Yves here. As much as the post below is a very useful recap of data in terms of the impact of QE, I need to hector “Unconventional Economist” for being pretty conventional. His headline question, whether intentionally or not, reinforces the notion that it was reasonable to think that QE, or super low rates generally (as in ZIRP) would lead to increase lending. That’s based on a view that is very popular among neoclassical economists, which is that everything can be solved by price. It follow that if you put credit on sale, companies and individuals will consume more credit, that is, borrow more, and will therefore go out and spend more, which will produce more growth.

The more formal name for that sort of thinking is the “loanable funds” theory. It was debunked more than 70 years ago by Keynes but refuses to die. As we wrote in 2011:

In really simple terms, there is a “loanable funds” market in which borrowers and savers meet to determine the price of lending. Keynes argued that investors could have a change in liquidity preferences, which is econ-speak for they get freaked out and run for safe havens, which in his day was to pull it out of the banking system entirely. [John] Hicks endeavored to show that the loanable funds and liquidity preferences theories were complementary, since he contended that Keynes ignored the bond market (loanable funds) while his predecessors ignored money markets.

But that’s a deliberate misreading. Keynes saw the driver as the change in the mood of capitalists; the shift in liquidity preferences was an effect. (In addition, Keynes held that changes with respect to existing portfolio positions, meaning stocks of held assets, would tend to swamp flow effects captured by loanable funds models.)

Making money cheaper is not going to make anyone want to take risk if they think the fundamental outlook is poor. Except for finance-intensive firms (which for the most part is limited to financial services industry incumbents), the cost of money is usually not the driver in business decisions, Market potential, the absolute level of commitment required, competitor dynamics and so on are what drive the decision; funding cost might be a brake. So the idea that making financing cheaper in and of itself is going to spur business activity is dubious, and it has been borne out in this crisis, where banks complain that the reason they are not lending is lack of demand from qualified borrowers. Surveys of small businesses, for instance, show that most have been pessimistic for quite some time.

If you want to put it in more technical terms, what is happening is a large and sustained fall in what Keynes called the marginal efficiency of capital. Companies are not reinvesting at a rate sufficient rate to sustain growth, let alone reduce unemployment. Rob Parenteau and I discussed the drivers of this phenomenon in a New York Times op-ed on the corporate savings glut last year: that managers and investors have short term incentives, and financial reform has done nothing to reverse them. Add to that that in a balance sheet recession, the private sector (both households and businesses) want to reduce debt, which is tantamount to saving. Lowering interest rates is not going to change that behavior. And if you try to generate inflation in this scenario, when individuals and companies are feeling stresses, all you do is reduce their real spending (and savings power) and further reduce demand (and hence economic activity).

And as we’ve seen, this is pretty much what has happened. To the extent companies have borrowed, it’s primarily in a speculative manner, either to buy back stock or to hoard cash (as in the cost of borrowing is close to zero in real terms after tax, so they might as well hoard up. They can always get rid of it somehow later).

The comment above discusses the lack of small business demand for loans. Although that is the primary driver, there is a second one I’ve been remiss in not mentioning: banks are pretty much not in that business any more, and why the Fed ignores that and pretends to act as if putting money on sale will lead to more small business lending is beyond me.

The barrier to small business lending isn’t the economics; it’s that most banks no longer have that skill. I’m not making that up. In the stone ages of my youth, all the big banks (and the industry was less concentrated, so there were more “big banks” back then) had two year credit officer training programs. Those credit officers would do the analysis and make recommendations on big corporate loans. Some would eventually become branch managers, and way back then, branch managers would have the authority to approve loans up to a certain level. They used not only their formal analytical skills, but also local information about the health of the economy, the reputation and stability of important local businesses. If the local hardware store owner came in looking for a loan to expand, the branch manager would have an informed view on whether his estimates of how much and how fast his top line would increase after his build-out. He’d even probably know if his cost assumptions were realistic based on prior experience.

That capability has been abandoned in large banks. Branches are just retail stores; lending is productized and based on whether the borrower meets certain criteria set at much higher levels in the bank. You might still find the old-fashioned case-by-case type of small business lending in small banks, but it’s as dead as a dinosaur in the big ones, and the big ones dominate the industry.

