By Delusional Economics, who is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness

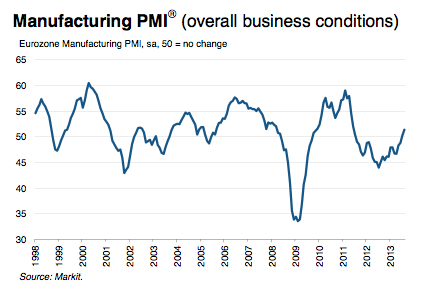

Another good week for Europe as the latest PMI data shows the tentative recovery is gaining pace.

Eurozone manufacturing recovery gathers pace in August

• Final Eurozone Manufacturing PMI at 26 – month high of 51.4 in August (July:50.3)

• Growth improves in Germany, the Netherlands, Italy, Austria and Ireland.

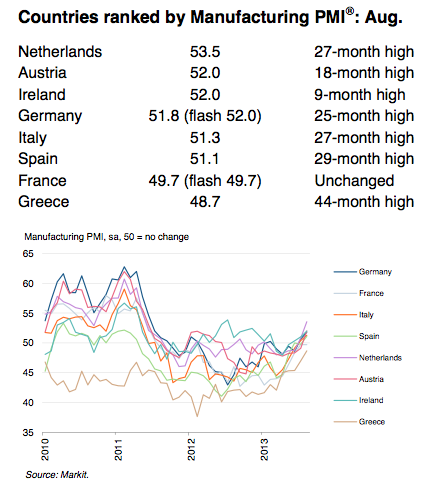

• Input prices broadly unchanged since JulyThe recovery in the eurozone manufacturing sector entered its second month during August. At 51.4, up from a flash reading of 51.3, the seasonally adjusted Markit Eurozone Manufacturing PMI rose for the fourth successive month to reach its highest level since June 2011. National PMIs improved in all nations bar France, while France and Greece were the only countries to register readings below the 50.0 no-change mark.

The Netherlands topped the PMI league table,followed by Austria and then Ireland. Growth rates for production, new orders and new export business all accelerated to the fastest since May 2011, with back-to-back increases also signalled for each of these variables. Meanwhile, the outlook for output remained on the upside as the new orders-to-inventory ratio hit a 28-month high and backlogs of work rose marginally.

The upturns in production at German, Italian, Dutch and Austrian manufacturers all strengthened on the back of improving inflows of new business. Output also rose further in Ireland and returned to growth in Spain as a result of an increase in new business. All of these nations also reported higher levels of new export business, with rates of increase hitting 28-month highs in Italy and the Netherlands, a 32-month record in Spain and a 29-month high in Austria. German exports rose following five months of decline, while the rate of growth in Ireland held broadly steady at July’s seven-month peak.

In contrast, output, new orders and new export orders fell at French manufacturers. Production also declined in Greece, despite stabilisations in both total new business and foreign demand following prolonged spells of contraction.

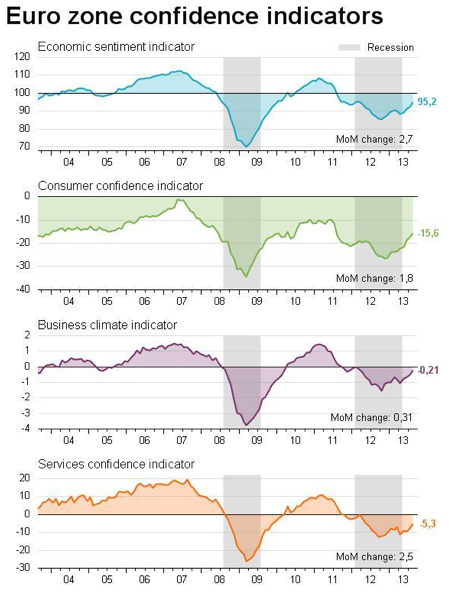

And, with improving PMI data, comes an improvement in confidence metrics.

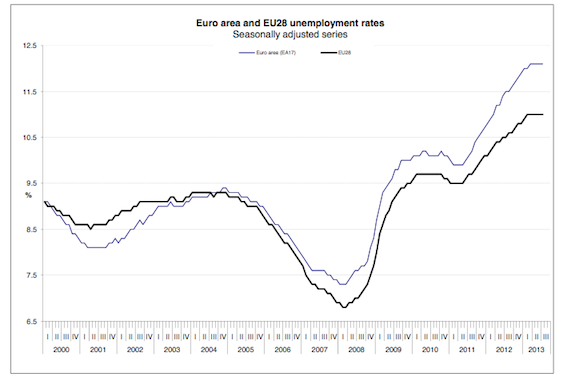

Certainly not out of the woods, but definitely on the up-trend. Unemployment, although intolerably high in many nations, also appears to be stabilizing across the region.

