Matt Stoller is a fellow at the Roosevelt Institute. You can follow him at http://www.twitter.com/matthewstoller

The economy bulls are back at it again, claiming that all is well. The most recent edition of this story is, “Consumers Paying Down Debt Helps Boost U.S. Expansion”, in a Bloomberg piece written by Rich Miller, Steve Matthews and Elizabeth Dexheimer. It’s a well-reported piece, replete with Mark Zandi quotes, that mixes financial analysts sounding the all clear with anecdotes of people who have paid back their overwhelming debts, and are now shopping again.

This is the thesis.

Three-plus years into a recovery from the worst financial crisis since the Great Depression, Americans finally are getting their finances back into shape, Federal Reserve figures show. Household debt as a share of disposable income sank to 113 percent in the second quarter from a record high of 134 percent in 2007 before the recession hit. Debt payments on that basis are the smallest in almost 18 years, while the delinquency rate for credit cards is the lowest since the end of 2008…

Consumers such as Atlanta’s Bullock-Morley also have broken with the past. The health-care worker says she’s “changed my lifestyle” with the help of Atlanta credit-counseling service CredAbility. She’s down to one credit card, has set aside about $500 for a trip to Italy, put money into her personal emergency fund and is saving more for retirement. “I just spend money very differently right now.”

Unfortunately, the economy bulls are leaving something very significant out: defaults. The data is pretty clear. In the latest quarter, first and second lien charge-offs were $303.7 billion (with Home Equity Lines of Credit defaults high and continuing to rise). Meanwhile, aggregate consumer debt dropped by $53 billion. That’s better than 2012 Q1, but the drop in debt from defaults is six times larger than the total drop in debt.

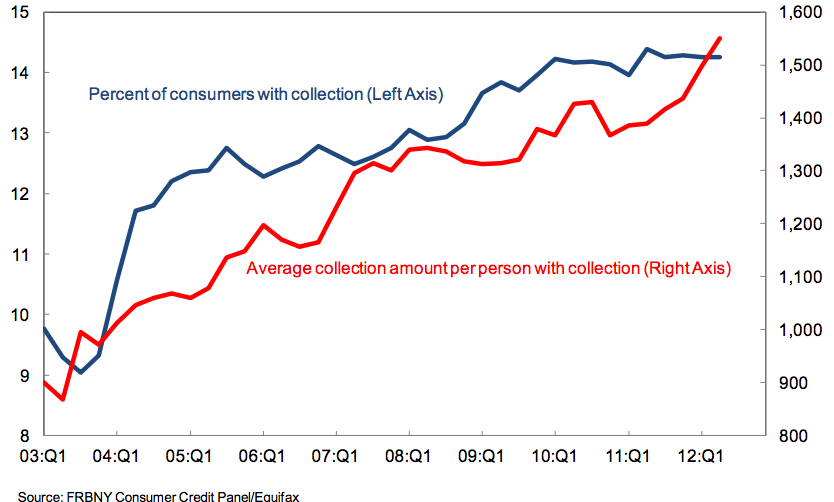

Consumers aren’t paying down their debts, they are simply defaulting. And here’s another way to look at the problem. One in seven Americans is being pursued by a debt collector. And the average amount of that debt pursued has increased by about 8% in just six months.

When debt collectors are doing a brisk business, the consumer typically is not. The American consumer is still a very stressed consumer

“One in seven Americans is being pursued by a debt collector.”

Yup, yup, that’s what I keep telling young people.

“You gotta play the odds, man. Get into debt collection. It’s the only growth industry left.”

“And it could very well explode exponentially, should there be another –relatively minor– shock to the ‘system,’ if you know what saying. Remember the Crash of 08?”

“Think about it. Are you really fulfilled selling slacks at Sears for 9 bucks an hour?”

“I know it’s collections, but at least you’d be putting that Master’s in Business to use.”

The only risk to collectors is a universal bailout that would wipe away all the debt. A universal bailout is also the only strategy with a chance to generate a real recovery. Isn’t it odd that almost nobody understands this?

Frankenbeard, is that you?

Those debts are someone else’s assets. Also, who has the authority to compel creditors to give up on claims en masse? No American institution has such powers absent criminal or civil culpability that I am aware of.

Well, what are you going to do if/when the debt burden reaches the point where an entire class of the 99%-ers have only one choice-to declare bankruptcy?

Ruin all their credit scores? Meh. Throw them all in jail? Maybe there are another set of criminals we should be going after. The ones who caused this in the first place.

Those creditors didn’t loan their own money, so they haven’t suffered any loss in the default. Have them open up their books and show the damages to the judge.

Besides, they probably got a payoff already via credit default swap (perhaps several payoffs by writing multiple CDSs against the same loan). Knowing these creditors, nothing is off limits.

You can compel a creditor to cancel a debt by giving them money.

We need a real lawyer to answer your query, but, it may be that a court could declare Force Majeure if there were some underlying cause – like say fraud. Still, I believe you are mostly correct – the U.S. Congress could no more pass legislation to eradicate debts than it could deny our rights to free speech. Oh, wait…

It’s done all day, every day, in bankruptcy court.

Is the answer to go back to our English roots and start Debtors prisons, put folks in prison until they pay?

While not the title of the Bloomberg piece, left out is the discussion of bank balanace sheets on the other side of the equation. And this talk of consumers once again buying cars and homes means taking on more debt and releveraging.

While savers bail out the banks with ZIRP, of course.

