By Timothy Wise, Director of the Research and Policy Program at the Global Development and Environment Institute, Tufts University. Cross posted from Triple Crisis

Just when you thought the unhealthy ties between food, fuel, and financial markets couldn’t get more perverse, we get the announcement that Vitol, the world’s largest independent oil trader, is entering the grain-trading business, hiring a team from Viterra, based in Toronto, to run the show. And lest we toss this off as just another corporate deal, Javier Blas in the Financial Times reminds us that Viterra has itself recently been bought by Glencore, perhaps the world’s greatest global commodity speculator.

What could go wrong?

For the world’s poor, plenty. They’ve already endured three food price spikes in the last six years, fueled in part by financial speculators gambling on agricultural, energy, and metals commodities as they fled the wreckage of the housing and stock market crashes. This corporate deal may not change a thing, but it is a powerful symbol of what’s wrong with our broken food system.

Vitol isn’t alone, of course. Mercuria, another leading energy trader, recently hired commodity traders from Morgan Stanley to build an agriculture portfolio. The connections couldn’t be clearer: energy trader hires investment bank to get it into agricultural commodities. According to Blas, the moves reflect declining profitability in energy. Why? Too little volatility. Remember, the traders are speculating, not investing. They need large and frequent price movements to make money. And if there’s one thing agricultural commodities markets are, it’s bullish on volatility.

Blas points out that the extension into agricultural markets is a natural because it can “allow oil traders to profit from the link between gasoline and diesel and the biofuel market.” And who wouldn’t want oil traders, whose interest is making money trading on vast energy markets, to use their insider knowledge to make money from movements on agricultural commodities markets, when in fact oil price movements are one of the main drivers of agricultural futures prices?

As a recent Oxfam report documents, the links go the other way as well, with the Big Four grains traders –Archer Daniels Midland (ADM), Bunge, Cargill and Louis Dreyfus, known collectively as ABCD – heavily invested in financial trading in the very commodities over which they have a high degree of control.

