I am delighted to be proven to be wrong on the premise of the last post, which is that lying pays and it has become so routine that an op-ed writer for a liberal newspaper can point that out without being concerned about the broader ramifications. But this is almost certain to fall into “the exception that proves the rule” category.

Lanny Breuer, former Covington & Burling partner and more recently head of the criminal division at the Department of Justice, had his resignation leaked today. The proximate cause may be a Frontline show that ran two nights ago, part of a series on the financial crisis. The segment in which Breuer speaks is below and of course on the PBS website (the last of four segments).

Watch The Untouchables on PBS. See more from FRONTLINE.

Breuer has been criticized for his lack of interest in prosecuting banks and more important, bank executives for their conduct during the crisis (and before you argue that such cases are difficult to make, please read Charles Ferguson’s Predator Nation, which selects specific banks and shows how, simply based on public information, a clear and compelling case exists, or look at some of our posts, for instance, here). He also was the DoJ co-chairman on the do-virtually-nothing residential mortgage task force formed as a way to suborn Eric Schneiderman, who was leading a group of state attorney generals that were on their way to putting in place tougher sanctions in the banks. We’ve noted how it was Breuer who had taken to embarrassing Schneiderman for his choice:

The Administration started undercutting Schneiderman almost immediately. He announced that the task force would have “hundreds” of investigators. Breuer said it would have only 55, a simply pathetic number (the far less costly savings & loan crisis had over 1000 FBI agents assigned to it). And they taunted him publicly by exposing that he hadn’t gotten a tougher release as he has claimed to justify his sabotage….

Marcy Wheeler, who has called repeatedly for Breuer’s resignation, was early to catch that Breuer would be departing. It’s not clear whether the proximate cause was just his performance or whether that plus the ham-handed pushback, which created a Twitter storm, was what made his cause irredeemable:

Here are is one howler from his Frontline performance (the bold is the Frontline interviewer):

But it has nothing to do with the financial crisis, the meltdown, the packaging of bad mortgages that led to the collapse that led to the recession.

First of all, I think that the financial crisis is multifaceted. But even within that, all we can do is look hard at this multifaceted, multipronged problem. And what we’ve had is a multipronged, multifaceted response.

When a criminal case can be brought, whether it’s from an originator, whether it’s from a bank executive who acted with criminal intent, we’ve brought those cases.

But in those cases where we can’t bring a criminal case — and federal criminal cases are hard to bring — I have to prove that you had the specific intent to defraud. I have to prove that the counterparty, the other side of the transaction, relied on your misrepresentation. If we cannot establish that, then we can’t bring a criminal case.

But we don’t let these institutions go. We’ve brought civil cases. We’ve brought regulatory cases. And the entire approach here is to have a multipronged, comprehensive approach to what gave rise to the financial crisis.

This is nonsense. We’ve discussed at length how top bank executives could be prosecuted for making false certifications under Sarbanes Oxley, which requires at a minimum that the bank certify the adequacy of internal controls, which for a large trading firm, includes risk management. We’ve also written about collusion and lack of arm’s length pricing in the CDO market, which would lend themselves to antitrust charges (price fixing is criminal under the Sherman Act). This is a Department of Justice that has been willing to pursue creative, more accurately, strained legal theories to go after John Edwards, and used a weak case to destroy Aaron Swartz, but becomes remarkably unimaginative as far as big bank misdeeds are concerned.

Here is another howler, from a speech in September last year:

One of the reasons why deferred prosecution agreements are such a powerful tool is that, in many ways, a DPA has the same punitive, deterrent, and rehabilitative effect as a guilty plea: when a company enters into a DPA with the government, or an NPA for that matter, it almost always must acknowledge wrongdoing, agree to cooperate with the government’s investigation, pay a fine, agree to improve its compliance program, and agree to face prosecution if it fails to satisfy the terms of the agreement. All of these components of DPAs are critical for accountability.

Huh? Notice no mention of indictment? The mere threat of indictment got Hank Greenberg, one of the most litigious and tenacious people on the planet, forced out of AIG pronto. That’s because an indictment is a death knell to a levered financial firm. Many customers and counterparties have to stop dealing with it immediately. That does not mean this weapon should be used casually. But the key element is not to destroy viable businesses through a prosecution, but to punish executives. There are ways to be far more aggressive and imaginative (for instance, under Sarbanes Oxley, the language for criminal violations tracks the language for civil violations’; a successful civil case could lay the groundwork for the related criminal action). But you’d never see that from Breuer, who as Marcy Wheeler pointed out, uncritically accepted presentations by economists hired by miscreant institutions who warned that indicting their client would be Too Terrible To Contemplate.

But sadly, Breuer’s resignation is unlikely to be a bellwether that lying does not pay. He simply didn’t lie well enough and that made him an embarrassment.

Update: As readers pointed out in comments, and as the article that in the Washington Post indicates, Breuer was also under attack from the right for “Fast and Furious.” So while his departure was likely in the cards, the fact that it was leaked so closely after his embarrassing Frontline performance (clearly understood to be embarrassing by virtue of the sharp reaction from the DoJ) suggests that it was leaked now so as to head off calls for his resignation or other forms of criticism. Why get worked up about a lame duck?

I just finished watching Fontline’s The Untouchables. I certainly don’t think it was a “hit piece” on Mr. Breuer, but he does not look like a competent prosecutor.

I also agree with your assesment that this is not going to substantially chnage the rather blatent “lack of procescution”, and I strongly suspect Mr. Schneiderman’s cases will also amount to nothing.

Bottom line in our financial sector – crime does pay, and pay extremely well.

From the Frontline piece quoting Breuer

“But in any given case, I think I and prosecutors around the country, being responsible, should speak to regulators, should speak to experts, because if I bring a case against institution A, and as a result of bringing that case, there’s some huge economic effect — if it creates a ripple effect so that suddenly, counterparties and other financial institutions or other companies that had nothing to do with this are affected badly — it’s a factor we need to know and understand.”

He is probably not all that sad. He probably heads back to Covington and a nice $XXXXXXXXXX salary. Rough life.

How many times in his long and high-credentialed career as a prosecutor has Breuer pondered externalities and collateral damage when he was bringing narcotics cases or cases against small fry in big schemes (i.e., the low hanging fruit).

His “higher ground” veneer was so visibly threadbare.

He and Khuzami should meet for coffee and discuss multi-pronged job search strategies!

Good riddance!

The false premise in the “protect the banks at all cost” has always been that it would cause too much collateral damage, but this left the American people to bear the cost of Wall St’s scams. Even any half cocked comparison of the relate “cost” being shoveled onto the American public compared to an FDIC resolution of even one of the TBTF banks shows this excuse not to prosecute is non-sense.

Of course. The selective “collateral damage” analysis (i.e., only for banks) is just an aspect of privatizing gains and socializing losses (otherwise known as Socialism for Banks and jail/catfood/hunger for everyone else.

…and jail/catfood/hunger for everyone else

Exactly! With a little addition, …and jail/catfood/hunger for everyone else and suicide for those special few willing to stand up and expose the rot.

@BrooklinBridge.

:-(

“Too big to Prosecute.”

Why do these things exist outside the law and goverment?

And … “compared to an FDIC resolution of even one of the TBTF banks” coupled with appropriate criminal prosecutions and jail time for all those who caused the need for an FDIC resolution.

Exactly. That assumes the bank would fail because of such prosecution, but as Bill Black states in this link:

http://www.nakedcapitalism.com/2012/09/black-report-top-justice-official-tells-wall-st-how-to-avoid-prosecution.html

The estimates at the total losses due to the crash were estimated to be $12 trillion that’s not putting a price on job loss, home loss, and the resulting misery, poverty, hunger, etc.