Which bears repeating about 2 million times a day. I wish a hacker could figure out how to insert a scrolling banner on the screen of CNN and MSNBC and Bloomberg “financial news” reports that says

“4 YEARS OF BAILOUTS FOR BANKERS AND ZIRP FOR YOU — DO YOU FEEL THE PAIN? OBAMA AND ROMNEY WANT YOU TO THROWN ALL YOUR REMAINING PENNIES INTO THE STOCK MARKET — DON’T DO IT! DEMAND 4% interest Savings Account at the US Post Office.”

The trouble is the saver isn’t giving any savings. Hence, the banks were never bailed out. You not getting it.

Personal net worth in the US is around 50-60 trillion, so I know there is someone out there besides me.

Zero Hedge wrote the same piece, that the major contributor to consumer deleveraging is defaulting, not restructuring. How many of the stories coming out are the result of media supporting the party in power, as there can be no other reason for such an obvious bias.

Actually, ZH had a figure of $900 billion in 1st & 2nd lien chargeoffs going back to 2008 (cummulative). And that was data collected by the guv (or fed, IIRC).

But leave it to Mark Zandi to lie with macroeconomics.

In most cases, isn’t restructuring just partial default? And while default is not a sign the the economy is improving, it probably IS a good thing for the economy. Lower levels of consumer debt service lead to higher levels of consumer spending. And I see no reason for those who MADE ill-advised loans not to suffer along with those to TOOK OUT ill-advised loans. That’s why I hated the tightening up of the bankruptcy laws a few years ago: changing the rules for EXISTING debt was a HUGE government gift to those who made loans unlikely to be paid off according to contract. After all, figuring out who can and will pay them back is supposed to the the core competency of lenders. If they consistantly get it wrong, they SHOULD be driven out of business.

For starters, if they would just make predatory adjustable rate teaser loans illegal that would clear up a big part of the problem. Then we just have moron lenders and moron borrowers left. Course then there is still securitization of everything, so maybe we don’t have moron lenders so much and something more needs to be done about underwriting standards.

And yet we still hear the inflation-scare. Thanks for the post.

Jim A says “And I see no reason for those who MADE ill-advised loans not to suffer along with those to TOOK OUT ill-advised loans.”

Problem is that those who TOOK OUT loans were advised that they were good loans to take out by those making the loans. Nobody advised those who took out loans that they should not. Those that made the loans actively avoided, purposely avoided their fiduciary duties….for the purpose of looting. The lenders advised the borrowers that, given their (lenders) extensive smarts in financial planning etal – that they (borrowers) should listen and act upon this invaluable advice or be left behind. The lenders gave the borrowers advice that the borrowers acted upon in good faith while the lenders knew or should have known that their advice (inducement) was wrong —- simply put – Defacto Fraud

…she has set aside about $500 for a trip to Italy”

$500 for a trip to Italy?

I just got back from my annual visit to the Tuscan wine country (Chianti/Montalcino). My 8 day trip – planned and executed VERY frugally – cost me around $3,200 total. Spent just one day in a “tourist” city (Florence, for the umpteenth time just to visit the Uffizi) and paid 6 (SIX) Euros for a Coca Cola at a non-descript sidewalk cafe. Oh and by the way, the benzina is around $9.25 a gallon. Filling the rental car (a small Alfa Romeo coupe) ran a cool $105 each time.

By my calcualtion, that $500 will buy her about 28 hours worth of Italy. Maybe by the time she’s actually saved enough to pay for a real vacation (assuming she lives that long) Italy will have already dropped out of the Eurozone and she will be able to really live it up for a week or so paying in Lira.

It says she set aside $500 for her trip to Italy. It doesn’t say she went to Italy. I understand she plans to go in 2019, by which time she will have the $3500.

This was an interesting little article picked up by my paper, sort of buried in the business section.

The choice of deleveragers seemed to serve a purpose– is this person really typical? She ran up 57K of credit card debt, but now has 1400 dollars a month to spare to pay down that debt. So, they found someone who was probably “irresponsible”– they obviously have a decent job and just spent too much. Perfect.

But, they seem to go seriously off message when they talk about the boon to the economy provided by paying down private debt. Did they forget? It is supposed to be OMG! The deficit! Drag on the economy!

And yes, I did wonder how much of this deleveraging was due to charge offs, so thanks for filling in the blanks.

Hmm…just read the original article. The one that appeared in my paper was shortened quite a bit.

$303.7 billion seems like a lot money.

Debt is being pursued because the economy is getting better and they are collecting more.

This post is so poor.

Please stop making stuff up. This post is based on data. Your comment isn’t consistent with the chart. The % of people who have debt collectors after them has risen in a supposedly improving economy. That’s the reverse what you’d expect to see if the economy were improving. In most states, statutes of limitations on debt collection are fairly short, and by the time debt collectors get their hands on debts, there is often only a year or two max to run. People with money can stare them down just as easily as people who are broke.

Just today spoke with AMEX cards and their relentless pursuit of my post-bk debt. Since it was Chapter 11 I made all my court-approved payments. As a result, AMEX decided I had made a payment on the original debt and therefore the clock was restarted and they were free to pursue the entire original debt.

I also tried to make all my post bk payments on my secured properties – payments which were refused by the banks for more than two years in order to trigger foreclosure.

Lawyered up and finally got one bank to settle – they were also pursuing a second on a property they had foreclosed on.

I lost my commercial property which I was current on because Jamie Dimon got the loan for free from WaMu and he needed some cash to pay some bills the London Whale incurred.

The phone rings all day, every day, with bill collectors completely ignoring my BK. Top it off, my new bk judge ignores the previous judges rulings (I think she’s trying to go work for a bank since the BK bar hates her.)

And the beat(ing) goes on.