation. Yet the shell company’s parent firms get to keep years of actual toll income, on top of millions in design-build cost overruns….

Of course, no executive comes forward and says, “We’re planning to go bankrupt,” but an analysis of the data is shocking. There do not appear to be any American private toll firms still in operation under the same management 15 years after construction closed. The original toll firms seem consistently to have gone bankrupt or “zeroed their assets” and walked away, leaving taxpayers a highway now needing repair and having to pay off the bonds and absorb the loans and the depreciation.

The list of bankrupt firms is staggering, from Virginia’s Pocahontas Parkway to Presidio Parkway in San Francisco to Canada’s “Sea to Sky Highway” to Orange County’s Riverside Freeway to Detroit’s Windsor Tunnel to Brisbane, Australia’s Airport Link to South Carolina’s Connector 2000 to San Diego’s South Bay Expressway to Austin’s Cintra SH 130 to a couple dozen other toll facilities.

We cannot find any American private toll companies, furthermore, meeting their pre-construction traffic projections. Even those shell companies not in bankruptcy court usually produce half the income they projected to bondholders and federal and state officials prior to construction.

Putting aside obvious public burdens like bankruptices, private ownership of infrastructure is inherently a bad deal for citizens. Financiers “sweat the asset” by jacking up charges, like landing fees for airports, and skimping on maintenance.

US healtcare, with its high costs and poor outcomes, is the poster child of what happens with profit incentives in all the wrong places. And now we have the EU and US set to bulk up on similarly overpriced arms spending.

So even if policy makers take proposals like these to heart, they have to overcome a lot of intellectual capture and corruption to get them implemented. And all the signs are that inertia and horrible leadership will guarantee that conditions will get worse, save for those at the top.

PS: Before you pooh pooh this article because its authors work for the IMF, keep in mind that there has long been a split between the research side of house, which has long advocated progressive (in the older sense fo the word) reforms, and the “program” side, which is a hard-nosed neoliberal enforcer.

By Era Dabla-Norris, Deputy Director, Fiscal Affairs Department International Monetary Fund, Davide Furceri, Division Chief, Fiscal Affairs Department International Monetary Fund. Zsuzsa Munkacsi, Economist International Monetary Fund, and Galen Sher, Economist, International Monetary Fund. Originally published at VoxEU

With high public debt and weak medium-term growth, finance ministries seek to do more with less. This column argues that efficiency gaps in public spending stand at about 30-40% globally and are pronounced in infrastructure investment and R&D spending. Using empirical and model-based analysis, it shows that reallocating spending to infrastructure, education, health, and R&D and closing efficiency gaps can raise GDP by 11% in emerging market and developing economies and 4% in advanced economies, over the long term, and crucially without increases in total spending.

Public debt is set to surpass 100% of GDP in the next four years globally, according to the latest IMF projections. Higher interest rates, and pressure to spend more on defence, ageing societies, and development create a constrained environment where every dollar of public money has to work harder in delivering better outcomes. Compounding this challenge, medium-term growth prospects have remained persistently subdued since the COVID-19 pandemic.

The IMF’s October 2025 Fiscal Monitor finds that countries have substantial scope to reallocate public spending to support economic growth, and they could gain around one third more value for money by adopting the practices of best performers (IMF 2025). Moreover, the report finds that spending smarter – through improved composition and increased efficiency – can raise GDP by 11% in emerging market and developing economies and 4% in advanced economies, over the long term.

Scope for Reforms

Public spending as a share of GDP has doubled in advanced and emerging market economies since the 1960s; however, the allocation has not been pro-growth. Globally, public investment as a share of total expenditure has declined by two percentage points, while spending on public education has stagnated at about 11% of total expenditure – less than half of public wage bills.

Critically, our new estimates for 174 countries suggest that nearly all have substantial room to improve the efficiency of public spending. Building on a rich literature (e.g. Apeti et al. 2023, Herrera et al. 2025), we measure the distance of countries from a production possibilities frontier, which represents the best possible outcomes in infrastructure, health, education, and research and development spending. Importantly, our estimates are the first to vary over time while also allowing for structural differences across countries, statistical noise, and uncertainty over the choice of outcome variables.

