In March 2007, Fed chairman Ben Bernanke said that he thought the impact of losses on subprime mortgages was likely to be contained. It took five months for events to start proving him wrong. August 2007 marked the onset of the first acute phase of the global financial crisis, when the asset backed commercial paper market seized up.

Last week, in a press conference, Bernanke indicated that he thought the likelihood of the crisis in Cyprus having larger ramifications was limited, and avoided using the “c” word. But the message was similar to that of March 2007. So now that Cyprus has agreed to resolve its problem banks on its own, the island nation has secured a short-term sovereign cash fix. As MacroBusiness described it:

The restructure is enough for the IMF to agree to release a 10 billion euro bailout, which will do nothing whatsoever to address Cypriot public debt sustainability or the economy (other than hurt both).

And there also is a rather visible inconsistency between the Eurocrats’ insistence that Cyprus was too small to make any difference and the stock and currency market response to the news of a deal.

So are we likely to see the sort of delay between the assessment and the onset of trouble, as we did in 2007, or is Cyprus a nothingburger, as the Troika and many investors contend? I welcome reader input, but I’d say the odds of knock-on effects are greater than the cheery official assessments would lead you to believe.

As we’ve indicated before, the threat is that bank runs start in other periphery countries, based on a recognition that their bank is at risk plus a concern that they will be made to take losses, as large depositors were in Cyprus. We never thought the odds of a “hot” run, as in people lining up at banks to withdraw money, was all that high, and it’s been reduced even further by the fact that depositors under €100,000 were spared. However, we think the slow-motion departure of depositors from periphery banks is likely to resume. It was arrested by the introduction last September of the OMT, which was peculiar since the OMT was merely a clever PR exercise that simply repackaged existing ECB powers. But the ham-handed ambush of the Cypriot president Anastasiades and the initial rejection by Parliament of the ultimatum elevated international interest in the negotiations. Commentators generally disapproved of the plan to whack all depositors, particularly small ones. Even though they are likely to be less critical of the final plan, which haircuts only big depositors at the two biggest banks, the imposition of capital controls has produced, if anything, an even more negative reaction. Here is the Prodigal Greek‘s summary of the major provisions of the legislation (hat tip David P):

Restrictions in daily withdrawals

Ban on premature termination of time savings deposits

Compulsory renewal of all time savings deposits upon maturity

Conversion of current accounts to time deposits

Ban or restrictions on non cash transactions

Restrictions on use of debit, credit or prepaid debit cards

Ban or restriction on cashing in checks

Restrictions on domestic interbank transfers or transfers within the same bank

Restrictions on the interactions/transactions of the public with credit institutions

Restrictions on movements of capital, payments, transfers

Any other measure which the Finance Minister or the Governor of Cyprus Central Bank see necessary for reasons of public order and safety

It isn’t hard to see why an business owner or a wealthy individual in the periphery countries who hasn’t moved his money out of banks in his country might think twice. Before, the worry was that some country might exit the Eurozone, and if that happened to be your country, your deposits would be redenominated in New Currency which would plunge in value relative to the euro, leave you poorer. While that risk may continue to be seen as de minimus, we now have two new reasons to wonder about the wisdom of standing pat with home-grown banks.

[At this point, Yves’s Internet connection failed. Lambert wrote up a fair bit of the balance based on guidance over the phone, then she was able to amplify some of the points when Verizon fixed its outage]

First, confiscating bank deposits is now on the table in any future crisis. That’s toothpaste that’s not going back in the tube. Commerzbank chief economist Jörg Krämer has already suggested (Google translates) “a one-time property tax levy” for Italy and “a tax rate of 15 percent on financial assets.” And adding fuel to the fire, the Leader of the UK Independence Party has urged expats in the periphery countries, in particular the 750,000 British in Spain to “Get your money out of there while you’ve still got a chance.”

Second, capital controls in Cyprus mean that there are now two Euros in effect: The Euro that you can use only in Cyprus, and the Euro you can use elsewhere in the so-called “monetary union.” So from the perspective of people in Cyprus, the results are in some ways worst that a breakup: rather than having depreciated dough, you have dough that has been impounded, particularly in terms of using it outside Cyprus.

In each case, why wouldn’t every business owner or wealthy Euro-holder in the periphery go into “First, they came for the Cypriots” mode, take economist Krämer at his word, and move their money to where they had some reason to believe it was safe?

Third, these concerns may be amplified by how rapidly and visibly the Cypriot economy craters. The “rapidly” is due to the fact, as discussed in greater detail in the post from Cyprus.com below, that the Cyprus economy will suffer a one-two punch: the loss of a big chunk of wealth, plus the disappearance of much of the financial services sector, which was 45% of GDP. The author estimates a 20% to 30% fall in output in two years; that could turn out to be conservative, given that the tender ministrations of the Troika will only make a bad situation worse. This is almost certain to be a more rapid and severe decay than in Latvia or Ireland.

But the “visibly” is just as important. The financial media has taken perilous little interest in the human suffering in Greece, Ireland, and Latvia (that should actually be no surprise given who their advertisers are). Oh, you’ll read the stories about how many medications aren’t being imported in Greece, sheets are being re-used in hospitals, suicides have skyrocketed, and trash collection is erratic at best, but these articles are few and far between. The dire conditions and the depopulation of Ireland and Latvia get even less press.

