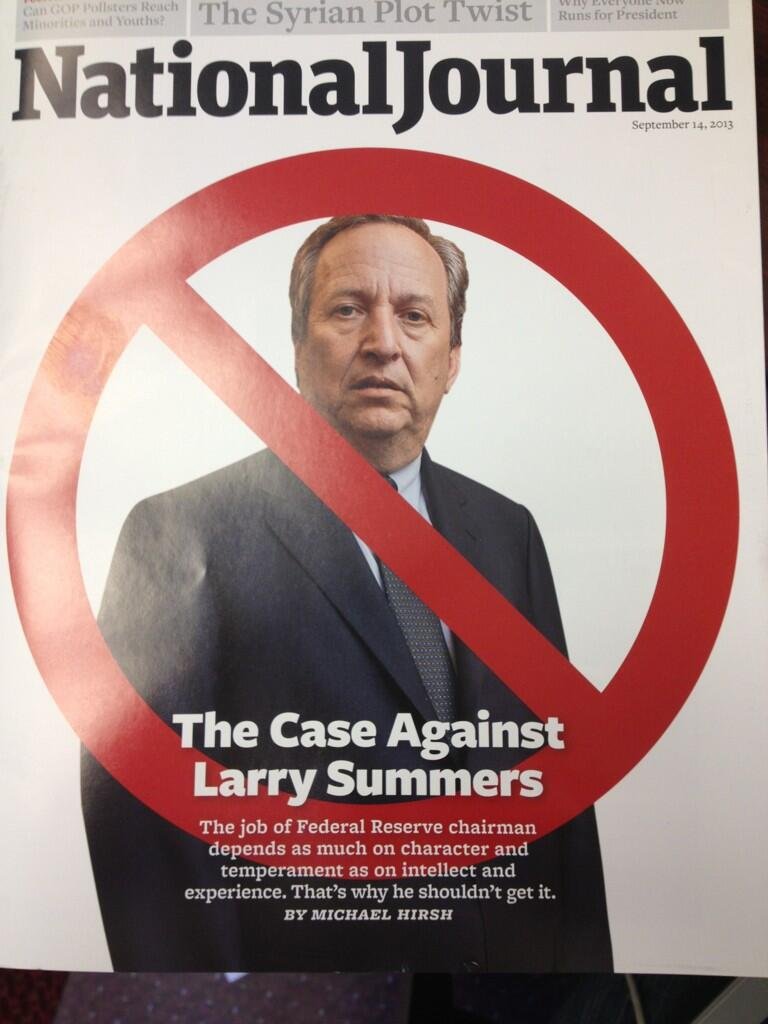

I was just working on a post saying that Larry Summers campaign to become Fed chairman was in serious trouble, and here he’s gone and done us all the favor of getting the message. Larry has such high regard for himself that I doubt he has the self-awareness for a day of fasting and atonement to have led to a change of heart. His withdrawal was more likely to be based on hardening media opposition and lack of enthusiasm even among his professional peers (polls of academic and Wall Street economists showed a marked preference for Janet Yellen; there was also considerable derision and a wee bond market slump when the Nikkei ran a story that the Administration was indeed going to nominate Summers).

Thing had gotten for Summers candidacy that various people had started making whip counts on the polling for Summers on the Senate Banking Committee. He already had four nos from Democrats (the usual bank skeptics of Sherrod Brown, Jeff Merkley and Elizabeth Warren were joined, in a very bad sign for Summers, by Jon Tester, who is seen as generally pro-bank, albeit worried about the power of Wall Street behemoths relative to small banks).

Summers was already nearing the danger zone (not that he would not necessarily get through the committee, but would be such damaged goods as to put the full Senate vote at risk).

Hopefully, Team Obama will do the sane thing and put Janet Yellen forward.

From the Wall Street Journal:

Lawrence Summers, a former U.S. Treasury secretary, called President Barack Obama Sunday to say he is pulling out of the contest to succeed Ben Bernanke as chairman of the Federal Reserve.

“I have reluctantly concluded that any possible confirmation process for me would be acrimonious and would not serve the interest of the Federal Reserve, the Administration or, ultimately, the interests of the nation’s ongoing economic recovery,” Mr. Summers said in a letter to the president that followed the telephone call.

Another bit of good news in the Journal account: the Administration will not pull a rabbit out of the hat in the form of Timothy Geithner. The Journal reports that Geithner has already said he does not want the job.

Update 9/16, 12:30 AM. Via e-mail rom Bill Greider, who among other things, wrote an authoritative book on the Fed, Secrets of the Temple:

This is a watershed moment. The defeat of Larry Boy marks the beginning of the end of the long political hegemony of Rubinoid bond traders and speculators. It took a generatl of collusion between the Federal Reserve, Congress, both parties and five presidents (not counting Obama) to dig this hole. It will take at least that long to rescure the country. But this is the starting point, where all of shouting and hollering suddenly has the possibility of being heard.

RIP Larry. Don’t kick his bones.

Great news!

One good piece of news among tons of bad ones.

Yet, let us not belittle that one. Champagne everyone!

Summers was just a setup for Geithner. Just wait and watch.

Can you please read posts before commenting!?!

The post clearly states that Geithner has already said he does not want the job.

But who really picks the Fed Chairman. Obama was happy with Summers. What power group decided Summer was not ok because I am sure one obscure Senator on the Banking committee being iffy would not torpedo the choice of Obama, Wall Street, and Robert Rubin.

Was it really just a coincidence? that Ben Bernanke (October 2006) “The U.S. housing market largely reflects a strong U.S. economy … the U.S. housing market has never declined.” also did a number on the Depression just a few years before being picked to be FED chairman. Somebody node what was coming and picked the right person to man the helicopter.

Since nothing has been fixed somebody knows it’s going to be evern worse when the next collapse happens. picking the timing of thses economic events is the tricky part

Sounds quite prophetic.

