By Servass Storm, Department of Economics, Faculty TPM, Delft University of Technology

It is truly ironic to see Lawrence Summers and Paul Krugman promote sustaining asset price inflation as the only viable option left to get away from secular stagnation. The curiosity is that Krugman does this invoking Keynes, while Summers has been co-responsible for engineering one of the greatest bubbles of all times, which ended in the Great Crisis. But let me leave aside this issue and the not so unimportant practical issue of how central banks and treasuries manage sustained asset price bubbles and instead turn to consider the logic of their argumentation.

Mario Seccareccia’s note last week did a great job of showing how the Summers/Krugman “liquidity trap” argument is just the old Wicksellian loanable funds market, which has acquired something like the status of a folk theorem in economics. “Within this neoclassical theoretical box”, the note states, “there is only one solution to move the economy out of secular stagnation. One must boost the Wicksellian “natural rate” by strengthening expectations of return.” This could be done, as the note argues and following Wicksellian logic, by a policy of negative real interest rates (amounting to a fiscal subsidy on borrowing) which might do the job of triggering an asset bubble.

What the note does not state so clearly, however, is that Wicksell assumed that the loanable funds market operates in a situation of full employment, i.e. income would be at the full employment level. The (natural) interest rate would then balance savings supply and investment demand, only affecting the composition (but not the level) of full-employment income. Keynes argued, of course, that it was possible for investment and saving to be equal at any level of income, which implies that the equilibrium rate of interest might be consistent with any amount of unemployment. Applying Wicksell’s loanable funds model in a blatantly non-full employment context, as Krugman and Summers are doing, is – therefore – a red herring, distracting attention from the real issue, which is: unemployment due to lack of demand.

Secondly, however perverse a monetary policy of negative real interest rates may be, I do think it is unlikely to have much of an impact in the current balance-sheet recession. The heavily-indebted private sector (mainly households) will take the credit (plus subsidy) to pay down its debts – yes, perhaps part of it will spill-over in higher asset prices (somewhere), but most will be used to reduce the debt overhang, without much impact on the real economy.

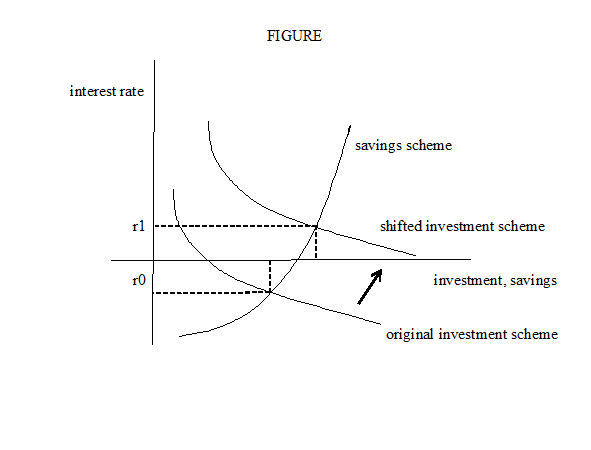

Now back to Summer’s and Krugman’s (faulty) Wicksellian logic. I am puzzled why they ignore the fiscal policy option. The position of the investment schedule (loanable funds demand) clearly depends upon the interest rate as well as the state of confidence of business investors. But it also depends on public investment. If public investment is stepped up, this raises the demand for loanable funds. With an unchanged loanable funds supply, the interest rate must go up, in the process crowding out interest-rate sensitive private-sector investment. New Consensus Economists never grew tired, back in the pre-crisis days, of pointing to the crowding-out impact of expanded public investment. But if it worked back then, it should also work now: any increase in public investment will push up the investment schedule (see FIGURE below) and this will help in raising the interest rate, increasing savings as well as aggregate investment – especially because (a) the savings scheme will be rather steeply increasing (people save out of the precautionary motive, and less in response to the interest rate); and (b) private investment will be overwhelmingly dependent upon a lack of confidence of the business investors (and less affected by the – low – interest rate).