The euro area (EA17) seasonally-adjusted unemployment rate was 12.1% in July 2013, stable compared with June. The EU28 unemployment rate was 11.0%, also stable compared with June. In both zones, rates have risen compared with July 2012, when they were 11.5% and 10.5% respectively.

These figures are published by Eurostat, the statistical office of the European Union. Eurostat estimates that 26.654 million men and women in the EU28, of whom 19.231 million were in the euro area, were unemployed in July 2013. Compared with June 2013, the number of persons unemployed decreased by 33 000 in the EU28 and by 15 000 in the euro area. Compared with July 2012, unemployment rose by 995 000 in the EU28 and by 1.008 million in the euro area.

Importantly we are seeing some improvements in South Europe. Portugal saw a 1% rise in QoQ GDP in Q2 with a 6.3% rise in exports. They have also seen a small up-turn in car sales and a small drop in unemployment.

Greece also had some good news this week.

Greece registered a primary budget surplus and a vast improvement in the deficit of its state budget as a whole in the January-July period, the Finance Ministry said on Tuesday. The primary surplus was 2,555 million euros, against a deficit of 3,083 million in the first seven months of last year, while the overall deficit came to 1,929 million euros, against a target of 7,528 million and 13,216 million euros in the same period of 2012.

While Spain is also slowly seeing some small improvements appear.

Spain said on Tuesday it had eked out a sixth straight month of shrinking jobless queues in August when the number of people registered as unemployed dipped by just 31 people.

The total number of registered unemployed — 4.70 million in raw figures — was basically unchanged, according to the Labour Ministry report.

But the decline of 31 people from the previous month was enough for the Spanish government to hail a sixth consecutive month of declines, and the first drop in the month of August since 2000.

That, however, has been offset by the latest poor lending data which continues to show a struggling private sector.

Outstanding credit extended by Spanish banks to companies in Spain in July declined 9.8 percent from the same month a year earlier to 677.431 billion euros, the lowest level since August 2006, according to figures released on Monday by the Bank of Spain.

The magnitude of the fall was the largest since the central bank began compiling the current historical series in 1995 and remains an obstacle to economic recovery. Compared with record levels reached in 2009 of some 950 billion euros, the amount of outstanding loans has fallen 29 percent.

So, overall, it’s more good news out of Europe as the national economies eke their way towards growth. Obviously there are still major issues, most notably the continued lack of demand for credit in many nations and the underlying issue of debt imbalances across the region. As I stated last week, the question now is whether the same adjustments in austerity policy that are supporting this recovery will continue after the German election, or whether we will see a return to old form and a renewed slow down. We’ll obviously have to wait until after September 22nd to find that out.

It must be said that while officially registered unemployment in Spain has gone down (very slightly so in any case and with very poor quality new jobs) the actual “active population” (workforce) has collapsed, be it because unemployed do not feel the need to be registered as such as they can’t expect any benefits anymore, because they are emigrating to Germany, Latin America or other places, and/or because of the general ageing of the population.

In technical terms the number of affiliates to social security (i.e. contributing workers) fell in August almost 100,000 members!!! 99,069 to be precise. 31 new jobs and 99,000 less workers… how do you digest that?! And more specifically, how do you consider that positive in any way?

Could not find English-language references for this datum so I have to provide a Spanish-language one: http://es-us.noticias.yahoo.com/espa%C3%B1a-celebra-minima-caida-desempleo-plena-crisis-175300931.html

On the general data, I remain highly skeptic: the PMI is just barely above 50 and that does not seem enough to drive the European economy to anything resembling a brilliant future. Overall the indicators do indicate a slight rebound after the second part of the “double-dip” but how strong is that rebound? My guts tell me that extremely weak and that we are bound to head to a third dip into recession. There’s no way out while the banks keep the economy hostage and no relevant measures have been taken against the excessive and parasitic power of the financial sector.

Looking at the overall data we can expect a slight recovery in 2014 but, barring miracles, I’d expect another collapse for 2015-16. Bouncing against the ground is not enough to drive economic growth, some sort of energetic engine is needed to keep the economy “flying” above recession levels and I do not see any such engine anywhere, with the very limited exception of German solar energy developments, which are not being yet reproduced anywhere else where it may matter.

