By Stephanie Kelton, Associate Professor of Economics at the University of Missouri-Kansas City. Cross posted from New Economic Perspectives.

My Twitter followers are constantly asking me if I think more spending would really help the economy recover. I understand their skepticism. Many are probably struggling with high debt levels, and the last thing they want is some economist urging them to rack up more debt for the good of the economy. (Bad advice, indeed.) Others have heard President Obama talk about putting Americans back to work by investing in our nation’s infrastructure, educational system, energy future, etc., but many aren’t sure if the “stimulus even worked“, so they, too, wonder if more spending is really the right way to grow the economy. Well, here’s the answer.

Spending isn’t the just the right way to grow the economy, it’s the only way.

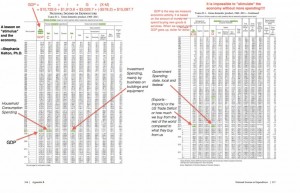

After all, what is “the economy”? For most economists, it’s a simple number. We use a country’s Gross Domestic Product (GDP) to measure its “economy.” So where does this GDP come from?

There are different ways to calculate GDP, but each method is designed to yield the same result. Let’s look at the most popular method — the one based on expenditure. GDP basically measures the total amount of spending (at market prices) on newly-produced goods and services (by their end users). In other words, GDP measure how much money we spend.

Who’s “we”? All of us. You and I belong to the household sector, and together with our friends and neighbors, our Consumption Spending normally accounts for about 70 percent of the expenditure that comprises our GDP (go team!). The business sector is important too, because that’s where Investment Spending comes from — the factories and office buildings most of us work in and the computers and machinery we use to make things. State, local and federal Government Spending also gets counted in GDP because they pay salaries, order supplies, buy aircraft carriers, etc. Finally, there are the things we import from foreign producers (European vacations, business travel, a foreign-made automobile) and the things we export to foreign consumers, businesses and governments. On balance, our Net Exports (Exports – Imports) are another potential source of GDP.

So how do we “grow the economy”? By increasing our GDP. And how do we do that? By increasing one or some combination of the four components of GDP:

1. Consumption Spending

2. Investment Spending

3. Government Spending

4. Net Exports

Without an increase in one (or some combination) of these components of total spending, GDP cannot increase.

Lesson on GDP [PDF]

Now for the hard part.

MULTIPLE CHOICE: Who is in a position to lead us out of this weak recovery?

a.) Household Sector (currently deleveraging – i.e. paying down debt)

b.) Business Sector (hesitant despite low borrowing costs and mountains of cash)

c.) Government Sector

1. State/Local (still struggling with shortfalls)

2. Federal (currency issuer that can spend more when others can/will)

d.) Foreign Sector (China, India, Brazil, Eurozone, Russia, UK)

If you agree with me, then I’ll c.) 2. it that you become an honorary owl.

What a weak post IHMO.

When an overindebted member of an overindebted household living in an overindebted country enters a local shop with a view to indulge into a massive spending spree of useless stuff, does one grows the GDP? Most certainly. Does it make it sounder? Ask the salesperson.

When a country builds massively useless infrastructure or real estate in the way some countries currently do, does it grow the economy? Most certainly.

Pyramid builders in Ancient Egypt did as well. It looks like the payback is coming now via tourism. But for sure, I do not expect that the initial business case was that brilliant.

Economics and finance are supposed to care about about the allocation of SCARCE resources. Human work work and commodities.

Not about the consumption of precious resources, by economic operators (state, household or any other) that can offer no value in return for their purchase.

The GPD growth is not a measure of wealth growth at all by the way! Check the Chinese banker NPL or Ramses II bankers acccounts…

Economies do not grow without spending. Period. Most of your post confuses various types of wealth and is not helpful.

Well then, maybe what we should be asking ourselves is whether or not endless growth is even desirable.

What we have on one hand is ideological, faith based belief that human ingenuity will always increase our material consumption, and on the other the fact that the world is running out of finite resources to feed an exponentially growing human population.

Though it might be delayed a bit, reality usually wins out over faith in the end. We are at the end now.

In the West economics has been about the (unequal) distribution of surplus resources. Now, at the limits to growth, it’s actually about the allocation of scarcer and scarcer resources -except that we collectively are unable to recognize this and think growth can restart. As for allocation, I think Warren Buffet has informed us who’s coming out ahead in the slicing up of the shrinking pie.

Any economic system that must constantly grow or implode is not one we should support. What we need is a stable economy, not one that is based on the population staying in unsustainable debt but that is exactly what most are advocating.

What we have is a crisis of confidence in both consumers and lenders. Can you blame them?

If anyone has any idea how to convert an economy from massive indebtedness for luxury items into one that is stable but still capitalist I would like to hear it because I certainly don’t.

If labor is massively unemployed it is not a scarce resource.

In that situation, the opportunity cost of putting people back to work is zero.

Bravissimo!

If they don’t get it from that clear and succinct explanation, you’ll need a baseball bat.

I’ll supply the bat, or a 2×4 with nails…

Weak post? It went right over your head.

Only the federal government issues the currency. State and local govts don’t. Neither do businesses or households. By spending into the economy when it’s in the shape it’s in right now with infrastructure, transportation, education, research, health care, communication and all the things the govt does much better than the private sector, you create the jobs that the private sector needs to buy the things it produces. Consumers create jobs. Not businesses. Businesses only hire when they’ve got sales.

BTW, where do you think we get our money? China?

“Only the federal government issues the currency.”

The but too this, it’s debt currency. Plus there is good debt for a government and bad debt, and this is the problem. The politicians do not seem to know the difference, so all spending seem bad tothe public at large.

Aren’t you a bit confused about the nature of money? Last time I looked the Federal Reserve, a private central bank representing the interest of its private member banks was the issuer of the currency we use as money in the United States. If you have a dollar bill in your pocket read the fine print. “Federal Reserve Note” — a promise to pay issued by a private entity. Currency of the realm only because Congress abdicated its constitutional responsibility.

In a fiat currency system with a private central bank, money only can enter into circulation through the creation of a loan and the accompanying obligation to pay the loan back plus interest to the lender. Guess what, the money supply will expand exponentially (due to that interest increment) until the last borrower is burdened with unsustainable and unpayable debt, and then it will collapse. Combine capitalist competition with simple mathematics and you actually have that predictable economic law that “Professional” Economists pretend to seek as they build complex models based upon fantasies about human behavior.

Multiple points on your post

1) The Federal Reserve is a public/private partnership and its profits go to the Treasury

2) The Treasury actually prints the money, albeit at the order of the Federal Reserve, so this one is sort of esoteric

3) When the Fed buys Treasury bonds, it is acting as a government entity to “spend money into existence.” Thus the USA does, in fact, still have the capacity to spend money into existence w/o Congress removing the Fed’s charter.

4) The only way that an economy can have a net growth is if the issuer of the currency (the Federal Government) has a deficit. The reason is that when loans are created, they money ‘created’ is balanced out by a promissary note (loan), but the net increase is zero.

5) Taxes, since our currency is not pegged, are a means of controlling inflation by taxing excess cash out of the system. If we have less than full employment (often 4-5% is cited as full employment due to people moving from one job to another, etc.) then the Federal Government can and should kick-start things. Preferably they will do so responsibly (invest in bridges, schools, etc. that can be used for many years), but there is no other means of getting that economy going when all others either can not (consumers, local gov’t) or will not (corporations sitting on mountains of cash but have no incentive to expand since they would simply end up with mountains of inventory instead) do the needed stimulating.

yikes. where did that come from? you work for the fed?

1. it’s not a “partnership”. it’s not “public” in any meaningful sense. it’s profits (up to 6%) go to its shareholders.