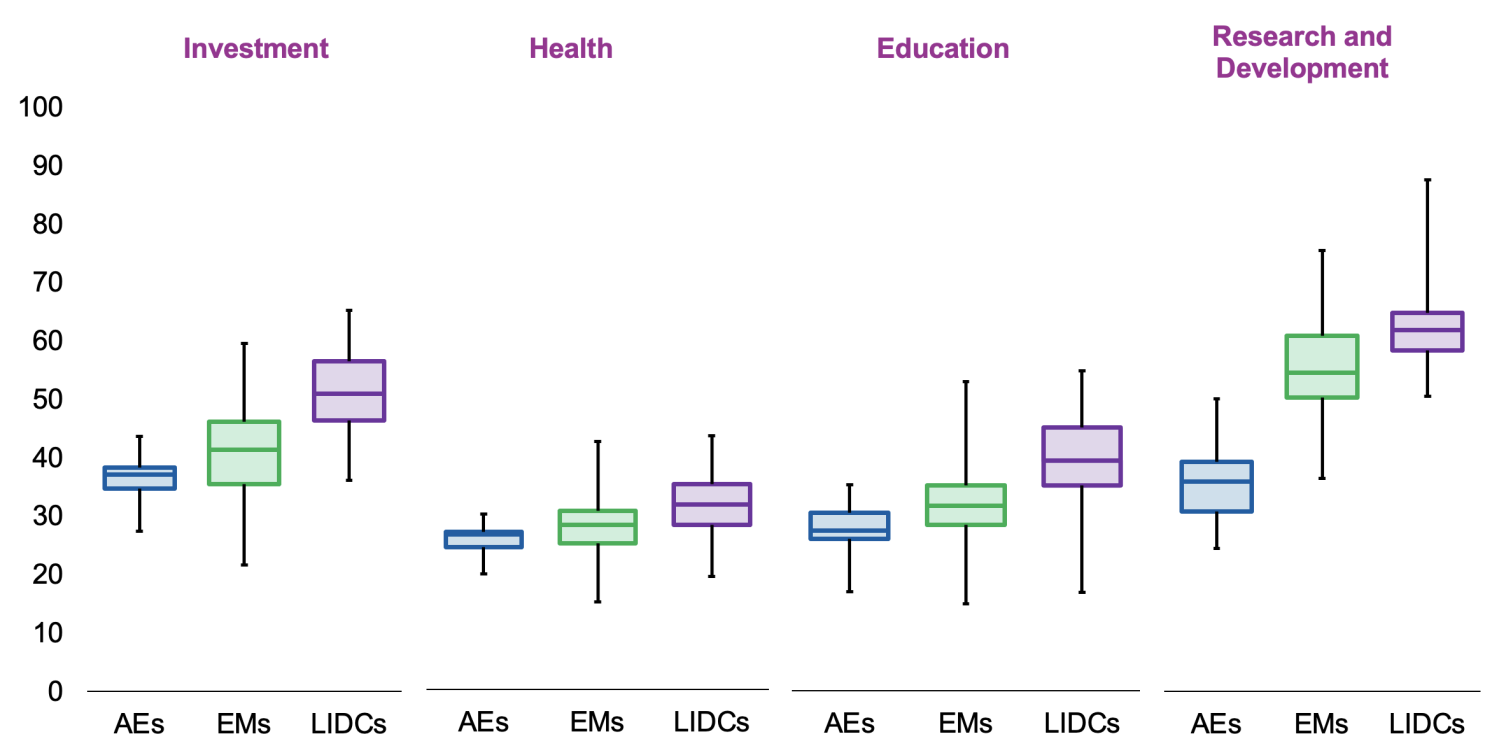

The dataset reveals that efficiency gaps stand at about 30-40% globally today and are pronounced in infrastructure investment and research and development spending (Figure 1). These gaps have narrowed considerably over the past four decades, reflecting worldwide increases in life expectancy, technological advancements, and expanded access to basic infrastructure in low-income developing countries.