Given those confidence figures all being negative, (but improving) I think that any attempt to paint a rosy picture for the EU is putting lipstick on a pig.

And this is pig is living in the house of straw, not the brick one……..anyone got a match?

It would be nice to know in quantitative terms how much austerity has been relaxed, and then, compare the economic performances, the fiscal balances, and the outstanding debts to check if austerity pays, or does not pay, for itself.

Don’t know if the UK is included in Europe (!) — that’s a big question with several answers, which actually don’t concern us here.

Anyhow, if I am allowed to discuss the UK, we’ve not lost the austerity mantra, but the un-real economy is picking up through a relating housing bubble.

It really is beyond parody (parody is here is you’re interested: http://www.thedailymash.co.uk/politics/politics-headlines/this-housing-boom-will-be-perfect-says-osborne-2013032163413) but it is, for the moment, better than being in an utter basket case (as far as I’m concerned anyway; suffering, through poverty and unemployment, is an abysmal experience for people and anything which lessens it is, if not A Good Thing, then definitely not A Bad Thing).

But, of course, it cannot last. On a long, long list of “things not fixed” we can cite continued rent extraction by capital, lack of real income growth for the 99%, an economy which doesn’t produce anything other than consumption (that last one gets my oxymoron of the week award).

Everyone — everyone — knows it can’t go on. I feel like I’m living in the Twilight Zone. But, like I say, it could be worse (and it will be, just not yet).

I am afraid this is rather like congratulating a 400 pound man on the loss of ten pounds. If the measured unemployment is 12.1%, one can only imagine what the real unemployment is.

Business confidence isn’t something I want to depend on.

It’s almost hilarious. Things are horrible but not as bad, so that shows the benefits of austerity…. Where do these guys come from. You have diabetes, typhoid fever, dementia and a rash on your hand, so let’s celebrate because your rash is going away!!! Whoopee, all is clear….

Austerity has been lifting Eurpoe out of its depression? Lifting it a centimeter a year?

It would have helped had the author given examples of austerity lifting. Of course the whole article begs the question, “Why do they have austerity, if lifting it grows the economy?”

See: http://mythfighter.com/2013/09/04/do-you-believe-in-magic-spain-does/ (Do you believe in magic? Spain does.)

Meanwhile the stock of european peripheral cars is aging rapidly.

Age of Irish stock of cars & commercial vehicles.

31 Dec Y2007 :

Private cars 4 years + : 65%

Private cars 6 years + : 50%

Goods Vehicles 4 years + : 57%

Goods vehicles 6 years + : 40%

31 dec Y2012

Private cars 4 years+ : 82.56 %

Private cars 6 years+ : 63.8 %

Goods vehicles 4 years + : 87.19 %

Goods vehicles 6 years + : 65.7 %

“Obviously there are still major issues, most notably the continued lack of demand for credit in many nations…”

Money can also be created as shares in Equity, not just as debt. But why share when we can steal from each other (but especially from the poor since they are deemed less so-called creditworthy) and pay the banks for that dubious honor? And have the oh-so interesting boom-bust cycle? And maybe WWIII?

But but, but, I need a house and a car now!

1) The entire population DESERVES restitution for past theft via credit creation. And who needs to borrow if one has sufficient equity*?

2) Non-suppressed real interest rates would make saving tenable.

3) The 100% private extension of credit is ethical.

4) In addition to restitution with new fiat, agricultural land redistribution is mandated by Leviticus 25.

5) In view of the fact that jobs have been automated away with the workers own stolen purchasing power, the redistribution of the common stock of all large corporations can be justified too as the return of stolen property.

*And having sufficient equity entitles NO ONE to steal anyway. Being able to return stolen goods plus interest is morally irrelevant. When it comes to stolen purchasing power,. NO ONE is creditworthy.

So Europe gets permanently high disemployment too. Mission accomplished!

Longing to be debt slaves to thieves was never a worthy goal anyway. Except for a mere handful, the ENTIRE generation* of Hebrews in the Exodus perished because God loathed them – partly because they wanted to return to slavery in Egypt.

Do not harden your hearts, as at Meribah,

As in the day of Massah in the wilderness,

“When your fathers tested Me,

They tried Me, though they had seen My work.

“For forty years I loathed that generation,

And said they are a people who err in their heart,

And they do not know My ways.

“Therefore I swore in My anger,

Truly they shall not enter into My rest.” Psalm 95:8-11 (New American Standard Bible)

Believe in God? The real problem is will He believe in us. He’s not on trial, we are.

*It was their children who entered and possessed Canaan.