By Richard Alford, a former New York Fed economist. Since then, he has worked in the financial industry as a trading floor economist and strategist on both the sell side and the buy side.

It is generally agreed that the recent recession was a balance sheet recession. The slow recovery has been widely viewed as the result of economic agents reducing the use of leverage and otherwise repairing their balance sheets. However, attention has been focused almost exclusively on the balance sheets and behavior of the financial sector. Policy initiatives aimed directly at rebuilding household balance sheets have garnered headlines, but have had little impact. There has been little discussion of the riskiness of the asset side of the household balance sheets and the appropriate use of leverage by the household sector. Nonetheless, some commentators have suggested that households have completed the deleveraging process. They cite as evidence the decline in the ratio of debt service income from a high reached in late 2007 to levels last seen in the mid-1990s.

This post reviews changes in the household sector’s balance sheet by focusing on the use of leverage by the household sector; the ratio of assets on the balance to the reported net worth of the household sector; and the asset mix on the household sector balance sheet. It parallels analyses of capital ratios and the balance sheets of the financial sector and financial institutions.

The post raises three questions. How has the risk appetite of the household sector, as reflected in the leverage ratio and the asset mix, changed over time? Does it appear as if the household sector has completed the rebuilding of its balance sheet? What are the implications, if any, if the deleveraging of the household sector balance sheet is incomplete?

(All the data is from the Fed’s Flow of Funds Accounts)

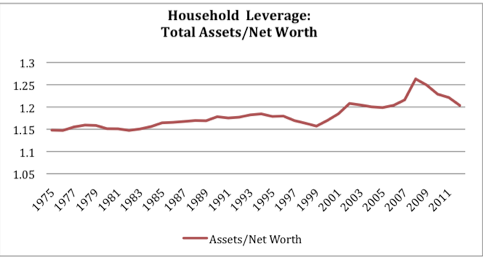

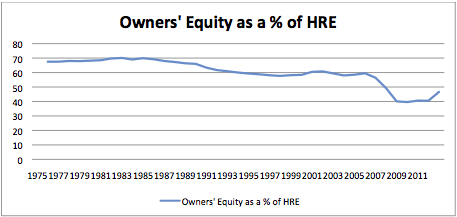

The leverage ratio (Total Household Sector assets divided by Household Sector Net Worth-all data from the Fed Flow of Funds accounts) is very modest compared to the leverage ratios of financial institutions. However, the chart indicates that the household sector’s use of leverage increased considerably, with asset size going from about 115% of net worth to over 125% of net worth between 1999 and 2007. The household sector’s increased use of leverage is also clearly reflected in the decline in owner’s equity as percentage of Household Real Estate.

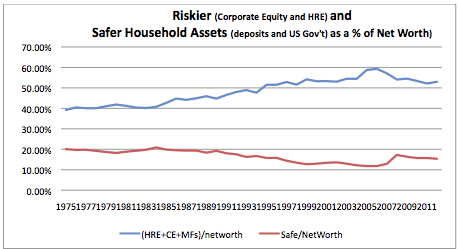

Changes in the asset mix since the 1980s are also consistent with households accepting greater risks. As the chart shows, riskier assets grew as a proportion of total assets while the proportion of the safer assets declined.

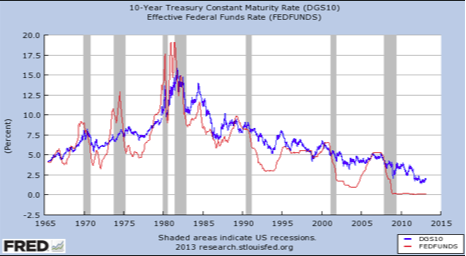

The increased use of leverage and the shift to riskier asset classes suggests that households were reaching for yield as far back as the mid 1980s. The start of this reach for yield roughly coincided with the decline in short-term rates in the mid 1980s as the need to address inflationary concerns abated.

This twenty-year reach for yield by households may have ended with losses suffered on risky assets during the crisis of 2007. The household sector’s use of leverage declined and the asset mix has shifted in favor of safe assets. However, the use of leverage and the portion of net worth in riskier assets remains elevated relative to levels of the mid-1980s and 1970s.