What I am arguing, therefore, is that Summers ignores the potential role which “expansionary Keynesian fiscal policy of massive public investment” might play in his own hybrid model, while Krugman’s enthusiasm for quantitative easing is really quite inconsistent with his often stated support (since the start of the crisis) for greater deficit spending. Their current silence on the recovery-role to be performed by public investment helps make the public believe that “asset price inflation” is the only way open to avoid a secular stagnation. Whatever they think privately, it all adds up to a public case for the idea that the only route to recovery goes through Wall Street itself.

Nobody is discussing “expansionary… public investment” because austerity planning is the capstone of the new consensus. Excuse me, but this is plainly obvious, and why economics faculty member Servass Storm has nothing to say about this reality is beyond me.

We will all soon be caught in overwhelming nostalgia for the glory days of Dick Cheney, who said that “deficits don’t matter.” The only consensus-regarded route to “recovery” (such as won’t happen in jobs) goes through Wall Street because the current method of boosting profits in a declining-growth economy (now on four decades of decline) is to push austerity planning so that bond values can be pushed upward and government assets can be stripped. What comes to mind at this point is Karl Marx’s equation of capitalists with vampires.

Look, the establishment vampires who push this stuff are still in power even in contracting economies like that of Greece, and Greece even has a historically-prominent Left.

In other words, this is not an economic crisis. It’s a political crisis.

Well, Duh!

And eventually some of you will figure out that much more than just an economic or political crisis we also have an environmental crisis on our hands–and that the current economic/political crisis is merely a symptom of the earth’s collapsing life support systems.

If we are very lucky, the political and economic system will collapse just enough to end most of the unsustainable economic paradigm we’ve got today, but not so much that we won’t be able to shut down the nuclear plants and move the waste deep into the earth’s mantle before that material sterilizes the biosphere.

If we had sense we’d be adopting Kunstler’s planned contraction model as the path forward, but we do not have sense. We have interests. We have lobbies. We have ideology, and that ideology tells us that growth is good and growth is eternal, that technology will bail us out if we only hold on and keep doing what we are doing long enough. We will drill and frack until “something better comes along.”

I’m 48 years old, and am finding it harder and harder to go on knowing full well that the best days are behind me, that my children will inherit the wind, and that people whom I have been told all my life were smarter and better than me are the cause of it all. And that I am powerless, with all my knowledge and insight, to do jack shit about any of it.

True. It strikes me as some sort of massive failure of the imagination amongst the educated, which I suppose says something about what we’ve “educated” people to be.

I’m not following this chart. We have interest rates on one scale and time on the other? What is this saying? interest rates decline year after year as savings rates increase? I must not be understanding this.

OK. I think I get it. You have interest rates versus available funds. So in the first case you have a fixed amount of funds that you distribute between savings and “investment”. In the second you start with a bigger “kitty” because the government is kicking in some, leading to an overall increase in net funds? That doesn’t sound right.

“Secondly, however perverse a monetary policy of negative real interest rates may be, I do think it is unlikely to have much of an impact in the current balance-sheet recession. The heavily-indebted private sector (mainly households) will take the credit (plus subsidy) to pay down its debts – yes, perhaps part of it will spill-over in higher asset prices (somewhere), but most will be used to reduce the debt overhang, without much impact on the real economy.”

Erm, no. Not in the UK it won’t. We’ll all go on the most outrageous housing splurge in recorded history. It’s bad enough now.

“If public investment is stepped up…”

Right, if public investment is stepped up on… what, roads? Rather apart from the whole economy, stimulus thing (or maybe not) there is the incidental fact that public expenditures do marshal the finite resources (given that we do still live in the natural univers where actual natural law and resource constraints operate, as difficult as it is to imagine sometimes) of a society and direct them towards projects deemed suitable by the political elite–a political elite many do sadly consider to be a group composed of corrupt, psychotic incompetents. Would it really be a good idea to do fiscal stimulus repairing highways that would much better serve society if allowed to decay and fruit trees planted in their place?

