By Philip Pilkington, a writer and journalist based in Dublin, Ireland. You can follow him on Twitter at @pilkingtonphil

In the first part of this piece we looked at the Thatcher government’s monetarist experiment in the early 1980s. It did not end well. So we must ask: did the Thatcher government and the monetarists believe in what they were doing or were they cynically using monetarist policy as a device to destroy large parts of British industry in order to destroy the trade union movement?

We turn to the British economist Nicholas Kaldor who was deeply engaged in monetarism as it emerged as a popular dogma in the 1970s and 1980s. Occasionally in his book ‘The Scourge of Monetarism’ Kaldor does seem to say that the policy is simply a ruse:

[Monetarism’s] real effect depends on the shrinkage of effective demand brought about through high interest rates, an overvalued exchange rate, and deflationary fiscal measures (mainly expenditure cuts), and the consequent diminution is the bargaining strength of labour due to unemployment. Control over the ‘money supply’ which has in any case been ineffective on the government’s own criteria, is no more than a convenient smokescreen providing an ideological justification for such anti-social measures.

On other occasions, Kaldor did suggest that the major practitioners actually believed in monetarism. And certainly, given the buzz surrounding it at the time it at least appeared that they did.

This question is not simply one posed to tickle our historical curiosity. It remains relevant today as central banks in many countries initiate ‘quantitative easing’ (QE) programs which are thought to function due to a theory of the money supply that is closely related to monetarism. So, the question of belief is one of utmost importance. Many supporters of QE will deny any connection between the two policies, of course, but it is no coincidence that Milton Friedman himself advocated the use of QE policies in Japan back in 1997:

The surest road to a healthy economic recovery is to increase the rate of monetary growth, to shift from tight money to easier money, to a rate of monetary growth closer to that which prevailed in the golden 1980s but without again overdoing it. That would make much-needed financial and economic reforms far easier to achieve.

The Bank of Japan can buy government bonds on the open market, paying for them with either currency or deposits at the Bank of Japan, what economists call high-powered money. Most of the proceeds will end up in commercial banks, adding to their reserves and enabling them to expand their liabilities by loans and open market purchases. But whether they do so or not, the money supply will increase.

There is no limit to the extent to which the Bank of Japan can increase the money supply if it wishes to do so. Higher monetary growth will have the same effect as always. After a year or so, the economy will expand more rapidly; output will grow, and after another delay, inflation will increase moderately. A return to the conditions of the late 1980s would rejuvenate Japan and help shore up the rest of Asia.

This is why the questions surrounding the monetarist doctrine are directly applicable to our world. They shine light on why certain economists and central bankers believe that QE policies are effective and why they continue to hold this belief despite the overwhelming evidence to the contrary.

An aside: I should clarify my position. I am not equating Thatcher’s vicious monetarist policies with the current QE. QE probably has some positive, albeit secondary effects – like giving borrowers some breathing room; but these are probably cancelled out by its negative effects – like removing interest income from savers and pension funds and the like (not to mention the commodities bubbles it has probably stoked).

How It Works…or Doesn’t

Monetarism arose largely because Milton Friedman found what he thought to be strong correlations between the amount of money in existence and the national income. At the time the Keynesian orthodoxy had postulated that the stock of money was indeed fixed but the velocity – that is, the speed at which this stock of money turns over in the economy – was variable. Keynes thought that people’s desire for money responded to the prevailing rate of interest and, given that Keynes still subscribed to the quantity theory of money, he assumed that adjustments must be made to national income by people speeding up or slowing down the outstanding stock of money in existence by spending faster or slower.

Friedman was convinced that if he could prove that Keynes was wrong by showing that the velocity of money was relatively fixed and that there was thus a fairly simple mechanical relationship between the money supply and national income, the Keynesian theory would largely fall apart. If Friedman was correct he would also be able to explain inflation as simply being due to the central bank allowing too much money flow into the economy relative to the size of that economy and that all they had to do was target a given money supply to bring the inflation under control. This, of course, was precisely what the Thatcher and other governments tried to do in the 1970s and 1980s.

