Yves here. I’m sure readers will find plenty of grist for discussion in this post. In general, Tverberg’s analytical focus on how energy prices interact with the economy (and on energy development itself) is a sorely neglected line of inquiry. But this (as she acknowledges) is a very complex problem, and here resource-centricity may lead her to attribute economic changes to rising energy costs when other factors are significantly, if not largely, culpable.

For instance, she attributes the decline in investment to rising energy costs. But as of 2000, many analysts didn’t see rising oil costs on the horizon. In fact, I recall an Economist story around that time that predicted the Saudis would pump more, bringing oil to $5 a barrel, to punish other OPEC members (I recall a chart from the story showing the marginal costs of the major exporters versus their reserves…). Yet as I wrote in 2005, the big driver of corporate stinginess was short-termism, which in the US translated into a focus on quarterly earnings. This came about as a result in a major shift in norms as far as corporate governance was concerned, with CEOs rewarded for goosing stock prices, which often meant it looked simpler and easier for them to buy back stock rather than invest in the business of the business.

Similarly, during the oil shock, it was not uncommon for analysts to say that expensive oil and expensive debt went together. Yet now we have the reverse. And Tverberg also has a gold standard view of government finances, which undermines some of her argument.

Despite its shortcomings, I think readers will nevertheless appreciate the effort that has gone into this piece and how Tverberg pushes to reach conclusions. I trust it will simulate your thinking.

By Gail Tverberg, an actuary interested in finite world issues – oil depletion, natural gas depletion, water shortages, and climate change. Originally published at Our Finite World

What is correct way to model the future course of energy and the economy? There are clearly huge amounts of oil, coal, and natural gas in the ground. With different approaches, researchers can obtain vastly different indications. I will show that the real issue is most researchers are modeling the wrong limit.

Most researchers assume that the limit that they should be concerned with is the amount of oil, coal, and natural gas in the ground. This is the wrong limit. While in theory we will eventually hit this limit, because of the way fossil fuels are integrated into the rest of the economy, we hit financial limits much earlier. These financial limits include lack of investment capital, inability of governments to collect enough taxes to fund their programs, and widespread debt defaults.

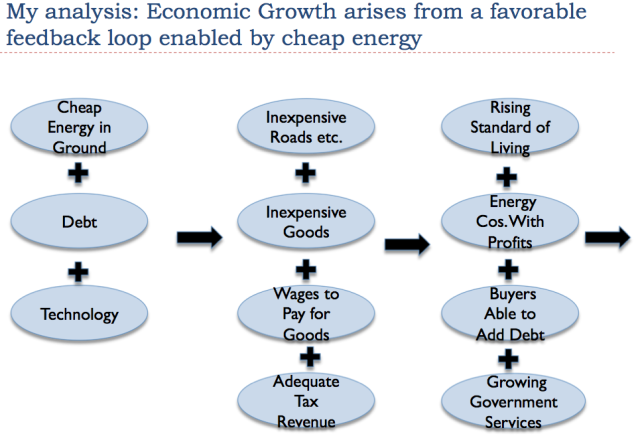

One of the things I show in this post is that Economic Growth is a positive feedback loop that is enabled by cheap energy sources. (Economists have postulated that Economic Growth is permanent, and has no connection to energy sources.) Economic Growth turns to economic contraction as the cost of energy extraction (broadly defined) rises. It is the change in this feedback loop that leads to the financial problems mentioned above. These effects tend to lead to collapse over a period of years (perhaps 10 or 20, we really don’t know), rather than a slow decline which is easily mitigated.

If, indeed, most analysts are concerned about the wrong limit, this has huge implications for energy policy:

1. Climate change models include way too much CO2 from fossil fuels. Lack of investment capital will bring down production of all fossil fuels in only a few years. The amounts of fossil fuels included in climate change models are based on “Demand Model” and “Hubbert Peak Model” estimates of fossil fuel consumption (described in this post), both of which tend to be far too high. This is not to say that the climate isn’t changing, and won’t continue to change. It is just that excessive fossil fuel consumption needs to move much farther down our list of problems contributing to future climate change.

2. It becomes much less clear whether high-priced replacements for fossil fuels are worthwhile. In theory, they might allow a particular economy to have electricity for a while longer after collapse, if the whole system can be kept properly repaired. Offsetting this potential benefit are several drawbacks: (a) they make the economy with the high-priced replacements less competitive in the world marketplace, (b) they tend to run up debt, increase government spending, and decrease discretionary income of citizens, all limits we are reaching, and (c) they tend to push the economic cycle more quickly toward contraction for the country purchasing the high-priced renewables.

3. A large share of academic writing is premised on a wrong understanding of the real limits we are reaching. Since writers base their analyses on the wrong analyses of previous writers, this leads to a nearly endless supply of misleading or wrong academic papers.

This post is related to a recent post I wrote, The Real Oil Extraction Limit, and How It Affects the Downslope.

Types of Forecasting Models

There are three basic ways of making forecasts regarding future energy supply and related economic growth:

1. “Demand Based” Approaches. In this method, the analyst first decides what future GDP will be, and uses that estimate, together with past relationships, to “work backwards” to figure out how much energy supply will be needed in the future. The expected needed future energy supply is then divided up among various types of fuels, giving more of the growth to types that are favored, and less to other types. Very often, estimates of growth in energy efficiency, growth in “renewables,” and growth in the amount of GDP that can be generated with a given amount of energy supply are included in the model as well.

This method is by far the most common approach for forecasting expected future energy supply, especially at high levels of aggregation. One advantage of this method is that can provide almost any answer the analyst wants. Governments are paying for reports such as the EIA and IEA forecasts, and oil companies are paying for forecasts such as those by BP, Shell, and Exxon-Mobil. Both governments and oil companies prefer reports that say that everything will be fine for the foreseeable future. Demand Based approaches are good for producing such reports.

Another advantage of this approach is that the analysts don’t have to think about pesky details like where all of the investment capital will come from, or how large an improvement in the ratio of GDP to energy consumption can actually occur. They can simply make assumptions and point out that the forecast won’t come true if the assumptions don’t hold.

2. “Hubbert Peak Model”. This model is based on an interpretation of what M. King Hubbert wrote (for example, Nuclear Energy and the Fossil Fuels, 1956) . The basic premise of this model is that future supply of oil, coal, or gas will tend to drop slowly after 50% (or somewhat more) of the fuel supply potentially available with current technology has been extracted.

In fact, we don’t really know how much oil or coal or natural gas will be extracted in the future–we just know how much looks like it might be extracted, if everything goes well–if there is plenty of investment capital, if the credit system works as planned, and if the government is able to collect enough tax revenue to fund all of its promises, including maintaining roads and offering benefits to the unemployed.

What most people miss is the fact that the world economy is a Complex Adaptive System, and energy supply is part of this system. If there are diminishing returns with respect to energy supply–evidenced by the rising cost of extraction and distribution–then this will affect the economy in many ways simultaneously. The limit we are reaching is not that oil (or coal or natural gas) extraction will run out; it is that economic system will at some point seize up, and rapidly contract. The Hubbert Peak Method shows how much fuel might be extracted in each future year if the economy doesn’t seize up because of financial problems. The estimate produced by the Hubbert Peak Method removes some of the upward bias of the Demand Model approach, but it still tends to give forecasts that are higher than we can really expect.

3. Modeling How the Economy Actually Works. This approach is much more labor-intensive than the other two approaches, but is the only one that can be expected to give an answer that is in the right ballpark of being correct with respect to future economic growth and energy consumption. Of course, observing signs of oncoming collapse can also give an indication that we are nearing collapse.