2. the bureau of engraving prints the stuff that will become currency, but it’s not monetized by the treasury but instead by the federal reserve. and the question of whether or not a federal reserve note is money .. that’s open for debate.

the mint is administratively placed within treasury, but so what? coinage and bills are a small fraction of the money supply. hell, even wikipedia has this sorted out:

http://en.wikipedia.org/wiki/Money_creation

3. and that means when china buys treasurys it is acting as “a government entity”?

when the fed credits the reserve accounts of its member banks, you would call that “acting as a government entity”?

if anything, the government now acts “as a central bank entity”.

actually, that would have made a funny post.

4. wow. that’s just plain wrong.

http://research.stlouisfed.org/fred2/series/FYFSD/

at (or near) zero deficit 1895-1970 (except for during world wars) and surplus in late 90s. your conclusion is that the US experienced no growth for most of a century.

5. taxes apply to persons in the us. all the inflated money supply that leaves the system goes untaxed out there. you could tax it all and there would still be 6 trillion dollars out there.

http://research.stlouisfed.org/fredgraph.png?g=6PL

that’s about the total value of all mortgages.

kinda cool to think that increasing taxes to the moon would preferentially target persons in the US, eliminate domestic commerce, eliminate jobs and savings, and deflate prices, allowing foreign holders of dollars to buy up every single property. and more.

4. wow. that’s just plain wrong.

http://research.stlouisfed.org/fred2/series/FYFSD/

at (or near) zero deficit 1895-1970 (except for during world wars) and surplus in late 90s. your conclusion is that the US experienced no growth for most of a century. specialK

Accelerating bank credit expansion can cause growth too but unlike Federal deficit spending, all of the principal (plus interest that does not even exist in aggregate unless it too is lent into existence) must be repaid or the collateral forfeited.

Here’s the thing though: the Federal Reserve Bank business is a sideshow, created by private banks to confuse us, in order to convince us NOT to print money when we SHOULD.

The US government, if Congress chose, could print *US Notes*, a.k.a.”Greenbacks”. Look them up. They had a red seal. They were printed by the Treasury and were direct from the Treasury, no Federal Reserve involved.

They were good money. We should go back to printing them.

The national economy is not a household; a household is not the national economy. Repeat over and over again until you understand.

The key is the federal government issues the currency.

As such, they can always pay their debts.

If they refuse to do the logical thing and tax those who can afford it to pay debts, then they can always issue more money to pay debts.

So if growing GDP is the same as spending money, why are they giving away $Trillions to companies that don’t spend it (banks) ? Seems to me they should give the money to someone who wants to spend it (consumers).

Of course the gov’t should put money in the hands of people who will spend it. Stats in 2010 (or was it 2011?) showed that the most effective stimulus came, not from anything enacted as part of the stimulus, but from unemployment insurance. :)

Because they care more about those companies than about those consumers.

Yes, Ben’s helicopter sure hasn’t flown over my house. But it has (via some proxies) definitely flown over the TBTF where I work.

Matt’s excellent post

http://www.nakedcapitalism.com/2012/08/the-real-rationale-for-the-romney-campaign-a-consultant-money-grab.html

kind-of explains that one though.

here’s how it works:

you *give* it (credit it) to the banks

they *lend* it to the consumers

big difference

the goal never was to “help” the consumers

when consumers collectively have enough assets/collateral, the lending will resume so that the assets can be taken again when the pool of borrowers ultimately defaults on the loans that were issued in excess of the amount of money that could be repaid.

there’s no mystery to it.

[quote]Business Sector (hesitant despite low borrowing costs and mountains of cash)[/quote]

By you own admission, the people best equipped to lead us out of this mess are the “Business Sector”. They will not; at least not too quickly. They want guaranteed profits before they will invest – ROI. The problem is that the interests of private capital and workers diverge.

The only long-term answer to the problem is to change the structure of ownership of capital.

This isn’t an issue I expect to see addressed at naked capitalism. You are all about (1) exposing the sleazy side (2) bigging-up Keynesians, but never about providing any long-term solutions.

Before you answer me with – more regulation – consider the reason why regulation is so weak: capital ownership gives private capital huge influence in politics, media and economics education – not to mention ‘regulatory capture’.

So what do you mean by “changing the structure of the ownership of capital,” if it is not too much to ask?

Something along the lines suggested here perhaps – http://www.futureeconomics.org/2010/10/towards-clever-capitalism

I think you’ve got the right idea – it’s not growth we need, but massive capital redistribution. Lets tax the shit out of millionaires and use that money to build some infrastructure that may be useful over the next century, instead of this dead dinosaur dependent highway and energy system.

We’ve got plenty of money in this country, plenty of able bodies, plenty of great ideas. Lets get it going.

I think you’ve got the right idea – it’s not massive capital redistribution we need, but just profligate spending.

Lets tax the shit out of students and future generations not yet born and use that money to fund military adventures to destroy economies around the world while draining every natural resource, and also to pay for insanely expensive drugs for 90 year olds in their last months of life.

We’ve got plenty of money in this country, plenty of not-yet-born taxpayers, plenty of militarized police and private prisons incarcerating millions of americans working at 23 cents per hour.

http://en.wikipedia.org/wiki/Incarceration_in_the_United_States

http://en.wikipedia.org/wiki/Federal_Prison_Industries

Lets get it going.

Are you on drugs? Your comment was a bizarre nonsequiter.

He is only describing, with sarcasm, the situation as it is today.

Yves, You missed the other half of the equation … writing off debt … In fact, allowing homeowners bankruptcy write downs, students, student debt write downs, allowing cities, school districts, counties and states write downs would unclog the system immediately giving people and local government the money they need to begin spending once again.

Think Iceland !!!

No point in mentioning it when it will never happen.

Universal debt forgiveness is not practical but a ban on further credit creation and a metered, universal bailout with new fiat is.

See Steve Keen’s “A Modern Debt Jubilee” for more details. Steve is not so radical as to ban all credit creation but he would greatly limit it to prevent another bubble.

The bailout checks would go equally to non-debtors too, in case you wondered, so no one could complain of favoritism.

well, that takes a load off my mind.

Steve Keen’s universal jubilee would cause a bank run.

The collateral for all the payments to both debtors and creditors (depositors) would be the bank deposits themselves.

Depositors would not actually gain anything: their original funds would be effectively redenominated.

In order to capture the phantom ‘gains’, the depositors would have to race out of their accounts taking their redenominated deposits in the form of currency.

Since the greatest debtors in America (besides the rich) are the banks themselves, the transmission channels would break down and only a handful would retrieve their deposits. More pressure would be added to the transmission channels, etc.

Keep in mind … as a brain teaser … if all the US debt was somehow made to vanish on Monday afternoon … by Wednesday morning new debts in the same amount as the old would have to be taken on. Our precious machines which we love so dearly at the expense of everything else including life-support on our one-and-only space ship … are completely dependent upon the expansion of debt.

No debt, no industry, no modernity. It’s that simple.

>Steve Keen’s universal jubilee would cause a bank run.

>The collateral for all the payments to both debtors and creditors (depositors) would be the bank deposits themselves.

What? This is completely nonsensical.

>Keep in mind … as a brain teaser … if all the US debt was somehow made to vanish on Monday afternoon … by Wednesday morning new debts in the same amount as the old would have to be taken on. Our precious machines which we love so dearly at the expense of everything else including life-support on our one-and-only space ship … are completely dependent upon the expansion of debt.

What. You’re making no sense what so ever.

steve from virginia…

There exists approximately $5 Trillion in net currency in the non-government and $54 Trillion in debt (currency plus currency liabilities).

Where do you think the $54 Trillion came from? Surely you don’t think it came from deposits.

Steve Keen’s universal jubilee would cause a bank run. steve from virginia

No. Instead it would provide new reserves to back US deposits. How would that cause a bank run?

Yves did not write the post.