The uncounted harm that you referenced — the price would have to be all the money in the world. How do you “price” the level of human misery, devastation, suffering and loss?

On top of the $12 Trillion.

Coollateral damage if we went after them? Im sorry … what about the people who are being hurt today because they were not perp walked?

How about the people who will be hurt in the future because these yahoos do it again.

Horse manure.

When you stop moral hazard induced economic (societal) percolation of the best rising to the top, you stop evolution. You stop improvement and institute repression.

Moral hazard is the enforcer of capitalism.

If you fail … you move to the back of the line and somebody else gets a crack at it. That’s the very definition of fairness. That’s the very definition of sanity … rationality. That is at the heart of capitalism.

Paraphrasing Einstein … doing the same thing over and over again is the definition of insanity.

Let’s have some moral hazard.

Geithnerism all the way. It pays to have a mole as Treasury Secretary.

“multi-pronged job search strategies” LMAO – Although the devils trident has three prongs…

A beverage of your choice —Cheers!

Well, at least he’ll get paid more to continue protecting the same criminals.

But we’ll still end up paying for it.

Yves, “The exception Proves the rule” comes from the early days of the firearms industry in Great Britain where “Gonnes” were sent to Proof houses to be “Proved” or tested by loading them with extra large charges of powder and ball. The idea being that they would be less likely to blow up in normal use if they survived. “proof loads” are still used in the industry. “The exception tests the rule” is a reasonably accurate translation into modern american english

i would bet other BIGLAW firms will bid against C&B for the return of his services as a white collar partner–he will have multiple offers

My favorite quote from Frontline came at the end, where Breuer said that he lay awake at night worrying about the poor innocent bank counterparties. I guess he meant the widows and orphans (with trust funds), whose fate justifies unlimited trillions of fraud just to protect them from taking a loss on their savings placed in crooked banks.

Now, go after Obama for protecting Breuer. Hollywood in the 30s would have made a film noir about the gangsters putting one of their own in the DA’s office — in this case the DOJ.

To get to Obama you’ll have to go through ferret-faced cozener Eric Holder, and as a CIA protege, Holder will be hard to dislodge.

My first thought too was that now we need Holder to resign next. If he resigned under similar “scandal”, I’m not so sure Obama wouldn’t cave in to pressure and appoint somebody willing to go after the crooks. He seems to have caved on cutting entitlements and deficit slashing (we hope, anyways).

Of course, the 5 yr. statute of limitations on securities fraud is up on many of the cases you could bring…… but not all. There is a 10 year SOL for bringing fraud against FDIC banks (and credit unions) per Martin Smith, who did the Frontline piece.

(At 2:22)

Martin Smith: Marty T. The issue of statute of limitations is a bit complicated. Most of the alleged crimes have a 5 year limit I think. But for FDIC banks or credit unions who bring fraud charges there is a 10 year limit.

http://www.pbs.org/wgbh/pages/frontline/business-economy-financial-crisis/untouchables/did-wall-st-get-away-with-it-live-chat-wed-2-pm-et/

Please don’t insult ferrets or, indeed, rodents by comparing them to Lanny Breuer.

Mr. Hudson;

Something like what Hubbard and the Scientologists did. I wonder if there are any Scientologists in the DoJ?

My error. The Scientologists infiltrated the Dept of Internal Revenue. Multiple times.

I’ve often said that the modern world reminds me of Noir Fiction. Stuff like Hammett’s Red Harvest. But the reason for that is that we are facing the same kinds of situations now that Hammett did when he was with the Pinkertons.

Lanny’s recent email:

‘Multiprong to get along’

‘Prong enhancement, make them beg’

‘Movie review: Enter the prong‘

the war on my rem is this statement:

“I have to prove that you had the specific intent to defraud. I have to prove that the counterparty, the other side of the transaction, relied on your misrepresentation. If we cannot establish that, then we can’t bring a criminal case.”

948 Intent to Defraud

The government must prove that the defendant had the specific intent to defraud. See United States v. Diggs, 613 F.2d 988, 997 (D.C. Cir. 1979) (“Because only ‘a scheme to defraud’ and not actual fraud is required, proof of fraudulent intent is critical.”), cert. denied, 446 U.S. 982 (1980); see also United States v. Costanzo, 4 F.3d 658, 664 (8th Cir. 1993) (intent is an essential element, inquiry is whether defendants intended to defraud); United States v. Porcelli, 865 F.2d 1352, 1358 (2d Cir.) (specific intent requires intent to defraud, not intent to violate the statute), cert. denied, 493 U.S. 810 (1989); cf. United States v. Reid, 533 F.2d 1255, 1264 n. 34 (D.C. Cir. 1976) (“Proof that someone was actually defrauded is unnecessary simply because the critical element in a ‘scheme to defraud’ is ‘fraudulent intent,’ Durland v. United States, 161 U.S. 306 . . . (1896), and therefore the accused need not have succeeded in his scheme to be guilty of the crime.”); United States v. Bailey, 859 F.2d 1265, 1273 (7th Cir. 1988) (court held that there must be sufficient evidence that the defendant acted with intent to defraud, that is,

*********”willful participation in [the] scheme with knowledge of its fraudulent nature and with intent that these illicit objectives be achieved.”*******

(quoting United States v. Price, 623 F.2d 587, 591 (9th Cir. 1980), cert. denied, 449 U.S. 1016 (1980), overruled on other grounds by, United States v. DeBright, 730 F.2d 1255 (9th Cir. 1984)), cert denied, 488 U.S. 1010 (1989)

im at a loss

For securities fraud, you don’t need to establish intent. What Breuer is saying is bullshit as far as securities law violations are concerned. Similarly, Sarbanes Oxley was intended to eliminate the “I’m the CEO and I know nothing” defense. False certifications under Sarbanes Oxley can also give rise to criminal actions.

And don’t you think, for instance, Citigroup hiding $40 billion of CDOs from investors wasn’t INTENTIONAL??? Like they somehow didn’t know they had them? Yet the CFO got only a $125,000 fine. Lots of examples of egregious behavior that was not pursued.

Exactly about the Citi matter.

And how about the circumstances presented by the quality control reviewers for the mortage pools in The Untouchables? Only an incompetent or politically compromised prosecutor would fail to jump on such evidence as having a high probability of implicating high level intentional criminal conduct Ditto with the circumstances related to us through Yves’s interviews in Part II of the great new series.

There has not been any shortage of prosecutable cases. We all know that. And it’s never been about that. Which explains the really rather pathetic performance of a Lanny Breuer doggedly parroting the same handful of lame and incredible excuses for The Great (DOJ) Failure of Obama’s tenure.

Exactly! Keep up the fabulous work Yves.

A comment from the WaPo piece on Breuer’s sudden departure:

CharlesReed3

7:29 PM EST

What did Lanny and his boys do with all the reports I made about the securitization of Ginnie Mae pools for over 2 yrs ago, starting on Oct 21, 2010 with a email to the Justice Dept? How is it that as a citizen and victims you present evident that only now is coming to light that the loans were foreclosed by the wrong parties.

I see my last post was deleted because I spoke truth to power.

================

I wonder how many more of these are going to come out thanks to The Untouchables. And I wonder if DOJ will start to take these seriously instead of suppressing them, now that Breuer is out.

I did the same thing with proof from Bloomberg, the SEC, annual reports, IRS publications, CDO agreements, county court records, bankruptcy filings…the silence was deafening. Every attonrey I ever hired quit after recieving a mysterious phone call so maybe they were listening…LOL. But they certainly have not taken any action. I mean, this is way beyond the “smoking gun” stage – there are dead bodies littering the landscape and yet NOTHING – except to reward Ocwen with RESCAP. Crime pays.

Whoever CharlesReed3 is, they should get in touch with this blog.