No, it was not “just one Senator.” It was a pro-bank Senator on top of three other nos from Dems and probable nos from 3-4 Republicans on the committee.

It was clear that Obama would have to spend a lot of his dwindling political capital to get Summers through, and he’d rather deploy it elsewhere, namely on the budget fight, the Grand Bargain, and on attacking Syria (you can bet they’ll try to bring that back to life in November).

I’d like to be as optimistic as Bill Greider, who certainly knows this beat as well or better than anyone. Even taken in isolation, Summers’ fall is as satisfying as it has been necessary.

I never really ‘got’ the reasons for why Summers was tipped for the Chair, other than his immense personal ego and countless army of cronies on the street. Summers had _no_ political constituency. His, ahhh, chequered record was likely to kill any momentum. And obviously it was just a political payoff for Obama to float Summers’ name, since Barak didn’t expend an ounce of political capital or effort to push this (but then does Obama do so on _anything_?) Summers through a tantrum it seems and called up all his friends to ring Obama’s team night and day, so he was give his little straw and left to face the opposition alone. It’s notable that there was NO public push for him by credible players.

Close the door on the way out Larry, we’ve had enough of your stink.

One of the reasons Obama may have suggested Larry is that he’s shown a strong aversion to having women in positions of real power. He had to grudgingly put up with Hillary at State for obvious political reasons, but he strongly dislikes getting intellectually complex advice or dissentlng opinions from women. There were several reports about the way Obama used to treat Romer condescendingly, sometimes even cutting her off rudely when she was trying to make important points at meetings, something he didn’t do to male cabinet members.

“Sweetie.”

I think being female isn’t a plus for Obama and is probably a negative. The underlying reason for Summers is Obama thinks he saved the economy. Nominating and confirming Summers would underscore this narrative, and considering most of his nominations thus far, Obama isn’t exactly an outside the box thinker. Obama is picking a name he knows who is loyal to Obama. Obama bothered to nominate Daschle despite the guy not paying taxes. He should never have made it through any kind of background check process. Bill occasionally hired people who weren’t Washington insiders. The celebrated head of FEMA was from Arkansas, but he was a very outside the box pick. Bill knew who he was and of what he was capable. Obama makes decisions to stroke his ego.

Where did the Obama is smart meme begin? He has proven to be glib, yes. Smart? Where?

It seems he understands little about economic theory. Less about banking. For a Constitutional professor, he has done a bang up job of undermining the 4th Amendment. Folks have been overestimating Obama (Nobel Committee) for years. The recent evidence shows him to be a marginally skilled, slow-learner (Syria).

Obama got good grades in college. Then he successfully ran a few election campaigns. That caused people to think he was smart.

And to be fair, I think he is smart, in a limited way. Unfortunately, he’s proven to be extremely *unwise*.

In particular, he’s demonstrably insane: he continues to believe that he can make Republicans like him. Despite over a decade of ever-stronger evidence that they will not like him, no matter what he does. That is an Aristotelean tragic flaw. Unfortunately the rest of us have to suffer for his flaw.

Indeed! It got so bad that Obama was forced to have a private meeting with the female staffers to clear things up.

Valerie Jarrett?

Summers is a “made-man” in Washington–one of many of the hustlers, fixers, strategists, consiglieri that float in and out of Washington and the centers of power. These people have enormous power and get what they want and find themselves in important positions because of their excellent connections.

I think it was the right move, even if an unwitting one and made for the wrong reasons. I just don’t know what rational person would want to be at the head of the Fed right now, which would be like conducting a train with no brakes and a full set of passengers shouting to go faster.

Don’t uncork that bottle just yet: you have no idea how vindictive, and petty, obama is. It would be unfortunately like him to now pick someone even more nauseatingly unacceptable. Just for spite. Let’s hope his handlers can get him on the bit, as the equine expression has it.

Yes, like “I’ll do whatever Mr. Greenspan or Mr. Bernanke say”, Janet Yellen.

julie driscoll & brian auger – season of the witch

http://www.youtube.com/watch?v=dgdNLDixf2U

Like this version better

Julie Driscoll – Season Of The Witch (1968)

http://www.youtube.com/watch?v=dCKZPEleI-U

Find Richard Thompson’s version- he owns the song.

And the songwriter’s version, which was a huge hit:

Donovan, “Season of the Witch”

http://youtu.be/b8_mJlGcNi0

Side note:

It kills me when my 20-ish daughter reveals yet another “alternative” musician to me. “Yep, that duo is S&G.” “Yep, that guy is a Donovan reprise.”

Pardon me, but for us Boomers, our parents were listening to Guy Lombardo (awful) and Glenn Miller (cool, but dated) when we were listening to Airplane and Hendrix. Has there been anything truly new in pop music since Baxters, Axis and Innervisions?

(Intentionally provocative)

Pop music peaked in 1964 as did American culture. It’s been cynicism since.

http://www.youtube.com/watch?v=1jVECp5Dzp4

http://www.youtube.com/watch?v=5DXKBnmYdds

kiss kiss in the rearview

Or maybe 1832: http://www.youtube.com/watch?v=QCL0WxQYN3k

What’s more painful? What we’ve become? Or what we’ve lost?

what we ‘lost’ carried us to this point

and it’ll continue until we break off the rearview mirror

did you know hawaiian music derived from cowboys

http://www.youtube.com/watch?v=B5r2uvzgqz0

fascinating ‘))

Yep, that was pretty painful but not in a good way. I do like his “We are the many” though.

Incidentally, for a lot of Brits, DDTWID was Thatcher’s requieum, which the Beeb initially refused to play despite it being the most requested song. They later relented.

Guys, for such an international outward looking group, it feels like many haven’t ventured fourth beyond the borders of the musical Anglosphere.