Interestingly – and much less talked about – is that Friedman’s monetarism also implied that if the economy had undergone a strong shock or financial crisis and was operating with large amounts of unemployment and excess capacity, all the central bank had to do was inject more money into the system. Since, pace Friedman, this extra money would contribute directly to increasing national income – that is, it would be spent and invested – unemployment would come down. Friedman had postulated that it was the failure of the central bank to undertake monetary stimulus that had led to the Great Depression and this was why Friedman was an early advocate of Japan’s QE program (which actually began in 2001 and was a dismal failure).

Related to this Friedman believed that financial crises, such as the 1929 stock bubble, were simply due to the central bank pumping too much money into the economy. The current Fed chairman is, or at least was, an adherent of this view. In a speech honouring Milton Friedman in 2002 Bernanke said:

Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve. I would like to say to Milton and Anna [Schwartz, Friedman’s coauthor]: Regarding the Great Depression. You’re right, we did it. We’re very sorry. But thanks to you, we won’t do it again.

Of course, if we assume that Bernanke was not merely posturing, according to his own logic the Federal Reserve did indeed “do it again”. A monetarist would blame the recent housing bubble in the US on an over-easy money supply. However, whether Bernanke believed this statement or not, he certainly acted in line with Friedman’s monetarist treatment when he undertook the QE programs in the wake of the crash.