At any rate, a good 90% of the things people do is utterly useless, and a good 90% of the crap people consume did not need to be consumed and should not have been consumed. Therefore what we need, and what the earth needs, is not “stimulus” but “anti-stimulus”; a way of causing people to not do economic things that are self-destructive and poisonous to the environment. And it would be a good idea to started on that right now while we still have some apparent control over the situation, rather than wait a couple of years and have nature do it for us (considering the often unpleasant and horrifying way nature has of doing such things. Humans can have pity; nature doesn’t).

A good new public works administration with a mandate to cure the environment fits the bill in both directions. Say, cars: the PWA can pay everyone for recycling their cars, and for not buying new ones and give everyone a subsidy for bus travel and other public transportation. Along with this unlikely sanity auto manufacturers could be retooled to make clean busses (as clean as possible) for municipalities and simply give them away. In conjunction with this stimulus, a nationwide effort to recycle stuff, a massive recycling effort, could put lots of people to work – the new mining industry. A government agricultural policy using the latest permaculture techniques could turn the suburbs into very productive places by decentralizing big agriculture and keeping it local to big and medium cities. Those measures would turn industry around, address the environment, produce healthy food and create 30 million jobs. But we do not live in a practical world.

There was a clip last night on our sick consumerism. I think it was on RT but I cant remember. Anyway it was a segment of an interview with an “environmental psychologist” explaining how we buy things in a frenzy and we don’t need them and usually can’t use them much. Duh.

“Managed degrowth” is only possible through a union of free producers — if everyone is intimately empowered with control of the means of production, then the parasitical professions can be eliminated. Otherwise forget it.

Why get all intellectual when it comes down to collusion, corruptness, and a big con:

The Money Changers Serenade: A New Plot Hatches

Former Treasury Secretary Timothy Geithner, a protege of Treasury Secretaries Rubin and Summers, has received his reward for continuing the Rubin-Summers-Paulson policy of supporting the “banks too big to fail” at the expense of the economy and American people. For his service to the handful of gigantic banks, whose existence attests to the fact that the Anti-Trust Act is a dead-letter law, Geithner has been appointed president and managing director of the private equity firm, Warburg Pincus and is on his way to his fortune.

A Warburg in-law financed Woodrow Wilson’s presidential campaign. Part of the reward was Wilson’s appointment of Paul Warburg to the first Federal Reserve Board. The symbiotic relationship between presidents and bankers has continued ever since. The same small clique continues to wield financial power.

Geithner’s career is illustrative. In the 1980s, Geithner worked for Kissinger Associates. In the mid to late 1990s, Geithner served as a deputy assistant Treasury secretary. Under Rubin and Summers he moved up to undersecretary of the Treasury.

From the Treasury he went to the Council on Foreign Relations and from there to the International Monetary Fund (IMF). From there he was appointed president of the Federal Reserve Bank of New York, where he worked to make banks more profitable by allowing higher ratios of debt to capital, thus contributing to the financial crisis.

Geithner arranged the sale of the failed Wall Street firm of Bear Stearns, helped with the taxpayer bailout of AIG, and rejected saving Lehman Brothers from bankruptcy in order to create the crisis atmosphere needed to more fully subordinate US economic policy to the needs of the few large banks.

Rubin, a 26-year veteran of Goldman Sachs, was rewarded by Citibank for his service to the banks while Treasury Secretary with a $50 million compensation package in 2008 and $126,000,000 between 1999 and 2009.

When a person becomes a Treasury official it is made clear that the choice is between serving the banks and becoming rich or trying to serve the public and becoming poor. Few make the latter choice.