From Unconventional Economist, who has previously worked at the Australian Treasury, Victorian Treasury and Goldman Sachs. Cross posted from MacroBusiness

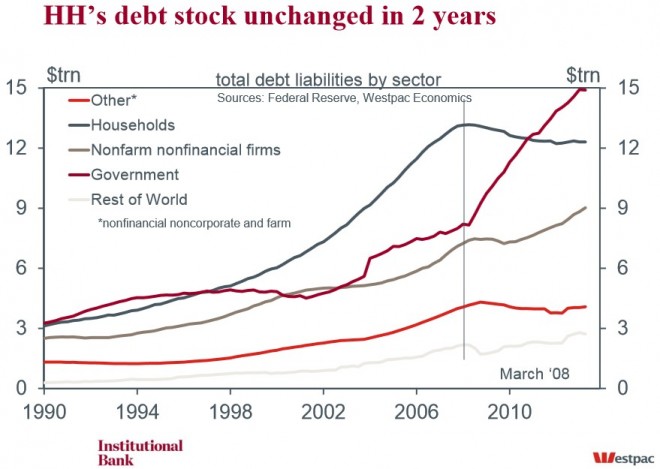

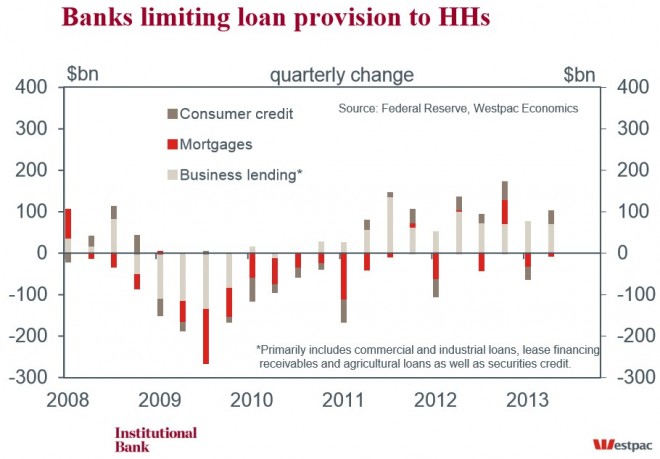

Westpac’s Elliot Clarke has today released the below note arguing that the Federal Reserve’s quantitative easing (QE) measures have done little to boost overall credit creation across the US economy, although it may have forestalled further weakness. Household credit growth remains soft, due to limited demand from end borrowers as well as the tighter lending standards introduced in the wake of the GFC. By comparison, corporate credit creation has been mixed, with a noticeable pick-up in non-financial firms’ credit growth offset by weakness in small business lending, where credit availability remains constrained. There has also been little increased corporate borrowing to expand productive capacity.

At its simplest, the credit easing undertaken by the Federal Reserve following the GFC was intended to improve credit conditions for end borrowers, both in terms of price and availability. On the price front, the FOMC has certainly met its objective, bringing borrowing rates down to historic lows and keeping them near those levels – the impact of 2013’s ‘taper talk’ on mortgage rates being an exception. However, more than four years on from the end of the recession, credit creation in the US economy remains decidedly sub-par.

This is most obviously true for households who have remained very cautious in their appetite for leverage in the wake of the GFC. Indeed, in dollar terms, the level of household credit has remained broadly unchanged for the past two years following a moderate deleveraging episode between March 2008 and June 2011. In the past two years, we have seen one notable quarterly increase in the size of commercial banks’ mortgage books (December 2012) and a singular quarterly increase in the combined loan book of Fannie Mae and Freddie Mac (June 2013), the two conforming-loan government sponsored entities – conforming in the sense that they require a solid credit rating, a sizeable deposit (typically 20%), and the loan to be smaller than the mandated loan limit. The remaining flow of credit provided to households during the past two years has been in the form of low-deposit, low-credit-score home loans facilitated by Ginnie Mae and the Federal Housing Administration (FHA) and consumer credit. The latter has primarily been in the form of government-funded student loans, although auto-loan growth has also been supportive.

As displayed by the October Senior Loan Officers Survey (SLOS), the absence of credit creation in the household sector is the result of limited demand from end borrowers as well as the tighter lending standards introduced in the wake of the GFC which were never really rescinded. While the SLOS indicates prime borrowers have benefited from looser lending standards in the past year, this improvement is negligible relative to the initial tightening.