Yves: I hate to contradict you, but securities fraud has always required proof of intent (known as “scienter”). In fact, the Supremes, in the 2007 Tellabs case, raised the bar for a securities fraud suit to survive dismissal, requiring that the pleading of intent must be “cogent and at least as compelling as any opposing inference of nonfraudulent intent.” This was an interpretation of the Private Securities Litigation Reform Act, Congress’ attempt to rein in the private securities bar, and it made private securities lawsuits substantially more difficult to file.

Martskers,

I am going to qubble with you. Scienter is intent OR knowledge that what they are doing is not permitted under securities laws.

The reason this is a crock for a huge number of cases is that anyone beyond a very junior person in a securities firm gets a Series 7 license. The more senior folks often have additional securities licenses.

The standards under 10 (b)5 are really clear. Anyone in a securities firm can recite them in their sleep. I can now even though I spent all of 2 years at Goldman 30 years ago.

So given the training in and frequent reminders of disclosure requirements you get on a day to day basis in your job, the idea that the DoJ can’t establish that these guys know the bedrock tenets of securities law is ridiculous.

To follow up on your thread earlier this morning about what you’d need to prove, two things: (1) the civil 10b-5 standards are not what the DOJ would be applying. Breuer would most likely indict people for mail or wire fraud (18 USC 1341 or 1343). (2) This makes Breuer’s statement about how hard it’d be to bring a criminal case even more ridiculous because under 1341 or 1343 you do not need to plead or prove either reliance or damages. According to Neder v. United States, common-law fraud requirements of “justifiable reliance” and “damages” have no place in federal criminal statutes proscribing mail fraud (18 USCS § 1341), wire fraud (18 USCS § 1343) and bank fraud (18 USCS § 1344), as (1) these statutes prohibit scheme to defraud, rather than completed fraud, and (2) thus, statutes’ language is incompatible with requiring justifiable reliance and damages. Neder v United States (1999) 527 US 1. The fact that he misquotes the elements of mail fraud and adds elements that aren’t there after being the country’s chief prosecutor for 4 years kind of says it all.

Hell, intent is easy to establish. Look at the Wells Fargo case which was linked by an earlier poster (diptherio) and tell me if you’d have any trouble proving intent. They deliberately programmed their computer systems to defraud people.

https://www.google.com/url?q=http://www.msfraud.org/law/lounge/jones-v-wells-fargo_3-million-punative-award-4-12.pdf&sa=U&ei=yPz-UOCgBevcigKvi4DICw&ved=0CA4QFjAD&client=internal-uds-cse&usg=AFQjCNEoTV4hbAAXHGCia48_xsf1n-8J_A

Yes, excellent example. There are so many. Just lying there waiting for DOJ to step up to its duty. Except for those already dead under the SOL.

Dear Ms G;

What would be the process if Criminal Negligence by the DoJ could be proven? Also, could a case be brought in the Bank for International Settlements? After all, the Fed has considerable risk associated with the TBTF American banks. Time to unwind it all on the International level?

Well beyond my ken, re BIS :)

I’m not sure whether there are any criminal negligence fraud statutes federally, though Sarbanes Oxley is nearly strict liability (you sign it, you vouch for it, regardless of what you were “thinking”).

The big problem is the prosecutorial monopoly under which (almost) nobody but the prosecutor has the ability to prosecute. This is compounded by prosecutorial discretion, under which the prosecutor has the power to let criminals go free.

Who prosecutes the prosecutors? The UK has private criminal prosecutions and that keeps them honest over there. We don’t, so prosecutors simply give free passes to some murderers while putting other jaywalkers in prison for life, and who’s to stop them?

Technically judges should, but they haven’t been willing to pull out the big guns — that would be to empanel grand juries to investigate corrupt prosecutors. Grand juries are the only entities capable under our current legal system of bypassing the prosecutorial monopoly. However, most judges have allowed grand juries to come under the thumb of prosecutors, completely contrary to their purpose and history under common law (grand juries existed to CONTROL the public prosecutors).

This is exacerbated by the odious and unconstitutional doctrine of “absolute immunity” for prosecutors — this is the one which allows prosecutors to commit perjury, suborn perjury, fabricate documents, and generally commit fraud on the court, while being immune to *civil* suits as well as the *criminal* suits which they are already immune to because nobody has authority to file a criminal case.

A prosecutor could announce, in court, that his policy was to prosecute everyone who failed to give him a big enough bribe, and to let free anyone who didn’t. And this prosecutor would be untouchable under current, completely corrupt, federal precedents such as “absolute immunity”.

You want to murder someone? Become a lead prosecutor, then shoot the person dead in open court. Finally, decline to prosecute yourself.

The prosecution bar as a whole is so corrupt at this point that I don’t know what’s to be done about it; the French and Russian Revolutions had some ideas, but if we could get judicial reform while avoiding that, it would be nice.

“Proof that someone was actually defrauded is unnecessary simply because the critical element in a ‘scheme to defraud’ is ‘fraudulent intent,’ Durland v. United States, 161 U.S. 306

the layers of proof are Maddening until Yves explained:

“For securities fraud, you don’t need to establish intent.”

Now I’ll cry myself to sleep.

There’s more everywhere you look.

A comment from the WaPo piece on Breuer’s sudden departure:

CharlesReed3

7:29 PM EST

What did Lanny and his boys do with all the reports I made about the securitization of Ginnie Mae pools for over 2 yrs ago, starting on Oct 21, 2010 with a email to the Justice Dept? How is it that as a citizen and victims you present evident that only now is coming to light that the loans were foreclosed by the wrong parties.

I see my last post was deleted because I spoke truth to power.

================

I wonder how many more of these are going to come out thanks to The Untouchables. And I wonder if DOJ will start to take these seriously instead of suppressing them, now that Breuer is out.

Another example, the U.S.A. ex rel. Sherry Hunt v. Citigroup, et al. whistleblower settlement. Heck, no proof needed. Citi admitted its intent to defraud. From pg. 5, Citi stipulated:

2(h) As a result, CitiMortgage submitted to HUD-FHA certifications stating that certain loans were eligible for FHA mortgage insurance when in fact they were not; FHA insured certain loans endorsed by CitiMortgage that were not eligible for FHA mortgage insurance and that FHA would not otherwise have insured; and HUD consequently incurred losses when those CitiMortgage endorsed loans defaulted.

Not only that, but per the agreement, the state reserves the right to pursue criminal charges!

http://portal.hud.gov/hudportal/documents/huddoc?id=CitiMortInc.SetAgr2.15.12.pdf

I also don’t think there’s any way that bank executives could claim that they had no intent to defraud when they *hired a company to fabricate documents in court cases*, as in the robosigning scandal.

This goes on and on and on. The frauds are obvious, and there is no innocent explanation for them, because honest people wouldn’t *do stuff like that*.

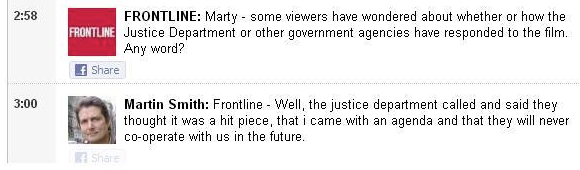

DOJ ADMITS IT ONLY ALLOWS ACCESS-JOURNALISM!

SEE Martin’s twitter about DOJ’s little message: “you came with an agenda. We’ll never talk to you again.”

Wow. In black and white. And in public!

This calls for a Multi Pronged Celebration!

Some companies make you sign a document that says you will never divulge how the company does business. Well, someone just did.

Now, DOJ looks like a director of coverup rather than investigator.

Is Holder still working there, or is he gone yet?