Has the household sector finished deleveraging and rebuilding its balance sheet? The answer is unclear. The use of leverage and the asset mix remain elevated compared to just 10 years ago. Unconventional monetary policy and near zero short-term interest rates have also clouded the picture. There are indications that unconventional policies have rekindled the reach for yield.

If unconventional policies have prevented a full balance sheet adjustment, any return to a normal policy stance will be followed by renewed deleveraging and further moves towards a less risky asset mix. This would imply that the current stance of monetary policy is not promoting a return to stability and full employment, but rather simply masking the symptoms and postponing needed adjustments in balance sheets and the real economy.

I guess this is useful stuff if one considers the context of the household sector …

Increased uncertainty over retirement, an aging demographic,increased unemployment periods,a new era of lower paying jobs with no benefits and a youth demographic that will be heavily indebted with education loans.

The question is: What is the “household” Alford discusses? What is the Mean and Median income and age … Too often the figures are skewed by the vast differences in wealth.

Or … How much does the average wealth of a room increase when Bill Gates walks in?

Yep.

When you have 400 people who have more wealth than half the population — that is more than 150,000,000 people, — one has to ask what exactly does an analysis like this mean:

http://www.youtube.com/watch?v=6niWzomA_So&feature=player_detailpage#t=567s

I think you are suggesting that this post is complete bullshit. If so, we agree.

Do people get paid for writing this tripe, and if so, by who?

The content needs to be tempered. Yesterday it was “Burn the OCC” not for their role in the liars loan industrial complex, mind you, but rather they failed to properly do the do-do diligence in their analysis of the great ‘foreclose-on-their-human-rights’ era of the American experience . The masses have been deleveraging since the Brady Bunch era.

A point I see made often where owners’ equity is examined is that the dataset includes those whose houses are paid in full. For the remainder, then, the percent representing equity is lower.

We know that most of the wealth is in the 55+.

As people age, debt should come down… but we have been witnessing the opposite. The fact that debt increased as a large cohort was approaching retirement is a red flag.

Lifestyles are too high for what people can afford unless they keep on racking on debt at historical low rates… or unless we, the Western world, keep on exploiting the rest of the world.

The cleanup has yet to occur.

http://www.nakedcapitalism.com/2013/04/richard-alford-has-the-household-sector-delevered.html#comment-1203449

This asset inflation is beneficial to banks as they are over-financing property so that the slug of cash that they finance is bigger and the interest stream they collect is larger + plus they get to leverage these dollars.

“Lifestyles are too high”

Speak for yourself. I’m worse off than my parents, and my son is worse off than me. And most of the rest of the world is too poor.

Too poor relative to who? The Queen?

We are not due anything on this planet.

We may be due nothing, but we should strive to create a world in which everyone is better off than just being an uneducated peasant/slave (the historical default human status).

If that isn’t possible, it’s just one more way in which this world sucks.

I doubt there has been much deleveraging by the households we need to worry about, those that make the minimum payment. They are still being charged usurious rates (one reason bank earnings look good, given the banks’ low cost of funds) that reduce amortization of principal to negligible levels. Hard to “deleverage” when “the vig” is eating up your money.

I think there has been deleveraging in that cohort: forced deleveraging (foreclosure, closure of credit card accounts, bankruptcy).

That said: deleveraging hasn’t yet happened in the next group up… those that can afford the monthly payments, but who can’t really afford to have the debt that they have. (can pay the monthly costs, but not the debt).

those are the people we need to delever, who haven’t. They have cashed in their 401k’s, etc but haven’t delevered.

Household debt = cost of putting a roof over ones head and, food, water, clothing, education, energy….you know, those things one needs for basic survival. It is very easy to see that if households are spending more and more for these items, they will have less to spend on other items…demand in the economy goes down. If you buy a house to make a profit when ya sell it….you are part of the cycle that raises the cost of living for the fellow that buys your house at inflated prices. Everytime you jack the price of land (we all need land to work and live) you raise the cost of products made or sold on that land. This asset inflation is beneficial to banks as they are over-financing property so that the slug of cash that they finance is bigger and the interest stream they collect is larger + plus they get to leverage these dollars.

