By Laurence Boone, European Economist at BofA Merrill Lynch, Research Division, Céline Renucci, Research assistant, Europe Macroeconomics, Bank of America Merrill Lynch, and Ruben Segura-Cayuela, Bank of America Merrill Lynch. Originally published at VoxEU.

What happens after the crisis ends? This column estimates the long-term effects of the current cyclical downturn on Eurozone economies. In the absence of any real impetus for bold reform, estimates show that the damage will indeed be long lasting, permanently impairing growth for an ageing population that requires higher growth capacity more than ever before.

The financial crisis that erupted in 2008, prolonged by a sovereign crisis in the Eurozone, led to a massive contraction in trade, as well as in investment in physical and human capital; thus undermining the foundations of future growth. This may well continue as growth will not rapidly rebound while deleveraging slowly proceeds across Eurozone economies. Empirical evidence suggests deleveraging episodes accompanied by a housing crisis will take on average five and a half years across high-income OECD countries (or seven years when accompanied by a banking crisis (Aspachs-Bracon et al. 2011, IMF 2012).

Little resolution of banking-sector difficulties in the Eurozone suggests that deleveraging and credit will probably remain slow and impaired for much longer than previously thought. Recoveries that happen without credit are, on average, a third longer than recovery episodes with credit (Darvas 2013). Eurozone policymakers have withdrawn support for a policy mix – in the form of rapid attempts at fiscal tightening, monetary easing providing liquidity to banks and not to end users – at a time when a large proportion of Eurozone governments (especially the most fragile ones) had engaged in structural reforms that deliver higher growth in the future but tend to dampen it in recession (Bouis et al. 2012).

All of this is compounded by very challenging trends in demographic changes that will prove a major headwind for long-term growth (Nuño et al 2012).

Damages to long-term growth

Damages to trend growth are notoriously difficult to assess, as methods of measuring trend growth tend to produce estimates that are heavily influenced by the estimation method itself (see OECD 2009). In addition, observed GDP growth tends to be revised until several years after the first estimate. The OECD (2009) shows that such revisions to trend growth and to the output gap can in fact be equivalent to several percentage points, thus making these exercises highly fragile. Empirical evidence shows that trend growth was, on average, overestimated prior to the crisis, but underestimated following the crisis (Borio 2012).

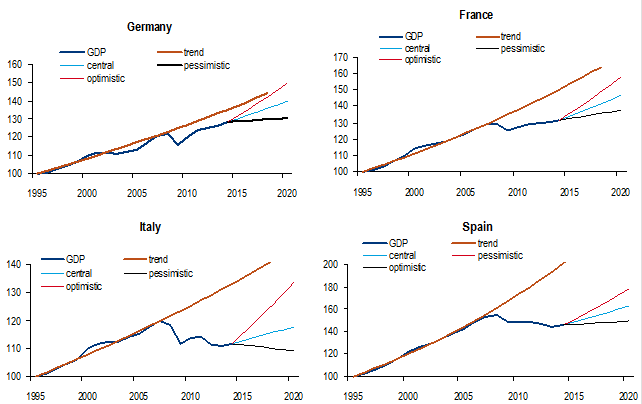

We draw simple scenarios in order to assess the extent of the crisis’s effect on damages to trend growth, and the scope for policy to reverse these damages. Our work is based on a simple Solow growth-accounting methodology. To take into account the impact of the crisis, we distinguish three time periods:

- The run-up into the crisis (1995-2007).

- The crisis period (which we estimate ends in 2014, in line with most international organisations implicit forecasts assumptions).

- The post-crisis period.

Thus we can compare the evolution of the three underlying sources of growth prior to and during the crisis, and make simple transparent assumptions on how they can evolve, post-crisis.

Trend growth before the crisis

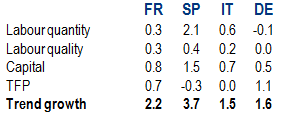

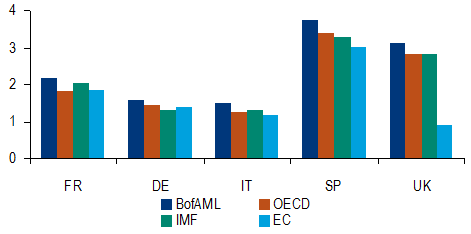

Results prior to the crisis are in line with most estimates (Figure 1): Spain had the highest trend growth (3.7% per annum, thanks to an inflated rise of capital and low qualified labour); followed by France; with Germany and Italy in the lowest positions because of subdued labour contribution in the former, and poor productivity in the latter (see Table 1).