By contrast, the revolt by Cyprus’ parliament and the fraught negotiations have given this bailout negotiation far more profile than its predecessors. There is almost certain to be a fair amount of media coverage of the immediate impact of the bank restructurings and the capital controls. And we are also likely to get the BBC effect, which is ongoing coverage by the English press of conditions in Cyprus due to the number of expats living there (Richard Smith tells me that it was popular among RAF retirees, since their modest pensions and savings would not allow them to buy adequate housing in the pumped-up English market). That will probably produce some echo coverage in other English language press and possibly on the Continent. So the odd favor having ongoing media depictions of Cyprus’ distress, which in turn would increase anxiety levels in periphery countries.

And now to an assessment of what the pact means for Cyprus itself.

By Cyprus.com. Cross posted with permission

The Cyprus (Self) Bailout – Time To Dig Deep

The Plan

Watching the Eurogroup conference call, the agreed plan appears to be:

1. Laiki is resolved via good bank / bad bank, with uninsured depositors (4.2B) most likely losing everything (along with shareholders and bond holders).

2. Bank of Cyprus will have a bail-in of uninsured depositors, with them losing between 30-40% most likely. Shareholders and bond holders will be wiped out.

3. Troika will lend 10B to the Cyprus government, solely for fiscal purposes and based on a memorandum to be determined. None of the troika funds will be used for the bank bailout.

4. Insured depositors will be protected (sub 100K euros).

5. The 9B of ELA at Laiki will be transferred to Bank of Cyprus. This is the single most bizarre and unfair part of the agreement. It has not been discussed why the Bank of Cyprus creditors should be paying for the ELA of Laiki and no reporter pressed with a follow-up question.

6. Note that for the most part the bailout is NOT hitting the Russian depositors that hard but will hit local Cyprus depositors hard. Russian depositors were not largely at Bank of Cyprus.

Some Learnings

1. At the end of the day, the appropriate rule of law approach held for the most part. This is a variation of our Scenario B.

Shareholders, bondholders and shareholders of the banks with the problems are the ones facing the consequences. Depositors at other banks (that are solvent) are not touched. This is what should happen under normal rule of law.

Given that the EU is *not* actually giving any money for this restructuring, Cyprus could have done this bank restructuring themselves anyway without this drama and reputational destruction re: its financial services industry.

The glaring exception to this is the transfer of the ELA transfer from Laiki to Bank of Cyprus which I simply cannot rationalize. Greece should be taking some of this pain given that a large part of this ELA was to finance losses in Laiki’s Greek branches. In any case, I am not sure *why* Bank of Cyprus creditors should be expected to take responsibility for Laiki’s official creditors, except for the fact that the official creditors don’t want to take losses.

(I suppose it is theoretically possible that Laiki has enough good assets to cover all the insured depositors and the ELA and will transfer a neutral Good Bank to Bank of Cyprus. However, that seems…optimistic..)

2. Given that the fiscal situation in Cyprus was not too bad even as recently as 2008 (the government ran a surplus!), one could have imagined if the prior government had been more serious about fiscal consolidation (and resolved the banks), the amount of the fiscal bailout could have been reduced to a level manageable in public markets.

3. Putting #1 and #2 above, if Cyprus had bitten the bullet itself and inflicted (severe) pain on itself, this all could have been avoided. In other words, Cyprus assumed, not unreasonably, that the pain might be spread out via the troika over several years. In practice, what happened is that it had to absorb all its pain anyway, but with the extra dose of public humiliation.

4. It is not a pretty sight being a small EU country and coming to the EU for help. Malta, Luxembourg and Latvia, take note…

5. It is also fair to say that Spanish, Portuguese and Italian uninsured depositors at weak banks should consider themselves duly warned…

6. Also: As if it was not clear before, it is perfectly clear now that the EU has no real institutional processes for this topics and basically makes things up as it goes along, based on what 4-5 people in a room decide at 3am. It is quite unbecoming for a serious Western super-power.

Implications

1. This will have an immediate negative effect on the local real economy through two mechanisms: (a) loss of savings of consumers hitting consumption and (b) partial or full loss of operating accounts of local businesses, some of which will never recover. The small and medium businesses in Cyprus will face a wave of bankruptcies unfortunately.

2. Additionally, the financial services sector (45% of the economy) will take a severe blow.

There is a mild positive in this approach in that, basically, Cyprus took all the pain itself and other foreign banks operating on the island (aka Russian Commercial Bank) have been spared.

Given this, there might be some ability to retain a few more customers under this approach rather than the across the board levies initially proposed.

3. Net net, we should expect a drop in GDP over the next 2 years in the 20-30% range. This will inevitably lead to significant social and business disruptions and hardship and greater need for fiscal consolidation (as certainly tax revenue will shrink and automatic stabilizers will increase). Government employees, take note…

4. Overall, this will be a very severe recession / depression.

How to Grow Now

So, what does Cyprus do now? It still has a highly educated workforce and would need to find something to do (quickly!) with it to avoid major brain drain and permanent diminution of its prospects.

1. Find a way to eliminate the capital controls as quickly as possible. Not much else is going to happen with capital controls in place.

2. Preserve as much of the financial services business as possible. This solution does at least allow a window for that to happen.

3. Push more aggressively on tourism related improvements – in particular, casinos should prove interesting given its geographic location (no country really ever replaced the hole left when Beirut lost that role in the 1970s)

4. Promote higher education. We have links to the University of Nicosia so are biased, but Cyprus has a surprisingly advanced private university system. With a few small tweaks to legislation to support it, it could be a significant growth driver.

5. Professional services outsourcing. The workforce is highly skilled, but still probably 50% less expensive than London and Western Europe.

