Yves here. The issue that Wolf highlights, of weak earnings masked by expectations headfakery, has been an ongoing complaint of reader Scott for over a year, so it’s good to see someone else take notice of the disconnect between hype and reality.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Testosterone Pit.

The S&P 500 index keeps bumbling from one all-time high to the next as corporations are issuing record amounts of debt to spend record amounts on buying back their own shares: $160 billion in the first quarter alone, according to CapitalIQ. Borrowing money to buy back shares and hyping it ceaselessly as “returning value to the shareholders” is the most effective way to manipulate up the stock, even if revenues are declining quarter after quarter.

In this climate of ZIRP, any major corporation can do it. The heavy buying during these low-volume times pushes up shares, the hype surrounding the buybacks pushes up shares, expectation of more buyback announcements pushes up shares, the mere idea that shares are being pushed up pushes up shares…. And in the end, the buybacks lower the share count for the all-important EPS ratio.

The game works wonderfully. Though a game is all it is. It’s not an investment in productive capacity, marketing, or expansion projects. It’s not an investment in people. It’s not an investment that will bring future revenues or earnings or efficiencies. It’s not an investment at all. It just blows a lot of cash on manipulating the one number that the entire world is focused on.

But it’s not even actual earnings as reported under GAAP that is the focus of all attention. It’s an estimate of “forward,” ex-bad-items, adjusted, pro-forma “earnings,” so an entirely fictitious number, helpfully provided by the Wall Street hype machine through its analysts and eagerly disseminated by the media.

That gloriously fictitious 12-month “forward” ex-bad-items, adjusted, pro-forma “earnings” per share then becomes the denominator in the 12-month “forward” P/E ratio, which, according to FactSet, currently stands at 15.4. But just how far off the wall have these fictitious numbers been in the past?

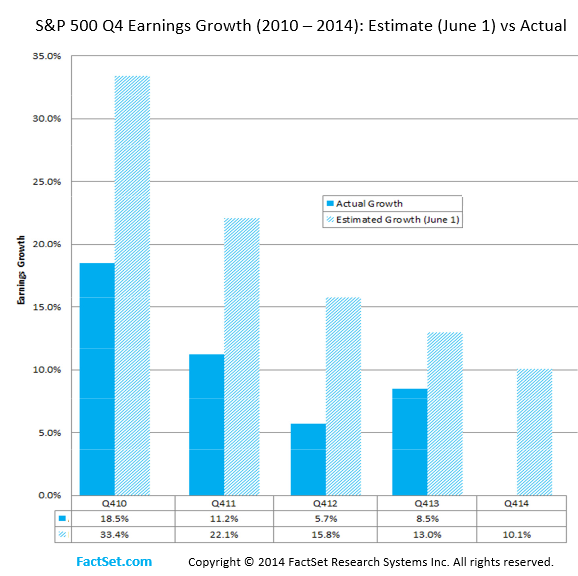

In its latest report, FactSet shed some light on this by comparing analysts’ estimates for earnings growth as of June 1 for Q4 of the same year, for the years 2010, 2011, 2012, and 2013. And it found, without explicitly saying so, that these projections are consistently the biggest hoax out there.

So for Q1 this year, the S&P 500 companies that have reported earnings so far generated an adjusted ex-bad-items pro-forma earnings growth of 2.1%. After inflation, there isn’t much left.

Nevertheless, analysts are currently estimating earnings growth of 10.1% in Q4 this year, a number they pulled out of thin air. But they’ll be busy over the next few months lowering their numbers to something that the most the companies can actually exceed, to give their stocks the momentum needed to rise to the next new high. Meanwhile, these “forward” EPS estimates, like today’s 15.4 for the S&P 500, are bandied about passionately as rationalization for the gravity-defying large caps that make up the index. Beneath the slick surface, momentum stocks and small-cap stocks are already re-experiencing the vertigo-inducing effects of gravity – the game doesn’t work forever.

That these metrics with “forward” components are the biggest hoax out there isn’t new. Everybody knows it. Everybody knows that they’re dragged out to bamboozle, well, exactly who? Everybody else?