Apparently it is common for the boundaries of interviews to be agreed upon ahead of time, e.g. what subjects may be discussed, what subjects can’t be discussed, sometimes even the answers that will be given and journalist’s line of questioning in response. I never knew that until recently when one of the major tv journalists talked about it in a show they were doing (sorry, forget who now) in relation to a guest crying foul afterwards.

I am the George Hartzman Rolling Stone’s Matt Taibbi wrote of the other week, and it appears that I am aware of a name/story that has not passed the Statute of Limitations.

Wachovia CEO Robert Steel bought Wachovia’s stock in a breach of trust, confidence and his fiduciary duty to my clients and shareholders while in possession of material, nonpublic information.

On July 9, 2008, Robert Steel became president and CEO of Wachovia after working for Goldman Sachs from 1976 to 2004 and the US Treasury under former Goldman Sachs CEO Henry Paulson from October 10, 2006 until July 9, 2008. Mr. Steel was “the principal adviser to the secretary on matters of domestic finance and led the department’s activities regarding the U.S. financial system, fiscal policy and operations, governmental assets and liabilities, and related economic matters,” according to Wikipedia’s biography. Mr. Steel most likely knew about other firm’s borrowings via his time spent at the U.S. Treasury Department.

On July 22, 2008, Mr. Steel personally purchased 1,000,000 shares of Wachovia’s stock as the company’s TAF borrowing reached $12.5 billion, which appears not to have been disclosed in securities filings audited by KPMG.

In an interview with CNBC’s Jim Cramer On Monday, September 15, 2008, Robert Steel said “I think it’s really about…transparency. People have to understand the assets and really be able to say, this is what I own… Complete disclosure. …we can work through this with transparency, liquidity and capital. …Our strategy was to give you all the data so you could make your own model. We tell you what we’re doing… …we’re raising capital ourselves by basically shrinking the balance sheet, cutting the dividend, cutting expenses. We can create more capital ourselves that way… for now, we feel like we can work through this…” After Jim Cramer asked “Should there be any sort of quick regulatory relief from the SEC that would make life easier to be able to make your bank much stronger?”, Mr. Steel responded “I don’t think it’s about my bank.”

After not reporting TAF loans, Wachovia’s CEO wrote “I, Robert K. Steel, certify that: I have reviewed this Quarterly Report on Form 10-Q for the quarter ended September 30, 2008 of Wachovia Corporation; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report” on October 30, 2008.

Mr. Steel was at least aware of Wachovia’s Federal Reserve loans since July, 2012, if not the undisclosed loans to multiples of other financial institutions.

If Mr. Steel was “the principal adviser…on matters of domestic finance and led the department’s activities regarding the U.S. financial system, fiscal policy and operations”, how could he not have known and acted on undisclosed material information?

On June 22, 2010, Robert Steel was appointed Deputy Mayor for Economic Development by New York City Mayor Michael Bloomberg, after which, Steel resigned his seat on the Wells Fargo board. According to Morningstar data, Mr. Steel owned 601,903 shares of Wells Fargo in 2010, which would be worth $20,446,644.91 as of October 26, 2012.

George Hartzman

Greensboro , North Carolina

That would be what they love to call a “slam dunk.”

If DOJ Criminal Division does not step up for this one, there should be hell to pay.

An honest, fearless man in North Carolina! Way to represent, George! Lucy and I were getting depressed….

Lucy here. All I can say is Wow! Slam dunk is right for inside trading if what you allege is true, I’d think (though I’m not an attorney). Seems to me I’ve seen your posts before, Mr. Hartzman, even think I responded, though if my foggy memories are correct, it was about another issue, maybe investment securities they were selling???? You worked for Wachovia as a financial advisor, correct?

Is there any way to force the DoJ to act? If not, can they be tied into it as ‘accomplice after the fact?’

Looks like it’s time to go to the Hague.

“Is there any way to force the DoJ to act?”

No.

If you can get a federal grand jury to kick out the DoJ guys (which they have the legal right to do) and start prosecuting on their own (which they have the legal right to do), that’s the only way around the DoJ.

The DoJ will attempt to attack the grand jury. So the grand jury had better have an angry judge backing it up. So step one is to find an angry judge willing to empanel a grand jury.

George,

So you’re saying he purchased the shares to goose the price of the shares your clients ending up paying for acquisition, and to improve the looks of the balance sheet, and he failed to disclose any of it? Is that right? Then he has the audacity to talk about transparency? Just wow!

Unless I misunderstand, George is saying he bought Wachovia on insider info that their balance sheets were being propped up by the Fed, which would have increased the value of his shares.

Ok, I guess I misunderstood. So they were hiding the fact that they were beholden to Fed loans to keep from going under, and hid that fact from the investing public.

Thanks for clarifying that for me LucyLu. By the way “lil Lulu” was one of my favorite cartoon characters when I was just a little guy, and as I remember she was always straightening out Chubby for one thing or another.

George,

My father lost the majority of his retirement holdings in Wachovia – $800,000+ (an optional payout from Wachovia when he retired from 35 years in banking, instead of the pension plan). He was recnetly offered a settlement somehwere between $1000 – $1200 for the trouble.

I am not a religious man, but I hope I am wrong. Because it sure seems like there is not going to be any justice for these people in this lifetime.

I am so sorry. That is terrible.

…noone so far has created a clear “follow the $$$$” tracking of mortgage processing from inception, to “securitized mortgage”, to MERS non-legal registration of mortgage, with discussion of what this means state by state, to

Wall $treet banks clamoring for mortgages=”securities”, explaining how “investment banks” use “securitized mortgages”, to “leverage”=collaterlizing, including Paulson going to SEC 2004 to deregulate amount of collateral necessary to hold when BORROWING against “securities”, to sending “securitized mortgages to offshore subsidiaries to be broken into parts and pieces=”tranches”, (and destruction of title-deed by so doing), combining with

credit card debt, student loan debt, car loan debt, thereby formulating “MBS”=”mortgage BACKED securities”, which were then rated by rating agencies banks themselves were paying-choosing those who positively rated what they knew to be loaded with risk “structured investment vehicles” (“CDO’S”), as Yves shows in “ECONned”, and further, writing “CDS’S” (derivatives) against products

banks were selling off as legitimate investment grade (“AA”-“AAA”) materials, all over the world….

..then we come to “guarantees” for bad MBS, FED to purchase back from banks through TARP which they bait and switched, FED under bushbama $ubsidizing

through “quantitative easing”, QE3=$40 billion per month..

and finally we come to reason this is dribbled out over so long a period-Wall $treet banks wish to get full paper debt value for MBS on books…as they realize

actual value is only 40-60% of. I have read, if all MBS were dumped at once they might value only 20% of full paper debt value…

This appears to be deal bushbama has cut with banks…full paper debt-on book “value” for buy back over time…boil the frog slowly…then, inflation of $$$$ printed…

I recommend these reading materials for those interested in international monetary-banking historical fraud and links:

http://www.amazon.com/dp/0230341721 (note review by Yves)

http://www.amazon.com/Hot-Money-Politics-Debt-Third/dp/0773527435/ref=sr_1_1?s=books&ie=UTF8&qid=1358991491&sr=1-1&keywords=hot+money+and+the+politics+of+debt

I’ll give it a shot. I may be missing some bits.

(1) “Sponsor” bank advertises for investors in MBS and CDOs and organizes a “trust” (paper entity) which will issue bonds to investors, while holding mortgages.

(2) Investors (suckers) put cash into the “Sponsor”, which is registered to the “trust”. The “Sponsor” bank collects fees.

(3) “Originator” bank (eg Countrywide) provides “liar loan” or NINJA loan or whatever. Collects fees from borrower.

(4) Loan/mortgage is purportedly sold to several new buyers (all banks) in quick succession and ownership is purportedly transferred. This is to evade bankruptcy rules (“bankruptcy remoteness”). The loan is supposed to end up in a “trust” for an MBS.