I’m a boomer, but I currently listen to a whole world (literally) of cutting edge, exciting music that’s happening at the moment (or in the case of Nusrat Fateh Ali Khan, the Emperor of Qawwali, a few moments ago). Africa in particular is a hotbed of unretreaded sounds. And there are many musicians as innovative and fresh as Philip Glass once was out there on the fringes.

And obscure indigeneous music such as Tuvan throat singing or Sami folksongs is now widely available.

True, this music and the musicians who perform it don’t receive much MSM attention, but they do exist.

IMHO.

Is that when Dylan came out with whatever album “Don’t think twice it’s alright” (or whatever quirky title he used for the song) was on?

Well, _my_ Silent Gen parents of two Boomers and one Buster listened to late 19th cen operetta, which was so out it was cool enough to come back in again.

I’d say Bjork and Sonic Youth were certainly something fresh in the rockosphere. Much harder to find anything with resonance in the last 15 years; some smallish outfits, and I do buy stuff, but even if it’s new Gogol Bordello and some don’t have the kind of kick I’ve been used to.

Always liked Donovan; bought him back in the day. Some of the ‘unknown oldies’ that have been resurrected by current twentysomethings are actually quite good. Linda Perhacs put out a beautiful album I’d never heard of. I’d never listened to Gene Clark’s solo career, some of which was quite good. Vashti Bunyan was found again after 30 years, and cut a second (and likely last) sweet album. But yeah, the ‘revival of S & G’ is a giggler, to me; I’d also heard that going round last year or so.

R.E.M.

Try this version, while you’re at it–from the late 60’s. Steve Stills, Al Kooper, and the late Mike Bloomfield.

https://www.youtube.com/watch?v=dnIFxKTxP5s

I’m going with the rocka-jazza-bluesy version: http://www.youtube.com/watch?v=NWkMMXgQohc

Fascinating.

He finally made a correct decision.

He’s 1 for 2,965

“Pull a weasel out of a hat.” Fixed it for ya.

Haha :)

Yellen is just anothe soldier of kleptocracy. We are never going to get out from under it by pinning our hopes on members of our corrupt elites, especially those who work for one of its greatest and most corrupt engines, the Fed.

Personally, I was doubtful that Summers ever had the votes to get past cloture. That Obama was pushing so hard for Summers just goes to show what a corporatist, anti-99%er he really is.

Taken together with Syria, the aborted Summers nomination shows how quickly this President is achieving lame duck status. Again in a kleptocracy, such transformations are mostly political theater to confuse and distract us rubes, but I still derive a certain amount of satisfaction from it.

Look, the very fact that Bob Rubin through his proxies took a fall is huge. Huge. This is a MUCH bigger deal than it appears to be on the surface. This is the formal end of the Rubin era in the Beltway. This is a necessary, if far from sufficient, condition for there to be meaningful curbs on the finance sector.

I heard from well placed DC sources that Rubin allies were putting the screws on Republicans on the Banking Committee since Tester said he was against Summers. A Dem who is bank friendly coming out against Summers was what likely killed him officially. The Rubinite arm-twisting was to see where the R votes stood, and my guess it was the failure of that effort that led to the formal withdrawal.

You may not be wild about Yellen, and I agree there are reasons not to be enthusiastic, but she is not part of the bank crony network. The banks were pushing hard to get a stooge in place, and if Yellen gets the nomination, that’s a big fail.

Rubin is far from dead. He just got Jacob Lew a job.

Point men for the Brookings – Heritage – Goldman trifecta having a bad day ie. one member of a five man team sent to sin bin is not something to get overly excited about.

“Just” was more than a year ago, which is an eternity in politics, and Lew is widely recognized as knowing bupkis about financial services firms. His job was to get the Grand Bargain through, another Hamilton Project pet agenda item.

I’m wild about Yellen. I’m also thrilled that the sexist pig got gutted. Period!

Yellen’s a woman. Surely that disqualifies her, at least for Obama and his inner circle?

@Yves,

“You may not be wild about Yellen, and I agree there are reasons not to be enthusiastic, but she is not part of the bank crony network”

Of course Bernanke, as far as I know, wasn’t part of the crony network either.

The institution is inseparable from its’ de facto merger with Wall Street and the Treasury. I thnk Bernanke finally figured this out to the point that he doesn’t even attend the Jackson Hole gig.

Why are central bankers giving news conferences anyway? Taking questions from somebody at Fox News? Really? That’s your job? Complete silliness…

In this sense, it doesn’t really matter who is the Fed Chair. THe whole institution is a bit of a joke.

Bernanke, academic expert on the Great Depression, knew exactly what FDR did right and didn’t do right.

So Bernanke got himself appointed Fed Chairman. Then he realized FDR was President of the United States, which is something different than Fed Chairman.

I agree with that. This looks like the beginning of a changing of the guard to me. The insider power elite that has run the Democratic Party since the late 80’s didn’t get their guy. They were licked.

Of course what the guard will change into is anybody’s guess. But as of right now Warren, Brown and others who stood up to the Rubinites have significantly upped their status from dissident outsiders to emerging party leaders and power brokers. And the vaunted invincibility of the Rubin/Wall Street crowd has been cracked. There is blood in the water.

If I were Hillary Clinton, I would be dialing up all my political advisers for desperately urgent trhinking on how to radically remake myself as a candidate between now and 2017. The Rubin machine and the Clinton machine are the same folks.

Clinton could start by supporting single payer. Warren opposes it. Not that she will. But it would be nice to see some Democrats dragging the Overton Window left.

Sorry to disagree, but this is not “huge” news or a signal of a changing of the guard. While certainly a pleasant surprise, it changes little in the way of the business-as-usual kleptocracy. When all is said and done Yellen will be no better at spinning this wealth extraction machine into something it is not. The Fed’s lack of credibility as an institution speaks for itself. It really makes no difference which double-speaking millionaire economist is occupying the chair.

‘[Yellen] is not part of the bank crony network.’

The Federal Reserve **IS** a bank crony network, for Goddess’s sake. If Yellen weren’t part of it, she wouldn’t be working there.