Figure 1 Public spending efficiency gaps (percent)

Notes: The figure shows efficiency gaps, which are distances to the spending efficiency frontier. Efficiency gaps range from 0 (fully efficient) to 100 (fully inefficient). The figure shows averages from 1980 to 2023. The boxes indicate medians and interquartile ranges (25th –75th percentiles), and the whiskers delineate the minimum and maximum values. AEs = advanced economies, EMs = emerging market economies, LIDCs = low-income developing countries.

Output Gains from Reforms

A vast literature examines how the allocation and efficiency of public spending contribute to growth. In standard growth models, public investment in physical and human capital increases the economy’s productive capacity, and public R&D spending adds to the knowledge base that firms use to innovate (Barro and Sala-i-Martin 2004). More efficient public investment adds more to the capital stock (Gupta et al. 2014, Presbitero et al. 2016).

We contribute to this literature in two key dimensions. First, we analyse – through both empirical and model-based analysis – how the composition of public spending affects economic activity, assuming total spending remains constant. Second, we assess how the economic effects vary across countries and over time, based on the new estimates of efficiency.

Empirical evidence – using local projection and synthetic control methods – from about 700 episodes of large reallocations in public spending in 155 countries suggests that output increases substantially in the short to medium term. A major reallocation to public investment is followed by an increase in output of about 4% ten years later. Reallocations to public health and R&D spending are followed by 3% increases in output over ten years. These gains start to emerge even in the first five years and increase over time.

Indeed, simulations of an endogenous growth model clearly illustrate the potential long-term gains and the economic mechanism. Public infrastructure adds to output alongside private capital and labour (as in Traum and Yang 2015), while public investment in human capital enhances the productivity of time spent in education, accelerating skill accumulation. Public R&D spending expands the stock of innovations available for firms to adopt, with technology diffusion occurring gradually as firms invest in adoption (as in Anzoategui et al. 2019). The model explicitly incorporates inefficiencies in public investment, human capital, and R&D, by allowing some public spending to be wasted instead of contributing to the stocks of capital and knowledge (as in Berg et al. 2019).

