Yves here. I don’t want to be withholding good news when there is good news to be had. But remember, the ISM results for Europe are just over 50, which is the difference between growth and contraction. So in this context, “good news,” given how high unemployment is in the Eurozone periphery, is sort of like “the vital signs are improving enough that the patient might be able to leave intensive care and go into a regular hospital room.”

By Delusional Economics, who is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness

Some more good news from the Eurozone, and in fact broader Europe, overnight with the release of the manufacturing PMI data.

Eurozone manufacturing returns to growth at start of third quarter

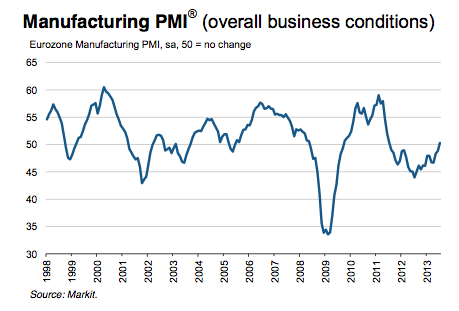

• Final Eurozone Manufacturing PMI at two-year high of 50.3 in July (flash: 50.1)

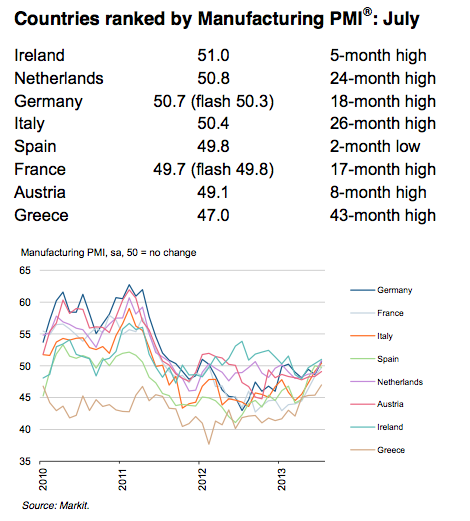

• PMIs rise in all nations except Spain

• Price pressures remain on the downside, as input costs and output prices fall furtherJuly PMI data signalled a welcome return to growth for the Eurozone manufacturing sector. Production and new orders both increased at the fastest rates since mid-2011, as new export business expanded and a number of domestic markets moved closer to stabilisation

Eurozone manufacturing production rose for the first time since February 2012, underpinned by the first growth in new order volumes for over two years. New export orders also posted a slight increase following June’s marginal decline.

By country, Germany recorded the strongest output growth in July, mainly due to improving domestic demand as new export orders declined (albeit at a slower pace). Production increased further in Italy, the Netherlands and Ireland, and returned to growth in France and Austria. Unlike Germany, the expansions in these nations were generally led by solid increases in new export business.

Greece remained the worst performer overall, recording the steepest reductions in output, new orders and new exports of all the nations covered by the surveys. Spain was the only nation to report a faster rate of contraction in output.

Job losses were recorded at eurozone manufacturers for the eighteenth month running in July, although the rate of reduction was the weakest during that period. Meanwhile, backlogs of work fell at the slowest pace in over two years.

Comments from Markit’s economists are more up-beat than they have been for some time, but there is still caution to be had on the back of unemployment.

Eurozone manufacturing made a positive start to the third quarter, with welcome signs of growth returning to the sector. The PMI rose to a two-year high, as rising export demand and stabilising domestic markets took growth of new orders and output to rates, albeit still modest, last scaled in mid-2011. This hopefully places the sector nicely to provide a positive spur to the third quarter GDP numbers and help the euro area exit recession.

Manufacturing output rose again in Germany, Italy, the Netherlands and Ireland during July, while there were welcome returns to growth for France and Austria. The breadth of the expansion will hopefully aid in its sustainability. Even the downturn in Greece showed signs of easing, while Spain saw its second-weakest contraction for over two years.

The bugbear of eurozone manufacturing remains its lacklustre labour market, which contributes to the persistent joblessness of the region as a whole. Even here there were tentative signs of recovery, with the rate of manufacturing job losses easing to a one-and-a-half year low. Meanwhile, falling commodity prices and intense competition are still keeping inflationary pressures in the sector at bay and posing no real issues for policymakers.

So overall some pretty positive news and I am happy to see Italy get a bit of a lift as I have some genuine concerns about the longevity of the Italian economy. That said, as I have been saying over the last few months, we need to caveat all of this with some macro-economic realities. As I mentioned again earlier in the week, although we are seeing some turn around in economic data in much of southern Europe government balance-sheets are still expanding in order to support this against the retrenching private sector.