6. Oil & gas: Important and meaningful, but as we saw with this week’s renewal of the Israeli-Turkish alliance, this is not going to be a walk in the park. We will need some serious coverage from a serious power if this will be extractable.

7. [longer-term] Start building software/tech capabilities. It is a good fit for a small, highly educated nation, though Cyprus has no pre-existing capabilities here, per se.

None of the above will be easy, but Cyprus did perform miracles economically after the Turkish invasion in 1974. This is the chance to aim for an Act 2 in this regard. And, cliched as it is, its greatest asset is its people.

It is time to dig deep and start again…

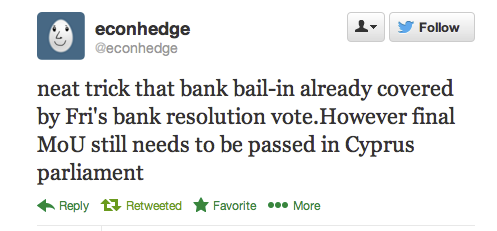

Update 6:00 AM: I have been operating on the assumption, as has our fairly well informed correspondent above and pretty much all of the financial media, that the deal negotiated in the early AM in Brussels was set because it relied on the bailout provisions already passed by the Cypriot parliament and did not require additional approvals. And of course, one of the biggest tricks in deal land is to act like something is done even if the remaining “technical” details aren’t technical but are actually substantive and could be used to stymie consummation of the transaction.

However, Richard Smith has found a tweet that suggests otherwise:

If this source is right, it’s still possible for the Parliament to reject the deal. Consistent with that being possible, I noticed how the recent rounds of messaging about the pact considerably downplayed how bad the hits to Cypriot borrower would be (as in it seemed to be more in sales mode than I would have expected). The early estimates (not official, just based on a look at the balance sheet and knowledge of what was on it) was that the Laiki depositors >€100,000 would be very lucky to get anything back, and the Bank of Cyprus losses for the over €100,000 depositors had been 22% to 25%, and that may not include the ELA transfer, which would presumably increase the losses considerably.

Admittedly, at this point, the inertial course would be to approve the agreement. However, the influential Archbishop of Cyprus advocated leaving the Eurozone over the weekend. That plus a show of outrage from the population could undo what seems to be a settled deal. And that would have more immediate, unexpected ramifications.

Quick initial reaction (there’s a lot to take in here, and there’s a lot of implications both for European citizens inside the Eurozone and outside) — capital controls will hurt tourism.

Tourism is capital intensive. Especially for the tour operators, hoteliers, cruise liners etc. etc. Landing fees, fuel, block bookings for 50 to 100 guests at lodgings, ships taking on provisions (there’s many more you can think of) — all $500k+ transactions. The mechanics of how you can get your money into the country (for a commercial enterprise more than an individual although clearly this affects people too) and then get your profit out (and you’d want to do that pretty darned quick considering the situation) in the presence of capital controls has not been explained.

Improving the tourist industry will be tricky unless the capital controls are removed.

Perversely, it’s easier to get round them for ordinary citizens. Again, showing the ignorance of the real world by the eurocrats, they’ve obviously never lived in an island state. The borders are super porous. Getting your wealth out either in cash or precious metals — or any other asset class that is a high density store of value — on a boat is impossible to stop apart from a few token round ups now and again for publicity purposes.

Seconded. A bullet-point outline of capital controls has been provided. But it’s the monetary thresholds and limits that are all-important with capital controls. No details have been provided yet. Maybe bureaucrats are still making them up.

For instance, how much cash can be physically carried out of Cyprus? What is the monthly limit that Cypriots can charge on their credit cards outside of Cyprus?

What are the rules for businesses? Presumably, Cyprus will need an import-licensing regime. Otherwise, the familiar dodge of having a friendly off-island shipper over-invoice the goods will serve to export capital.

So much for the EU common market. The Turks on the other side of the island probably will face fewer restrictions. Letting the more populous half of a politically divided island join the euro zone was a catastrophic cock-up to begin with.

Jim,

From Zero Hedge 3/25

http://www.zerohedge.com/news/2013-03-25/have-russians-already-quietly-withdrawn-all-their-cash-cyprus

” While ordinary Cypriots queued at ATM machines to withdraw a few hundred euros as credit card transactions stopped, other depositors used an array of techniques to access their money.

No one knows exactly how much money has left Cyprus’ banks, or where it has gone. The two banks at the centre of the crisis – Cyprus Popular Bank, also known as Laiki, and Bank of Cyprus – have units in London which remained open throughout the week and placed no limits on withdrawals. Bank of Cyprus also owns 80 percent of Russia’s Uniastrum Bank, which put no restrictions on withdrawals in Russia. Russians were among Cypriot banks’ largest depositors”.

Once the Euros were in London they could instantly be Bitcoined down the wormhole to emerge as dollar accounts in the Caymans or Panama under a nice name like Universal Capital Holdings.

So it looks like the whole notion of capital controls is either a comedy of Eurocrat incompetence or a cover-up designed to screw the remaining mid-sized Cypriot businesses and Russian and UK middle class expatriots who had invested in the country.

Sorry , but Ireland is not being depopulated.

Its pop. is increasing & thus its consumption per person drop is probably bigger then Latvia.

Young Irish are leaving all right.

But the Vacuum is being filled by Foreign workers and workers which arrived these past 10+ years who are now reaching prime child bearing age.

Its not very politically correct but I am afraid its the truth.

As I keep saying Ireland as even Irish people imagine it does not exist anymore.

The scale of population movement is getting close to the 1600s era plantation era.