This acceptance of the idea that the actual past, as accounted for under GAAP with warts, bad breath, and all, doesn’t matter, that only these beautified pro-forma adjusted numbers matter is one of the greatest accomplishments of the Wall-Street hype machine.

But it works – as long as everyone believes that everyone believes that this will drive stocks higher. Many people believing in the same thing generates momentum, which generates even more momentum, and behind it all stands what everyone believes is the guarantee by the Fed to prop up the markets should they begin to ratchet down. And so everyone is trying to get their slice of the “wealth effect” while they still can. It’s a consensual hallucination. The Fed provides the nearly free liquidity and the encouragement. The Wall Street hype machine brings it all together and drives it forward, while profiting from the fees at every step along the way. It works, until it suddenly doesn’t….

n 2000 and 2007, it happened. The consequences were spectacular. Now, it happened a third time in fifteen years. And it’s forming an increasingly terrifying chart. Read…. This Happened Twice Before, And Each Time Stocks Crashed

Shared psychotic disorder, or folie à deux, is a rare delusional disorder shared by two or, occasionally, more people with close emotional ties. An extensive review of the literature reveals cases of folie à trois, folie à quatre, folie à famille (all family members), and even a case involving a dog.

– Medscape Reference

H/T – Philip Pilkington

skippy… maybe cats are insulated to this condition.

It’s your beloved Fed that makes it possible.

Criminals and those afflicted by wacky ideology’s can inhabit any institution, its an endless chore to keep cleaning the mess they create.

This controversial documentary film by acclaimed filmmaker John Pilger draws on his long association with Indigenous Australians. Utopia is Pilger’s investigation into Australia’s colonial past and wealthy present. It sets out to break the stereotypes of the first people of Australia. Pilger travels to Darwin, then to Western Australia and to the outback of New South Wales, where he explores the high rate of Indigenous people imprisoned, the low average life expectancy, and the prevalence of preventable diseases and malnutrition among indigenous communities. Utopia is both a personal journey and a universal story of power and resistance, of how modern societies can be divided between those who conform and the dystopian world of those who do not. (An Australian Production) (Documentary) M(A,L) CC

http://www.sbs.com.au/ondemand/video/259748419676/Utopia

Think I saw some of you mates in their Beardo.

Skippy…. yes beardo we know all the upstanding corporatist’s were forced to engage in criminal acts, we know with out the Fed we would all be living in your utopia by now.

folie à famille => folie en famille

The same social phenomenon crosses linguistic boundaries without the slightest impediment …

The chronic, decadent end-game of paradigm lost. The ‘excellence’ of Joseph Garber’s novel ‘Rascal Money’ (1990) in the financialisation ‘bolting to seed’ stage. The underlying (and ongoing) ‘Plan B’ is the seizure of assets by the rich to protect them in the after-shock. Meanwhile, we know about positive, democratic money and can’t swing this into political action. Our “best”, doing “god’s work” write tax evasion plans to conceal dividends as management fees for work never done and curiously related to the decimal point with equity share.

Bejan and Lorente – http://www.topopleidingen.org/Fractalisme/Constructal-law.pdf – offer a scheme to view economics from thermodynamics (with elements of chronic positivism if we aren’t careful) that could be used to show the disjuncture between actual capacity creation and real wealth institutional finance has created, and perhaps new ways to get evolutionary intelligence working in our flow system. The most obvious issue is we have lost grip on money systems as ‘constructors’ (the most obvious scientific ones are catalysts) – in the terms Wolf uses money is now poisoned, creating copies of itself not the products we want. Catalysts here are not the speeders-up-and-down of school chemistry, but construct conditions for ‘manufacture and control’ of flow.

Rascal Money sounds good. ‘Paradigm lost’ sounds like you. If any of this stock market behavior makes any sense it might be the runway foam Timmy talked about. In all of the metrics and criteria to determine how valuable and profitable a company is, there really is no category for sustainability, nor for socially beneficial. We need new analysis. So maybe we’ll get it. After our present profligate corporations have been given time to retrench; to downsize hand over fist without losing value catastrophically. Like they already claimed profits from the efficiencies they gained from laying off 30 million workers; now they are buying back all their shares to wring out the inflation they created – they’ll all do reverse splits soon. They when society finally asks what the hell good they are, they can focus on some obscure aspect of their remaining enterprise and survive as businesses that produce a good the rest of society wants. Or maybe not.