Until this data release, and in spite of the on-going political issues and and massive unemployment problems, Spain was looking like it was doing a fair job of slowly moving towards an export driven recovery. It must be noted however, as reported by El Pais, the Spanish central government has already reached its deficit limit of 3.8% for the year and there is still 6 months to go. The government is hoping for increased tax revenues in the second part of the year, but it is quite possible that this will have a more negative effect than a positive one. It will therefore still take quite a substantial lift in GDP to get Spain back into a situation where it can bring down its deficits. so without a further uplift in internal economic activity and/or export demand it is likely that Spain at some time in the future will require some further form of debt relief. This is obviously also true for Portugal, Cyrpus and Greece which, once again, the IMF all but admitted in its latest review.

Services PMIs are due on the 5th, hopefully we’ll see an uplift there too.

Overnight the ECB left rates on hold. The full text of Mario Draghi’s press conference is here and the web stream is here if you are interested. There really wasn’t anything new in any of it in terms of economics, although there was some interesting discussion in the Q&A about the way in which the ECB will provide forward guidance in the future.

Full report from Markit below

The first Manufacturing PMI chart shows quite distinctly that the current uptick similar to an uptick in 2012. In 2012, the high was followed by an immediate decline. Since 50 means no change, the changes are rather small. Furthermore, half the countries in the EU stay mired below 50.

So, the good news should actually be written in rather small font.

And the bad news is that industrial production and other human activity continues to degrade the planet’s ecological ability to support its human population. We still do not have a comparable statistic to measure this condition, but if someone managed to come up with one we would expect it to be in negative territory, and getting worse.

We also do not have a statistic measuring how increases or decreases in industrial production affect the well-being of the general population. Since the benefits of production increasingly flow to the top, and do not trickle down, we would expect the correlation between economic production and general economic comfort to be low, and decreasing. What good, really, does economic production do if all the benefit accrues only those control it, and not at all to those who actually generate it?

In the absence of additional, interpretative statistics the value of the information summarized in the PMI index is extremely limited. This situation presents an opportunity for statisticians and economists to come up with new, more insightful, and more useful measures.

We do have the so-called Misery Index, but that number is intentionally misleading and, again, not very useful.

Ignorance is bliss, until it’s not.

The blog software appears to be determined to prevent me from posting my completely relevant and highly-insightful comment. I really ought to be sharing these delightful little gems with others, and not keeping them to myself.

Let’s see the data for what it is: of the eight reported states, four are barely above the “no growth” mark (none significantly higher, being the highest index 51.0), and the other four are under it (three barely so but Greece clearly worse). True that the trend is clearly upwards (“Great Latvia success story” anyone?) but it does not look like a clear recovery yet. These are surely the best figures since the 2011 collapse but I would not throw my cap up in celebration yet: a short-term clinical stabilization is not yet recovery of health.

The most spectacular (and synchronous) pseudo-recovery is from the three Latin states (France, Italy and Spain), which I wonder if it is related to the somewhat reduced pressure for draconian austerity from the part of Brussels in the last months (notice that many industries depend on state demand, directly or indirectly). For example, Spanish industrial economy clearly collapsed upon Brussels’ demands of austerity in 2011, remaining in negative state since then (it still does now in spite of slightly “doing the Latvia” in these last few months).

Interestingly, all the rest followed suit soon after (first Ireland, Italy and Austria, then France and the Netherlands and finally Germany), suggesting that effectively the Eurozone economy is strongly inter-linked and that the collapse of any major economy means the collapse of the rest (Ireland and Greece may be partial exceptions for different reasons).

Well, we will be better able to evaluate if this is something more than a mirage around the end of the year.

Manufacturing is up but employment is down. Sounds familiar.

A Dead-cat Bounce……. Euroland is dee-aid;; just like Stasiland, it is bereft of any moral and ethical considerations. Germany needs to separate from Euroland, else it is doomed.

Kaj,

Britain is not considered part of continent…Europe-being connected at the “City of London” banking secrecy jurisdiction, to U.S.

Walter-Europe is definitely still polluting, but has undergone green revitalization-even Germany now produces 1/3 renewable energy…Energy Director, Berlin, asked how they could move 10 years towards renewable in 2 years stated, “We have publicly financed elections”…(no special interest influences…)

In particular, eurozone manufacturing production was weak and declined for the tenth successive month in December, as companies were hit by reduced inflows of both total new orders and incoming new export business.