Those are fair points, but the outflow of working age adults (and presumably the most skilled) replaced by newborns also increases the dependency ratio. And I’m not sure I buy the “population is increasing” story.

In Latvia, where the population has collapsed (IIRC, 2.7 million in 1991, down to an official 2.0 million as of the last year reported, probably 2011, due to the hour I’m not taking the time to search my own archives), the population figures were revised upwards from an initial count of 1.88 million, which local demographers regarded as on the high side. 2 million was deemed to be politically important. so 2 million it eventually was.

If you look at this report, you’ll see the cumulative revisions to Ireland’s recent population totals are a pretty large 90,000+ increase, and would be enough to swing the picture from a loss to its current very modest population gain.

http://www.cso.ie/en/media/csoie/releasespublications/documents/latestheadlinefigures/popmig_2012.pdf

@Yves

Skilled workers only game the declining capital better then unskilled workers.

They work in offices in the main (doing nothing really useful) other then extracting the declining capital base.

Skilled workers therefore follow the capital abroad.

They do not dig drainage ditches or dig turf.

There has been a structural change in Irish population dynamics since 1990 ~ with about 1 million ~ extra people in the south and also major population increases in the North.

Our traditional role as a surplus country for deficit England cannot be achieved without destroying peoples energy usage per person given the population rises inbuilt in the system with todays birth rates at Edwardian highs.

Also when Ireland was part of the Sterling peg Remittances was a major part of income.

Back then (before the mid 1970s) GNP was actually higher then GDP.

The small farmer was kept going by the sons sending money back from London & New York.

This was deeply studied back in the day.

Strangely the reversal of this dynamic is not really given much attention in the modern Irish market state.

The Irish pseudo state is leaking all over the shop.

And nothing will be done.

This is Irish 1820s post Napolonic boom /bust stuff of declining energy density per person.

Only another 20 years before a dramatic (surprising ?) drop in population again.

If austerity and bank account levies went together with prospects of less unemployment soon, austerity might be palatable in the PIIGS. But something tells me employment won’t recover soon enough and the masses will get impatient with austerity. After that, I don’t know. There could be a big compromise with losses on bonds. The German election is mentioned as a decisive time, this year. Maybe NC could have discussions, posts and links about it some time ?

Tangental to all bar the opening paragraph I’m surprised NC hasn’t commented on UK Chancellor Osborne’s enthusiasm for pushing in the UK the kind of sub-prime mortgage lending which has had such spectacular effects on the US economy within living memory.

“Had we been asked to design a policy that would guarantee maximum damage to the UK’s long-term growth prospects and its fragile credit rating, this would be it,” concluded thinktank Fathom Consulting.”

http://www.guardian.co.uk/business/nils-pratley-on-finance/2013/mar/22/post-mortem-cyprus-ugly

And as if to confirm that the higher you go the less you seem to be capable of learning, the very next passages of Pratley’s piece describes how Peter Marks, CEO of the UK’s Co-op Bank, appears detirmined to do a Moynihan with it.

If you are facing destitution and a crushing depression, fight back. As Emiliano Zapata said, “Men of the South! It is better to die on your feet than to live on your knees!”

South America did not escape the worst aspects of neoliberalism until the governments began to fear their citizenry and presidents resigned rather than face the wrath of the people in the streets.

Glenn Greenwald: In a free and healthily functioning political culture, people who wield power, do so with great fear of the consequences of what will happen if they abuse that power… Some necessary, healthy fear has to reside in the hearts of those who wield power, about the consequences of what will happen if they abuse their power, if a society is to be free.

Folks like Zapata do not fit neatly within the confused ideological categories that plague the Left, not just in Mexico but the world. It is this lack of ideological awareness — really what amounts to ideological ignorance and obliviousness — which Michael Parenti speaks of here, and which keeps the left off balance and debilitated:

http://www.youtube.com/watch?feature=player_detailpage&v=bZ7bVhJ0-n0#t=851s

Zapata hailed from the rural indigenous peasantry, and his enemey was liberalism, first the perverted Porfirio Díaz variety (what we would today call neoliberalism or fascism) during the first stage of the Mexican Revolution and then during the second stage, the purer variety of Venustiano Carranza and the provincial middle and upper classes — middle-class professionals, intellectuals, ranchers, and merchants who envisioned a modern, democratic, progressive Mexico ruled from the center by a strong national government — who coalesced behind Carranza. Zapata’s goal’s were anathema to both of these varieties of liberalism, since he advocated social justice based on local self-rule.

The exact same history repeated itself in Europe as local self-rule competed with liberalism and fascism, along with an additional enemy called Marxism or communism, during the first half of the 20th century. Scott Noble did a wonderful job of piecing this history together, which can be seen here and which lasts about 30 minutes:

http://www.youtube.com/watch?v=2q0Wdk7ek7Q&feature=player_detailpage#t=3762s

Several years ago I remember reading an obscure passing referrence to a “Peasant Party Green Movement” lasting a year or so in immediately post-WWI-Europe. It was supposedly inspired and driven by a Peasants’ Party based in Bulgaria and was savagely suppressed by a coalition of Communist and Socialist and Capitalist anti-ruralitic urban supremacists. The Peasants’ Party even called it a Green Revolution. I have never seen any but that one referrence to it.

Green, Peasant parties were quite a big deal in Eastern Europe, especially the balkans, between ww1 and 2.

They were in power between in Bulgaria1918 IIRC and 1923, when there was a rightwing coup. The communists, who were the second largest party, refused to intervene, then staged a really lame revolt and got brutally put down.