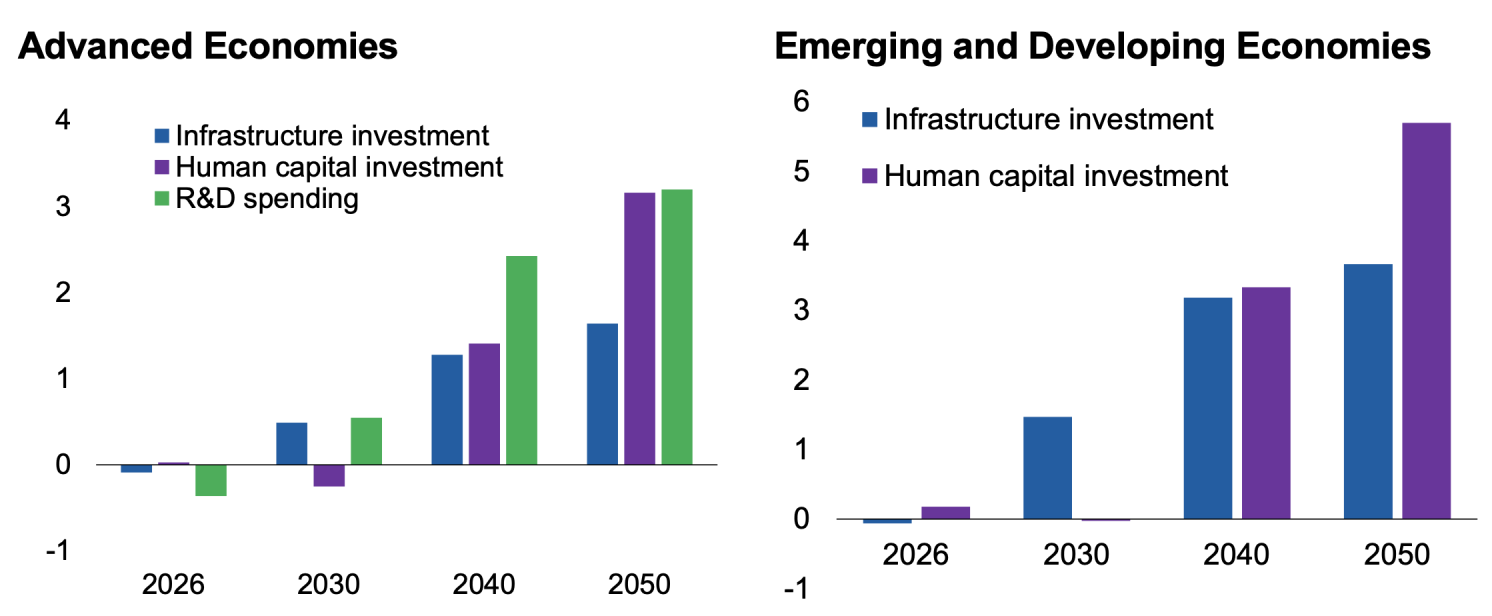

Figure 2 Long-term output gains from reallocating spending (percent)

Notes: The bars show long-term output gains due to a permanent increase, in the expenditure categories listed in the legend, of 1% of GDP in 2025, funded by a cut in public consumption.

The results show that reallocating 1% of GDP from government consumption (such as administrative overhead) to public investment in human capital – such as updating national curricula and equipping schools – can increase output by 3% in advanced economies and 6% in emerging market and developing economies over the long term (Figure 2). The larger gains for emerging market and developing economies reflect their lower initial levels of human capital, which implies a higher marginal return on investment. These findings are echoed by de La Maisonneuve et al. (2024), who highlight that boosting participation in early childhood education and increasing education spending among the lowest-spending countries could generate large gains in long-run productivity. The output gains emerge only after about 15 years, when the next generation enters the labour force.

Similar reallocations to infrastructure investment yield long-term output gains of 1.5% in advanced economies and 3.5% in emerging market and developing economies. In advanced economies, reallocating public spending toward R&D by 1% of GDP could boost output by 3% over the long term.