We shouldn’t lapse into the MSM paradigm of treating this as a Summers-Yellen horse race which just yielded a winner. Think outside the box: tear down this blighted racetrack, and the money changers who profit from it.

One hundred years of biz-gov-partnership value subtraction is e-damned-nough. Let’s repurpose the Marriner S. Eccles Building as a Financial Holocaust Museum by 23 Dec 2013, before the clock strikes a hundred.

JH wins the Internet. Make the meme and the chant.

Here’s a ditty, based on JH’s creating Word:

The Mariner Eccles Building shall become

A “Financial Holocaust Museum” Dumb.

No word from merchant priests forevermore

Shall have us crucified from shore to shore.

And what? Free-banking? Bitcoins? More laissez faire?

No thanks, I’ll take a centralized banking system.

I am sad. I was really hoping for Summers to get in the Fed.

But anyway, at G20 the Obama regime stated that the Fed will be winding down QE soon, so I’m not sure how Yellen suddenly becomes a viable choice for the regime now that Summers is out.

Cause he’s scairt that he’d be the inevitable Fall guy? Not a Winter soldier but only a Summer one?

[note the use of only three seasons; a better writer could have worked in Spring too. :) ]

He’s no spring chicken.

That could easily work too.

Cause he’s scairt that he’d be the inevitable Fall guy, should his own trap Spring shut on him. Not a Winter soldier but only a Summer one?

Bravo!

Good. I have a very thin vindictive thread that wouldn’t mind having seen that a-hole humiliated, on the other hand sociopaths probably aren’t easily humiliated, and its safer that this a-hole is just out of play.

Ideally, this will be enough of a CV implosion that this a-hole not be appointed to any governmental post in the future. A lame buffalo at the waterhole has no friends.

Let him focus on being a private sector leech, but who really wants a negatively productive bag of damaged meat and hot gas on their team? Rhetorical question, we will see who. Good riddance a-hole, I hope he reads this.

The illogical choice now is Kerry. Will help the Middle East.

Good one!

Obama will come up with someone just as bad.

The FED or BoE/ECB leaders don’t matter. They all subscribe to the financial alchemist fantasy that if you leave $100 in a shoebox it will double in a week. 5 years on from Lehman the banks/shadows are in the same mess. In this time we could have established alternative clean energy via decent job guarantee and be on our way to freeing the world from Nazis.

A huge victory for women.

Yellen might not be perfect, but she sure as hell isn’t a misogynistic cretin.

there are pods in the attic..

good one frosty, indeed there are

No, just a cretin.

Larry Summers isn’t a misogynist. He hates everyone! **rimshot**

Paul Volcker for Fed Chair ;-)

He’s only 87 ( Born: September 5, 1927 ) but is 6′ 7″ so has commanding presence ;-)

Do you think the Japanese have a hard time figuring us out? From Friday, 9.13.2013 Reuters:

—————————————————–

TOKYO | Fri Sep 13, 2013 6:05am EDT

(Reuters) – U.S. President Barack Obama will name former Treasury Secretary Lawrence Summers as chairman of the Federal Reserve Board, Japan’s Nikkei newspaper said on Friday.

The newspaper, quoting unnamed sources, said in its original Japanese version that Obama was “in the final stages” and moving toward naming Summers.

The English-language version said the president “is set to” name Summers as early as late next week.

Asked about the story, a White House spokeswoman said Obama had not made his decision about the Fed job.

Debate in Washington has focused on whether Obama will pick Summers or Fed Vice Chair Janet Yellen to succeed Ben Bernanke, whose term as head of the U.S. central bank expires in January. The appointment must be approved by the Senate.

Reports in the New York Times and Washington Post earlier this month suggested Obama was strongly inclined to pick Summers.”

http://www.reuters.com/article/2013/09/13/us-usa-fed-summers-report-idUSBRE98C06120130913

We dodged that bullet. What’s next?

Summers even looks sleazy.

Good riddance!

NEWSFLASH!!!!

FED CHAIR WITHDRAWS AS FED CHAIR

Grateful Planet Erupts In Peace*

*instead of the usual pieces..

Collateral damage from the Snowden Effect. Summers knows what is hidden in the Cayman accounts but he wasn’t sure that NSA and Snowden didn’t know as well.

Wonder if the Snowden Effect is still keeping Obomber up at night? Unfortunately the Syria diversion was very short lived. Thats what happens when you send a boy to negotiate with a KGB hard case who braves Siberian winters without a shirt.

Yeah, and Mao swam across the Yangtze River in January when he was 85 years old. Heck, I couldn’t do that and I’m only 76. Well, come to think of it, Putin ain’t that old. No wonder he can go shirtless.

Summers is a lot of things but he isn’t a complete fool.

A crash is coming and the Fed will be helpless. Summers is smart to let someone else take the fall/blame.

Meanwhile, keep an eye on Bill ‘Goldman-Sachs’ Dudley. Yellen will be subject to the whispering campaign now that she’s the ‘favorite’, that will leave an opening.

Bingo! Summers slipped the noose. Benny will now slink off to asylum, and Janet will be left tholding the bag.

No, Summers really wanted the job. He even tried getting a meeting with Warren in August to change her mind.

Geithner turning it down being on the list may be as a result of recognizing the blow-up risk. Larry has a big enough ego that he’d relish the opportunity to

again loot taxpayers in a financial crisisget kudos for saving the financial system as Bernanke, Paulson, and Geithner have (yes, pull out the barf bag, but there’s a huge number of articles that accept that meme).Yves,

Isn’t it true that the rich saved the financial system and have let everyone else burn?

You just made me think of someone worse than Yellen. Bill Dudley. That would be like Tim Geit…….oh no.

I think the basic problem here is Obama doesn’t know anyone we would like.