After a bit of this bubble blowing, the cost of a place to work and live goes up so that the wealth creation (and wealth creation requires land, resources and labor to create) needs to price in the inflated assets in those wealth created products and services. At some point, those items of wealth will be too expensive to purchase and demand will fall – sticky prices are items that humans need to survive….. huge reserves of cash at companies represents a price imbalance in the market and a looting of labor wages that ultimately creates market demand. A demand that is increasingly being syphoned off in debt service payments. IE: on balance, this country, europe, china and most other places are in hock over their heads.

Corporations do not pay taxes….they only transfer taxes from the consumer to the tax collector (government). Increasingly, companies have come up with ingenious ways to subvert the collection of taxes from the consumer away from the revenue otherwise had by the government – tis the reason for hiding ill gotten gains in lands afar. – It is also the reason you see so many people being priced out of a place to live or stand on this planet – in fact, the cross-border, asset inflation dis-equalibrium found on this planet is a feeding ground for arbitration in human, financial and wealth creation activities. Those arbitration opportunities are an advantage for financial capital, interest stream development and, are a distinct dis-advantage for wealth creation and industrial and human capital.

It is not pretty. The world is awash in liquidity that is free to overwhelm any nation and plunge them, at a moments notice into the untenable situation of debt servitude (The servicing of unsustainable debt misallocation that favors financial capital). Financial capital is directly comparable to the story of Noah’s Ark. We humans, through our own folly and deliberate manipulation of law, resources, greed and speculation are pricing the majority of humans off of the very planet we depend on.

I will directly report and blame the Oligarchs, the plutocracy for their concerted effort at achieving this end. I will further accuse the financial capitalists of undermining the peace between nations and within nations. I further accuse them of crimes against humanity, treason and inciting insurrections. They have committed capital offenses and are being aided and abetted by our elected officials.

These are high crimes against nations and humanity.

Truly, it’s amazing how little we truly need to survuve.

We don’t need 3000 square foot houses, nor do we need more than 1.

Too much entropy.

We are all clinging to the unsustainable.

One thing that amazes me is the number of women with high paying jobs who skimp on services such as the Nanny so they can afford their Mercedes and the big luxury house. Then they have the gall to complain when the Nanny gets “stolen”.

For the life of me, I can’t understand why many people can not seem to grasp that it’s the services of the loyal people around you that increase your quality of life, not the goods you buy while sending your added value to another nation.

Status is more important than quality of life, and many people are idiots.

Plenty of people live in a dump, but spend all they have on wardrobe and transportation.

If you are trying to acquire status, then wardrobe and transportation are a lot more important than your home. Unless you have a lot of dinner parties.

If you already have status, of course, you don’t need to grasp after it.

expensive wardrobe + car + crummy home = social climber.

that’s easy. An experiment was done in which a luxury car, and some crummy car stayed unmoving in an intersection:

http://www.socio.ethz.ch/research/datafiles/Diekmann___Jungbauer-Gans_Social_status_and_aggression.pdf

It took a lot longer for anyone to honk at the luxury car. Because of fear.

People who buy luxury cars want to inspire fear in their fellow man. (Or, if they can actually afford them, because they usually are pretty nice.)

I look at the pictures of the stuff from the 70s and 80s… can’t believe we thought it looked nice no matter how expensive it was!

Most of the value is in our head.

Monetas example (of the nanny) is not a good one. I agree with the basic statement we could all (or most of us) live better lives using many less expensive things or houses or cars or vacations or detritus of our consumer society. That said it is just wrong that while there are homeless children it is wrong that there are empty 2nd homes (most of the year). Or there are people that are beyond greed that are rubbing the powerless in the dirt so they can have even more.

This was a pretty stupid wonky type article that says not much at all.

TomDor says:

I don’t buy that at all.