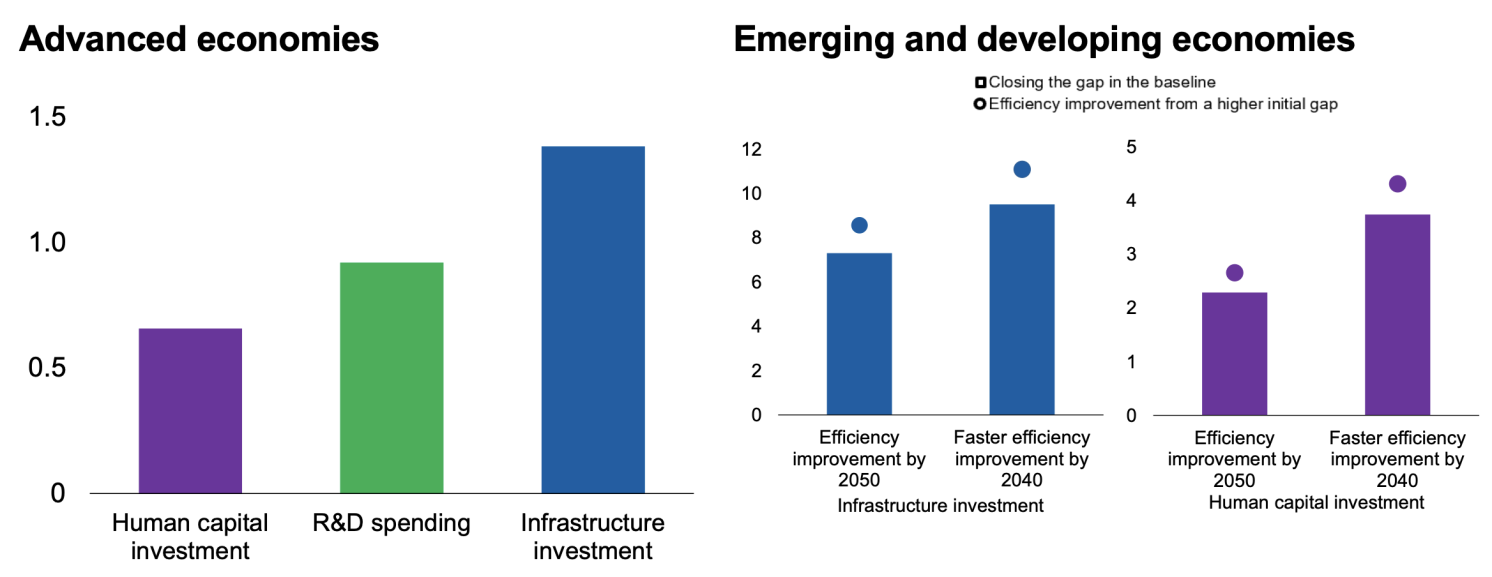

Crucially, closing gaps in spending efficiency can further increase the output impact by 1.5% in advanced economies and 2.5-7.5% in emerging market and developing economies, as more of the available public spending translates into productive forms of capital and scientific knowledge (Figure 3). The output gains can be up to 2% larger if spending efficiency is improved faster.

Complementary policies can further augment these gains. In advanced economies, combining investments in human capital and R&D yields greater benefits than focusing exclusively on one area, as innovation and skills complement each other. For emerging market and developing economies, pairing infrastructure and human capital investments capitalises on both short-term and long-term gains.

Figure 3 Long-term output gains from improving spending efficiency (percent)

Notes: The bars show the long-term output gains when gaps in spending efficiency are gradually closed, by 2050 in the left panel, and in the right panel, by 2040 or 2050 as indicated on the horizontal axis. In the right panel, the circles show the larger gain that is achievable for countries starting from a higher initial efficiency gap.

See original post for references

It’s good to see this kind of research that quantifies return on investment in social and human capital, giving value to things that are typically externalities. Even if we all know education is good, without proof there is an easy argument against it by those who disagree.

I certainly have my complaints about the structure of the current educational system but do you mean people wanting to abolish schools entirely?

“Yet many advanced economies have bought the neoliberal fairy tale that private development and ownership of pubic services such as infrastructre will be more efficient.”

That is a definite fairy tale but, if you are a private developer, financier or owner of public services then it is not a fairy tail and it will be more “efficient” in extracting rent, wealth and profit from the public.

Below are two quotes from – Project 2025 PRESIDENTIAL TRANSITION PROJECT

“public–private partnerships” is a euphemism for agency capture, a thin veneer for corporatism. “

and

“Much infrastructure could be funded through public–private partnerships (P3s), a procurement method that uses private financing to construct infrastructure. In exchange for providing the financing, the private partner typically retains the right to operate the asset under requirements specified by the government in a contract called a concession agreement.”

I would note that this Heritage foundation project was started just before rReagan came to office and a bunch has not changed … but both parties are mentioned in implementing a great deal found in it … a big share of it’s success is attributed to Reagan and Clinton

Both parites are united in the neoliberal fairy tale – and dedicated to it’s survival as some more quotes from Project 2025 PRESIDENTIAL TRANSITION PROJECT

“Privatizing all lending programs, including subsidized, unsubsidized, and PLUS loans (both Grad and Parent). This would allow for market prices and signals to influence educational borrowing, introducing consumer-driven accountability into higher education. Pell grants should retain their current voucher-like structure”

“The next Administration should promulgate a new regulation to require the Secretary of Education to allocate at least 40 percent of funding to international business programs that teach about free markets and economics and require institutions, faculty, and fellowship recipients to certify that they intend to further the stated statutory goals of serving American interests.. “

“The remaining 14 science and energy labs should focus on basic research projects; demonstration and deployment of technology should be left to the private sector.”