Table 1. Trend growth breakdown (1995-2007)

Figure 1. Trend growth estimates (1995-2007)

Source: BofAML Global Research.

Whereas capital and productivity growth lifted GDP growth in northern Eurozone countries, with little contribution from labour growth, the opposite occurred in Spain and Italy (OECD Sources of Growth 2013). Productivity was flat in Italy and negative in Spain (as can be expected when growth comes from low-technology content sectors), but capital and labour growth, especially the quantity of labour, inflated GDP growth.

Trend growth during the crisis

Results for the crisis period are also similar to other ‘standard’ analyses, because we assume an end year of 2014 for the crisis. We proceed in a similar way to the European Commission by assuming that the output gap is close to closing in on pre-crisis levels by the end 2014 (see AMECO). For GDP inputs, we use AMECO projections, using total factor productivity as the adjusting residual.

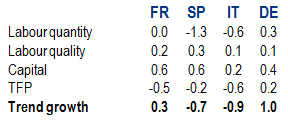

Based on these assumptions, growth accounting provides us with an estimate of the extent of the damages caused by the crisis and the magnitude of the drop in growth over this period (see Table 2). A common feature of all economies is a collapse in productivity, which is typical of a big recession. In addition, Spain and Italy also underwent a very sharp labour contraction.

Table 2. Trend growth breakdown (2008-14)

Source: BofAML Global Research.

Trend growth after the crisis

The post-crisis exercise is more interesting, though more perilous in terms of measurement, because we need to project the evolution of fundamentals – investment, labour inputs and total factor productivity. We run several scenarios for each of the three input factors in order to span a wide range of scenarios, and provide a framework for assessing:

- Long-lasting damages from the crisis.

- The additional effect of ageing.

- Some benchmarks for the capacity of economic policy to lift growth.

We also assume several things about capital and productivity:

- Regarding physical capital, we assume that the investment growth rate returns to its pre-crisis level by 2020.

A downside risk is that investment growth does not recover fully (for example, because banks fail to provide the necessary funding). In this case, we assume investment growth is only half what it was before the onset of economic turmoil. An upside risk to our estimates would be if investment were to bounce back by 2020 to the level that would have prevailed had the financial crisis not occurred.

- Regarding human capital, we use the UN’s working-age population projections for taking account of demographics and run two scenarios for the unemployment rate.

One where we assume strong hysteresis and that the working-age levels stay at the European Commission’s 2014 estimates (i.e. permanently higher than before the crisis), and another where unemployment rate steadily declines (using IMF projections) on the back of the ongoing, albeit slow, recovery.

- We assume that productivity was likely over-estimated pre-crisis but collapsed to an unusually low level during the crisis.

As a result, we filter total factor productivity over the whole historical period (1995-14) and use this value for the projection period (2015-20). We also estimate productivity through a convergence equation, which would slightly lift productivity in peripheral countries in the future. In that case, we use the framework of a standard convergence equation with a large sample of countries, controlling for country-specific effects, which allows speed of catch-up to vary with the distance to the technology frontier and the initial level of human capital. To this effect, we estimate total factor productivity through a Nelson-Phelps technology diffusion model similar to Foure et al. (2010).

This exercise suggests that in the absence of policy reforms, trend growth will have been damaged significantly, by at least one percentage point, post-crisis, compared with pre-crisis levels, although our range of estimates is quite large depending on the set of assumptions being used. However, under the most favourable set of assumptions which would assume significant policy reforms (investment recovers to pre-crisis growth levels, rapid decline in the unemployment, rapid catch-up with the technology leader), trend growth would be in line with pre-crisis levels and could even be higher in Italy and Germany which had the lowest trend growth prior to the crisis.

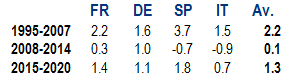

- Our central scenario requires the most agnostic assumptions: permanent loss in the level of capital, but the growth rate recovers; unemployment improves in line with previous recoveries; productivity growth remains in line with historical average.