In actual fact, loan may have been “sold” to multiple trusts simultaneously, generating duplicate payment for “Originator”. The loan’s ownership is generally not actually transferred legally. The sequence of transfers generally does not follow the rules required by the trust. The banks keep no records of any of this and rely on “MERS”, a computer database with no security in which anyone can enter anything. At this point nobody really knows who owns the right to collect on the loan. This doesn’t stop them.

(5) Once “Originator” has its money, the loan papers are frequently shredded (legally forgiving the loan, not that the “Originator” will admit this).

(6) “Originator” now doubles as “Servicer”. In this role, “Servicer” collects interest and principal from the borrower — and also fees, frequently fraudulently and in violation of contract.

(7) “Servicer” mails the interest and principal to some bank. Ideally to the trust which owns the loan. But because of the records mess wih MERS, it could be any bank. Or the servicer might not mail the money at all. Confusingly, the servicer mails the money to the trust or the Sponsor or some other bank *before* collecting the money from the borrower.

(8) The really really stupid bankers who set up all this fraud proceed to invest in the MBS/CDO trusts.

(9) When the “trust” isn’t getting its money, whether due to actual trouble with the mortgage, or (equally likely) due to fraud on the part of the Sponsor, or fraud on the part of the Servicer, or records incompetence at MERS, the “trust” announces to the investors that they’ve lost money and the investors panic and bail out, selling their shares on the open market.

(10) The “Servicer” goes bankrupt, because it’s sending interest and principal out before it receives it, it wrote lots of bad loans, and it can’t make up for that even with fee fraud.

(11) The “Servicer” gets partly bailed out by the government. Some other bank buys “servicing rights”. This confuses the money flow even more.

(12) The banks all realize they’re insolvent *because they invested in each other’s frauds*, so they fake their accounting, and ask for bailout money from the government, which they get.

(13) In a further attempt to cover up their insolvency, the banks start foreclosing on anything they can claim a connection to, without any regard to whether the bank actually owns the loan; at best they rely on the defective MERS database; at worst they just make stuff up. So the Servicer, Sponsor, Trust, and any intermediate bank may all try to foreclose on the same property.

(14) Since they have no documentation, they hire a fraudulent document preparation firm to fabricate documents so that they can defraud the court. This is the robosigning.

Yves, what have I missed? You could probably write a better summary than I.

Breuer’s problem was that he told the truth when he as much as admitted that Wall Street criminals are untouchables.

If he had lied through his teeth like everyone else is doing then he would have been just fine. So your original premise was correct after all.

I suspect Lanny Breuer will “be talking again.” Only his next words of wisdom will be doled out in support of his employer – one of the world’s largest banks. It is time for him to reap his reward.

Poor Lanny, he looked like he was about ready to cry there a couple of times.

:_(

His tells are pretty obvious too. I definitely wouldn’t recommend a career in poker for him (on second though maybe I would…).

Altogether, a solid piece of reporting. Funny that the DOJ is calling it a “hit piece.” Apparently, they think giving voice to critics of the Department (and by implication, the Administration) is a form of journalistic assassination. I thought it was just free speech…

“I thought it was just free speech…”

Me too — go figure!

yeah – he was crying for “poor innocent bank counterparties” – the folks illegally foreclosed on by the very government that should be protecting them – not so much. Investors who believed the regulatory regime would protect them – again, not so much.

@diptherio

Your comment is the first time I’ve seen any mention of tells – the one that seemed blatant to me was here:

Smith: ‘A number of people told us that you didn’t make this a top priority.’

Breuer: ‘Well, I’m sorry if they think that, because I made it an incredibly top priority.’

Leaving aside the passive-agressive tone (the’I’m sorry’ was clearly a ‘fuck you’ rather than an expression of remorse) and the awkward grammar (‘incredibly top’?), right when he said the word ‘top’, he blinked and looked downward.

Sure seemed like a tell to me. Terrible liar – I don’t know how he could be an attorney. ;-)

The Department of Injustice doesn’t seem very useful any more. Something for the next President to dissolve and replace?

(Along with the military which can’t win wars?)

The military doesn’t need, nor is it asked, to win wars, just to invent them.

… and to keep them going, for ever … “permanent warfare” and all that.

Another self-licking ice cream cone.

How did that work out for Kaiser Wilhelm? Or Tsar Nicholas?

But that was before drones!!

If I am elected President, I will immediately get rid of three Federal agencies: The Department of Injustice, The Department of Offense, and…uh…ummmm…er…what’s the other one?

What an effing joke! Just when I think I cannot get any angrier I see this vile man going down on the banksters and then and then spit out the resulting lies….I may have to take a vacation from NC. It is becoming unbearable…

CNBC’s talking (or other act I can’t discuss here) Khauzami tomorrow.

But here’s a good laugh, interestingly timed….

Why just not get into SEC whistleblowers? Trying to confuse or conflate? Who would do that? A pro-business news outlet? Puh-leeze honey!!!

http://video.cnbc.com/gallery/?play=1&video=3000143056

Lanny Breuer and Martin Short’s Nathan Thurm — separated at birth?

http://youtu.be/Wc2o8ywKqos

I was thinking PeeWee Herman, but I like Thurm better.

ProPublica piece on a case involving MorganStanley…

“Hundreds of pages of internal Morgan Stanley documents, released publicly last week, shed much new light on what bankers knew at the height of the housing bubble and what they did with that secret knowledge.”

http://www.propublica.org/thetrade/item/explosive-charge-morgan-stanley-peddled-security-its-own-employee-called-nu

Well…Lanny is “personally offended” so I guess all’s well that ends well.

nicely laid out

BUT last Oct. James Gorman said he cleared all that STUFF out:

This is a firm that had a tiny wealth management business a few years ago,” he said, “had underinvested in fixed-income, had underinvested in infrastructure, ran a hedge fund that was unprofitable. … We had a lot of problems and were doing a lot of swings for the fences in the merchant bank. We’ve cleared all that stuff out.”

http://www.bloomberg.com/news/2012-10-14/can-morgan-stanley-s-gorman-save-wall-street-.html

The biggest surprise is this piece comes from PBS; the folks who won’t say the word, torture as long as the presnichent says it’s not torture cause if the presnichent says something, that means it’s true (unless – of course – you are talking about another country such as, quelle surprise, in deserts where brown people live.

Letting that Frontline program hit the air has got to be a slip up. It’s got to be. Watch any PBS broadcast such as Gwen Ifil’s Washington Week, or PBS NewsHour, for five minutes and tell me that allowing an actual hard hitting journalistic broadcast that questions the establishment to go live “on air” isn’t a major administrative screw up.

Frontline needs to keep up the pretense that they are a hard-hitting investigative program.

Lanny is being put out there as the bad guy (don’t cry for Lanny he’s going to make a pile very soon). It’s such a shame the statue of limitations has run out.

We’ll get them next time don’t worry. They paid us back and all so no big deal.

You are absolutely right, Frontline is all about perception and appearances and little else which is why this particular broadcast is so surprising. The program is usually perfectly calibrated to sound hard hitting but to do no actual damage.

Here we have a possible case where their report has actually resulted in something happening.

Nothing happened from Frontline.

Not by design, not by accident.

The bankers are free and they know it.

A little finger is being pointed at Lanny. They have to point it somewhere. It isn’t going to hurt him any.

I didn’t think there was a statute of limitations on fraud.

..as John Rendon=”Rendon Group” propaganda said of Iraq; “We didn’t have complete control of message…next time we will…”

NPRsays this:I can’t find a statement from Justice on Breur’s defenestration. And I did Google “spend more time with my family.”

NOTE This could have been a sop to the right as well, since Breuer was part of “Fast & Furious,” the ginned up scandal the Republicans fired up their base with, instead of going populist and going after the banks.