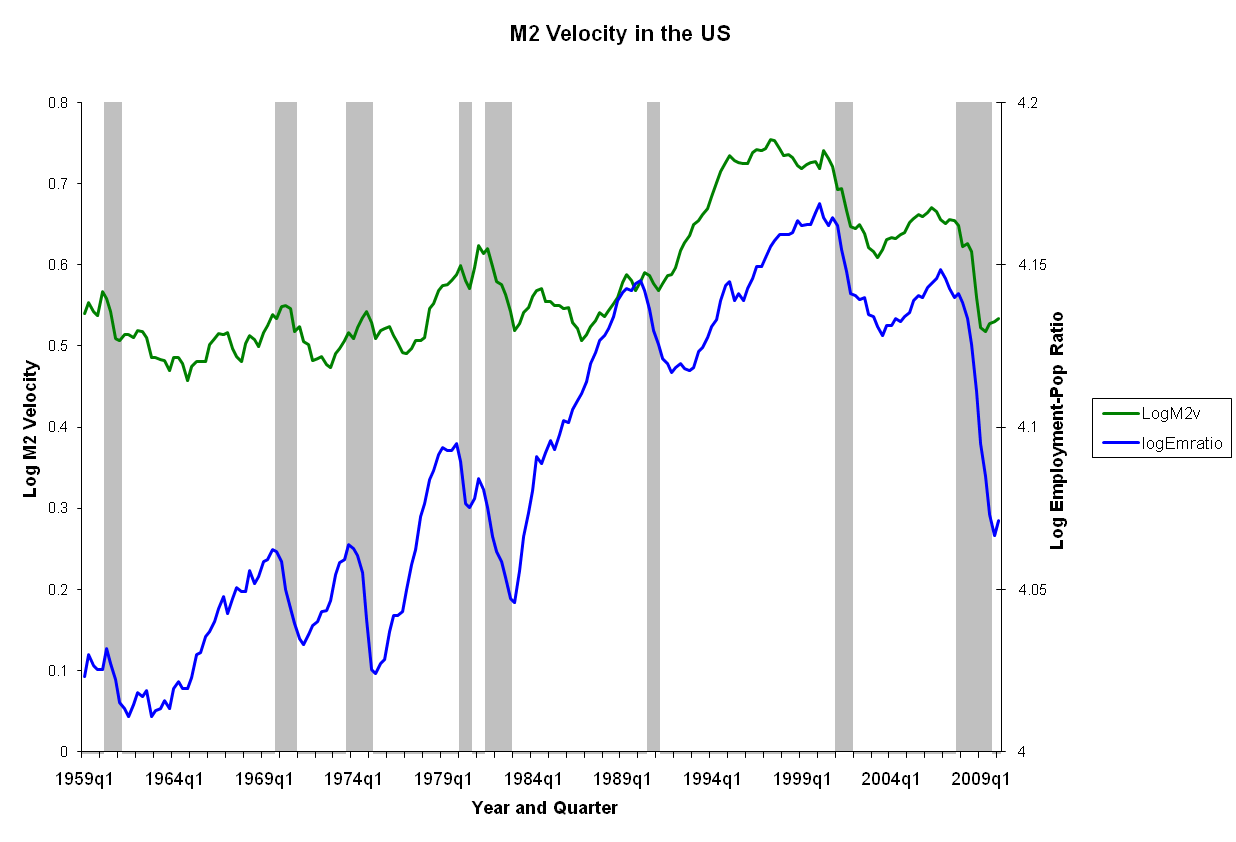

So, what was wrong with Friedman’s basic theory? Well, first of all the correlations he thought he found were not the same across time and space. If the data for many countries is compared across time we see strong fluctuations in the velocity of money. Indeed, even within single countries the velocity of money fluctuates quite aggressively in line with overall economic growth. Here, for example, is the velocity of the M2 money supply in the US charted together with the employment-population ratio – an indicator of economic health that is used to determine the ability of the economy to produce jobs:

Clearly the velocity of the M2 is not at all constant and moves in rough correlation with the employment-population ratio and, hence, with the health of the economy. So, Friedman was wrong on even the simplest measure. The velocity of money does, in fact, vary over time.

Does this mean that Keynes was correct and large-scale unemployment could not be cured by monetary stimulus due to a falling velocity? No, not really. Keynes’ idea that the velocity of money would move together with the level of economic activity (and the interest rate) was simply a modification of the old quantity theory of money. Thus all Friedman had to do was show a constant velocity and he could debunk Keynes. But in actual fact, both Friedman and Keynes were using a moribund theory that had no basis in reality (albeit Keynes’ version was far closer to the truth than Friedman’s).

It is on this point that both Friedmanite theory and Friedmanite policy must be debunked today. Because neither Keynes nor Friedman – nor most economists today, some of whom still pour over monetary data as if it were goat entrails – understood how the existing money system actually operated. In actual fact, neither velocity nor the outstanding stock of money have any real bearing on economic activity. As Keynes knew well, but could not articulate within the outmoded framework he was using, only the interest rate set by the central bank has any effect on economy activity – and this is through the saving/lending channel, not through some money supply/velocity mysticism.

This theory is called the ‘endogenous theory of money’ and while there are many ways of approaching it, perhaps we should continue in our historical investigation and look at it through the prism of the Radcliffe Commission which was set up in Britain after the war to determine the true role of monetary policy. We shall investigate this fascinating historical event in the third and final chapter of this series.

Not strictly related to the topic, more a question out of curiosity (since I’m not massively familiar with economic theory, but have been reading up on it): How does this affect the value of money?

While adjusting the money supply as a means of controlling economic activity seems mostly debunked, it is still beneficial to adjust it (in line with economic growth, or thereabouts) to keep the long-term value of money relatively static, yes?

I suppose this can be achieved with the interest rate instead, since its mainly banks that determine the money supply (through reserve lag); just am curious of the relationship here with regards to maintaining the value of money.

Much of my curiosity on this, comes from trying to properly understand arguments against a gold standard, and trying to counterargue support of it; my general understanding is that it’s deflationary (thus increasing the value of money over time), but am trying to understand every angle, so I know there are no alternative ways of setting it up to avoid deflation (which doesn’t practically turn it into fiat).

The key point is that, as I wrote in part I, the government/central bank were actually unable to control the money supply AT ALL. So, even if there was a relationship between the money stock and the value of the currency (note that I don’t think there is such a relation) controlling the value of the currency through controlling the money supply wouldnot work because the government/CB cannot control the latter.

As for interest rates. Yes, raising interest rates may cause the currency to appreciate (and vice versa), but there is no hard and fast rule here. For example, look at the dollar since the crisis. Interest rates have fallen to zero and the US continue to run a deficit but because developing countries want dollar holdings the dollar maintains much of it value.

As for gold standard, the simplest way to think of it is that it (theoretically) limits the issuance of credit and this makes it harder for the economy to grow.

Meh, gold would do jack on the credit issuance. At best there would be a reserve requirement, but those requirements can be gamed to hell and then some.

The main issue basically is that bank issued credit becomes the same as central bank issued money after having exchanged hands once. This especially now that physical money is a very small part of the overall exchange process (most happen as accounting between banks and credit companies unless it is over legally questionable goods or services).

