The head of Carrington, which is known as an established distressed debt investor, a servicer that has been a target of litigation, and more recently, an early entrant in the single family home rental business, said this week it was no longer buying houses for lease because dumb money had ruined the market. From Bloomberg:

“We just don’t see the returns there that are adequate to incentivize us to continue to invest,” Rose, 55, chief executive officer of Carrington Holding Co. LLC, said in an interview at his Aliso Viejo, California office. “There’s a lot of — bluntly — stupid money that jumped into the trade without any infrastructure, without any real capabilities and a kind of build-it-as-you-go mentality that we think is somewhat irresponsible.”

The degree to which the housing “recovery” has been driven by speculators isn’t fully appreciated. Reuters tried to pin down a number, but they apparently did it by identifying specific private equity firms and tying them to purchases. They came up with “at least 10%” in Las Vegas, suggesting that was representative for the most distressed markets.

But while it’s hard to get good data in such a fragmented field, that estimate is likely to be markedly too low. Some sources have said that cash buyers have accounted for as much as 50% of the activity in the hottest states, and those would also have a bigger impact in the national estimates of home price appreciation.

Why are these investors so hard to identify? Many are newbies. One colleague reports that he knows roughly 15 newly minted real estate mini-moguls. They might have had some cash from a previous life on Wall Street, and raised a bit more initial dough from well-heeled friends. But most after buying a few houses then raised money overseas, mainly from the Middle East and China. They may call themselves hedge funds as a way of glamorizing their strategy and justifying asking for hedgie-type fee structures, but it’s more accurate to simply call them investors.

A tally by lawyer and foreclosure fraud investigator Lynn Szymoniak illustrates how the players in her backyard, Palm Beach County, are mainly buyers you’ve never heard of, as opposed to the big PE firms, but upon further digging, a different picture emerges. Her comment via e-mail:

I’ve been researching who is buying up properties from Fannie, Freddie, HUD and the big trustee banks.

You can do this easily enough by searching Deeds filed in 2013, by county.

The systems will provide an alpha list of purchasers from any single seller.

Once you get the name of the purchasers, such as 2012-C Property Holdings, Badger Investments, or THR Florida, LP, then the trick is to find the parent. Many roads seem to lead to Minnetonka, MN.

I like reading the credentials of the management – such as the top officers of Two Harbors Investment Company, a company favored by Deutsche Bank. Interesting to see that experience with a failed mortgage company is touted like a victory of some strange kind.

After you find the names of the most frequent buyers, you can search deeds by that name to see how many properties were acquired by that company by county in the past 18 months.

Two Harbors is buying many Deutsche Bank foreclosed homes through its subsidiary, THR Florida, LP, after Deutsche Bank loaned Two Harbors $600 million in October 2012.

Interesting, too, to compare the sales price to the value of the mortgage on the trust records.

None of this bodes well for any real housing recovery.

The banks are indeed selling a small portion of their stockpile, and these are some of the buyers

in Palm Beach County so far in 2013:Break Point Verde, LLC (3)

Cani Vida Corp. (2)

Dalipa, LLC

Danelia, LLC

Delle Alpi, Corp. (3)

Emerald White York, LLC

Expedits, LLC

Fast Holding I, LLC (2)

Grenoble G & F, LLC

Guamavel, LLC

Javelin Holdings, LLC (2)

Just Makers, LLC

Mafal Corp.

Mapag, LLC

Marsh Harbor Investments, LLC (3)

National Nine, LLC

Shiu, LLC

Sociedad Familiar, LLC

St. Andrews Venture, LLC (2)

Tinfloor

Viento Sur Corp.

View Holdings, LLC

AHE Enterprises, Inc.

AIC, LLC

Altun Real Estate LLC

America On Land, LLC

Beckmann, LLC (2)

Bentley Capital Partners, LLC

BMAN Enterprises, LLC

Cabrera Construction, Inc.

Carmenohio Properties, LLC

Clever House, LLC

Come Home, LLC

EDG 302, LLC

EH Pooled Investments, LP

El Torreon, LLC

First Heritage Holdings, LLC

Florida Rental Specialists, LLC

FTC Group, LLC

GHI Capital, LLC

Golden Arrow Management, LLC

Golden Goose Properties, Inc.

GQ Holdings 1329 LLC

Harvest Residential II, LLC

Honey Dew Cleaning, LLC

Juto Rentals 1, LLC

Kamis Properties, LLC

KG Investments Group, LLC

Letana Delray, LLC

M Y N Investments LLC

Maju Enterprises, LLC

Max Simon Properties, LLC

Palm Beach Financial Solutions, LLC (8)

Park Manor Capital Partners, LLC

Portico Properties, LLC

Pure Properties, LLC

RBD Lending Financial, Inc.