Under that scenario, trend growth for the four main Eurozone countries lies between little less than 1% and slightly less than 2%, post-crisis, with trend growth highest in Spain and France; and the lowest for Italy and Germany. Ageing explains a large part of this variation (see Table 3). Lower productivity and employment are the main reasons for the drop in trend growth compared to pre-crisis levels. The evolution of investment is the more sensitive assumption in determining trend growth in our set of scenarios, though the impact is not uniform across countries.

Table 3. Weak trend growth in a central scenario

Source: BofAML Global Research.

In the event that investment fails to recover quickly – perhaps because bank health takes too long to restore and transmission mechanisms of monetary policy remain impaired – or unemployment levels take longer to fall than in previous recovery episodes, then trend growth would be significantly lower for longer. Trend growth might well remain negative in Spain and Italy, and may fail to increase for Germany or France. Conversely, should economic policy support a faster investment recovery and swifter return to work of the unemployed, trend growth would return to something closer to that of pre-crisis levels. Allowing for convergence in productivity would also offer some pick up in productivity growth in periphery countries.

Figure 4.

Conclusion

With a simple Solow framework, we assess to what extent the cyclical downturn has damaged European economies in the long run. In the absence of impetus for bold reform, this exercise shows the damage will indeed be long lasting, permanently impairing growth in a context of an ageing population that needs higher growth capacity than ever before.

Lambert interjects: Mission accomplished!

References

Aspachs-Bracon, O J, Jodar-Rosell and J Gual (2011), “Perspectives de desapalancamiento en Espana”, Documentos de economia, La Caixa, No 23.

Boone, L, and R Segura-Cayuela (2013), “Europe: when will growth return?”, BofAML European Economic Viewpoint, February.

Borio, C (2012), “The financial cycle and macroeconomics: What have we learnt?”, BIS Working Papers 395, Bank for International Settlements.

Bouis, R, O Causa, L Demmou, R Duval and A Zdzienicka (2012), “The Short-Term Effects of Structural Reforms: An Empirical Analysis”, OECD Economics Department Working Papers 949, OECD Publishing.

Darvas, Z (2013), “Can Europe recover without credit”, February, Bruegel Policy Contribution.

Foure, J, A Benassy-Quere and L Fontagne (2010), “The world economy in 2050: a tentative picture”, WP 2010-27, CEPII.

IMF (2012), World Economic Outlook, October.

Nuno, G, C Pulido and R Segura-Cayuela (2012), “Long-Run Growth and Demographic Prospects in Advanced Economies”, Banco de España Occasional Paper No. 1206.

OECD (2010), OECD Economic Outlook, 2009/2, OECD Publishing.

OECD (2012), Economic Surveys, Spain, November.

OECD (2013), Economic Policy Reforms, Going for growth.

OECD (2014), Economic Outlook, December.

Trends are not where people live. There is nothing average about what is currently happening. The major economic powers and blocs are all in late state kleptocracy. A more pertinent measure than investment or capacity utilization would be wealth inequality which the article does not address.

Growth on a finite planet whose carrying capacity we have long since exceeded is a problematic concept to say the least. The real game is sustainability, again unaddressed by the article. But more than this and getting back to the previous point, growth for whom? As the Sayez data show, all the benefits from what “growth” has occurred in the US went to the 1% and the situation of the 99% has, in fact, deteriorated. So whether we are talking the US or Europe or wherever, why should any of us support growth that increases our debt servitude to the 1% and further exhausts our planet and its resources to no useful or sustainable end?

Excellent points. And since when is the current situation a “cyclical downturn”? How nice to simply drop the real cause of the disaster, which by doing of course, the problems with the banks become a “who coulda thunk?” results of the “unusually long cyclical downturn” and not the destrution of honest and competent finanace. New bank bailout anyone?

As in growth trends in ghost towns.

The cyclical downturn vrs. the downward spiral.

I’m taking the “pessimistic” forecasts as “central”, the “central” as “overly optimistic” and the “optimistic” as delirious fantasies. It can still be worse than the “pessimistic” forecasts suggest, IMO.

At least in Spain the only thing that could save the day (or actually the decade) would be a nationalization of all banks and utilities and the planned demolition of the housing bubble. It’s impossible to increase competitivity with these stagnated housing prices (add to that the extremely high cost of basic services like electricity and water). That, together with food and clothing, make the essentials of the cost of labor and you cannot sell yourself for less than it takes you to survive.