Should I guess the Communists refused to support the Peasants Party government because the urban supremacist anti-ruralitic Communists hoped the Right Wing coupmakers would exterminate the Peasants Party first to make Bulgaria safe for urban supremacy, and then the Communists would displace the Right Wingers to paint that Urban Supremacism red?

If that doesn’t explain the Communist hang-back, what does?

It’s worth noting that there was an ethnic element to the conflicts in Mexico. The rural *indigenous* peasantry versus the elites who considered themselves *Spanish* in background.

Ethnic conflict always makes things messier.

You can hear this penny dropping . Right now anybody who has followed the situation in Cyprus will be wondering might it be my country, my bank, my money that comes next . The mere possibility that your money deposited in a bank, any bank, is not inviolately yours, that it could be confiscated at any moment is sufficient to shatter the visceral belief that when you deposit money ( in whatever form ) in a bank, it is there, safe inside that bank, that building, and the moment that belief is shattered there will be an epidemic of bank runs that no government will be able to contain. The queues will form just like they did with Northern Rock only this time it will be every bank. Suddenly the weapon that the banks have used as their trump card throughout this crisis – their ubiquity – will itself be trumped .

I would be more worried if I lived in a country that could not print its own money.

The people behind the Euro can now turn a entire country into a zoo when you have capital controls without a national currency or the ability to legislate in the domestic populations interests.

Occasionally the animals can be left out for the day but their zoo ration can be cut at any time.

They are dead bipedal creatures walking.

http://www.youtube.com/watch?v=ZL_6Lb6QKBM

once again we can take Ben at his word. there will be No Ramifications to ‘Them’ nor ‘Theirs’…

But indifference would ultimately commend itself as a devastating weapon. l.shriver

&

Familiarity makes the lion more dangerous. j.murray

Creditors MUST take loses. If you gamble and lose, you assume the consequences. And gambling debts are sacred.

I hope that the Cypriot Parliament says “no” again. After all it is now an internal Cypriot problem and the Troika should just shut up.

Personally I feel less and less comfortable with sharing Union with Germany (and possibly others like Finland). Any alliance must be based on fair play and they (the states, not necessarily the people) are not playing fair at all but behaving like bullies. I don’t want to be “friend” of any bully but rather kick hard their sensible parts.

Maju – your solution assumes they have sensible parts.

Claim: ‘The Cypriot Finance Ministry said in a January presentation that bailing out the country may push debt to a peak of about 140 percent of GDP next year.‘

http://www.bloomberg.com/news/2013-03-25/cyprus-to-chop-banking-system-to-win-aid-avoid-default.html

Reality: What did we learn from Greece’s Bailout I, class?

Right — the one-two punch of post-bailout economic contraction and escalating defaults on domestic bank loans sends debt-to-GDP rocketing higher. If FinMin’s estimate of 140% [unsustainable to begin with] is correct, one can expect Cypriot debt-to-GDP to be pushing 200% within a couple of years.

With the currency devaluations that the IMF used to impose in adjustment programs off the table (thanks to the IMF being run by ex-Eurocrats), there is no bounce-back effect from the export and tourism sectors. You kick these small countries into the gutter, and they just lie there gurgling.

Therefore, as with Greece, Cyprus can be expected to need a second bailout soon. You read it here first.

Yep. And “Nobody bats zero for the season without a plan.”

The outcomes are so clear it’s impossible to believe that the European Oligarchy does not intend them.

Never underestimate the stupidity of powerful people.

It is perfectly possible that they are living in a world of delusions, and that all these results are contrary to their plans.

Like the mythical King Canute, their response will be to order the tide to recede. This is the mental hazard for people in power.

I remember reading in an encyclopedia once ( World Book Encyclopedia?) that the reason King Canute ordered the tide not to come in was to demonstrate to his over-servile courtiers that he did not have the power to order the tide.

Debt-to-GDP, and entitlements, is too big for the size of the economy.

Either we do write-offs or we create growth (i.e. inflation). And it’s probably going to be a mix of both.

They started with deficits which made the numerator soar. Now, with austerity, they are trying to control the numerator but it will make the GDP drop and bring them back to where they started.

That’s when we will see the haircuts… It started with Greece, then Cyprus and will move up the curve.

The lack of trust in the system and the amount of financial engineering going on leads me to believe that there will be more inflation than growth over the next decade. Too many people don’t care about being efficient and productive, they just want more paper than their neighbor.

A few lucky an/or astute investors will win over the next decade but the majority will see some portfolio and purchasing power losses.

I don’t understand why so many are so indignant. We’ve been living above our means for a long time out here in the West and it’s time to pay the piper.

One reason our leaders are lying and cheating is because they have to take these losses but NOBODY wants to pay the piper so the squeaky wheel gets the grease.

Please do your homework rather than offering uninformed stereotypes. Cyprus’ debt to GDP ratio was 74.6% in 2012, which was not bad at all by European standards. The reason it blew out was:

1. Massive explosion on a military base in 2011 took about $1 billion a year out of GDP

2. Cyprus sent money to help Greece (several billion)

3. Like Ireland, the problem was much more the private banking sector, which went south due to its exposure to Greece (particularly Laiki, which was purchased by Gulf interests).

http://www.financialmirror.com/news-details.php?nid=26955

I should have been more specific as I was not pin-pointing Cyprus in this comment.

Many countries in the developed world are over-extended, in just as bad a shape as Cyprus when you add up all the debt and entitlements. `

Actually, because of specific variables, Greece and Cyprus are the unfortunate ones to unravel first. How many more will have to endure what Greece and Cyprus are going trough, I don’t know. But for sure, most developed countries need to go through huge restructurings over the next decade.