Rebound Residential, LLC

Reliable Housing Management, LLC

Seaward T & X, LLC

Spark Propetries, LLC

Stellar Alon, LLC

Strategic Investor Group, LLC

THR Florida LP (2)

Top Red Business LTD

Tundra Realty, LLC

Via Carbonara, LLC

Walnut Street Capital, LLC

WSC Trust LLC

Zakai, LLC

815 7th Street, LLC

To clarify matters, Minnetonka is the home of Pine River, a hedge fund that also owns a REIT, and I’m told the REIT is likely the buyer of the homes. But REITs are required to pay out most of their cash flow as dividends, which limits how much they can spend on maintaining properties. That means that if the REIT is indeed the buyer, Pine River is probably fixing up the homes before flipping them to the REIT. An awful lot less than arms-length pricing, needless to say.

An additional issue is that if Pine River is indeed buying homes all over Florida, as opposed, say, to concentrating in a few markets, that’s also contrary to what most PE investors consider to be a viable strategy. In the discussions I’ve attended, they stressed that there was a dead zone between four houses and about 200, that you can get economies of scale over that level. And if you are managing 200 or more, they need to be in clumped geographically, say a large grouping on the north side of Atlanta and another on one area of another MSA.

Now I’d anticipate, given the keen interest in Florida, that Szymoniak’s list includes some of the real estate mogul wannabes that my colleague discussed. Given all the press about rentals, most observers would assume that they were playing that game too. But my source with the 15 newbie investors said that was often not the case. He said even with other people’s money in the form of foreign investors, they were also leveraging, just not in the form of a mortgage. Berkshire Hathaway, for instance, is providing warehouse lines, marketing them to people who are over the friends and family level of investing but below $25 million. They are expected to repay in 18 to 24 months.

And what are these investors doing? According to my source, they often aren’t renting but are warehousing the properties, sometimes renovating them (I didn’t nail down whether to flip to a renter or to sell to a buyer) or simply holding them for expected appreciation.

So consider what this means. An unknown but in certain locations, meaningful proportion of homes sold are being warehoused yet again, and will be dribbled out later. This means we have not only servicers keeping homes off the market to keep from depressing prices, but certain investors also contributing to the the perception that inventories are tight by keeping homes unoccupied and off the market.

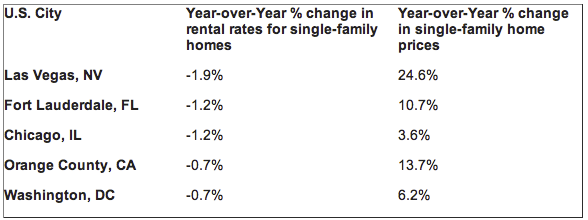

And this strategy is not looking like it will necessarily be a winner. The Bloomberg article reports, as we predicted, that the very act of putting more rental homes on the market has lowered rental rates. And rents are falling before PE investors are showing a profit. Now they may argue that they will, but at this point, it’s what the Japanese call “seller talk”. The big PE rental empire builders have yet to reach “stabilized yields” where they’ve got their portfolios leased up and can say based on experience what typical vacancy costs and maintenance costs are. From the story:

Even as demand for rentals rises amid a falling homeownership rate, yields are declining and companies formed to buy the homes that have gone public haven’t yet been profitable…

Funds are buying property now, including homes sold by Carrington, for rents that yield 6 percent to 8 percent a year, before costs such as insurance, taxes and vacancies, according to Rose. Carrington’s model called for mid-single digit net returns on annual rents on an unlevered basis, according to Rose. While returns would vary by market, they would generally be in the mid- to high teens over the duration of the holding period, with the profit from home price appreciation.

This chart from Michael Lombardi, via Testosterone Pit, shows how rent levels are softening:

Mind you, last October, I had institutional investors telling me PE funds who were pitching them were forecasting 5% per annum rental increases. That looked ridiculous to them given stagnant wage growth.

The Bloomberg account makes clear that one of the true believers is PE kahuna Blackstone:

Blackstone Group LP, the largest investor in single-family rentals, has spent $4.5 billion to amass more than 26,000 homes and continues to buy, according to Eric Elder, a spokesman for Invitation Homes, the rental housing division of the world’s largest private equity firm.

“We’re continuing to purchase homes where they fit into our business plan,” Elder said.

Blackstone’s net yields on its occupied houses are about 6 percent to 6.5 percent, Jonathan Gray, the firm’s global head of real estate, said during a May 3 conference call with investors. That’s before using leverage from a $2.1 billion line of credit the private-equity giant arranged in March from a lending syndicate headed by Deutsche Bank AG.

While about 85 percent of Blackstone’s renovated homes were leased, Gray said, “we’ve got an awful lot of homes to continue renovating.”

Sounds like whistling in the dark to me. But Blackstone has a record of continuing to buy at the peak, famously evidenced in the last cycle by buying Equity Office Trust from Sam Zell in February 2007. And that’s not as irrational as it sounds. Blackstone will make money regardless of how its investors do, and it has such an established brand name that it is virtually immune to its own performance (remember how John Meriwether, former head of LTCM, has become a serial fund manager failure yet can still raise money).