“[Monetarism’s] real effect depends on the shrinkage of effective demand brought about through high interest rates, an overvalued exchange rate, and deflationary fiscal measures (mainly expenditure cuts), and the consequent diminution is the bargaining strength of labour due to unemployment. Control over the ‘money supply’ which has in any case been ineffective on the government’s own criteria, is no more than a convenient smokescreen providing an ideological justification for such anti-social measures”

Best way to describe Monetarism!

Awaiting Part 3.

“Awaiting Part 3.”

Yup. Good stuff.

So we have too much debt and not enough money, then the solution would be create more money and no new debt?

Gee, that would imply money isn’t the same as debt.. I think my brain just melted.. the debt merchants will be visiting me for sure.

Time to mint a few $100,000,000,000 platinum coins. ;)

v.g. post.

I think its fair to criticize both the QE “monetarism” – again because it CANNOT but create excess reserves awaiting demand pull in a balance sheet recession – and at the same time criticize THAT aspect of Friedman’s “monetarism” related to pushing on the interest-rate string in an attempt to change monetary aggregates so as to fuel demand.

But Friedman’s original theories about state control of the money supply, and the role of the central bank, evolved upon the failure of the mass of economists to engage with his earlier proposals. He advocated to DIRECTLY issue the money supply by government payments into the economy, without reference to the interest-rate tool.

Friedman’s earliest and perhaps best postulation of direct money issuance is contained in his “A Fiscal and Monetary Framework for Economic Stability”. I’m pretty sure its available free online.

A quick read of that document shows his appreciation for NOT using the cost of money (Reagan-Thacherism), and rather directly impacting the quantity of money to increase demand.

More importantly to those who understand the problems of debt-based money, he also advocated an END to private bank based credit-creation, what he termed the creation and destruction of capital, and the change over to a “permanent” money system.

So, just as proposed by Fisher, Douglas and others in the 1939 Program for Monetary Reform, Friedman advocated for an end to the fractional-reserve, debt-based system of money creation and destruction, and a public money authority responsible for establishing the level playing field for free-market economics. What I would call monetarism.

The money system should NOT be part of the free market, it should be its foundation.

Again, the essence of Friedman’s “Framework” (also his later Program for Monetary Stability) and the 1939 reform proposal is contained in the Kucinich Bill H.R. 2990.

http://kucinich.house.gov/uploadedfiles/need_act_final_112th.pdf

For the Money System Common

“He advocated to DIRECTLY issue the money supply by government payments into the economy…”

Friedman was an extremely vague man and I do recall him saying something along these lines at some point. The problem is that this is fiscal policy, not monetary policy and thus cannot be controlled by the central bank. If a government did simply issue money to people in the form of transfer payments this would be identical to classic Keynesian fiscal stimulus. Thus, if Friedman ever advocated this — and I would not be remotely surprised if he did — he would have been implicitly admitting that his own theories were flawed.

This is Friedman all over though. He was an evasive character who flip-flopped on just about every issue. Perfect person to provide a pseudo-scientific mask for an ideologically motivated policy.

Yep, it reads like MMT under a different name.

This in that it sounds like he advocated that the government should spend money into existence.

Not sure of the need to continue to knock this aspect of Friedman’s work.

Of course he did say it, and he continued with his ‘direct money creation’ in many re-publications of A Program for Monetary Stability.

No, this is not fiscal policy.

The fact that the government must be the vehicle for introducing new debt-free money into the economy, in effecting monetary policy initiatives, does not make it fiscal policy at all.

Fiscal policy is about the government’s budget and operations (taxing and spending). Monetary policy is about having a system in place that ensures the well-being of the money system and the national economy.

True, it is joined at the issuing mechanism.

But expanding the money supply to accommodate potential growth of the economy remains a monetary policy issue.

It is what’s needed for full-employment and stabilizing the purchasing power of the currency.

Friedman wrote that in the late 1940s. He changed he tune over the next 15 years, so that the money supply mechanism became interest rate driven, which is a way to shift control of the money system from public to private means.

Maybe the Fed vs. Truman Administration battles showed Friedman which was the wind was blowing and he decided to slightly shift his views. Or maybe he was an opportunist.

That is a very good observation on the cause of Friedman’s course change.

Too much headwind from the Fed bankers and their control of the monetary establishment.

I’ve seen it written thus.

However, the rationale for what makes good monetary policy is sound regardless of administration or the flavor of the week.

His Framework piece is good policy today.