Sure, the income and other taxes that corporations don’t pay can accrue to the corporation’s customers. But to assume those taxes-not-paid can not accrue to the corporate managers in the form of massive pay packages or to the bottom line, later to be redeemed by shareholders in the form of capital gains, is a terribly one-eyed analysis.

The product or service a company sells to a consumer is priced to include overhead costs. Overhead costs include a projection of taxes upon earnings so that shareholders have an idea of where their stocks may be. If you are a corporation breaking even – then your taxes are zero, however, your suppliers will be trying to make profit and, if they do, they will be paying the pass thru of the consumer taxes.

A little tidbit from Tax Facts published through the 1920’s

In the United States, people are wont to talk feverishly and vindictively about the “non-taxpayer”, for it is here that our brother from Mexico, our cousin from over the Canadian Border, our friends from India and the Middle East come to escape the rigors of their respective locations

They proceed to use our highways and our libraries, our water systems and our police protection. If they have children old enough and stay long enough, they use our public schools etc., whereupon there is a great cry about non-taxpayers taking advantage of our benefits of government. Because these visitors and temporary residents don’t own property and are not listed with the tax man, the general supposition is that they pay no taxes.

A itemized account of the money spent by these “guests” over a period of time would yield some surprises. Naturally, the itemization includes practically everything permanent residents would buy, food, clothing, housing, luxuries and the usual necessities.

A little thought will show clearly that while the guest owned no property here, the hotel proprietor, the restaurateur, the merchant, the grocer, the druggist, everyone in fact, from whom he made purchases did own property, and that property was subject to taxation. The tax on the buildings and merchandize was simply added to the other overhead expenses in the bill of the proprietor and merchant.

The property owner acted as a collector and ultimate consumer, whether a native son or a wandering guest, paid the tax. The guest who owned no property himself in the United States paid a tax whenever he slept with a roof over his head, paid taxes every time he bought a cigar or steak. A man could no more pass through the United States and purchase a meal or a night’s lodging without paying taxes than he could buy a gallon of gasoline for his car without paying the gasoline tax.

The “non-taxpayer”? He belongs to the class of griffins and unicorns and other fabulous animals. There is no such creature.

I dont at all propose this policy, but im going to say it here anyway just because its hilarious.

So,under Muammar Gaddhafi, there was this one time when housing speculation in Libya got out of control, and made it difficult for people to buy homes.

So Gaddhafi made it illegal to own more than one home. Problem solved!

There are ways to stop speculation, though I would prefer one that is less ham-fisted than this one…

“Corporations do not pay taxes….they only transfer taxes from the consumer to the tax collector (government).”

Fine by me. Since most of the MNCs claim they derive much of their sales overseas these days, I’m happy to replace purely domestic taxes (e.g. personal income) with a mix of domestic and international taxes (corporate taxes). It’s still a net win for the American citizen.

Now if only we can tax companies’ overseas profits in the year they are earned rather than the year they are re-patriated. After all, if corporations are like people, they should be subject to the same tax standards as expats who earn foreign money.

Try, Try, Try Again

The majority breeds on government as the solution instead of the problem because it is paid, in debt, to do so. It supported the jokers that gave China our factories, China leveraged the “income” to buy America, exchanging jobs for welfare, Bill Clinton became its icon accordingly, and these same robots are now pushing to put Clinton’s old lady in office. If it wasn’t Kissinger, Brown and Obama profiting off the exercise, it would be somebody else.

The Bay Area efficiently puts America out of work, paid for with Bernanke’s printing press. That’s what it does. Why would you bother bombing America when you can get it from a used-up wh- for pennies on the dollar? By the time Jerry Brown and crew get done, you won’t be able to pay your property taxes with social security. Why wouldn’t you expect the hedge funds to short America?

The last couple of generations have sold out their children and parents for pension promises, which are always inflated away, if not outright confiscated. If you must assign blame, look no further than the mirror. You are the only person you can change.

America and China is just the latest in a long line of marriages gone bad, but not before its example infected the entire global economy. The economy is going down because labor didn’t get on that ship. Labor doesn’t play by reptile rules. Capital replaced it with automatons.