Further complicating the picture of a profitable exit is the Fed’s talk of ending QE. Even if the central bank has overestimated the pace of “recovery”, the mere talk of ending QE has put the mortgage market in a swoon. Fixed-rate mortgages reached their highest interest rate in a year last week and with the increase in Treasury yields this week, are almost certainly higher. This might complicate their plans to have homebuyers take them out. Even if banks loosen underwriting standard (which are tight right now), it won’t take all that much in the way of mortgage rate increases to reduce affordability (the PE funds are more likely to exit via selling the operating company that owns and manages the rentals in an IPO, but the experts thought you needed 1000 homes or so for that to be attractive, which is well beyond the scale of the small fry).

Many of these players have a had a great ride being long real estate in many forms over the last few year. How well the market fares when they choose to cash in their chips is very much an open question. I would not want to be on the other side of their trade.

Great piece! I laugh every time I hear our local real estate board trumpeting the horn about surging sales and home prices, while conveniently omitting the tidbit about all of the out-of-town investor purchasers.

Ditto on that “great piece” comment!

Reminds me of when I was explaining the tax returns of the Starr Foundation (purportedly among the top five foundations in America by wealth?) some years back, as to how they were making “foreign donations” to promote the original and continued offshoring of American jobs to China and India.

Not surprised the Blackstone Group is involved. Even after everything Peterson has done while there (buying then shutting down those refineries to help drive up the price of oil, cornering the [useless and worthless] anthrax vaccine market after the anthrax attacks in the 00s, endless destructive leveraged buyouts of telecoms, real estate, private clinics and retirement homes and perhaps the most egregious to those of us ginger beer lovers, doing and LBO on Cabury Schweppes, then shutting down their Schweppes Ginger Beer line [the finest ginger beer ever made!!!!!]). And, of course, taking Blackstone Group public, after buying up the requisite congressional critters, to make sure they could still pay the same capital gains tax rate, even though they should now be paying the corporate tax rate.

Why are Americans so gullible today? Could it be from being raised on Sesame Street viewing? And who financed and produced that show: Peter G. Peterson and his wife, that’s who!

(we’re goin back to ashes…mark my southern word)

Collectively, firms like Colony, Waypoint, Blackstone Group LP, Silver Bay Realty, Sylvan Road Capital, and others are trying to drive at least a short-term economic recovery in an effort to capitalize on a steady and growing demand for rentals. Prices of distressed properties have already started to increase faster than anticipated, thanks in part to heavy buying at county foreclosure auctions around metro Atlanta. There are signs some firms plan to speed up purchases before rising prices cut into profits.

Blackstone Group, the largest private investor in real estate in the United States since the start of the recession in 2008, has ramped up purchases of homes to turn into rentals. The company owns 16,000 homes around the country, and spent more than $1 billion in 2012 alone to pad its inventory. It’s currently seeking to double its line of credit from $600 million to $1.2 billion to help with purchases this year, according to Bloomberg.

&

“One of the big questions is whether the kind of stabilization in prices we’re seeing, which in general is a good thing, is sustainable over time,” says Dan Immergluck, a professor at Georgia Tech’s School of City and Regional Planning and author of 2009’s FORECLOSED: High-Risk Lending, Deregulation, and the Undermining of America’s Mortgage Market.

“Another big question is what they do with properties that don’t turn out to be profitable,” Immergluck says. “If they see them as not profitable, they’re less likely to keep them up, and they’ll start minimizing investment in them, and then that could cause spillover problems.”

(fuck…a spill over, ?really? dumperDan)

http://clatl.com/atlanta/big-business-bets-billions-on-atlantas-housing-recovery/Content?oid=7372353&showFullText=true

I am a small investor. I buy based on a cap rate of 7-8% and typically use 35% of expected rental income for expenses. I don’t use a expected rental rates increase variable. I do pay cash. I am not leveraged. I take care of my properties and am 100% occupied with a waiting list. I am very picky about where my properties are located.

I don’t typically buy bank owned properties because the price they want to sell their properties for is too high.

In the past 18 month or so big dogs have come into my little market throwing money around (which isn’t their money) with big excel sheet in the sky business plans. Its made it hard to find properties which meet my requirements.

However … I expect that over the next few years these guys will fail.

Agree with you completely. It’s one thing to play with other people’s money, quite another when it’s your own skin in the game. Rest assured, these clowns will be screaming for a bailout when their VaR models blow up in their faces.

I smell HUD and subsidized house rents. Nice big McMansions in the outer ring of suburbs and exurbs.

It will benefit everybody:

*McDonald’s and WalMart workers will finally have the new American Dream

*The Auto Companies because they’ll definitely need new rides

*Oil Companies because they’ll be selling more gas

*Construction because once a govt program is started that’s it…it never ends

This is win, win, win for everyone. Now, how do we sell it overseas???

A lot of these players will fail but they don’t care because they probably set up their business in a way where they funnel millions out for their own personal use and put the debt in the structure that goes under.