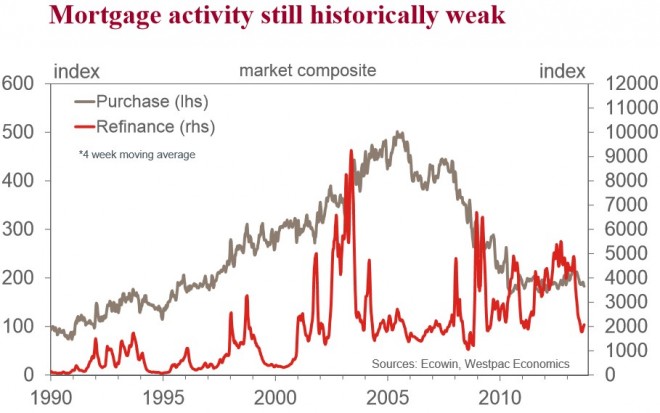

As an aside, it is worth noting that a special question in the October survey sought to assess the impact higher mortgage rates have had on household loan demand. The answers were consistent with available data on mortgage approvals, indicating a noticeable, albeit moderate, impact on purchase applications and a much larger impact on refinance applications. The timing of this deterioration also corresponds with the 5.6% decline in pending home sales seen in September.

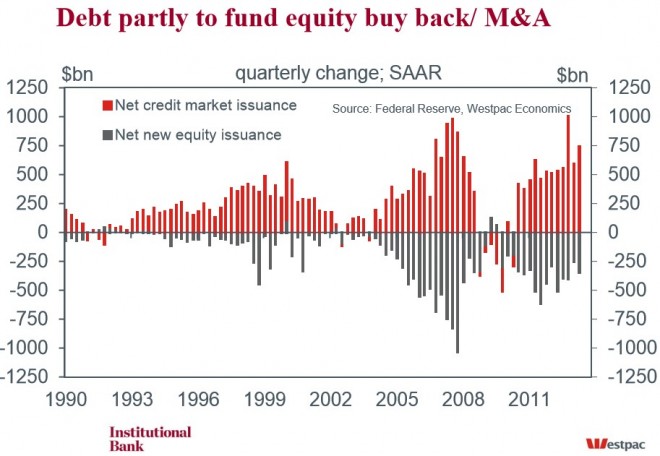

Turning to the corporate sector, there has been a much more noticeable pick-up in credit creation. Indeed, an uptrend has been apparent in nonfinancial firm credit liabilities since the end of 2009, with the pace of growth accelerating moderately over the past year.

That this acceleration has occurred at a time when annual growth in business investment has decelerated from over 9% in June 2012 to little more than 2% in June 2013 is somewhat surprising – one would normally expect higher leverage to be taken on to finance greater real investment. But we don’t have to go too far for an explanation. From the flow of funds data, it is evident that nonfinancial firms have been adjusting their financial structure, funding stock buy backs and acquisitions with borrowed funds. This is not only a recent phenomenon; it has been seen throughout the recovery.

On small business lending, good information is hard to find. As best can be assessed, lending conditions for small businesses remain restrictive. The latest NFIB small business survey indicated a historically-low 30% of respondents were borrowing on a regular basis; of that group, a net 5% reported loans were “harder to get” compared to their last attempt.

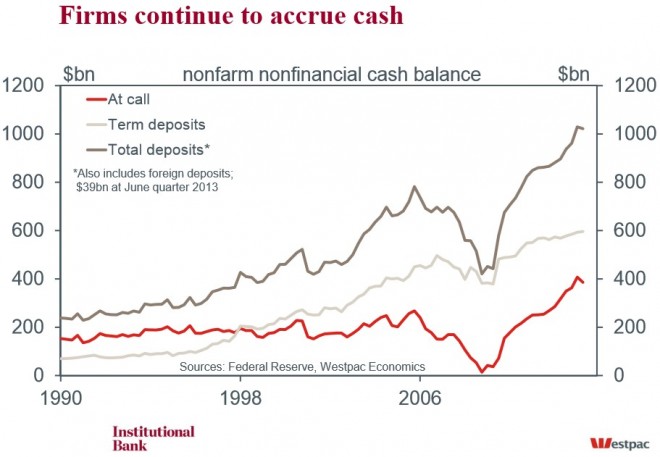

This recovery’s business investment narrative then looks to have been all about US corporates maximising reported profits (both by making the financial structure more efficient and through acquisitions) as opposed to expanding capacity. It is hardly surprising then that jobs growth has remained so fickle, and that what jobs growth there has been has been focused toward household service provision instead of production and business services. That cash continues to be accumulated amongst US corporates is yet another sign of a lack of investment opportunities and a high degree of uncertainty over the outlook.

In the past we have often emphasised that, despite its end-user focus, US credit easing has failed to spark persistent momentum in the aggregate economy. Arguably, the lesson to draw from this experience is that alternative policy measures are certainly an effective way to forestall further weakness and maintain the structural integrity of the financial system. However, in and of themselves, these policies are unable to engender greater dynamism. For that, confidence and clarity around fiscal policy, household’s financial health and the broader economy are key. On each front, there is a great need for improvement.