And he did continue with the “real” monetarism into re-publication of “A Program for Monetary Stability”. even into the ’90s.

What happened between the Fed and Truman?

Suasn,

I think this will serve you better than any of those Fed pubs from a GoogleSearch.

Joe

http://www.peri.umass.edu/236/hash/7e9aa43be768d1d353920f60bcfacce1/publication/485/

Sorry, Susan

The money system should NOT be part of the free market, it should be its foundation. joebhed

That’s true for government money which should only be legal tender for government debts (taxes and fees). But for private debts only, we should allow private money supplies. How else can we ever escape usury if people are not allowed to create their own money?

And for investment bankers and derivatives traders every commodity would have its own currency? What you say makes good sense but it’s just so complicated.

It’s not necessarily complicated. People could use good ole fiat for all debts, not just private debts. But it does free up government to spend freely since if it overspent relative to taxation then people could switch to a private money supply and avoid the “stealth inflation tax.” In other words, coexisting government and private money supplies would insulate the private sector from government monetary mismanagement and vice versa. Just the mere possibility of people switching from fiat to private money and vice versa would tend to keep both sectors honest.

With all due respect, sincerely, I will place my bets with Lincoln’s hard-gained perspective on public money.

“”The government should create, issue, and circulate all the currency and credit needed to satisfy the spending power of the government and the buying power of consumers.

The privilege of creating and issuing money is not only the supreme prerogative of government, but it is the government’s greatest creative opportunity. The financing of all public enterprise, and the conduct of the treasury will become matters of practical administration. Money will cease to be master and will then become servant of humanity.””

The creation of every $US-denominated “money-thing” represents a claim against the future national economy.

Why should the citizens grant anyone this privilege? It is our collected right.

Why would any business need to create the money that it uses?

Money-creation is a government function.

MMT says that fiat is fully backed by the taxation authority and power of government. Thus it is NOT necessary that fiat be legal tender for private debts. Nevertheless, people will be still required to obtain some fiat in order to pay their taxes.

However, I do advocate that full legal tender fiat be used for Steve Keen’s universal bailout so the banks can be forced to accept it. But in the longer run, we need more principled money creation in accordance with Matthew 22:16-22 (“Render to Caesar …”).

And, of course, all government privileges for the banks must be abolished if we are ever to have a level playing field for private money creation.

We can perpetually struggle over who gets to create money or we can decide on principled money creation and accomodate all legitimate concerns.

MMT says a lot of things.

All national money is backed by the national economy.

If it is not issued in accord with the growth potential of that national economy, either inflation or deflation will be effected.

If it is so issued, then full-employment and stable purchasing power of the currency is possible.

All money must be equally found.

All money is full legal-tender fiat.

Or it wouldn’t be money.

There is no real barrier between the government’s sector of the economy and the private sector, as far as money goes.

If you want alternative currencies, then fine.

But they cannot be $US.

Thanks.

All money is full legal-tender fiat.

Or it wouldn’t be money. joe

Not true. In England, BoE Notes were not legal tender for private debts till 1826 if I recall the date properly.

If you want alternative currencies, then fine.

But they cannot be $US. joe

Of course not. But neither should the US dollar be legal tender for private debts*. Otherwise, the entire purpose of private currencies is negated.

*After a universal bailout till ALL private debt is paid off.

If it is not issued in accord with the growth potential of that national economy, either inflation or deflation will be effected.

If it is so issued, then full-employment and stable purchasing power of the currency is possible. joebhed

Measuring price inflation is very subjective and problematic. By allowing private currency alternatives, price inflation in fiat becomes a problem of the issuing government and its payees only. Likewise, price inflation in a private currency would only affect the private currency issuer. In both cases, the currency issuer has the strongest incentive to spend wisely. That is how it should be.

I would think that even with ‘alternative currencies’ the freedom remains with any borrower to choose which currency in which to borrow.

Why would you prevent a borrower from using the national currency.

Say I sell widgets to GOVUS and get paid in $US.

Why would I not want to borrow in $US?

More important, why should I not be allowed to do so?

Would the $US only be used for payments and not for borrowing?

Thanks.

Why would you prevent a borrower from using the national currency. joebhed

Who said I would? People should be free to use anything, including fiat, for private debts.

But banks don’t lend fiat, except to themselves. Using their government privileges, the banks create credit in almost unlimited amounts and drive us into debt therewith.