‘That these metrics with “forward” components are the biggest hoax out there isn’t new. Everybody knows it.’

Forward earnings are a PR device for sell-side analysts and financial journos. Successful trading systems incorporating forward earnings are nonexistent, as far as I know, since the metric incorporates no exploitable information.

Naturally Alan Greenspan thought the so-called Fed model, which based its P/E ratio on forward earnings, was pretty cool.

How will we know when Bubble III is officially over? When the idiot Greenspan announces that at the current pace of corporate buybacks, all publicly-traded equity will disappear within a decade, and the NYSE will be obliged to close its doors for lack of product to sell.

INNOVATION & REPLICATION

The game works wonderfully because of an innate attribute of all of us. Often dormant, but never dead, cupidity comes to the fore when foolish-people think they can make-money with little physical effort.

It has been and always will be a characteristic of financial markets. The phenomenon’s newest twist is called “Silicon Valley Entrepreneurship” by means of which once Internet-nerds become, literally overnight, Megabuck Zillionaires. Just because they have a cute-program that can entice the attention of billions of Internet-Zombies in need of the latest-‘n-greatest buzz.

About “facebook” with a small-“f”:

(From here.

So, pray tell, how can an idea that has at least existed since 1936 become an overnight hit on the internet and make its innovator a zillionaire? The truth is that Zuckerberg is no “innovator”. He is a replicator, someone who replicates what has gone before.

He replicated facebook on the internet and became an overnight success (and zillionaire).

It am not attempting to diminish his success. I do want to put it in its proper context. The real innovators in this story are a number of people, but foremost in my mind “Sir Tim” – that is, Tim Burners-Lee, since knighted by the Queen of England and now running the WWW Consortium out of MIT.

Vincent Cerf is another and there are arguably even others, like Bob Kahn. But, I focus on Tim because I met him when he was working at the European Nuclear Research Center in Geneva/Ferney-Voltaire. Tim at the time wanted to link electronic-documents and, though it took a long time to develop, the CERN was the first and most frequently attended site on the European Internet in the late 1980s.

My point is this: At the time I was working for an American computer-company in Geneva and was asked to see Tim’s work at linking-documents by means of something called “hypertext” on a CERN program called ENQUIRE. When I reported to my management that Burners-Lee was onto something “big”, I was told to forget-it and stay on “strategy”, which at the time was to sell “Videotext“.

Which had a short history and was finally put out of its misery by the Internet.

So, not all innovation is as apparent as one might think. But all replication is apparent- despite the profits it engenders – but not quite the same thing.

Methinks …

The innovation of Facebook was really in bringing back something the advertising world had lost: a common watering hole with a captive audience. Up until the rise of cable TV (150 channels with nothing on) advertisers had a closed pool of a captive audience. There were 3 (then 4) networks and everyone watched the same programming. An advertiser could reach vast numbers of audience easily.

Cable TV starting splitting audiences into subject niches, which effected advertising by making them work a lot harder for reach. As audiences split further and further, the days of insanely popular shows that were common watercoolers with enormous reach came to a close. Days of MASH and Seinfeld, where everyone had a common experience were no more. It became harder and harder to have that expansive advertising reach – and more expensive.

What Facebook did was bring audience back to a common watering hole. It created a commons square where most of the town passes through on a regular basis. This was of enormous import to advertisers, who lost that reach in the expansion of cable and then Internet.

Innovation in technology now falls into one of two realms: products with buyer revenue generation abilities and services with advertising revenue generation abilities. The more users on a service, the greater advertising potential – which is where these insane valuations and IPO’s come from. The tech sector knows perfectly well that advertising dollars are there in large quantity for platforms that can attract large numbers of users, so that’s what they build. There’s still plenty of innovation happening on the other side of tech, but the easy (and really BIG) money is on chasing advertising dollars.