“The spiraling debt of the Federal Government to “Federal” Reserve, is due to repeated quantitative easing policies, i.e. primarily “printing” new money, supposedly made to stimulate the economy. Instead, however, the money went solely to bailout biggest banks, some of which participate in the “Federal” Reserve! Which means that, money returned to the banks through a circle, while uploaded US government with more debt, which will be passed on to future generations! Unanswered questions remain also, about the case on the basis of which, the “Federal” Reserve secretly supplied through the “back door” with more than $ 9 trillion, various financial institutions with questionable balance sheets during the financial crisis in the US. Nobody seems to deal with this issue today.”

http://failedevolution.blogspot.gr/2013/10/new-deal-vs-obamacare-one-reality-and.html

Actually, QE has reduced the Treasury debt. Since the Fed began its QE programs of buying treasuries and other financial assets, its earnings have soared. Those earnings are remitted to the US Treasury. Here the amounts that have been remitted over the past five years.

2008: $32 million

2009: $47 million

2010: $79 million

2011: $75 million

2012: $88 million

Fed projections are that those amounts will go down over the next few years as the Fed begins to reduce its asset-purchasing programs.

These numbers should also give pause to those who are convinced that QE asset purchases is part of an “extend and pretend” stealth bailout. If that were the case, then the Fed would not be increasing its earnings from its asset purchases, but would be losing money.

There is a propaganda effort underway, driven by far right populist cranks and the cynical plutocrats who exploit them, to convince young people that there is a terrifying public debt crisis taking place that is going to make them poorer in the future by burdening them with hideous debts and tax loads. They are doing this to try to mobilize the young politically to slash Social Security and Medicare, and reduce public support for government programs of all kinds. At the same time they have worked on getting older Americans to support education privatization schemes which will continue to make true higher education prohibitively expensive and more unequal, and will drive increasing numbers of post-secondary young people out of liberal education and into various forms of menial job training.

In other words, this conservative, anti-social and anti-democratic agenda aims to promote intergenerational hate and resentment among the poor and working classes, to undermine what is left of social solidarity and common purpose in America, and to dismantle any forms of progressive government.

The entire campaign is based on arrant lies and misinformation.

Thanks for clearing up elements of the QE mythology and persuasively stated comments about the generational marketing efforts on behalf of neoliberals.

I hope you are kidding. Nearly every article in the specific website is an accusation against neoliberalism.

Thanks for replying Dan

If you take a look at the data you will see that the share of the US government debt held by the “Federal” Reserve reached record levels in 2011, reaching 11.2% of GDP, the highest since 1940 onwards, and possibly the historically higher. In 2012, this rate was also high at 10.6% of GDP. Only once this figure reached such levels, in 1946, i.e. shortly after the end of WWII, when it reached 10.7% of GDP. [Source: Table 7.1, http://www.whitehouse.gov/omb/budget/historicals%5D

Debt equal to 11.2% of GDP in 2011, means more than 1.5 trillion dollars in absolute numbers, as well as in 2012. Therefore, as you understand, the 75 million or 88 million remitted to the US Treasury in 2011 and 2012, mean nothing, it’s just a drop in the ocean.

Some people exploit debt continuous rising to express their fear that America is not actually an independent state but controlled through debt even from foreign interests. You can name this a conspiracy theory, but it doesn’t mean that all these people belong to the far right. They are probably belong to the patriotic right and yes probably some exploit them too for their own purposes.

In any case, whatever the purpose is and who is exploiting what, the truth is that public debt is continuously rising and this is a problem which even the most developed countries face today. Again, if a problem is exploited from some people to pursue their own interests does not mean that the problem is not real.

Therefore, the QE is not the problem itself. The problem is how the system uses it. And the system uses it in the direction of loading more debt to the governments and future generations than in the direction of relief the majority, for example through viable social security and medicare programs or state investments to create new jobs in public sector and generally upgrade the government role in the economy.

If you take a look at the data you will see that the share of the US government debt held by the “Federal” Reserve reached record levels in 2011, reaching 11.2% of GDP, the highest since 1940 onwards, and possibly the historically higher.

That is generally a good thing NMB. The Treasury sells debt to the private sector, and the Fed then buys some of that debt back from the private sector. The ratio of debt held by the Fed increases the more of it the Fed buys. Since Fed earnings are returned to the Treasury, that means that when the Fed buys government securities, the net interest payments by the Treasury are reduced. Generally speaking the USG has more space to spend on worthwhile things if it doesn’t have use up its policy space sending interest payments to financiers.