“You missed the other half of the equation … writing off debt”

writing off debt is not for homeowners or students or credit card holders.

writing off debt is for banks and other large corporations.

banks lend money into existence. the money has to all be paid back, with interest. this is an impossibility. so you create a corporation to assume the impossibly large debt obligation. the corporation can’t pay it back (duh), but during its lifetime it pays its employees and (especially) executives shit tons of money, which they get to keep.

then the corporation defaults on its loans.

personal wealth gets created hand-in-hand with corporate bankruptcy.

exhibit A: willard

GDP is an irrelevant number.

We have to start by asking “why do we have an economy?”

The correct answer is NOT “to increase a number.”

The correct answer is “to improve the conditions of the people.” Or more specifically, “to provide decent jobs that ordinary people can do, and to provide decent stuff that ordinary people can buy.”

When did the correct answer apply to America? Roughly 1940 to 1980. During that period we had high taxes and low taxes, high spending and low spending. This tells us that taxes and spending are NOT the relevant independent variables.

Three things that WERE consistent during that period: strong regulation of financial institutions, strong limits on corporations, and careful limitation of foreign trade.

Are those the relevant “forcing factors”? Maybe. At least they’re not disqualified.

If one focuses only on the recession portion of the economic cycle, then Stephanie Kelton’s argument for countercyclical government spending seems plausible enough.

But take a step back to examine the entire cycle, and it becomes obvious that government plays a procyclical role in the expansion phase of the cycle. Making the same error as businesses which build excess capacity by mistaking bubble-driven demand as sustainable, government continues deficit-financed program spending even during expansions. Usgov ran only a couple of annual surpluses since 1969.

Keynesianism fails because government does not play a consistent anticyclical role. Procyclical government spending in expansions actually amplifies the severity of subsequent slumps.

Between Kelton and the other MMT bozo from UMKC who posts here, this provincial Missouri campus is establishing a worldwide reputation for tax-feeder flake-o-nomics. One trembles imagining fresh-faced, tow-headed farm kids being brainwashed with this Bizarro World garbage by state-funded employees. Fortunately the security guards at the Kansas City Fed have mug shots of these deranged professors posted on the wall, to ensure they can’t infiltrate places where actual policy is conducted!

“Procyclical government spending in expansions actually amplifies the severity of subsequent slumps” is not Keynesian. Bill Clinton’s gov’t surpluses in the late 1990’s were classic keynesian policy. Bush spent like crazy

to deliberately break the solvency of the federal government , and succeeded beyond his wildst dreams.

Jim Haygood says:

August 30, 2012 at 11:06 am

bozo

Speaking of bozo’s…

Pro-cyclical government spending in booms is specifically a trait of the modern Republican “know-nothing” party. Reagan did it, and Bush II did it.

It’s not actually required for government to act stupid. Bush I didn’t do pro-cyclical spending and neither did Clinton.

We are back to the simple fact that *there is no substitute for competence*. If we elect the sort of flim-flam men who are like Reagan, Bush II, and Romney, we will get the sort of flim-flam government which borrows money to give to its buddies, with predictably bad results.

Or on the other hand, we could elect actual Keynesians, who would cut the deficit in boom times. But perhaps I am too optimistic about the ability of the American people to elect competent government. There is a long history of Americans electing flim-flam men, after all.

No, Jim, the US government has been pro-austerity, even in booms. The US needs to run deficits to finance its imports, even in booms. It can’t really prevent the rest of the world from using the dollar as a reserve currency – see Triffin’s dilemma.

The problem is that the US wisely spends more money than say Europe has since the 70s, but it spends its money more unwisely top-down, trickle-down, on welfare for the rich, on negative value military spending, which is more inflationary, creates bigger deficits. Keynes’s Keynesian spending is what the MMTers want – spending on the bottom up, to do real, good stuff, not on garbage produced for parasitical plutocrats. And since functional finance is sounder than sound finance, this will end up with lower debt/GDP than austerity – as practiced e.g. by Clinton.

The Bizzarro World is the one we live in, courtesy of these plutocrats & their puppet morons & madmen in government & academia. MMT, Keynesian, Institutional economics is just common sense and arithmetic.

Not all spending is equal.

If a consumer buys a nice new foreign made car (like in cash for clunkers) most of the spending goes to boost foreign GDP.

But if money is spent on a locally produced wind turbine, oil imports are reduced (increasing GDP) and the manufacture of the turbine also increases GDP.

What we need is not more spending, but smarter spending.

Careful, Bil…someone’s gonna call you a protectionist.

What we need is not more spending, but smarter spending. billwilson

Generally, an unsubsidized marketplace will result in that.

I know many of you think windmills = smart and they are for SOME applications but they are not a panacea. Instead, they are a government subsidized boondoggle in many cases.

If windmills make economic sense then that’s what will happen but if they don’t then that’s what should not happen.

There is a massive problem there however, fossil fuels are still the most cost-effective way to produce energy, yet those are precisely what we must get rid of by any means necessary.

While admittedly positive reinforcement by propping up renewable sources can be ineffective at times, it’s still better than riling up people by taxing fossil fuels more. At least from the idiot politicians and brainwashed fuckwit-on-the-streets point of view. At least by going with positive instead of negative reinforcement /we can actually get something passed through our braindead, decaying political systems/.

The holy Free market and its Sacred Hand of Divine Guidance only work on the present, and poorly at that. The markets have proven beyond any doubt that they have zero ability to look to the future. Whether its because market actors have an irrational hate of losing (very typical human bias, weighing loss over potential gain of shifting) resources already committed to existing way of doing things or something else is causing it, we just flat out cannot leave our future in the hands of capricious, self-interested cunts like that.

And if tolerating inefficiencies is the price of actually having a future, then so be it. It’s a price I’m willing to pay.

“If a consumer buys a nice new foreign made car (like in cash for clunkers) most of the spending goes to boost foreign GDP.”

Not if it’s paid for in US dollars.

The transaction ends with a net transfer of funds ($) out of the domestic economy if exports are less than imports (trade deficit).

Dollars pile up in bank accounts at the Fed and remain on the sidelines until the foreign entity decides to buy something from us.

What we need is savings and investment, not borrowing and spending. The fiat ponzi has required more borrowing than can be supported by the productive economy. Let the malinvestments be purged, tighten credit, let the interest rates be determined by the markets, remove onerous regulations, NO bailouts to anyone, and after 10 or so years we might step out of the rubble. Or we could press on the accelerator of consumerism, debt and crony capitalism and become Escape from New York within a few years. Even doing the right thing will be collapse and higher crime, but the crash will be less severe than where we’re headed.

“What we need is savings and investment, not borrowing and spending.”

Apparently you are unaware of the Paradox of Thrift™. If people save it reduces private-sector spending, which reduces economic activity, which reduces tax receipts, which reduces government spending, which reduces private-sector spending…rinse and repeat.

As the economy collapses and people become unemployed they must spend their savings to survive, undermining the original goal of saving.

The tyranny of the arithmetic is strong here, and this tyranny can only be overcome if the government creates new (deficit) spending to replace the funds lost to saving.

To not do so would surely result in a depression.

Gee … There is spending savings and then there is imaginary spending aka debt/credit.

Spending imaginary money gets you imaginary GDP.

Spending imaginary money gets you imaginary GDP.

The “imaginary” would become real with a universal bailout till all debt was paid off.

This country was built with stolen purchasing power via credit creation. There’s no reason it should remain in debt created by counterfeiting.

I thought all money was imaginary. Unless you barter wheat for gasoline, or something like that.

“I thought all money was imaginary. Unless you barter wheat for gasoline, or something like that.:

Money isn’t imaginary. Every dollar ever created exists on balance sheets in the non-government as cash, either as currency or govt. bonds issued to the public.