Water holes are tricky – they can dry up, or be poisoned or hold other hidden dangers. I’m sure there is some industry metric for advert $ effectiveness and spending via f to f’s market cap that proves me wrong but I just don’t think f is the 1 ‘indispensible’ advert pot to pee in, or spot to be in for that matter.

Heh, my bet is that the Facebook emperor had no clothes. Right now CMO’s have lots of pretty graphs to justify their ad spend and jobs, I think there comes a point where some bean counter genius is going to realize that FB advertising dollars aren’t moving the sales needle and then the whole thing blows up. Same deal with Twitter.

FB’s success was due to its original exclusive nature when it was limited to Boston-area, Ivies, and public ivy email addresses. It expanded as investors flocked to it. It was exclusive and known to exist to 20 year Olds and teens before they had access, and it didn’t take as long to load as myspace with its countless screen garbage and limited names. FB was a better platform for searching for people than myspace. It came out in the spring of 2004, and those kids who had it had a summer to demonstrate it to their high school friends.

Then it went to high school email addresses, and eventually, the wider community. The original aura of exclusivity is what spread it. As investors poured in, people used it in various cooperative efforts, and one can pretend to work while they are goofing off. How closely are the net nannies looking at individual FB pages?

I think the poison to the well to borrow from the comment below is kids are more connected already and won’t provide new users as FB’s current user base drifts away because it’s not novel and it’s not necessary to finding friends who moved away without doing leg work because losing contact isn’t as easy to do except by choice. As they grow more numerous, people using FB as a lazy way of communicating with their kids will drift away. Quirky Aunts won’t have audiences for their collections of cat clothing. I suspect it’s well under way. As FB tries to monetize their platform, it’s going to become unusable for work style efforts.

Wasn’t t Ford who pulled their ads?

Another techno-update that’s bubbled up is the whole e-commerce world. Those of us who grew up in the Heartland remember mail-order catalogs as part of the yearly life cycle, the US Mail substituting for department stores hours away in the big cities. Amazon is just Monkey Wards piggy-backed on this new, government-developed communications network.

Also, with indoor plumbing on farms there’s less need for last year’s catalog, so that worked out okay.

At least 4 of the houses on the street I grew up on were from the Sears Roebuck catalog, and they were assembled around 1925. One was quite large and came with a matching two story carriage house.

Bubble markets depend on hype and the hype works then why isn’t it real? The mechanism described in this article makes sense–if investors believe there is a floor established by the Fed (actually I believe this floor is maintained by more actors than the Fed) then they feel freer to speculate and ride out and play in the little bubbles and froth that the market provides. At some point, critics have been saying for some time, there will be a reckoning–just not today. So why wouldn’t this scenario stretch out as far as the eye can see?

Banger;

Social Entropy, also known as Crapification will bring this latest expression of magical thinking to its’ well deserved end. Despite what some people may imagine, real flesh and blood people need goods and services to live. These goods and services are palpably real. When delusional finance reaches a certain threshold, where the finances needed for a survivable life style exceed the capacity of the average producer to aquire, the medium used for exchange in the marketplace loses its’ currency. That medium loses its’ social utility, since a threshold number of people can no longer afford to use it. Defining that threshold value is the hard part, but it is there.

.

Were that true then the last Real Estate bubble and its Toxic Waste that seized the nation’s Credit Mechanism in the fall of 2008, which provoked the Great Recession of 2009, would not have been an almost identical repeat of its precursor the stock-market crash of 1929 and the Great Depression. We dropped upper-level income-taxes drastically, provoking the greed on financial markets. (See the history of US upper-incomes tax levels and note the precursor rate reductions before both the Great Depression and Great Recession.)

So, it is quite likely to repeat itself in 30/40/50-years when this present generation is no longer at the helm of Wall Street. If there was any failure, it was that of moral turpitude. Some people knew full well that the Waste was Toxic, and they securitized it anyway by getting their cronies at the Rating Agencies to give their pontifical blessing of “Triple-A”.

Then the “crapification” was exported to the world, creating one of the most serious world-wide recessions in peacetime history.