“The supposed Federal Central Bank of the US (Federal Reserve or briefly Fed), controls completely the monetary policy and the money flow in the country, while being under control of large private banks. It is characteristic, that one of the largest lenders of the US government is Fed, which holds a significant share of public debt. The debt of the Federal Government to Fed, is due to quantitative easing policies, i.e. mainly, printing new money.

Similarly, the ECB becomes a corresponding Fed in the European area, “serving” the problematic economies that are excluded from the bond markets, through the print of new money. Therefore, the problematic economies will be loaded with more and more debt which the ECB, i.e. the largest private European banks will hold.”

http://failedevolution.blogspot.gr/2012/09/lea-jacta-est-by-emperor-draghi.html

Aargh, your source is embarrassingly incorrect.

1. QE is not printing money. Repeat after me, “QE is not printing money.” I’d debunk it myself but I need to turn in.

http://www.cnbc.com/id/100760150

http://pragcap.com/understanding-quantitative-easing

2. The Fed is not under the control of private banks. although it is so cognitively captured that it acts as if it is. The Board of Governors (which includes a large staff) is a Federal agency. The regional Feds have a peculiar public/private status. The banks own non-voting preferred stock. The regional Fed boards DO NOT play a governance role. Their function stems from the days when local economic data sucked, so the Fed would gather various local luminaries from a broad range of walks of life (but weighed towards business types, since they’d have a wider view of economic conditions) to get a reading of the state of the economy.

An indicator that the banks don’t play a governance role: they can’t remove a regional Fed president or any staff member. They do not approve any personnel policies, like compensation. They are not briefed on pending litigation. In other words, they do not perform the oversight function of a private sector board. That falls to the Board of Governors, which is public.

The effect is not that the Fed is controlled by the banks. It is that it is accountable to no one.

Yes, QE is not money printing, and I’m pretty sure that it’ll lead to some seriously nasty deflation rather than inflations. Anyway, a quible from me about your source:

“{The truth is that permanent open market operations merely change the composition of outstanding private sector assets and serve no role in helping to fund the US government. It’s true that the government could use the Fed to fund the US Treasury’s spending, but that would involve a full blown rejection of bonds by the Primary Dealers and the private sector (something that would likely only occur during a very high inflation).”

This is a rather offensive statement in that it’s a direct contradiction of reality. That blog post is undated, but hopefully it was written prior to Ben threatening to taper QE3/4 because otherwise the author looks either clueless or seriously intellectually dishonest.

Yes, primary dealers are still eager to lap up all the treasury debt they can, but that’s only because they know that they can realize nominal gains on all this stuff with access to free zirp credit, and if not they can turn right around and hand it off to the Fed for fat commission fees. Let the Fed start talking about tapering again and we’ll see just how fast the bond “market” collapses. Or maybe it won’t do anything now, just because people stopped believing the Fed’s “forwards guidance” lies.

Thanks for replying Yves

In my view:

QE is not JUST printing money, but it is printing money too. You’ve noticed that the word printing is written with quotation marks, therefore “printing” money does not mean necessary printing money in physical form.

The Fed is completely controlled by the biggest private banks.

The Board of Governors is Federal agency does not mean that Fed is not controlled by private banks. Also, it doesn’t matter that banks can’t remove a regional Fed president or any staff member, or they do not approve any personnel policies.

It doesn’t matter that the Board of Governors is public simply because US presidents themselves are puppets and governments are tools of the biggest private banks since they are funding election campaigns.

What matters is who are the private banks who control the Fed because those banks are pulling the strings.

In many cases, even the US secretary of Treasury comes from a big private bank and his actions fully support the banking cartel. The cases of Robert Rubin and Henry Paulson are characteristic.

In fact, Federal Reserve is controlled by private banks since 1913 under Woodrow Wilson administration, with the Federal Reserve Act.

“The effect is not that the Fed is controlled by the banks. It is that it is accountable to no one.”

No one except its shareholders.

Please bone up on corporate finance. Preferred sharedholders do not have a vote. They sit below bondholders and get a fixed dividend if there is money left after the creditors are paid and priority over equity in liquidation. They don’t have any say in governance unless it is explicitly provided for in the terms of the security (they pretty much never have a vote, but sometimes they have a veto over a very few major corporate actions, like a change in control).

This is all consistent with extend and pretend and backdoor recapitalization. If Bernanke actually believed QE would reflate the economy, he’s a fool. An astonishingly thorough fool.

Perhaps, though, he’s not a fool. Just a card carrying, water carrying factotum for the new oligarchs.