“Unleash private-sector energy innovation by ending government interference in energy decisions.”

“The agency is unnecessary, risks taxpayer dollars, and interferes with risk-benefit decisions that should be made by the private sector.”

I have definitely seen the benefits of govts investing more in education, I would just stress that this needs to be in tandem with infrastructure investments so that when those kids graduate they can get jobs.

Currently, my country is reportedly scaling back on accepting students for medical training after pumping out hundreds a year for maybe the last decade. All of the hospitals/clinics are poorly equipped and maintained (eg. being deemed a public health risk after nurses finally start fainting when months of them reporting constant ‘chemical smells’ were ignored). This especially includes any that are newly built, which are not enough anyway because there are so few openings we somehow still have a shortage of doctors.

Regardless, educational investment is great but definitely needs to go in tandem with encouraging a healthy job market.

Talk about toll roads. My great-great-great Grandfather Hiram Shartzer was an early owner and loser, here is his story.

A beautiful tree-lined street, The Alameda, between San José and Santa Clara and linking to El Camino Real on the San Francisco Peninsula was another road that the county found difficult to maintain. The triple row of willow trees that shaded The Alameda during the hot summers prevented evaporation of moisture from the adobe soil during the winter months.

The resulting quagmire made vehicular traffic almost impossible for four or five months out of the year. Hoping to escape the high maintenance costs for this road, the Board of Supervisors awarded a franchise to the Alameda Turnpike Company in 1862. The county promised the company, organized by Hiram Shartzer, an 18 percent annual return on his improvements and to repay the full cost in 1872, when the franchise expired. Despite the tolls collected and subsidies from the county, the turnpike company never successfully kept the road repaired year round. The poor condition of The Alameda and the opening of other free roads through nearby fields cut into the toll company’s revenues, forcing the county to make good its 18 percent guarantee. Finally, responding to citizen complaints, the board purchased the franchise in 1868 for $17,737 and declared the road free once again. COUNTY OF SANTA CLARA HISTORIC CONTEXT STATEMENT.

I’m sorry we can’t have nice things due to cities, counties, and states are too busy investing in things to keep Main Street under control.

https://thegrayzone.com/2025/11/02/drones-gaza-spying-us-cities/

The Sea to Sky highway mentioned in the intro was not a toll road, the government significantly enhanced it for the 2010 Olympics, but it was always a public asset and remains so.

Honestly, with the supremacy of US military power declining and the rise of BRICS, alternative payments, and division of the world into new blocs, eventually I see a band of global south countries united in declaring much of the debt odious.

This is obviously not in the immediate future, but as Michael Hudson points out, exponential expansion of debt via interest rates is not sustainable. Eventually there needs to be debt forgiveness, and if that is never going to be approved by the US and its financial tools like the IMF, countries will band together and declare it for themselves, supported in some ways by China and Russia

This would of course create a collapse in the west, because we are absolutely dependent on debt traps placed on much of the world to keep our lifestyle.

I personally hope there will be preparation for this transition which would include reindustrialization, but it looks like the elites have doubled down on the old methods – using military power and covert ops to take down countries trying to get out of the system.

This ongoing absurd obsession with public debt (of a currency issuing government that provides the debt free lifeblood activating the non-government) instead of personally bankrupting private debt which leads to destruction of societies-economies says it all about mainstream economists, captured politicians and churnalists.

Debts that can’t be paid won’t be paid as NC’s own Michael Hudson has explained again and again. As the non-government owns no currency creating means, other than that protected species of state licensed banksters entitled to create credit in the currency of the state, it is those who are resident in the non-government that suffer the fallout from indebtedness. I’m yet to witness a taxpayer dollar being recycled as per double entry bookkeeping that defines fiat money creation and destruction.