We never ever learn. The present generation just makes the same stoopid mistakes as its forebears, because it does not want to learn. The temptation is too high – marginal income tax on upper-incomes is a measly 30% nowadays, when in the pre-1960s it was close to 90%.

Paraphrasing philosopher George Santayana: Any people who do not understand the mistakes of the past are condemned to repeat them.

David Hannum, in criticism of P. T. Barnum: There’s a sucker born every minute …

It was all enabled by deregulation. Congress and the government regulators are all captured by Wall Street.

Price of i-Phone clone Cubot £50, estimate for plumber to fix blocked loo £175. DIY on the loo. Meanwhile, as Wolf has it, cheap money produces stock prices that ‘protect’ my pension via investments through PE that attack my wages and conditions of employment, and steal tax. Social entropy sounds about right.

when all the molecules of equality and all the molecules of freedom have finally annihilated each other….

Dear sto;

A Manichaean world view? My question being; why are equality and freedom opposed? I think they are not. Are you conflating freedom with liberty? If we equate Libertarianism with Freedom, then, we must redefine freedom. I’m in here with the muddled up masses. Besides, Doppelgangers are mythological creatures, aren’t they? (If Gandhi met Dimon, would they mutually annihilate each other?)

I know Ambrit. Our definitions fail us every time. Just thinking about the friction whereby one person’s freedom impacts another’s equality. Then there is the question freedom for or freedom from? And the sleazy hedge: not equality across the board, but merely equal opportunity. Right. It’s a weasel world.

Dear allcoppedout;

Price of replacing broken i-phone, fifty quid plus inflation. Price of bringing under control cholera epidemic caused by breakdown of sewer system, Lives and Treasure.

As you put it, Wolfs disquition describes a giant financial circle jerk. Who’s the pivot man? Also, does everyone c— at the same time? I think not.

Sto’s annihilation actually produces light. Many of our terms like freedom and democracy contain paradox of some kind. The universe we live in had a slight imbalance towards matter rather than anti-matter. Freedom requires freedom to and freedom from, democracy moved from very restrictive ‘only entitled males’ to one person one vote and remains in peculiar relation to our ranking through education on ‘knowledge’.

Erect enough protections from punishment and looters will invent all manner of ways to extract unearned “compensation.” It helps if there are some compliant (sponsored) academics around to write Serious articles extolling bad behavior as a new form of virtue.

Worse than that WO – they have us having to ‘seriously argue’ in their own madness without us being able to withdraw and get on with different practice.

There’s a season for sowing and there’s a season for reaping. “Groaf” is what happens in between and winter is what follows (and precedes). The Sophists would have us ‘believe’ that summer is eternal, despite 200K years of accumulated genetic wisdom.

+100

These are all moral complaints at bottom and the Great Technician can’t worry about a few million ruined lives. Sin may increase, but the balance sheet can be expanded to cover it. It’s the new way of the world and what was thought to be reality is shown to be lack of imagination. The only way heaven ends is if gasoline prices outpace incomes. Or if the technicians become unimaginative, in which case the very rich will be warned six months before anyone else.

Wolf, good update on “consensual hallucination”. Yet another confirmation that “The Emperor has No Clothes” – http://www.triplepundit.com/2011/09/state-world-economy-emporer-clothes/

If true, it would really mean that the Emperor has all of the clothes, and the rest of us are bare ar–d.

Yes, EVERYBODY who participates in this game called, “society,” is lying.

A couple of questions that beg asking are, “why everybody on this discussion-list refuses to acknowledge their complicity [as if somehow they are above the fray?]. And, secondly, “why this is taking place?” Where exactly is the dis-connect?

These are the real questions, not the constant referencing/cataloging of the deceit, stealing, and cheating [that which defines nearly all social organization] that has been going on since Og and Fleg first sat down at the cave-fire and decided that they were going to bilk Zlot out of his arrowheads.

“It’s funny because it’s true.” Tina Fey

Not to mention selling corporate bonds for the sole purpose to buy back stock shifts the bad news from the income statement to the balance sheet – where it seemingly is safe from public/investor view.