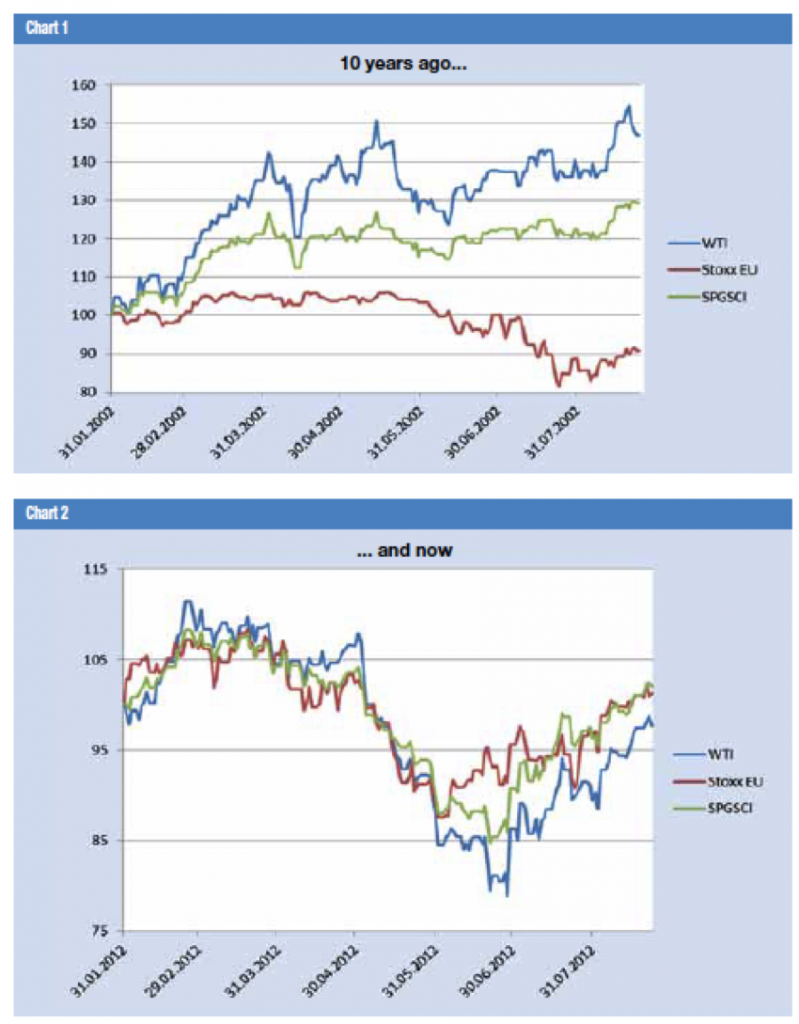

UNCTAD brought home these perverse connections in a short policy brief last year. They offered two telling graphs that compared price movements of the stock market (red), oil prices (green) and commodity prices (blue) in the first eight months of 2002 and 2012. (Forgive the resolution; they are clearer in the UNCTAD brief.)

In 2002, before the rise of biofuels and before deregulated financial markets had gone full-in on commodities, price movements were largely independent of one another. Particularly notable is the opposite movement of the stock market from oil and from the broader commodity index, the very relationship that led portfolio managers to recommend commodity investments as a hedge against stock market losses.

In 2012 that hedge was a fiction, though still a profitable one for traders who get paid partly by the trade. As the graph shows, co-movement is nearly complete. Co-movement suggests that supply and demand fundamentals in oil and broader commodities markets, which are indeed independent of one another, no longer determine price. UNCTAD attributes this to “herding behavior” among financial investors still flush with speculative capital in search of quick returns.

UNCTAD’s conclusions: “Because of these distortions, commodity prices in financialized markets do not provide correct signals about the relative scarcity of commodities. This impairs the allocation of resources and has negative effects on the real economy. To restore the proper functioning of commodity markets, swift political action is required on a global scale.”

It hasn’t happened yet, as the financial industry uses the profits from trading to weaken regulations and tie them up in court, a battle that is still going on in the United States.

Why does this matter? Because what happens on international commodity markets does not stay on commodity markets. It ripples out through an increasingly interconnected world. Large international price movements, which may or may not be driven by supply and demand fundamentals in those particular markets, drive commodities prices all over the world. Price transmission is by no means immediate nor complete; local conditions and weak integration with global markets still have an impact on local price movements. But global price volatility is highly contagious.

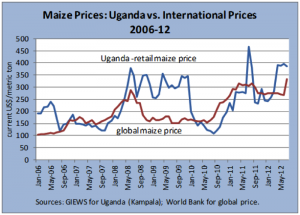

Consider Uganda, a net exporter of maize. As the graph below shows, maize price spikes transmitted to local retail markets, with a short lag. High demand from Kenya, in response to high global prices, contributed to price transmission. Not atypically, the high prices were “sticky,” holding on despite declining global prices. This is often an indicator of the market power of local traders, who can extend scarcity-prices by inducing continued scarcity.

The food security impacts? An estimated 65% of Ugandans’ cash income is used for the purchase of food, and the urban poor are most dependent on purchased maize, which gives them 20% of their calories. With the price spikes, the poor get poorer. (See my report.)

Energy traders hiring Wall Street firms to get them into agricultural commodities is truly the least of our problems when it comes to the unhealthy links between food, fuel and financial markets. But it is yet another powerful symbol.

More important is getting Wall Street to stop gambling on food, and getting food out of our gas tanks.

The global oligarchy, i.e., finance, corporations and politicians, are so immersed in their own superiority and infinite wisdom that they now propose to financialize what little remains of the global economy, namely foodstuffs.

It would seem our Masters require a lesson in history once more, particularly in terms of their own infallibility, suffice to say, when daily foodstuffs become all but unobtainable to the poor due to excessive costs, revolution is not far behind, one only has to look at the origins of the French Revolution or Arab Spring this century to understand this link.

Whilst most in the West, with the honourable exception of Greece & Spain, have been most quiet in terms of revolting, hunger may do what all the other daily assaults on our lives have failed to do, namely; incite the masses – perhaps this is why the US has stockpiled millions of ‘dumb dumb’ bullets, unlike counterparts in most EU nations – still its frightening to think what could happen and this could finally be the last straw that breaks the canals back of neoliberalism globally?