This would imply massive “haircuts” for some parasitic capitalists and their cronies but it’s the only way ahead other than total socialism.

This collapse of Europe is anyhow very important for the global economy because Europe is (or used to be) one of the major markets of this planet, not just for Germany but also for China, the USA, and a long etcetera.

I don’t get nationalizing the banks. I totally get the government setting up a public bank to the what private banks currently do, but when you nationalize the banks you also nationlize their debts. The debt of the financial sector is massive. The total debt of US banks (especially when taking derivatives into account) has to be much larger than US GDP. So why nationalize and not simply set up a public bank that can be built, debt free, from scratch?

“This collapse of Europe is anyhow very important for the global economy”

Agreed, but what Europe and the people of Europe do to deal with their massively overbloated financial sector is just as important for them and the world at large as their economy. If they rescue the banks while destroying their countries they make financial capital stronger and set a horrible precedent. I see nothing from the EU or the ECB to make me hopeful.

Why nationalize the debt? That’s ridiculous! First bankruptcy (creditors/gamblers lose as they must) and then buy the skeleton for peanuts and refloat it with the profits going to the public.

Nationalizing the debt is what is happening now, at least in Spain and Ireland (not sure how does Cyprus pan out in this matter yet). In Spain and Ireland: the public has been forced to assume bankers’ debts, just not to let their creditors to have major loses.

Creditors must pay first, then nationalize the remains and start anew with a bank that actually serves the public and not just the bottomless greed of some private actors.

“If they rescue the banks while destroying their countries they make financial capital stronger and set a horrible precedent”.

Exactly my point. Put the banks to serve the people and not the people to serve the banks. That applies for the whole economy, it must be said, but very especially for banks these days.

Trend growth is all dependent upon what you think money is, how its used and whether you believe the natural default position of the domestic private sector on its own is deficit or surplus.

http://neweconomicperspectives.org/2013/02/real-dollars-and-funny-money.html

http://neweconomicperspectives.org/2013/03/the-i-o-u-in-the-u-s-dollar.html#more-5001

Could we please hear from a person who takes a complete view of the economy? All of the economic discussion is centered around short term trends and minor “fixes” for a systemically flawed economy. The economy does not exist in a vacuum, nor does it have infinite resources to turn into “growth”. Our entire system is based on the production of oil and the destruction of the ecosystem. Whether or not you believe that we’ve reached peak oil or not you must admit that it will happen at some point. Also, if you don’t depend on a stipend from an oil company to feed your family then you also take climate change seriously. Infinite growth is neither possible nor desirable. We must acknowledge that humanity is an organism operating within an ecology. Our transfer of materials and production of food relies on the same system as every other organism. We were unlucky enough to discover a finite resource which allowed for the total destruction of our ecosystem, creation of products that have an average lifetime of 6 months before they’re thrown away, weapons capable of obliterating the planet, a food system that literally turns oil (planting, fertilizing, harvesting, plastic packaging/bags, transportation are all petroleum based functions)into food, turns soil into dirt, and all of this in a very short period of time. Assuming 200 years of oil production, it isn’t even a blip on the 200,000 year timeline of homo sapiens.

That being said, you don’t get a system without actors within the system. Billions of interrelated actors create this system that we live in and create what we designate as the “economy”. Even the most isolated tribe of undiscovered Amazonian peoples are being effected by the system and they also act on the system. They are presumably busy taking what they need from the forest and replenishing the systems they rely upon as they see fit – albeit an unforeseen impact from the outsiders perspective. Take the “forest dweller” as an abstract entity. It has certain inputs and outputs, characteristics, that are required. It is like H2O, the two hydrogen atoms and the oxygen could split and still exist in isolation, but we would no longer call the new form water. When the Amazon is replaced with cattle and sugarcane, the planet will be changed forever and the forest dweller will no longer exist.

Now this is what will be required to maintain growth. This is what is required to sustain the wealth divide and a nonproductive % at the top of the pyramid. The Banksters, Congress, the President, Industrialists, Oil Tycoons, Monsanto – all of these entities are part of a larger system that is unraveling. None of this sacrosanct system is impervious to change. In fact, the only constant in this world is change. We, humans, wouldn’t be here if we lived in a universe which never changed – aka a universe without evolution.