They are doing just that. Their local front guys are charging big time management fees. The investors … whomever they are … will be holding a bag of odiferous material.

But … but … Bernanke said we could use 2% compounding inflation in our models. They’ll be shocked to learn that blood from turnips and shoddy construction isn’t a money maker

fools.

‘Excel sheet in the sky’ – so stealing that. LOL

Well, look at the bright side. A least somebody is saving many neighborhoods (for the time being) from blight by being the only people to actually care about these homes and tend to them. Without the air conditioning humming along, homes in Florida have a short life.

On the gloomy side, maybe we are propping up a high energy way of life which is stopping us from creating sustainable neighborhoods.

I don’t know where you are, I see rot, holes in roofs and this is in the middle of a wealthy metro area. Which means, banks know most people aren’t interested in renting them. Curiously, Banks acted like violent sociopaths unwilling to work out any kind of deal with their predatory lending victims, a redline of sorts to protect the wealthy. Hell, they drop bombs in other countries, and as they’ll always remind us, it’s not that bad here. You’re not actually on a chain gang, etc.

The very same somebodies who were behind the global economic meltdown, and profited so greatly from it!

Not an acceptable comment, sorry chum!

Where did the fraudclosure model originate: JPMorgan Chase, just as the Credit Default Swap, those carbon derivatives, and the Glass-Steagall: Overdue for Repeal report originated.

And who profits from national food stamp explosion? JPMorgan Chase, of course!

Here in Canada we are living the US 2005-2006.

While at the peak, we are already witnessing “des economies de bouts de chandelles”. A translation would be frugality through the use of old candle stubs.

In the burbs, when redoing the curbs and sidewalks, they will redo 90% but keep the “still good enough” in place. I am seeing this in Ottawa and saw this in Montreal 5 years ago and it looks awful, especially on a road of McMansions valued over 500K! If this is the best they can do in a market peak, I can only imagine in a trough!

But for some reason, no one seems to notice the disconnect.

Despite the out of control dandelions due to a pesticide ban, the suburban neighborhoods are still getting built around outdated 1950s ideals… better living through chemistry.

It’s unsustainable. Yet something tells me our market will drop and just like in the US, there will emerge a big group of vultures. But maybe, here in Canada, the vulture will be CMHC which will conveniently get privatized after the bust but just in time to become a rentier.

Moneta, when you make comparisons with what went on in the US during 2005-6, you really have to talk about sub-prime mortgages, toxic securitizations that were fraudulently labelled AAA and CDOs and CDSs. I am not aware that these activities are taking place in Canada at the moment. Harper did for awhile begin deregulating the housing market by increasing mortgages to 40 years and by losening buyer requirements but these new rules have since been rescinded.

Mind you, it is worthwhile keeping an eye on the high salaries of our bankers who now can sell insurance, who are now investment banks and who continue to be commercial banks. The 5 biggest Canadian banks are now described as Too-Big-To-Fail and that is not a good thing. We are also up to our eyeballs in derivatives and that will prove interesting in the future what with the bail-in provisions in the latest omnibus budget which can be used to bail-out Canadian bank failures by using depositor’s money. Canada may flop but it will do so in its own unique way.

Argh, “loosening”

With home ownership at 70% just like the US peak, one has to assume that the total pool of homeowners is of the same quality as that of the US. If not, you are assuming that Canadians are better debtors. I doubt it as our lifestyles are closely tied to the US.

While the average US price revolved around 350K at the peak, ours was still around 175K. Now we are at 350K while the US is back at 2003 levels. And this 350K is even higher when one considers that the Canadian dollar has moved from 63 cents to par during the same time frame.

On the construction front, housing starts peaked at 240K while the US peaked at around 2 million… on a population conversion of 10/1, we could say that Canada has built more houses than the US. The avergae household formation has averaged 175-200K, yet we have been building more than 200K per year for quite a while now. I guess there are a lot of second homes out there that will end up on the market when people realize they can’t maintain more than 1 for too long.

Here in Canada we have bullet loans, so within five years, if rates rise, Cdn homeowners will suffer much more than Americans. Let’s not forget that bullet loans devastaded the US during the great depression and it was one of the reasons why FNM and FRE were founded and started to offer 15-30 year mortgages.

There are some significant differences between Canada and the US for sure. Our cities’ economies are more diversified and benefit from higher concentration so IMO, our burbs will probably fare better than US burbs over time.

I don’t think we have to worry about the titles here in Canada. I’m pretty confident that everyone knows exaclty who owns what. Also, our banks did not slice and dice like the US banks did.

Therefore, our banking system might not be as mismanaged as the US one but they will still go through the wringer as households start defaulting on their debt over the next few years.

75%+ of debt over the last decade has been taken on by 50+ who got house horny or just thought real estate would fund their retirement. But you can’t eat bricks.

2/3 of boomers have less than 100K in liquid assets. And the average retiree is collecting about 500$ in monthly CPP payments and only starts getting his/her 7200$ OAS at 65. So many will have to sell. The writing is on the wall.