Dudley Eat an iPad :-/

yellen’s more like the bernake

The problem is Obama is incredibly arrogant and considers wisdom to be splitting the baby, a childish position. From his perspective, Obama has done a great job so far because Obama is Obama, and Summers was part of his team. The criticism from the “left” only underscores Obama’s certainty because it reinforces his childish notions about half forgotten and misunderstood metaphors about the straight and the narrow.

I think it’s far more likely that he withdrew subsequent to a telephone call from Obama warning him that he could no longer nominate him because of public pressure and giving him the opportunity to “withdraw” instead.

I agree, although I think the why is open to question. If Obama and the banks really wanted Summers that badly then I doubt this would have happened. Everybody has their price, unless they are incorruptible, and we know very well that Summers is not. I’m sure it wouldn’t have been hard to scrape together enough of a bribe to keep his hat in the ring if they really wanted.

The cynic in me worries that he was cut loose because he was too obviously a corporate stooge and would therefore make it harder to spin bank-friendly decisions as For Your Own Good. If that view is accurate then he will be replaced by a deep cover corporate stooge with a more convincing alibi. I don’t know enough about Yellen to guess whether she might be that person, but her nomination doesn’t seem to have generated the kind of foaming at the mouth that you see in response to names like Elliot Spitzer (though admittedly Spitzer has few equals in that department).

I did read a recent comment in the press from Yellen that back just before the GFC, she said she never saw it coming.

Not a good thing on the resume, methinks. It also probably applies to everyone else at the Fed too.

Both Ben and Tim G. (when heading the NYFRB) have made comments that the Fed is not a regulator. But in fact, they are supposed to share regulatory responsibility with the OCC for large banks.

But instead they think their job is to just open the money firehouse and hose down the FIRE sector whenever it goes up in flames.

Not good enough.

Summers almost certainly didn’t have the votes.

And, in other news, someone named Blasio seems to have come from virtually nowhere using an electoral message about the dangers of inequality in a bid to become Bloomberg’s successor.

There must be weird magnetic storms in the universe or something; this all seems to portend larger shifts.

Over the past 18-24 hours, I had started to see an emerging theme of “If Summers had any decency, he would withdraw.” Once it became clear this was shaping up to be a major political fight, calls would have come to Summers from many quarters urging him to pull out.

Dumb withdraws, leaving us with Dumber. Oh, joy.

Exactly! Tweedle Dee vs Tweedle Dum.

All hail the great and powerful Oz.

http://vimeo.com/channels/staffpicks/72106045

Ms. Yellen is a better choice, since she’s not locked into the antigovernment, antiregulation blowhard regime. And if the Fed crashes and burns, and needs to be nationalized, she’s not locked into years of years of privatization rhetoric or privatization advice that’s turned out a series of predictable disasters.

That said, it’s probably impolitic to grind Barry’s face in his latest disaster. Don’t poke at the spin too hard, just let him claim the credit for diplomatic genius. Oh, sorry. Wrong line of bullshit.

His alternative is to name a stealth candidate, someone who’s never had his name in a national media outlet. Who, you can be sure, is the same banker lackey with the same deregulation fantasy. Fat Larry without the Fat Larry baggage.

“So let’s see … I wonder what Robert Rubin’s up to these days?”

Does Mrs. Obama have to keep her husband from indulging in late night “drink and dial” sessions?

Look at Obama’s statement on Summers’ withdrawl: “Larry was a critical member of my team as we faced down the worst economic crisis since the Great Depression, and it was in no small part because of his expertise, wisdom, and leadership that we wrestled the economy back to growth and made the kind of progress we are seeing today,”

Obama obviously thinks that he (Obama) has done a great job with the economy. It’s a rerun of the Bush mission accomplished stupidity. Obama had to nominate Summers or he would have to admit to his bad judgement.

I agree with what many others are posting; you can count Obama to appoint someone just as bad as Summers for the job. I hope I’m wrong.

Agreed. I’ve seen a couple of articles recently to the effect that “Obama and his advisers actually think they’ve done a great job with the economy for the last five years. That’s why they really, really wanted to bring Fat Larry back. They are completely cut off from the real world.”

I feel very sorry for Yellen in the coming sh*tstorm. I was halfway looking forward to seeing Summers ample neck in a noose.

Yes, Yellen-watch to me is now the more interesting phenomena, although we mustn’t take our eyes off Larry either. (Did Obama forget that Harvard faculty and alumni hire and fire their governors, at least ostensibly?)

In a more interesting, bolder, universe, Yellen could give Obama a shake up and withdraw *her* own name too, touché!

She could then go teach at Georgetown or George Mason, and hang around stirring up the Warren-Grayson-Rand Paul trifecta, but that is surely too much magical thinking.

It sounds like it would be trading in current power for less influence, but perhaps in the long run such a move could pay big.

Is there momentum for a Paul-Christy vs. Warren-Grayson election?

Rand Paul in that “trifecta”? Good lord.

The Treasury doesn’t believe it has enough money to buy a noose big enough to hang Larry with.

“Ding dong, the witch is dead”

— the title is priceless, and so appropriate.

+1000

Very interesting.

What will the next layer of the onion reveal?

A turn towards societal sanity or a stronger jump off the cliff?

Both, probably. The elites will double down, the rest of us will get more sane.

Summers is pro-big bank, anti-regulation,not a consensus builder and perhaps an ends justifies the means kind-a-guy. I suppose Brooksley Born just let out a sigh of relief on this one.

guess he didn’t have an “innate ability” or “natural ability” for the job

for jollies they could tap ‘lean into it’ sandberg for the ‘position’

http://www.huffingtonpost.com/sheryl-sandberg/what-larry-summers-has-do_b_142126.html

So I’m guessing the position to which you are referring involves alot less leaning in and alot more bending over?

Well,

What a surprise that Summers has withdrawn his name to succeed Bernanke at the Fed – evidently Team Obama are unhappy at this and are presently too busy fighting fires everywhere it seems presently, as such, don’t be surprised to see a huge ‘positive spin’ placed on a Yellen nomination. First woman and all that.