Banks that launder money for drug cartels, and terrorist organizations require people willing to grow the drugs, move them, buy them, ingest them, sometimes a complicit CIA or similar agency, an Orwellian Justice Department, and an apathetic and myopic public. Any part of this particular system has the power to change the system.

Neo-liberal economists will never produce an economic model that does not promote the status quo, and by definition they can’t – if they did they wouldn’t be a neo liberal economist, and they wouldn’t be hired by millionaire university presidents, billionaire bankers, or on the staffs of congressional millionaires. No one promoting neo liberal economics or growth promoting economics in general has a near term interest in promoting anything else. The general population needs to realize this and act on it.

All the blog posts, documentaries, white papers, newspaper articles, editorials, conspiracy theories and conferences in the world amount to a waste of time if humanity refuses to change. I’m reminded of one of George Carlin’s routines; he states, correctly, the planet will be fine, we are f-ed. This isn’t about saving the planet, or saving humanity – it’s the realization that we are world and the world is us.

Suppose Cheney and Bush did have something to do with 9/11. Suppose Monsanto is a psychopathic corporation determined to patent life and starve millions. Suppose we were told 900+ lies before the Iraq war. What if Obama is a Muslim from Kenya? What if millions of Chinese are wage slaves? Suppose the Clintons do really kill people and have a hand in the drug trade. Maybe the price of gold and silver is being manipulated? What if we lived in a world where a few or all of these theories are true. Would bringing all these people to justice change the fact that we all participated to some extent in executing these events. Are you less guilty with your iPad, Samsung, the GMO foods you buy, the clothing you wear. We’re all tainted, and all guilty to a certain extent – certainly some more than others. Even those most guilty require a large number of collaborators. The 1% meme has been great at raising awareness, but the Walton family didn’t grow all the food, produce all the clothing, stock the shelves, vote at all the community board meetings to allow their stores, and then buy and consume the products themselves. Drones don’t fly and drop bombs autonomously – yet. Monsanto doesn’t force feed the masses, they just make it cheap and easy to pillage the planet.

You have to start somewhere and at some point, why not now? An individual cannot solve everything, but they can stop being a part of the problem. Grow what food you can in your own yard without chemicals. Monsanto will collapse under its own weight if the individuals buying their products vanish, we are energy that supports the system. Buy clothing locally. It may not be totally sustainable, but at least you know it doesn’t involve forced labor and wasn’t transported from 10,000 miles away. Remove your deposits from banks that have admitted to criminality and they will no longer have the capital that’s required to function no matter how badly they fudge their models.

We will never reach a point where everyone is totally happy with the way things work, but we do have the resources to supply everyone with the necessities of life. As Ghandi said, we have enough for everyone’s need, but not enough for even one man’s greed. It’s time for us to say enough.

Even if those of us who adopt some of these goals and methods can not fix or replace the system all by ourselves, we can build the visible appearance of personal credibility to be given a hearing if/when we talk or write to others about the system wide changes which have to be forced to raise our collective survival chances.

Those who can display that they are walking the walk will be more listened to by others when they talk the talk as well. Those who walk the walk have visible credility when they say: ” I am doing all I can to conserve in a waste-based civilization. I can’t take the train if there is no train to take. So now I get to say that we need to tax the anti-train sector enough to make it pay to restore the train travel it carefully destroyed over the last 60 years.” For example.

The downward spiral of industrial civilization has commenced, in conjunction with the perfect storm of overpopulation, resource depletion and climate change. We must all think anew about our dependence on a destructive and dysfunctional system and act in radically different ways in order to diminish our individual impact. Those “leaders” in positions of power must be made to understand that policies aimed at propping it up will only increase the severity of its demise. The U.S. must begin by significantly reducing our devotion of resources to the military and using them for the development of renewable energy, infrastructure, sustainable agriculture, and human health and welfare.

In the meantime, indididuals or groups who/which support that goal will have to find individual or group thingmaking/thinggrowing or service-doing institutions who also support that goal . . . and buy from them.

Supporting little lifeboats or mini-fortresses of sustainability may preserve them in the teeth of an OverClass-government prime-directive to destroy them.

Laurence Boone, European Economist at BofA Merrill Lynch: “In the absence of impetus for bold reform…….”