UPDATE Corrected sourcing. Too many tabs open!

Wait, was that a typo in the NPR clip or was it for real (i.e. they meant exactly what they wrote?)

I’ve googled far and wide and so far there’s only Yves, Pravda, Firedoglake (Masaccio), and sites starting to link to these 3.

(Maybe the WaPo “glowing profile” piece was part of Lanny’s “exit package” to help shine up his vibe a bit before he hits the foamy runway back to C&B or … my guess would be Citi’s Compliance Dept. (you know, making sure Citi isn’t committing frauds and stuff like that).

If you look at this from a kleptocratic perspective, it is almost trivial to see why Breuer basically unplugged the Criminal Division in response to the largest frauds in human history. You see these frauds were not just big but the biggest. They weren’t just pervasive. They were systemic. They did not occur at a few points but at every point in the mortgage securitization chain. The government had the experience from the S&L crisis. It had dozens of points at which to take down the malefactors. It had criminal law, civil law, Sarbanes-Oxley, the tax code and the threat of rescinding tax exemptions, and it had RICO.

So we have the biggest, most blatant criminal activity in history and suddenly main Justice and the South District of New York go stupid and can’t find their ass with both hands, a searchlight, and a map with diagrams. Of course the fix was. Those in our elites like Breuer dutifully went along for the “greater good”, that is the greater good of the rich and elites, and pretended to see nothing or maintained that routine slam dunk prosecutions had suddenly become impossibly difficult.

The US has a two-tiered justice system. One, a pitiless, implacable, draconian cross between Dickens, Kafka, and Hugo’s Javert for most of us. And the other, a stack of “Get out of Jail Free” cards for the rich and powerful of the 1%. It is not that Breuer did something exceptional by not investigating and prosecuting the greatest financial crimes in 5,000 years. It is that what he did was so unexceptional. In a kleptocracy, what Breuer did and did not do was baked in. He’s gone not for his manifest complicity in protecting the great villains of our or any age, but because of some self-inflicted bad PR. And as others have noted, his landing after his stint at Justice will be a soft, and cushy one.

yeah, something doesn’t feel right here.

Was Lenny, Lanny, Lumpy just running out of places to hide, convincingly, from the sheer volume of evidence and facts surrounding this issue, in which case he would have no other foreseeable alternative than to bring an actual indictment and criminal case ??

Was this just some rear-gaurd action by the DOJ to tack time in the statute of limitations, and maybe Lennys been relieved of his post ??

There’s very little of what happens in finance and government that i’d be willing to take at face value.

Maybe the Attorney General threw lenny under the bus to save his one true love…”O” ??

These are people that will lie when the truth actually sounds better.

You know, too, if you think about it, once Lenny is gone there is an entire playbook of charades and excuses available to the administration and DOJ as to why we’re, once again, not really getting anywhere with criminal enforcement.

They just reset the game..let the lying commence!

Did the dictates of his religion have anything to do with it? Is he religious? Anyone know?

well said

YOu are a poet, Hugh. Your comments warrant their own blog. HAve you considered writing your own articles about this debaucle and attempting to get the MSM to publish? HAH – what am I saying? But I’m serious you are a very eloquent writer. Thank you for your comments.

Yah. Let’s phone up some local DAs and see if they lie awake at night worrying about the crackheads and pillpoppers they love to fill up the jails with….my guess is not so much, at least as long as they’re getting paid by both the Gubmint and the Prison Industrial Complex to keep ’em full.

I found the reaction by that Senator from DE to be the best, by far: he was totally appalled that DOJ was even remotely “concerned” about the effects of prosecution. Too bad he left office; probably couldn’t stand it after two years.

Baby Breuer also opened up in the interview to tell us how he loses sleep at night…

…not over the millions of unemployed and destitute from the banksters’ rein of terorr, but from the possible negative effects on bank finances if he were to bring a strong criminal suit against an offending financial institution.

That was the most outrageous part of the whole Frontline piece, and i had to seriously hold back from smashing my screen.

Are we so beholden to the daily whims of the market that we can’t stomach a 200 point loss on the DOW to bring justice and credibility to a broken financial system?

Lany Breuer was not an exception but part of a culture and policy that pervaded 1601 Pennsylvania Avenue. It came from Tim Geithner, Larry Summers and probably leads all the way up to Robert Rubin who many believe still holds influence and sway with Obama.

Breuer blew himself out of the water in his own interviews. He cut a neurotic, Woody Allen-type figure; too paralysed by the imagined failures of potential actions to actually get up and do anything. An Attorney General should be hungry for cases, not worried about indigestion.

“An Attorney General should be hungry for cases, not worried about indigestion.” So stealing that line…

The problem isn’t Breuer – its his bosses failure to fire Breuer (and failure to prosecute him for gross negligence…) But obviuosly, Breure was just following orders.

Yup. Impeachment proceedings need to follow abrupt resignations all ’round.

My cat has no problem catching rats.

That DoJ believes TBTFs need clueless CEOs (see Taibbi)tells all.

I’m new but has anyone identified the traffic pattern of the so-called fines? Can these funds be used to increase the DO”J”‘s apparently limited budget to recruit more talented people? Or perhaps a cathartic cleansing of its ethos.

This has nothing to do with talent at the DoJ. This is a directive from above Lanny Breuer’s paygrade. If it came out of Breuer’s office, he would be the source of books written by former staffers looking to cash in on doing the right thing. Why does the division go along? Faux-patriotism and pulling “the needs of the many…” conjob are common ways to confuse people into doing the wrong thing. Lanny Breuer doesn’t have the standing to con a division into going along with him. The White House does.

I was being sarcastic. What I meant was un-corrupted, or better yet un-corruptible, i.e., cleanse the ethos. If that aint viable, then why waste time bitching about it.

Even though the criminal side of the case might not be ‘provable’ there is still the civil side. The False Claims Act. I am sure this would provide an enterprising insider or an enterprising lawyer looking through public documents.

This from Wiki:

The elimination of the “government possession of information” bar against qui tam lawsuits;

The establishment of defendant liability for “deliberate ignorance” and “reckless disregard” of the truth;

Restoration of the “preponderance of the evidence” standard for all elements of the claim including damages;

Imposition of treble damages and civil fines of $5,000 to $10,000 per false claim;

Increased rewards for qui tam plaintiffs of between 15–30 percent of the funds recovered from the defendant;

Defendant payment of the successful plaintiff’s expenses and attorney’s fees, and;

I would certainly feel good to see criminal convictions but sometimes you have to settle for 2nd best.

One of the reasons why deferred prosecution agreements are such a powerful tool is that, in many ways, a DPA has the same punitive, deterrent, and rehabilitative effect as a guilty plea:

Sorry, I haven’t read all comments . . . but when I read this statement from Breuer I had to ask myself: Do these arrogant, self-important people really believe this crap? I follow a lot of pharma misdeeds . . . and some of the big boys of Pharma and healthcare are operating under two, three or MORE deferred prosecution agreements–SIMULTANEOUSLY. How is this a deterrent? Rehabilitative?

Lanny Boy is a GIANT LYING SACK OF BULL SHIT …… http://www.bing.com/search?q=Land+Fraud+Bank+Looting+Cover+Up+Witham&go=&qs=n&form=QBLH&pq=land+fraud+bank+looting+cover+up+witham&sc=0-26&sp=-1&sk=

It is very hard for us on the ground of the foreclosure defense practice to prove obvious forgery and perjury to wilfully blind judges.

I have laid two signatures purporting to be signed by the same person, acting as a senior officer of two separate financial institutions, in front of the chief judge of a federal district court, which any teenager working in retail would identify as not possibly signed by the same hand. I asked the court to stop allowing cases to proceed where forgeries were involved.