Actual currency ie coins and bills are physical representaions of money. Money is an accounting construct.

once upon a time, money was also a fungible store of wealth

once upon a time, money was also a fungible store of wealth”

Money is not a thing, it is a score-keeping system. That said, there is no better risk-free store of wealth than U.S. Treasuries.

Over the past 30 years the dollar has out-performed gold and equities.

paul says (below):

“Over the past 30 years the dollar has out-performed gold and equities.”

this is nonsense

1982: dow averaged less than 1000 dollars

http://stockcharts.com/freecharts/historical/djia1900.html

2012: dow averaged more than 10,000 dollars

tenfold increase, annual growth of 8%

1982: gold averaged 376 dollars

http://www.nma.org/pdf/gold/his_gold_prices.pdf

2012: gold averaged more than 16,000 dollars

http://www.kitco.com/charts/techcharts_gold.html

4.25x increase, annual growth of 5%

1982: federal reserve note averaged 1 dollar

2012: federal reserve note averaged 1 dollar

one-fold increase, annual growth of 0%

even if you use the BLS flawed inflation calculator

http://www.bls.gov/data/inflation_calculator.htm

the dollar has retained only 0.42 of its purchasing power from 1982,

annual “growth” of negative 10%

say more funny things! be outrageous!

“over the past 30 years, the population of california has dropped to 100 people”

“over the past 30 years, computers have slowed way way down”

“over the past 30 years, US exports surpluses have surged”

Adjusted for inflation moron.

>>(Over the past 30 years the dollar has out-performed gold and equities.) Adjusted for inflation moron.

How do we measure performance if not by the gain or loss of purchasing power over time?

“Spending imaginary money gets you imaginary GDP”

I think this is termed a “bubble”.

“There is spending savings and then there is imaginary spending aka debt/credit.”

So numbers represented by magnetic domains on a computer disk are real if they’re in a category called “savings” but imaginary if they’re in a category called “debt”? That’s great! My savings are real but my debts are imaginary!

“My savings are real but my debts are imaginary!”

By definition, savings are income not spent.

If you have debt, you’ve already spent the money. Your payments are dis-saving plus a redistribution of other income in the form of interest. All you get out of the transaction is the ability to consume before earning.

Saving though borrowing produces zero net savings.

The trouble arises because the folks that accumulate the asset side of borrowing are not the same as the folks that retain the liabilities.

When individuals can no longer borrow to maintain their level of spending the economy locks up.

The dollars necessary to extinguish the liabilities are held by folks that have no reasion to give them up. They don’t need your labor anymore, they need the labor of people that still have assets.

When that pool is exhausted it’s game-over.

This post is atrocious, but typical of people of those who know a lot about economics and nothing of reality.

The reason the economy is bad is because of the laws of thermodynamics; not because of not enough government spending or bad Fed policies. And it took over 200 years for America to add its first trillion dollars of debt, and 283 days for it to add its last. If that’s not a clue for you that the financial system is coming unglued, I don’t know what is.

Occam’s Razor!

Why drag in thermodynamics when excessive debt is clearly the problem?

Why drag in Thermodynamics? Because finance and debt are a fantasy of self referential mirrors that have little or nothing to do with reality. Thermodynamics is an actual physical process that exists in the real world.

When the fantasy of finance and economics meets the reality of physics, the fantasy will give way. That’s why I bring it up.

Although it’s true the principles of thermodynamics are relevant to an understanding of the system, You are mis-understanding the 2nd Law and/or applying it to economics improperly.

The economy is essentially a closed system of dollars (U.S). Only the government can introduce new net dollars to the system, an external source just as the Sun is the external source of energy introduced into the closed system Earth.

The expansion of “debt” (all money is debt) is necessary because of a combination of saving (individual saving and massive wealth accumulation by the few) , leakages (trade) and growth (increased population).

The alternative to “borrowing” (printing money) is heavy taxation at the top end of the spectrum, reducing accumulation of dollars that renders them inert, no velocity. A certain level of expansion of the net money supply would be necessary in any case, just not as great if targeted taxation was increased.

Economic activity is a direct function of the size and distribution of the pool of funds (dollars in our case) available for spending.

Also, effectively there is no National Debt since the debt of a monetary sovereign is ITSELF a form of money.

Right but America has 5% of the world’s population and consumes over 25% of the world’s annual energy productions.

All while running a massive trade deficit and accumulating massive amounts of fiat debt that will never, ever be repaid.

While in theory we can print all of the money we will ever need, in reality other countries will stop sending us thier oil and consumer goods if we actually try to do that. And since we are actually trying to do that, you can look forward to insane energy and food prices in the near future.

“accumulating massive amounts of fiat debt that will never, ever be repaid”

It isn’t meant to be repaid, it isn’t that kind of “debt”. English is a context-rich language. The same word has many different meanings depending on the context.

Fiat “debt” is an oxymoron. How can you “owe” something that was created ex nihilo?

By accounting, if the non-government is to have a positive cash balance, the central bank must hold an off-setting cash liability. This is “debt”.

Are you saying we have to return this cash?

We earned the cash by producing goods and services.

The problem comes about through the nature of capitalism whereby profits are skimmed from wages and accumulated by a relatively small cohort.

This results in a combination of saving and redistribution of funds as wealth transfer from the wage-earner to the top 0.1%.

As these funds are withdrawn from the spending pool how do you propose to replenish them?

I’m sorry. I suppose I will have to be more clear here. I spent too much time on this, but oh well. I really want to help people get through the times coming up ahead.

First an important point: all money today has an interest bearing component that is always and everywhere exponentially growing, and at the core of the system today money=debt. For an important parable of why having a money system that is premised on exponential growth is insane, have a look here:

http://www.singularitysymposium.com/exponential-growth.html

This is not a theoretical abstraction. Today, the debt in the system is exploding while the real economy that feeds people is stagnating because of that. And incidentally, meanwhile the actual collateral available to the system relative to the amount of debt is shrinking logarithmically. Because accumulating interest debt does not magically cause new collateral to be created.

That is why crazy things like the ECB lending to Greece so that Greece can pay back loans taken out from the ECB is happening all over now. It’s a good indication that the system is about to blow, and it’s why the ECB, or the Fed for that matter, “rescuing” anyone is laughable. If Greece were entirely liquidated for cash today and the whole damned thing gifted to the ECB and the various other money men Greece allegedly owes money to, it would not even satisfy a tiny fraction of Greece’s debt. It’s “fiat debt”. It’s phony. There is no collateral there. Just very large numbers on a computer that can’t be translated into reality. I am perfectly well aware that the US debt can never be paid back, and that is precisely why this system will collapse. Collapse was built into it from the get-go.

But all that is rumination on semiotic fantasies, and I don’t really care much for it. Here is what is actually important:

Societies do not function because of the amount of fiat money that exists, or because of policies implented by the government or by the plutocrats or whatever, or even because God wills it to be so. At the most fundamental level societies function because they have an energy surplus available to them.

Why we have been in a horrible economic depression for the past five years, and the reason we will continue to be have one basically from now on forever (or until the market economy collapse which is not far off actually) is that the net energy available to operate society on has been empirically declining since about 2005. The economic depression that we are find ourselves in is only a minor symptom of far bigger problems that the human race is facing right now, and focusing on the absurd surreality of finance and economics for solutions to our Big Problem is a ridiculous waste of time that is only going to cause extreme hardship on those who persist in it.

But there are actual solutions that do not involve begging the Fed or ECB to print and lend more money or involve begging the government to come over and fix your problems for you. I recommend discovering what those solutions are and then taking steps to implement them. No one is going to save you and your loved ones but you, and imagining that some politician or corporate ladder climber is going to do anything for you is not going to be beneficial to your health.

JGordon says:

August 30, 2012 at 2:51 pm

You are talking about private debt. Public debt is not subject to this singularity, and all private debt could be taken on as public debt if need be.