So when the bubble bursts it might not be as messy as the US one but it will still cause misery for many Canadians.

And there are as many subprime in Canada than in the US but CMHC was polite and did not call them that.

I have a little experience in property management, I told my sister that I was thinking the banks must need help with all their property, and maybe it might be a good opportunity?

She looked startled, and then told me about a friend who had been doing contract property management for a big bank, for twenty years. Cut the grass, mow the lawn, keep the pipes from freezing, that sort of thing.

The guy charged the bank $40/month for this service, and after twenty years, they quit doing business with him.

You cannot cut the grass, mow the lawn, and keep the pipes from freezing for less than $40/month and make money.

My point?

The big boys are not re-habbing, they’re not even maintaining, they’re playing some sort of short-sighted game as usual, and the result so far seems to be a warped RE market, much like the stock market, dominated by gamers.

Surprise!

You cannot mow a yard and maintain a house for $40 a month.

Try $160 at least during grass growing season.

not to mention an oil flood

Yeah, I remember one of the most shocking bits of information to me from during the housing boom was that despite this unprecedented explosion of money, our housing stock was actually older than ever.

We weren’t actually investing the money in things like repairs and updates and sensible new home construction. So now we have all these older properties in various states of disrepair and newer exurban McMansions worth far less than the phony paper price for which they sold.

Oh hell no. Don’t make the mistake the casino had anything to do with actual housing. I wonder what the future in gambling holds, perhaps we should play more games with public utilities and water, or medicine – keep ’em away, game them, make unaffordable seem normal. While one group profits hand over fist, what’s to stop them?

Of that list, medicine stands out to me. The federal government already spends more than half the dollars in the entire healthcare industry (much more if you count the tax subsidies).

Yet we have huge numbers of people who can’t afford even the most basic and routine care, and we conveniently ignore the bigger picture of health (the intersection of work stress and environmental pollution and healthy food and leisure time for adequate exercise and sleep).

I recently made inquiries about volunteering as a human test subject in an FDA approved clinical drug trial of a product that may, or may not, be effective for a chronic condition from which I suffer. I was shocked to find that test subjects must foot the bill for the cost of the drug, about $20K per year. Silly me, still naive after all these years.

Drug: Ampligen

Manufacturer: Hemispherx (HEB)

Condition: Chronic Fatigue Syndrome/Myalgic Encephalomyelitis

Don’t make the mistake the casino had anything to do with actual housing.

And pleae, Mochafrappe, don’t make the mistake that this entire housing thing was really the cause of the global meltdown and frozen LIBOR rates, that was due to hundreds of trillions of dollars of unregulated insurance polices written – – otherwise known as insurance swindles ($2 trillion on $190 billion of Bear Stearns’ external debt with potential payout of $200 trillion, $460 billion worth of CDSes sold by AIG’s Financial Products, with the potential payout of from $20 trillion to over $40 trillion, and many, many more we are ignorant of due to the purposely opaque nature of the CDS market, thanks to that Commodity Futures Modernization Act); when the banksters realized simultaneously that they were all involved in the same insurance swindles, but nobody was keeping track of who was screwing whom, then the LIBOR rates immediately froze!

If I had to guess, I’d guess that part of the business model is to extract the repairs from the renters’ deposits, and use mandatory arbitration clauses in the leases to ensure a friendly forum.

The idea would be to hide the damage, then refuse to pay for upkeep (by claiming the tenants caused the damage), and then suing the tenants for the losses. This would be done by the management company, who would milk the company holding title to the property for big management fees while also trying to stick the tenants with the deferred maintenance-related costs.

The folks running the management companies, like the loan servicing companies, will be making the money.

Ooooooh….. I think you got it.

Related: http://www.nakedcapitalism.com/2013/05/private-equity-residential-landlords-rushing-to-cash-out-via-ipos.html

Making money off rentals through price appreciation? Good luck! Who is going to buy them, renters making $25K a year?

Oh that’s right, the government. Fortunately, corporate welfare doesn’t cause inflation. It only causes prices to be higher than they otherwise would be…

A lot of these investors are not looking for price appreciation or increasing rental rates.

The marketing material might say revenue through rental increases and cap gains but their goal is to get access to easy money so they can funnel millions for their personal use.

the largesse of the Obama administration for his bffs, like Mitt, makes sense

It’s really fascinating contrasting this piece with the Steve Keen piece about QE irrelevance. The ‘dumb money’ ruining the housing market, underneath it all, is the USFG. Private gain, public pain.

It’s quite the exercise to imagine what would happen if the Fed sold its holdings (or even just stopped buying new securities).

Right, skyrocketing house prices (36% in Phoenix last year) are a striking example of the impact of “Fed” money printing, as is the stock market, which the “Fed” is buying directly.

Here in San Diego, all the buyers I have competed with are Chinese. They pay cash, and I am told this is black money trying to leave China so ROI is not their main concern.