The most important variable for the survival of a system is energy and as it increases in complexity it becomes less efficient energetically.

Countries will never cut their energy consumption unless all the other ones do also. This will happen when pigs fly!

Therefore, we can predict that an increasing percentage of the workforce will be directed into energy producing industries at the exact same time we need to increase services in the energy consuming ones (health care).

As the system implodes, the focus will be on essentials: energy, resources, food.

And energetically speaking, some countries will have everything to gain by having an increasing number of countries suffer the same fate as Greece so they can keep as much energy as they can for themselves.

Do we need to name those countries?

As the system implodes, the focus will be on essentials: energy, resources, food.

———

Those with huge energetic appetites will put even more energy into securing more energy.

This means the US has a lot to gain by putting energy into maintaining its military and seeing many more countries collapse.

GROW YOUR OWN FOOD.

The Anglo-Saxon economic model is based on growth and a total disregard for the energetic potential of the land that is been occupied.

When England reached its limit, it colonized so it could bring home the missing resources and energy.

Now that this model has been applied to the planet, the countries with the resources will get plundered while the ones with the added value will do everything in their power to control those resources.

Those who control these resources will make sure to get hundreds of millions so they can buy their own private island and move out when the land has been raped and no further gains can be had.

Asking for world peace is like expecting a lion to become a vegetarian.

Moneta says:

The plight for the plundered countries is called the “resource curse,” which Michael Parenti describes here:

Never mentioned, of course, are the millions upon millions of people that the imperialists — and Parenti singles out the UK and the US in this regard — kill in their insatiable quest for resources.

Most Americans, and the MMT crowd seems to be especially prone to this blinkerdness, are completely blind to this use of the state’s instruments of violence — it’s miliatry and police — for genocide and mass murder, or what existence is like under US dominion. To wit, notice Dan Kervick’s comments to this post yesterday:

“The tendency has been, insofar as this is possible,” James Baldwin wrote in The Fire Next Time, “to dismiss white people as the slightly mad victims of their own brainwashing.”

To be fair, Mexico, for all our faults (Ill be the first to say we have more than our fair share unfortunatly -_-), Marxists such as myself have always been very good at talking about Imperialism, whereas the MMT crowd and other leftist crowds sort of just regard imperialism with passing interest, almost assuming its a coincidence and not directly caused by the economic realities of the world.

My own ideas are heavily influenced by the Marxists, them and the anarchists and world systems theorists.

What gives the dollar value in international markets is, in my opinion, due to three types of US might: military, industrial and financial.

But the question I find myself asking is this: What is it that the MMTers find so objectionable to the notion that much of the value of the dollar is due to the way the US goes around the world, whipping up on and plundering other nations and peoples?

I think a lot of Americans have a good heart. They want to believe in world peace and that if everyone did like them, they’d be able to consume as much. Canadians are like that also and they consume even more energy per capita.

For me, the proof is in the large number of people with a huge ecological footprint who want the military to get shrunk so America can spend on other energy consuming projects as if that will solve the country’s economic problems.

Most Westerners don’t seem to realize or accept that we are plundering the world to live the way we do.

I was in a board meeting a few years ago and used the word exploitation in the same sentence as China and India. One person flipped. According to his worldview, the Chinese were happy (his words!) to work for peanuts because we were giving them the opportunity to get out of poverty.

I basically see 2 scenarios ahead of us:

1. Western wealth gets redistributed globally and we end up with a small rich elite and a lost middle class.

2. The US and a few well positioned countries manage to collapse many more countries in order to secure oil supply for a few more decades. Of course, this would lead them to place dictators in those collapsed countries to make sure the population does not get to consume too much energy.

Very heavy on “MMTers,” very light on actual citation. Lot of that going around.

Wow, I didnt see those Kervick comments before. Sort of insane. Its almost like victim blaming.

The main problem is that Fractional Reserve Banking is not viable anymore due no economic growth not even in its post war form with large doses of keynsian stimuluses (read debt jublee).

Distribution of money via salary/wages is very dependent on money creation via FRB. Less FRB = Less Total Wages in the Economy.