FBeard :

“”Of course not. But neither should the US dollar be legal tender for private debts*. Otherwise, the entire purpose of private currencies is negated.””

Am I missing something?

What you may be missing is the fact that the US Dollar has lost 97% of its value since 1913. Of course it would have been worse if the US Dollar had gained value (since that would have rewarded risk-free hoarding) but nonetheless that 97% dilution of purchasing power is an indication of theft and is a disgrace. Genuine private monies would have allowed the population to escape that “stealth inflation tax” and would have encouraged the US Government to spend more wisely (less military spending, no bailing out banks, and no Federal borrowing*).

*Bill Mitchell calls the debt of a monetary sovereign such as the US “corporate welfare.”

Of course I agree with Bill Mitchell on government debt – as far as he goes.

His is the most coherent of any MMTer in discussion why we should end it.

That 97 percent loss of $US value thing is kind of an Austrian view – compared to what?

If wages, prices, GDP, etc. all go up, there must be an increase in the number of $US.

The thing that determines loss of value – is the relative change either between the economic components – internally speaking – or the change in relative value to other currencies.

The latter has been all over the board.

On the former , the economic component that has most lost value is not the currency, it is wages.

Thanks to whom?

Finally, do you relegate to government the cause of the changes in the monetary policy and quantities of the country?

Because if you do, I just remind that ALL of the nation’s money throughout the period in question has been

created by the private bankers.

At will.

Thanks.

If wages, prices, GDP, etc. all go up, there must be an increase in the number of $US. Joebhed

Of course. And an increase in the number of dollars is good so long as their value does not dilute. Otherwise, it’s like diluting wine and claiming there’s more of it.

I am NOT a Austrian. The Austrians are opposed to money creation except for gold which somehow, magically, is always mined at the optimum rate for economic growth. If pressed on that absurdity they’ll say that an absolutely fixed (non changing) money supply would work fine too. That’s even more crazy since it would reward risk-free hoarding of money.

Because if you do, I just remind that ALL of the nation’s money throughout the period in question has been

created by the private bankers. joebhed

Well, the private banks create credit which I hear is 97% of the money supply. I would abolish their ability to do so or at least remove all government privileges for banking. And assuming that the banks might still be able to create credit without government privileges then the allowance of other private money forms would allow the population to not use bank credit.

Oh, so you ARE Fatbeard aka frlbane. I thought so. Why would you want to hide that fact?

I think it’s becoming more apparent to more people that what is needed is “QE” from the treasury directed to individuals, backed by keystroke-money-creation from the Fed. Obviously, giving more money to those who already have too much is not going to do anything. MMT, your day is coming…

In other words, Keen’s modern debt jubilee. Give every person x amount with the stipulation that if they have debt, said amount is to be used to pay it down.

Keen’s debt-jubilee transfers the problem of the debt-saturation of all the citizenry that results from debt-based money to the government of that citizenry and leaves it at that.

If you want to have a jubilee, then end the debt-based money system.

Or have the grandkids do it all over again.

For the Money System Common

I thought Keen did end the debt based system because after the jubilee he advocates a system of funding directly throuth the treasuries (of various govts); am I just reading what I am assuming? The vocabulary can be very byzantine.

Let’s check.

Keen is an “endogenous money” adherent, I think his closest tie to MMT.

While proponents of the endogenous money paradigm usually focus on the “internally-generated” determinant of the quantity of money, what it really means is that, with no public money-creation mechanism (all private debt), it is the borrower who is determining the amount of money in existence. Thus , it is all borrowed money.

MMT has no problem with leaving the private debt-based system of money creation in place.

Neither does Keen as far as I have seen.

What this begs for discussion is the rampant departure of wage-based wealth from the wealth that is created.

Wages go down, for decades.

Guess what, wage-earners must borrow.

It’s like magic – endogenous.

Monetarism was simply a shabbily constructed, intellectual cover for class war. Manufacturing was gutted, unions were destroyed, and the path was laid for the publically subsidized casino capitalism that has dominated the UK ecomomy ever since (privatized gains and socailized losses).

The clues are everywhere: one example, government spending as a percentage of GDP did not decline during the Thatcher period, despite claims about ‘shrinking the state.’ Expenditure was simply transferred into corporate welfare and away from social programs.