There is no way I can compete with that.

NAR has been granted a special exception by Congress from money-laundering statutes. It’s basically an open invitation for Chinese politicos, Russian oligarchs, and international narco-lords to wash their loot in US real estate. The law-breaking at the top is breathtaking, the worst of it under the Obama regime.

http://www.zerohedge.com/news/2012-09-30/money-laundering-driven-real-estate-boom-ending

First response went into moderation probably due to ZH link.

NAR was granted a special exception by Congress from money-laundering statutes, which is basically an open invitation for Chinese politicos, Russian oligarchs, and international narco-lords to wash their loot in US real estate. Indeed, it’s hard to compete with the criminal elite.

To be more specific, tyaresun, those are EB5s you are competing with:

http://www.eb5vermont.com/eb-5-visas/

http://www.miamitodaynews.com/news/130425/story4.shtml

(Ignore that part about creating jobs for American workers – – that’s a bunch of malarky!)

http://www.visaeb-5.com/

http://www.eb5-investor-visa.com/

And in some Bank attacked neighborhoods, no one is renting, and houses are sitting vacant. While foreclosure was necessary to score the payout, where are those victims who could in fact still make a mortgage payment, lining up to get screwed again? This is finance in a nutshell, blight the neighborhood, play keep away from people who need housing, qualify the behavior with thoughtful data driven anaylsis like it’s a highly regarded business model, one that represents the worst of human behavior. Face it, you can’t generally make money without f$%king someone else, as much as you obscure and rationalize it away.

Renting a SFH, in case anyone is confused, can be as bad as a form of imprisonment.

I read the article and the comments…still don’t get it. So they kicked out the homeowner, now they can’t rent the house, sell the house or maintain the house. What is the plan?

Well it was interesting to see Bloomberg quote Lynn Szymoniak. Nice. The plan is probably what the Fed plans to do once it has aspirated all the bad MBS and needs to keep them sanitized. Like Deutschebank, they’ll “privatize” and in order to make it all run smoothly they will also fund their own title insurance company. Problem solved, because we all know it’s not that antiquated old title that is important, it’s the title insurance. Duh. Maybe calling it Federal Title Co. In order not to implode the illusion of a recovery, the Fed will keep all those MBS on its books until they “mature.” Whatever that will entail is anybody’s guess. But, basically, problem solved even tho’ it really looks like the most vertical of monopolies. Interest rates will stay low. And so will inflation. Because no jobs will be created in this enormous enterprise.

No, no, yours truly quoted Lynn. The post says the stuff from Lynn came via e-mail.

What’s the plan? The homes deterioriate and go ghetto. Taxpayers bail them out and wind up ownining this trash.

I am afraid its a friday afternoon comment from me this time.

A bank underling goes into the Bank CEO’s Office and announces.

Bank Underling : Sorry boss we cannot make any more loans.

Bank CEO : So what, I didn’t know we where still in that business.

Bank Underling : It means you will not get a bonus this year.

Bank CEO : Well you better fix it then or you will be looking for a new job. Whats the problem anyway.

Bank Underling : Well its all the capital tied up in drecky housing that we have misappropriated.

Bank CEO : So why dont we sell it.

Bank Underling : Nobody really wants to buy it and if we sell too much our balance sheet looks rubbish.

Bank CEO : So why did we aquire all this stuff.

Bank Underling : Your bonus comes out of all the fees we have been collecting by messing around with the aquisitions of housing.

Bank CEO : Seems like its time for me to retire and collect as much as I can.

Bank Underling : Well there is an old trick we might apply, that the regulators in this country might turn a blind eye to.

Bank CEO : I dont wont to be involved in lying to Congress again.

Bank Underling : No its perfectly legal, its a derivative of the old off balance sheet trick.

Bank CEO : How does it work.

Bank Underling : Well we have a chat to some of our golf course buddies and talk up housing and get them to buy the houses as rentals.

Bank CEO : Yes but none of them have the money at the moment its all tied up in Gold and Emerging markets.

Bank Underling : Well we could lend them the money.

Bank CEO : Do you think the OCC will notice the risk in the loans.

Bank Underling : Just have a chat with them at the gala lunch and we will set up some obfuscated hedging which does not really work or cost anything.

Bank CEO : What happens when our friends start loosing money and we have to mark down the loans.

Bank Underling : We will be long gone by then relaxing in a sunny hot climate and the clawbacks and punishment are unlikely to amount to much.Most of our friends will have stashed a large slice of the cash offshore for themselves so they will not mind.

Bank CEO : What if the population turn nasty and come after us with pitchforks when the housing market crashes.

Bank Underling : Dont be silly we have greased the path of so many politicians to keep them asleep. Besides who could have known it would turn out badly.

Bank CEO : OK we will give it a try, but dont think you are getting a pay rise. You know how difficult the economy is and I have just ordered some diamond encrusted shoes for my pet rat.

And I bet the rat never sees the gems, either. That was just an end run around the fat wife who will never notice because she has this phobia about rats and thus avoids him.