As MIchael Hudson has informed us, the goal of the financial sector has always been to convert all income, from corporate profits to government tax revenues, to the service of debt. From the bankers standpoint, the more debt the richer the bankers. Rubin, Summers, Paulson, Geithner, and now banker Treasury Secretary Jack Lew faithfully serve this goal.

This vast con game remains unrecognized by Congress and the public. At the IMF Research Conference on November 8, 2013, former Treasury Secretary Larry Summers presented a plan to expand the con game.

Summers says that it is not enough merely to give the banks interest free money. More should be done for the banks. Instead of being paid interest on their bank deposits, people should be penalized for keeping their money in banks instead of spending it.

To sell this new rip-off scheme, Summers has conjured up an explanation based on the crude and discredited Keynesianism of the 1940s that explained the Great Depression as a problem caused by too much savings. Instead of spending their money, people hoarded it, thus causing aggregate demand and employment to fall.

Read more at http://www.wirenews.co/op-ed/usa/16459/the-money-changers-serenade-a-new-plot-hatches#QrwHgRFJm4Cigh0p.99

Did you know it is estimated that Earth as a whole is struck by an average of more than a hundred lightning bolts every second. It just never strikes the right places as I see it.

Keynes explained the length of the Great Depression as a problem caused by too little spending causing aggregate demand and employment to fall.

We’re caught in a prison of our own design.

Using debt for money.

Rather than dwell on the Wicksell and Gesell ‘velocity’ fix for a broken money supply, there is already a bonafide monetary mechanic out there with a real fix, which is Adair Turners Permanent Overt Money Finance.

http://www.group30.org/images/PDF/ReportPDFs/OP%2087.pdf

It is nothing more or less than plain old fiscal (government spending) intervention, but rather than enjoining the austerian debate, the ‘money-finance’ is via direct spending into circulation, and not by issuing more public debt. Because it is OUR money system.

It has taken someone with the monetary gravitas of Turner to broach the real taboo, both in monetary economics and on these pages, of having the government take back the issuing power and, as the issuance is ‘permanent’, remove us from the Summers/Krugman secular stagnation discussion. It is precisely for this reason that the original POMF solution was proposed to FDR in the 30s.

See Turner’s full explanation at the INET conference here. http://www.youtube.com/watch?v=ZhrY_coLK_k

He starts about 8 minutes in, after Soros’ introduction.

Take the time. It’s worth the education.

Thanks.

They don’t intend to ever talk about fiscal stimulus because that would make them sound naïve and irrelevant to the people they are courting at the top.

There is probably no way out. Anyone who will be listened to cannot tell the truth (or has forgotten what it looks like). Those who tell the truth are systematically denied a place at the decision-making table. No one who cheered on Greenspan and Bernanke lost their positions in academia or government. No significant institution went out and hired those who saw the crash coming. The same players are fixed in place. The pecking order remains intact. We will go down this road until we fall off a cliff.

We need a lot more than fiscal “stimulus”. We need social transformation with a lot of engaged public and governmental action. The fact that much of that transformative effort will require government outlays which are therefore in some formal economic sense “fiscal policy” doesn’t tell us much about what needs to be done.

We need social transformation with a lot of engaged public and governmental action. Dan K

No Dan. What the population needs is restitution for theft, not government programs. And it needs that restitution because the banking cartel has cheated them, both debtors and non-debtors. And we needs fundamental reform wrt money creation so the banks can’t do it again.

But any excuse to jam some agenda down the country’s throat, eh? And thus the suffering continues because Progressives can’t get their way?

He has told you, O man, what is good;

And what does the Lord require of you

But to do justice,

to love kindness,

And to walk humbly with your God? Micah 6:8

It’s a mistake to look to macroeconomists for significant guidance on our most important social challenges. They take social institutions for granted and view the economic functioning of those institutions from a very abstract and uncritical perspective. Even the debate about monetary vs. fiscal policy is, for them, just a debate about the optimal mechanics for restoring a higher-employment equilibrium state – in other words, restoring our disordered and depraved society to a somewhat more energetic level of stable performance.