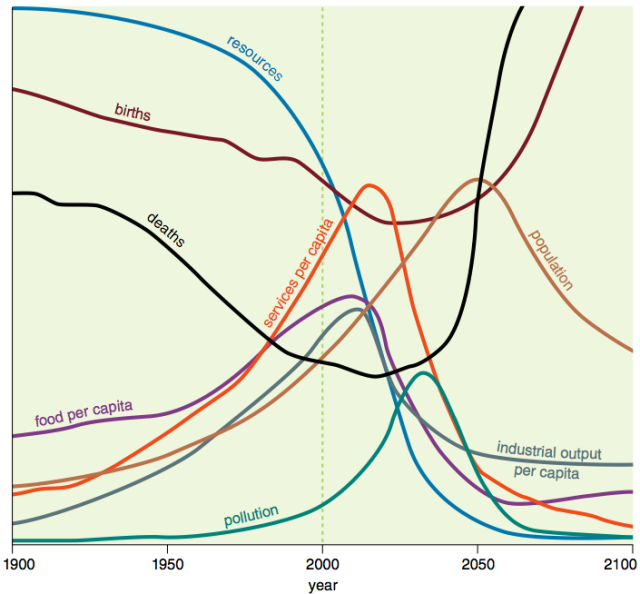

The only study to date modeling how long the economy can grow without seizing up is the one documented in the 1972 book The Limits to Growth, by D. Meadows et al. This analysis has proven to be surprisingly predictive. Several analyses, including this one by Charles Hall and John Day, have shown that the world economy is fairly close to “on track” with the base scenario shown in that book (Figure 1). If the world economy continues to follow this course shown, collapse would appear to be not more than 10 or 20 years away, as can be seen from Figure 1, below.

Figure 1. Base scenario from 1972 Limits to Growth, printed using today’s graphics by Charles Hall and John Day in “Revisiting Limits to Growth After Peak Oil” http://www.esf.edu/efb/hall/2009-05Hall0327.pdf

One of the findings of the 1972 Limits to Growth analysis is that lack of investment capital is expected to be a significant part of what brings the system down. (There are other issues as well, including excessive pollution and ultimately lack of food.) According to the book (p. 125):

The industrial capital stock grows to a level that requires an enormous input of resources. In the very process of that growth it depletes a large fraction of the resource reserves available. As resource prices rise and mines are depleted, more and more capital must be used for obtaining resources, leaving less to be invested for future growth. Finally investment cannot keep up with depreciation, and the industrial base collapses, taking with it the service and agricultural systems, which have become dependent on industrial inputs (such as fertilizers, pesticides, hospital laboratories, computers, and especially energy for mechanization).

Jorgen Randers’ 2052: A Global Forecast for the Next Forty Years

In 2012, the same organization that sponsored the original Limits to Growth study sponsored a new study, commemorating the 40th anniversary of the original report. A person might expect that the new study would follow similar or updated methodology to the 1972 report, but the approach is in fact quite different. (See my post, Why I Don’t Believe Randers’ Limits to Growth Forecast to 2052.)

The model in Jorgen Randers’ 2052: A Global Forecast for the Next Forty Years appears to be a Demand Based approach that perhaps uses a Hubbert Peak Model on the fossil fuel portion of the analysis. One telling detail is the fact that Randers mentions in the Acknowledgements Section only one person who worked on the model (apart from himself). There he thanks “My old friend Ulrich Goluke, for creating the quantitative foundation (statistical data, spreadsheets, and other models) for this forecast.” Ulrich Goluke’s biography suggests that he is able to prepare a Demand Model spreadsheet. It would be hard to believe that he that he could have substituted for the team of 17 researchers who put together the original Limits to Growth analysis.

The Need to Add to the Original Limits to Growth Analysis

The original Limits to Growth analysis was primarily concerned with quantities of items such as resources, pollution, population, and food. It did not get into financial aspects to any significant extent, except where flows of resources indicated a problem–namely in providing investment capital. One thing the model did not include at all was debt.

In the sections that follow, I show a model of how some parts of the economy that weren’t specifically modeled in the 1972 study work. If the economy works in the way described, it gives some insights as to why collapse may be ahead.

Economic Growth Arises from a Favorable Feedback Loop

Economic growth seems to arise from a favorable feedback loop, as shown in Figure 2, below.

Figure 2. Author’s representation of how economic growth occurs in today’s economy.

This model above is intended to reflect the situation from, say, 1800 to 2000. The situation was somewhat different before the use of fossil fuels, when far less economic growth took place. Furthermore, as we will see later in this post, the model changes again to reflect the impact of diminishing returns as the cost of energy production increases in recent years and in the future.

The critical variables that allow economic growth to take place are (1) cheap energy available from the ground, such as coal, oil, or natural gas–if cheap renewables were available, these would work as well (2) technology that allows us to put this cheap energy to work to make goods and services, and (3) a way to pay for the new goods and services.

Debt. In this model, debt plays a significant role. This happens because fossil fuels allow a huge “step up” in the quality of goods and services, and debt provides a way to bridge this gap. For example, with fossil fuels, we have electric light bulbs, metal machines in factories, and farm machinery, all of which vastly improve efficiency. The ability to pay for the new fuel and the new devices using the fuel, is much greater after the new devices using the fuel are put in place. The way around this problem is simple: debt.

The use of debt becomes important at many points in the economy. Increased debt can theoretically help (a) the companies doing the energy extraction, (b) the companies building factories to create the new goods and services, and (c) the end consumers, since all of these benefit greatly from the services that cheap fossil fuels provide, and can better pay afterward than before.

Government debt, such as debt used to finance World War II, can also be used to start and maintain the cycle. John Maynard Keynes noticed this phenomenon, and recommended using an increase in government debt to stimulate the economy, if it was not growing adequately. The detail he was unaware of is the fact that the debt only works in the context of cheap energy supplies being available to make use of this debt, enabling growth.

How the Feedback Loop Works. The loop starts with the combination of a cheap-to-exploit energy resource, technology that would use this resource, and debt that allows those would like to gain access to the resources to have the benefit of them, before they are actually able to pay cash for them.

This combination allows goods to be produced which initially may not be very cheap. Over time, new methods are tried, allowing technology to improve. Consumers are able to buy increasing amounts of goods and services, both because of their own increased productivity (enabled by fossil fuels and new technology) tends to raise their wages, and because the improving technology lowers the cost of goods. Government services are expanded as tax revenue per capita increases. Infrastructure such as roads are expanded making the economy more efficient.

In this context, profits of companies grow, allowing reinvestment. Investment is also enabled by increasing debt. This allows the cycle to start over again, with better technology and more infrastructure in place. The economy tends to grow, and the standard of living tends to rise.

Overview. One way of explaining the tendency toward economic growth is that a cheap-to-extract fossil rule has an extremely high return on investment. This very high return enables benefits to all: workers receive higher wages; businesses receive higher profits; and governments receive both higher tax revenue and the ability to build new roads and other infrastructure cheaply.

Another way of describing the tendency toward economic growth is to say that the value to society of the (cheap) energy product is far greater than its cost of extraction. This difference provides a benefit which flows through to many parts of the economy. Economists do not recognize that this situation can happen, but it seems to be a major source of economic growth.

The Spoiler: Diminishing Returns

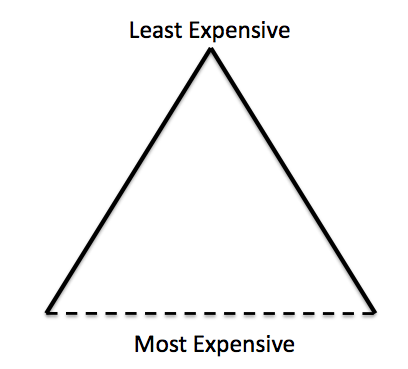

The problem with energy extraction is that we extract the inexpensive-to-extract energy sources first. Eventually these sources get depleted, and we need to move on to more expensive-to-extract energy sources. I illustrate this situation with a triangle that has a dotted line at the bottom.

Figure 3. Resource triangle, with dotted line indicating uncertain financial cut-off.

Businesses start by extracting the cheapest to extract resources, found at the top of the triangle. As these resources deplete, they move on to the more expensive to extract resources, further down in the triangle. Looking downward, it always looks like there are more resources available–it is just that they are more expensive to extract. This is why reported reserves tend to increase over time, even as supplies are depleted. The limit is a financial limit, illustrated by a dotted line, which is why virtually no one can figure out when the limit will actually arrive.