Once upon a time in the corporate world that would have been viewed as complete nonsense.

craazyboy;

Unfortunately, most of what passes as finance today no longer takes place in the corporate world, but has migrated to the oligarchy world. In that sphere, the behaviours we decry make perfect sense.

It’s called “if only” accounting.

If only my pension assets would yield 10%, my liability would be only x. Unfortunately, they yield about 3%, so my liabiltiy is 3 times higher. No worries, in your accounts….. :-)

Reminds me of socialist planing accounts…… “if only”….. we would had build ten tractors….. :-)

In the Bible, profits are good but profit TAKING isn’t good. Common stock as endogenous money allows profit but WITHOUT* profit taking thus resolving a paradox in Scripture.

*The profits accumulate in the fiat price and number of shares with stock splits to keep the price per share within reach of even the poorest to maximize market acceptance. So much for Berkshire Hathaway?

The government-backed credit cartel strikes again!

“And in the end, the buybacks lower the share count for the all-important EPS ratio.”

Thinking as a dividend oriented investor, the buybacks also allow for higher dividends per share. What is wrong with that?

If it is true that non-financial corporate growth is going to be lower in the foreseeable future compared to post-WWII history, then the way for companies to prosper like they did before is to lower their output capacities to match falling demand. Companies can adjust to this new environment while we stock owners can have value inflation in the stocks and increasing dividends. If this buyback is done with idle cash rather than by borrowing, then it isn’t even mortgaging the future of the company.

What are the flaws in this line of reasoning?

If it really is surplus cash then there is no problem with paying it out. Whether it goes out as dividend or as buy-back depends on the relative tax effectiveness of the two modes, both for the corporation and shareholders. I am no tax expert, so can´t speak to that. If earnings are constant, the fact that EPS goes up after a buyback should be exactly offset by the lower number of shares. However if all the focus is on EPS, then the market gets another boost. It´s sustainable as long as there is surplus cash, but long term that needs earnings. If debt is being used to buy back shares then the company becomes more vulnerable to earnings and interest rate shocks, but this can be managed for quite a while too, maybe until earnings recover. It can´t continue forever, but if you are an optimist, another year always looks achievable…

SG,

If ,in fact, buybacks reduce shares outstanding. I worked for GE and it has announced buybacks for decades and shares outstanding has been constant at around 10B (just checked – 10.06B). I assume GE issues the purchased shares to executives as compensation instead of paying out earnings as dividends. In this way buybacks can hurt dividend investors – who ,of course, can avoid the stock.

Jim

Well, when GE drastically cut its dividend, I wrote it off as a company I would be interested in investing in. It was clear from that action that, for one reason or another, GE could not be depended on for a steadily increasing stream of dividends.

When companies buy back shares so that they can distributed a given amount of money as a higher dividend per share, then, and only then, am I not upset as an investor.

You build a machine to defeat the gawdless commies… gawdless commies gone [gawds work]…. they steal ball… momentum carry’s freedom team over the cliff…. Victory!!!!

There’s not much to show for an entire cycle’s production, and nothing I’d judge as emerging from this cycle that will have a huge role in the next. I think lot’s of companies would be more interested in investing right now if a large and seemingly permanent degree of uncertainty concerning key vital national, international regional and global issues going forward will continue to favor and pursue imaginary stability whereas it is real instability the US has opted for all this century.

I think lot’s of companies would be more interested in investing right now if they had enough customers to merit such investment. With shrinking middle-class income, increasing amounts of money going toward paying off student loans, with no real-estate bubble to finance increased consumer spending, and with plants that have been idled because there is no demand for what they produce, why on earth would a company invest in more production capacity?

If there were customers out there demanding more than what could be produced right now, companies would be investing like mad, uncertainty or no uncertainty in foreign or domestic affairs.

I call this “the what part of no freakin customers do you not understand, theory of the economy.

This article, read together with Joe Costello’s piece on shrinking O&G profits, makes me want to head for the exit. But what can you do if the whole economy is a based on an energy bubble and a(nother) financial bubble.

Thanks, Yves, for the cold dose of reality.

Science does not need to perfect physical cloning. Our society, institutions and economic philosophy creates them daily.