I don’t know what he thinks now, but like most people, Bernanke became Bernanke in his 20’s. Much of his academic work revolves around a 1929 stock/financial market crash and freeze of the Great Depression. If we accept that explanation and view as the source of the Great Depression, then QE made a bit of sense, but if we acknowledge the problem was that millions of Americans were going bust* during the late 20’s and that capital flight from Europe and even European colonies kept the financial/stock markets booming in the U.S. then we might want to rethink the Oct. ’29 date as the start of the Great Depression. Its 1927 in much of the world.

Since the popular narrative of The Great Depression is radically different than reality much like headline stats and economic health today, I think Bernanke is largely motivated by ignorance.

I’m not dismissing his love of the banks/money, but I think there is evidence to think Bernanke can seem intelligent and be as dumb as any other American. I think there is sufficient evidence to demonstrate why someone might think QE would save the economy and restore prosperity given the state of American historical education.

*business cycle, scams, the dust bowl, wage decline

Hmm, QE stimulating credit?

More like QE stimulating a huge racket in carry trading for obvious reasons. It’s also made US equities – at least for domestic investment purposes – the only game in town with treasuries and other debt vehicles having miniscule yields.

Notably QE has stimulated a great increase in that nascent sign of the US kleptocracy: inequality. Savers get destroyed with those lofty 0.01% CD yields while speculators wipe the floor in profits.

Daily Kos

News, Community, Action

Joan McCarterFollowRSS

Daily Kos staff

Profile

Diaries (list)

Stream

Mon Nov 04, 2013 at 02:39 PM PST

What the 1 percent thinks about you

by Joan McCarterFollow

Rich guy in front of yacht with quote superimposed:

It’s all so easy if you’re part of the one percent.

(Reuters) – I asked a financial services executive recently how our retirement saving system can be considered a success, considering that all but the highest-income households are approaching retirement with next to nothing saved.

His reply: “They don’t have any money while they’re working, so why would they have any money in retirement?”

It’s just that simple. If, like 45 percent of Americans, you’re of working age and you don’t have a retirement plan, well that’s your problem. You can just eat cake when you get old. Because the only the rich deserve to have comfortable retirements.

Yves, thanks for translating here. It is increasingly difficult to discern between neoclassical writers and those who peddle “uncoventional” ideas under the neoclassic rubric.

Two ideas I struggle with when I read articles like these are:

1. Is the snapshot of the economy even relevant given that the central issue in my mind (Trust) has been so severely damaged?

I think this is Yves point about “loanable funds” & Keynes. Each day we are exposed to more and more data and its direction, but there is usually some other hidden or opaque reaction. This causes me to wonder if “consumer trust” will really ever fully recover in world of complex trades, financial innovation and globalized game theory trading practices.

2. I read this on Chris Martenson website, but aren’t we looking at a generational or demographic shift in terms of those with an ability to even buy securities. In other words, are we looking tens of thousands of less potential buyers of securities chasing security prices which are massively inflated already? As the baby-boomers begin to enter retirement, are they not selling securities periodically (even in the ZIRP environment) to live on? And how might this massive $30trillion hole in the world economy affect this as well?

Overall, my main question is if there a lack of trust in the marketplace, and not enough buyers for every seller for the next decade, then can we understand capital/corporate absence as a purposeful tactic as they are trying to shape the next boom (and for them who cares while millions of Americans wait for solutions)?

I don’t know, but I am curious how others here have made sense of this article and what questions they have when they read about these issues.

Is the snapshot of the economy even relevant given that the central issue in my mind (Trust) has been so severely damaged?

That’s a good point. We are seeing a terrifying decline in social solidarity and public spirit. This is a phenomenon that, it appears to me, exists on both right and left to some degree, and among both the young and the old. It is a symptom of neoliberal culture, a decadent approach to life that teaches that the point of living is to serve one’s own turn and maximize one’s own personal pleasure, and that proposes that everything needed to hold society together will simple “emerge” from the hubbub of self-interested transactions. I believe that philosophy is quite wrong. Thriving societies cannot be fashioned from the weak bonds of self-interested tit-for-tat alone. Unless people experience healthy amounts of love of others, a generous willingness to live for others and deep commitment to ends that extend beyond the short period of their own lives, a society is doomed.