One somewhat minor point: When I say, “Cheapest to extract resources,” I am referring to broadly defined costs. What businesses want is resources that produce goods and services most cheaply for the consumer. Thus, they are really concerned about cheapest total cost, considering the entire chain that goes all the way to the consumer, including refining and transportation. The costs would include energy used in extraction, labor costs, transportation costs, taxes, and the cost of debt. It probably should include the cost of mitigating pollution effects as well.

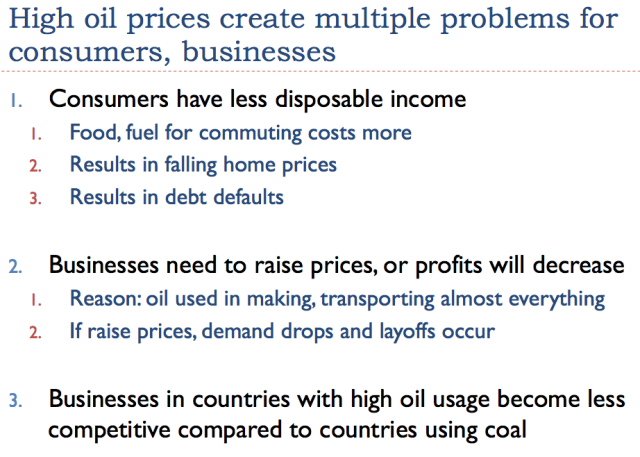

A major problem is that as the cost of energy extraction grows, the favorable gap between the cost of extraction and the benefit to society (as mentioned in the previous section) shrinks. There are many ways that this problem manifests itself in the economy. Figure 4 shows a list of such problem with respect to higher oil prices:

Figure 4. Image by author listing some of the problems created by rising oil prices.

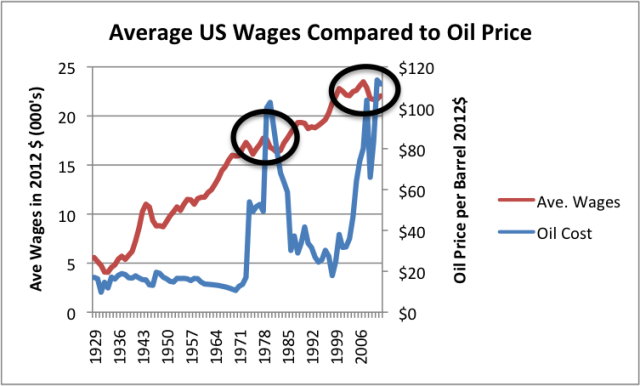

One indirect impact of these issues is that there are more layoffs and fewer new job opportunities. If we calculate average wages by taking (total US wages) and dividing by (total US population), we see that during periods of high oil prices, wages tend not to grow, as they had in periods when oil prices were lower–just as we would expect (Figure 5, below).

Figure 5. Average US wages compared to oil price, both in 2012$. US Wages are from Bureau of Labor Statistics Table 2.1, adjusted to 2012 using CPI-Urban inflation. Oil prices are Brent equivalent in 2012$, from BP’s 2013 Statistical Review of World Energy.

Another issue is that it is not just the price of oil that rises. The price of natural gas rises as well. We have not felt this in the United States, because demand has kept the price down below the price of shale gas extraction. The cost of coal, delivered to its destination, has risen because transport uses oil, and transport costs are a significant share of total costs. The cost of base metals has also risen since 2002, because oil is used in metal extraction. Food prices in general have tended to rise as well, because oil is used in production and transport of food. When wages are close to flat, and the cost of many goods are rising, workers find that their paychecks are increasingly squeezed.

While costs of making goods in the US are rising, and paychecks are stagnating, an increasing amount of goods are imported from areas around the world where energy costs and wage costs are lower. This helps keep the cost of consumer goods down, but it makes the problem of lack of jobs for US workers worse.

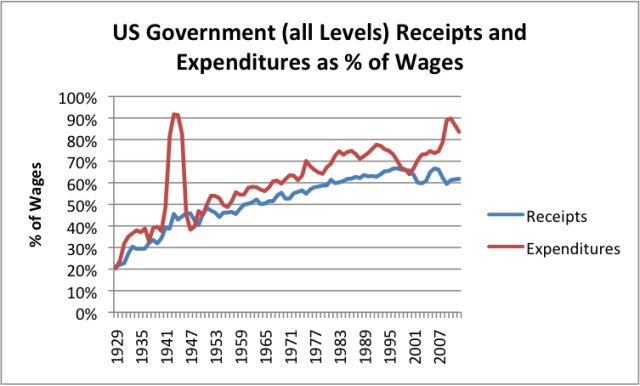

With all of these things happening, the government has more and more problems with its funding. Expenditures continue to rise, but taxes flatten, as the government tries to help the economy grow by not raising taxes to match expenditures (Figure 5, below).

Figure 6. Based on Table 2.1 and Table 3.1 of Bureau of Economic Analysis data. Government spending includes Federal, State, and Local programs.

Government expenditures can be thought of as expenditures out of the surpluses of the economy. As indicated previously, these are to a significant extent possible because of the favorable difference between the cost of extracting fossil fuels and the benefit those fossil fuels provide to the economy. As the use of fossil fuels has grown over the years, these government services have grown. In recent years, the presence of more unemployed workers has driven a need for more government services.

Since the early 2000s, government revenues have flattened. The lack of revenue, together with the ever-rising government spending, is what is driving continued big deficits. The danger is that this difference cannot be fixed, without huge cuts to programs that people are depending on, like unemployment insurance, Social Security and Medicare.

How the Economic Growth Loop Changes to Contraction

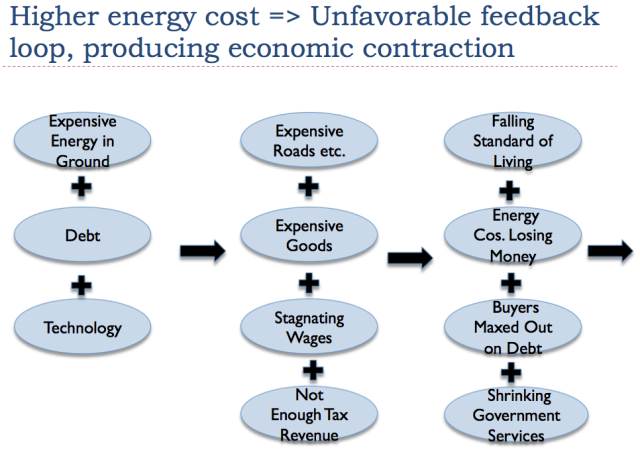

In my view, what causes a shift to contraction is a shift to higher energy costs. With higher energy costs, there is less surplus between the cost of extraction (broadly defined) and the benefit to society. Because of the smaller surplus, the parts of the economy that use this surplus, such as government spending, must shrink.

Figure 7. Higher energy cost leads to unfavorable feedback loop. (Illustration by author.)

We gradually find that all the great things we had learned to enjoy–inexpensive roads and other infrastructure, cheap goods, rising wages, and rising government serves–start going away. We increasingly find consumers maxed out on debt. We also find companies (especially energy companies) reporting lower profits, so they have more trouble investing in new energy extraction. The government cannot collect enough taxes for all of its services, so finds itself needing to keep raising its own debt levels.

The government can kind of “paper over” its difficulties with growing debt levels for a while, by using Quantitative Easing (QE). QE has the effect of making the interest the US must pay on its own debt lower. It makes the cost of business investment in new plants and equipment (including shale oil drilling) cheaper. It also helps stretch the incomes of increasingly impoverished workers by allowing monthly payments on homes and cars to be lower than they would otherwise would be.

The Party Ends With a Thud

Most readers can deduce that a shift from a growing economy to a shrinking economy is not a pleasant situation. It has all of the makings of collapse.