In that same case, I pointed out that the Affidavit of someone pretending to be a “Vice President” of a TBTJ bank was “authenticated” by a notary named “License” which followed the word “Driver’s” filled in on the preceding blank line which was meant to state the type of identification required of the signer, Essentially, [Driver’s] License authenticated the “Vice President’s” signature on the Affidavit.

Summary judgment of foreclosure was granted on the Affidavit authenticated by no person’s signature but was vacated because the bank’s attorneys had produced copies of two different mortgage notes in the proceedings–one which was not endorsed (first) and then one which was endorsed “in blank.” It was the signature on the endorsement in blank that was impossibly different than the signature of a person whose name was also used to endorse a note on behalf of a different corporate entity in the same judicial district. (The notary seal on the Affidavit was not even from the same county as that where the Affidavit was made and did not even identify what state issued it.)

How did the judge react? He was angry–at me. The case was to proceed to trial for foreclosure on my clients’ home notwithstanding the undisputed evidence of forgery and perjury in the pre-trial motions, but bankruptcy was filed instead because the client was being denied the opportunity to depose the pseudo-signers once the forgeries were exposed.

Here is the problem as I see it: the crimes are so obvious that they cannot be admitted by the judicial system. As Cynthia Kouril pointed out at Firedoglake in reference to 49 State AG “settlement” coverup of what is inaccurately depicted as “robo-signing,” it is not as if forgery and perjury cannot be proved. She pointed out that evidence of forgery and perjury is abundant in the robo-signing scheme and is easy for law enforcement to prove.

I have concluded that because forgery and perjury are so easy to prove, the evidence of those crimes had to be ignored and covered up by the pretense that the banks had settled the “robo-signing” claims with law enforcement. Yet, the banks cannot stop committing forgery and perjury in almost every judicial foreclosure now ongoing. They are not being required to return the homes they stole with forged and perjured documents and are going forward with the same documents and new forgeries and perjuries in every continuing and subsequent case.

And Lanny Breuer cannot find a single crime when forged and perjured documents are a matter of public record. The transmission of forged and perjured documents into the public record by wire and mail with the intent to take homes for a claim of debt which cannot be proved without forgery and perjury is the very definition of millions of predicate acts of racketeering. The Enterprise is easily identified: the banking system itself, linked together by a share computer system into which images of millions of mortgage notes are digitized, to be downloaded and printed by whatever entity wants to claim the real estate. Mortgage Electronic Registration Systems, Inc. (MERS) is a database. Its Vice Presidents (and other signing officers) are merely document processors for mortgage servicers. In MERS cases, a database is foreclosing on our homes with documents signed by administrative assistants pretending to be its officers.

This is the very definition of RICO and the Enterprise is all users of the MERS database. In non-MERS cases, the banks use the same type of forgery and perjury scheme but just do not pretend to assign mortgages from MERS to themselves. My suggestion is to start with MERS (>60% of the cases) as the RICO enterprise and set example that the other <40% will also be pursued for wire fraud and mail fraud. 18 USC secs. 1341 and 1343.

Were it not for the misconduct in public office of Lanny Breuer and the state AGs, the crimes could have been prosecuted long ago. The cover-up of these crimes are crimes themselves: misprision of multiple felonies, 18 USC sec. 4.

The settlements may have covered all past robosignings but they didn’t cover any future actions. The consent orders were basically cease and desist orders. It comes down to the luck of the draw, IMO. I.e., which judge’s courtroom you end up in. And some jurisdictions have a really lousy selection of judges to choose from. As an attorney once told me, the covey of judges meet secretly once a year in a local tavern, under cover of the stealth of night, and come to a unanimous consensus on how they will rule on certain issues. (Same attorney who said ‘the law is whatever the judge says it is’.)

“How did the judge react? He was angry–at me.”

Are judges elected in your area?

It’s becoming clear that the entire “judicial” system is irredemably corrupt in large parts of the country. The most democratic way to fix this is to toss judges out at election time. If that doesn’t work, the next steps are harder.

Alternatively, what are the procedures for removing a judge for commission of felonies? Allowing foreclosure based on this incompetent and blatantly fraudulent evidence is not merely clear error, but also felonious behavior by the judge.

Thank you Old Soul – for HAVING a soul. I went through multiple attorneys who refused to address the fraud. Won a DWP as Pro Se and was shocked to experience what you describe – the violent, aggressive anger directed NOT at the FC mill/servicer as layer after layer of fraud and criminality was exposed, but at ME. The contempt and the, dare I say it,RAGE directed against me for having the audacity to not relinquish my house (never in default) was so palpable in the small Clerk of Courts conference room that at one point I worried the clerk might actually strike me. They appealed but have not docketed, but that’s okay – I have a little rage of my own. Bring it.

So why do Holder and Obama get a free pass when it was admin policy Breuer was implementing, or was at least left alone to do (or not do) ? In the Frontline piece, I guess the higher-ups are implicitly to blame, but why not make it explicit and go after it?

Breuer made the fatal mistake of agreeing to be interviewed. Obama and Holder didn’t.

Ever notice how Holder avoids the spotlight? Rarely do you hear him talk to the press. I read one speech he gave some law students justifying executive privilege to violate civil rights. It was really bad.

They make sure they are too slippery too nail down. Recently a FOIA request for administration memos covering legal justification of the use of drones from the Obama administration by the NYTimes and ACLU was denied in US District Court. The judge said:

“I find myself stuck in a paradoxical situation in which I cannot solve a problem because of contradictory constraints and rules — a veritable Catch-22,” the judge wrote. “I can find no way around the thicket of laws and precedents that effectively allow the Executive Branch of our Government to proclaim as perfectly lawful certain actions that seem on their face incompatible with our Constitution and laws, while keeping the reasons for their conclusion a secret.”

Even part of her ruling was considered too secret for the plaintiffs:

“Part of her opinion was filed under seal, unable to be seen even by lawyers for the Times and the ACLU, and may be read only by people with security clearance.”

Such a twisted web that’s woven.

http://bigstory.ap.org/article/judge-us-can-keep-secrets-targeted-killings

Holder is guilty of misprision of felony.

It’s only a matter of how long it takes people to decide to “establish justice, ensure domestic tranquility,” etc.

why all the igdination and outrage? This is how plutocary works. People like Breuer and Khuzami are stooges of the banking industy and they were hand picked for those SEC jobs precisely because they were expected to do next to nothing. Same thing with Shapiro. Nobody who is serious about regulation would put the head of FINRA in charge of the SEC. And of course they went after people like Fabrice Tourre, the hapless Goldman Scum banker because he embarrassed the industry and a message needed to be sent to all employees to toe the line and protect the industry.

This thread is posted under Banana Repuclic where it belongs becuase it involves the world’s largest Banana Republic.

It ain’t hard to prosecute. You have to follow the money then say, you’re guilty until you prove your innocent. Put a noose around their neck and give them two minutes to explain themselves. If the explanation doesn’t sound good, pull the lever. Will some innocent folks swing? Yes, they will, but it won’t be any different from our current form of justice.

Matt Taibbi said it best: “You put just one of these Lloyd Blankfein types in a real, pound-me-in-the-ass prison, and all this bullshit will stop overnight.”

With the Patriot Act, this isn’t particularly difficult. Would anyone miss a Gitmoed Wall Street exec? Oh no, this fund looks like it may have some “IRANIAN MONEY” in it. Send in the black helicopters.

Its much more important the FBI focus on entrapping 16 year old Muslims.

Why settle for a “Lloyd Blankfein type”?

Make it Lloyd Blankfein.

Lloyd Blankfein works for a group of someones that own it all.

They are the ones that need to be stripped of everything and taught that sharing and compassion are better human traits than greed and avarice…..unfortunately we will see nuclear winter before that ever happens.