The problem’s not ‘entitlements’ or public debt. The problem is a vast pyramid of toxic, private debt accumulated by criminal banks over the last two decades. The only ‘re-structuring’ that needs to take place is definancializtion.

Sometimes the squeaky wheel gets changed out…won’t be pretty when we finally are pushed to that limit and snap From the oil patch

It won’t be pretty. I don’t see how this whole mess does not get fixed without new ideologies and new political movements.

My father and FIL are 67 and 70 respectively and they are pretty upset with what is going on economically. They might be in the top 10%, but they can not splurge as they never had a guaranteed pension.

I know they are sitting tight, hoping that the status quo will be held up long enough for them to just pass away without having to change their ways.

My father keeps on saying that they better not come and take what he has and I keep on reminding him that the .5 percenters (and leaders which are tied at their hip) are moving up the curve. They squeezed the middle class and will come for the top 20% unless someone or some group stops them.

He says that he will go out and fight if and when that happens but in the mean time it’s just business as usual.

When the Quebec students did a huge protest last spring (a clarion if you ask me) the top 20% were disgusted calling students entitled little brats. Thus, it is hard to believe that a bunch of 65+ will go out and protest as revolutions are usually initiated by the young.

There is so much noise out there, red herrings, that no one seems to see the signs of stress.

As we witness the istitution of policies increasingly squeezing the young so as to maintain the benefits that were promised to the older cohort, it is hard to imagine a peaceful resolution.

As we witness the institution of policies increasingly squeezing the young so as to maintain the benefits that were promised to the older cohort,

AAAargh. Maintaining – increasing! – “the benefits promised to the older cohort” – HELPS the young. Cutting Social Security for oldsters HURTS the young. This is the trap of full-employment assumption, zero-sum, real=nominal thinking. The whole world is very far from full employment. The old would spend maintained, increased payments – providing employment and income to the young, and adding to the real wealth of society. A free lunch win-win-win. That confused thinking, that false alternative is the “divide” that the oligarchs use to “conquer” everyone else.

It just ain’t true, ain’t a correct or consistent description of the real world.

80% of the wealth is owned by the 55+. And of that 80%, most of it is concentrated in the top 1%.

The 55+ are not going to change their ideologies on a dime.

Not only are generational stereotypes a sloppy analytical tool, their use militates against the kind of ~20+ / ~55+ alliance (quite visible in Quebec and the Tahrir to Zucotti Occupations) that you presumably seek.

(I add “~” to 20 and 55 to imply some and not all. English as a really language seems to have a really hard time with fuzzy sets. It’s a real problem for “class” analysis…)

Social Security recipients don’t and won’t burn or bury the money. They won’t spend the money buying distressed people and assets (Yeltsinization). They spend/ will spend it right back into the jobdoer economy.

Lambert,

I am in my 40s and during the student strike I defended the students because the argument was lobsided against them. I tend to be the devil’s adovcate. Not one person in the 55+ agreed with me. They all expressed their idea that the young were entitled.

If you read the comments in the Globe and Mail on the Quebec situation at the time, you would have seen the same thing except that in the ROC, all Quebeckers are free loaders and not only the students.

OK, I don’t have a scientific analysis but stereotypes exist for a few reasons.

I’m going by the pictures I saw and the statements I read when I covered the Carre Rouge daily in the summer. Plenty of ~55+s in the crowds. They did not predominate, but their presence was real. (In general, and I may be taking this personally, I regard generational generalizations as part of Boomer Hate, and Boomer Hate as a species of strategic hate management whose purpose is to loot Social Security as a precursor to destroying all forms of social insurance in favor of “market state” solutions feeding rentiers.)

80% of the wealth is owned by the 55+. And of that 80%, most of it is concentrated in the top 1%.

OK.

But this is sleight of hand:

The 55+ are not going to change their ideologies on a dime.

Whoa…! How did “the top 1%” (or “top 1% of the 55+) turn into “The 55+”? Maybe the top 1% won’t change their ideologies on a dime. Sure, teach them, with sword and bayonet if necessary, that their idea that they are entitled to everything is wrong.

But the 99% of the 55+ – do they have to change their ideologies? They worked all their damn lives. They’re entitled to their entitlements, and more. And these entitlements and more are a frigging free lunch to modern economies and to the young in particular. To economies which have been zealously organized for the last 4 decades to be run as stupidly, profligately, inflationarily and inequitably as possible.

Lambert, thanks for the kind words earlier about rectifying names. That was my precise intention. May the proprieties and music flourish!

Lambert,

I don’t know what is better or not… I am convinced of some things but ambivalent on many more. Should we pay or cut SS? I don’t know. Should the young and the old work together in harmony, of course. Will it happen, I am much less sanguine.

One thing I do know is those who are nuanced in their thinking usually don’t force their ideologies on others because they understand the law of unintended consequences.

Those at the top are very often those with the stongest ideologies and force them down a population’s throat.

I am probably more fatalistic. The train is in motion and a lot of people will have to stand in front of it to make it stop. The only ones who will are those who have nothing left to lose.

We are far from there still. In Canada anyway.

Moneta:”a bunch of 65+ will go out and protest as revolutions are usually initiated by the young.”

I fight for my children. I am with my children. Initiate that revolution and see how many 60+ fight. Don’t resign or compromise yourself by anticipating disappointment.

Famous story: Elders chasing Dan Rostenkowski down the hall waving their canes over Social Security. All the interns and staffers on Capitol Hill are too young to remember that, so be sure to mention it if you ever call.