One of the big problems is debt defaults, as it becomes increasingly impossible to repay debt with interest. This creates conflict between borrowers and lenders. Debt defaults are also likely to cause huge problems for banks, insurance companies, and pension plans, because of the impact on their balance sheets. Some institutions may close.

To the extent new credit is cut off, the lack of credit cuts off new investment in energy extraction, in buying new cars and trucks, and in almost everything else. Such a cut-off in credit is likely to increase job layoffs and to lead to yet more defaults. Lack of investment in new energy extraction causes oil supply to fall quickly–far more quickly than standard “decline” models would suggest.

Businesses that in the past found that they could benefit from “economies of scale” as they grew find that fixed costs stay the same, even as sales shrink. This means that they either need to raise prices to cover their higher per-unit costs, or lose money.

Governments find that they need to cut government services to balance their budgets. Discontent grows among citizens as those who lose their benefits become very unhappy. Discord grows among political parties, because no one can agree how to cut programs equitably.

We don’t know how this will end, but we do know that the Former Soviet Union collapsed into its constituent parts when fossil fuel surpluses were reduced, prior to 1991. Egypt and Syria both have had civil unrest as their oil exports ended. Clearly very large government changes are possible, as surpluses disappear.

This list of potential impacts could be expanded endlessly, but I will spare readers from a more comprehensive list.

In my area here in Canada, houses from the 60s to 80s are typically between 1400-1800 square feet. From the 80s to 00s around 1800 to 2200 square feet. And over the last decade, 2200-3000 square feet.

When I bought a 1950s house, we still had the same furnace in 2000 and many in the neighborhood still had the same windows. Our current 1989 house needed the furnace and windows to be changed at around 20 years.

I was told that the new furnace would probably last 14-18 years. I gather the windows will last as long since houses built 5-7 years ago are already starting to need new windows!

On top of adding fast depreciating infra over the last few decades, we have neglected the infra that was already there. We will require a lot of resources and energy to fix this… if we can.

IMO, if municipalities had been maintaining their infra properly, they would not have been able to keep on growing the burbs and the houses would not have gotten as large as they have. All the growth has been based on future abundance of resources and energy.

A few years ago, my multi-millionaire boss was complaining about his rising property taxes which were about 4000$. In a sense, he is probably right as a good chunk of his taxes are probably funding the new developments. But I told him that he has not see anything yet and he genuinely looked perplexed. He asked me if I liked paying taxes. My answer was no but that I am a realist.

IMO, most people are totally disconnected from reality. Most never wonder about how much energy is required to sustain their living arrangements. Just like most condo fees rarely include the right amount for future maintenance, our municipalities have mismanaged on a grander scale.

We are going to keep on developing as if energy is not a issue and as sectors suffocate other sectors, many more people will get marginalized.

And the chickens will come home to roost… yet the munis will probably do whatever then can to bam chicken coops.

Moneta – Taxes go to paying interest on debt not funding maintenance and growth. Municipalities like every other operation from households, cities, counties, states, nations, business, education, everything operates on debt and therefor require growth in order to increase tax/income in order to borrow more to pay off debt and fund growth and rinse and repeat.

Any glitch in this cycle and the whole thing comes crumbling down.

Energy represents an ever increasing cost in this cycle and so something must give.

I might be wrong, but where I am here in Ontario, I don’t think all my taxes are going to pay interest on debt yet… they are paying city workers working and retired, services, and all the work needed from the city for new development.

We are in a n man’s land right now because of 2 significant variables: forced mega mergers and the real estate bubble.

Canada had a debt crisis in the 90s. To protect our credit score, the feds had to cut the deficit so they pushed a lot of stuff down to the provinces. The provinces then pushed some stuff to the municipalities. Under the weight, the largest cities that were bleeding households to the burbs forced mega mergers in major metro areas, essentially a mega tax grab. We should have felt the pinch but we were spared because of the real estate bubble. Thanks to rising home prices and equity lines of credit, municipalities have been able to increase their budgets quite easily over the last decade.

The thing is that households are now in debt to their eyeballs and all future increases will be quite painful.

I noticed that a few small municipalities have issued bonds over the last few years to fund services to their new McMansion developments. So those in older developments would be paying taxes to pay interest on the debt that went to fund the development of those Mcmansions which will, quite likely, depreciate faster than older homes, therefore needing a lot more resources and energy to maintain in the future.

Houses should not have gotten bigger over the last few decades. They should have stayed the same (or smaller) and closer.

We are certainly seeing an increase in population density here in Toronto. I live near downtown, along a railway line. Between commuter train access and trackside industrial land (no longer needed ‘coz we don’t make anything in the city anymore) the old railside lands are becoming canyons of condominiums. Many of the industrial-themed: The Toy Factory (old Hasbro), the Candy Factory (former O-Pee-Chee factory), the Linseed Oil Lofts, and, my personal fave, The Standard, modified and extended from the old American Standard toilet factory. In addition to soaking up water, electricity, garbage collection and housing cars at a much greater rate per acre than our residential areas, these buildings are also much more dependent on services. In my little house I can collect rainwater if a watermain breaks, light with candles, heat with fireplace and barbecue if gas or Hydro fail (done all that). When my friends in the 37th floor condo have a power out it’s everything — no water, heat/air, no way to flush toilets and it’s a *very* long climb up and down. On the bright side, they ditched their car and now walk, take TTC, bike-share (BIXI) and Car-2-go to get around.

IMO, over the last few decades we should have used the Paris model with 4 floor row houses, limiting high rises and exurb McMansions.

I think we will end up with a lot of blight over the next few decades. We have a lot of space and no respect for the environment. I am appalled at the ugliness of most areas after a few decades.

Actually, in Paris it’s 7 floors with the ground floor as commercial.

In Switzerland built-up private living space (counting halls, cellars, stairs, elevators, balconies, communal space like laundry rooms) pp has doubled from 1960 to 2000.

From 25 m2 to 50m2. (Rough, I don’t have the nos. to hand.)

If one adds in the space taken up by private cars – underground, surface parking, garages etc. it is more than 2x.

“we had learned to enjoy roads”

I have never learned to enjoy roads………they are not a destination.

I enjoy Beer.

She fails to see how bank credit itself warps the demand signal in a quite profound manner.

There is no shortage of primary input goods for real final demand.

The lack of final demand is the problem.

But why is there a lack of final demand ?

Intermediate consumption of goods (much of it in pursuit of credit tokens to satisfy final demand)

Look people must engage in ever more pointless jobs (burning BTUs) to as to access credit tokens.

This can be seen in Ireland where more and more people are finding themselves on the Cork to Dublin road.

Typically these new jobs orbit the splitting up of natural utilities.

In order to maintain the rate of profit these companies must become less productive , less closed to a local area or country.

This is in fact a major jobs programme in Ireland.

Look,in Ireland this stuff is very easy to read as it is so absurd.

Its a Storm crow of a country.

We have been sold a story about water shortages in this country of all places.

Well they have spent no less then 85million euro on “consultants” to solve this non problem.

50 million went to IBM and its “software”

We can be pretty sure that very little energy will go into below ground “hardware”….the excuse ? shortages of course………….of course.

The energy used to create the software has been burned already ……

Huge amounts of Kerosene have been used to fly these consultants into and out of Dublin.

The crisis we see today is a artificial one.

Its goal is simply to scale up operations to a ever more pointless scale.

This causes the apparent shortages of energy to fix real and local things.

God forbid – but the system managers hope never to fix things.

That would surely be the end of them as they are the ultimate scarcity lords on this planet.

These are the guild navigators

Otherwise known as the Anglo / Dutch monetary /oil cartel.

IMO, most people are totally disconnected from reality. Most never wonder about how much energy is required to sustain their living arrangements

——

It’s about how your home fits in the community which fits in the city, then in the province and the country, finally in the world. You have to add up all the energy from all sources that are needed to keep you living there and moving about your daily routine.