The point of my life, or anyones life for that matter, is to live for oneself. I don’t, nor can’t, live for anyone else. That’s impossible. That doesn’t mean that living for myself doesn’t benefit others. In fact a big part of living for myself, pleasing myself, is to see others around me happy and content, but also free like me–not pushing their authoritarian agendas down my throat. I selfishly desire that end–end of heirarchy. Every action I take is an action soley native to my own volition. I do any and all things to benefit me. I do nothing for the abstraction called society, whatever that is. At base, and I’ll say it again, I do what makes me happy, as does everyone else does what makes them content and happy. I am a social being, but that does not imply that I desire heirarchy or any authoritarian arrangement, including lording myself over others. Bottom line I am soley an individual and not a part of you or anyone else. I am not a part of any of the popular abstractions floated by the left or right. I’m not a state, a libertarian, conservative, liberal, society, mankind, community, social purpose or a wage laborer. I’m me, an individual who desires free association, unfettered by heirarchical arrangements that enslave rather than free me. I’m 100% selfish, as are you, only I admit it. My only restriction (which is part of my selfish nature) is not to coerce or harm another. The best living arrangement would promote this basic truth–live and let live. Everything else is just new boss is same as the old boss authoritarianism. No thanks.

That’s impossible.

No it isn’t. People sacrifice their own well-being for others all the time. Sometimes they even die for others.

It’s impossible. All human action is proximate. Claiming you are doing said action for another does not negate the fact. We all act ultimately to benefit from what is important to us INDIVIDUALLY. If I choose to die for someone I do so because I see it as noble or something along that line and thus my act–my act, not the person who lives because of my act– is what I value utmost to please Myself in the end. I’m doing the act, no one else–not society, Jesus or the state. Just ME always being the doer. Period. I am not a state or a society, etc., and neither are you. Everything I do I do to please me in the end. You too. In can be no other way.

Well sure, but that’s not the claim you made originally. Of course if you do something, you must have been motivated to do it, and those motives are things that in some sense lie inside you (whatever the boundaries of i are).

But what might motivate you is the well-being of others, and it might motivate you to such a strong degree that you are willing to sacrifice your own well-being for others, and to live for others. You originally said that it is impossible to live for others. Now you just seem to be saying that it is impossible to live for others unless you are motivated to do it. The latter claim is trivial, and not an argument for the former claim.

I am always and everywhere living for me alone. It is no contradiction to say that what makes me happy is to see others happy. I am living for me, not you, or anyone else as that would be logically impossible. If living for me means that I prefer a living arragnment that benefits not only me but others too, then there is no contradiction either, since I am happy (that is my ultimate endpoint) when others are happy. The living arrangement that best benfits us all isn’t made up of reified life, but rather authentic interactions not predicated on heirarchy or coercion. Absent free association we’re all slaves. Revolutionary changing of the guard only changes who will enslave us next. A good start for true emancipation/maximum self actualization would be abolishing “bosses” (wage labor) and most property rights, especially land. That’s where my individual freeing plan commences. The rest is all same old same old.

Well, you are speaking for yourself then, because I know for a fact I am not living for myself alone. In fact, the older I get, the less important my own stupid and limited life seems and the easier it is to live for the sake of others.

I agree with Dan here. Individualistic self-interest seems less and less important. I think parenting teaches us this as well as watching our parents age, experience health problems and die. In my mind, this is why we need reminders to achieve some sort of balance in our identity, relationships, and time here on earth.

I love the Jim Valvano ESPY speech where he suggests the key to living a few days before he dies (paraphrased): “If you spend part of your day in thought, experienced a strong emotion, and have laughed, well that’s a full day. Thinking, feeling and laughing is life.”

This leads to my thesis comment here as I believe we have too many specialists in a high-tech world where knowledge is at our immediate finger tips. This leads to a lack of balance in multiple systems and makes it easier for the social threads like trust to be frayed and uncertain. This is why I love this site, I am neither an economist, nor an attorney, but these ideas contribute to a larger general knowledge base I can apply to consumer education, family therapy or ecological oppression.

I agree – to a point. Not too long ago, I had somebody insist that “self interest is a mortal sin”, which is a downright psychotic perspective.

I agree – to a point. Not too long ago, I had somebody insist that “self interest is a mortal sin”, which is a downright psychotic perspective.

This person also stated that “I completely distrust self interest”. Really? Who is this “I” that trusts and distrusts?

Such views are intellectually dishonest. If not, they are just stupid.

Agreed up to a point.

Not too long ago, somebody I thought I knew kept agressively insisting that “self interest is a mortal sin” on the basis that humanity would have to get rid of self interest if it is to survive. Excuse me, but this is absurd. It’s taking a statement out of E.O. Wilson’s paper in Nature out of context about group fitness (e.g. “intrinsic fitness has collapsed”) to mean that intrinsic fitness doesn’t matter.

This person also got on a breast beating high horse saying “I completely distrust self interest”. Again, excuse me? Who is this “I” that trusts and distrusts?

If this isn’t a dialectical intellectual conceit, (potentially psychotic) it’s just stupid.