Further, private debt has a functional limit, based on the borrowers ability to earn income in excess of his/her necessities. Private debt cannot be extended into infinity.

The real singularity happens when the credit circuit being used to fund growth can’t be expanded further and the economy collapses.

Welcome to the present.

Private debt does not create the balances needed to pay the interest, only the principal, however the interest paid is no different than any other extractive process characteristic of capitalism. It is a redistribution of wealth from wage-earners to the wealthiest members of society. It mrely moves existing funds around within the economy. It’s zero-sum.

The interest paid on public debt is inconsequential as it is never paid by agents in the non-government. In fact, public debt adds interest payments to the non-government pool of state-backed financial assets

I’ll say it again, public debt adds money to the economy. Unfortunately it adds it where it is unlikely to do any good.

Since the money-creating entity (Government/Treasury/Fed) creates new funds ex nihilo it’s source of funds is unlimited, ie infinite.

Thus there are no mathematical constraints on public debt. There are other constraints possible however, the main one being inflation.

JGordon, if the Federal Reserve prints Federal Reserve Notes, or if the US Treasury prints US Notes, those are *non-interest bearing*.

The US government has the power to create money which is not interest bearing and escape the otherwise-inevitable scenario you describe.

The elite private bankers demand that the US government “pay interest” when it prints money, for the purpose of benefitting the elite private bankers. The decision of the US government to kowtow to their antisocial whims is what puts the US in the scenario you describe.

In other words, yes, you’ve described a problem, but *printing money gets us out of the problem*. Think about it carefully.

The interest paid on public debt is inconsequential as it is never paid by agents in the non-government. In fact, public debt adds interest payments to the non-government pool of state-backed financial assets paul

While I usually agree with you, here I don’t.

The debt of a monetary sovereign (“corporate welfare” according to Bill Mitchell) typically transfers purchasing power from the poor (who can’t afford to buy that debt) to the rich (who can).

Plus, since deflation increases real yields but not default risk (there can be none) then the debt of a monetary sovereign creates a class of people who oppose counter-cyclical policies.

Great post, but no one seems to understand it.

what about government run call centers? why should Buffalo get all the business?

If we can collect every penny owed, we wouldn’t have a bad economy because we’d have much more money to spend!

Where is that money by the way? God I hope it’s not in pennies in jars on people’s dressers, that would almost make me want to forget about even trying. Who has it? If we only knew who has it and where and whether it’s in pennies, it would be easier. Quarters would be OK. That’s what the call center can do.

Mr. Incog, yes that’s the one! Hilarious stuff. Funny how everything makes sense when you can relate it to a Star Trek episode. At least for me it does.

Hmmm… while, like Peter Pan and Tickerbell, I so *want* to believe that stimulus spending is indeed an answer, I can’t shake the notion that it has downside as well as upside.

Take, for example, China. Now there, all the time, we get to read how their stimulous is “bad” because it is going into unproductive assets or is mal-investment. Or Japan, which quite happily splurged it’s way up to 230% GDP national public debt on a fantastic set of infrastructure (the shin-kan-sen is a wonder) to off-set private sector deleveraging — but no, that’s “bad” as well and it will apparently all end in inflationary tears or default or a plague of locusts or something.

If I could live anywhere, I’d happily live in Japan with its excellent public services and transport, low (by other standards) unemployment and still a strong desire for a Social Contract. Better that than here in Austerity Britain 2.0

Yet having actually lived through a currency crisis, very high inflation and consequent civil unrest which was certainly correlated to a lack of competitiveness caused by government spending papering over the cracks in an economy addicted to the endless supply of porkbarrel funding… that wasn’t exactly a day at the beach either.

I think then that the honest answer is that there isn’t a nice way out of our problems. You pick your poison as John Maudlin would say.

Pretending that Solution A or Solution B is THE answer doesn’t seem legitimate to me. We do need an honest debate — which NC is helping to get towards. But all I ever read is one extreme or the other — not a summary of the pro’s and con’s of each approach (unfunded stimulus vs. austerity).

Why is “unfunded” government spending only bad when it goes (theoretically) to infrastructure, jobs and American citizens? Why isn’t “unfunded” government spending on wars and associated police actions around the world just as bad? Somehow the people who decry the former do not seem bothered by the latter.

And what do you have to say about Iceland, Clive?

Downside? The downside is, if you spend the money on the wrong things, you get some major trouble.

So, for instance, right now far too much money is being shovelled directly into the pockets of the 0.1%.

If you have a stimulus package which spends money on the RIGHT things — sending money directly to the poor, building train lines and sewer systems, etc. — then *THERE IS NO DOWNSIDE*.

Money is a tool. If printing it feeds the poor and cleans the water, it’s being used correctly. If it gives the Koch Brothers more power and throws the sick out on the streets, it’s being used wrongly.

In the USA Bush trickle down is the problem with any stimulus we get Plus foreign sovereign wealth funds siphoning off stimulus money to Wall St. to their foreign nations. We need to admit the cheapest is not the best. Each nation should have it own substantiating industry base and trade tariff to protect their standard of living.

The powers that be know that, but they prefer to screw the system with Bush trickle down to recoup their losses in the global markets they invested in with a direct cash infusion to their portfolios via bail outs. They make more money that way and all the losers get to steel it all back. If they fix the system a lot of them will be poor and some will go to jail. It’s Big scam

Consequences of long term free trade agreements with merchantilist nations. Instead of figuring out how to get the government to spend more money, figure out how to get the government to enforce fair trade agreements.

Excellent lesson, Professor! I want to live in your world.

If I understand your lesson correctly, we don’t even need the currency producer to spend the money it produces. We can all vote to have the currency producer send us the currency it produces so that we can spend it. If we spent all the currency that the currency producer sent us, that would increase GDP too, right? That would be great. I could stay at home and eat bon bons all day long while listening to cheerful reports about our ever rising GDP. Sign me up!

But I have a question. You mention three ways to calculate GDP. I thought I heard somewhere that one way involves summing up all production, and I thought I heard that all three ways are supposed to total to the same number. But if that’s the case, then all that spending I’m doing while sitting home eating bon bons also has to equal production. And I’m not producting anything, so where does all that production come from? Do we produce stuff when we spend? I don’t get it. Which comes first? Oh, it’s all too complicated. Just have the currency producer send me some money so I can buy my bon bons. I’m sure someone will make them for me if I have the money to buy them.

The producing comes in when the bon bon maker makes new candy to replace the ones you bought and ate. Now stop making me hungry!

The money-creation entity must create enough spending so that we have full employment and price stability.

Too much and the economy overheats creating inflation.

Too little and production goes unsold, leading to higher unemployment.

I would say right now we aren’t creating enough new money.

Further, this obsession with production tends to cloud the issue. The average American worker produces enough stuff (including necessities) to provide for at least 3 or 4 non-workers. This excess production must be consumed or inventory will pile up and companies will end up having to lay off workers, furthr reducing demand in a downward spiral.

“Giving” money to the unemployed and lazy makes the workers lives better up to the point where the productive capacity is outstripped by demand.

Where we are headed is a bad place but it isn’t because of too much spending. It’s because of the unequal distribution of that spending.

As mechanization in the future decreases the need for human labor we will all eventually be unemployed and lazy. Then what?

Whether it’s a Corporation of today or a monopoly of the past too large to fail has always meant a disaster for a national.

Just an FYI, nobody on this site is a ‘Keynesian’.

Yes, Keynes believed in pump-prining and all that, but he also believed in the real world.

Keynes was quite vocal that, as important as finance is, it cannot overcome rapid population growth. Certainly for societies without an open frontier it never has.

Here is the analysis that Keynes would have made: thanks to government programs aimed at maximizing population growth/hiding the negative effects of same, there are about 100 million new mouths to feed each year. For over a decade crop yields per acre have not increased, and we have no new arable land or sources of fresh water. All of our technologies are in the phase of rapidly diminishing returns, and ‘green tech’ is like saying ‘magic fairy dust’.