For example, here in Ontario, electricity generation is becoming an issue. The oil is in Alberta which is not keen on sharing. We are sending our young over there but we are left with the old. Many nuclear plants will need to be reconditioned. Our government has been investing in alternatives but corruption is rampant so efficiency is dubious. Our electricity costs will be going up 40% over the next few years and everyone is up in arms about this yet the writing was on the wall.

They want to live like kings in their 3000 square feet houses when they are full of debt.

I do not think this sort of analysis is worth the trouble to refute. Industry is fully capable of solving the technological problems of increased energy extraction costs. Our problem is a business system hell bent on maximizing rent extraction by absentee owners. Read Veblen and ignore stuff like this.

Yep and moreover debt is pushed as part of the solution. It’s funny that Progressives hate drug addiction yet push credit addiction. They sound rather more like slave overseers who want the slaves to remain healthy, and in LR Wray and Co’s case, well-trained and broken too. Some liberators! Not!

Yet liberty and justice are coming nonetheless – on the ashes of those who oppose them.

Progressives: T Roosevelt and Wilson, two of the greatest frauds in American history. Both were Morgan henchmen and Morgan cashed in on their every initiative.

Your certainty is so refreshing and sexy. Could you tell me the meaning of life and age of the universe while weve got you?

I’ll bite too:

The Universe is about 14 billion years old and life is a test since Lucifer, though created perfect, inexplicably rebelled against his Creator.

So, “thanks” to Lucifer’s failure we have to undergo a rigorous testing before we’re allowed into Paradise.

You would bite…

Well, one should not ask questions he doesn’t want answers to.

But note the standard answer to the meaning of life – 42 – is the number of God, 7, times the number of Man, 6 = 42. Odd coincidence, no?

Just answering nonsense in kind.

Good luck with all that certainty.

Lots of certain people at Jamestown.

If one has not achieved some certainties by my age he has’t really been trying.

Or call them working hypotheses arrived at by logical deduction, probability theory, game theory and personal preference.

jgibbs,

“I do not think this sort of analysis is worth the trouble to refute. Industry is fully capable of solving the technological problems of increased energy extraction costs.”

So long as they’re heavily subsidized and allowed to pollute at will, and all the way through the product life-cycle – or set up shop somewhere else to avoid the cost of “clean” energy having foiled all attempts to establish international rules/standards on emissions/toxins etc. No sector has fought change harder than fossil fuels, and it is going to take an ecosystem or weather catastrophe to alert its primitive fossil brain to danger.

Economics, as currently described, can only exist within a political framework. Fossil fuel economies, in the beginning, emerged out of the 19th century and solidified and matured in the 20th century and, I suggest, are now maintained through political power and coercion nor “natural” historic forces. Alternatives to fossil fuels are abundant but the political reality is that since these industries lack clout in world capitals they suffer from neglect and sanction while the old models are maintained by subsidies, in the U.S. at least, by government and the regulatory structures where the real costs of fossil fuels are ignored.

The reality is that our political structures are profoundly conservative–they want to keep everything the same and tinker at the edges while we are entering a unique time when that technology and systems analysis is beginning to take off that could provide us with cheap energy, cheap food and a sustainable economy if the current oligarchs who owe their power to the fossil fuel economy would lighten their control. Even the idea of economic “growth” needs to be questioned. What do we mean by “growth”? Most economists just assume that it is the same as it always was, industrial production, more cars, refrigerators, electronic toys and so on. But what if people are tired of that endless cycle of consumption? What if people decided that it was better to spend their time and money playing music, or getting together with people to enjoy interacting with other people in ways that do not require commercial products? What would growth look like? We often say, from a psychological perspective, that “growth” means greater consciousness or a more nuanced and mature attitude with, for example, limiting negative emotions and perhaps not scratching every momentary itch because we saw a commercial that makes us feel that some beer we drink will attract a certain class of sex partner.

To put it another way–reason would indicate that we are in all areas of our culture, “economics”, social and political institutions, consumer goods and services, energy, social relations, the environment, reaching, simultaneously, the law of diminishing returns. We are closing our eyes to obvious problems like climate, like high stress levels (most disease is caused by stress not biological agents), political corruption, social inequality and so on including those who will acknowledge these problems exist. We believe that economic “growth” measured by false indicators like GDP will fix all these problems. They will not do anything of the kind.

We need a new focus on purpose and have to stop just thinking in ways that were once appropriate for mid-20th century but no longer have value today. There are hundreds of elegant solutions to all the problems we face or at least good starts to solving them yet we will not look at them because it would change the power structure. Our issues are based no in economics but power. Those that have it don’t want to let it go and those that don’t are afraid to to say anything because it would force change and unless things get really bad most people in the developed world can cocoon into their boxes, i.e., houses, cars, electronic devices and become ever more shallow and ever more asleep.

I believe you are closest to being correct. The main reason we’ve gotten this far down the wrong road is that every one wants to be like the rich, so they emulate them. But the rich are the most venal, corrupt, narcissistic, and boorish among us. They are brought up to be that way, as they are taught that everything they have they deserve to have and you don’t, because you’re not, well … them. This leads to the madness of modern life in a Democracy, where it has nothing to do with Commonwealth and everything to do with grabbing for yourself, before anyone else gets it, the best, or at least the brightest, trinkets. If the rich have cars, get the biggest gaudiest car, if the rich have computers, get the $600 I-phone, and if this leaves a trail of recyclable, toxic trash in its wake, that’s really not your problem, nothing is your problem, that’s someone else’s concern, and that someone else is just a doormat for you to wipe off the detritus of your own existence on.

But instead of repudiating such boorishness, we embrace it. That, as you say, is not economic, that is political and moral, and that we swallow it as a paradigm of existence impoverishes not only our spirit, but, as we can see when we have the humanity to look, our societies. Instead we avert our eyes and look for means to achieve economic growth on the strange theory that if you grow the pie, the juices of it as it boils over will “trickle down”. Such is the rotten fruit of a democracy that we shove down the throat of the rest of the world’s nations as “The end of History”. And that is exactly what it may well prove to be.

You’re blaming the victims. If people lead boorish lives it’s because their birth right – family farms and businesses – have been stolen from them by the banks.

You’re right and Lowry’s right too. As things stand the only sane behavior is personal withdrawal from the cycle of endless work to feed endless consumption. I dropped out more than 20 years ago. It is difficult; your friends think you must be crazy, or a sore loser. You must grapple constantly with feelings of personal failure. It helps if you believe yourself smarter than everyone else, and it helps even more if you are.

But where do you live then, and what on?

This is what happens when absolutely NO political decision is made with any sort of real scientific inquiry. Politics in America (and the rest of the world) is absolutely removed from scientific research/ engineering principles that, even if it does include ‘science’, its from corrupted professors (i.e. Jonathan Gruber). The emissions cutbacks Obama spouted during his campaign were so outrageous that even if we divinely removed every single automobile on this planet, we still wouldn’t make a dent in our total CO2 emissions, let alone our CH4 emissions, radioactove waste, plastics, etc.

My wife has a PhD in environmental engineering from Northwestern (i’m manufacturing, oh the irony…). Grant money was so scarce in the enviro PhD program she switched to a dual PhD (in civil) JD program. Over 80% of my engineering colleagues went into finance/consulting. The rest, if they were lucky enough to find a job in their field, quickly realized there is absolutely NO money in engineering unless your chemE/petroE. I now work at a hedge fund, she works as a patent lawyer. Why are we telling our youth to go into science? Hell, if we ever have children I’m going to tell them NEVER to go into science/engineering. No college life, shitty job prospects. The worlds decision making is left to those who are more about their career than knowledge, care more about profits and ‘connections’ than strategy and discourse, care more about extraction than preservation, hype than reality.

Don’t beat yourself up. Lots of intelligent people opt for industry, only to discover it has been captured by business on behalf of absentee ownership. Read Veblen, Absentee Ownership (1923).