One confounding variable. The amount of new construction has been extremely low for the past six years – well below population growth. That’s long enough to make up for the overbuilding that occured from roughly 2002-2007.

Sure, household formation can act as a buffer. But seems that insufficient house building should push up rents, house price or both if new housing completions don’t increase.

The 2004-2007 homebuilding was heavily second homes, ~40%.

We’ve had declining average household size for a VERY long time. I’m a skeptic re household formation. Josh Rosner has the data and for a long time it’s been concentrated in the 50+ year old cohorts, basically empter-nester divorce and separations.

We are seeing more extended family living than every due to middle aged unemployment (parents moving back in with kids) and young people moving out later than ever (due to lack of jobs and underemployment of the young, plus opportunism, staying at home to save more and/or pay down debt). We’ve seen some improvement in HH formation in the last six months, but I would not expect a return to historic trends, not even close.

And you get to 2018-2020 and demographics REALLY start to bite. That’s when boomers start downsizing in retirement and dying and moving into nursing homes or independent living. The echo boom isn’t big enough to offset that

Do you think we’ll see a replay of the 30-40s where all those big Victorian homes were divided-up and turned into apartments/boarding houses, only this time involving Mc-Mansions in suburbia?

I have a hard time looking at those vast Mc-Mansion developements and not seeing future slums.

Yves, I very much agree with the importance of the observation that household formation has been decreasing for a long time.

But it makes me uncomfortable that you seem to buy at least somewhat into the establishment meme that there are legitimate reasons for that happening, as you say opportunism or the echo boom being smaller than the baby boom.

I would push back strongly against that notion. The one and only reason is wage stagnation – the theft of productive output by the predator class. Younger Gen Xers and Millennials are not of the desire to move back in to the parents’ basement; there is no opportunism or whatever. It is almost universally an act of desperation. Millions of unrelated young adults live together as one of the coping mechanisms for dealing with high prices that allows one to not move back home. And the Millennial generation is actually larger than the Baby Boom generation in terms of current US population, if one defines Boomers from the mid 40s to mid 60s and Millennials from the 1980s to the end of the millennium. The median age in the United States, despite all the corporate commentary about an aging population and unskilled workers and all that kind of nonsense, is under 40 (roughly 37 – people born after 1975!). Over a quarter of the US population is under 20.

The return to multigenerational households is one of the starkest markers of the long-term decline in living standards of the general population, and it’s a decline that has been hitting younger people earliest and hardest (because existing workers, in aggregate, have largely kept their living standards – attrition has been the primary method of decline). Pew did a good look at generational differences in wealth a couple years ago.

http://www.pewsocialtrends.org/2011/11/07/the-rising-age-gap-in-economic-well-being/

The challenge isn’t that there aren’t enough young people. The challenge is that young people are paid significantly less compensation than Baby Boomers.

P.S., this is part of what is so mind-boggling about people who see no inflation in the US. That kind of mindset can only come from within an enclosed sphere of affluence that is structured purposefully to ignore what is going on in broader society.

The real estate term is “bleeding”. Absentee owners take the rent, but never make the repairs. We had bled-out ghettos of degraded properties that became so crime-infested they were torn down, but never replaced with affordable housing. The Wall Street crime-wave used fraud and a pass-thru scheme with investors still trying to get into criminal court. In Sacramento Blackstone spent $200 million on mostly empty new subdivisions. We have a corridor of over-built hotels that remain mostly empty 30 years later. We have commercial buildings without tenants. We had high tech during the 90’s, but they moved overseas with only a few smaller operations still open. Empty overbuilt buildings and homes are a history of the past 40 years. What we need are jobs, but no hope in sight.

When the world is awash in trillions of dollars of liquidity all crowding after returns, isn’t almost all of it “dumb” by default?

Exactly!

When there are no ‘good’ investments, (read sure-thing 25% returns) and too much money just piling up, they just start throwing it at anything they can game.

To much virtual capital, you mean?

No I mean real money, cash.

Investors sitting on cash they are too smart to put in the stock market because they know the game is rigged.(85% of the market is HFTs screwing big investors and each other)

They feel stupid letting it sit, so they convince themselves that there must be something else they can do.

I have no idea why they think real estate is safer at the moment.

The dumb money were the investors who bought the homes from the banks in the first place. Those banks had $Trillions in losses they were looking for someone to share with them.

Association with any banking establishment == nose dive into the abyss.

“Two Harbors is buying many Deutsche Bank foreclosed homes through its subsidiary, THR Florida, LP, after Deutsche Bank loaned Two Harbors $600 million in October 2012.”

Isn’t this Enron like accounting? I lend you money so you can buy my money losing asset. My balance sheet looks better and you can run off with the money when it falls apart.