Agreed up to a point.

Not too long ago, somebody I thought I knew kept agressively insisting that “self interest is a mortal sin” on the basis that humanity would have to get rid of self interest if it is to survive. Excuse me, but this is absurd. It’s taking a statement out of E.O. Wilson’s paper in Nature out of context about group fitness (e.g. “intrinsic fitness has collapsed” [e.g. as dominant]) to mean that intrinsic fitness doesn’t matter.

This person also got on a breast beating high horse saying “I completely distrust self interest”. Again, excuse me? Who is this “I” that trusts and distrusts?

If this isn’t a dialectical intellectual conceit, (potentially psychotic) it’s just stupid.

I had to cut the person off after a 35 year friendship. he’s now going around saying I have a “pure Randian position”.

All very bizzare! What this all showed is that while Randianism is a pathology, there is also an inverse pathology.

Due to frustration with inciting constructive change, people are resorting to irrational extremes.

“His headline question, whether intentionally or not, reinforces the notion that it was reasonable to think that QE, or super low rates generally (as in ZIRP) would lead to increase lending. That’s based on a view that is very popular among neoclassical economists, which is that everything can be solved by price.”

Something I used to believe…Anyway, here is a very amusing anecdote about insulation, cleaning out attics, and price:

http://conversableeconomist.blogspot.com/2013/10/rilchard-thaler-on-behavioral-economics.html

Let me tell you another story about the U.K. We had a meeting with the minister in charge of a program to encourage people to insulate their attics, which they call “lofts”—I had to learn that. Now, any rational economic agent will have already insulated their attic because the payback is about one year. It’s a no-brainer. But a third of the attics there are uninsulated. The government had a program to subsidize insulation and the takeup was only 1 percent.

The ministry comes to us and says, “We have this program, but no one’s using it.” They came to us because they had first gone to the PM or whomever and said, “We need to increase the subsidy.” YOU KNOW, ECONOMIST HAVE ONE TOOL, A HAMMER, AND SO THEY HAMMER. You want to get people to do something? Change the price. Based on theory, that’s the only advice economists can give. …

So we sent some team members to talk to homeowners with uninsulated attics. “How come you don’t have insulation in your attic?” They answered, “You know how much stuff we have up there!?” So, we got one of the retailers, their equivalent of Home Depot, that are actually doing the [insulation] work, to offer a program at cost. They charge people, say, $300; they send two people who bring all the stuff out of the attic. They help the homeowners sort it into three piles: throw away, give to charity, put back in the attic. And while they’re doing this, the other guys are putting in the insulation. You know what happened? Up to a 500 percent increase. So, that’s my other mantra. If you want to get somebody to do something, make it easy.

Give Bernanke and the Fed a break. They wouldn’t have to resort to the known inefficient QE as stimulus if the rest of the government would use the known effective tool of fiscal stimulus.

The President has just started touting a chart that shows that the deficit is rapidly being cut. Infrastructure spending is also on a downward spiral.

There is no amount of monetary policy that can counter this retrograde fiscal policy. However, since it is the only game in town, you might as well give it a try to see if can at least do some good.

Also, why would taxes have to be raised to pay back the treasuries? Most treasuries are just rolled over when they expire. By the time that the Fed may not want to roll its treasuries over, it will just get its principal back. If there needs to be USD money, the Fed can just make it to help the government pay back for the treasuries.

There is something like $500Billion in treasuries traded every day, so whatever amount the Fed does not want to rollover on any given day will be a miniscule part of the existing market.

Credit is something called debt, debtpushers are much like drugpushers. Do you want to deal with a drugpusher?

the aging population is not going to take on the credit monster again, DebtZilla blew out their candles and brought down whole cities, killing many poor souls.

I used to look at a 100 credit applications a day, I bought paper on fundamentals like DTI, PTI, credit quality, LTV and income. It was easy to weed out credit criminals by digging a little. I just believe that credit officers are not as well rounded today as they were in the past. Sometimes making decisions on your own is required. Sometimes your wrong but if the majority of your decisions were right than your volume of A Paper would overwhelm your C paper deicisions negating a edgy decision.

The issue today is that risk is improperly priced, chasing yield has delivered undesireable results that are only festering. Think of yields in todays abs, mbs paper….a borrower with a bk can get rates at 10%, in our days that risk was priced at 19%…the risk was real..now its smoothed over by the fed downplaying risk with low yields…it shall be interesting moving forward as wages are just not helping drive credit demand. A borrower is now confined to borrowing what they need not what they dream ala 2005 underwriting.

All these people worrying about credit demand are focused on the wrong thing, wages are the issue…