Whilst Yellen is a dove, my own opinion of her is that she’s certainly not been corrupted by her few years in DC, it helps that her husband in none too keen on corruption within banking – so maybe, just maybe, we’ll see a sea change.

What’s interesting, if Yellen gets nominated, who take the Vice Chair position, in a sane world we’d be looking at someone like Hoenig, or indeed Ms. Bair!

Obviously I’m drinking too much koolaid in these considerations though.

What’s interesting, if Yellen gets nominated, who take the Vice Chair position, in a sane world we’d be looking at someone like Hoenig, or indeed Ms. Bair! Chris Rogers

Only if a money system based on so-called “prudent” theft is sane – which it isn’t.

But also, a return to so-called sound banking could trigger a crash which is certainly not just. Instead, we need more radical thinking such as Steve Keen’s universal bailout of the population which he calls “A Modern Jubilee.”

In our present climate of total corruption, it’s probably safer to say, “Ding Dong, The witch is dead, Long live the witch!” Who’s to say Obama won’t find someone just as bad just to get even with “the f**king retards” who soured the deal?

That said, and I repeat this from a previous comment section, one can only hope that with his failure to date to get another war going and now to get a deregulation happy Wall Street favorite shoe horned in to a position where he could do serious global damage, Obama may be loosing his magic of destruction and impoverishment to everything he touches and finally becoming a lame duck President. If this carries through to his efforts to gut and cut SS and Medicare, Obama’s loss will be of immeasurable benefit to millions of senior citizens. Given the other mayhem Obama has caused to civil liberties, international treaties, our whole legal system, millions of hapless families now without homes, and good grief the list goes on, saving seniors from his lethal clutches may not be much by comparison, but it’s still huge.

The Summers’ withdrawl combined with the Obama administration backing off the Syrian strike suggests a ripple in the force field.

The people have had it. The smart criminal elite maybe thinking time to back off a little as they do want to come outside of their gates dwellings sometimes. Then again, maybe the criminal elite are just fighting amongst themselves.

Those are not mutually exclusive propositions. Pass the popcorn.

+ 1

Never underestimate the power of a pitchfork…and a determined populace willing to use it!

There is a war brewing between Wal-Mart and the banks, Wal-Mart and healthcare, and where ever customers are being squeezed. Wal-Mart is starting to offer banking and healthcare services in their stores. I think I saw T.RowePrice with a commercial describing how a bus boy started investing early. TBTF is moving to consume each other.

I am with the rest of you, except for a couple points of fine print. There were only two serious contenders for the job, Janet Yellen and he who shall not be named. My opinion of Yellen is she would be a warm and cuddly grandmother who I love to see baking tollhouse cookies for me, even as a fed governor she was competent if somewhat misguided about life in the real world. Now, she will be the next chairsatan. That misguided outlook will be a de facto continuation of the current policies only more so. Might just as well reappoint Bankbernie. (I just made that up, feel free to let it trend)

Try to remember there is nothing our president or congress can do that does not affect us other than through the lens of the US dollar. By far the largest problem facing our (and thus the world) economy is wealth inequality, Yellen will aggrevate this until the only resolution will come in the form of revolution by starving masses when supplies at the feeding stations do not arrive.

I believe that the next fed chairman should be Ron Paul, he did not have the scope to be president, and his age precluded any serious vote for him anyway, that and his religious bent, but as a plain speaker he would be a breath of fresh air. I am tired of paying at the pump or in the grocer for the higher prices brought on by speculators while the markets sift through the chairsatans most recent comments to decide if they are bullish for the banks and the 1% or not. I am at the point of saying hang the lot of them, and if we have to call eachother commrade for 70 years so be it.

Ron Paul is for a gold-backed dollar which would simply replace one form of injustice with another – and a stupider form of injustice at that.

Awwwww with Ron Paul we could go back to the good ol’ days when currency was feathers and beads or gold dust. He’d make banking retro. LOL

This would explain Ron Paul’s apparent appeal to hipsters. Hand-made organic artisinal gold bars will be our currency under a Ron Paul “Administration.”

If there is someone out there worse than Summers – and there might not be given how odious and incompotent he is – Obummer will find a way to nominate them.

Should we clean the gutters to prevent Obama from finding his ideal candidate? Maybe send Robert Samuelson, Greg Mankiw, and Erskine Bowles on a research trip to Detroit until Yellen gets confirmed?

My sources say that Putin was able to secure this position as part of the Syria negotiations. I’m not sure how that will work, but he can’t be worse than Summers!

“Summers is going.”

As imperceptibly as greed

Summers lapsed away, —

Too imperceptible, at last,

Not to seem like perfidy.

An egotism distilled,

As high life long begun,

Or banker, spending on himself

Sequestered money funds.

The fees drawn earlier in,

The hubris he had known, —

A bounteous, yet harrowing greed,

For thief who would be gone.

And thus, without a win,

Or service of the Hill,

Summers made his light escape

Into the profitable.

Very nice! You, sir, have talent.

https://www.youtube.com/watch?v=DcEAI5p-wUg

A++

Perfect!

The snarkiest comment I’ve read so far is on the Washington Post website:

“Actually, Summers bowed out because he is playing Jabba the Hut on the new Star Wars redo.”

Do you folks honestly think this matters?

Please read up on the history of the Fed, in particular the role past chairmen have played. I’m not going to do your homework for you.

Which part of the history do you prefer?

1. The part where Greenspan and Bernanke blew several of the biggest bubbles the U.S. has ever seen, and then mused afterwards in hindsight that they really might have been clueless as the bug hit the windshield?

2. The part where the Fed backstopped a $multi-trillion bailout of some of the biggest control frauds on Wall Street and left Americans to pay the bill so those same Wall Street companies could continue paying record bonuses to their CEO’s?