More at:

http://aquinums-razor.blogspot.com/2013/02/the-banking-system-and-economic-growth.html

Mansoor H. Khan

If you watched the CNBC shows such as Fast Money, etc. from 2008 onward during our economic heart attack, you will recall that betting (speculating) on commodities was the safe “play” to guarantee future revenues: food, fuel, finance. Inflation is not some mystery event. It’s speculation, controlling supply against NEED (demand). It’s exploitation of the poor to make your nut.

During this time, the wonder of playing the BRICs came into being. That was Brazil, Russia, India, China. The rush was on in those regions and they either needed or produced commodities, producing or consuming hand over fist. And then, the BRIC play was over, waiting to be recycled for the next mad rush to the watering hole.

China in particular was in it’s explosive growth phase, Russia producing oil, India – I forget, and Brazil in particular worried me, because everyone knows that cutting down the Amazon to plant agriculture/soybeans (thanks, ADM – Archer Daniels Midland) and decimating swaths of rainforest will not end well for the planet. Brazil has sold out the oxygen supply for the planet, but hey, you gotta make a buck. Brazil banks didn’t do so bad, either if I recall, watching Jim Cramer in Mad Money shill the BRICS.

It comes down to the total speculation and extortion of what should be conserved for human kind, being sold out to make their killing.

Prieur du Plessis (Investment Postcards): there is a lot of truth to the following quote from The Economist (1986):

“The best investors are like socialites. They always know where the next party is going to be held. They arrive early and make sure that they depart well before the end, leaving the mob to swill the last tasteless dregs.”

As someone I know told me, the wealthy really don’t care, as long as they and their children get to sit in first class. I guess they can take an X Prize shuttle to Mars when we have extinguished the earth’s resources. Lest I forget that no doubt, we will figure out how to “fix” the global problem of global warming, extreme weather, food shortages, a barren ocean, etc. with our genius technology. We are gods.

Technology usually finds solutions to the problems that are generated by the increasing complexity of a system.

I’m not convinced technology will solve the issues at the root of the problem.

This article shines a light on a conflict of interest that needs more attention; however, its reliance on spurious correlations and conjecture leaves it short on quality and rigor. Inflation has several different forms, cost push (the cost of oil increases thus increasing the price of everything that uses oil), demand pull (stable supply increasing demand equals higher prices), and monetary inflation (supply and demand remain balanced but monetary policy devalues the currency/measuring stick and increases all prices).

1. Blaming commodity inflation on “speculators” who “control” the underlying commodities is illogical and intellectually dishonest. First, if the companies control the commodities, they aren’t speculating. Second, can we really put all (or even most) of the blame for commodity price inflation on these companies? Central banks are engaged in globally coordinated currency devaluations that massively distort the price of anything priced in dollars? The other-side of MMT (Modern Monetary Theory) endorsed by Bill Black, Krugman, and Bernanke, is inflation. So we should not be surprised by inflation when the Fed is printing $85 billion everyday and handing it to the banks. In this case, it would be the banks speculating, not the “ABCD” companies mentioned above.

2. Central banks are devaluing currencies with the expressed intent of causing inflation and “increasing asset prices”, and market participants are altering their behavior accordingly. With the Dollar, Yen, Euro, etc… under attack, market participants are seeking different stores of value than in periods of stable monetary policy. The recent increase in correlation of financial and commodity markets could just as easily be attributed to the persistence of “extraordinary monetary policy”.

3. Can you really talk about commodity prices over the last few years and ignore the weather? We have had flooding, drought, and embargoed crops, which have clearly impacted the market supply, and thus prices, of various crops.

4. The increase in oil prices is increasing the price of food, because farming in increasingly energy intensive. If I am farming the same amount of land I farmed 10 years ago, it stands to reason that I am using the same amount of fuel for my equipment. With the price of oil and gasoline increasing 200% in that time, it increases the cost of crop production, putting upward pressure on crop prices.

I don’t disagree with the conflict of interest presented by the author, but commodity inflation is a much more intricate, and dynamic, picture than was presented here.