The worlds decision making is left to those who are more about their career than knowledge, care more about profits and ‘connections’ than strategy and discourse, care more about extraction than preservation, hype than reality.

Yep. Not what you know but who you know. Ironically, they are correct. It is WHO you know assuming He can know you.

Still, ultimately the world needs technical expertise more than it does the party crowd. Engineers should definitely organize into a labor cartel so long as the banking cartel exists.

political power and coercion ARE “natural” historic forces

These sort of analyses bubble up from the energy scarcity community like old Sinatra tunes at Christmas time. The tune is always the same, and while a pleasing accompaniment to a holiday season, have no other tangible value.

Starting with the idea that money to fund government programs comes from taxing the economy … false. If the first economic claim is false, the rest of the analysis is probably useless. The nail in the coffin is the claim economic crises are caused by energy production patterns … not under capitalism. Come back and try again after reading The Limits of Capital as a starting point.

You mean The Limits to Capital by David Harvey?

Depends on whether you want to survive – we have toxic energy in abundance, and require clean energy on a global scale (along with a number of other truly transformative changes) before 2035 or that’s pretty much it, we’ll have guaranteed we f-k ourselves and much of life on this planet.

Gail’s papers are interesting.. She has a gift for explaining simply. This paper pulls together many of her views. The summary of ‘3 models’ is bang on imho.

It is hard to estimate how much rising (or lowering for that matter) energy costs – as one factor amongst many – contributes to, or interacts with, economic changes, as Yves points out. Gail’s pov is energy-centric. That multiple actors (within Gail’s pov) simply fail to notice this and act following other assumptions is, imho, perfectly possible.

We can note that Gail mentions debt, and rising debt as a way to ‘patch over the gap’, be it, for ex for the Gvmt. / households. Yves mentions investment. In the context of this conversation, they are the same thing, in the sense that biz. may use ‘profit’ from the past, or borrowing ‘money’ against future projected gains, as well as many other measures (cheaper better technology, longer working hours, relocating, etc. etc.) to raise revenue, augment productivity, sell more, etc. to overcome the gap. > Basically shunting around the costs of inputs, say, though even that is a particular and v. brief description.

The whole conversation stalls, or is doomed to a sort of argumentative stasis, because dollars are a poor – very approximate, volatile, bizarre – measure of energy inputs, energy costs as a whole, energy transformation losses, waste in the input and the output, etc.

We are lacking a general, even if rough, unit of account in terms of energy. If we had one, the dollars paid for oil / coal / workers to be able to eat, house themselves to work / machines / etc. would show up in a startling, new, different light.

This is also the reason why the discourse and actions around ‘sustainable’ (whatever that is) development and the like is a total mess. Nobody knows what it means or is supposed to mean.

In my entourage I noticed that the non science types are convinced that technology and human ingenuity will save the day while the science types are more skeptical. No it’s not just money, it’s the generalized belief that resources and energy are plentiful.

As long as scarcity can not be proved, optimists will rule because humans are optimists by nature.

http://www.themonkeytrap.us/twenty-important-concepts-i-wasnt-taught-in-business-school-part-i

I think people just don’t realize how much of what we have is due to cheap energy. Here in the San Joaquin wells and pumping stations are the only reason you can have modern agriculture. As real prices rise for energy, those costs HAVE to be passed on. As water is used up, and lower quality water has to be processed more and more to be potable, it will take more, and more expensive energy to do that.

“The chemical potential energy available from the burning of things (e.g. wood) is rather astounding when compared with the energy which we supply our bodies in the form of food, and the fossil fuels of coal, oil, and natural gas burn even hotter while also being much easier to store and transport. We quickly learned that using some of this heat to perform work would transform what we could accomplish in massive ways. One barrel of oil, priced at just over $100 boasts 5,700,000 BTUs or work potential of 1700kWhs. At an average of .60 kWh per work day, to generate this amount of ‘labor’, an average human would have to work 2833 days, or 11 working years. At the average hourly US wage rate, this is almost $500,000 of labor can be substituted by the latent energy in one barrel of oil that costs us $100. Unbeknownst to most stock and bond researchers on Wall Street, this is the real ‘Trade’.”

One other point:

“Oil is a renewable resource, with no intrinsic value over and above its marginal cost… There is no original stock or store of wealth to be doled out on any special criterion… Capital markets are equipped to handle oil depletion…It is all a matter of money”, M.A. Adelman, Professor of Economics, MIT Source”

“Physics informs us that energy is necessary for economic production and, therefore growth. However, economic texts do not even mention energy as a factor that either constrains or enables economic growth. Standard financial theory (Solows exogenous growth model, Cobb Douglas function) posits that capital and labor combine to create economic products, and that energy is just one generic commodity input into the production function – fully substitutable the way that designer jeans, or earrings or sushi are. The truth is that every single transaction that creates something of value in our global economy requires an energy input first. Capital, labor and conversions are ALL dependent on energy. For instance, the intro text by Frank and Bernanke (2d ed., 2004, p. 48) offers explanations for increased productivity: …increased quantity of capital per worker, increased # of workers, and, “perhaps the most important,…improvements in knowledge and technology.” Nowhere in standard economic literature is there even a hint that the “improvement” in technology they refer to has, historically, been directly linked to the progression of displacing solar-powered human and animal muscle with larger and larger quantities of energy from oil, coal, and gas”

What an amazing statement by Mr. Adelman. I imagine that when he finished he got on his unicorn and rode off into the sky. In general, the more people know about the energy industry, and the more technically astute they are, the less you hear such foolishness.

All I have to do is think about of how many calories were burned so my grandmother could get 3000 calories in her day 80 years ago on the farm. And during the day, a large percentage of her movements went towards generating those 3000 calories.

Today, I can’t even imagine how many thousands of calories are going into generating my 3000 calories… not to mention that most of my daily activities are going into more resource depletion activities highly dependent on fossil fuel.

And 5 billion people want to emulate us.

Baloney! Hydrocarbons are easily synthesized from:

1) Carbon (from the air if necessary)

2) Hydrogen (from water if necessary)

3) Energy from thorium reactors till fusion power is perfected.

But the future is endangered by the usury for stolen purchasing power cartel and its enablers.

But keep blaming the poor for the sins of bankers and their enablers.

Yes it’s so easy, proven by the fact everyone is doing it. Wait, no one is extracting carbon from air and oxygen from water at scale because the processes are power-intensive and the up-front capital costs would be tremendous. And thorium continues to be an unproven pipe-dream.

But in libertarian sci-fi books these things are going to happen, so it’s all cool.

Libertarianism seems to be like cognitive fracking bad stuff goes in and worse stuff comes out.

Well I do believe in limited government – it should be limited to promoting the general welfare – not the interests (pun intended?) of usurers and gamblers.

You?

More government please, of course after some house cleaning. Were not living in the 16th – 17th century’s any more or did you not notice.

Well, I support as much socialism as is needed to counter the current fascism but mostly in the form of fiat, not government “help.”

Do you seriously think looking out your window, that just throwing money at our problems is a sure fix of anything.

Do you have any clue as to how modified the population is after decades of Bernays style machinations.

Do you think for a second more consumerism is a way out of this evolving (climate et al) dilemma.

skippy… hint… in the past 90% of regional civilizations collapsed due to environmental degradation… we are – one big civilization – today via the global markets and long supply lines.

There’s still easy fruit to be picked is why.

And the processes I listed were worst case. Progress is being made on water cracking catalysts and we have huge amounts of coal as the carbon source should we decide carbon-neutral is not necessary.

Did you say water???

SAN FRANCISCO — Amid California’s driest year on record, Gov. Jerry Brown on Friday officially declared a drought emergency in the state.

Speaking at a San Francisco news conference, Brown also called on “all citizens” to cut back “at least 20% of their water use.” He was flanked by charts and photos showing the state’s anemic precipitation and snowpack.

http://www.latimes.com/local/political/la-me-pc-jerry-brown-declares-drought-emergency-in-california-20140117,0,3244744.story#axzz2qhBWh8Yg

Ever hear of desalination?