Of course, and don’t forget that JP Morgan Chase colluded with Enron and hid their loans (several billion dollars worth) as commodity trades!

it is a simple commodity play. In Florida around 2004-05 there were articles regarding the shortage of “low income housing” (which in Florida means cops, teachers, firefighters, etc) and the fact these young families could not afford the 2 – 3 bedroom houses selling for around $300,000.00 at that time. Now, those same houses are under $100,000.00 and these same low income families can afford them. In fact they are paying more in rent. They could raise children, improve the neighborhood, etc. but, they can not get a mortgage.

Well these investors, “middlemen” will fix that. Soon the interest rates will go up (making banks happy), the prices on houses will go up and the investors will facilitate (lobby) to help these young, new aspiring home owners get THE AMERICAN DREAM and the profit will be realized.

Can we eliminate the middleman? Yes, but it would take an act of Congress. Good luck with that.

Hmmmm…and Duestch just voluntarily dismissed most of their Florida Foreclosures…

And lest we forget the actually prosecutable crooks:

Northern California Real Estate Investor Agrees to Plead Guilty to Bid Rigging at Public Foreclosure Auctions

http://www.fbi.gov/sanfrancisco/press-releases/2013/northern-california-real-estate-investor-agrees-to-plead-guilty-to-bid-rigging-at-public-foreclosure-auctions-1

Out of curiosity, I attended a foreclosure auction that was being conducted on the back steps of city hall in Oakland, CA. There were maybe two dozen bidders there, who appeared to be well known to one another, and properties were indeed being snapped up on single bids by one and then another as if by prior agreement. I started asking questions of those conducting the auction and participants. I was met with blank, unresponsive stares, physically blocked from approaching the podium and in one case subjected to a thinly veiled threat in the form of a suggestion that I was somehow in the wrong place at the wrong time, which of course I wasn’t.

Read up on the 2005-06 fiasco bidding process between Vail Ski Co. and Talisker Development to buy American Ski Co assets at The Canyons Resort in Utah. Vail submitted the low bid but somebody (no proof of just who did it) slipped the bid to Talisker. A big lawsuit ensued. Talisker won! Now it’s finally resolved as the land development company doesn’t really want to mess with running a real business and has sold its ski concession to Vail. What a bunch of cut throats.

We now need a new definition of “dumb money”. After the subprime disaster, dumb money is following the hedgies’ blood-from-turnips scheme. Much worse is anyone buying an IPO or REIT from the “smart money” trying to exit early. That’s not just dumb, but brainless, dim-witted, and probably quite insane. These exiting hedgies will likely bet against their own dreck as CDS. What a con.

There is probably no more rigged market now than housing, although the “Fed” directly buying the stock market qualify. If Phoenix is any gauge, the 10% investor house sales in Vegas are grossly underestimated. From AZcentral.com, “[i]nvestors have purchased more than 30 percent of all single-family houses and condominiums sold this year [Phoenix 2012] . . .” And many of those investors (18% by one estimate) are foreign buyers seeking safety and laundering money via the special exception specifically granted to NAR by Congress. Inventory is a fraction of ‘09’s and yet more than 15% houses are sitting vacant in Phoenix, 1 in 7 houses, most of it held off the market as ghost inventory (foreclosure stuffing) parked at the “Fed” at fantasy values. It’s a strange market, up 36% in one year with investor flipping back to 2005 levels. It’s déjà vu all over again, determined to test Einstein’s definition of insanity. It cannot end well.

I have a hunch that some thing very opaque and dark is going on, which if it turns out to be true, would be a death-knell for this economy. Yet, Home Depot sales are high and bursting; and (I did not know this) their stock is around $80 or something which came as a surprise to me: the last time I looked it was around $30! I wonder if that is the reason why Fed-Chief Bernanke it is rumored, wants to exit after winning the Nobel this winter.

I talked to a builder’s rep near UC-Davis and she was extremely arrogant and couldn’t care-less if I was or not interested in buying. California is ablaze with high prices far in excess of earning capacity and I believe when the next big wave comes these ameteur surfers will get wiped out. My gut feeling tells me that something is very fishy and there is nothing really exciting in the technology pipeline which might be the engine to new growth. This blog shares the same opinion. But hey, we are all human and I have made my share of mistakes before.

I have a hunch though that this is going to be a slow and grudging recovery and it just might pull through for the next 4 to 5 years. This is a country of optimists, salesmen and hucksters. The merry-go-round will probably go on till the music stops in 1916 just before the presidential elctions just like the last days of Clinton-Gore.

We have Plan B in Britain, which seems to be to repeat the ‘triumph’ of the US system, combined with a bail out from our chancellor from his fees on return to the stage with Black Sabbath. Or am I confused again?

I suspect the real Plan B is the City of London Corporation’s ultra-rehypothecation plan?

Florida is one of the worst rental markets in the country. Tenants will steal the toilets and bathtubs from under your nose if you don’t watch them like a hawk. This is the fraud capital of the world. Anyone ever see Pacific Heights? I hope Blackstone gets their scam back in spades.

REITs have to distribute 90% of their taxable income, not cash flow.

http://en.wikipedia.org/wiki/REIT