The answer is yes, I agree. The UK and the US both used economic rationalizations to gut their own industries and impoverish their own people. The tell is that even now there is no explanation: how could they NOT have readily understood the immediate effects of their actions? Not to mention the long term ones. Which seem to have become a tsunami.

In physics energy is defined as the ability to do work.

The quality and quanity of fuels has simply declined as investment was defered to maximise tempory profits and will now be subsequently socialised.

In the words of Wikis take on the now defunct Central Electricity generation board.

“The organisation was unusual in that most of its senior staff were professional engineers, but with excellent support in financial and risk-management areas.”

How many of todays utilties are so structured ?

None.

Their function today is merely to socialise losses on the wider population via their now sophisticated entropy operations.

I recommend you look at the UKs DECC PDF documents from July 2011

Entitled

PDF]

Overall energy consumption in the UK since 1970

[PDF]

2011 Transport energy consumption in the UK since 1970 Summary

http://www.decc.gov.uk

In the first document Y1970 fuels(TPEC) was dominated by (chart 2)

Solid fuels : 47%

Oil : 44%

Gas : 5%

Elec. : 4% (Hydro / Nuclear)

By 2000

Solids : 17%

Gas : 41% (changes in electricity area – the so called dash for gas)

Chart 7 is also interesting

Energy intensity of all areas (Domestic ,services , Industry ) have dived with the exception of transport which has remained pretty stable.

What you are infact witnessing post 1970 is a deindustrialisation of a country with global rent flows helping to sustain the Transport sectors energy intensity.

The “Free market” has exposed the UK to a dramatic energy cliff – with no strategic sense to the policey only other then make hay via the dash for Gas post 1990.

Now with only a almost non existent Nuclear industry and 19th century railway cuttings to fall back on.

The transport PDF document is perhaps more interesting

With Y2010 transport consumption down to Y2002 levels(chiefly because of declines in air transport according to the doc.)

With road transport accounting for 74%(40,995TTOe) of energy consumption(68% road passenger / 32% road freight)

Air accounting for 22%(12,288TTOe)

Water accounting for 3%( 1,469TTOe)

rail accounting for 2%( 992TTOe)

See chart 1.

Of these only rail transport energy use fell 38% despite reaching post war highs & now all time highs in passenger numbers although with declining freight carriage.(1,611 TTOe to 992TTOe)

Road transport increased 91%

Water transport increased 14%

Air transport more then tripled………

The free market is not a free market – thats a illusion – this is the global energy / labour arbitrage coming collapse.

This is not a age of sail with little Habsburg trading towns.

This is a energy black death which should be welcomed by the Labourers and toilers of Europe that somehow survive this coming entropy.

“did the Thatcher government and the monetarists believe in what they were doing or were they cynically using monetarist policy as a device to destroy large parts of British industry in order to destroy the trade union movement?”

Are there respected people in think tanks around the world that sincerely believe that radical Islamist terrorists really and truly pose a threat to the existence of the United States and the Western world and that the War on Terror is NOT a cynical ploy by which to subjugate large swaths of humanity and steal their resources?

I’m sure there are but should those viewpoints even be engaged is the bigger question.

Are there respected people in think tanks in America who sincerely believe that the electoral system really and truly functions as an honest means by which the American people are able to express their democratic intentions?

Again, I’m sure there are but at this point in time, should intelligent people even be wasting their breath arguing/engaging with the holders of such beliefs?

PP, your argument is well and good but I get the sense that for some reason you feel the need for approbation from the very people who hold/promulgated the failed ideas/polices of which you speak.

That for some reason it’s not enough to say: these ideas are shite let’s move on, but rather you need these players who have made a career/fortune off of these “failed” policies to come clean and admit that they were wrong.

Listen good, PP.

These people have murdered hundreds of thousands if not millions of innocent human beings because of “failed” ideas without the slightest tinges of hesitancy or remorse.

They are not playing around and certainly will never admit to being wrong just because their ideas have don’t pass intellectual muster.

At the end of day, one must remember the terrible consequences of the failed ideas that many of the above mentioned people hold and resist speaking to them as their failed policies in a number of arenas – economic, geopolitical, etc – are just academic points of contention rather than the catalyst for so much entirely avoidable human suffering and misery.