Look there’s tribal warfare going on between the “1% Tribe” and the “99% Tribe” it may not show it as conventional violence but it’s going on in terms of money buys power and in no way is Barack Obama going to change his cosy relationship with “1% Tribe” and to that end he has worked to avoid any accountability over government bailout money and to prevent any of his Wall Street paymasters going to jail. If it means making sure any of his underlings have to go because the media are exposing his duplicity so be it. Barack Obama knows they’re expendable and easily replaced by another dupe who’ll do his duplicitous business without question. Afterall Wall Street will reward them with a well paid job!

The financial and corporate elite know they will not be prosecuted for fraud, they have created a stock market completely made on the back of immense fraud for the explicit purpose to enrich executives. The executives in turn allow the politicians to become wealthy from the information they are given. The goal is to be wealthy without labor, and to live on a permanent vacation financed by the theft of assets.

I do not see any defense or, reason why, DoJ could not go forward with constructive fraud which is deemed equally reprehensible. Same goes for – Fraud in fact, fraud in law, Fraudulent concealment, Fraudulent conversion, fraudulent conveyance, Dishonest acts.

Just amazing this ‘intent’ portion – Nice deflection by using the definition ‘intention’ in the civil ‘preponderance of evidence’ and ‘proof beyond a shadow’ criminal. When criminal ‘intent’ is same for both. A person who contemplates any result, as not unlikely to follow from a deliberate act of his own, may be said to intend that result, whether he desire it or not.

Deliberately shopping for ratings, deliberately setting up MERS, deliberately misleading and defrauding hundreds of thousands of customers to act on acquiring a mortgages to feed the securities industry of which they were apart and profited from, deliberately and falsely extending reps and warranties to sell to investors and then falsifying documents to the court (perjury and fraud upon the court).

Lawbreaking going on at many levels in a conspiratorial fashion (MERS) and fraud upon the court (alone it enough to jail and fine the crap out of them). Then, obstruction of justice by the DoJ –

Lets not forget money laundering, aid and comfort to the enemy, tax evasion, failure to pay courthouses transfer fees, recording fees and anything else they can manage.

If this ain’t a plutocracy that we are living in – then sell me all your worthless baubles. If de-facto fraud, money laundering, and treasonous acts of aiding the enemy are not being found and prosecuted then, we live in a lawless land.

Wow – guess voting no longer has an impact because the Plutocracy is now official.

Mad as hell

The 2007-08 financial crisis is still a rolling trainwreck. The financial/media cabal spins our current situation as a saccharin happy days are here again story while:

1.A whole generation of college graduates struggle to find work and may continue to be underemployed for the rest of their lives.

2. Baby Boomer’s face painful everday reality from lost (stolen) pensions.

3.The resulting falling tax revenue.

4.Our cities infra/social stucture crumble under our feet bringing us to the brink of Third World existence.

To add to this insult is Lanny Breur’s prevarication explaining his lack of aggressiveness in pursuit of the criminals on Wall Street came about because he didn’t want to hurt the economy! Lay awake worrying about Wall Street! What a chump. To the average person, we ask, what economy?

Good riddance to him, he is either grossly incompetent or criminal himself!

The government is always overthrown when the 99% no longer find it acceptable.

Rampant crime committed by those who are supposedly “ministers of justice” is a necessary (but not sufficient) step for that to happen.

Unfortunately for our idiot elites, they have also been pursuing several of the other necessary steps. One is stealing elections and making it clear that they will not change their behavior in response to elections or public pressure. This is… not clear yet, but is becoming clearer, unfortunately.

Another is failure to provide housing, food, and work to the general populace. For some reason most of our psychopathic elites are trying to do that too. (Obama seems to be smarter than *that* at least.)

There is an escape valve from revolution, but it depends on the loyalty of a large, competent military (10% of the population minimum) who is loyal to the elite because they are given the things which the general population has in healthy states. Our idiot elites seem to be willing to abuse the potential military elite too.

Interestingly enough other news sites i.e. Huff and Raw Story and perhaps NPR don’t cover this story.

Did DOJ threaten them too? “We’ll never speak to you or your news org again ? ”

Or did Lanny boy in a fit of anger do this all by himself ?

It almost seems as if Lanny boy is upset that he is caught in a lie.

And just perhaps he can be disbarred for failing to prosecute. Of course he won’t but anyone can protest to the bar and if he has enough enimies there it might be interesting

Yves, I hope you have a chance to read this comment. There is something very disturbing in your piece and I flat missed it – the statement by Martin Smith that DOJ has threatened to limit access to Frontline. I hate to sound like Chicken Little while the sky falls down all around us, but access is everything to a free press. Let us recall that in the runup to invading Iraq, Judith Miller of the NYT had access to very high level officials and could therefore speak with the voice of authority (even while she peddled lies), while Seymour Hersh, lacking access to VIPs, ferreted out the facts without attribution (there were no WMDs) – and was ignored. About 1 million people died from the invasion and occupation and the U.S. went broke – so, hell yes, access matters. I encourage everyone, from NC and HuffPo, to PBS to scream loud and long that this threat undermines a free press and informed citizenry, imperative to a functioning democracy. Holder should either resign (my strong preference), or issue an internal directive and PR that such threats will not be tolerated. Make noise. Make a lot of noise.

I have to tell you, access journalism is old news.

The only unusual thing is the DoJ being open about it.

steelhead,

I hate to be so cynical but you seem to be operating under a naive and misguided assumption that we live in a “functioning democracy” This ain’t no democracy and hasn’t been one for some time now. The sooner people start to realize this the sooner something can be done. That is my biggest frustation, everyone seems to look to our polictial system for a solution when it’s the very system that is the problem. It’s been captured and is utterly unresponive to the needs of the public at large. I feel bad when I see Martin Smith sitting there in his interviews wondering why there have been no prossectuiosn. Of courser there are no prosecutions because people like Breuer and Khuzami were put in those jobs to make sure there were no prosecutions. WAKE UP!

There is no longer any attempt to pretend rule of law exists for these criminals. The “justice” system serves mainly to prosecute potheads and dissidents.

Only smoke and mirrors and American Idol remain to confuse the populace and the tiny minority wailing away in Internet isolation can be safely ignored.

Thanks for trying.

This guy truly think everyone not from the DOJ is stupid.

Reading the word “rehabilitative”, I barely can contain myself not to blow up a torrent of curse words that would make a bona fide member of the MS-13 gang sound like Baroness Windemere conversing with her Majesty at a social event at Balmoral Castle.

Lemme ask you Lanny Boy how come your beloved DPAs can be called “rehabilitative” when (and this is just ONE example among many) a Pharma corporation like Pfizer has just agree to a legal settlement with the bunch of weak-kneed you belong to, for the FOURTEENTH TIME in 12 years?

Where the rehabilitation here Lanny? I mean, let’s keep this shit ghetto simple, shall we? 14 times caught for crimes, this is called a rap sheet now, ain’t it?

Aren’t you guys and gals supposed to be tough on crime? What happened to your mojo? I’ll tell ya what’s obvious here: You get tough only against defenseless individuals, but you quake in your panties when it comes to corporations.

And the reason you quake is simple: your Masters in Congress and the White house gave you clear instructions. Screw the people, fellate the corporations.

While it is good to see lanny boy gone the thing to remember is that he did not act alone – he was following orders –

Orders from his good buddy eric

And orders from the king who immediately upon election made a deal to protect the bankers and their ilk.

The same deal that the media has made to fill the space with endless shots of young starlets.

Free press my ass

Who’s his replacement? Anybody left from Goldman Sachs who would take one for the team?

Eric Holder worked at Covington with Larry Bauer….so they practiced the art of “partners in crime” for many many years.