Quit embarrassing yourself, you naysayer.

BTW did you see this?

http://tucsoncitizen.com/wryheat/files/2013/06/CMIP5-73-models-vs-obs-20N-20S-MT-5-yr-means1.jpg

Embarrassing coming from a commenter that has gotten so many things factually wrong over the years is farcical rhetoric.

Beard,

You need to do a LOT more homework. Desalination takes a considerable amount of energy and produces nasty residues. It’s not a viable solution on a large scale.

http://en.m.wikipedia.org/wiki/Desalination

Its reasonable technology but us lazy people live on thegreat lakes instead.

Bottomline for desert locales( like much of California) is that it has developed beyond the natural carry capacity of the water resource. Not a good long term strategy

As often, such problems are mainly problems of defective social technology putting welfare for the rich above all, and have less to do with nature or material technology. Irrational subsidization of water for agriculture squanders an enormous amount of California’s water, for the benefit of a minute number of wealthy individuals. See this recent counterpunch. for one.

@ Calgacus:

If I understand correctly from stuff I read years ago, certain crops such as cotton, alfalfa and rice are featured in the Sac delta precisely because they consume so much water, thus preserving those farmers (corporations now?) rights to the use of that water.

With respect, Yves,

nature does desalination every day and man can mimic that process and generate power too using the ocean temperature gradient that exists in many places.

See Ocean thermal energy conversion for more info.

But whatever the difficulties, I’m sure we could please our Creator with ethical reforms and if He doesn’t exist we are doomed anyway whatever we do.

Thing is, F., what the naysayer’s claim is that those “sources” will take a tremendous amount of energy to put on-line and then maintain. They claim or assert that all the costs added up, energywise, exceed the benefits. I don’t know if it will prove to be true or not. I hope very much it isn’t, but I also don’t think it’s a concern one can dismiss kind of with a wave as you appear to be doing here.

Some of the costs are hysterical ones (such as saving a rare species of tick or mosquito? Not yet I hope!)

There are legitimate concerns but living is a 99.999999?9% fatal endeavor and cowardice is a major sin which nature often punishes with death anyway.

Well of course people are confused about sustainable development since the discourse is almost exclusively political. There is no neutral “place” where that discussion can occur. Even if there was such a place there is no agreement of what development is nor even of what our collective goals are. Discussion has to start, these days, with meaning of life issues. We can no longer drift through life indulging in our baser instincts and expect nature to tolerate it. Empires could despoil their geographic area and fall–Rome really only destroyed the ecology of Italy for a few centuries so people moved elsewhwhere. In our age everything is connected–there’s nowhere to move to.

Nowhere to move to? The way things are going there will soon be plenty of space, far fewer people in it, and no way to go from where you are to anywhere else, except on foot. Will this be better or worse? That depends upon how you feel about televised sports, deodorant, hand to hand combat, etc.

I would love to be around to see how they get property rights out of that society.

Try starting a libertarian moment in China, send a post card will ya.

What is this Libertarian stuff about? Just asking.

j gibbs,

“The way things are going there will soon be plenty of space, far fewer people in it”

Two major differences between our civilization and the non-industrial past are:

A) Far greater portion of humanity today lives in cities than it ever did.

B) Rate of material goods production was very low compared to our industrial civilization’s

There is still (even today) plenty of empty space on the planet. You just have to live “off the grid”.

Mansoor H. Khan

Banger,

“Discussion has to start, these days, with meaning of life issues.”

Yes. But I really think that question of meaning of life will be forced upon us by physical realities of resource depletion and environmental degradation (Read: starvation, destitution, people freezing to death, massive crime, etc).

If we don’t adjust politically & economically & banking systemwise & psychologically & culturally we will have far too much chaos to have any semblance of law and order.

May god help us and guide us!

Mansoor H. Khan

It’s good to see Gail the Actuary getting some exposure with the NC readership. She was one of the most valuable contributors to the late, lamented Oil Drum, and IMO she – like Yves – continues to be a must-read on the issues in her wheelhouse.

If you’re in the mood for some happy talk wrt the US oil supply, try “Oil Security 2025: US National Security Policy in an Era of Domestic Oil Abundance”

Here’s the link:

http://secureenergy.org/oil2025

This report – fresh out this week – is co-authored by a former US Director of National Intelligence with extensive input from DOE and other agencies. It’s a good indicator of current official thinking – and it lives on a different planet from the one Tverberg is describing.

Ordinarily I don’t have much use for suggestions that data in government reports are fudged for the sake of some hidden agenda. But in this case it’s hard not to notice how much it helps the conduct of US foreign policy to have the Saudis and the Iranians – not to mention the Israelis – believing that the US no longer has to care quite so much how much of a mess the local players may make of the Middle East.

Well, these are the guys that decided it would be better (in some universe) to leave the cheapest to access/produce/refine/use oil in the ground in Iraq, Iran and Libya (total cost $3 trillion and counting), and plow hundreds of billions into developing the most expensive and most environmentally destructive oil – tar sands and oil shale.

So far as I can determine, only the Saudis, Wall Street and US oil companies could go for that insane proposition.

Tverberg just skimmed over global warming (I think she even said that it is ominous and we have overestimated demand for oil going forward which means less capital investment in oil which means inevitable recession and decline…) and barely touched on “pollution” saying it might be a good idea to include mitigation expense in the balance sheet. That she agrees with Steve Keen that current models aren’t modeling anything accurately unless they include debt is interesting – but she doesn’t have a very nuanced idea of debt because she barely addresses the above (global warming and pollution). Congress just passed a 1.1 Tr budget which included over 500 Bn for the military for around 6 months. That’s one trillion a year for the military? It is, above all other demand, the US military that demands a supply of oil. If capital is not being invested in oil production, the government/military will “invest” whatever is necessary and Congress will just rubber stamp the budget. So oil supply isn’t even a logical economic issue. The real issue is Global Warming and a toxic planet. That, not “energy”, is what our official “unit of account” should be based on. And also this question: since methane is going to enter the atmosphere in increasingly large amounts as GW occurs, why aren’t we mining it and leaving oil in the ground?

I think you can chalk this all up to a few factors, two of which are that there is no realistic strategy and there is no coherent planning. Governments almost everywhere are controlled by shifting alliances of wealthy and well-connected actors with astonishingly short-term time horizons. In the USA the only thing the Democrats seem to worry about consistently is not losing, while all the Republicans care about is winning. Both mindsets are circumscribed by the need to placate their big donors. Electoral politics are all about gloom and doom scenarios that can be miraculously reversed by voting for one or the other party. Real, intractable problems are therefore off the table. Just vote for us and all will be sweetness and light.

Perhaps the deeper problem is that the last generation of Westerners who actually saw hardship and had to overcome it (the people who lived through the Depression and fought World War II) has almost completely died out and long ago lost any sway in our societies. Men and women of Obama’s generation grew up in a safe, affluent, and, generally speaking, socially, economically, and technologically advancing age. They can’t wrap their heads around the fact that this rosy period may be as over as the Belle Epoque of 110 years ago. Those people knew in 1914 that they were going over into the abyss because by November 1914 it was clear that the old world was dead. We don’t seem to be experiencing such a neat threshold, which makes the transition even tougher to fathom and to address (that is, if anyone in power even wanted to address the new reality, which they don’t and won’t until they are forced to or lose control altogether).

At least that’s the way I see it.

I’m convinced that those in power who see scarcity don’t care because they are convinced they will be part of the haves.

And they will be until the day before the whole edifice collapses, maybe even a month or two after that.

The short (two seasons) of the new Dallas seemed to indicate that methane hydrates were going to be a big player in the future – don’t laugh, tv is where our thoughts are molded…

she doesn’t mention war either, but both are implicit in the model. the massive population drops you see in the chart are not solely the province of starvation. resource scarcity and economic malaise will lead to both more conflict and environmental destruction which leads to even more difficult to extract resources and a more depleted environment, etc.