For another view:

“Talk of the major capitalist economies entering a state of ‘secular stagnation’ continues to cause debate in mainstream economics.”

http://thenextrecession.wordpress.com/2013/11/30/secular-stagnation-or-permanent-bubbles/

Well, TPTB have decided that fiscal policy can’t be used. “Washington is broken!” and government deficits are taboo.

What economists should be doing is talking about why we are where we are, and offering solutions to prevent such an occurence.

We are in a ‘liquidity trap’ (zero real rates) because that is what massive bubbles do: they cause malinvestment that shocks the economy when if falls apart.

Loanable funds is only one problem for the myopia. Another is the rational markets hypothesis.

Economists should talk about:

* how bubbles are boondoggles for Wall Street via tax incentives (like ‘carried interest’), trading volume, etc.

* how bubbles = malinvestment

* how to prevent bubbles and pay for economic adjustment when they do occur

Bubbles are somewhat similar to CEO pay. Both can lead to failure (of a company / of an economy). We now recognize that executive compensation has to be altered and even clawed back. The same should be true of the ill-gotten gains from bogus ‘bubble-generated’ returns.

Negative real rates are not an inconvenience to be finessed. They are an important indicator of the degree of malinvestment and the amount of bogus investment gains. These bogus gains should be clawed back to pay for stimulus, in much the same way that we treat stolen goods.

The choice is not bubbles vs. deficit spending. The choice is markets that work as they should vs. systemic plundering.

Furthermore, it is well known that excess profits are being used to ‘buy’ our democracy. In that light, PhDs that advocate for bubbles are traitorous quislings.

The problem is that if I sent in a paper which stated that the Battle of Jutland was fought in the pool at the Bellagio Hotel in Las Vegas and won by the Siamese it couldn’t get published, but if someone from the University of Chicago or MIT writes a paper and says that the cause of all our troubles are those pesky subprime “minority” (cough-colored-cough) borrowers and government deficits, it gets published and quoted. Economics is a discipline entirely captured by dogma, and all tenured posts in the top 12 Eco programs go to grads of those same 12 programs (well, I think the number when last tallied was 89%, so I exaggerate, slightly) and they must tow the line or no nice job and no happy future consulting for them. All testing in neoclassical Economics seems to be by a priori reasoning. It is a closed shop, and one that does everything to police orthodoxy and nothing to police truth.

Note that there are many different ways in which an economy could grow, economically speaking. Some types of growth would give us nightmare worlds that most of us wouldn’t want to live in, but where the aggregate output of whatever assortment of debauched “products” that world produces is according to some standard measurement technique greater than it is now.

Fixating on macroeconomic categories alone can produce brain-dead social thinking.

http://archive.org/stream/roleofmoney032861mbp/roleofmoney032861mbp_djvu.txt

The Role of Money

-What it should Be

Contrasted With What It Has Become

Dr. Fredrick Soddy

Just read The Preface……….. if you can.

Father of Ecological Economics.

Source for Herman Daly’s work on The Common Good.

Basis for Simons, Fisher, Friedman public money thinking and also for Adair Turner’s Permanent Overt Money Finance(POMF) linked above.

Permanently sustainable resource stewarship through permanent, sustainable money. The antithesis of, and in opposition to, brain dead social thinking.

Whenever we’re ready.

Some types of growth would give us nightmare worlds that most of us wouldn’t want to live in, DK

That’s why we need DECENTRALIZED, ETHICAL private money creation so some tyrant can’t jam, for instance, his hair shirt down our throats.

Of course, YOUR form of tyranny is an exception, no doubt. That’s what they all say?