Most people are going to become miserably poor, but the rentiers on top will live like feudal lords. Mere finance cannot change this. The people in charge will like this state of affairs just fine.

“…as important as finance is…”

Finance isn’t nearly as important as people think.

“…government programs aimed at maximizing population growth/hiding the negative effects of same, there are about 100 million new mouths to feed each year”

How can government spending be used to reduce population growth? I hope you mean through increased spending on education.

I guess Keynes would have supported education of women, empowerment of women, and free birth control.

All proven to reduce the population over the medium and long runs.

I support these things too.

So I’m a Keynesian, I guess.

This post makes valid points, if you grant the fundamental premise that GDP is a useful metric for the health of an economy. My take-away from this article is that GDP is a terrible metric to fixate on, and economists should be ashamed for pretending otherwise. It provides little insight into national wealth and the standard of living. If the government were to print trillions of dollars and make every taxpayer a millionaire, this would show up as a hugely positive effect on GDP (at least initially), but the true wealth of the nation would be unaffected. If your metric can be easily manipulated to yield nonsensical results, what value does it have?

“If your metric can be easily manipulated to yield nonsensical results, what value does it have?”

Right, If the speed of your car can be easily manipulated by pressing the gas pedal on and off what value does it have?

agreed with the first commenter. the post should be retitled “why do keynesians think more spending will stimulate GDP growth”.

i am tired of the claim that government should spend more on stimuli. time and time again the result of this spending is more upward wealth distribution at the taxpayer expense so even if in principle having government spend on infrastructure and the such is a great idea, the government in its current form just has no track record of making it work – using “stimulus” as an excuse to embezzle instead and making us poorer rather than better off.

this is why i understand the tea party view even though i don’t agree with their solutions. better to cut spending altogether than syphoning off public wealth and giving it to the connected.

government spending is a great theoretical idea but until there are better safeguards in place, it’s better off staying in academia.

“government spending is a great theoretical idea but until there are better safeguards in place, it’s better off staying in academia.”

Government spending is the root source of all spending. This is a mathematical reality so I would like to see how you propose getting around it.

“…better to cut spending altogether than syphoning off public wealth and giving it to the connected.”

In both cases you starve. Is that the outcome you’re looking for?

At least the public gets to handle the money a little before the connected gets it if we spend it on the poor and working class.

Our efforts to control spending would be better spent convincing the masses that we don’t depend on the rich for anything.

Tax cuts for the rich just puts more money on the sidelines, ready to buy your local politician.

You lost me at “Federal (currency issuer)”

the federal government does not issue currency.

It collects currency through taxes.

Spends it through appropriations.

Borrows it by issuing treasurys (not currency).

The currency is issued by a private corporation misnamed “federal reserve”. not by the federal government.

like crazy horse said.

“Borrows it by issuing treasurys (not currency)”

At the end of the transaction cash on balance sheets in the non-government are increased by the amount of a deficit, decreased by the amount of a surplus.

Treasuries are cash that pays interest.

Further, the National Debt™ is about $16 Trillion but only about $11 Trillion is bonds held by the public.

Clearly the federal government can create net currency.

I’m reasonably certain that when the Federal Reserve Act of 1913 was enacted we didn’t have $5 Trillion in currency in the non-goverment.

“The currency is issued by a private corporation misnamed “federal reserve”. not by the federal government.”

Take a dollar out of your wallet and start reading. See where it reads “THE UNITED STATES OF AMERICA”?

How about “THIS NOTE IS LEGAL TENDER FOR ALL DEBTS, PUBLIC AND PRIVATE”?

Or the seal over ONE that reads “The Department of the US Treasury”.

Or the signature below of the Secretary of the Treasury?

Talk about CRAZY horse.

“Treasuries are cash that pays interest.”

good grief. treasurys are not cash any more than money market accounts are cash. but if you want to play the any-debt-is-cash game, that’s cool. a mortgage is cash that pays interest.

“Further, the National Debt™ is about $16 Trillion but only about $11 Trillion is bonds held by the public.”

you had intended to say something relevant, but instead you wrote that. at least there’s the cute little trademark symbol.

who, by the way, is actually entitled to hold a trademark on the phrase “national debt”?

“Clearly the federal government can create net currency.”

congress could authorize that if it wanted to. maybe it will one day.

would you support that?

“I’m reasonably certain that when the Federal Reserve Act of 1913 was enacted we didn’t have $5 Trillion in currency in the non-goverment.”

you are asking about the monetary base in 1913?

http://thefalconpost.com/wp-content/uploads/2009/07/Monetary-Base-1913.png

Take a dollar out of your wallet and start reading. See where it reads “THE UNITED STATES OF AMERICA”?

yes!

it also says “Washington D.C”!

How about “THIS NOTE IS LEGAL TENDER FOR ALL DEBTS, PUBLIC AND PRIVATE”?

yes!

congress has established legal tender laws!

http://en.wikipedia.org/wiki/Legal_Tender_Cases

Or the seal over ONE that reads “The Department of the US Treasury”.

yes!

and another seal on the back!

http://en.wikipedia.org/wiki/Novus_ordo_seclorum

Or the signature below of the Secretary of the Treasury?

yes!

and did you notice there is a second signature as well?

the note has the appearance of a negotiable instrument, doesn’t it!

http://en.wikipedia.org/wiki/Negotiable_instrument

person1 directs person2 to pay money to person3 (you, the holder of the note)

the cool thing about the federal reserve note is that it doesn’t actually direct that anything be paid at all!

and if there were a payment, it would evidently be the note itself!

This Note Directs that This Note be Paid to the Bearer of the Note.

it’s like a funny joke.

to see where the joke came from, you can search online for examples from the past where the note was actually a promise to pay something to the person holding/bearing the note.

http://upload.wikimedia.org/wikipedia/commons/2/21/US_%2420_1929_Federal_Reserve_Bank_Note.jpg

what a wacky concept. the federal reserve note was a promise to pay the bearer actual dollars. redeemable as lawful money. which meant that the language on the note made it clear that the note was not itself lawful money.

super fun question: what was the lawful money for which the federal reserve note could be redeemed in 1929?

treasurys are not cash any more than money market accounts are cash. specialK

The debt of a monetary sovereign IS money except it pays interest. That’s why, btw, that QE has not caused inflation since it simply swaps one form of money, new bank reserves, for another form, the debt of a monetary sovereign.

1. The Federal Reserve is widely described as “public-private”. Its Board of Governors, and even the NY Fed are subject to FOIA. Fed employees are paid well below what private sector employees of comparable responsibility would make.

2. The boards of the various regional Feds do not serve a governance function, which is what you’d see in a private corporation. They meet for tea and cookies and discuss the state of the economy. While each board nominates a regional Fed president, these nominations are subject to the approval of the Board of Governors. The boards cannot fire Presidents, as private boards could. Per Wikipedia:

Regarding the structural relationship between the twelve Federal Reserve banks and the various commercial (member) banks, political science professor Michael D. Reagan has written that:

2. The Fed can and does create currency. There was a huge discussion on various sites, including this one, of mechanisms by which the Fed and Treasury could circumvent budget ceiling constraints, for instance.

“MULTIPLE CHOICE: Who is in a position to lead us out of this weak recovery?”

left out a couple of other choices

– Exchange Stabilization Fund (ESF). you talk about increasing nominal gdp, priced in dollars. if the dollar strengthens (even via manipulation), real gdp goes up.

– IMF. after another round of SDR’s are created from thin air and handed out to the club members, more of our exports can be purchased. If we make anything to export, that is.

– China. they just announced a trillion dollars worth of new money. they can choose to buy US products any time they want to.