I’ve been telling Yves Smith and her cohorts most of what you wrote for over a year now. My impression initially was that that Naked Capitalism was an economics blog. After viewing the content for while now, I am convinced that it functions in a slightly covert way as a political blog. At worst it is an activist blog whose premise is if we had socialism instead of capitalism we wouldn’t have any problems. Yves hasn’t this said this specifically but she has hinted that may be what she believes. Many of her supporters think that the government can indefinitely print money to create well paying jobs in the social services sector or somehow tax the rich so that everyone can live comfortable middle class lifestyles. Other common beliefs I feel that are repeated on this blog is that everything is Wall Street’s fault, Everyone is a victim, and that deficits don’t matter.This is not to say that the power and reach of financial institutions are not at all time high–but they are at a all-time high because of other deeper problems that most people are uncomfortable talking about.

Please cite to “indefinitely” print money (although I think you mst mean print lots of money really fast, since the Brits just recently psid off the consols (iirc) from the Napoleonic wars a year or ago, and two centuries is pretty “indefinite” ….)

Yes: control of food and fuel is in the hands of Wall Street. You forgot ownership of prime agricultural land and water resources.

The crash-caused deflation in prices, plus the Fed’s free money subsidy, is creating the conditons for an elite takeover of the essential resources for life on earth.

This is no accident.

They will not be happy until they own the air we need to breathe, and sell it back to us by the liter.

Previous cycles of this type of ownership bring to mind fuedal lords and latin american slums.

The US has been here before: and it spawned some great progressive reforms: like unions, and the ag grange/cooperative era, and FRD.

Becuase, when the 1% gains ownership not just over consumer goods and service, but over the basic necessities of life, very bad things happen: https://en.wikipedia.org/wiki/Great_Famine_%28Ireland%29

Reminded me of that Lord Monckton video. Despite his rather more… colorful… delivery I think he was saying the same thing. Perhaps Mr. Wise wishes to avoid direct confrontation with the GW set, but until they acknowledge the destructive aspect of biofuels change won’t gain much traction. Then too there is the USG control of the developing nations via food scarcity.

You can’t blame global warming activism for starvation for God’s sake.

(1) People were starving long before Al Gore got fat and made his movie.

(2) Wall Street controls the ag/food nexus and capital allocation, not climate activists.

(3) We still devote an obscene amount of land to making corn syrup, a fraction of the land used to make soda pop could feed the world.

(4) If we don’t slow warming, even more people will starve than are now.

(5) Food price spikes had little to do with physical supply/demand and everything to do with speculative swings.

While I definitely disagree with Mockton that climate change activists are to blame, and I disagree with him that global climate change is a ‘scam’, there is truly no argument that Biofuels are a waste of both food and fuel, and something of a terribly devastating problem. Biofuels add to the problem rather than reducing it.

Biofuels do not destroy food in the case of corn ethanol it just converts some of the starch to ethanol which is just carbon, hydrogen and oxygen it does not contain extra minerals like iron or magnesium and what is left over from the process is dried distillers grains (a cereal) which makes a excellent high protein animal feed or can even be made into bred so there’s not really much of a loss with biofuels.

http://en.wikipedia.org/wiki/Distillers_grains

One thing I don’t understand is that everybody knows that drinking beer makes people fat and in making ethanol fuel they are just removing the alcohol leaving the rest behind but a lot of people in the media and academics seem to believe that one fools report with his kindergarten level math that it takes more energy to make it than you get out of it which is not the case. All the new ethanol refinery’s use plate heat exchangers and vacuum distillation or membrane separation that uses almost no energy and the refinery’s use the stalk and other leftover parts of the plant to make biogas to run the plant and fertilizer so the process doesn’t even require inputs anymore.

And on top of that the new ethanol plants also produce corn oil that could be used to power the tractors on a farm.

Lordie, do you have THAT wrong.

Ethanol production in the US consumed enough corn in 2009 to feed 330 million people (no typo) for a full year at average daily calorie rates. Taking that much of a staple out of production pressures the entire cereals complex. From a 2011 post:

The United States is the major player in the world corn market providing more than 50% of the world’s corn supply. In excess of 20% of our corn crop had been exported to other countries, but the government ethanol mandates have reduced the amount that is available to export.