IMHO, any economist that speaks about interest rates without mentioning the effects of compound interest and its corresponding assessment and assignation of risk, is either a willing or unwitting obscurantist. The Summers, Krugmans and Rogoffs are just posturing or being postured to be the prognosticators of “the way forward” without accounting for their roles in the lead up to the GFC and lack of solutions afterwards. Larry Summers, for example, in his IMF speech analogized the “crisis” with a power outage. At least he recognizes that the payment system can be thought of as a utility. What he failed to mention was that in electrical engineering, the real world has real limits and these limits are well known, and can be controlled and regulated (even though the “smart” guys at Enron tried to f—k with it). Maybe Regulators can be thought of as “circuit-breakers”. He wants us to believe that “intermediation” is THE viable substitution for regulation, i.e., that “financialization” is a substitute for governance.

Their presupposition is that -“how the zero dot zero oner’s sucked up the “wealth” is irrelevant and irreversible and we need to accept this as a fact. That “the way forward” is to tweak the “system” so as to maintain the illusion of viability long enough for the anger to subside and the sucked-up “wealth” to be made permanent”. Not even a casual recognition of the illegitimacy of the “sucking” nor the legitimacy of the anger.

If these so-called “saviors” of “Capitalism” are to be positioned as philosophizers of “the way forward”, why shouldn’t they be pressed to answer real concerns and questions? How much “intermediation” is required between getting sick and convalescing? How much “intermediation” is required between an Electric Power Provider and paying your electric bill so you can turn your switches on and off in your home (if you still have one)? Would we tolerate an Electric Power Provider holding its(our) service hostage for ransom(outrageously disproportionate rates)? How much “intermediation” is required to match the work that needs to be done with the un/under/mis-employed willing to do it and the resources to get it done? Why should “high finance” be the “default” “intermediator” and decide if and how “we” move forward? Has Congress willingly or unwittingly legislated itself on a path of irreversible irrelevance and subsequent obsolescence? Aren’t the TPP and TTIP the emergent evolution of this path?

“Krugman’s enthusiasm for quantitative easing is really quite inconsistent with his often stated support (since the start of the crisis) for greater deficit spending. Their current silence on the recovery-role to be performed by public investment helps make the public believe that “asset price inflation” is the only way open to avoid a secular stagnation. Whatever they think privately, it all adds up to a public case for the idea that the only route to recovery goes through Wall Street itself.”

Krugman’s support for QE seems to me to be faute de mieux, given the current deadlock in Congress. That is not really inconsistent.

I agree that not repeatedly and consistently making the case for public investment plays into the hands of its opponents. Let the politicians worry about second best.

Krugman and Summers are propagandists for kleptocracy, class warriors of the status quo. Their mission is not to elucidate but to obscure. So according to them, the problem isn’t looting by the elites and 1%. It’s an agentless “secular stagnation”.

We have seen this movie so very, very many times before. Krugman or some other Establishment liberal will shed a few crocodile tears over the middle class or the unemployed. They will throw out some progressive catch word or idea to show they are really, really on our side and really, really understand our issues. And then the next time we hear from them they are back to flogging the neoliberal, kleptocratic line.

Make no mistake their job is to promote looting and to keep any serious opposition to kleptocracy from forming. What makes Krugman and Summers’ current proposal to blow bubbles, bubbles being a primary looting tool of the kleptocrats, is just how over the top and in your face, they are being this time around.

And can we finally put to rest once and for all the one about Krugman just doing his best with bad material? If Krugman were truly on our side, he would be on the barricades with the rest of us. He would be using his notoriety to spearhead opposition to the kleptocrats, not, as he does now, use his position to subvert that opposition when and wherever he can.

Totally agree, but……

If any of them, or anyone else, were on our side of the ramparts where the progressive idealists are holding up and putting forward populist policies that restores wealth distribution among The Restofus wealth creators, what polcies would they be supporting, and who, if anyone, is the leading protagonist for that which benefits the Ninety-nine Percent, who is it that the righteous liberals might be joining?

Thanks.