I’m sorry if I am annoying but I am surrounded by the top 20% and frankly, I don’t see many fighting for anything. Most are still basking in their gains.

I am in Canada where real estate is up in the stratosphere and collapses only happen in the US. I won’t get any support until they get scorched.

Frankly, I only expect disappointment from the top. IMO, it is going to get much worse before it gets better.

But from the bottom, I can stay optimistic because there is a lot I can do to give meaning to my life even if the financial structures crumble around me.

Moneta,

Yes ” it is going to get much worse before it gets better.”

but then you wisely say: “But from the bottom, I can stay optimistic because there is a lot I can do to give meaning to my life even if the financial structures crumble around me.”

I believe that is time for you and us all to move beyond the disappointment that you know (and are honest enough to disclose).

While you regain your strength from this newfound meaning in your life, stay alert. Stay poised for action. Take the lead. Show others. Be yourself.

Dan

P.S. Lambert, if you read this, know that it is no cane, but the most damaging weapon that I bring.

I thought I read somewhere that what made some old people chase Rostenkowski with canes was some kind of Catastrophic Coverage premium added to Medicare. The uproar caused it to be repealed. It also caused much of official Washington to regard “old people” as a detestable ungrateful “hate object” to be conspired against over the decades to come.

http://www.aolnews.com/2010/08/11/rostys-catastrophic-moment-over-health-care-was-a-first/

” It also caused much of official Washington to regard “old people” as a detestable ungrateful “hate object” to be conspired against over the decades to come.”

Oh those elected representatives, so rational, such good judgement, so wise and decent. Serves those F_king old people right for carrying those F_king canes. I mean, who else but old F_Kers carry those things anyway. Kill em!

Calgacus,

Coincidentally, this time machine came out today:

http://www.theglobeandmail.com/globe-investor/personal-finance/household-finances/why-todays-young-adults-have-it-worse-much-worse-than-30-years-ago/article10280516/

Will Cyprus be “contained”? Asked another way: 1-2 years from now, will Cyprus not be considered the foreshock of a trembler that relieved a significant portion of the pressure/stress built up into the financial system? I suspect not. Why not? Because the USG financial complex is still operating in emergency mode.

In 2007, I suspect the Fed was probably hoping to jawbone the market into a soft landing. When markets went haywire, it was like a “financial 911” that precipitated massive USG response at many levels (including $16 trillion in loans and $3+ trillion in direct handouts plus Hank Paulson engaging the rest of the government). It seems the entire USG financial complex has stayed in this mode ever since. Behind the scenes, the Fed is probably working like crazy — much harder than before 2008Q3 — to “keep it together”.

Now, maybe I’m suffering from recency bias. In the past 4 years, the Fed proved to me “there is no spoon”. This Cyprus event is another test to see how powerful they really are.

…

Then again, if Cyprus *isn’t* a foreshock of a large trembler that relieves the pressure in the financial system, I wonder: what will?

I love the word “contained” because, in LA Confidential, it was a verbal “tell” for Dudley Smith, a fabulously corrupt drug-dealing LAPD officer with a fake Irish schtick, who ordered several people killed in the course of the book (and film).

Not that our banksters are anything like Dudley Smith. Modulo his particular flavor of blarney.

Oh Oh…Trading halted in Italian bank/s due to possible Cyprus contagion..

http://www.borsaitaliana.it/homepage/homepage.htm

I tried a Google translation on that page and can’t find that trading was halted?

Just to clarify, from Bloomberg and in English:

http://washpost.bloomberg.com/Story?docId=1376-MK7F1G6KLVR901-2N6Q57V6CUN8RDSEGEAO7QAKBF

“Italian lenders were among the biggest decliners on the Stoxx 600 and trading in them was briefly halted in Milan”.

Just briefly.

Looks like the Butterfly Effect wings have some legs…

http://www.zerohedge.com/news/2013-03-25/european-markets-sliding-fast

Check out ZH for charts on Spanish and Italian bonds and bank stocks. Tried posting link, but algo moderator ate it.

i tried too…no go

I added some of this material to Links as an update.

So much for being contained. lol.

thats real people already experiencing a world of hurt with nowhere to go

not funny

I’m laughing at the idiotic hubris of the oligarchs.

It is contained … ( as Jon Stewart once said) on planet Earth.

But the trigger of Cypriot woes was the 2012 Greece bailout, which was authored by the Troika’s crack team of bailer outers, seemingly unable to extrapolate consequences no matter how simple the link between cause and effect:

“Making it worse, Cyprus was a major Greek bondholder, so when the second Greek bailout package went through last year, it caused a 4.5 billion euro ($5.9 billion) hole in the Cypriot budget.”

http://www.forbes.com/sites/abrambrown/2013/03/19/the-meltdown-on-cyprus-a-faq-guide-to-the-latest-european-financial-crisis/

And the trigger of Grecian woes can be traced back to the U.S.:

http://preview.bloomberg.com/news/2010-05-11/greece-mess-has-roots-in-indulgent-u-s-policy-commentary-by-amity-shlaes.html

http://www.spiegel.de/international/europe/greek-debt-crisis-how-goldman-sachs-helped-greece-to-mask-its-true-debt-a-676634.html

http://www.bloomberg.com/apps/news?pid=20601087&sid=asBNXSLtlN9E&pos=3

http://www.nytimes.com/2010/02/14/business/global/14debt.html?hp

http://www.bloomberg.com/news/2012-03-06/goldman-secret-greece-loan-shows-two-sinners-as-client-unravels.html

http://www.bloomberg.com/apps/news?pid=20601109&sid=aViC_3fxSWK8&pos=13

http://online.wsj.com/article/SB10001424052748703791504575079743591308292.html?mod=WSJ_Markets_section_Deals

Greece and the IMF: Who is Being Saved?, by Ronald Janssen, Center for Economic and Policy Research

I have to give credit where credit is due: We Americans sure know how to take a baseball bat to a hornet’s nest, all the while pretending it is a piñata.