3. The part where the Fed provided banks an exemption for ownership and trading of commodities so they could game the markets and jack up prices for essentials and other items?

Please clarify

You act as if the Fed did all of those things on it’s own.

I’m pretty sure that Congress had a hand in quite a few of those things. Should we abolish it too?

So you are telling me you believe the Fed has no history prior to Reagan appointing Greenspan.

Go to the back of the class.

Of course the Fed has a history prior to Regan, Greenspan; however, just like the Congress they’ve devolved to servants of the master class. Each of these supposedly “independent” bodies are now co-dependent, fumbling from one crisis to the next looking for the other to do the right thing.

Just as you previously accused me of “confirmation bias” in regards to Mary Jo, I would suggest that your optimism is sorely misplaced. What I find particularly interesting is that we keep placing our hopes in new names at failed institutions thinking that maybe, just maybe this time they’ll do the right thing.

Straw man. I never said anything of the kind.

I said:

1. This is a huge loss for the Rubinites

2. Yellen will be better than Summers. Given how I said Summers was unfit to run a dog pound, all I’ve said in effect is I would let Yellen run a dog pound. Being better than Summers is an extremely low bar.

3. I also said who runs the Fed matters. Volcker v. Greenspan alone is ample proof. Or try Burns v. Volcker, or Martin v. Burns.

The article should have asked : why did Potus nominate him in the first place? Was it an AIPAC compulsion?

Huh? We’ve mentioned “Bob Rubin” in the post and comments.

Bahaha. Frequently I get pop-up ads in the middle of NC text, based, I guess, on the content of what I’m reading there. The latest was “are you searching for ‘the witch’?”

Nope, not any more.

I sent six emails to the White House forwarding posts by Dan Kervick, Barry Ritholtz and Simon Johnson opposing this nomination. What’s stupifying is the effort needed to get our government to do the right thing. For anyone who has followed economic policy for the last fifteen years this choice should have never gotten half a thought. Crony capitalism has so corrupted our government I have little if any confidence we’ll ever get the upper hand on it. We need a more informed citizenry carrying pitch forks. Anyway, Horray to all the Dorothys that assisted our political class’ decision making process.

Thanks Teejay.

I think the historical contingencies of the crash created a bubble of overconfidence and historical amnesia in the White House. The final trigger for the collapse happened on Bush’s watch, so the official story of the crash that Obama and his Rubinite insider retreads talked themselves into believing is that it happened because of excessive public debt under the Republicans, and “putting two wars on a credit card.”

I can’t think of anybody serious who believes that theory, and it certainly wasn’t one of the factors concluded in the bipartisan Financial Crisis Inquiry report – which singled out Summers’s failures in several places and that Obama has apparently never read.

That’s why they have been busy trying to move the country back toward a budget surplus. They are still living back in the 90’s in the land of Rubinomics. They think big government crowds out the private sector and that surpluses are stimulative. They want to vindicate the Grand Unified Theory of the Clinton Surplus to smooth the path for Hillary in 2016. They think Larry and Timmy and Bob are the greatest geniuses of the past half century, and that they laid the foundations for decades of Clintonian economic awesomeness until Bush messed it all up. They have never had to face the music on the Democratic role in the neoliberal dismantling of the social contract and financial stability, because they got a lucky pass from the gods who decide when bubbles will pop.

But now people are starting to get it. There is a gradual influx of new blood in the Democratic Party that isn’t pumped by the old Clinton machine, and that has new ideas and new loyalties. Obama has stupidly thrown in his lot with the dinosaurs. But people in politics smell “loser” from a mile away, and my guess is that this major defeat for the old guard cronies could spark a bit of a run from the old-timers and a coalescing around people like Brown and Warren.

Obama has no idea what kind of mental bubble he is in. I doubt he reads anybody but folks like David Brooks and Ezra Klein. He choked on excreta from his own beltway bullshit machine.

Yellen is a fine traditional macroeconomist, and the last in a line of Tobin students who peopled the Fedfrom the mid-60s to the late 90s. She’s the ladt true Keynesian left standing. I believe her hands are tied with respect to monetary policy. Given the looming ‘correction’ in the stock market and the on-going ‘uncorrected’ recession, the odds of monetary tightening wete always close to zero. Bernanke was whistling n the dark and believing his own misguided econmics. Where Yellen might make adifference is in bank regulation, where the Fed still possesses considerable clout if it wants to use it. Everything else has got to be on automatic pilot until we get a government that believes in and prosecutes countercyclical fiscal policy.

Geithner was in charge of the selection process. Should be no surprise that Summers was a favorite.

The best choice for Fed Chairman would be Warren Mosler. See: http://mythfighter.com/2013/09/16/warren-mosler-for-fed-chairman/

Everyone seems to be forgetting the first and second rules of the road for centrist Dems in DC:

1) When the Masters of the Universe doubt your fealty, punch a hippy.

2) When the lefties appear to actually win a skirmish, punch two hippies.

I don’t know how good a Fed chair Yellen would be. But the fact is the left backed her, and helped sink Obama’s choice.

So I’m not convinced she will get the nod. We are due for some epic hippie-punching.

Please.

1. Academic economists (and the academy is overwhelmingly neoclassical economists) overwhelmingly polled as preferring Yellen to Summers

2. Wall Street economists overwhelmingly polled as preferring Yellen to Summers

3. Stocks futures went up over 1% on the news Summers was out of the running.

You’ve got it wrong in pinning this on liberals. Republicans were also opposed. The #2 Republican in the Senate, John Cornyn, was firmly opposed:

http://www.reuters.com/article/2013/09/12/us-usa-congress-fed-idUSBRE98B1AN20130912

Pat Roberts (R from Kansas) said he wouldn’t let Summers mow his yard:

http://jaredbernsteinblog.com/i-can-no-longer-sit-on-the-sidelines-in-the-debate-over-the-next-fed-chair/

Of course the loyal opposition was opposed. They will oppose Yellen, too, if she gets the nod.