Looking for European growth? Then, for ‘The Powers That Be’ (TPTB), it’s time they got their TPTB “impetus for bold reform” game on, by:

More effective use of the EU structural funds:

1. Reduce the co-financing quotas for a two years period, at least– as has already been done in Greece. The 2013 structural funds, that the EU still have to pay out, amount to 232 billion euro (e.g. the amount to be paid to Greece, is more than 12 billion euro, of which 5 billion have not yet been distributed).

Create a European investment and reconstruction fund (Yanis Varoufakis’ ‘Marshal Plan’?):

1. Implement an investment and reconstruction fund (IARCF ) which is not financed by increasing national debt, but by redirecting existing funds, strengthening the EIB, by issuing project bonds and by a tax on financial transactions (see below).

2. Bundled and average of 25% (pro-rated) of the EU’s structural funds into the IARCF. Funds not allocated by the end of 2014/2015 are not to all flow back into national budgets, but transferred to the IARCF equally, on a prorated basis.

Establish a ‘real’ economic and financial union (once Cyprus is out of the game):

1. Establish a common taxation evaluation system and minimum taxation rates – make it a level playing field. Tax evasion and tax avoidance must be given top down commitment at the European level and national level ownership (but, ask Cyprus, Luxembourg, Switzerland and the UK).

2. Eliminate economic imbalances within the Eurozone – all EU member states make contribution(s). The major flaw of the monetary union is the lack/incoherence of a common economic and financial policy.

Augment the European Investment Bank (EIB):

1. Increase its share capital by at least 15 billion euro; focus on financing employment and growth. Increase the EIB’s capital by means of a wealth tax – not provided by all 27 EU members, but by those with a Debt to GDP ratio equal to or less than 100% (or pick a ratio that works with the math).

(Tobin) Tax the financial markets:

1. Financial markets underwrite the costs of the(ir) crisis by paying tax on financial transactions – founded on as broad an assessment as possible – and applied to gains from transactions with stocks and shares, bonds, foreign exchange and derivatives (The UK (City of London) is key – and, likely, impossible; unless there’s social unrest).

European project bonds:

1. Issue European “project bonds” – absorb the flow of private (flight of Cyprus’ ‘tax haven’) capital (see tax below) into European backed (not national), high yielding, index linked investments; and target European growth and innovation policies (yes I know one man’s newspaper-mulch in Cyprus is considered as much innovation as bio-technology nano-bots in the Ruhr Valley)

Implement a European debt repayment fund:

1. Take on joint European liability for part of national debts, by implementing a European debt repayment fund with joint liability for outstanding national debts exceeding 60% of GDP, coupled with a debt-cut plan which is binding for the individual countries (Solidarity!).

Implement Structural changes in the EU budget:

1. The EU budget must focus more on employment, growth, innovation, technology, education and research. At the same time, agricultural subsidies, which still account for more than 40% of the EU budget, must be reduced.

2. Raise the EU budget for research and innovation to 10 %; augmented by common European objectives to increase funds spent on education by 5% of national GDP and 5% of the EU Budget – so as to reflect Europe’s demographic changes (not growth per se), statistically.

A common industrial policy:

1. EU countries with a strong real-economy, modern industries and production-related services have survived the collapse in growth better. Europe needs to set the course towards a real economy – reindustrialization (before the US, Japan and BRIC countries).

Uniform rules of law and competitiveness.

1. Modernize national tax collection ’systems’, and optimize tax collection.

2. Eliminate high market entry barriers – which are not demonstrably justified – which block enlargement of the single market.

Creation of a European social union:

1. If Europe really has social and economic union as its principal objective it needs to start where it counts most for the next five years:

2. A pan-European emergency program to combat youth unemployment; obligatory targets and measures to combat youth unemployment must be agreed upon quickly and on a Europe-wide basis. There are more than six million people, under the age of 25, many well qualified and educated, that are without jobs; endangering social cohesion and threatening European and national unity (for some, such a disaffected human flotsam might be a means-towards-an-end; and if it is, the human and economic consequences to Europe as a whole will be catastrophic).

3. If employment is addressed; focus on augment financial union a social union with an EU Charter of Fundamental Rights – set of social values which strongly uphold basic social rights (union, workers councils, worker equality etc.).

But, that is, if TPTB really want a viable European Union; and at this juncture it really is an open question.

The whole debate on the deficit and growth in this country is remarkably uninformed because it completely decoupled from the issue of the issue of international rebalancing, global oversavings (Benanke’s Saving’s Glut), and America’s misguided role of reserve currency issuer.