At the micro level, I believe some analysts are considering ROEI (Return on Energy Invested) in analyzing the economic viability of fossil energy projects, although I suspect the approach used materially understates indirect energy costs and the potential economic and social costs of disasters like Deepwater Horizon.

Besides energy conservation and other policies mentioned here and elsewhere, a possible partial solution to both the energy and climate change conundrum I have not seen mentioned here might be to gradually and incrementally begin to phase in renewable green energy consumption as a benchmark for growth of the money supply (Using the old M3 measure of the money supply). Yes, this could be a somewhat inequitable transition for many whose economic interests are embedded in the oil/finance status quo. But it need not be catastrophic, and it might even be life affirming. It could provide an incentive for developing alternative energy resources for a sustainable future. And it already has a name: the “Greenback” :-)

Just a thought. (h/t “Helasious” at the now extinct Sudden Debt blog).

The comment by “Susan the other” on pollution and global warming is particularly important.

I also would like to stress that carbon dioxide pollution is not taken into account in the limits-to growth modeling: particularly one fact- that it is not reversible in the medium-term future (hundreds of years). David Archer has written well about this geochemical reality. Neither global temperature nor ocean acidity can significantly decrease within this time frame after a peak is reached if one excludes catastrophic human action. . Therefore, the limits-to growth curve for pollution must be way off, approximating a plateau rather than a steep fall after peak. Doesn’t this parameter need to be rethought and remodeled? ( In addition human habitat loss due to global climate change does not seem to be factored into this modeling.) Don’t these considerations need to be dealt with?

The reason Tverberg’s analysis works at all is because her formulation

“Another way of describing the tendency toward economic growth is to say that the value to society of the (cheap) energy product is far greater than its cost of extraction”

is, to a degree, consistent with a resources, as opposed to financial, approach. However, Tverberg slips in the growth mantra although she qualifies it with “tendency toward”. Here’s the kicker. Fossil fuels are finite. As a result, growth based on them is by definition unsustainable. In addition, they have extremely high externalities (pollution, climate change, environmental degradation, loss of arable land, etc. To be fair, Tverberg does take note of many of these on her blog Our Finite World). Their costs go far beyond simply the cost of extraction. If we were to factor in these externalities, then the societal costs already exceed the societal gains, creating the imperative of transitioning out of fossil fuels while and if we still can.

Although Tverberg is criticizing the limitations of standard analyses her own falls within the traditional economic mainstream. Much of what she writes of in impersonal natural law terms are actually the results of kleptocracy, wealth inequality, and class war. Nor is there any treatment of how population growth increases pressure on resources, their unsustainable exploitation and use.

Miscellaneous other points: Is there some reason Tverberg can not directly name the Club of Rome as the funder of the Limits of Growth study? Also the birth trend line spiking after 2050 seems very odd. During periods of instability, disruption, and chaos, birth rates generally fall.

Her reference doesn’t really make clear which BLS tables she is using. A link or the survey or series name would have been useful.

What a coincidence. I just wrote a post on the development of a new natural gas pipeline in Vermont. The backers promise cheap energy for all time. The problem is that foreign (read: major) investment in shale gas plays has dropped by a factor of 10 in the past couple of years. The drillers have been losing the investors’ money in wads, hoping to be the last company standing when drilling drops off and prices go up. The investors have gotten tired of pitchforking money into the bonfire and are going to actually make shale gas profitable by temporarily defunding it.

One of the unmentioned factors behind Ms. Tverberg’s analysis is the loss of EROI, Energy Return On Investment. (I understand that Ms. T knows all about EROI) Newly discovered (non-renewable) energy resources are giving back less and less for the energy invested in them. We’re actually on the plateau of peak coal energy in this country. We’re mining slightly more each year in absolute tons, but the average energy content per ton keeps dropping and the energy cost per ton keeps going up. That transfers into the world of economics in a bad way.

Interesting article from the Guardian today discussing presentations at London conference about peak cheap-and-abundant oil: http://www.theguardian.com/environment/earth-insight/2014/jan/17/peak-oil-oilandgascompanies

I would encourage everyone to read the paper Gail links early on in her piece – I think some of those who’ve been harsh with her are missing some important points, perhaps in part due to language and editing. The narrative goes back to the ’60’s and forward to the bust in ’08.

http://www.esf.edu/efb/hall/2009-05Hall0327.pdf

You’ve only covered half the equation – resource discovery, namely how much capital it takes to find and extract new reserves. You hint at diminishing returns but you don’t really cover the issue of stages of technological growth, which is the other half of the problem.

Oil and the internal combustion engine are quite old technologies dating back more than a century. It’s only natural that returns from investing in them would diminish. If you want to look at what will replace them, look at the annual improvement on the cost curves associated with new power generating technologies like solar.

Since the chip industry has transformed the manufacturing of solar cells into a semiconductor etching problem, the solar business has started accelerating, though at not nearly the pace as Moore’s Law where transistor counts doubled on chips every 18 months. It seems to take about three years to double the installed base of solar cell generating capacity but that’s a continuous improvement in efficiency that oil can’t match. In terms of generating efficiency, solar has already outpaced coal on a $/watt basis. Nobody seems to be paying any attention to this.

Take a look at the speed of improvement in battery technologies. Since mobile computing started driving the battery business, that’s accelerating too. There’s nothing Detroit or Exxon can do to hold back these guys now. It’s out of their hands (as it should be).

Which is not to mention the millions of dollars of investments spread across several firms in cold fusion which appears to have a cost curve that blows solar out of the water – e.g., Black Light Power, Brilloiun, Rossi and Defkalion.

None of this would be hard to understand if you’d referenced the work of Walt Rostow and his growth and technology models.

Walter Rostow was an unabashed techno-enthusiast whose major works focused on especially the US experience which he then elevated to the status of economic law. He believed that a mass consumption society was the pinnacle of human achievement, and the US had a positive duty to “spread” this to the world. This was a colossal error in judgment.

http://en.wikipedia.org/wiki/Rostow%27s_stages_of_growth

Similarly, Moore’s Law has been taken by others to imply all manner of “explosive growth” phenomena. See this nutshell in Wiki:

http://en.wikipedia.org/wiki/Moore%27s_law

And then we can all just sit back while Ray Kurzeil’s “Singularity” takes the wheel and whisks all 7.5 billion of us to techno-nirvana.

While solar and other alternatives must be deployed, and as rapidly as possible it is the consumption and waste sides that must come down even more so. All clean alternatives remain less than 2% of total global energy production. There are serious people who question whether the materials even exist in the quantity required to “convert” the entire system before the effects of oil kill the biosphere, which means the conversion must be complete well before mid-century.

Solar enthusiasts, like their fellows in all facets of high tech, from medicine to Monsanto, tend always not to ask what hidden costs lurk within a technology. An excellent recent example is the wholesale trashing of a paper-based economy and knowledge base that had taken thousands of years to build and was dispersed across the globe to be replaced by One Big System (Internet, servers, PC’s, communications devices, etc.) which, if ever taken down for any period longer than a few weeks would destroy the global economy and most of us with it. We know the US has the capability to do it, and very likely several others nations could as well. How bright was that, given we know also know just how crazy our various leaderships are?

Anyway, Moore’s Law and attempted variants have been about information, computing, networking etc. Solar power as our main source of energy is going to be a lot more complex than the ability to produce chips. There are already known downsides, eg., the toxic wastes generated by Silicon Valley, but here’s something to consider along the lines of my prior comment on the Internet – in a world of solar power, what does 1 major volcanic eruption along the lines we’ve experienced a number of times in the last few hundred years do the equation when the sky is filled with dust for up to 3 years? There is no doubt this will happen again.

I suggest that we cannot afford to make the same mistake again – becoming completely dependent on toxic fossil fuels was not very smart, as all we really managed to achieve was to grow billions of human mass consumers who every time out have voted for whomever they believe will keep the ball rolling the fastest, irrespective of the fatal curve up ahead.