This year, the US will harvest approximately 12.5 million bushels of corn. More than 42% will be used to feed livestock in the US, another 40% will be used to produce government mandated ethanol fuel, 2% will be used for food products, and 16% is exported to other countries. Ending stocks are down 963 million bushels from last year. The stocks-to-use ratio is projected at 5.5%, the lowest since 1995/96 when it dropped to 5.0%. As you can see in the chart below, poor developing countries are most dependent on imports of corn from the US. Food as a percentage of income for peasants in developing countries in Africa and Southeast Asia exceeds 50%. When the price of corn rises 75% in one year, poor people starve…The 107 million tons of grain that went to U.S. ethanol distilleries in 2009 was enough to feed 330 million people for one year at average world consumption levels…

The amount of grain needed to fill the tank of an SUV with ethanol just once can feed one person for an entire year. The average income of the owners of the world’s 940 million automobiles is at least ten times larger than that of the world’s 2 billion hungriest people. In the competition between cars and hungry people for the world’s harvest, the car is destined to win. In March 2008, a report commissioned by the Coalition for Balanced Food and Fuel Policy estimated that the bio-fuels mandates passed by Congress cost the U.S. economy more than $100 billion from 2006 to 2009. The report declared that “The policy favoring ethanol and other bio-fuels over food uses of grains and other crops acts as a regressive tax on the poor.” A 2008 Organization for Economic Cooperation and Development (O.E.C.D.) issued its report on bio-fuels that concluded: “Further development and expansion of the bio-fuels sector will contribute to higher food prices over the medium term and to food insecurity for the most vulnerable population groups in developing countries.” These forecasts are coming to fruition today.

http://www.nakedcapitalism.com/2011/01/la-nina-as-black-swan-–-energy-food-prices-and-chinese-economy-among-likely-casualites-2.html

When they use corn to make ethanol they separate the starch first from everything else including the germ and sell that as feed and then they ferment only the starch which makes only alcohol and a cereal called distillers grain it doesn’t make it disappear into thin air there is still food left and lots of it.

http://www.ethanolrfa.org/pages/how-ethanol-is-made (scroll down to wet milling)

Im a home brewing hobbyist to an extent and I can say personally that the food doesn’t just vanish into thin air it gets converted into distillers grains that I either leave in the beer or make bread from it.

And as a side note dried distillers grains doesn’t go bad unlike corn does, it can be stored almost forever without refrigeration.

Hah, Monckton does grate, doesn’t he? But I believe his beef with the activists is that they are mindlessly propagandising just as the Hitler Youth mindlessly propagandised, not that they are actively packing people into gas chambers, so to speak.

His message beyond his roughing up of those kids is that we shouldn’t make fuel out of our food. Do you disagree with that in principle? Setting the issue of climate change aside momentarily, I am appalled at the vast acreage of forests and grasslands that have and are being converted to cornfields for the purposes of biofuel, soda pop, and factory farming. You’ve made your position on soda pop clear; do you think that biofuel is worth the habitat destruction it has caused? If you haven’t asked yourself that yet, you ought to. I for one think there are better alternatives than corn for producing biofuel–algae off the top of my head. I believe Yves has linked to plenty such stories in the past.

Again, do you or do you not think that there are downsides to making biodiesel out of corn? Are you or are you not willing to consider that it might be counterproductive to the aim of reducing environmental impact? My sense is that climate change proponents as a whole are deeply uncomfortable about discussing the current biofuel regime. If they are honest and serious they will face it and ask the hard questions. The regime won’t be broken up until they do.

Monckton is an ass. He is welcome to be offended that he was interupted by slogan-chanting youths, and I am not offended by his Hitler Youth retort.

But I also happen to agree that people with really bad ideas and a big podium should be shouted at and interrupted as rudely as possible by the less powerfull.

I do not happen to be particularly concerned with biofuels one way or the other, there’s enough land and capacity available to feed the world many times over. Any shortfalls are due to other problems besides amount of land under food (or fuel) cultivation.

In my view, the important consideration is not of whatever we use for fuel, but in how we find a way to use LESS of it.

We need to end speculation in all commodities and get back to the days when

only producers and end users were allowed in the markets.

“Catch-22 says they can do anything we can’t stop them from doing.”