– Asset purchases. the federal reserve has demonstrated that it can simply by stuff, like real estate. any time it wants to. whether or not accountants include the purchase itself in gdp, it puts newly invented money in the hands of persons who can then spend or lend.

“- China. they just announced a trillion dollars worth of new money. they can choose to buy US products any time they want to.”

We don’t accept Yuan in payment, nor do we accept any foreign currency.

China holds a $Trillion in US dollar assets. They could buy whatever they wanted with that money – if they wanted to. They don’t need to print Yuan.

“nor do we accept any foreign currency”

sure “we” do. you just don’t notice it happening.

The beautiful thing about a not-audited federal reserve is they have decided that they can freely “swap” unlimited amounts of dollar-flavored bank-medium with foreign banks and keep it all off the book. hey, here’s 500 billion dollars in exchange for a like amount of euros or renminbi or whatever! now that you have the dollars, spend them wisely! thanks!

the familiar concepts of “market” and “import” and “export” are so 1990s. it’s all changed. unreported. dark pools. shadow banking is larger is size than visible banking .. so says nyfed (page 8) http://www.ny.frb.org/research/staff_reports/sr458.pdf

I think it’s time for you to put on your tinfoil hat.

http://www.reuters.com/article/2011/04/18/china-newzealand-swaps-idUSL3E7FI0LH20110418

so china engages in currency swaps.

the fed swaps with japan, korea, singapore, new zealand

http://en.wikipedia.org/wiki/Central_bank_liquidity_swap

which in turn swap with china

http://en.wikipedia.org/wiki/Chiang_Mai_Initiative

it would require a tinfoil hat for someone to suggest that banking is now done some other way than this. or maybe you just didn’t know.

The consumer is for all practical purposes bankrupt. Until that is remedied nothing will help the GDP. Or national debts.

My Walmart I work at depends on welfare checks, wic, SS checks, and various government paychecks. (can’t forget the Canadians)

And where are the “cuts” in government spending?

Some people have never lived in the real world when taking my companies customers away so I can lose my job is considered sensible or necessary.

Can’t wait to vote against these silly ignoramus’ who believe that the government has to tax and spend and balance these things off of our backs.

Hey, the Republicans lost me years ago over this. You can’t balance a federal Budget during a depression as it destroys the consumer.

And they vote!

oh .. and not to forget derivatives.

sheer betting, with proposed payouts that exceed the actual amount of available money. I can bet you a gazillion dollars that tomorrow will be rainy. even though I don’t have (and don’t have access to) a gazillion dollars.

if you accept my bet, you have just permitted my gazillion dollars to exist, albeit in a limbo-like state.

if there’s no rain tomorrow, I default on the gazillion. but you still carry it on your books as though it were ever really there.

and you use it as collateral so that you can borrow from others.

great way to grow the gdp

Keynes on stimulating the economy: http://tinyurl.com/9ox33a8

I think many here are missing the point. This post is a useful tool to provide to all those RW relatives who forward emails about how Debt will Murder Us in our Beds and how “it’s just common sense” that the government “shouldn’t spend more than it takes in” and other nonsense they hear on talk radio about why we’re in this mess and why we need to cut taxes on the “jaaahhbb creators” to bring back the Good Old Days. It is also a good counterweight to all the hatred about “government spending” that we’ve been indoctrinated about for at least 30 years.

(And also to counter Obama and other neolibs who talk about how the economy is like a household. No, it isn’t, for the very simplified reasons outlined above.)

“economy is like a household”

Watching the film “Iron Lady,” one could get the idea Margaret Thatcher came up with this one.

Catharine Beecher would love it. (Although to be fair, being a 19th century protestant moralist she would probably love Kelton too).

We have tons of countries that collapsed in debt or hyperinflated their way to oblivion, but what single example is there of a country that borrowed its way to prosperity? They want higher GDP in Europe to grow their way out of debt, but how has borrowing worked out for them? The fact is that $1 of national debt buys far less in GDP. Also, our citizens our up to their gills in debt and cannot spend without getting into even more debt. Consumption should be less than the earnings of a nation or individual, with the balanced saved to finance investment/capital. Otherwise we are in an unsustainable economy with every can kicking excercise making the inevitable crash worse.

What part of “debt = money” don’t you understand?

Do you think money just magically appears in an economy?

You have little understanding of monetary economics.

England during its period of greatest industrial growth. Japan too, for that matter.

See Figure 1 in this paper:

http://www.nextnewdeal.net/wp-content/uploads/2010/12/a-world-upside-down

The post-war miracle in the US was entirely due to the massive debts incurred during WW2. It didn’t hurt that productive capacity had been put to good use during the war by a government that didn’t suffer from a businessman’s “lack of confidence.”

Right-wingers often claim that the New Deal didn’t end the Great Depression, WW2 did. They are right. Maybe they should follow their own line of argument.

Stephanie Kelton says, “Spending isn’t the just the right way to grow the economy, it’s the only way.”

I disagree wholeheartedly with Stephanie’s conclusion, which is an excellent example of circular reasoning.

US national debt is $16 trillion dollars. Adding in Fannie Mae and Freddie Mac GSE debt brings it to $22 trillion dollars. National debt to GDP is 141%. We have hit a debt wall. The problem is too much debt. Adding even more debt does not solve the financial crisis. Increasing federal spending now is insanity. It has not, and will not, get us out of this credit crisis.

What is measured incentivizes economic actions. In this case, justifying more federal government spending (something politicians do NOT have to be encouraged to do). GDP is the wrong measure of economic wellbeing. Economists devised the GDP measure, which is leading us in the wrong direction.

The US needs an economic convention of independent economists, accountants and management scientists (not shills for the status quo) to devise new economic measures.

US national debt is $16 trillion dollars. Adding in Fannie Mae and Freddie Mac GSE debt brings it to $22 trillion dollars.”

You are apparently unaware of the difference between public debt and private debt. I reccomend you go read some Steve Keen.

GSE debt is the government backstopping private losses. No money has changed hands. The economy doesn’t “see” this money. If the government let the banking cartel “see” their losses we would have a different world right now.

This thread is a target-rich environment. So much stupid, so little time.

““Economists devised the GDP measure, which is leading us in the wrong direction.”

Modern (neoliberal) economics is a fabrication based on false premises. Only heterodox economists (non-mainstream) have anything relevant to say.

The entire economics academic institution should be thrown away and re-built within the departments of engineering, social sciences and finance.

The only relevant part of GDP is the part that includes a wage component. The rest is like capillaries in our bloodstream, it gets money to the places that need it.

Unfortunately the financial industry has found a way to make money off of blood clots, while the other parts of the economy die.

I agree with many of the points raised. Most importantly, I would ask who cares if government spending stimulates the economy if that stimulus does not primarily help the 99%?

Implicit in this question is the issue of wealth inequality. What we saw in the recent pseudo-recovery was that virtually all of its gains went to the rich. What this means is that for the vast majority of Americans there was no recovery. For many the recession and depression never left.

Along with this, there has to be some forgiveness of debt whether this is calle a write down, a bailout, or a jubilee. Otherwise a lot of any stimulus will end up servicing old debt which ultimately funnels money back to the rich and maintains wealth inequality.

It’s important too to remember that Keynesian stimulus is about increasing aggregate demand, especially through job creation. This does not happen or happens less if you have big infrastructure projects where say all the structural steel comes from China or if on smaller projects, contractors are used that hire illegal immigrants who remit a lot of their wages back to their country of origin. And it doesn’t happen if profit margins are high, again with these passing back to the rich.