“These people have murdered hundreds of thousands if not millions of innocent human beings because of “failed” ideas without the slightest tinges of hesitancy or remorse.

They are not playing around and certainly will never admit to being wrong just because their ideas have don’t pass intellectual muster.

At the end of day, one must remember the terrible consequences of the failed ideas that many of the above mentioned people hold and resist speaking to them as their failed policies in a number of arenas – economic, geopolitical, etc – are just academic points of contention rather than the catalyst for so much entirely avoidable human suffering and misery.” jsmith

Well said jsmith; just as the only issue in presidential election are laws both sides pasted, laws that enable vulture capitalism which both refuse to debate.

A nation is a single country and it succeeds or fails on the laws that govern it; not on law that succeeds in the world.

If Philip is constructing a veritable legal argument backed by data collected by the government itself, that should be a good thing.

only the interest rate set by the central bank has any effect on economy activity – and this is through the saving/lending channel, not through some money supply/velocity mysticism. Philip P

The central bank sets the interest rate on reserves but will nonetheless provide as many as are needed to support bank lending? So raising interest rates has no necessary impact on bank lending? So long as willing borrowers can be found? So long as price inflation exceeds borrowing costs? Is this the explanation for stagflation? High interest rates (causing stagnation) combined with increased credit (causing inflation)?

You’ve apparently misused “pace” in the phrase “pace Friedman”.

pace 2 (ˈpeɪsɪ, English ˈpɑːkɛ)

— prep

with due deference to: used to acknowledge politely someone who disagrees with the speaker or writer

[C19: from Latin, from pāx peace]

====================

“Since, [with due deference to] Friedman, this extra money would contribute directly to increasing national income – that is, it would be spent and invested – unemployment would come down.”

====================

Tis legal speak I think. Family of lawyers and judges… what can you do?

so… I almost guessed it; cool

“pace” literally means “peace”, but its use as a Latin tag means roughly “despite what X might say”. But doesn’t Friedman precisely contend that variations in money supply will directly translate into levels of output?

No. After a deflationary event Friedman claims boosting the money supply would boost output — hence the paragraphs quoted at the start of the piece.

E.g.

“There is no limit to the extent to which the Bank of Japan can increase the money supply if it wishes to do so. Higher monetary growth will have the same effect as always. After a year or so, the economy will expand more rapidly; output will grow, and after another delay, inflation will increase moderately.”

Other than that, excuse my arcane English.

Of course you know, your English is arcane only because it is cut to the bone and 99% of communication occurs on an emotional level… I don’t suffer from confusion, I suffer from what I perceive to be a lack of facts. My brain doesn’t understand that there really are only a very few facts. I have to sit it down and tell it.

Here’s the paragraph in question:

“Interestingly – and much less talked about – is that Friedman’s monetarism also implied that if the economy had undergone a strong shock or financial crisis and was operating with large amounts of unemployment and excess capacity, all the central bank had to do was inject more money into the system. Since, pace Friedman, this extra money would contribute directly to increasing national income – that is, it would be spent and invested – unemployment would come down. Friedman had postulated that it was the failure of the central bank to undertake monetary stimulus that had led to the Great Depression and this was why Friedman was an early advocate of Japan’s QE program (which actually began in 2001 and was a dismal failure).”

It’s not a matter of arcane English, but incorrect or unclear English.

“an indicator of economic health that is used to determine the ability of the economy to produce jobs”

How is the ability to produce jobs an indicator of health? The ability of an economy to produce jobs is an indicator of the willingness of capitalists to invest. Period. Why is it assumed that simply by producing jobs, the “economy” is doing us a favor?

“More generally, the notion that jobs are what is needed, rather than a decent, rewarding way of life for all, is in itself a perversion, more smoke and mirrors intended to confuse working people regarding their own needs and desires. No one needs a “job.” What is needed is a meaningful and rewarding lifestyle. Most people are willing to work, and even work hard, in order to achieve such a lifestyle, but work (aka a “job”) has never been an end in itself for anyone.” From Mole in the Ground http://amoleintheground.blogspot.com/2012/07/oh-dont-ask-why-more-questions.html

WE…US$ is reserve currency. ALL the BERNANK $’s are going to where someone will make the most money! ! THUS oil/commodities…Real Things people eventually need will continue to go UP in the Real World ! ! thanks….(all the rest is just gibberish ! !)