Kind of an irony: modern commodity futures markets were originally created in part to protect food producers and goods manufacturers from banks and corporate cabals, by giving them some bilateral pricing power, and predictailty of costs and prices…

Futures markets developed several centuries ago for a reason. They allow producers to hedge their production, so that costs and revenues can be matched up with reasonable certainty and the business will be viable year to year. If there were no futures markets, only large players could participate in production, and prices would be higher because of their monopoly power and because the cash management efficiencies futures markets provide would be gone.

Price discovery is another important function of futures markets. Speculators have their uses.

We have noticed that when we go out to eat at non fast food restaurants that the portions are decreasing. This is probablly due to what is stated in this article.

We fully expect that soon there will be two level of restaurants available……Fast food that is carry out only in which you order and pay for your food by smart phone and pick it up based upon the order number which you key in without human contact…the only work force will be the kitchen staff…there will be no eat-in facilities….

The other will be upscale restaurants where the quality not the price is the only concern.

There won’t even be food preparers. Just a couple robots that pull the celophane off of frozen prepared portions in pre-packaged foam trays and then stick them in the microwave oven.

Maybe the restaurant industry will shrink as more families are forced to live on pea soup.

Repeat after me: THE CFMA MUST DIE!

(um,the Commodities Futures Modernization Act.) Ala ‘Carthage must’ etc.

CFMA DELENDA EST!!!

There, fixed it for you.

It is a sad state of affairs.

Once upon a time, the typical farm raised crops and livestock. Aside from having an “end” product from the animals you could put back on the fields, this diversity provided security. If prices were low, you could feed crops to livestock and hold on until prices rose. Then the government decided to start insisting on specialization. If you raised crops, they needed to be ditch-to-ditch, no fences that alloowed you to glean the fields with livestock. If you raised livestock, it needed to be a big operation that you could never support with the crops you raised. If you didn’t, you couldn’t qualify for financing and support programs.

What was the purpose to all this? I’ll let you draw conclusions based on the results. First, many simply abandoned farming, causing concentration of land in corporate ownership. Second, farms became dependent on outside resources. If they raised livestock, they had to be lots more feed, and they couldn’t hold livestock in poor markets. If they didn’t raise livestock , not only were they at the mercy of the markets, but they had to buy fertilizer (Petroleum-based, I might add.). People were driven off the land in droves, with further corporate concentration of food production.

Production has only become more and more skewed as this process has progressed. Agricultural production is no longer driven by what people want to eat but by what will deliver quarterly returns. We have compacted history so that we have tragedy and farce simultaneously, and the results will not be pretty.

I still own our family farm, which began to be assembled by my great-great-great grandparents in 1822. Up until WW1, the farm was completely self contained. There was surprisingly sophisticated machinery, including a molasses mill and a cotton gin. They made everything but their shoes. Between the wars, there was a movement towards cash crops like peaches (cotton had already been a cash crop) and later, cattle. Also family members started to get jobs or start businesses in town. After WW2, it was all cattle, partly because there was no one to do the farm labor required to grow crops. Southern farm goods couldn’t compete with low priced production from the mid-West, transported on the new Interstate Highway system.

I am nostalgic for the old days of self sufficiency. I wouldn’t know one end of a tractor from another, but the lure of organic farming is strong. We are close enough to big cities for it to make sense as a cash crop, but I’m more concerned about the healthful aspects of eating food that is not over processed and filled with additives.

Land in the boondocks of SC and many other states is cheap. I think one could build a self sufficient life with little debt growing crops and figuring out something to do on the internet. That is if one avoids over-education.

As long as vast swaths of the population are conditioned through formal education and consumer culture to desire to work for someone else, usually large corporations or large governments, instead of being self-employed the problem of resource concentration, and power concentration will remain a problem.

It really doesn’t make a difference whether someone votes for a Republican or a Democrat.

On this topic, I know there was an episode involving a surge in rice prices in the mid-2000s where a US government agency (USAID?) was able to break the back of the speculative bubble by relatively small releases of rice stockpiles. If anyone can refresh my memory on this (ideally with a link to an article) I’d be grateful.

Thanks,

P

Center for Global Development 2008 (6pgs)

http://www.cgdev.org/files/16028_file_Solve_the_Rice_Crisis_UPDATED.pdf