It was the pressure from the lefties that changed the outcome:

http://www.thenation.com/blog/176175/populist-rebellion-tripped-larry-summers#

I predict we will be punished for that sin.

Did you miss that the Nation is a leftie magazine? So of course its bias will be to give the lefties credit.

I was told by Congressional sources that Rubin allies were whipping Republicans over the weekend. It was the inability to get enough Republicans to support Summers that appears to have killed him.

Two observations:

a) Oblahma has already had another hissy fit, indicating that everybody that wanted Yellen instead of “Larry” willb e disappointed Just Because. Incompetence meets indignation.

b) Yellen in October 2005: “First, if the bubble were to deflate on its own, would the effect on the economy be exceedingly large? Second, is it unlikely that the Fed could mitigate the consequences? Third, is monetary policy the best tool to use to deflate a house-price bubble? My answers to these questions in the shortest possible form are, ‘no,’ ‘no,’ and ‘no.'” As quoted by Hussman.

In my mind, Bernanke should receive a life sentence as chairman of the Fed, with the abolition of the Fed in its current form proceeding apace.

And without even a mention of JFK, no less!

I think with another financial crisis coming, the money-people really, really want their man in position to, how should I say this, to, um, take advantage of ‘the situation.’

Who knows, here is a chance to remake government for the next 100 years, at least. Imagine, a century of martial law under the NSA (I am on my knees as I write this).

No way they give up that chance, knowing another crisis is coming.

No mammon worshipper would shirk that duty. Persist – that’s how one makes money for decades, centuries and millennia

Friends, Summers was never a viable candidate. He was Obama’s muleta.

Please consider just how visceral (and consistent) the aversion in this thread alone is towards Summers. Admitting that NC comment threads aren’t exactly a microcosm of the national discussion, at least it intimates the broader disposition towards him. And in this regard Summers is a pretty rare species, eliciting this reaction across the political spectrum. Seriously- he’s up there with Fred Phelps, y’all.

But it begs the following question: given the obvious, if not necessarily deep qualifications deficit (except with respect to consensus building) between him and Yellen then why did anyone take his candidacy seriously? Am I missing something here? Aside from a procession of mostly unsourced articles saying insiders simply knew the President favored him, I’m at a loss for a serious argument in his favor.

Perhaps it’s a logic too elliptical to be trusted, but it reads to me that opponents to his nomination (pretty much every non-Rubinite) should have articulated a stronger argument for why he *should* be credibly considered the best candidate, all things considered. And I don’t think that claim can be made cogently. In other words, was this a misallocation of attention, and was it a reaction that could be predictably provoked?

P.S. I welcome a less distasteful metaphor, but am at a loss for anything so well suited. And all my questions are sincere- please educate me where I’m misinformed or simply dense.

I think Summers is just the ultimate crony insider who has all of the key academics, key machine politicians, key Wall Street bosses, key financial regulators and key Fortune 500 CEOs in his contact list and knows them all on a first name basis. He knows how everything really works, who actually runs it all, and where all the bodies are buried. So Obama, a neophyte in 2008 came to rely heavily on him and thinks of him as a great crisis manager.

I hear that, and agree with the underlying premise that future financial crises are not merely feared but anticipated in the foreseeable future. But it suggests that Obama’s first concern is with the role of chairman as crisis manager. That’s a pretty impoverished view, especially if in discounting the materiality of the Fed’s decisions day-to-day it precipitates the next crisis. Housing, round 3?

I’m also skeptical that an individual who is both infamously abrasive and a quintessential insider could sustain the confidence of his colleagues. Were some full on catastrophe to develop during his tenure he would lack credibility on a personal level with everyone else there, and he would come off like an industry confederate. Then again, just because it’s a bad idea doesn’t really say anything about it being less likely to be implemented…

Thanks for the input, though. I end up overestimating people and processes, so I could definitely be mistaken here.

Sorry we won’t be treated to his confirmation hearing, though. It would have been a hoot! Then they could have voted him down. Better and more deserved ending. Serious rejection instead of withdrawal. Maybe DE Shaw would like him back. Who knows?

It’s late, I know, but I’d like to offer this in Larry’s honour for any interested in a little evening protest/blues:

“Even Cross Eyed Snake Oil Salesmen

Sometimes Get The Blues”

http://bit.ly/14h7ioo

Could be illusion, or maybe it’s real

In the back of your mind it’s not what you feel

Deliberate confusion, fail by design

An infinite jest or a storm warning sign

Live through the moment, thrill to give in

Double or nothing, you lose if you win

Even Cross Eyed Snake Oil Salesmen

Sometimes Get The Blues

Prisoner’s dilemma, zero sum deal

Glance in the mirror and you’re under the wheel

Strike out on balance, shift out of time

Labor distortion for a dollar and a dime

The wages of progress, so much for so few

But the deal of a lifetime is waiting for you

On the stages of history, they’ll mark what we do

When stories are told, none will be true

Middle of nowhere, remains to be seen

Double or nothing, lay it down on a dream

Even Cross Eyed Snake Oil Salesmen

Sometimes Get The Blues

Risk is reward, a means and an end

We’re all standing in line with our psychotic friends

On the magnetic river, micro trade winds blow

Middle ground disappears, there’s nowhere to go

Power times privilege, who would lead us astray?

Count all the toys at the end of the day

Your none structured future, gravitational words

Logic is tortured, extreme and absurd

Caught on a floodplain, wholesale fear

Double or nothing, the reasons are clear

Even Cross Eyed Snake Oil Salesmen

Sometimes Get The Blues

Trust no one at all, trust two even less

We’ll externalize costs for this unholy mess

Let cities lie fallow, in the heart of ambition

Til we market a cure for the human condition

Steal from the moment, cast on the wind

Double or nothing, you lose if you win

Even Cross Eyed Snake Oil Salesmen

Sometimes Get The Blues