It seems that the lesson to be learned is the value of economic diversification spread across many business sectors. If the number is correct that Financial Services comprises 45% of Cyprus GDP then they are looking at a pretty bleak near term future.

Pushing paper is a poor path for achieving egalitarian national prosperity. An excessive financial sector only benefits the few, and the costs seem to always be borne by the average citizen.

surely, the lesson to be learned is that a bank should be permitted to undertake retail or investment banking not both. Government guarantees would not, therefore, apply to investment banks.

In discussions about this a few days ago there was a thread arguing that the Russians could use their economic presence in Cyprus to extract a base for their Med fleet and/or even an airfield or 2. The general thought was that this was unlikely due to EU/NATO resistance.

Now, of course, this game has changed totally. Once the Troika’s tried & true austerity driven economic devasation program has run its savage course and the Cypriot economy has collapsed to levels that make Greece look like Germany then Russia can step in as a saviour & extract whatever concessions it wants.

By that time I’ve no doubt that the EU/EZ will be seen as so poisonous in Cypriot eyes they won’t care in the slightest about any consequences of a Russain military presence.

As always timing is everything …

To be truly Machiavellian we could envisage, at this point in the new Great Game, that Turkey (owner of Northern Cyprus) would step in with a white knight offer to rescue the whole island in return for a path to EU membership.

When all is considered, it seems that leaving the euro would be, after a couple of very hard years, the best way to go for Cyprus (and all the other Eurozone members, by the way

Remember the Fall of 2008. We had all sorts of resolutions taking place over weekends, so things could “open up” OK on Monday. How many people were in the room when ‘we’ decided how AIG woud be resolved? The decision to let Lehman go? FNM’s bailout? It is not a great way to operate, but I am not surprised by the last-minuteness of the decisions.

All you need to know is that DHS has been frantically preparing for civil war since 2007. They expect economic collapse, domestically and globally. There is no way you can put the Cyprus debacle back in the tube. Watch out for the “c” word. Yves is right as usual.

DHS is a bunch of loser incompetents. Civil war? Hah. They couldn’t handle serious civil unrest.

The problem is rigid, ideological thinking. Put me in charge and I could figure out how to stabilize and take over the country but they don’t have anyone whose thought processes are radical in the correct way. (Probably the people who thought that way were forced out.)

G W Bush scared me partly because he seemed like he, or one of his advisors, actually understood one of the principles behind pacifying the populace — you gotta have carrots as well as sticks. Now all the people who realized that seem to be gone.

Does anyone know which middle eastern interests bought Laiki at some point? I know Lebanese interests bought Laiki Australia, but can’t find the owners of the main bank.

I doubt the story is over as I suspect many of the large depositors were given an escape route via London and Russia – this matter has hardly been a secret since December 2011.

The elite bankers in Europe are so damn stupid that they can’t remember what propaganda line they’re supposed to push. This guarantees that the Cyprus mess will not be contained.

“Dijsselbloem: Cyprus deal is template for the future”

http://www.guardian.co.uk/business/2013/mar/25/eurozone-crisis-cyprus-bailout-deal-agreed#block-51506c6ab5795d794abf445a

You’re not supposed to TELL people that, Dijsselbloem!

If you follow the Guardian’s live blog you’ll see that Mr Dijsselbloem was given a serious Euro-slapping following which his rowing back was probably the most entertaining bit of EU language mangling I’ve seen for a while.

Giving the Finance Minister and the head of the Central Bank authority to do whatever it takes to ensure “public order and safety” pretty much lets the cat out of the bag.

Maybe they want a bank run to happen in fact. I’m not sure why but it’s not impossible that their power-mongering sick minds want to cause a socio-economic catastrophe so they can impose (or attempt to impose) some sort of fascist rule on that pretext.

Said that, it’s also possible that the guy is a bit dumb. There’s always someone who falls off the line: you just can’t control everything, it’s against chaos science.

– Slovenia.

– “The glaring exception to this is the transfer of the ELA transfer from Laiki to Bank of Cyprus … I am not sure *why* Bank of Cyprus creditors should be expected to take responsibility for Laiki’s official creditors, except for the fact that the official creditors don’t want to take losses.”

Laiki’s creditors were better connected.

– The hated Russians may have been able to remove much of their funds by way of London branches of BoC and Laiki.

– Cyprus will take a ‘hit’ on fuel consumption of 30-40%. No mon, no fun. Cuba after the fall of the Soviet Union only took a 20% hit. The USA fuel embargo in 1973 was only a 5% hit.

– Cyprus done in by the ECB: if Cypriot banks had lent to the Germans rather than the Greeks there would be no crisis in Cyprus.

– Cyprus done in by ECB 2: Ireland has been borrowing from ELA for years … why the panic in Cyprus?

– Currency risk is on as Russia mulls options. Will it refuse to accept euros for fuel purchases? It just inked a crude oil- gas pipeline deal with China.

Morals to this story: avoid EU bailouts at all costs, resolve banking problems early before they get out of hand.

Another moral is it’s time to end energy consumption and embrace conservation. Otherwise, it’s ‘conservation by other means’.