Unless you are part of the global capital cabal, your economic prosperity depends upon three things:

Whether you are married;

How many children you have; and

How well you build a family bank.

Everything else is whistling past the grave.

China knows all about gold, currency and technology, but it forgot how to love its children, like every failed culture, including America. Try as it might, the majority will never replace parents, not with socialism, not with communism, and not with capitalism. FU all and your “it takes a community to raise a child.”

The majority bet against parents with family law, lost, and now it pays. Insurance is and always has been a Ponzi scam. Slice ‘em, dice ‘em, and rearrange the resulting securities any way you like; measuring productivity by the ability to create debt against future generations, and call it money, always ends badly, for the majority.

Very interesting article, but…

The type of leverage indulged-in by households, call it leverage by the 99%, is not, and was not the problem that tanked ‘our’ economy, the real-economy, as we have been calling it.

Households employed leverage as the opportunity presented itself, mostly in an effort to maintain or raise their standard of living in an era of stagnant wages and lower prices, all the while assuming, right or wrong, that wages would eventually rise, and or home prices would rise forever as we were encouraged to believe.

As unwise as that behavior looks in retrospect, it was not the underlying cause of our current misery.

The cause of our not-so-recent, and on-going economic malaise was the type of leverage employed by the financial sector, which securitized household real-estate debt, including an enormous amount of sub-prime paper that it created virtually overnight, first by convincing our government to de-regulate lending, and then convincing us that real estate values would rise forever.

The financial sector leveraged our mortgages, good and bad, to create Mortgage Backed Securities which they leveraged to create CDOs, which they leveraged to create CDSs, all of which they pretended was sensible and safe behavior, when in fact it eventually proved so disastrous that it required a tax-payer bail-out to save the financial sector from choking to death.

So…

When the sh*t hit the fan, and the American people bailed-out the banks, one would expect an enormous wave of de-leveraging to occur on the part of the financial sector.

This hasn’t been the case, in fact, as far as I can see, as illustrated by the graphs presented by the author of this article, the only real, certifiable, de-leveraging taking place has been by us, the 99% who represent the ‘real’ economy.

It’s a slow and painful process, but we’ve bought less, and we’re paying down our debts and that’s what the graphs show.

On the other hand, the folks that caused the whole mess have hidden the MBS they hold because they are not worth what they make believe they are worth, and they’ve hidden the CDOs backed by those MBSs, and they’ve continued to make-believe that the whole secret pile of sh*t is worth so much that they can continue to buy and sell even more of the same sort of dangerous derivatives that nearly blew up the world economy to start this whole Great Recession in the first place.

So, has the Household Sector Deleveraged?

Yes, we have deleveraged as fast as we can, which isn’t very fast, and besides, it doesn’t matter how fast those of us at the bottom of the pile deleverage, as long as those at the top hold onto everything they have, no matter how ‘toxic’ and keep adding more and more sh*t to the pile 24/7/365.

The author writes about Household Sector Deleveraging because it’s possible, as opposed to the oh-so secret. and almost non-existent deleveraging of the financial sector.

Shorter;

Yes, but so what?

Again from the 1920’s Tax Facts

Legal Gambling

The gloom is fading from the real estate situation. More nibbles during the last few weeks than the last three years. If January brings us good rains, this next year will open the door to the sunshine – a case of rain bringing the sun.

It is to be hoped, however, that there will never be another boom. The crash of the boom of 1923 was due to the same causes that wrecked the wall street stock market. People sold what they did not own. They made a payment down in the hope of getting the property off their hands before it began to burn. Real estate fell into the hands of sharp-shooting gamblers who had no interest in land. To them it was just a pile of blue chips on a roulette wheel.

“Kissinger, Brown and Obama”

Now there are three names you wouldn’t expect to see listed together.

Jim

Even _if_ the household sector is delevered back to “normal” levels…their willingness or ability to take on credit from a broken banking system is suspect.

The fact remains that we need a nice fiscal jolt to the economy to promote velocity, jobs, and spending.

Monetary velocity is at multi-decade lows — we need to get money out of the hands of hoarders and put it into the lower-class with high-MPC…