Another aspect of how stimulus is spent is sustainability. What we need is stable, long term, well paying new jobs. The days of digging holes and filling them back up are over. Our resources need to be directed toward the long term needs of our society. In other words, we need socially useful spending, spending which creates a better and more maintainable standard of living for all of us, and one which keeps jobs and the benefits of those jobs in this country. This will mean things like ending free trade treaties not just NAFTA but probably GATT as well, and it means finally getting serious about illegal immigration. This would not mean the end of international trade but the institution of fair trade that serves the interests of the 99%. Similarly, I am not advocating closing the borders. We can push for aid, investment, and reform in Mexico and Central America so that people have a future in their own countries. We can penalize employers for employing illegals and discriminating against say Hispanic Americans. And we can make sure that all jobs in this country pay a living wage and thereby make them more attractive to Americans. Will your lettuce or roof cost more? Yes, but would you prefer cheap lettuce and high unemployment among Americans instead?

Kelton’s addresses none of this, and comes across as almost neoclassical in its oversimplification of both stimulus and the economy.

calle > called; Kelton’s addresses > Kelton’s post addresses

Yes we should spend to grow out of this… but we need to redefine the word “product.” I’m nervous about global trade – it’s just a currency devaluation trade right now and it isn’t good for anybody let alone any country. So when I’m told that exports are one way to grow the GDP I back off. A few products, which one country does better than all the others, maybe. But not all the garbage and sweat-shop merchants we have now. We don’t need that kind of growth. We do need lots of “low productivity jobs of high social value.” Since we have such powerful computers we could do a useful social experiment. The government could pay us for our comments – blogs would go crazy. Oh, I forgot, they already compile our comments without paying us. Well, besides the professions and the services using computers, schools, medical industry, entertainment, etc. productivity has reached a level that destroys old-fashioned capitalism. So GDP might not be a useful tool.

Consume Mass Quantities!

http://amoleintheground.blogspot.com/2012/07/consume-mass-quantities.html

Exponential growth is neither desirable nor possible in a finite world. Your precious GDP is what’s killing the planet. Where do you think wealth comes from? Resources!

These might be stupid questions, I’m a little behind on my MMT reading, but what does the $16 trillion US debt represent. Is this money owed to somebody? If it is who is it owed to? If the Fed gov creates the money how can it be in debt?

but what does the $16 trillion US debt represent. Is this money owed to somebody? If it is who is it owed to? If the Fed gov creates the money how can it be in debt?”

If there is $16 Trillion in net dollar financial assets in the non-government (domestic and foreign combined), by accounting there must be $16 Trillion in liabilities on the government side of the ledger. That is the National Debt™.

The National Debt™ of the government is also the National Savings™ of the domestic non-government plus dollar assets held by foreign entities.

There can’t be non-goverment financial assets without equal government liabilities. That is how it is “debt” but “debt” is a vague term that has many meanings depending on the context.

This kind of “debt” is not meant to be paid back, it is nothing more than an abstract accounting construct.

If we were to “pay back” this debt there would be zero net dollars in the economy. Good luck with that.

http://www.efinancialnews.com/story/2012-08-03/us-treasury-floating-rate-notes

when the govt owed 16 trillion plus variable-rate interest, the interest payments can swing up and down such that this month the payment is 10 billion and next month the payment is 20 billion.

so the “asset” that matches the variable-priced liability must be one that itself fluctuates accordingly.

super fun game: Name That Asset!

Excellent, excellent comments, Paul, but here are a few cavils.

“accumulating massive amounts of fiat debt that will never, ever be repaid”

It isn’t meant to be repaid, it isn’t that kind of “debt”. English is a context-rich language. The same word has many different meanings depending on the context.

Fiat “debt” is an oxymoron. How can you “owe” something that was created ex nihilo?

By accounting, if the non-government is to have a positive cash balance, the central bank must hold an off-setting cash liability. This is “debt”.

…

There can’t be non-goverment financial assets without equal government liabilities. That is how it is “debt” but “debt” is a vague term that has many meanings depending on the context.

This kind of “debt” is not meant to be paid back, it is nothing more than an abstract accounting construct.

If we were to “pay back” this debt there would be zero net dollars in the economy. Good luck with that.

No, debt is not a vague term. It has only one meaning. Fiat debt is not an oxymoron, but a tautology, a pleonasm. There is no other way to create an “owing”, a fiat debt, but ex nihilo by the issuer / debtor, saying I O U . Debt, money are not really “accounting constructs” if that is meant to say they don’t “really” exist. It’s not really “accounting” that causes government (better than ‘central bank’) to have a liability if the non-government has a monetary asset, but the nature of money itself. Money is a relationship of a creditor to a debtor. If it isn’t an asset/liability aka credit/debt pair, if it is not a relationship, it is not money.

The debt that money IS is a very real, very ordinary sort of debt, the realest & most ordinary. A dollar bill means the government owes the holder something, will sell it something. The biggest thing the gov sells nowadays is the right to engage in activities which are “taxed”. One dollar entitles one to one dollar’s worth of stuff at government stores, or one dollar’s worth of right to engage in taxed activities, hold taxed properties, both subsumed by the concept of one dollar’s liability TO the government, a debt going the other way.

And so these “fiat debts” are CONSTANTLY being “paid back”, whenever anyone accepts a dollar, whenever the government accepts a dollar to extinguish a dollar’s worth of liability to it. Just as a theater ticket indebts the theater to the holder for one performance, and this debt is extinguished at each performance. That the national debt is growing is of no more import than the fact that the theater is selling more and more tickets, more than it is shredding – because it is showing more performances, because it is expanding its theater, because the tickets don’t expire and are a handy savings vehicle. All MMT is saying is that the theater should issue enough tickets – to the performers themselves that want to see more dramas put on by their fellow performers, rather than have an empty theater!

If the Federal government never ran a budget surplus and sometimes ran budget deficits then (ignoring the Fed for simplicity) SOME debt-free fiat would accumulate in the economy equal to the some total of those deficits.

So, practically speaking, debt-free money is possible even with fiat.

SOME debt-free fiat would accumulate in the economy equal to the some total of those deficits.

So, practically speaking, debt-free money is possible even with fiat.

F. Beard: I use “debt” correctly, in the way it is used in ordinary life & in ordinary dictionaries. What you are calling “debt-free fiat” is just currency, non-interest bearing reserves, dollar bills or coins. The whole point of MMT is that this IS debt (credit), according to the normal definitions of debt that everyone naturally understands, that is implicit in human cognition.

Bad economics indulges in crazy mental gymnastics to convince us currency, debt-free fiat, is not debt, and make a hallucinatory distinction of kind between it & interest-bearing debt.

Currency which is still running around the economy is debt which has not yet been used by the creditors, the holders of this government debt, to pay debts going the other way – to buy something from the government, to pay taxes (which one can/should think of as buying something from the gov.) Debts which have not yet been repaid / cancelled / redeemed are still debts, and that is what a dollar bill in your pocket is.

If the government has a candy machine that takes a dollar, it is saying that upon receipt of that dollar it OWES you a candy bar, or whatever else you might want to buy at the gov’s price.

You might have gotten it from the gov for working for Uncle Sam – he gave you the dollar which represents a debt he owes you. You did something nice for him, he promises to do something nice for you. Uncle Sam is so powerful that his promises to be nice are very, very valuable.

and make a hallucinatory distinction of kind between it & interest-bearing debt. Calgacus

Haha! I see sovereign debt as a form of currency and you see currency as a form of sovereign debt.

But my point is that a debt that need never be paid can hardly be considered debt anymore. A monetary sovereign, imo, should ALWAYS run a deficit (though it might vary in size) and NEVER run a surplus.

As of August 28, 2012 the federal debt was $15,978,918,589,911.74

This is split into $4,780,127,371,177.68 of intragovernmental holdings, essentially debt the government owes itself,

and $11,198,791,218,734.06 of debt held by the public.

As of the end of June 2012, $5.2923 trillion (47%) of this was held by foreign entities.

The 5 largest of these were:

Mainland China: $1.1643 trillion

Japan: $1.1193 trillion